Key Insights

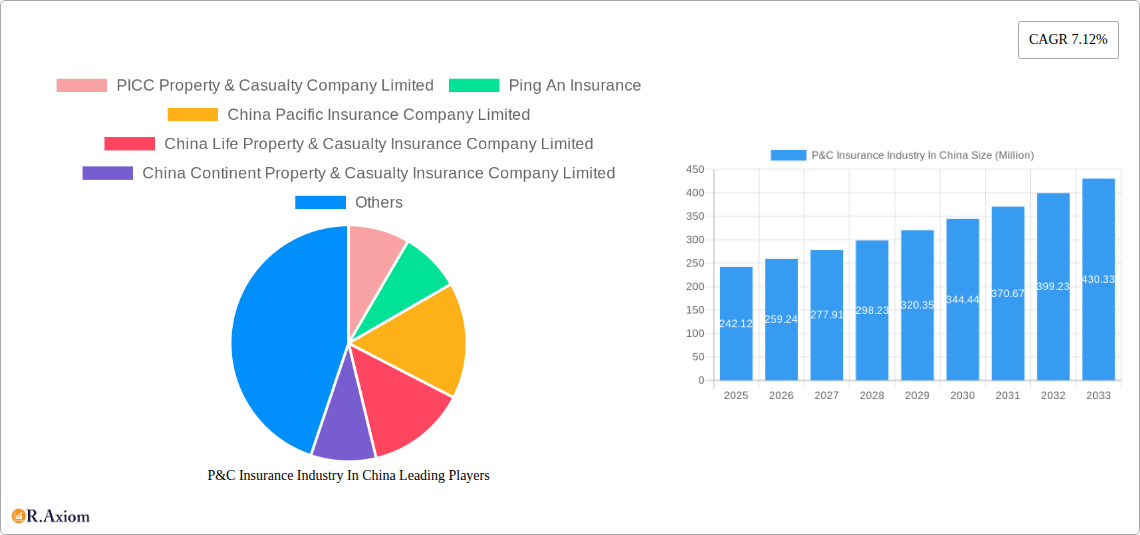

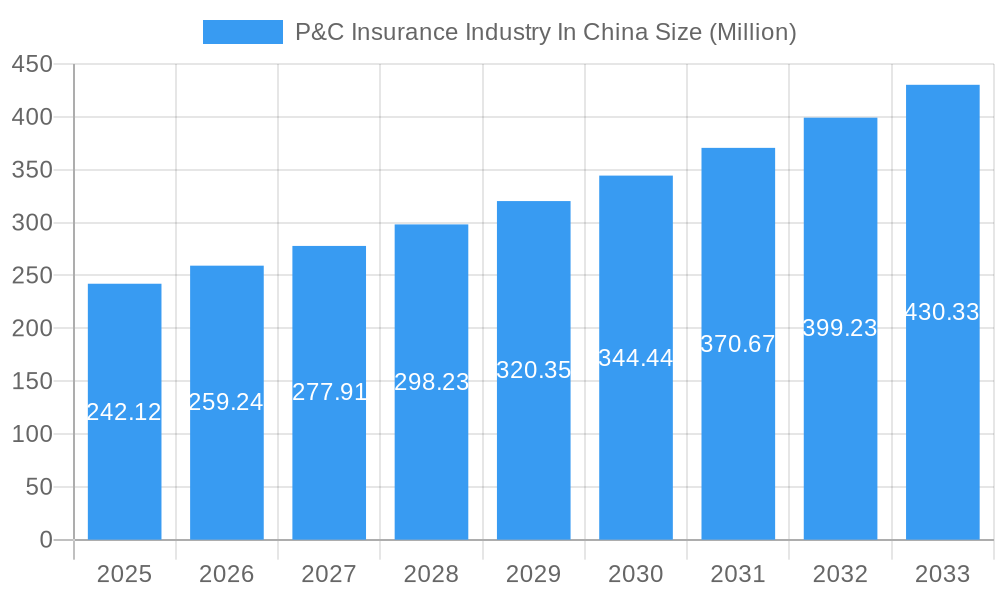

The Chinese Property & Casualty (P&C) insurance market presents a compelling investment opportunity, exhibiting robust growth and significant potential. With a 2025 market size of $242.12 million and a Compound Annual Growth Rate (CAGR) of 7.12% projected from 2025 to 2033, the sector is poised for substantial expansion. This growth is driven by several factors, including rising disposable incomes, increasing awareness of insurance products, and supportive government policies promoting financial inclusion. The expanding middle class fuels demand for personal lines insurance like auto and health, while robust infrastructure development and industrial growth boost commercial lines, particularly liability and property insurance. However, challenges remain, including the need for enhanced consumer education to address the relatively low insurance penetration compared to developed markets, and the ongoing need to improve claims processing efficiency and transparency. Competition among established players like PICC Property & Casualty Company Limited, Ping An Insurance, and China Pacific Insurance, alongside emerging insurers, is intensifying, spurring innovation in product offerings and distribution channels. This dynamic market necessitates a sophisticated understanding of both opportunities and challenges for strategic success.

P&C Insurance Industry In China Market Size (In Million)

The segmentation of the Chinese P&C insurance market is complex, reflecting both the diverse nature of the economy and its evolving risk landscape. While specific segment data is unavailable, industry trends suggest strong growth in health insurance due to an aging population and increased government emphasis on healthcare accessibility. Similarly, the expanding automotive sector fuels demand for motor insurance. Agriculture insurance is another area with significant potential, particularly given government support for rural development and the need to mitigate agricultural risks. Regional variations also play a significant role, with coastal regions and major urban centers exhibiting higher insurance penetration rates compared to less developed areas. Addressing this disparity will require tailored products and distribution strategies that cater to the specific needs of varied geographic segments. This segmentation offers strategic avenues for insurers to target specific customer needs and achieve competitive advantage.

P&C Insurance Industry In China Company Market Share

P&C Insurance Industry in China: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Property & Casualty (P&C) insurance industry in China, covering the period from 2019 to 2033. It offers invaluable insights for industry stakeholders, investors, and strategic decision-makers seeking to understand this dynamic and rapidly evolving market. The report leverages extensive data analysis, incorporating key industry developments and forecasts to illuminate opportunities and challenges. With a focus on market concentration, innovation, key players, and future trends, this report is an essential resource for navigating the complexities of the Chinese P&C insurance landscape. The Base Year is 2025, and the Estimated Year is 2025, with a Forecast Period spanning 2025-2033 and a Historical Period covering 2019-2024.

P&C Insurance Industry In China Market Concentration & Innovation

The Chinese P&C insurance market exhibits a concentrated structure, with several dominant players commanding significant market share. The top five insurers—PICC Property & Casualty Company Limited, Ping An Insurance, China Pacific Insurance Company Limited, China Life Property & Casualty Insurance Company Limited, and China Continent Property & Casualty Insurance Company Limited—account for a combined xx% of the market in 2025 (estimated). This high concentration is influenced by factors such as strong government support for state-owned enterprises, extensive distribution networks, and brand recognition.

However, the industry is also characterized by increasing innovation, driven by technological advancements such as AI, big data analytics, and Insurtech solutions. These technologies are transforming underwriting processes, claims management, and customer service, enabling insurers to offer more personalized and efficient services. Regulatory frameworks, while supportive of growth, also emphasize risk management and consumer protection, shaping innovation strategies within the sector. The increasing penetration of digital channels and changing consumer preferences are further stimulating product diversification and service enhancement.

Mergers and acquisitions (M&A) activity has played a significant role in shaping market dynamics. Recent deals, such as Generali's acquisition of its Chinese subsidiary in January 2024, and BYD's acquisition of Yi'an P&C Insurance Co. in May 2023, highlight the strategic importance of the Chinese market and the ongoing consolidation within the industry. The total value of M&A deals in the P&C insurance sector in China reached xx Million in 2024, with an average deal size of xx Million.

- Market Concentration: Top 5 players holding xx% market share (estimated 2025).

- Innovation Drivers: AI, big data, Insurtech.

- Regulatory Framework: Focus on risk management and consumer protection.

- M&A Activity: Significant consolidation through acquisitions, with a total value of xx Million in 2024.

P&C Insurance Industry In China Industry Trends & Insights

The Chinese P&C insurance market is experiencing robust growth, driven by a combination of factors. The expanding middle class, rising disposable incomes, and increasing awareness of insurance products are fueling demand. Government initiatives promoting financial inclusion and insurance penetration are further contributing to market expansion. The Compound Annual Growth Rate (CAGR) for the P&C insurance market is projected to be xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033.

Technological disruptions are reshaping the competitive landscape. Digital insurance platforms are gaining traction, offering greater convenience and accessibility to customers. Insurers are leveraging data analytics to improve risk assessment and pricing, enhancing operational efficiency. Furthermore, the growing adoption of telematics and IoT devices provides insurers with richer data for risk management and personalized product offerings. The market penetration rate is expected to increase from xx% in 2025 to xx% by 2033.

Consumer preferences are also evolving, with a growing demand for customized and digital-first insurance solutions. Insurers are adapting their product offerings and distribution channels to meet these changing expectations. The competitive dynamics are intense, with both domestic and international players vying for market share. Strategic partnerships and collaborations are becoming increasingly important for insurers to expand their reach and enhance their capabilities.

Dominant Markets & Segments in P&C Insurance Industry In China

The Chinese P&C insurance market is geographically diverse, with significant variations in growth rates and penetration across different regions. While specific regional dominance requires detailed data analysis, it's predicted that coastal regions and major urban centers will continue to exhibit higher growth compared to less developed areas. This is driven by higher economic activity, greater insurance awareness, and better infrastructure.

- Key Drivers of Regional Dominance:

- Rapid economic growth in coastal regions.

- Higher insurance awareness and penetration in urban areas.

- Well-developed infrastructure supporting insurance distribution.

- Government policies promoting financial inclusion in certain regions.

The market is segmented by various product lines, including motor insurance, property insurance, liability insurance, and others. The motor insurance segment is currently the largest, driven by the rapid expansion of the automobile market. However, other segments such as health insurance and travel insurance are also exhibiting strong growth potential. The dominance of motor insurance reflects China's growing vehicle ownership and the mandatory nature of motor insurance for many vehicles. Continued economic development and regulatory changes will affect segment shares.

P&C Insurance Industry In China Product Developments

The P&C insurance industry in China is witnessing significant product innovation, driven by technological advancements and evolving customer needs. Insurers are developing tailored insurance products for specific customer segments, using data analytics to offer more personalized and affordable coverage. Innovative products incorporating telematics and wearable technology are improving risk assessment and promoting preventive measures. The emergence of micro-insurance products catering to low-income populations demonstrates responsiveness to market demands. These advancements are enhancing customer experience and improving the overall efficiency of the insurance value chain.

Report Scope & Segmentation Analysis

This report segments the Chinese P&C insurance market based on various criteria, including product type (motor, property, liability, health, etc.), distribution channel (online, offline, bancassurance), and geographic location (urban vs. rural). Each segment’s market size, growth projections, and competitive dynamics are analyzed in detail, providing a granular understanding of market opportunities and challenges. The report offers projections for market sizes across different segments for 2025, 2030, and 2033. These projections consider the impact of economic factors, technological developments, and regulatory policies.

Key Drivers of P&C Insurance Industry In China Growth

Several factors are driving the growth of the Chinese P&C insurance industry. Firstly, rapid economic growth and rising disposable incomes are boosting demand for insurance products. Secondly, the increasing awareness of the importance of risk management and financial security is encouraging higher insurance penetration. Thirdly, government policies aimed at promoting financial inclusion and developing the insurance sector are creating favorable conditions for industry expansion. Finally, technological advancements are enhancing operational efficiency and driving innovation in product offerings.

Challenges in the P&C Insurance Industry In China Sector

Despite the positive growth outlook, several challenges hinder the development of the Chinese P&C insurance industry. These include: intense competition from both domestic and international insurers, regulatory complexities that can impede business operations, and the need for advanced risk management capabilities to manage emerging risks associated with technological change. The relatively low insurance penetration in certain segments of the population and the prevalence of fraud pose additional obstacles. These challenges necessitate strategic responses from industry players to ensure sustainable growth.

Emerging Opportunities in P&C Insurance Industry In China

Despite the challenges, significant opportunities exist for growth and innovation within the Chinese P&C insurance industry. The expansion of the middle class and the growing demand for diversified insurance products create substantial market potential. The development and adoption of Insurtech solutions can transform underwriting processes, risk assessment, and customer service, improving efficiency and creating new revenue streams. Furthermore, leveraging big data and AI enhances the effectiveness of risk management and fraud detection. These opportunities present substantial potential for market leaders and new entrants alike.

Leading Players in the P&C Insurance Industry In China Market

- PICC Property & Casualty Company Limited

- Ping An Insurance

- China Pacific Insurance Company Limited

- China Life Property & Casualty Insurance Company Limited

- China Continent Property & Casualty Insurance Company Limited

- China United Insurance Service Inc

- Sunshine Insurance Group

- China Taiping Insurance Group Ltd

- China Export & Credit Insurance Corporation

- Tian an Property Insurance Company

Key Developments in P&C Insurance Industry In China Industry

- January 2024: Generali acquired a 100% stake in its Chinese P&C insurance subsidiary, consolidating its presence in the market. This signifies increased foreign investment and confidence in the Chinese market.

- May 2023: BYD acquired Yi'an P&C Insurance Co., demonstrating the growing interest of non-traditional players in the insurance sector and potential diversification within the industry. This highlights a shift in market dynamics, with the integration of technology and finance.

Strategic Outlook for P&C Insurance Industry In China Market

The future of the Chinese P&C insurance market appears bright, with significant growth potential driven by economic expansion, rising insurance awareness, and technological advancements. Strategic partnerships, product diversification, and technological innovation will be crucial for success. Insurers that can effectively adapt to changing consumer preferences, leverage data analytics, and navigate regulatory complexities will be well-positioned to capture market share and drive sustainable growth in this dynamic and lucrative market. The market's potential for further consolidation remains high, with opportunities for both organic growth and strategic acquisitions.

P&C Insurance Industry In China Segmentation

-

1. Line of Business

- 1.1. Motor Insurance

- 1.2. Enterprise Property Insurance

- 1.3. Home Insurance

- 1.4. Liability Insurance

- 1.5. Marine Insurance

- 1.6. Other Non-Life Insurance

-

2. Distribution Channel

- 2.1. Direct Sales

- 2.2. Individual Agency

- 2.3. Online

- 2.4. Bancassurance

- 2.5. Other Distribution Channels

P&C Insurance Industry In China Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

P&C Insurance Industry In China Regional Market Share

Geographic Coverage of P&C Insurance Industry In China

P&C Insurance Industry In China REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Economic Growth and Rising Awareness of Risk Management

- 3.3. Market Restrains

- 3.3.1. Economic Growth and Rising Awareness of Risk Management

- 3.4. Market Trends

- 3.4.1. Online Insurance and Digitalization is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global P&C Insurance Industry In China Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Line of Business

- 5.1.1. Motor Insurance

- 5.1.2. Enterprise Property Insurance

- 5.1.3. Home Insurance

- 5.1.4. Liability Insurance

- 5.1.5. Marine Insurance

- 5.1.6. Other Non-Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct Sales

- 5.2.2. Individual Agency

- 5.2.3. Online

- 5.2.4. Bancassurance

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Line of Business

- 6. North America P&C Insurance Industry In China Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Line of Business

- 6.1.1. Motor Insurance

- 6.1.2. Enterprise Property Insurance

- 6.1.3. Home Insurance

- 6.1.4. Liability Insurance

- 6.1.5. Marine Insurance

- 6.1.6. Other Non-Life Insurance

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Direct Sales

- 6.2.2. Individual Agency

- 6.2.3. Online

- 6.2.4. Bancassurance

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Line of Business

- 7. South America P&C Insurance Industry In China Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Line of Business

- 7.1.1. Motor Insurance

- 7.1.2. Enterprise Property Insurance

- 7.1.3. Home Insurance

- 7.1.4. Liability Insurance

- 7.1.5. Marine Insurance

- 7.1.6. Other Non-Life Insurance

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Direct Sales

- 7.2.2. Individual Agency

- 7.2.3. Online

- 7.2.4. Bancassurance

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Line of Business

- 8. Europe P&C Insurance Industry In China Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Line of Business

- 8.1.1. Motor Insurance

- 8.1.2. Enterprise Property Insurance

- 8.1.3. Home Insurance

- 8.1.4. Liability Insurance

- 8.1.5. Marine Insurance

- 8.1.6. Other Non-Life Insurance

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Direct Sales

- 8.2.2. Individual Agency

- 8.2.3. Online

- 8.2.4. Bancassurance

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Line of Business

- 9. Middle East & Africa P&C Insurance Industry In China Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Line of Business

- 9.1.1. Motor Insurance

- 9.1.2. Enterprise Property Insurance

- 9.1.3. Home Insurance

- 9.1.4. Liability Insurance

- 9.1.5. Marine Insurance

- 9.1.6. Other Non-Life Insurance

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Direct Sales

- 9.2.2. Individual Agency

- 9.2.3. Online

- 9.2.4. Bancassurance

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Line of Business

- 10. Asia Pacific P&C Insurance Industry In China Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Line of Business

- 10.1.1. Motor Insurance

- 10.1.2. Enterprise Property Insurance

- 10.1.3. Home Insurance

- 10.1.4. Liability Insurance

- 10.1.5. Marine Insurance

- 10.1.6. Other Non-Life Insurance

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Direct Sales

- 10.2.2. Individual Agency

- 10.2.3. Online

- 10.2.4. Bancassurance

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Line of Business

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PICC Property & Casualty Company Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ping An Insurance

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 China Pacific Insurance Company Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China Life Property & Casualty Insurance Company Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 China Continent Property & Casualty Insurance Company Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 China United Insurance Service Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sunshine Insurance Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 China Taiping Insurance Group Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 China Export & Credit Insurance Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tian an Property Insurance Company **List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 PICC Property & Casualty Company Limited

List of Figures

- Figure 1: Global P&C Insurance Industry In China Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global P&C Insurance Industry In China Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America P&C Insurance Industry In China Revenue (Million), by Line of Business 2025 & 2033

- Figure 4: North America P&C Insurance Industry In China Volume (Billion), by Line of Business 2025 & 2033

- Figure 5: North America P&C Insurance Industry In China Revenue Share (%), by Line of Business 2025 & 2033

- Figure 6: North America P&C Insurance Industry In China Volume Share (%), by Line of Business 2025 & 2033

- Figure 7: North America P&C Insurance Industry In China Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 8: North America P&C Insurance Industry In China Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 9: North America P&C Insurance Industry In China Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America P&C Insurance Industry In China Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America P&C Insurance Industry In China Revenue (Million), by Country 2025 & 2033

- Figure 12: North America P&C Insurance Industry In China Volume (Billion), by Country 2025 & 2033

- Figure 13: North America P&C Insurance Industry In China Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America P&C Insurance Industry In China Volume Share (%), by Country 2025 & 2033

- Figure 15: South America P&C Insurance Industry In China Revenue (Million), by Line of Business 2025 & 2033

- Figure 16: South America P&C Insurance Industry In China Volume (Billion), by Line of Business 2025 & 2033

- Figure 17: South America P&C Insurance Industry In China Revenue Share (%), by Line of Business 2025 & 2033

- Figure 18: South America P&C Insurance Industry In China Volume Share (%), by Line of Business 2025 & 2033

- Figure 19: South America P&C Insurance Industry In China Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 20: South America P&C Insurance Industry In China Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 21: South America P&C Insurance Industry In China Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: South America P&C Insurance Industry In China Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: South America P&C Insurance Industry In China Revenue (Million), by Country 2025 & 2033

- Figure 24: South America P&C Insurance Industry In China Volume (Billion), by Country 2025 & 2033

- Figure 25: South America P&C Insurance Industry In China Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America P&C Insurance Industry In China Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe P&C Insurance Industry In China Revenue (Million), by Line of Business 2025 & 2033

- Figure 28: Europe P&C Insurance Industry In China Volume (Billion), by Line of Business 2025 & 2033

- Figure 29: Europe P&C Insurance Industry In China Revenue Share (%), by Line of Business 2025 & 2033

- Figure 30: Europe P&C Insurance Industry In China Volume Share (%), by Line of Business 2025 & 2033

- Figure 31: Europe P&C Insurance Industry In China Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 32: Europe P&C Insurance Industry In China Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 33: Europe P&C Insurance Industry In China Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: Europe P&C Insurance Industry In China Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 35: Europe P&C Insurance Industry In China Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe P&C Insurance Industry In China Volume (Billion), by Country 2025 & 2033

- Figure 37: Europe P&C Insurance Industry In China Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe P&C Insurance Industry In China Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa P&C Insurance Industry In China Revenue (Million), by Line of Business 2025 & 2033

- Figure 40: Middle East & Africa P&C Insurance Industry In China Volume (Billion), by Line of Business 2025 & 2033

- Figure 41: Middle East & Africa P&C Insurance Industry In China Revenue Share (%), by Line of Business 2025 & 2033

- Figure 42: Middle East & Africa P&C Insurance Industry In China Volume Share (%), by Line of Business 2025 & 2033

- Figure 43: Middle East & Africa P&C Insurance Industry In China Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 44: Middle East & Africa P&C Insurance Industry In China Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 45: Middle East & Africa P&C Insurance Industry In China Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Middle East & Africa P&C Insurance Industry In China Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Middle East & Africa P&C Insurance Industry In China Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East & Africa P&C Insurance Industry In China Volume (Billion), by Country 2025 & 2033

- Figure 49: Middle East & Africa P&C Insurance Industry In China Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa P&C Insurance Industry In China Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific P&C Insurance Industry In China Revenue (Million), by Line of Business 2025 & 2033

- Figure 52: Asia Pacific P&C Insurance Industry In China Volume (Billion), by Line of Business 2025 & 2033

- Figure 53: Asia Pacific P&C Insurance Industry In China Revenue Share (%), by Line of Business 2025 & 2033

- Figure 54: Asia Pacific P&C Insurance Industry In China Volume Share (%), by Line of Business 2025 & 2033

- Figure 55: Asia Pacific P&C Insurance Industry In China Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 56: Asia Pacific P&C Insurance Industry In China Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 57: Asia Pacific P&C Insurance Industry In China Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Asia Pacific P&C Insurance Industry In China Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Asia Pacific P&C Insurance Industry In China Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific P&C Insurance Industry In China Volume (Billion), by Country 2025 & 2033

- Figure 61: Asia Pacific P&C Insurance Industry In China Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific P&C Insurance Industry In China Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global P&C Insurance Industry In China Revenue Million Forecast, by Line of Business 2020 & 2033

- Table 2: Global P&C Insurance Industry In China Volume Billion Forecast, by Line of Business 2020 & 2033

- Table 3: Global P&C Insurance Industry In China Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global P&C Insurance Industry In China Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global P&C Insurance Industry In China Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global P&C Insurance Industry In China Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global P&C Insurance Industry In China Revenue Million Forecast, by Line of Business 2020 & 2033

- Table 8: Global P&C Insurance Industry In China Volume Billion Forecast, by Line of Business 2020 & 2033

- Table 9: Global P&C Insurance Industry In China Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global P&C Insurance Industry In China Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global P&C Insurance Industry In China Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global P&C Insurance Industry In China Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Global P&C Insurance Industry In China Revenue Million Forecast, by Line of Business 2020 & 2033

- Table 20: Global P&C Insurance Industry In China Volume Billion Forecast, by Line of Business 2020 & 2033

- Table 21: Global P&C Insurance Industry In China Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global P&C Insurance Industry In China Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global P&C Insurance Industry In China Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global P&C Insurance Industry In China Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Brazil P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Argentina P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Global P&C Insurance Industry In China Revenue Million Forecast, by Line of Business 2020 & 2033

- Table 32: Global P&C Insurance Industry In China Volume Billion Forecast, by Line of Business 2020 & 2033

- Table 33: Global P&C Insurance Industry In China Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global P&C Insurance Industry In China Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global P&C Insurance Industry In China Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global P&C Insurance Industry In China Volume Billion Forecast, by Country 2020 & 2033

- Table 37: United Kingdom P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Germany P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: France P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Italy P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Spain P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Russia P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Benelux P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: Nordics P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Global P&C Insurance Industry In China Revenue Million Forecast, by Line of Business 2020 & 2033

- Table 56: Global P&C Insurance Industry In China Volume Billion Forecast, by Line of Business 2020 & 2033

- Table 57: Global P&C Insurance Industry In China Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 58: Global P&C Insurance Industry In China Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 59: Global P&C Insurance Industry In China Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global P&C Insurance Industry In China Volume Billion Forecast, by Country 2020 & 2033

- Table 61: Turkey P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Israel P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: GCC P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: North Africa P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: South Africa P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: Global P&C Insurance Industry In China Revenue Million Forecast, by Line of Business 2020 & 2033

- Table 74: Global P&C Insurance Industry In China Volume Billion Forecast, by Line of Business 2020 & 2033

- Table 75: Global P&C Insurance Industry In China Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 76: Global P&C Insurance Industry In China Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 77: Global P&C Insurance Industry In China Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global P&C Insurance Industry In China Volume Billion Forecast, by Country 2020 & 2033

- Table 79: China P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 81: India P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 83: Japan P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 85: South Korea P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 87: ASEAN P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 89: Oceania P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific P&C Insurance Industry In China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific P&C Insurance Industry In China Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the P&C Insurance Industry In China?

The projected CAGR is approximately 7.12%.

2. Which companies are prominent players in the P&C Insurance Industry In China?

Key companies in the market include PICC Property & Casualty Company Limited, Ping An Insurance, China Pacific Insurance Company Limited, China Life Property & Casualty Insurance Company Limited, China Continent Property & Casualty Insurance Company Limited, China United Insurance Service Inc, Sunshine Insurance Group, China Taiping Insurance Group Ltd, China Export & Credit Insurance Corporation, Tian an Property Insurance Company **List Not Exhaustive.

3. What are the main segments of the P&C Insurance Industry In China?

The market segments include Line of Business, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 242.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Economic Growth and Rising Awareness of Risk Management.

6. What are the notable trends driving market growth?

Online Insurance and Digitalization is Driving the Market.

7. Are there any restraints impacting market growth?

Economic Growth and Rising Awareness of Risk Management.

8. Can you provide examples of recent developments in the market?

January 2024: Generali announced that it would be acquiring a 100% stake in its Chinese property-casualty (P&C) insurance subsidiary, previously 49% owned by the Italian group.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "P&C Insurance Industry In China," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the P&C Insurance Industry In China report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the P&C Insurance Industry In China?

To stay informed about further developments, trends, and reports in the P&C Insurance Industry In China, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence