Key Insights

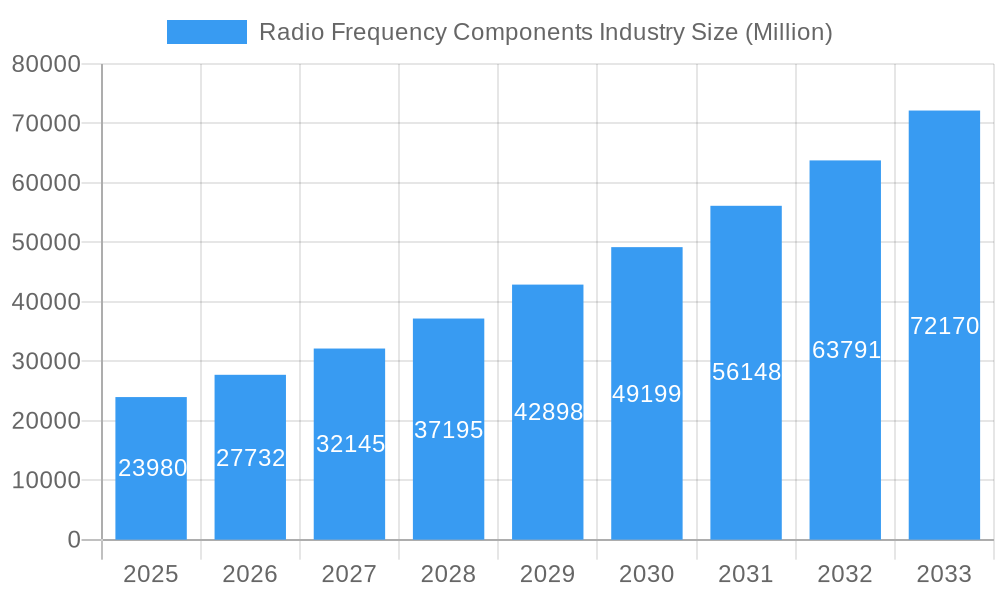

The global Radio Frequency (RF) Components market is poised for substantial expansion, projected to reach $23.98 billion by 2025, driven by an impressive compound annual growth rate (CAGR) of 15.89%. This robust growth is fueled by the escalating demand for advanced wireless communication technologies, including 5G deployment, IoT proliferation, and the increasing sophistication of consumer electronics. The intricate interplay of power amplifiers, antenna switches, duplexers, and RF filters is critical in enabling seamless data transmission and reception across these rapidly evolving sectors. Key market drivers include the continuous innovation in semiconductor technology, miniaturization of components, and the growing adoption of RF solutions in automotive applications, particularly for advanced driver-assistance systems (ADAS) and in-car connectivity. The military sector also contributes significantly to market demand, with a sustained need for high-performance RF components in radar, electronic warfare, and secure communication systems.

Radio Frequency Components Industry Market Size (In Billion)

The market's trajectory will be shaped by emerging trends such as the integration of AI and machine learning into RF systems for enhanced performance and efficiency, the rise of GaN (Gallium Nitride) and GaAs (Gallium Arsenide) based components for superior power handling and frequency capabilities, and the increasing adoption of software-defined radio (SDR) architectures. While the market presents immense opportunities, it is not without its challenges. Supply chain disruptions, intense price competition, and the need for stringent regulatory compliance for RF emissions can act as restraints. However, the overall outlook remains highly positive, with significant opportunities for market players to capitalize on the burgeoning demand for high-speed, reliable, and efficient RF solutions across diverse applications. The Asia Pacific region is expected to lead market growth due to its burgeoning manufacturing capabilities and rapid adoption of new technologies.

Radio Frequency Components Industry Company Market Share

Radio Frequency Components Industry: Market Intelligence & Growth Forecast 2019–2033

This comprehensive report offers an in-depth analysis of the global Radio Frequency (RF) Components Industry, providing critical insights and future projections from 2019 to 2033. The study period encompasses historical data (2019-2024), a base year analysis (2025), and an estimated year analysis (2025), culminating in a robust forecast period (2025-2033). The market is driven by the ever-increasing demand for high-speed wireless communication, advanced consumer electronics, and critical applications in automotive and military sectors. We delve into key segments including Power Amplifiers, Antenna Switches, Duplexers, RF Filters, and Modulators and Demodulators, analyzing their individual growth trajectories and contributions to the overall market expansion. Leading companies such as Arrow Electronics Inc, NXP Semiconductors NV, Cree Inc, Skyworks Solutions Inc, STMicroelectronics NV, Renesas Electronics Corporation, Qorvo Inc, TDK Corporation, Murata Manufacturing Co Ltd, and Analog Devices Inc are meticulously profiled, alongside their strategic initiatives and market positioning. This report is an indispensable resource for stakeholders seeking to understand the dynamics, challenges, opportunities, and future trajectory of the RF Components Industry.

Radio Frequency Components Industry Market Concentration & Innovation

The Radio Frequency Components Industry exhibits a moderate to high market concentration, characterized by the presence of several large, established players and a growing number of specialized innovators. Key companies like Skyworks Solutions Inc, Qorvo Inc, and Broadcom Inc (though not listed as a primary focus, a significant player) dominate market share in specific segments, particularly for high-frequency applications. The market’s innovation landscape is profoundly shaped by the relentless pursuit of higher bandwidth, lower power consumption, and miniaturization, driven by advancements in 5G, 6G, IoT, and advanced driver-assistance systems (ADAS).

Innovation Drivers:

- 5G and Beyond: The rollout of 5G networks and the anticipation of 6G technologies necessitate sophisticated RF components capable of handling higher frequencies and greater data volumes. This fuels innovation in areas like GaN and GaAs-based power amplifiers and advanced antenna systems.

- Miniaturization and Integration: The increasing demand for smaller, more integrated electronic devices across consumer and automotive sectors pushes for the development of highly integrated RF front-end modules and System-in-Package (SiP) solutions.

- Power Efficiency: With the proliferation of battery-powered devices, energy efficiency in RF components is paramount, driving research into low-power amplifiers and optimized filtering solutions.

Regulatory Frameworks: Compliance with global spectrum regulations, electromagnetic interference (EMI) standards, and safety protocols significantly influences product development and market entry. Bodies like the FCC (Federal Communications Commission) and ETSI (European Telecommunications Standards Institute) play a crucial role.

Product Substitutes: While direct substitutes for core RF functionality are limited, advancements in digital signal processing and software-defined radio (SDR) technologies can influence the architecture and design of RF systems, indirectly impacting component demand.

End-User Trends: The explosive growth of mobile data consumption, the rise of smart homes, connected vehicles, and the expanding IoT ecosystem are fundamental drivers pushing the demand for advanced RF components.

M&A Activities: Mergers and acquisitions are a common strategy for market consolidation and technological advancement. Significant M&A deals, such as the proposed acquisition of VMware by Broadcom, while not directly RF-focused, highlight the broader trend of consolidation in technology sectors, often impacting supply chains and component availability. Deal values in the broader semiconductor industry often run into tens of billions of dollars, indicating substantial capital flowing into strategic acquisitions. The RF components sector itself sees frequent, albeit smaller, acquisitions by larger players seeking to bolster their product portfolios or gain access to specialized technologies.

Radio Frequency Components Industry Industry Trends & Insights

The Radio Frequency Components Industry is poised for robust expansion, propelled by a confluence of technological advancements, burgeoning application demands, and evolving consumer preferences. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 12.5% over the forecast period, reaching an estimated market value exceeding $65 billion by 2033. This growth is underpinned by the insatiable demand for faster, more reliable wireless connectivity across virtually every facet of modern life.

The escalating adoption of 5G technology is the primary growth catalyst. As 5G networks continue their global rollout and evolve towards 5G Advanced and the nascent stages of 6G, the requirement for sophisticated RF components that can handle higher frequencies, wider bandwidths, and increased data throughput becomes critical. This includes advanced Power Amplifiers (PAs) utilizing Gallium Nitride (GaN) and Gallium Arsenide (GaAs) technologies, high-performance Duplexers and RF Filters to manage complex signal paths, and efficient Antenna Switches for seamless connectivity. The market penetration of 5G-enabled devices, ranging from smartphones and tablets to IoT sensors and automotive modules, is rapidly increasing, directly translating into higher demand for these specialized components.

Beyond mobile communication, the automotive sector is emerging as a significant growth driver. The integration of advanced connectivity features for infotainment, telematics, and particularly for Autonomous Driving Systems (ADAS) and vehicle-to-everything (V2X) communication, requires robust and reliable RF components. This includes components for in-car Wi-Fi, cellular connectivity, GPS, and dedicated short-range communications (DSRC) or cellular-V2X (C-V2X) technologies. The sheer volume of vehicles equipped with these features, coupled with the increasing complexity of their communication systems, represents a substantial market opportunity.

The consumer electronics segment continues to be a cornerstone of RF component demand. Smart home devices, wearables, and next-generation gaming consoles all rely heavily on wireless connectivity, driving the need for efficient and cost-effective RF solutions. As these devices become more sophisticated and interconnected, the demand for integrated RF front-end modules, which combine multiple RF functions into a single package, will surge.

Technological disruptions, such as the continued advancement in semiconductor manufacturing processes and the exploration of new materials, are enabling the creation of smaller, more power-efficient, and higher-performance RF components. This innovation cycle allows for the integration of more functionality into a single chip, reducing bill of materials (BOM) costs and enabling new device form factors. The competitive dynamics are characterized by intense R&D efforts, strategic partnerships, and a constant drive for cost optimization. Players who can offer a comprehensive portfolio of high-performance RF components while maintaining competitive pricing are best positioned for success.

Dominant Markets & Segments in Radio Frequency Components Industry

The global Radio Frequency Components Industry is characterized by its widespread application across diverse sectors and geographies. The dominance of specific regions and segments is driven by technological adoption rates, infrastructure development, and the presence of key end-user industries.

Dominant Region: Asia Pacific is the leading region in the RF Components Industry, driven by its massive manufacturing base for consumer electronics and the rapid deployment of 5G infrastructure. Countries like China, South Korea, and Japan are at the forefront of both production and consumption. The region's economic policies, which often favor technological advancement and domestic manufacturing, further bolster its dominance. The substantial investments in 5G networks and the high consumer demand for mobile devices contribute significantly to market penetration.

Dominant Country (within Asia Pacific): China stands out as the dominant country, owing to its vast electronics manufacturing ecosystem and its aggressive 5G rollout strategy. The Chinese government’s initiatives to promote domestic semiconductor production and its sheer market size make it a critical hub for RF component consumption and innovation.

Dominant Component Type: Power Amplifiers (PAs) are currently the dominant segment within component types.

- Key Drivers:

- 5G Deployment: The increasing number of 5G base stations and user equipment (UEs) necessitates a significant number of high-performance PAs capable of handling multiple frequency bands and power levels.

- Automotive Connectivity: The growing demand for in-car connectivity, ADAS, and V2X communication systems requires robust PAs for reliable data transmission.

- Consumer Electronics: Smartphones, tablets, and other portable devices with advanced wireless capabilities are substantial consumers of PAs.

- Dominance Analysis: PAs are fundamental to signal transmission in virtually all wireless communication systems. The complexity and power requirements of modern wireless standards, especially 5G and its successors, directly translate into high demand for advanced PA technologies, including GaN and GaAs. The market for PAs is driven by both volume and technological sophistication, with a constant push for higher efficiency and smaller form factors.

Dominant Application: Wireless Communication is the predominant application driving the RF Components Industry.

- Key Drivers:

- Mobile Network Infrastructure: The continuous expansion and upgrade of cellular networks (2G, 3G, 4G, 5G, and future 6G) are the backbone of this demand.

- Wi-Fi and Bluetooth: The ubiquity of Wi-Fi and Bluetooth in consumer electronics, industrial IoT, and smart home devices fuels significant demand for RF components.

- Satellite Communications: Emerging applications in satellite internet and communication systems also contribute to this segment's growth.

- Dominance Analysis: Wireless communication encompasses a broad spectrum of connectivity needs, from long-range cellular networks to short-range device-to-device communication. The fundamental reliance of global communication infrastructure on RF technology makes this application segment the largest and most influential in the market. The ongoing transition to higher frequency bands and increased data rates for wireless communication necessitates a continuous evolution of RF components, ensuring sustained demand.

While Wireless Communication and Power Amplifiers currently hold the dominant positions, the Automotive application segment is experiencing the fastest growth rate due to the transformative changes in vehicle technology. Similarly, RF Filters and Antenna Switches are critical enablers of advanced wireless systems and are witnessing substantial market expansion.

Radio Frequency Components Industry Product Developments

Product developments in the RF Components Industry are primarily focused on enhancing performance, reducing size and power consumption, and improving integration. Innovations in materials science, such as the increased use of Gallium Nitride (GaN) and Gallium Arsenide (GaAs) for high-frequency power amplifiers, are enabling higher power efficiency and greater bandwidth. The trend towards System-in-Package (SiP) and RF Front-End Modules (FEMs) integrates multiple RF functionalities, such as filters, switches, and amplifiers, into a single compact unit. This is driven by the need for miniaturization in smartphones and the complexity of 5G and emerging 6G applications, offering significant competitive advantages in terms of board space and BOM cost reduction.

Report Scope & Segmentation Analysis

This report meticulously segments the Radio Frequency Components Industry to provide granular market insights. The analysis is broken down by Component Type and Application.

Component Type Segmentation: The report examines the market dynamics for Power Amplifiers, Antenna Switches, Duplexers, RF Filters, and Modulators and Demodulators. Each segment is analyzed for its current market size, projected growth, and key demand drivers. For instance, the Power Amplifiers segment is projected to grow at a CAGR of approximately 13.0% driven by 5G infrastructure and advanced mobile devices. Antenna Switches and Duplexers are crucial for managing complex signal routing in multi-band devices and are expected to see robust growth driven by increasing device complexity. RF Filters are essential for signal selectivity and are seeing increased demand due to crowded spectrums and higher frequency bands. Modulators and Demodulators are foundational to digital communication and will benefit from the overall growth in wireless data traffic.

Application Segmentation: The report provides a detailed analysis across Consumer Electronics, Automotive, Military, Wireless Communication, and Other Applications. The Wireless Communication segment, encompassing cellular infrastructure and private networks, is the largest contributor, with projected growth fueled by 5G and the anticipation of 6G. The Automotive segment is experiencing the highest growth rate (CAGR ~14.5%) due to the rapid integration of connected car technologies and ADAS. Consumer Electronics, while mature, continues to be a significant volume driver, with ongoing innovation in smart devices. The Military segment, characterized by high-reliability and specialized requirements, offers stable demand. Other Applications, including industrial IoT and medical devices, represent emerging growth areas.

Key Drivers of Radio Frequency Components Industry Growth

The Radio Frequency Components Industry is experiencing significant growth driven by several interconnected factors. The relentless global rollout and advancement of 5G networks, and the groundwork for 6G, are paramount. This requires increasingly sophisticated RF components capable of handling higher frequencies, wider bandwidths, and increased data speeds. The burgeoning Internet of Things (IoT) ecosystem, with its diverse array of connected devices from smart homes to industrial sensors, is another major driver, necessitating reliable and efficient wireless communication modules. Furthermore, the automotive sector's transformation towards connected and autonomous vehicles, incorporating advanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) communication, creates substantial demand for specialized RF components. Finally, advancements in semiconductor technology, enabling smaller, more power-efficient, and cost-effective RF solutions, are crucial enablers of broader market adoption.

Challenges in the Radio Frequency Components Industry Sector

Despite its robust growth, the Radio Frequency Components Industry faces several challenges. Supply chain disruptions, exacerbated by geopolitical tensions and global manufacturing complexities, can lead to lead time extensions and increased component costs. The intense price competition, particularly in high-volume consumer electronics segments, puts pressure on profit margins for component manufacturers. Evolving technological standards and rapid obsolescence require continuous and significant R&D investment to keep pace, posing a financial burden. Furthermore, the increasing complexity of RF designs and the need for highly skilled engineering talent present a barrier to entry and operational efficiency. Navigating the intricate landscape of global regulatory requirements and spectrum allocations also adds to the complexity and cost of product development and market access.

Emerging Opportunities in Radio Frequency Components Industry

The Radio Frequency Components Industry is ripe with emerging opportunities. The ongoing development and eventual standardization of 6G technology promise a new wave of innovation and demand for next-generation RF components capable of terahertz frequencies and beyond. The expansion of satellite communication networks, such as low-earth orbit (LEO) constellations, for global broadband coverage presents a significant growth avenue. The increasing sophistication of industrial IoT (IIoT) applications, requiring robust and reliable wireless connectivity in challenging environments, offers substantial market potential. The continuous evolution of connected vehicles, including advanced infotainment systems, V2X communication for safety, and autonomous driving functionalities, will drive demand for highly integrated and reliable RF solutions. Finally, the growing adoption of advanced sensing and radar applications in various sectors, from automotive to security, opens new frontiers for specialized RF component manufacturers.

Leading Players in the Radio Frequency Components Industry Market

- Arrow Electronics Inc

- NXP Semiconductors NV

- Cree Inc

- Skyworks Solutions Inc

- STMicroelectronics NV

- Renesas Electronics Corporation

- Qorvo Inc

- TDK Corporation

- Murata Manufacturing Co Ltd

- Analog Devices Inc

Key Developments in Radio Frequency Components Industry Industry

- 2023/01: Skyworks Solutions Inc. announces a new portfolio of 5G front-end modules designed for enhanced performance and power efficiency in smartphones and other mobile devices.

- 2023/03: Qorvo Inc. introduces advanced GaN-based power amplifiers for 5G infrastructure, supporting higher frequency bands and increased data throughput.

- 2023/05: NXP Semiconductors NV expands its RF component offerings for automotive applications, focusing on radar and V2X communication modules.

- 2023/07: Murata Manufacturing Co Ltd. unveils a new generation of compact, high-performance RF filters for 5G devices, enabling improved signal clarity.

- 2023/09: Analog Devices Inc. showcases integrated RF solutions for advanced IoT applications, emphasizing power efficiency and connectivity.

- 2024/01: STMicroelectronics NV announces strategic investments to boost its capacity for RF component manufacturing to meet the growing demand for 5G and automotive applications.

- 2024/03: TDK Corporation expands its portfolio of duplexers and antenna switches, critical components for multi-band wireless communication.

- 2024/05: Renesas Electronics Corporation introduces new RF solutions targeting the growing market for connected industrial equipment and smart infrastructure.

- 2024/07: Cree Inc. (now Wolfspeed) highlights its advancements in GaN technology for high-power RF applications in telecommunications and defense.

- 2024/09: Several industry leaders collaborate on initiatives to accelerate the development of RF components for future 6G networks.

Strategic Outlook for Radio Frequency Components Industry Market

The strategic outlook for the Radio Frequency Components Industry is exceptionally bright, driven by pervasive technological advancements and expanding market applications. The ongoing transition to 5G and the nascent development of 6G will continue to fuel innovation in high-frequency, high-performance RF components. The increasing integration of RF capabilities into the automotive sector, enabling advanced connectivity and autonomous driving, presents a significant growth catalyst. Furthermore, the widespread adoption of IoT devices across industrial, consumer, and smart city applications will ensure sustained demand for a broad range of RF solutions. Strategic investments in R&D, focus on advanced materials like GaN, and the development of integrated RF front-end modules will be crucial for players to maintain a competitive edge and capitalize on the immense future market potential.

Radio Frequency Components Industry Segmentation

-

1. Component Type

- 1.1. Power Amplifiers

- 1.2. Antenna Switches

- 1.3. Duplexers

- 1.4. RF Filter

- 1.5. Modulators and Demodulators

-

2. Application

- 2.1. Consumer Electronics

- 2.2. Automotive

- 2.3. Military

- 2.4. Wireless Communication

- 2.5. Other Applications

Radio Frequency Components Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East and Africa

Radio Frequency Components Industry Regional Market Share

Geographic Coverage of Radio Frequency Components Industry

Radio Frequency Components Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Advancement in Electronic Warfare (EW) Technology Caters the Demand of RF Components; Adoption of Front-end Modules in Telecom

- 3.3. Market Restrains

- 3.3.1. ; High Power Consumption and High Investment in RF Amplifiers; Low Demand Due to Impact of COVID-19

- 3.4. Market Trends

- 3.4.1. Automotive Sector to Hold Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Radio Frequency Components Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 5.1.1. Power Amplifiers

- 5.1.2. Antenna Switches

- 5.1.3. Duplexers

- 5.1.4. RF Filter

- 5.1.5. Modulators and Demodulators

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Consumer Electronics

- 5.2.2. Automotive

- 5.2.3. Military

- 5.2.4. Wireless Communication

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 6. North America Radio Frequency Components Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component Type

- 6.1.1. Power Amplifiers

- 6.1.2. Antenna Switches

- 6.1.3. Duplexers

- 6.1.4. RF Filter

- 6.1.5. Modulators and Demodulators

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Consumer Electronics

- 6.2.2. Automotive

- 6.2.3. Military

- 6.2.4. Wireless Communication

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Component Type

- 7. Europe Radio Frequency Components Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component Type

- 7.1.1. Power Amplifiers

- 7.1.2. Antenna Switches

- 7.1.3. Duplexers

- 7.1.4. RF Filter

- 7.1.5. Modulators and Demodulators

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Consumer Electronics

- 7.2.2. Automotive

- 7.2.3. Military

- 7.2.4. Wireless Communication

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Component Type

- 8. Asia Pacific Radio Frequency Components Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component Type

- 8.1.1. Power Amplifiers

- 8.1.2. Antenna Switches

- 8.1.3. Duplexers

- 8.1.4. RF Filter

- 8.1.5. Modulators and Demodulators

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Consumer Electronics

- 8.2.2. Automotive

- 8.2.3. Military

- 8.2.4. Wireless Communication

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Component Type

- 9. Rest of the World Radio Frequency Components Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component Type

- 9.1.1. Power Amplifiers

- 9.1.2. Antenna Switches

- 9.1.3. Duplexers

- 9.1.4. RF Filter

- 9.1.5. Modulators and Demodulators

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Consumer Electronics

- 9.2.2. Automotive

- 9.2.3. Military

- 9.2.4. Wireless Communication

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Component Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Arrow Electronics Inc *List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 NXP Semiconductors NV

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Cree Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Skyworks Solutions Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 STMicroelectronics NV

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Renesas Electronics Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Qorvo Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 TDK Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Murata Manufacturing Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Analog Devices Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Arrow Electronics Inc *List Not Exhaustive

List of Figures

- Figure 1: Global Radio Frequency Components Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Radio Frequency Components Industry Revenue (undefined), by Component Type 2025 & 2033

- Figure 3: North America Radio Frequency Components Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 4: North America Radio Frequency Components Industry Revenue (undefined), by Application 2025 & 2033

- Figure 5: North America Radio Frequency Components Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Radio Frequency Components Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Radio Frequency Components Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Radio Frequency Components Industry Revenue (undefined), by Component Type 2025 & 2033

- Figure 9: Europe Radio Frequency Components Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 10: Europe Radio Frequency Components Industry Revenue (undefined), by Application 2025 & 2033

- Figure 11: Europe Radio Frequency Components Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Radio Frequency Components Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Radio Frequency Components Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Radio Frequency Components Industry Revenue (undefined), by Component Type 2025 & 2033

- Figure 15: Asia Pacific Radio Frequency Components Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 16: Asia Pacific Radio Frequency Components Industry Revenue (undefined), by Application 2025 & 2033

- Figure 17: Asia Pacific Radio Frequency Components Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Radio Frequency Components Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Radio Frequency Components Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Radio Frequency Components Industry Revenue (undefined), by Component Type 2025 & 2033

- Figure 21: Rest of the World Radio Frequency Components Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 22: Rest of the World Radio Frequency Components Industry Revenue (undefined), by Application 2025 & 2033

- Figure 23: Rest of the World Radio Frequency Components Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of the World Radio Frequency Components Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Radio Frequency Components Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Radio Frequency Components Industry Revenue undefined Forecast, by Component Type 2020 & 2033

- Table 2: Global Radio Frequency Components Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Radio Frequency Components Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Radio Frequency Components Industry Revenue undefined Forecast, by Component Type 2020 & 2033

- Table 5: Global Radio Frequency Components Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Radio Frequency Components Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Global Radio Frequency Components Industry Revenue undefined Forecast, by Component Type 2020 & 2033

- Table 10: Global Radio Frequency Components Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Radio Frequency Components Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Germany Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: France Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Radio Frequency Components Industry Revenue undefined Forecast, by Component Type 2020 & 2033

- Table 17: Global Radio Frequency Components Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: Global Radio Frequency Components Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: India Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: China Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Japan Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Global Radio Frequency Components Industry Revenue undefined Forecast, by Component Type 2020 & 2033

- Table 24: Global Radio Frequency Components Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 25: Global Radio Frequency Components Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Latin America Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Middle East and Africa Radio Frequency Components Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Radio Frequency Components Industry?

The projected CAGR is approximately 15.89%.

2. Which companies are prominent players in the Radio Frequency Components Industry?

Key companies in the market include Arrow Electronics Inc *List Not Exhaustive, NXP Semiconductors NV, Cree Inc, Skyworks Solutions Inc, STMicroelectronics NV, Renesas Electronics Corporation, Qorvo Inc, TDK Corporation, Murata Manufacturing Co Ltd, Analog Devices Inc.

3. What are the main segments of the Radio Frequency Components Industry?

The market segments include Component Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Advancement in Electronic Warfare (EW) Technology Caters the Demand of RF Components; Adoption of Front-end Modules in Telecom.

6. What are the notable trends driving market growth?

Automotive Sector to Hold Significant Growth.

7. Are there any restraints impacting market growth?

; High Power Consumption and High Investment in RF Amplifiers; Low Demand Due to Impact of COVID-19.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Radio Frequency Components Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Radio Frequency Components Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Radio Frequency Components Industry?

To stay informed about further developments, trends, and reports in the Radio Frequency Components Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence