Key Insights

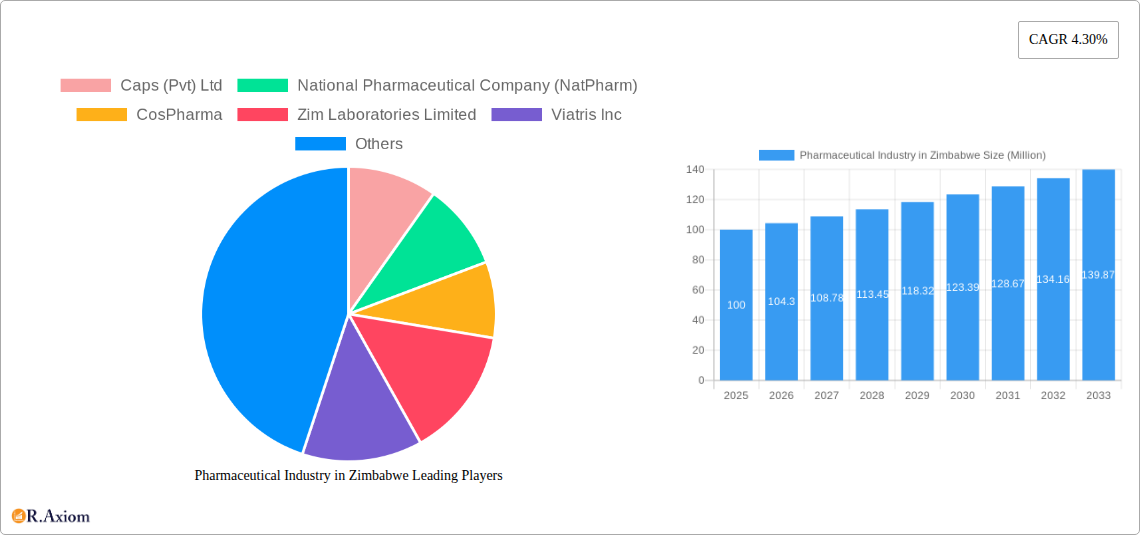

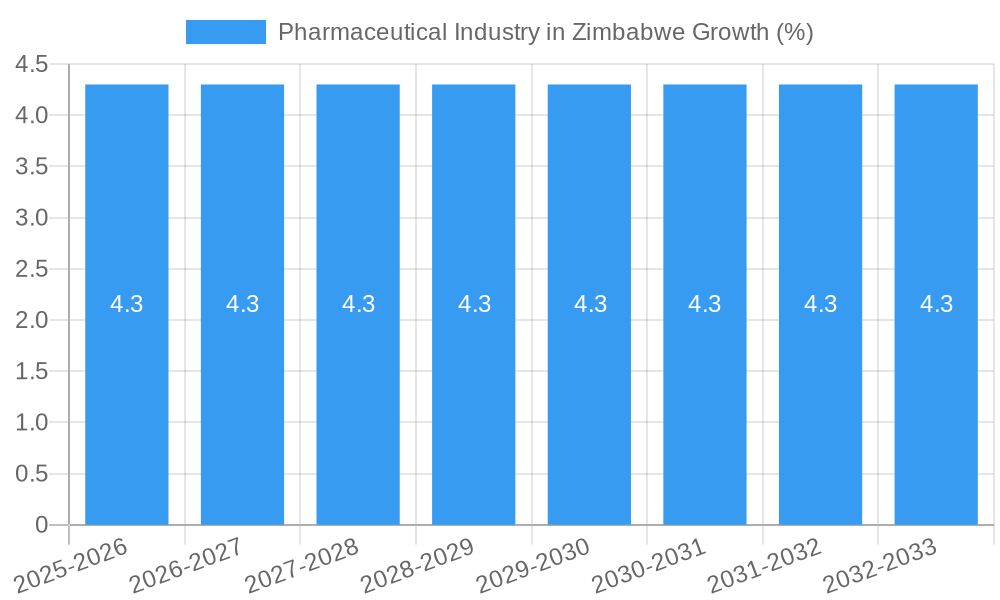

The Zimbabwean pharmaceutical market, valued at approximately $XX million in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.30% from 2025 to 2033. This growth is driven by several factors. Rising prevalence of chronic diseases like cardiovascular conditions, diabetes, and cancer, coupled with an aging population, fuels demand for prescription drugs. Increased healthcare expenditure, albeit still modest compared to regional averages, and growing government initiatives to improve healthcare infrastructure contribute positively. The market is segmented by therapeutic area (covering blood and hematopoietic organs, digestive system, cardiovascular system, nervous system, musculoskeletal system, anti-infectives, respiratory system, and others) and drug type (prescription and over-the-counter medications). The dominance of prescription drugs reflects the prevalent need for specialized treatment. Key players, including Caps (Pvt) Ltd, National Pharmaceutical Company (NatPharm), CosPharma, Zim Laboratories Limited, Viatris Inc, B Braun SE, Pharmanova, Datlabs (Pvt) Ltd, and GlaxoSmithKline PLC, compete within this landscape. However, challenges persist, including limited healthcare access in rural areas, affordability constraints, and potential supply chain disruptions affecting drug availability. Further growth hinges on improving healthcare access, enhancing affordability through generic drug promotion, and robust regulatory frameworks ensuring drug quality and safety.

The competitive landscape is characterized by a mix of local and multinational pharmaceutical companies. Local players like Caps (Pvt) Ltd and NatPharm hold significant market share, catering predominantly to the generic drug segment. Multinationals like Viatris Inc and GlaxoSmithKline PLC provide access to innovative drugs and specialized therapies, albeit at a premium. The growth trajectory will likely be influenced by factors such as disease prevalence changes, government policies related to drug pricing and reimbursement, and economic stability in Zimbabwe. Strategic partnerships between local and international players could play a crucial role in expanding access to affordable and quality medicines across the country. The market's future evolution hinges on addressing existing constraints and capitalizing on growth drivers.

Pharmaceutical Industry in Zimbabwe: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the pharmaceutical industry in Zimbabwe, covering market size, growth drivers, challenges, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. This report is invaluable for investors, industry stakeholders, and policymakers seeking to understand the dynamics of this vital sector.

Pharmaceutical Industry in Zimbabwe Market Concentration & Innovation

The Zimbabwean pharmaceutical market exhibits a moderate level of concentration, with a few dominant players alongside numerous smaller companies. Market share data for 2024 suggests NatPharm holds approximately 25% market share, followed by Caps (Pvt) Ltd with 15%, while the remaining share is dispersed among other players like CosPharma, Zim Laboratories Limited, and international companies such as GlaxoSmithKline PLC and Viatris Inc. Innovation is driven by the need to address prevalent diseases, such as HIV/AIDS, tuberculosis, and malaria, alongside growing demand for chronic disease management medications. Regulatory frameworks, while present, face ongoing challenges in keeping pace with global advancements and ensuring affordable access. The industry experiences limited M&A activity, with deal values in the xx Million range over the past five years. Product substitution is a factor, particularly in the generic drug segment. End-user trends show increasing demand for quality, affordable medications and a preference for generic alternatives where appropriate.

- Market Concentration: Moderate, with NatPharm leading.

- Innovation Drivers: Disease prevalence, chronic disease management.

- Regulatory Framework: Challenges in keeping pace with global advancements.

- M&A Activity: Limited, with deal values in the xx Million range.

- End-User Trends: Demand for quality and affordability.

Pharmaceutical Industry in Zimbabwe Industry Trends & Insights

The Zimbabwean pharmaceutical market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by increasing healthcare expenditure, rising prevalence of chronic diseases, and government initiatives to improve healthcare access. Technological disruptions are limited but growing, with a gradual adoption of digital technologies in distribution and supply chain management. Consumer preferences are shifting towards more affordable generic drugs while maintaining a preference for quality. Competitive dynamics are shaped by the interplay between established local players and international pharmaceutical companies. Market penetration of key therapeutic categories is highest in Antiinfectives and Cardiovascular drugs, while areas like Oncology and advanced biologics remain less penetrated.

Dominant Markets & Segments in Pharmaceutical Industry in Zimbabwe

The Zimbabwean pharmaceutical market is primarily driven by domestic consumption, with regional exports remaining limited. Within the therapeutic categories, the largest segments include:

- Blood and Hematopoietic Organs: Driven by high HIV/AIDS prevalence and increasing cancer rates.

- Digestive Organ and Metabolism: High rates of diabetes and other metabolic disorders are key drivers.

- Cardiovascular System: Growing prevalence of heart disease and hypertension.

- Nervous System: Demand for drugs to manage neurological disorders.

- Musculoskeletal Organ: Addressing the needs of an aging population.

- General Antiinfectives Systemic: Essential for managing infectious diseases.

- Respiratory System: Addressing respiratory illnesses prevalent in the population.

- Other ATC/Therapeutic Categories: Includes a range of specialized medications.

- Prescription Drugs (Rx): Dominant segment due to the need for regulated medications.

- Generic OTC Drugs: Growing segment due to affordability and accessibility.

Key drivers for segment dominance vary, but common factors include:

- Economic Policies: Government healthcare spending and pricing regulations.

- Infrastructure: Availability of healthcare facilities and distribution networks.

- Disease Prevalence: Rates of key illnesses influencing demand.

Pharmaceutical Industry in Zimbabwe Product Developments

Product innovation in Zimbabwe's pharmaceutical sector is primarily focused on adapting existing drugs to address local disease burdens and enhancing affordability. Technological advancements are gradually being integrated, with a focus on improving drug delivery systems and formulation. The market is seeing an increasing number of generic drug versions, leading to greater competition based on pricing and quality. The fit of these products generally aligns with the high demand for affordable and effective treatments.

Report Scope & Segmentation Analysis

This report segments the Zimbabwean pharmaceutical market across various parameters:

- ATC/Therapeutic Categories: Detailed analysis of each category's market size, growth projections, and competitive dynamics.

- Drug Type: Comprehensive analysis of Prescription (Rx) and Over-the-Counter (OTC) drugs, including market size and growth projections for each segment.

Each segment's market size is estimated in Million Zimbabwean Dollars (MWD) for the historical, base, and forecast periods. Competitive landscapes are assessed based on market share, product portfolios, and competitive strategies.

Key Drivers of Pharmaceutical Industry in Zimbabwe Growth

Several factors drive the growth of Zimbabwe's pharmaceutical industry. These include:

- Increasing government healthcare spending aimed at improving access to essential medicines.

- Growing prevalence of chronic diseases requiring ongoing medication.

- Rising disposable incomes leading to greater affordability of healthcare.

- Initiatives to promote local pharmaceutical manufacturing and reduce reliance on imports.

Challenges in the Pharmaceutical Industry in Zimbabwe Sector

The industry faces significant challenges, including:

- Regulatory hurdles: Complex and sometimes inconsistent regulatory processes can delay product approvals and market entry.

- Supply chain issues: Inadequate infrastructure and logistics can lead to shortages of essential drugs.

- Economic instability: Inflation and currency fluctuations affect pricing and profitability.

- Competition: Balancing the needs of local manufacturers with the presence of international pharmaceutical companies.

Emerging Opportunities in Pharmaceutical Industry in Zimbabwe

Opportunities exist in:

- Expanding access to essential medicines through public-private partnerships.

- Investing in local pharmaceutical manufacturing capacity to reduce import dependency.

- Developing innovative solutions to address prevalent diseases using technology advancements.

- Leveraging telehealth and digital health to improve healthcare access.

Leading Players in the Pharmaceutical Industry in Zimbabwe Market

- Caps (Pvt) Ltd

- National Pharmaceutical Company (NatPharm)

- CosPharma

- Zim Laboratories Limited

- Viatris Inc

- B Braun SE

- Pharmanova

- Datlabs (Pvt) Ltd

- GlaxoSmithKline PLC

Key Developments in Pharmaceutical Industry in Zimbabwe Industry

- October 2022: Zimbabwe approved the use of long-acting injectable cabotegravir (CAB-LA) as pre-exposure prophylaxis (PrEP) for HIV prevention. This significantly expands HIV prevention options.

- October 2022: China donated a state-of-the-art pharmaceutical warehouse to Zimbabwe. This greatly enhances drug storage capacity and improves health delivery system efficiency.

Strategic Outlook for Pharmaceutical Industry in Zimbabwe Market

The Zimbabwean pharmaceutical market holds substantial growth potential driven by the factors outlined above. Addressing challenges through policy reforms, investment in infrastructure, and fostering innovation will be crucial to unlock this potential. Opportunities for growth exist within local manufacturing, expanding access to essential medicines, and adopting technological advancements in healthcare delivery. A focus on sustainable practices and affordability will be key to securing long-term success.

Pharmaceutical Industry in Zimbabwe Segmentation

-

1. ATC/Therapeutic Category

- 1.1. Blood and Hematopoietic Organs

- 1.2. Digestive Organ and Metabolism

- 1.3. Cardiovascular System

- 1.4. Nervous System

- 1.5. Musculoskeletal Organ

- 1.6. General Antiinfectives Systemic

- 1.7. Respiratory System

- 1.8. Other ATC/Therapeutic Categories

-

2. Drug Type

-

2.1. Prescription Drugs (Rx)

- 2.1.1. Branded

- 2.1.2. Generic

- 2.2. OTC Drugs

-

2.1. Prescription Drugs (Rx)

Pharmaceutical Industry in Zimbabwe Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Pharmaceutical Industry in Zimbabwe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Geriatric Population; Increasing Incidence of Chronic Diseases

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. The Generic Drugs Segment Holds a Significant Share and is Expected to Continue the Trend During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmaceutical Industry in Zimbabwe Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Category

- 5.1.1. Blood and Hematopoietic Organs

- 5.1.2. Digestive Organ and Metabolism

- 5.1.3. Cardiovascular System

- 5.1.4. Nervous System

- 5.1.5. Musculoskeletal Organ

- 5.1.6. General Antiinfectives Systemic

- 5.1.7. Respiratory System

- 5.1.8. Other ATC/Therapeutic Categories

- 5.2. Market Analysis, Insights and Forecast - by Drug Type

- 5.2.1. Prescription Drugs (Rx)

- 5.2.1.1. Branded

- 5.2.1.2. Generic

- 5.2.2. OTC Drugs

- 5.2.1. Prescription Drugs (Rx)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Category

- 6. North America Pharmaceutical Industry in Zimbabwe Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Category

- 6.1.1. Blood and Hematopoietic Organs

- 6.1.2. Digestive Organ and Metabolism

- 6.1.3. Cardiovascular System

- 6.1.4. Nervous System

- 6.1.5. Musculoskeletal Organ

- 6.1.6. General Antiinfectives Systemic

- 6.1.7. Respiratory System

- 6.1.8. Other ATC/Therapeutic Categories

- 6.2. Market Analysis, Insights and Forecast - by Drug Type

- 6.2.1. Prescription Drugs (Rx)

- 6.2.1.1. Branded

- 6.2.1.2. Generic

- 6.2.2. OTC Drugs

- 6.2.1. Prescription Drugs (Rx)

- 6.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Category

- 7. South America Pharmaceutical Industry in Zimbabwe Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Category

- 7.1.1. Blood and Hematopoietic Organs

- 7.1.2. Digestive Organ and Metabolism

- 7.1.3. Cardiovascular System

- 7.1.4. Nervous System

- 7.1.5. Musculoskeletal Organ

- 7.1.6. General Antiinfectives Systemic

- 7.1.7. Respiratory System

- 7.1.8. Other ATC/Therapeutic Categories

- 7.2. Market Analysis, Insights and Forecast - by Drug Type

- 7.2.1. Prescription Drugs (Rx)

- 7.2.1.1. Branded

- 7.2.1.2. Generic

- 7.2.2. OTC Drugs

- 7.2.1. Prescription Drugs (Rx)

- 7.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Category

- 8. Europe Pharmaceutical Industry in Zimbabwe Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Category

- 8.1.1. Blood and Hematopoietic Organs

- 8.1.2. Digestive Organ and Metabolism

- 8.1.3. Cardiovascular System

- 8.1.4. Nervous System

- 8.1.5. Musculoskeletal Organ

- 8.1.6. General Antiinfectives Systemic

- 8.1.7. Respiratory System

- 8.1.8. Other ATC/Therapeutic Categories

- 8.2. Market Analysis, Insights and Forecast - by Drug Type

- 8.2.1. Prescription Drugs (Rx)

- 8.2.1.1. Branded

- 8.2.1.2. Generic

- 8.2.2. OTC Drugs

- 8.2.1. Prescription Drugs (Rx)

- 8.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Category

- 9. Middle East & Africa Pharmaceutical Industry in Zimbabwe Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Category

- 9.1.1. Blood and Hematopoietic Organs

- 9.1.2. Digestive Organ and Metabolism

- 9.1.3. Cardiovascular System

- 9.1.4. Nervous System

- 9.1.5. Musculoskeletal Organ

- 9.1.6. General Antiinfectives Systemic

- 9.1.7. Respiratory System

- 9.1.8. Other ATC/Therapeutic Categories

- 9.2. Market Analysis, Insights and Forecast - by Drug Type

- 9.2.1. Prescription Drugs (Rx)

- 9.2.1.1. Branded

- 9.2.1.2. Generic

- 9.2.2. OTC Drugs

- 9.2.1. Prescription Drugs (Rx)

- 9.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Category

- 10. Asia Pacific Pharmaceutical Industry in Zimbabwe Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Category

- 10.1.1. Blood and Hematopoietic Organs

- 10.1.2. Digestive Organ and Metabolism

- 10.1.3. Cardiovascular System

- 10.1.4. Nervous System

- 10.1.5. Musculoskeletal Organ

- 10.1.6. General Antiinfectives Systemic

- 10.1.7. Respiratory System

- 10.1.8. Other ATC/Therapeutic Categories

- 10.2. Market Analysis, Insights and Forecast - by Drug Type

- 10.2.1. Prescription Drugs (Rx)

- 10.2.1.1. Branded

- 10.2.1.2. Generic

- 10.2.2. OTC Drugs

- 10.2.1. Prescription Drugs (Rx)

- 10.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Category

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Caps (Pvt) Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 National Pharmaceutical Company (NatPharm)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CosPharma

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Zim Laboratories Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Viatris Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 B Braun SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pharmanova

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Datlabs (Pvt) Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 GlaxoSmithKline PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Caps (Pvt) Ltd

List of Figures

- Figure 1: Global Pharmaceutical Industry in Zimbabwe Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Zimbabwe Pharmaceutical Industry in Zimbabwe Revenue (Million), by Country 2024 & 2032

- Figure 3: Zimbabwe Pharmaceutical Industry in Zimbabwe Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Pharmaceutical Industry in Zimbabwe Revenue (Million), by ATC/Therapeutic Category 2024 & 2032

- Figure 5: North America Pharmaceutical Industry in Zimbabwe Revenue Share (%), by ATC/Therapeutic Category 2024 & 2032

- Figure 6: North America Pharmaceutical Industry in Zimbabwe Revenue (Million), by Drug Type 2024 & 2032

- Figure 7: North America Pharmaceutical Industry in Zimbabwe Revenue Share (%), by Drug Type 2024 & 2032

- Figure 8: North America Pharmaceutical Industry in Zimbabwe Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Pharmaceutical Industry in Zimbabwe Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Pharmaceutical Industry in Zimbabwe Revenue (Million), by ATC/Therapeutic Category 2024 & 2032

- Figure 11: South America Pharmaceutical Industry in Zimbabwe Revenue Share (%), by ATC/Therapeutic Category 2024 & 2032

- Figure 12: South America Pharmaceutical Industry in Zimbabwe Revenue (Million), by Drug Type 2024 & 2032

- Figure 13: South America Pharmaceutical Industry in Zimbabwe Revenue Share (%), by Drug Type 2024 & 2032

- Figure 14: South America Pharmaceutical Industry in Zimbabwe Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Pharmaceutical Industry in Zimbabwe Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Pharmaceutical Industry in Zimbabwe Revenue (Million), by ATC/Therapeutic Category 2024 & 2032

- Figure 17: Europe Pharmaceutical Industry in Zimbabwe Revenue Share (%), by ATC/Therapeutic Category 2024 & 2032

- Figure 18: Europe Pharmaceutical Industry in Zimbabwe Revenue (Million), by Drug Type 2024 & 2032

- Figure 19: Europe Pharmaceutical Industry in Zimbabwe Revenue Share (%), by Drug Type 2024 & 2032

- Figure 20: Europe Pharmaceutical Industry in Zimbabwe Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Pharmaceutical Industry in Zimbabwe Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Pharmaceutical Industry in Zimbabwe Revenue (Million), by ATC/Therapeutic Category 2024 & 2032

- Figure 23: Middle East & Africa Pharmaceutical Industry in Zimbabwe Revenue Share (%), by ATC/Therapeutic Category 2024 & 2032

- Figure 24: Middle East & Africa Pharmaceutical Industry in Zimbabwe Revenue (Million), by Drug Type 2024 & 2032

- Figure 25: Middle East & Africa Pharmaceutical Industry in Zimbabwe Revenue Share (%), by Drug Type 2024 & 2032

- Figure 26: Middle East & Africa Pharmaceutical Industry in Zimbabwe Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Pharmaceutical Industry in Zimbabwe Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Pharmaceutical Industry in Zimbabwe Revenue (Million), by ATC/Therapeutic Category 2024 & 2032

- Figure 29: Asia Pacific Pharmaceutical Industry in Zimbabwe Revenue Share (%), by ATC/Therapeutic Category 2024 & 2032

- Figure 30: Asia Pacific Pharmaceutical Industry in Zimbabwe Revenue (Million), by Drug Type 2024 & 2032

- Figure 31: Asia Pacific Pharmaceutical Industry in Zimbabwe Revenue Share (%), by Drug Type 2024 & 2032

- Figure 32: Asia Pacific Pharmaceutical Industry in Zimbabwe Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Pharmaceutical Industry in Zimbabwe Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Pharmaceutical Industry in Zimbabwe Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Pharmaceutical Industry in Zimbabwe Revenue Million Forecast, by ATC/Therapeutic Category 2019 & 2032

- Table 3: Global Pharmaceutical Industry in Zimbabwe Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 4: Global Pharmaceutical Industry in Zimbabwe Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Pharmaceutical Industry in Zimbabwe Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global Pharmaceutical Industry in Zimbabwe Revenue Million Forecast, by ATC/Therapeutic Category 2019 & 2032

- Table 7: Global Pharmaceutical Industry in Zimbabwe Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 8: Global Pharmaceutical Industry in Zimbabwe Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Pharmaceutical Industry in Zimbabwe Revenue Million Forecast, by ATC/Therapeutic Category 2019 & 2032

- Table 13: Global Pharmaceutical Industry in Zimbabwe Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 14: Global Pharmaceutical Industry in Zimbabwe Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Pharmaceutical Industry in Zimbabwe Revenue Million Forecast, by ATC/Therapeutic Category 2019 & 2032

- Table 19: Global Pharmaceutical Industry in Zimbabwe Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 20: Global Pharmaceutical Industry in Zimbabwe Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Pharmaceutical Industry in Zimbabwe Revenue Million Forecast, by ATC/Therapeutic Category 2019 & 2032

- Table 31: Global Pharmaceutical Industry in Zimbabwe Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 32: Global Pharmaceutical Industry in Zimbabwe Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Pharmaceutical Industry in Zimbabwe Revenue Million Forecast, by ATC/Therapeutic Category 2019 & 2032

- Table 40: Global Pharmaceutical Industry in Zimbabwe Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 41: Global Pharmaceutical Industry in Zimbabwe Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: ASEAN Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Oceania Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Pharmaceutical Industry in Zimbabwe Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Industry in Zimbabwe?

The projected CAGR is approximately 4.30%.

2. Which companies are prominent players in the Pharmaceutical Industry in Zimbabwe?

Key companies in the market include Caps (Pvt) Ltd, National Pharmaceutical Company (NatPharm), CosPharma, Zim Laboratories Limited, Viatris Inc, B Braun SE, Pharmanova, Datlabs (Pvt) Ltd, GlaxoSmithKline PLC.

3. What are the main segments of the Pharmaceutical Industry in Zimbabwe?

The market segments include ATC/Therapeutic Category, Drug Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Geriatric Population; Increasing Incidence of Chronic Diseases.

6. What are the notable trends driving market growth?

The Generic Drugs Segment Holds a Significant Share and is Expected to Continue the Trend During the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

October 2022: Zimbabwe approved the use of long-acting injectable cabotegravir (CAB-LA) as pre-exposure prophylaxis (PrEP) for HIV prevention.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharmaceutical Industry in Zimbabwe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharmaceutical Industry in Zimbabwe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharmaceutical Industry in Zimbabwe?

To stay informed about further developments, trends, and reports in the Pharmaceutical Industry in Zimbabwe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence