Key Insights

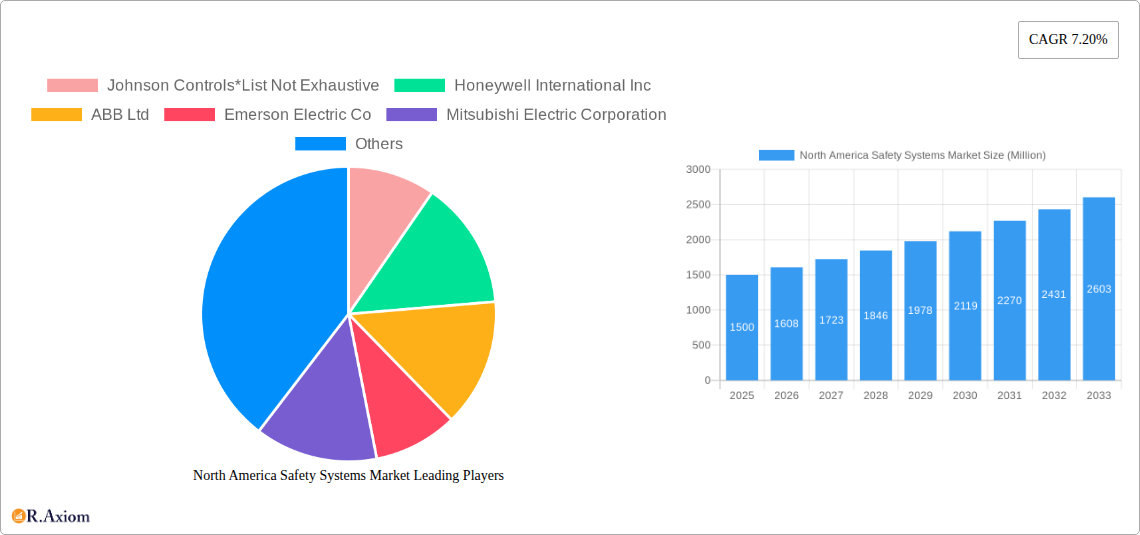

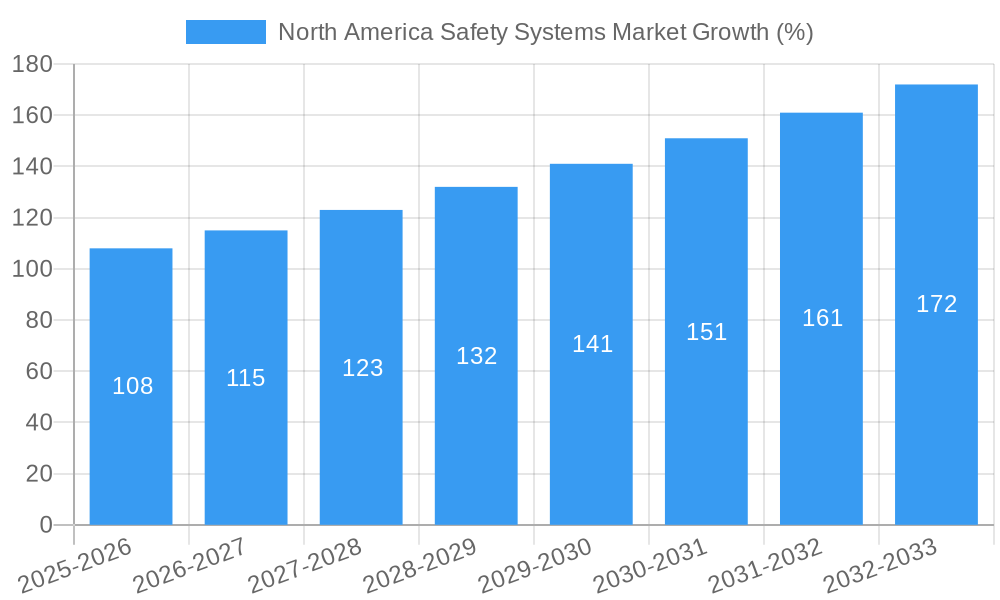

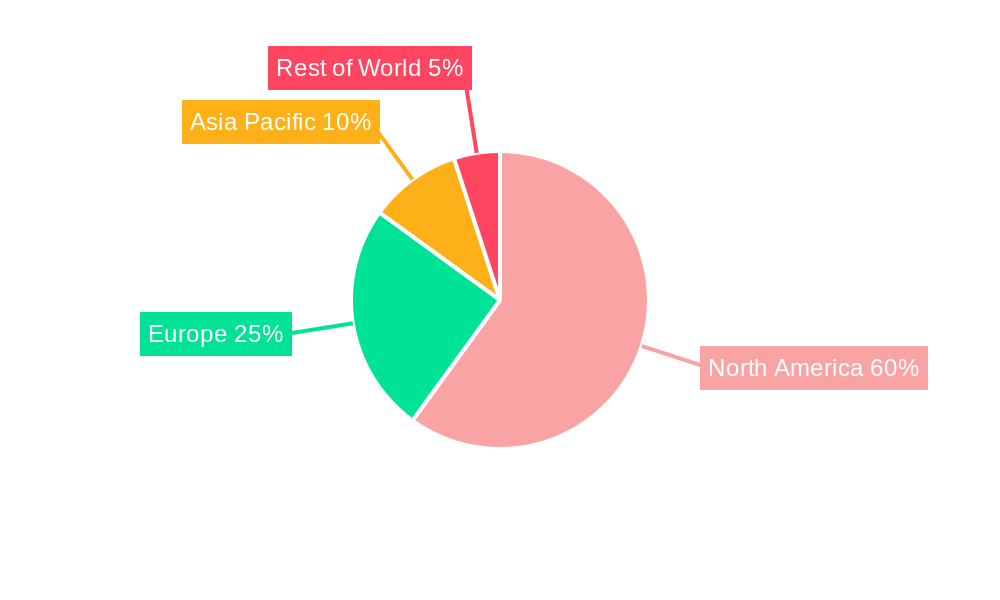

The North American safety systems market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 7.20% from 2025 to 2033. This expansion is fueled by several key factors. Stringent government regulations mandating enhanced safety protocols across various industries, particularly in oil & gas, energy & power, and chemicals, are significantly impacting market demand. Furthermore, increasing automation and the adoption of advanced technologies like AI and IoT in industrial processes are creating opportunities for sophisticated safety systems. Growing awareness of workplace safety and the escalating costs associated with industrial accidents are also prompting companies to invest heavily in preventative measures, boosting market growth. The market is segmented by safety system type (PCS, PSS, SSS, FGS, others), component (sensors, controllers, switches, etc.), and end-user industry (oil & gas, energy, chemicals, etc.). The United States currently holds the largest market share within North America, followed by Canada, reflecting the region's significant industrial base and substantial investments in safety infrastructure.

While the market shows strong growth potential, certain restraints exist. High initial investment costs associated with implementing advanced safety systems can be a barrier for smaller companies. Additionally, the complexity of integrating these systems into existing infrastructure and the need for specialized expertise can hinder widespread adoption. However, the long-term benefits of improved safety, reduced downtime, and enhanced compliance outweigh these challenges, leading to continued market expansion. The market is expected to see increased competition among established players like Johnson Controls, Honeywell, ABB, and Emerson Electric, along with emerging players offering innovative solutions. The focus is shifting towards integrated safety solutions, providing comprehensive protection across multiple aspects of industrial operations. Future growth will likely be driven by technological advancements, focusing on predictive maintenance, real-time monitoring, and enhanced data analytics capabilities for improved safety management.

North America Safety Systems Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America Safety Systems market, offering valuable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market trends, growth drivers, competitive landscapes, and future opportunities. The market is segmented by region (United States, Canada), safety system type, component, and end-user industry, providing a granular understanding of market dynamics. The total market size is predicted to reach xx Million by 2033.

North America Safety Systems Market Concentration & Innovation

The North America safety systems market exhibits a moderately concentrated landscape, with key players like Johnson Controls, Honeywell International Inc, ABB Ltd, Emerson Electric Co, and others holding significant market share. However, the presence of numerous smaller, specialized companies indicates a dynamic competitive environment. Market share fluctuates based on technological advancements, M&A activity, and regulatory changes. Recent M&A activity, such as Honeywell's acquisition of US Digital Designs, Inc. for approximately 14X EBITDA in December 2021, highlights the strategic importance of expanding capabilities and market reach. The deal value of such acquisitions varies considerably, depending on the size and target of the acquired company and can range from tens of Millions to hundreds of Millions.

Innovation is a crucial driver, fueled by advancements in sensor technologies, automation, and data analytics. Stringent safety regulations across various industries necessitate continuous improvement in safety systems, creating demand for sophisticated and reliable solutions. Product substitutes are limited, as safety is a paramount concern, but cost-effective alternatives and integration with existing systems are constant areas of innovation. End-user trends reveal a growing preference for integrated, intelligent systems that offer enhanced monitoring, predictive maintenance, and remote control capabilities.

North America Safety Systems Market Industry Trends & Insights

The North America safety systems market is experiencing robust growth, driven by several factors. Stringent safety regulations across various sectors, particularly in oil & gas, energy & power, and chemicals, mandate the adoption of advanced safety systems. The rising adoption of Industry 4.0 technologies, including IoT and AI, is transforming safety systems, enabling predictive maintenance and real-time monitoring, leading to increased efficiency and reduced downtime. The increasing focus on worker safety and reduced workplace accidents are also driving the demand. Consumer preferences are shifting towards user-friendly, integrated systems that provide seamless integration with existing infrastructure. Competitive dynamics are characterized by intense innovation, strategic acquisitions, and a focus on delivering customized solutions tailored to specific industry needs. The market is predicted to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration reaching xx% by 2033.

Dominant Markets & Segments in North America Safety Systems Market

By Region: The United States dominates the North America safety systems market, driven by its robust industrial base and stringent safety regulations. Canada also shows significant growth potential, particularly in sectors like oil and gas. Key drivers include government initiatives focused on workplace safety and infrastructural investments.

By Safety System: Process Safety Systems (PSS) and Fire and Gas Systems (FGS) hold the largest market share, reflecting the critical need for preventing catastrophic events in high-risk industries. The growth in these segments is propelled by increasing automation and digitalization in industrial processes.

By Component: Programmable safety systems and safety controllers/modules/relays are major market segments, with growth fueled by the demand for advanced functionality and reliable operation.

By End-User Industry: The oil & gas, energy & power, and chemicals sectors are the largest consumers of safety systems, reflecting the inherent risks associated with their operations. The growth in these sectors directly translates to increased demand for safety solutions. Other end-user industries such as food and beverage and automotive are also showing significant growth potential.

North America Safety Systems Market Product Developments

Recent product developments focus on integration with IoT platforms, advanced analytics, and cloud-based services. This allows for enhanced monitoring, predictive maintenance, and remote diagnostics, significantly improving the efficiency and effectiveness of safety systems. The emphasis is on user-friendly interfaces, improved reliability, and seamless integration with existing infrastructure. These advancements cater to the increasing demand for intelligent, interconnected safety systems that enhance operational efficiency and minimize risks.

Report Scope & Segmentation Analysis

This report provides a detailed analysis of the North America Safety Systems market, segmented by region (United States, Canada), safety system type (PCS, PSS, SSS, FGS, Others), component (Presence Sensing Safety Sensors, Programmable Safety Systems, Safety Controllers/Modules/Relays, Safety Interlock Switches, Emergency Stop Controls, Two-Hand Safety Controls, Others), and end-user industry (Oil & Gas, Energy & Power, Chemicals, Food & Beverage, Metals & Mining, Automotive, Others). Each segment's growth projections, market size, and competitive dynamics are thoroughly analyzed. For example, the US market is projected to grow at a CAGR of xx% during the forecast period due to the robust industrial base, while the process safety system segment is expected to maintain its dominance due to its critical role in preventing catastrophic events.

Key Drivers of North America Safety Systems Market Growth

Several factors drive the growth of the North America safety systems market: increasing government regulations on workplace safety; the growing adoption of automation and Industry 4.0 technologies; the rising demand for enhanced safety and security across diverse industries; and continuous innovations leading to more sophisticated and reliable safety solutions. The increasing awareness of safety among end-users and the significant investments being made in improving infrastructure and operational efficiency also fuel market growth.

Challenges in the North America Safety Systems Market Sector

Challenges include the high initial investment costs associated with implementing advanced safety systems; the complexity of integrating new systems with existing infrastructure; and the potential for cybersecurity vulnerabilities in connected safety systems. Supply chain disruptions and skilled labor shortages also pose significant challenges. These factors can impact market growth and lead to delays in project implementations, impacting the overall market size by an estimated xx Million annually.

Emerging Opportunities in North America Safety Systems Market

Emerging opportunities include the growing demand for cybersecurity solutions for safety systems; the integration of AI and machine learning for predictive maintenance and anomaly detection; the adoption of cloud-based services for remote monitoring and management of safety systems; and the expansion into new and emerging end-user industries, such as healthcare and aerospace. These opportunities are expected to significantly influence market growth in the coming years.

Leading Players in the North America Safety Systems Market Market

- Johnson Controls

- Honeywell International Inc

- ABB Ltd

- Emerson Electric Co

- Mitsubishi Electric Corporation

- Siemens AG

- Schneider Electric SE

- Omron Corporation

- Baker Hughes Company

- Rockwell Automation Inc

- Yokogawa Electric Corporation

Key Developments in North America Safety Systems Market Industry

- June 2022: Mitsubishi Electric Corporation's U.S. subsidiary secured a contract for safety instrumentation and control systems for Holtec's SMR-160 small modular reactor, highlighting the growing importance of advanced safety systems in the nuclear energy sector.

- December 2021: Honeywell's acquisition of US Digital Designs, Inc., expands its fire and life safety solutions, enhancing its capabilities in emergency response communications and improving situational awareness.

Strategic Outlook for North America Safety Systems Market Market

The North America safety systems market is poised for significant growth, driven by technological advancements, stringent safety regulations, and increasing demand for enhanced safety and security. The focus on digitalization, automation, and predictive maintenance will continue to shape market dynamics. Opportunities exist in the integration of emerging technologies, expansion into new markets, and the development of customized solutions to address specific industry needs. The market's future potential is substantial, promising continued growth and innovation in the years to come.

North America Safety Systems Market Segmentation

-

1. Safety System

- 1.1. Process Control Systems (PCS)

- 1.2. Process

- 1.3. Safety Shutdown System (SSS)

- 1.4. Fire and Gas System (FGS)

- 1.5. Others (

-

2. Component

- 2.1. Presence Sensing Safety Sensors

- 2.2. Programmable Safety Systems

- 2.3. Safety Controllers/Modules/ Relays

- 2.4. Safety Interlock Switches

- 2.5. Emergency Stop Controls

- 2.6. Two-Hand Safety Controls

- 2.7. Others

-

3. End-User Industry

- 3.1. Oil & Gas

- 3.2. Energy & Power

- 3.3. Chemicals

- 3.4. Food & Beverage

- 3.5. Metals & Mining

- 3.6. Automotive

- 3.7. Others (

North America Safety Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Safety Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Demand for Reliable Safety Systems to Ensure the Protection of People and Property; Strict mandates for safety regulations

- 3.3. Market Restrains

- 3.3.1. High investments required for automation and installing industrial safety systems

- 3.4. Market Trends

- 3.4.1. The Safety Controllers/Modules/Relays Segment is Expected to Drive the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Safety Systems Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Safety System

- 5.1.1. Process Control Systems (PCS)

- 5.1.2. Process

- 5.1.3. Safety Shutdown System (SSS)

- 5.1.4. Fire and Gas System (FGS)

- 5.1.5. Others (

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Presence Sensing Safety Sensors

- 5.2.2. Programmable Safety Systems

- 5.2.3. Safety Controllers/Modules/ Relays

- 5.2.4. Safety Interlock Switches

- 5.2.5. Emergency Stop Controls

- 5.2.6. Two-Hand Safety Controls

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Oil & Gas

- 5.3.2. Energy & Power

- 5.3.3. Chemicals

- 5.3.4. Food & Beverage

- 5.3.5. Metals & Mining

- 5.3.6. Automotive

- 5.3.7. Others (

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Safety System

- 6. United States North America Safety Systems Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Safety Systems Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Safety Systems Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Safety Systems Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Johnson Controls*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Honeywell International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 ABB Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Emerson Electric Co

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mitsubishi Electric Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Siemens AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Schneider Electric SE

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Omron Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Baker Hughes Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Rockwell Automation Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Yokogawa Electric Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Johnson Controls*List Not Exhaustive

List of Figures

- Figure 1: North America Safety Systems Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Safety Systems Market Share (%) by Company 2024

List of Tables

- Table 1: North America Safety Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Safety Systems Market Revenue Million Forecast, by Safety System 2019 & 2032

- Table 3: North America Safety Systems Market Revenue Million Forecast, by Component 2019 & 2032

- Table 4: North America Safety Systems Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 5: North America Safety Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Safety Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Safety Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Safety Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Safety Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Safety Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Safety Systems Market Revenue Million Forecast, by Safety System 2019 & 2032

- Table 12: North America Safety Systems Market Revenue Million Forecast, by Component 2019 & 2032

- Table 13: North America Safety Systems Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 14: North America Safety Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Safety Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Safety Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Safety Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Safety Systems Market?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the North America Safety Systems Market?

Key companies in the market include Johnson Controls*List Not Exhaustive, Honeywell International Inc, ABB Ltd, Emerson Electric Co, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, Omron Corporation, Baker Hughes Company, Rockwell Automation Inc, Yokogawa Electric Corporation.

3. What are the main segments of the North America Safety Systems Market?

The market segments include Safety System, Component, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High Demand for Reliable Safety Systems to Ensure the Protection of People and Property; Strict mandates for safety regulations.

6. What are the notable trends driving market growth?

The Safety Controllers/Modules/Relays Segment is Expected to Drive the Market's Growth.

7. Are there any restraints impacting market growth?

High investments required for automation and installing industrial safety systems.

8. Can you provide examples of recent developments in the market?

June 2022 - Mitsubishi Electric Corporation's U.S. subsidiary Mitsubishi Electric Power Products, Inc. (MEPPI), received a contract from Holtec International (Holtec) to expedite the design engineering of safety instrumentation and control systems (I&C) for Holtec's SMR-160 small modular reactor, an advanced small reactor with efficient safety and reliability levels, featuring a natural cooling ability in case of any accidents.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Safety Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Safety Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Safety Systems Market?

To stay informed about further developments, trends, and reports in the North America Safety Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence