Key Insights

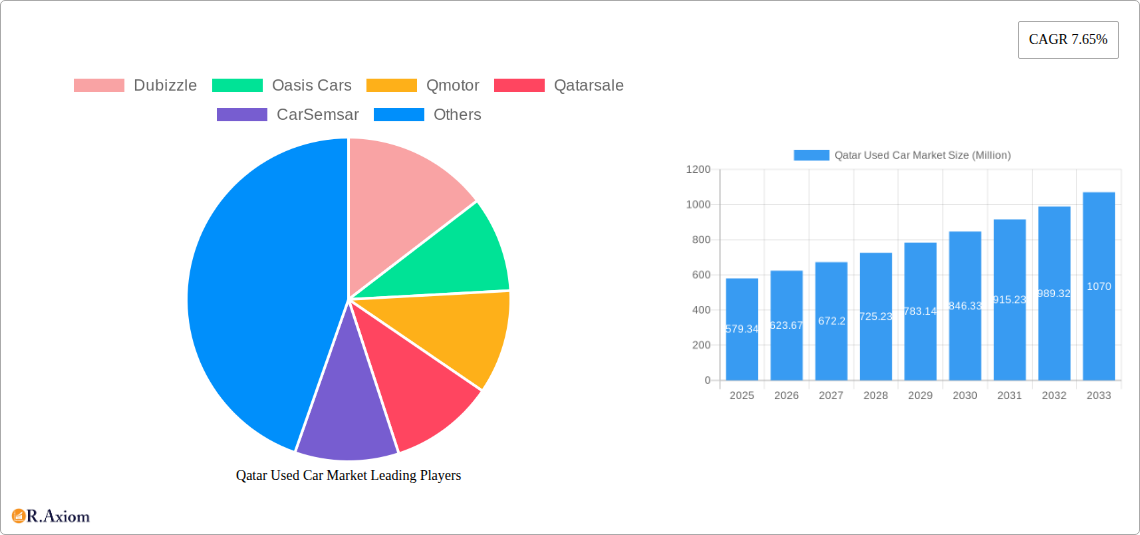

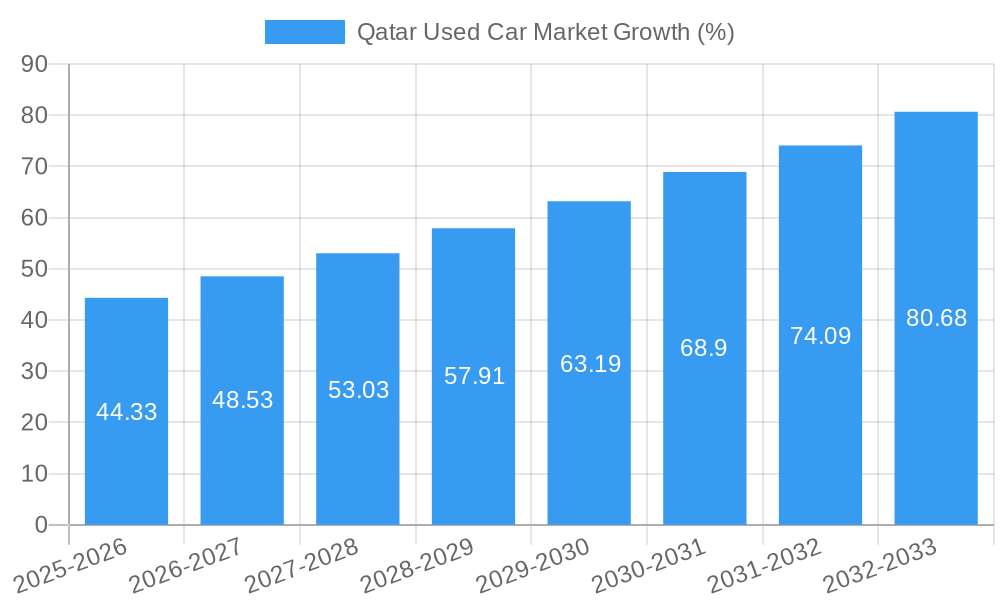

The Qatar used car market, valued at $579.34 million in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 7.65% from 2025 to 2033. This growth is fueled by several factors. Rising disposable incomes among Qatar's population, coupled with a preference for frequent vehicle upgrades, contribute significantly to the market's dynamism. The burgeoning online used car marketplace, offering convenience and transparency, further accelerates market expansion. Increased government initiatives to improve infrastructure and enhance public transportation might slightly moderate growth; however, the continued influx of expatriates and a preference for personal vehicles are expected to offset this impact. The market is segmented by fuel type (petrol dominating, with growing electric vehicle adoption), sales channel (online platforms gaining traction against established offline dealerships), vehicle type (SUVs maintaining popularity), and vendor type (organized dealerships competing with the unorganized sector). Competition among numerous online and offline players, including Dubizzle, Oasis Cars, and Qmotor, ensures a dynamic and competitive landscape.

The projected market size for 2033, extrapolated using the provided CAGR, signifies substantial growth opportunities for both established and emerging players. Strategies focusing on digital marketing, robust inventory management, and transparent pricing models will be crucial for success. Moreover, catering to the evolving consumer preferences towards fuel-efficient and environmentally friendly vehicles, particularly electric options, presents a key avenue for market penetration. Understanding the dynamics of different segments and proactively addressing the evolving needs of the Qatari consumer will be critical in capitalizing on the market's growth trajectory.

Qatar Used Car Market: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Qatar used car market, offering invaluable insights for industry stakeholders, investors, and businesses operating within this dynamic sector. The report covers the period from 2019 to 2033, with a focus on the estimated year 2025 and a forecast period spanning 2025-2033. Key market segments are analyzed, including fuel type, sales channel, vehicle type, and vendor type, providing a granular understanding of market dynamics and future growth potential. The report also incorporates valuable data on market concentration, innovation, industry trends, and leading players, offering actionable strategies for success in the competitive Qatar used car market. The total market size is projected to reach xx Million by 2033.

Qatar Used Car Market Market Concentration & Innovation

The Qatar used car market exhibits a moderately concentrated structure, with several key players vying for market share. While precise market share data for individual companies is unavailable publicly, key players such as Dubizzle, Qmotor, and Qatarsale hold significant positions, driven by their established online presence and extensive reach. The market shows a trend towards consolidation, with larger players acquiring smaller ones or merging to gain a competitive edge. Innovation in the sector is driven by the adoption of online platforms for sales and the integration of technology to enhance the buying and selling experience. Regulatory frameworks are evolving to enhance consumer protection, and the increase in online sales shows the growth in innovation. Substitutes for used cars include leasing and ride-hailing services, and end-user trends reflect a growing preference for SUVs and online purchasing convenience. M&A activity within this sector is expected to further increase in the coming years. While precise deal values are not publicly available, there are indications of a moderate level of M&A activity over the studied period.

- Key Players: Dubizzle, Qmotor, Qatarsale, Oasis Cars, CarSemsar, Autobahn Qatar, Hatla2ee, Edition Motors, Elite Motors, Automall Qatar, Qatar Living, AutoZ Qatar, Yallamotor.

- Market Concentration: Moderately Concentrated

- M&A Activity: Moderate, with a trend towards consolidation.

Qatar Used Car Market Industry Trends & Insights

The Qatar used car market is experiencing significant growth, driven by factors such as a rising population, increased vehicle ownership, and the availability of various financing options. The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) is estimated to be xx%, with an expected CAGR of xx% during the forecast period (2025-2033). Technological disruptions are transforming the industry, with online platforms facilitating convenient transactions and increasing transparency. Consumer preferences are shifting towards fuel-efficient vehicles and SUVs, reflecting changing lifestyles and preferences. The competitive landscape is intense, with both online and offline players vying for market share. Market penetration of online sales channels is rapidly increasing, surpassing xx% by 2025. This growth is driven by the ease of access and convenience offered by online platforms.

Dominant Markets & Segments in Qatar Used Car Market

The used car market in Qatar is primarily driven by the demand within the country, with no single region dominating.

- By Fuel Type: Petrol remains the dominant fuel type due to established infrastructure and lower initial costs, although the adoption of diesel and electric vehicles is gradually increasing.

- By Sales Channel: Online sales channels are witnessing rapid growth, overtaking offline channels in terms of market share in the forecast period, driven by convenience and ease of access.

- By Vehicle Type: SUVs and MPVs are highly sought after due to their versatility and suitability to family needs. Sedans still maintain a significant market share, followed by hatchbacks.

- By Vendor Type: Organized vendors, including established dealerships and online platforms, have a larger share of the market compared to unorganized vendors due to higher trust and better after-sales services.

The dominance of specific segments is influenced by several factors:

- Economic Policies: Government initiatives to support vehicle ownership and infrastructure development contribute to market growth.

- Infrastructure: Well-developed road networks and supporting facilities facilitate vehicle usage and increase demand.

- Consumer Preferences: Shifting lifestyle and demographic trends significantly impact consumer choices regarding fuel types and vehicle types.

Qatar Used Car Market Product Developments

Technological advancements are transforming the used car market, with innovations focused on improving the customer experience, enhancing transparency and offering better maintenance options. Online platforms use data analytics and AI for more efficient searches and customer recommendations. Features like virtual inspections, detailed vehicle histories, and online financing options are becoming increasingly common. These developments cater to the growing demand for convenient and transparent transactions, enhancing consumer confidence in online used car marketplaces.

Report Scope & Segmentation Analysis

This report segments the Qatar used car market across several key parameters:

- By Fuel Type: Petrol, Diesel, Electric, Other Fuel Types (LPG, CNG, etc.) – Petrol dominates currently, but electric and other fuel types are showing growth potential.

- By Sales Channel: Online, Offline – Online sales are experiencing rapid growth and are expected to significantly increase their market share.

- By Vehicle Type: Hatchbacks, Sedans, SUVs/MPVs – SUVs and MPVs are highly popular and driving market growth.

- By Vendor Type: Organized, Unorganized – Organized vendors are expected to maintain a larger market share due to trust and service quality.

Each segment is analyzed in detail, considering its growth projections, market size, and competitive dynamics.

Key Drivers of Qatar Used Car Market Growth

Several factors are driving the growth of the Qatar used car market:

- Rising disposable incomes: A growing middle class with higher purchasing power is fueling demand for vehicles.

- Population growth: An increasing population requires more vehicles for transportation.

- Favorable government policies: Supportive economic policies create a conducive environment for vehicle ownership.

- Technological advancements: Online platforms and technological integration are enhancing customer experience and driving market efficiency.

Challenges in the Qatar Used Car Market Sector

The Qatar used car market faces several challenges:

- Regulatory compliance: Stricter regulations and enforcement can increase compliance costs.

- Supply chain disruptions: Global supply chain issues can affect the availability of vehicles.

- Competition: The presence of numerous players creates a highly competitive environment.

- Counterfeit vehicles: The market also faces challenges from fraudulent activities and counterfeit parts.

Emerging Opportunities in Qatar Used Car Market

The Qatar used car market presents several promising opportunities:

- Growth in online sales: Expanding the online sales channel and enhancing user experience.

- Increased adoption of electric vehicles: Capitalizing on the growth potential of the electric vehicle market.

- Expansion into financing services: Offering integrated financing solutions to improve customer access to vehicles.

- Focus on sustainable practices: Creating a focus on eco-friendly alternatives to conventional vehicles.

Leading Players in the Qatar Used Car Market Market

- Dubizzle

- Oasis Cars

- Qmotor

- Qatarsale

- CarSemsar

- Autobahn Qatar

- Hatla2ee

- Edition Motors

- Elite Motors

- Automall Qatar

- Qatar Living

- AutoZ Qatar

- Yallamotor

Key Developments in Qatar Used Car Market Industry

- March 2023: Qatari authorities issued fines to 36 used and new car dealerships for non-compliance with consumer protection laws, highlighting the increasing regulatory focus on consumer rights and fair trade practices. This development is expected to improve the credibility of the used car market.

- May 2022: Automall Qatar's CSR initiative of distributing 1,000 iftar meal boxes demonstrates a growing emphasis on social responsibility among market players, potentially attracting consumers valuing ethical business practices.

Strategic Outlook for Qatar Used Car Market Market

The Qatar used car market is poised for sustained growth, driven by several positive factors. The increasing adoption of online platforms, combined with supportive government policies and a growing population with rising disposable incomes, creates a positive outlook for market expansion. Players who can adapt to evolving consumer preferences, embrace technological advancements, and maintain ethical business practices will be best positioned for success in this dynamic market. The market is expected to witness significant growth in the next decade, offering attractive opportunities for investment and expansion.

Qatar Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedans

- 1.3. Sports U

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

-

3. Fuel Type

- 3.1. Petrol

- 3.2. Diesel

- 3.3. Electric

- 3.4. Other Fuel Types (LPG, CNG, etc.)

-

4. Sales Channel

- 4.1. Online

- 4.2. Offline

Qatar Used Car Market Segmentation By Geography

- 1. Qatar

Qatar Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.65% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Digital Technologies; Others

- 3.3. Market Restrains

- 3.3.1. Promotion Offers on New Car Models of Chinese Make to Hamper the Demand for Used Cars

- 3.4. Market Trends

- 3.4.1. Rising Adoption of Digital Technologies Will Foster the Growth of the Target Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Used Car Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedans

- 5.1.3. Sports U

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Petrol

- 5.3.2. Diesel

- 5.3.3. Electric

- 5.3.4. Other Fuel Types (LPG, CNG, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Dubizzle

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Oasis Cars

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Qmotor

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Qatarsale

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CarSemsar

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Autobahn Qata

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hatla2ee

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Edition Motors

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Elite Motors

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Automall Qatar

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Qatar Living

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 AutoZ Qatar

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Yallamotor

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Dubizzle

List of Figures

- Figure 1: Qatar Used Car Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Qatar Used Car Market Share (%) by Company 2024

List of Tables

- Table 1: Qatar Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Qatar Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Qatar Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 4: Qatar Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 5: Qatar Used Car Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 6: Qatar Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Qatar Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Qatar Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 9: Qatar Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 10: Qatar Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 11: Qatar Used Car Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 12: Qatar Used Car Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Used Car Market?

The projected CAGR is approximately 7.65%.

2. Which companies are prominent players in the Qatar Used Car Market?

Key companies in the market include Dubizzle, Oasis Cars, Qmotor, Qatarsale, CarSemsar, Autobahn Qata, Hatla2ee, Edition Motors, Elite Motors, Automall Qatar, Qatar Living, AutoZ Qatar, Yallamotor.

3. What are the main segments of the Qatar Used Car Market?

The market segments include Vehicle Type, Vendor Type, Fuel Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 579.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Digital Technologies; Others.

6. What are the notable trends driving market growth?

Rising Adoption of Digital Technologies Will Foster the Growth of the Target Market.

7. Are there any restraints impacting market growth?

Promotion Offers on New Car Models of Chinese Make to Hamper the Demand for Used Cars.

8. Can you provide examples of recent developments in the market?

March 2023: Qatari Authorities issued fines to 36 used and new car dealerships across Qatar for non-compliance with consumer protection law. The authorities undertook the decision after receiving several complaints from consumers that these dealerships needed to adhere to contracts by delaying the delivery of purchased or reserved cars despite the transactions being made.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Used Car Market?

To stay informed about further developments, trends, and reports in the Qatar Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence