Key Insights

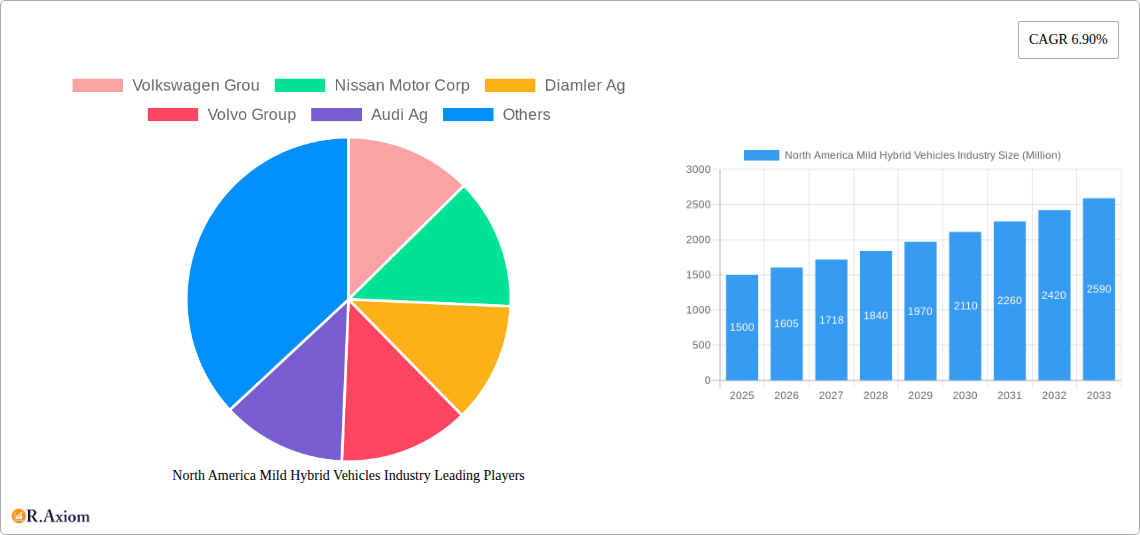

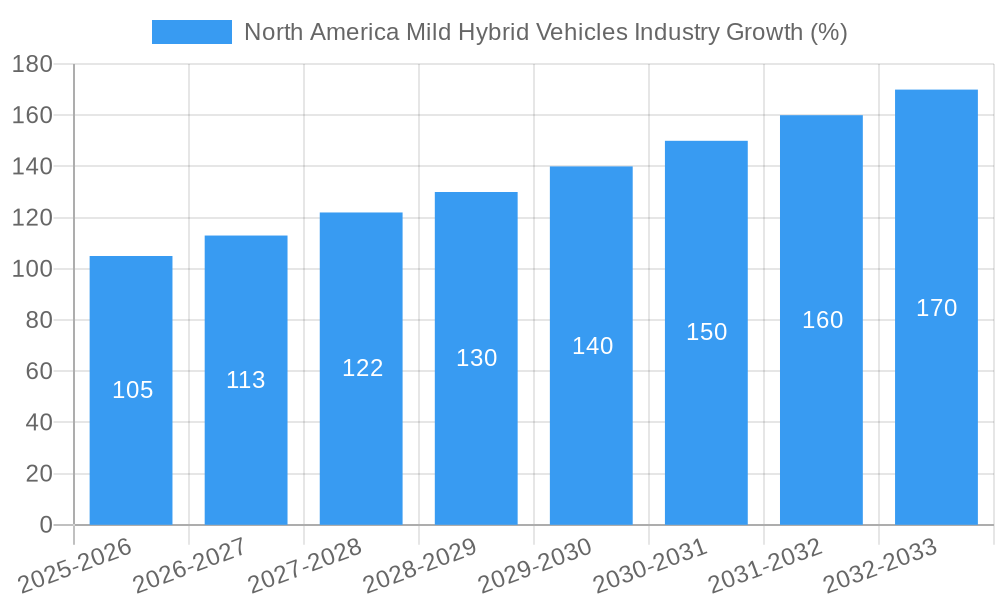

The North American mild hybrid vehicle (MHEV) market is experiencing robust growth, driven by stringent emission regulations, increasing fuel efficiency standards, and consumer demand for environmentally friendly vehicles. The market, valued at approximately $X million in 2025 (assuming a logical market size based on global trends and the provided CAGR), is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.90% from 2025 to 2033. This growth is fueled by several key factors. Firstly, the increasing adoption of 48V mild hybrid systems in both passenger cars and commercial vehicles is significantly contributing to market expansion. Passenger cars currently dominate the segment, but commercial vehicle integration is expected to accelerate, driven by fuel economy benefits and potential for fleet optimization. Secondly, technological advancements leading to reduced costs and improved performance of MHEV systems are making them a more attractive option for automakers and consumers alike. Furthermore, government incentives and subsidies aimed at promoting fuel-efficient vehicles are boosting market adoption. However, challenges remain, including the relatively higher initial cost compared to conventional vehicles, which could potentially restrain market penetration in certain consumer segments.

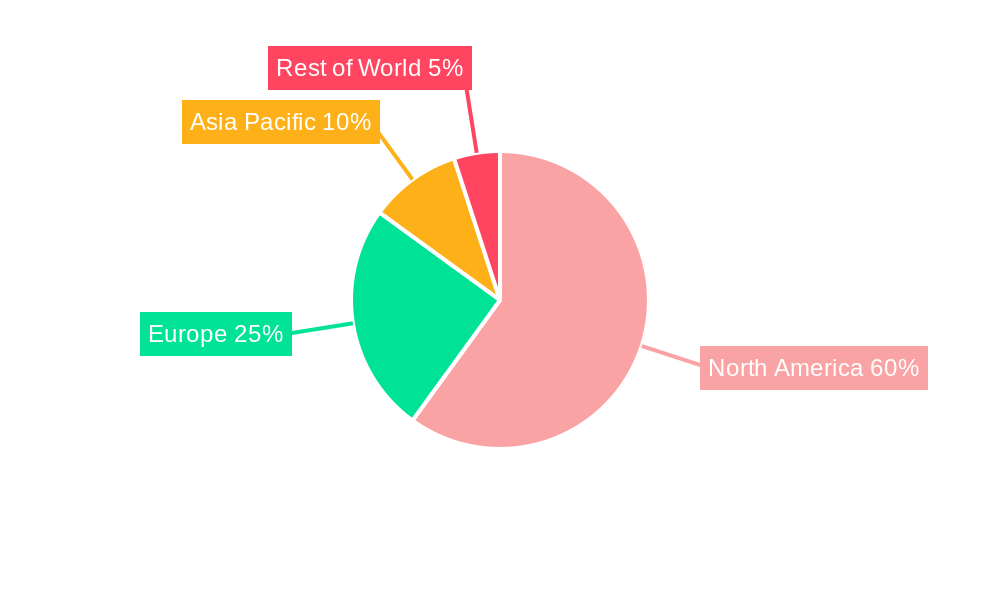

Despite these restraints, the long-term outlook for the North American MHEV market remains positive. The continuous improvement in battery technology, the development of more sophisticated hybrid systems, and the ongoing commitment to reducing carbon emissions will collectively drive significant growth throughout the forecast period. Regional variations within North America are expected, with the United States likely to maintain the largest market share due to its larger automotive market and stronger regulatory push for fuel efficiency. Competition among key players like Volkswagen Group, Nissan Motor Corp, Daimler AG, and others is intensifying, leading to innovation and potentially lower prices, further accelerating market growth. The segmentation by capacity (less than 48V and 48V and above) will continue to evolve, with 48V systems becoming the dominant technology due to their superior performance and cost-effectiveness.

North America Mild Hybrid Vehicles Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America mild hybrid vehicles industry, covering the period from 2019 to 2033. It offers valuable insights into market trends, competitive dynamics, and growth opportunities, equipping stakeholders with actionable intelligence for strategic decision-making. The report incorporates extensive data analysis, forecasts, and expert commentary to deliver a holistic understanding of this evolving market.

North America Mild Hybrid Vehicles Industry Market Concentration & Innovation

The North American mild hybrid vehicle market exhibits a moderately concentrated landscape, dominated by established automotive giants. Key players such as Toyota Motor Corp, Volkswagen Group, Honda Motor Corp, and BMW AG hold significant market share, collectively accounting for an estimated xx% in 2025. However, the market is witnessing increased participation from other manufacturers, leading to intensified competition.

Market Concentration Metrics (2025 Estimates):

- Top 5 players: xx% market share

- Top 10 players: xx% market share

- Market Herfindahl-Hirschman Index (HHI): xx

Innovation Drivers:

- Stringent emission regulations driving the adoption of fuel-efficient technologies.

- Advancements in 48V and above mild hybrid systems enhancing performance and fuel economy.

- Growing consumer demand for environmentally friendly vehicles.

Regulatory Framework & M&A Activity:

The regulatory landscape is significantly influencing market growth, with stricter fuel efficiency standards and emission norms driving innovation. M&A activity has been relatively moderate in recent years, with deal values totaling approximately xx Million in the period 2019-2024. Future M&A activity is expected to focus on technological advancements and expansion into new market segments.

North America Mild Hybrid Vehicles Industry Industry Trends & Insights

The North American mild hybrid vehicle market is experiencing robust growth, driven by several key factors. Increasing environmental concerns, coupled with government incentives promoting fuel efficiency, are significantly boosting demand. Technological advancements, such as the development of more efficient and cost-effective 48V and higher-voltage systems, are further fueling market expansion. Consumer preferences are shifting towards fuel-efficient vehicles, leading to increased adoption of mild hybrid technology across various vehicle segments.

The market is expected to witness a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. Market penetration is projected to increase from xx% in 2025 to xx% by 2033. Competitive dynamics are characterized by intense rivalry among established automakers and the emergence of new entrants focused on niche market segments. Technological disruptions, such as advancements in battery technology and powertrain integration, are continually reshaping the competitive landscape.

Dominant Markets & Segments in North America Mild Hybrid Vehicles Industry

The United States represents the largest market for mild hybrid vehicles in North America, driven by high vehicle ownership rates and strong consumer preference for fuel-efficient vehicles. Within the capacity type segment, 48V and above systems are experiencing faster growth due to their superior performance and fuel efficiency benefits. The passenger car segment dominates the market, though commercial vehicle adoption is also steadily increasing, particularly in urban logistics and fleet operations.

Key Drivers of Market Dominance:

- United States: Strong consumer demand, supportive government policies, and well-developed automotive infrastructure.

- 48V & Above Segment: Superior fuel efficiency and performance compared to less than 48V systems.

- Passenger Cars Segment: High vehicle sales volumes and widespread consumer adoption.

Dominance Analysis: The dominance of the US market is largely attributed to its large economy, high vehicle ownership, established automotive industry, and supportive government regulations. The preference for 48V and above systems stems from their superior performance and ability to deliver tangible fuel economy benefits. The passenger car segment's dominance is linked to higher consumer demand and the availability of a broader range of mild hybrid models compared to commercial vehicles.

North America Mild Hybrid Vehicles Industry Product Developments

Recent product innovations focus on enhancing fuel efficiency, reducing emissions, and improving vehicle performance. Manufacturers are integrating advanced battery technologies, optimizing powertrain systems, and developing sophisticated energy management strategies. These developments aim to improve the overall driving experience while minimizing environmental impact and aligning with stricter emission regulations. The market is witnessing a gradual shift towards higher-voltage mild hybrid systems (above 48V), offering enhanced performance and energy recovery capabilities. This trend is expected to gain further momentum in the coming years.

Report Scope & Segmentation Analysis

This report segments the North America mild hybrid vehicle market based on capacity type (Less than 48V, 48V & Above) and vehicle type (Passenger Cars, Commercial Vehicles). Each segment is analyzed based on its market size, growth rate, competitive dynamics, and key trends. Detailed growth projections are provided for each segment across the forecast period.

Capacity Type: The 48V and above segment is projected to grow at a faster CAGR compared to the less than 48V segment, driven by technological advancements and improved fuel efficiency.

Vehicle Type: The passenger car segment currently dominates the market, but the commercial vehicle segment is expected to witness significant growth due to increasing fleet electrification initiatives and stringent emission norms.

Key Drivers of North America Mild Hybrid Vehicles Industry Growth

Several factors are driving growth in the North American mild hybrid vehicle market. Stringent government regulations aimed at reducing carbon emissions are incentivizing the adoption of fuel-efficient vehicles. Advancements in battery technology and powertrain systems are making mild hybrid technology more cost-effective and efficient. Growing consumer awareness of environmental issues and a rising preference for sustainable transportation are also contributing to market expansion. Furthermore, the availability of government subsidies and tax credits further boosts the adoption rate.

Challenges in the North America Mild Hybrid Vehicles Industry Sector

Despite promising growth prospects, the North American mild hybrid vehicle market faces certain challenges. The high initial cost of mild hybrid systems can be a barrier to adoption, particularly for price-sensitive consumers. Supply chain disruptions and the availability of key components, such as batteries and semiconductors, can impact production and market growth. Intense competition among established automakers and new entrants creates pricing pressures and limits profit margins. Fluctuations in fuel prices can also influence consumer demand for fuel-efficient vehicles. These factors collectively impose an estimated xx Million negative impact on market growth annually.

Emerging Opportunities in North America Mild Hybrid Vehicles Industry

The North American mild hybrid vehicle market presents several emerging opportunities. The increasing demand for fuel-efficient vehicles in urban areas offers significant growth potential. Technological advancements in battery technology and powertrain systems are creating new opportunities for innovation and differentiation. The development of cost-effective and highly efficient mild hybrid systems will expand market access and adoption. Furthermore, integration of mild hybrid technology with other advanced driver-assistance systems and autonomous driving features can enhance market appeal.

Leading Players in the North America Mild Hybrid Vehicles Industry Market

- Volkswagen Group

- Nissan Motor Corp

- Daimler AG

- Volvo Group

- Audi AG

- Honda Motor Corp

- BMW AG

- Toyota Motor Corp

- Suzuki Motor Corp

Key Developments in North America Mild Hybrid Vehicles Industry Industry

- January 2023: Toyota unveils its next-generation hybrid system with improved fuel efficiency.

- March 2022: Volkswagen announces significant investment in expanding its mild hybrid vehicle production capacity.

- June 2021: Honda launches a new line of mild hybrid SUVs targeting the North American market.

- October 2020: Nissan and Daimler announce a strategic partnership to collaborate on the development of mild hybrid technologies.

Strategic Outlook for North America Mild Hybrid Vehicles Industry Market

The North American mild hybrid vehicle market is poised for significant growth in the coming years. Continued advancements in technology, coupled with supportive government policies and growing consumer demand for fuel-efficient vehicles, will drive market expansion. The emergence of new technologies and innovative business models will further shape the market landscape. Opportunities exist for manufacturers to differentiate their offerings through advanced features, superior fuel efficiency, and attractive pricing. Focus on efficient supply chains and strategic partnerships will be critical for success in this competitive environment.

North America Mild Hybrid Vehicles Industry Segmentation

-

1. Capacity type

- 1.1. Less than 48V

- 1.2. 48V & Above

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

North America Mild Hybrid Vehicles Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest Of North America

North America Mild Hybrid Vehicles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Warehousing and Logistics Sector to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Initial Purchase Cost to Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Mild Hybrid Vehicles will face competition from HEV and PHEV

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Mild Hybrid Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Capacity type

- 5.1.1. Less than 48V

- 5.1.2. 48V & Above

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest Of North America

- 5.1. Market Analysis, Insights and Forecast - by Capacity type

- 6. United States North America Mild Hybrid Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Capacity type

- 6.1.1. Less than 48V

- 6.1.2. 48V & Above

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Capacity type

- 7. Canada North America Mild Hybrid Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Capacity type

- 7.1.1. Less than 48V

- 7.1.2. 48V & Above

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Capacity type

- 8. Rest Of North America North America Mild Hybrid Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Capacity type

- 8.1.1. Less than 48V

- 8.1.2. 48V & Above

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Capacity type

- 9. United States North America Mild Hybrid Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Mild Hybrid Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Mild Hybrid Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Mild Hybrid Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Volkswagen Grou

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Nissan Motor Corp

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Diamler Ag

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Volvo Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Audi Ag

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Honda Motor Corp

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 BMW AG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Toyota Motor Corp

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Suzuki Motor Corp

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Volkswagen Grou

List of Figures

- Figure 1: North America Mild Hybrid Vehicles Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Mild Hybrid Vehicles Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Capacity type 2019 & 2032

- Table 3: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Mild Hybrid Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Mild Hybrid Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Mild Hybrid Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Mild Hybrid Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Capacity type 2019 & 2032

- Table 11: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 12: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Capacity type 2019 & 2032

- Table 14: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 15: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Capacity type 2019 & 2032

- Table 17: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 18: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Mild Hybrid Vehicles Industry?

The projected CAGR is approximately 6.90%.

2. Which companies are prominent players in the North America Mild Hybrid Vehicles Industry?

Key companies in the market include Volkswagen Grou, Nissan Motor Corp, Diamler Ag, Volvo Group, Audi Ag, Honda Motor Corp, BMW AG, Toyota Motor Corp, Suzuki Motor Corp.

3. What are the main segments of the North America Mild Hybrid Vehicles Industry?

The market segments include Capacity type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Warehousing and Logistics Sector to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

Mild Hybrid Vehicles will face competition from HEV and PHEV.

7. Are there any restraints impacting market growth?

High Initial Purchase Cost to Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Mild Hybrid Vehicles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Mild Hybrid Vehicles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Mild Hybrid Vehicles Industry?

To stay informed about further developments, trends, and reports in the North America Mild Hybrid Vehicles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence