Key Insights

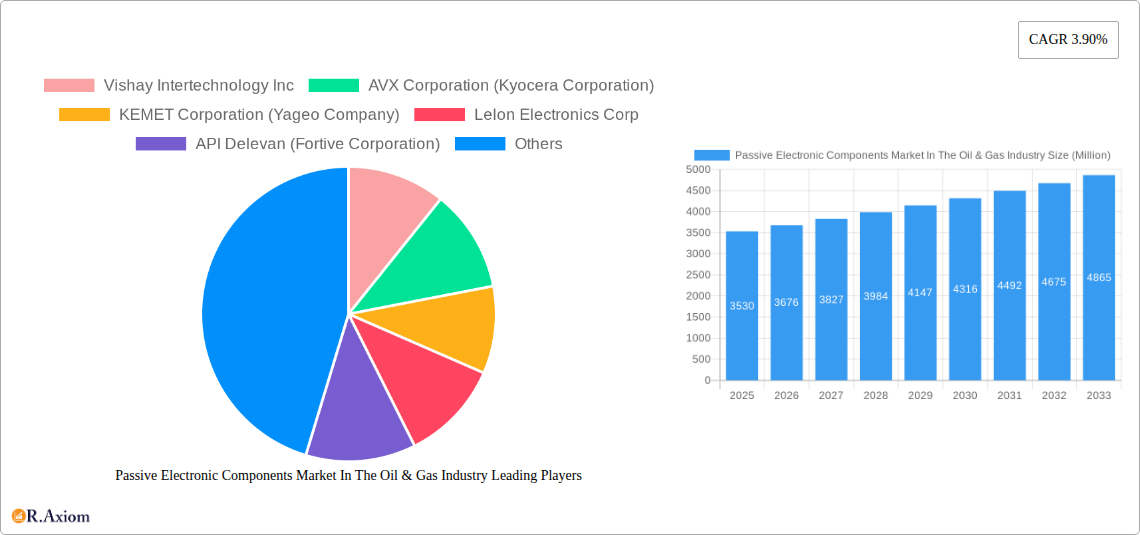

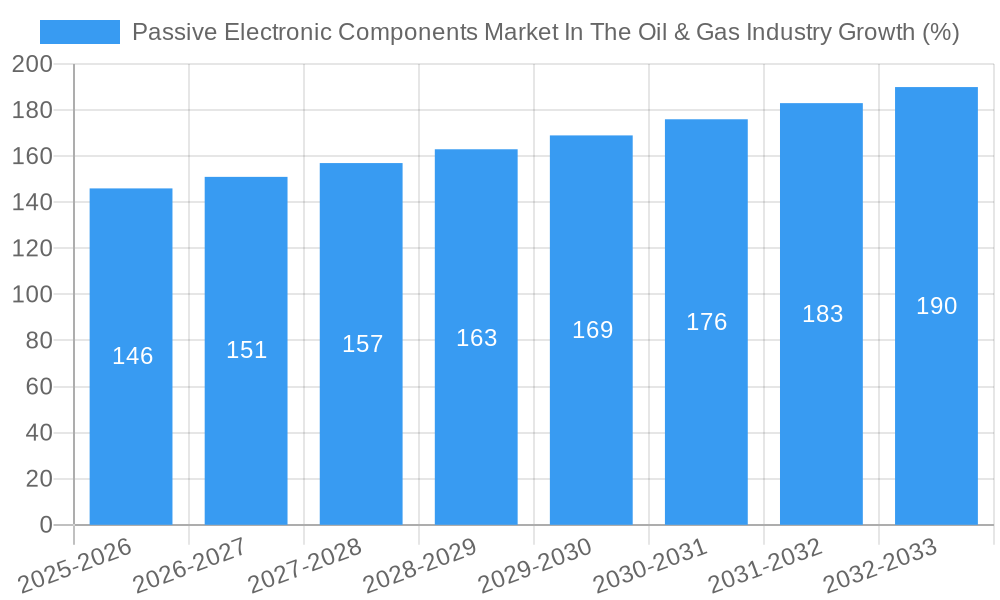

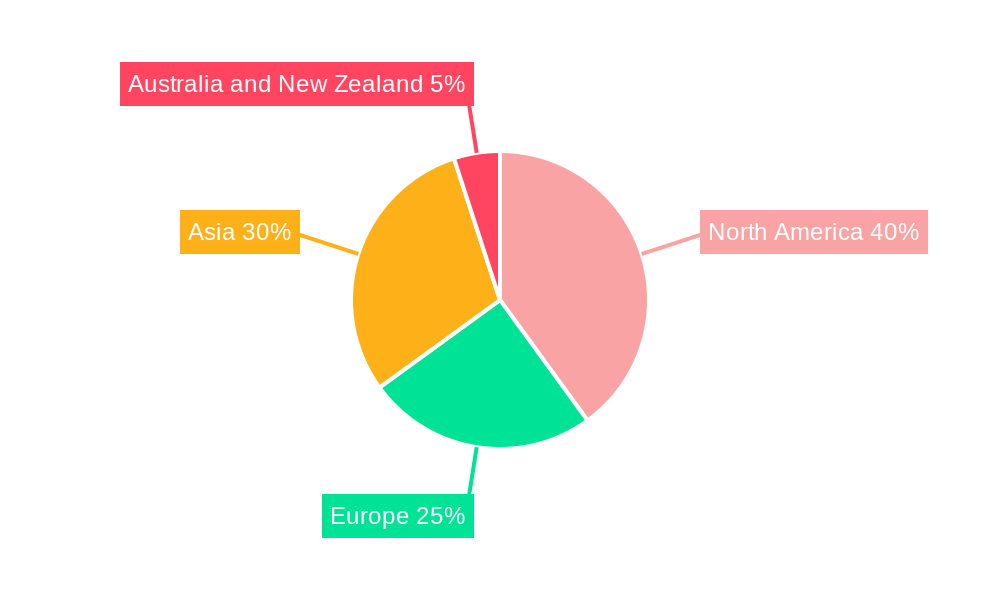

The Passive Electronic Components (PEC) market within the Oil & Gas industry is experiencing steady growth, projected to reach $3.53 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 3.90% from 2025 to 2033. This growth is fueled by increasing automation and digitization within oil and gas operations, demanding sophisticated sensing, control, and communication systems. The rising demand for enhanced safety features and improved operational efficiency in drilling, refining, and pipeline infrastructure further contributes to market expansion. Key drivers include the adoption of advanced technologies like smart meters, remote monitoring systems, and subsea production systems. These systems rely heavily on reliable and durable PECs such as capacitors, inductors, and resistors, which are crucial for power management, signal processing, and filtering in harsh environments. While the market faces challenges like fluctuating oil prices and stringent regulatory compliance, the overall outlook remains positive, driven by long-term investments in infrastructure modernization and the ongoing need for efficient resource management. Major players like Vishay Intertechnology, AVX Corporation, and KEMET Corporation are actively engaged in developing specialized PECs tailored to the demanding conditions of the Oil & Gas sector, fostering innovation and competition within the market. The North American market currently holds a significant share due to established oil and gas infrastructure and technological advancements, but the Asia-Pacific region is projected to witness faster growth fueled by expanding exploration and production activities.

The segmentation of the PEC market within Oil & Gas mirrors the broader electronics industry, with capacitors, inductors, and resistors representing the core components. Capacitors, crucial for energy storage and filtering, are expected to maintain a dominant share. Inductors, vital for managing current flow and filtering, and resistors, essential for controlling voltage and current, also contribute significantly to market value. The choice of specific component types depends heavily on the application, with factors such as operating temperature, voltage tolerance, and size constraints influencing selection. Future growth will be influenced by the ongoing shift towards renewable energy integration within the Oil & Gas sector, as companies strive for greater sustainability. This trend is likely to spur innovation in PECs designed for renewable energy integration technologies, ultimately shaping the market's trajectory in the coming years.

This detailed report provides a comprehensive analysis of the Passive Electronic Components market within the Oil & Gas industry, offering valuable insights for stakeholders, investors, and industry professionals. The study period covers 2019-2033, with 2025 as the base and estimated year. The report meticulously analyzes market trends, competitive dynamics, technological advancements, and future growth potential. It includes detailed segmentation by component type (Capacitor, Inductor, Resistor) and regional analysis, providing a granular understanding of the market landscape. The report also profiles key players including Vishay Intertechnology Inc, AVX Corporation (Kyocera Corporation), KEMET Corporation (Yageo Company), Lelon Electronics Corp, API Delevan (Fortive Corporation), TE Connectivity, Cornell Dubilier Electronics Inc, TDK Corporation, Ohmite Manufacturing Company, Panasonic Corporation, Honeywell International Inc, Eaton Corporation, and others, offering a complete picture of the market's competitive structure. Projected market values are presented in Millions (USD).

Passive Electronic Components Market In The Oil & Gas Industry Market Concentration & Innovation

The Passive Electronic Components market in the Oil & Gas industry exhibits a moderately concentrated landscape with a few dominant players holding significant market share. The xx% market share held by the top five players indicates a degree of consolidation. However, the presence of several smaller, specialized companies introduces competitive dynamism. Innovation is driven by the increasing demand for improved efficiency, reliability, and safety within oil and gas operations. Stringent regulatory frameworks focusing on environmental protection and operational safety necessitate the development of advanced, durable components. Furthermore, the push towards automation and digitalization in oil and gas exploration and production is fueling the demand for miniaturized, high-performance passive components.

- Market Concentration: Top 5 players hold approximately xx% of the market share.

- Innovation Drivers: Enhanced efficiency, reliability, and safety standards; automation & digitalization; stringent regulatory compliance.

- Regulatory Frameworks: Emphasis on environmental protection, operational safety, and energy efficiency.

- Product Substitutes: Limited substitutes exist; focus is on performance enhancements within existing component types.

- End-User Trends: Demand for miniaturization, higher power handling capacity, and improved temperature stability.

- M&A Activities: Moderate M&A activity observed in recent years, with deal values averaging approximately xx Million USD per transaction. These transactions often involve consolidation and expansion into new market segments.

Passive Electronic Components Market In The Oil & Gas Industry Industry Trends & Insights

The Passive Electronic Components market in the Oil & Gas industry is projected to witness significant growth during the forecast period (2025-2033), with a CAGR of approximately xx%. This growth is primarily fueled by the increasing adoption of advanced technologies in upstream, midstream, and downstream oil and gas operations. Technological disruptions, such as the deployment of IoT devices and smart sensors, are driving demand for high-performance, reliable passive components capable of operating under harsh environmental conditions. Furthermore, the shift towards renewable energy sources and the implementation of carbon capture technologies is creating new growth opportunities. The competitive dynamics are characterized by technological innovation, product differentiation, and strategic partnerships. Market penetration rates are continuously rising, driven by the increasing adoption of automation and digitization across all stages of the oil and gas value chain.

Dominant Markets & Segments in Passive Electronic Components Market In The Oil & Gas Industry

The North American region currently dominates the Passive Electronic Components market in the Oil & Gas industry, accounting for approximately xx% of the global market. This dominance can be attributed to robust oil and gas production activities, coupled with high investments in technological upgrades and infrastructure development. Within the component types, Capacitors hold the largest market share, driven by their widespread use in power conditioning, filtering, and energy storage applications.

Key Drivers for North American Dominance:

- High Oil & Gas Production Levels.

- Substantial Investments in Infrastructure Modernization.

- Strong Adoption of Advanced Technologies.

- Favorable Government Policies.

Capacitor Segment Dominance:

- Wide Application in Power Conditioning, Energy Storage, and Filtering.

- Increasing Demand for High-Performance Capacitors in Harsh Environments.

- Continuous Technological Advancements Improving Performance and Reliability.

Passive Electronic Components Market In The Oil & Gas Industry Product Developments

Recent product innovations focus on miniaturization, higher power handling, and improved reliability under extreme temperature and pressure conditions. The launch of products such as Cornell Dubilier Electronics' 944L series of low inductance, high current DC link film capacitors and TT Electronics' TFHP series thin film high-power chip resistors exemplifies this trend. These advancements address the specific needs of the oil and gas industry, enabling more efficient and reliable operations. The competitive advantages are mainly derived from superior performance characteristics, durability, and compliance with stringent industry standards.

Report Scope & Segmentation Analysis

The report comprehensively segments the market by component type:

Capacitors: This segment is expected to register a CAGR of xx% during the forecast period, driven by increasing demand for energy storage and power filtering solutions. The market is highly competitive, with leading players focusing on innovation and product differentiation.

Inductors: This segment is projected to grow at a CAGR of xx%, driven by the rising demand for power management and signal processing applications. The market is characterized by moderate competition, with players focusing on cost optimization and improved performance.

Resistors: This segment is anticipated to grow at a CAGR of xx%, driven by the increasing need for precision and high-power applications. The market is relatively fragmented, with several players vying for market share.

Key Drivers of Passive Electronic Components Market In The Oil & Gas Industry Growth

Technological advancements, such as the development of high-performance passive components capable of withstanding harsh operating conditions, are a key driver of market growth. Economic factors, including sustained investments in oil and gas exploration and production, and the increasing implementation of automation technologies also play a critical role. Lastly, stringent government regulations regarding environmental protection and safety are driving the adoption of advanced components with improved efficiency and reliability.

Challenges in the Passive Electronic Components Market In The Oil & Gas Industry Sector

Supply chain disruptions and price volatility of raw materials pose significant challenges, potentially impacting production costs and timelines. Furthermore, intense competition among players may exert pressure on profit margins. Regulatory compliance and stringent safety standards necessitate significant investments in research and development, adding to overall operational costs.

Emerging Opportunities in Passive Electronic Components Market In The Oil & Gas Industry

The increasing adoption of digital technologies in oil and gas operations presents significant opportunities for the market. The development of new, specialized components for emerging applications like carbon capture and renewable energy integration offer exciting prospects for growth. Furthermore, the rising demand for miniaturized and high-reliability components in harsh environments creates lucrative opportunities for market players.

Leading Players in the Passive Electronic Components Market In The Oil & Gas Industry Market

- Vishay Intertechnology Inc

- AVX Corporation (Kyocera Corporation)

- KEMET Corporation (Yageo Company)

- Lelon Electronics Corp

- API Delevan (Fortive Corporation)

- TE Connectivity

- Cornell Dubilier Electronics Inc

- TDK Corporation

- Ohmite Manufacturing Company

- Panasonic Corporation

- Honeywell International Inc

- Eaton Corporation

Key Developments in Passive Electronic Components Market In The Oil & Gas Industry Industry

- March 2023: Cornell Dubilier Electronics Inc. introduced the 944L series of low inductance, high current DC link film capacitors, enhancing efficiency in power applications.

- September 2022: TT Electronics launched the TFHP series thin film high-power chip resistors, improving precision and performance in power management.

Strategic Outlook for Passive Electronic Components Market In The Oil & Gas Industry Market

The Passive Electronic Components market in the Oil & Gas industry holds significant future potential, driven by continuous technological advancements, and rising investments in digitalization and automation. The focus on enhanced energy efficiency, reliability, and safety standards will continue to fuel demand for high-performance components. Opportunities for growth exist in the development of specialized components for emerging applications in renewable energy integration, carbon capture, and advanced monitoring systems.

Passive Electronic Components Market In The Oil & Gas Industry Segmentation

-

1. Type

- 1.1. Capacitor

- 1.2. Inductor

- 1.3. Resistor

Passive Electronic Components Market In The Oil & Gas Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

Passive Electronic Components Market In The Oil & Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Investments in Oil & Gas Industry

- 3.3. Market Restrains

- 3.3.1. Rising Metal Prices Impacting Component Production Costs

- 3.4. Market Trends

- 3.4.1. Increasing Invesment in Oil & Gas Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Passive Electronic Components Market In The Oil & Gas Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Capacitor

- 5.1.2. Inductor

- 5.1.3. Resistor

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Passive Electronic Components Market In The Oil & Gas Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Capacitor

- 6.1.2. Inductor

- 6.1.3. Resistor

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Passive Electronic Components Market In The Oil & Gas Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Capacitor

- 7.1.2. Inductor

- 7.1.3. Resistor

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Passive Electronic Components Market In The Oil & Gas Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Capacitor

- 8.1.2. Inductor

- 8.1.3. Resistor

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Passive Electronic Components Market In The Oil & Gas Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Capacitor

- 9.1.2. Inductor

- 9.1.3. Resistor

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Passive Electronic Components Market In The Oil & Gas Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Passive Electronic Components Market In The Oil & Gas Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Passive Electronic Components Market In The Oil & Gas Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Australia and New Zealand Passive Electronic Components Market In The Oil & Gas Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Vishay Intertechnology Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 AVX Corporation (Kyocera Corporation)

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 KEMET Corporation (Yageo Company)

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Lelon Electronics Corp

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 API Delevan (Fortive Corporation)

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 TE Connectivity

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Cornell Dubilier Electronics Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 TDK Corporation

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Ohmite Manufacturing Company

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Panasonic Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Honeywell International Inc *List Not Exhaustive

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Eaton Corporation

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.1 Vishay Intertechnology Inc

List of Figures

- Figure 1: Global Passive Electronic Components Market In The Oil & Gas Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Passive Electronic Components Market In The Oil & Gas Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Passive Electronic Components Market In The Oil & Gas Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Passive Electronic Components Market In The Oil & Gas Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Passive Electronic Components Market In The Oil & Gas Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Passive Electronic Components Market In The Oil & Gas Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Passive Electronic Components Market In The Oil & Gas Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand Passive Electronic Components Market In The Oil & Gas Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand Passive Electronic Components Market In The Oil & Gas Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Passive Electronic Components Market In The Oil & Gas Industry Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Passive Electronic Components Market In The Oil & Gas Industry Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Passive Electronic Components Market In The Oil & Gas Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Passive Electronic Components Market In The Oil & Gas Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Passive Electronic Components Market In The Oil & Gas Industry Revenue (Million), by Type 2024 & 2032

- Figure 15: Europe Passive Electronic Components Market In The Oil & Gas Industry Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Passive Electronic Components Market In The Oil & Gas Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Passive Electronic Components Market In The Oil & Gas Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Passive Electronic Components Market In The Oil & Gas Industry Revenue (Million), by Type 2024 & 2032

- Figure 19: Asia Passive Electronic Components Market In The Oil & Gas Industry Revenue Share (%), by Type 2024 & 2032

- Figure 20: Asia Passive Electronic Components Market In The Oil & Gas Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Passive Electronic Components Market In The Oil & Gas Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Australia and New Zealand Passive Electronic Components Market In The Oil & Gas Industry Revenue (Million), by Type 2024 & 2032

- Figure 23: Australia and New Zealand Passive Electronic Components Market In The Oil & Gas Industry Revenue Share (%), by Type 2024 & 2032

- Figure 24: Australia and New Zealand Passive Electronic Components Market In The Oil & Gas Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Australia and New Zealand Passive Electronic Components Market In The Oil & Gas Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Passive Electronic Components Market In The Oil & Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Passive Electronic Components Market In The Oil & Gas Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Passive Electronic Components Market In The Oil & Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Passive Electronic Components Market In The Oil & Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Passive Electronic Components Market In The Oil & Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Passive Electronic Components Market In The Oil & Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Passive Electronic Components Market In The Oil & Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Passive Electronic Components Market In The Oil & Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Passive Electronic Components Market In The Oil & Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Passive Electronic Components Market In The Oil & Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Passive Electronic Components Market In The Oil & Gas Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Passive Electronic Components Market In The Oil & Gas Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Global Passive Electronic Components Market In The Oil & Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Passive Electronic Components Market In The Oil & Gas Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Global Passive Electronic Components Market In The Oil & Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Passive Electronic Components Market In The Oil & Gas Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Global Passive Electronic Components Market In The Oil & Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Passive Electronic Components Market In The Oil & Gas Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Passive Electronic Components Market In The Oil & Gas Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Passive Electronic Components Market In The Oil & Gas Industry?

The projected CAGR is approximately 3.90%.

2. Which companies are prominent players in the Passive Electronic Components Market In The Oil & Gas Industry?

Key companies in the market include Vishay Intertechnology Inc, AVX Corporation (Kyocera Corporation), KEMET Corporation (Yageo Company), Lelon Electronics Corp, API Delevan (Fortive Corporation), TE Connectivity, Cornell Dubilier Electronics Inc, TDK Corporation, Ohmite Manufacturing Company, Panasonic Corporation, Honeywell International Inc *List Not Exhaustive, Eaton Corporation.

3. What are the main segments of the Passive Electronic Components Market In The Oil & Gas Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.53 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Investments in Oil & Gas Industry.

6. What are the notable trends driving market growth?

Increasing Invesment in Oil & Gas Industry.

7. Are there any restraints impacting market growth?

Rising Metal Prices Impacting Component Production Costs.

8. Can you provide examples of recent developments in the market?

March 2023: Cornell Dubilier Electronics Inc. introduces the 944L series of low inductance, high current DC link film capacitors. The series uses large diameter non-inductive windings and low inductance internal bus connections resulting in equivalent series inductance (ESL) values in the 10 to 15 nano henry range. It is also available in values from 33 to 220uF with voltage ratings of 800, 1000, 1200, and 1400VDC.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Passive Electronic Components Market In The Oil & Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Passive Electronic Components Market In The Oil & Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Passive Electronic Components Market In The Oil & Gas Industry?

To stay informed about further developments, trends, and reports in the Passive Electronic Components Market In The Oil & Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence