Key Insights

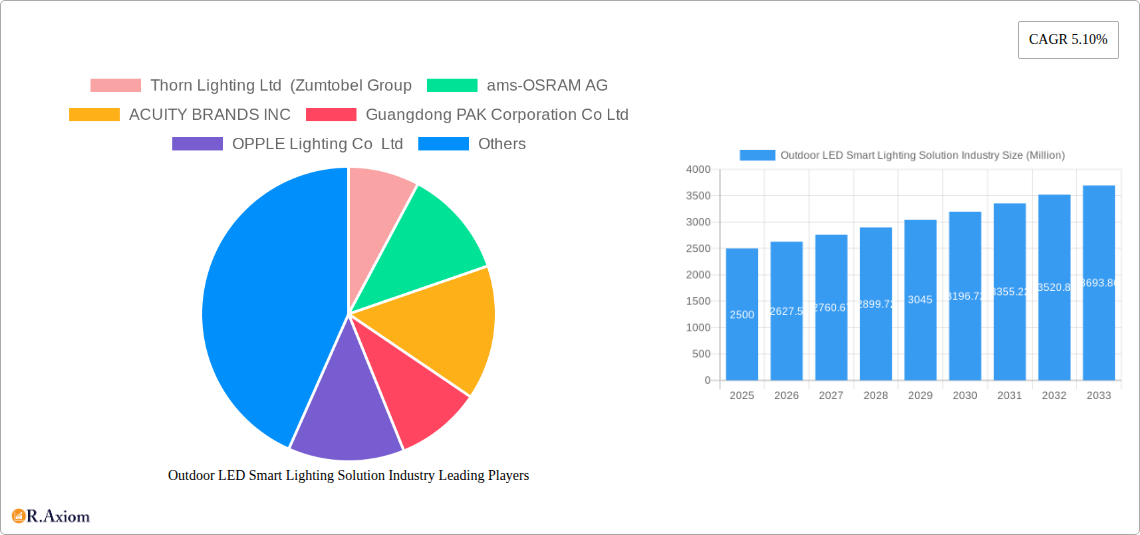

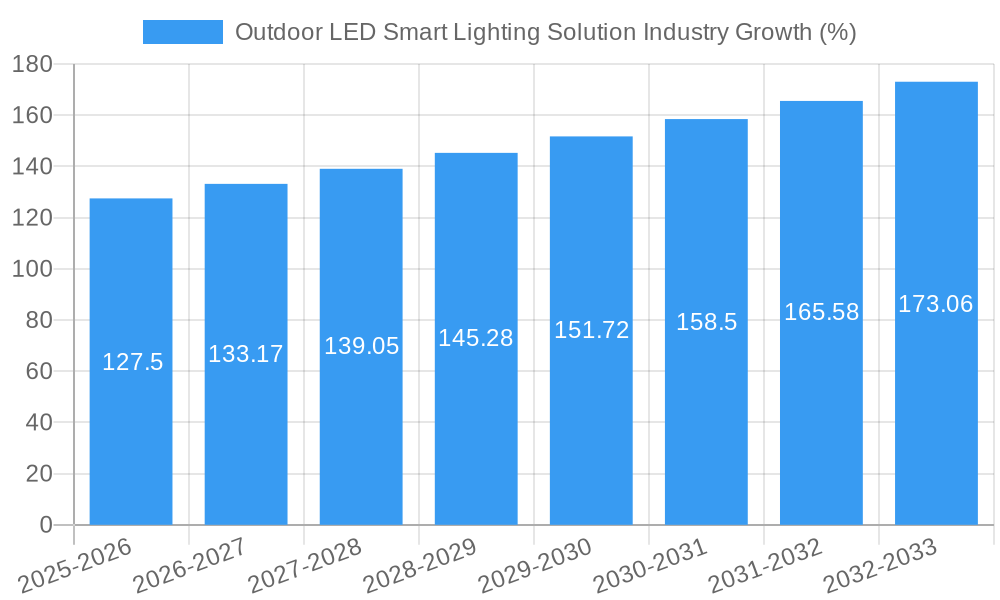

The global outdoor LED smart lighting solutions market is experiencing robust growth, driven by increasing urbanization, rising energy efficiency concerns, and the growing adoption of smart city initiatives. The market, estimated at $XX million in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 5.10% from 2025 to 2033. This growth is fueled by several key factors. Firstly, the inherent energy efficiency of LED technology compared to traditional lighting options leads to significant cost savings for municipalities and businesses, making it an attractive investment. Secondly, smart features, including remote monitoring, control, and dimming capabilities, enhance operational efficiency and reduce maintenance costs. The integration of smart lighting with other smart city infrastructure, such as traffic management systems and security networks, further boosts market adoption. Key segments driving growth include LED streetlights, which constitute a significant portion of the market due to widespread deployment in public spaces, and LED floodlights, widely used in sports arenas, parking lots, and industrial areas. Technological advancements, such as the integration of IoT (Internet of Things) sensors for improved data collection and analysis, and the development of more durable and aesthetically pleasing fixtures, are further contributing to market expansion.

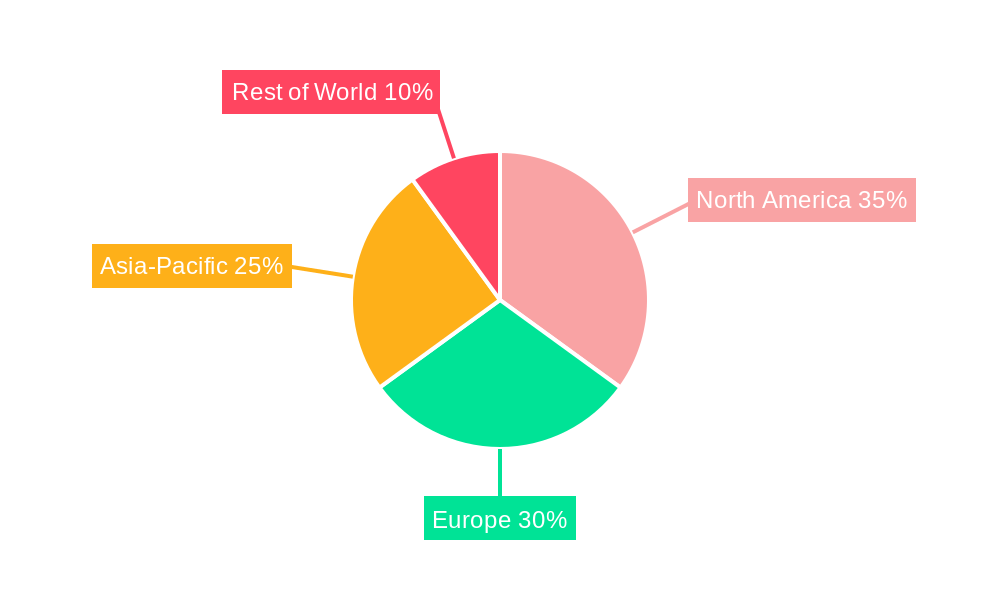

Despite the positive growth outlook, the market faces some challenges. High initial investment costs for implementing smart lighting systems can be a barrier to entry for smaller municipalities and businesses. Furthermore, concerns about data security and privacy related to the collection and use of data from smart lighting systems need to be addressed. However, ongoing technological advancements, decreasing costs of LED technology, and supportive government policies promoting energy efficiency are expected to mitigate these restraints. Leading companies in the market, including Thorn Lighting Ltd, ams-OSRAM AG, Acuity Brands Inc., and Signify Holding (Philips), are actively investing in research and development to improve product features and expand their market reach. The market is geographically diverse, with North America and Europe currently holding significant market share, however, rapid growth is expected in Asia-Pacific regions due to increasing infrastructure development and government initiatives.

Outdoor LED Smart Lighting Solution Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Outdoor LED Smart Lighting Solution industry, offering valuable insights for stakeholders across the value chain. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033, and utilizes 2025 as the base year. The market is segmented by type (LED Streetlights, LED Floodlights, LED Bollard Lights, LED Wall Lights) and application (Public Places, Streets and Roadways, Others). The report projects a market size of xx Million by 2033, with a CAGR of xx% during the forecast period. Key players analyzed include Thorn Lighting Ltd (Zumtobel Group), ams-OSRAM AG, ACUITY BRANDS INC, Guangdong PAK Corporation Co Ltd, OPPLE Lighting Co Ltd, LEDVANCE GmbH (MLS Co Ltd), EGLO Leuchten GmbH, Current Lighting Solutions LLC, Signify Holding (Philips), and Panasonic Holdings Corporation.

Outdoor LED Smart Lighting Solution Industry Market Concentration & Innovation

The Outdoor LED Smart Lighting Solution market exhibits moderate concentration, with a few major players holding significant market share. Signify (Philips) and Acuity Brands Inc. are among the leading players, commanding a combined market share of approximately xx%. However, the market also features several regional and niche players, leading to a dynamic competitive landscape. Innovation is driven by factors such as advancements in LED technology, increasing demand for smart features (connectivity, energy efficiency, remote control), and government regulations promoting energy conservation. The industry witnesses frequent mergers and acquisitions (M&A) activity, with deal values exceeding xx Million in recent years, reflecting the industry's consolidation trend. For instance, Signify's acquisition of Wiz in 2019 significantly expanded its smart lighting portfolio. Regulatory frameworks, particularly those focused on energy efficiency and sustainability, play a crucial role in shaping market growth. Product substitutes, such as traditional lighting solutions, pose a limited threat due to the superior energy efficiency and smart features of LED smart lighting. End-user trends show a growing preference for smart, connected lighting systems, driving the market's expansion.

- Key Market Concentration Metrics:

- Top 5 players' market share: xx%

- Average M&A deal value (2019-2024): xx Million

- Innovation Drivers:

- Advancements in LED technology

- Growing demand for smart features

- Stringent energy efficiency regulations

Outdoor LED Smart Lighting Solution Industry Industry Trends & Insights

The Outdoor LED Smart Lighting Solution industry is experiencing robust growth, fueled by several key trends. The increasing adoption of smart city initiatives globally is a major driver, as municipalities invest in advanced infrastructure, including energy-efficient and remotely managed lighting systems. Technological advancements, particularly in areas like sensor integration, AI-powered controls, and improved energy efficiency, are significantly impacting market dynamics. Consumer preferences are shifting towards energy-efficient and aesthetically pleasing lighting solutions, further boosting market demand. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants offering innovative products and solutions. The market is expected to witness a CAGR of xx% during the forecast period, with market penetration increasing from xx% in 2025 to xx% by 2033. These factors contribute to a positive outlook for the industry's future growth.

Dominant Markets & Segments in Outdoor LED Smart Lighting Solution Industry

The North American region currently holds the largest market share in the Outdoor LED Smart Lighting Solution industry, driven by strong government support for smart city initiatives and high adoption rates among municipalities and commercial entities. Within the segments, LED Streetlights constitute the largest market share, followed by LED Floodlights. The Public Places and Streets and Roadways applications dominate, owing to significant infrastructure investments and government mandates.

- Key Drivers for North American Dominance:

- Strong government support for smart city projects

- High adoption rates in municipalities and commercial sectors

- Well-developed infrastructure

- Dominant Segments:

- Type: LED Streetlights (xx Million in 2025)

- Application: Public Places (xx Million in 2025)

Outdoor LED Smart Lighting Solution Industry Product Developments

Recent product innovations focus on enhanced energy efficiency, advanced connectivity features, and improved design aesthetics. Companies are increasingly integrating smart sensors, enabling remote monitoring and control of lighting systems. The integration of AI and machine learning algorithms allows for optimized energy consumption and adaptive lighting schemes. These developments cater to the rising demand for smart, connected, and energy-efficient outdoor lighting solutions, providing competitive advantages in a rapidly evolving market.

Report Scope & Segmentation Analysis

This report comprehensively segments the Outdoor LED Smart Lighting Solution market by type (LED Streetlights, LED Floodlights, LED Bollard Lights, LED Wall Lights) and application (Public Places, Streets and Roadways, Others). Each segment is analyzed in detail, providing market size estimations, growth projections, and competitive landscape analysis. For example, the LED Streetlights segment is projected to experience significant growth due to increasing investments in urban infrastructure, while the Public Places application segment is expected to benefit from the rising adoption of smart city initiatives.

Key Drivers of Outdoor LED Smart Lighting Solution Industry Growth

Several key factors drive the growth of the Outdoor LED Smart Lighting Solution industry. Government initiatives promoting energy efficiency and smart city development create significant demand. Advancements in LED technology, such as improved energy efficiency and longer lifespans, reduce operating costs and increase adoption. Furthermore, the increasing preference for smart and connected lighting solutions enhances convenience and security, boosting market demand.

Challenges in the Outdoor LED Smart Lighting Solution Industry Sector

The industry faces several challenges. High initial investment costs for smart lighting systems can hinder adoption, particularly in budget-constrained regions. Supply chain disruptions can impact the availability of components and lead to delays in project implementation. Intense competition among established players and new entrants exerts pressure on profit margins.

Emerging Opportunities in Outdoor LED Smart Lighting Solution Industry

Emerging opportunities lie in the expanding smart city market, the integration of advanced technologies like 5G and IoT, and the growing demand for sustainable and eco-friendly lighting solutions. The development of innovative lighting designs and functionalities, such as integrated security features and adaptive lighting systems, opens up new market segments. Expansion into underserved markets and regions offers significant growth potential.

Leading Players in the Outdoor LED Smart Lighting Solution Industry Market

- Thorn Lighting Ltd (Zumtobel Group)

- ams-OSRAM AG

- ACUITY BRANDS INC

- Guangdong PAK Corporation Co Ltd

- OPPLE Lighting Co Ltd

- LEDVANCE GmbH (MLS Co Ltd)

- EGLO Leuchten GmbH

- Current Lighting Solutions LLC

- Signify Holding (Philips)

- Panasonic Holdings Corporation

Key Developments in Outdoor LED Smart Lighting Solution Industry Industry

- September 2023: Signify launched its Philips Smart LED bulbs under the "Wiz Connected" brand, expanding its smart lighting portfolio.

- May 2023: Cyclone Lighting (Acuity Brands) launched the Elencia luminaire, a modern post-top lighting solution.

- April 2023: Hydrel (Acuity Brands) added the M9700 RGBW fixture to its M9000 ingrade luminaire family.

Strategic Outlook for Outdoor LED Smart Lighting Solution Industry Market

The Outdoor LED Smart Lighting Solution market presents significant growth opportunities driven by technological advancements, increasing urbanization, and government initiatives promoting energy efficiency and smart city development. Continued innovation in smart lighting technologies, coupled with rising consumer demand for enhanced functionality and energy savings, will propel market growth in the coming years. The market is poised for substantial expansion, with significant potential in both developed and emerging economies.

Outdoor LED Smart Lighting Solution Industry Segmentation

-

1. Outdoor Lighting

- 1.1. Public Places

- 1.2. Streets and Roadways

- 1.3. Others

Outdoor LED Smart Lighting Solution Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Outdoor LED Smart Lighting Solution Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Enhanced Precision and Accuracy over Conventional Alternatives; Miniaturization of Component Parts

- 3.3. Market Restrains

- 3.3.1. Regulation Compliance Associated with Laser Usage

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Outdoor LED Smart Lighting Solution Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 5.1.1. Public Places

- 5.1.2. Streets and Roadways

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 6. North America Outdoor LED Smart Lighting Solution Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 6.1.1. Public Places

- 6.1.2. Streets and Roadways

- 6.1.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 7. South America Outdoor LED Smart Lighting Solution Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 7.1.1. Public Places

- 7.1.2. Streets and Roadways

- 7.1.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 8. Europe Outdoor LED Smart Lighting Solution Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 8.1.1. Public Places

- 8.1.2. Streets and Roadways

- 8.1.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 9. Middle East & Africa Outdoor LED Smart Lighting Solution Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 9.1.1. Public Places

- 9.1.2. Streets and Roadways

- 9.1.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 10. Asia Pacific Outdoor LED Smart Lighting Solution Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 10.1.1. Public Places

- 10.1.2. Streets and Roadways

- 10.1.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Thorn Lighting Ltd (Zumtobel Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ams-OSRAM AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ACUITY BRANDS INC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Guangdong PAK Corporation Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 OPPLE Lighting Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LEDVANCE GmbH (MLS Co Ltd)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 EGLO Leuchten GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Current Lighting Solutions LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Signify Holding (Philips)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Panasonic Holdings Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Thorn Lighting Ltd (Zumtobel Group

List of Figures

- Figure 1: Global Outdoor LED Smart Lighting Solution Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Outdoor LED Smart Lighting Solution Industry Revenue (Million), by Outdoor Lighting 2024 & 2032

- Figure 3: North America Outdoor LED Smart Lighting Solution Industry Revenue Share (%), by Outdoor Lighting 2024 & 2032

- Figure 4: North America Outdoor LED Smart Lighting Solution Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: North America Outdoor LED Smart Lighting Solution Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: South America Outdoor LED Smart Lighting Solution Industry Revenue (Million), by Outdoor Lighting 2024 & 2032

- Figure 7: South America Outdoor LED Smart Lighting Solution Industry Revenue Share (%), by Outdoor Lighting 2024 & 2032

- Figure 8: South America Outdoor LED Smart Lighting Solution Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Outdoor LED Smart Lighting Solution Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Outdoor LED Smart Lighting Solution Industry Revenue (Million), by Outdoor Lighting 2024 & 2032

- Figure 11: Europe Outdoor LED Smart Lighting Solution Industry Revenue Share (%), by Outdoor Lighting 2024 & 2032

- Figure 12: Europe Outdoor LED Smart Lighting Solution Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: Europe Outdoor LED Smart Lighting Solution Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Middle East & Africa Outdoor LED Smart Lighting Solution Industry Revenue (Million), by Outdoor Lighting 2024 & 2032

- Figure 15: Middle East & Africa Outdoor LED Smart Lighting Solution Industry Revenue Share (%), by Outdoor Lighting 2024 & 2032

- Figure 16: Middle East & Africa Outdoor LED Smart Lighting Solution Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: Middle East & Africa Outdoor LED Smart Lighting Solution Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Outdoor LED Smart Lighting Solution Industry Revenue (Million), by Outdoor Lighting 2024 & 2032

- Figure 19: Asia Pacific Outdoor LED Smart Lighting Solution Industry Revenue Share (%), by Outdoor Lighting 2024 & 2032

- Figure 20: Asia Pacific Outdoor LED Smart Lighting Solution Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Outdoor LED Smart Lighting Solution Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Outdoor LED Smart Lighting Solution Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Outdoor LED Smart Lighting Solution Industry Revenue Million Forecast, by Outdoor Lighting 2019 & 2032

- Table 3: Global Outdoor LED Smart Lighting Solution Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Outdoor LED Smart Lighting Solution Industry Revenue Million Forecast, by Outdoor Lighting 2019 & 2032

- Table 5: Global Outdoor LED Smart Lighting Solution Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Outdoor LED Smart Lighting Solution Industry Revenue Million Forecast, by Outdoor Lighting 2019 & 2032

- Table 10: Global Outdoor LED Smart Lighting Solution Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Brazil Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Argentina Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of South America Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Outdoor LED Smart Lighting Solution Industry Revenue Million Forecast, by Outdoor Lighting 2019 & 2032

- Table 15: Global Outdoor LED Smart Lighting Solution Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Russia Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Benelux Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Nordics Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Outdoor LED Smart Lighting Solution Industry Revenue Million Forecast, by Outdoor Lighting 2019 & 2032

- Table 26: Global Outdoor LED Smart Lighting Solution Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Turkey Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Israel Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: GCC Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: North Africa Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: South Africa Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Middle East & Africa Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Outdoor LED Smart Lighting Solution Industry Revenue Million Forecast, by Outdoor Lighting 2019 & 2032

- Table 34: Global Outdoor LED Smart Lighting Solution Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 35: China Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: India Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Japan Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: South Korea Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: ASEAN Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Oceania Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of Asia Pacific Outdoor LED Smart Lighting Solution Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Outdoor LED Smart Lighting Solution Industry?

The projected CAGR is approximately 5.10%.

2. Which companies are prominent players in the Outdoor LED Smart Lighting Solution Industry?

Key companies in the market include Thorn Lighting Ltd (Zumtobel Group, ams-OSRAM AG, ACUITY BRANDS INC, Guangdong PAK Corporation Co Ltd, OPPLE Lighting Co Ltd, LEDVANCE GmbH (MLS Co Ltd), EGLO Leuchten GmbH, Current Lighting Solutions LLC, Signify Holding (Philips), Panasonic Holdings Corporation.

3. What are the main segments of the Outdoor LED Smart Lighting Solution Industry?

The market segments include Outdoor Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Enhanced Precision and Accuracy over Conventional Alternatives; Miniaturization of Component Parts.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Regulation Compliance Associated with Laser Usage.

8. Can you provide examples of recent developments in the market?

September 2023: Signify, the owner of the Philips Hue brand announced the global launch of its Philips Smart LED bulbs. The new portfolio is the result of Signify's 2019 acquisition of Wiz, and it is distinguished from Hue products by the "Wiz Connected" badge on its blue box.May 2023: Cyclone Lighting, a well-known manufacturer of outdoor luminaires of Acuity brand announced the debut of its Elencia luminaire. Outdoor post-top lighting has an upscale look thanks to high-performance optics and revised, modern lantern style.April 2023: Hydrel, an established innovator and producer of outdoor architectural and landscape lighting systems of Acuity brand, announced the addition of the M9700 RGBW fixture to its M9000 ingrade luminaire family.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Outdoor LED Smart Lighting Solution Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Outdoor LED Smart Lighting Solution Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Outdoor LED Smart Lighting Solution Industry?

To stay informed about further developments, trends, and reports in the Outdoor LED Smart Lighting Solution Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence