Key Insights

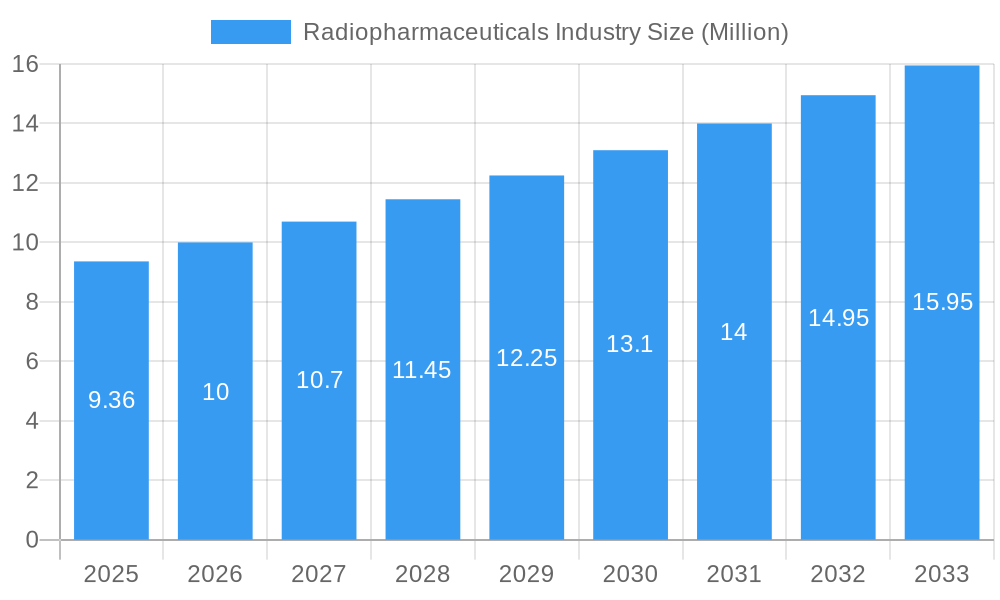

The global Radiopharmaceuticals market is poised for significant expansion, projected to reach $9.36 million in market size. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 6.81% anticipated from 2025 to 2033. This upward trajectory is driven by a confluence of factors, including the increasing prevalence of chronic diseases like cancer and cardiovascular conditions, which necessitate advanced diagnostic and therapeutic interventions. Furthermore, substantial investments in research and development by leading pharmaceutical and healthcare companies are fueling innovation in radiopharmaceutical development, leading to the introduction of novel and more effective diagnostic agents and therapeutic isotopes. The expanding applications of radiopharmaceuticals across various medical fields, particularly in oncology, cardiology, and neurology, are also contributing to market demand. Technological advancements in imaging modalities such as PET and SPECT scans are enhancing diagnostic accuracy, thereby driving the adoption of radiopharmaceuticals.

Radiopharmaceuticals Industry Market Size (In Million)

The market is segmented across key imaging modalities including SPECT, PET, MRI, and Ultrasound, with Radiopharmaceuticals and Contrast Media forming the primary types. Application areas are dominated by oncology, cardiology, and neurology, reflecting the high unmet needs in these fields. Key players like Siemens Healthineers, GE Healthcare, Bayer AG, and Lantheus Holdings Inc. are at the forefront of this dynamic market, actively engaged in product development, strategic collaborations, and market expansion initiatives. However, the market also faces certain restraints, including the high cost of production and regulatory hurdles associated with radiopharmaceuticals, alongside the requirement for specialized infrastructure and skilled personnel. Despite these challenges, the persistent demand for accurate and early disease diagnosis and targeted therapies, coupled with continuous technological evolution, ensures a promising outlook for the radiopharmaceuticals industry.

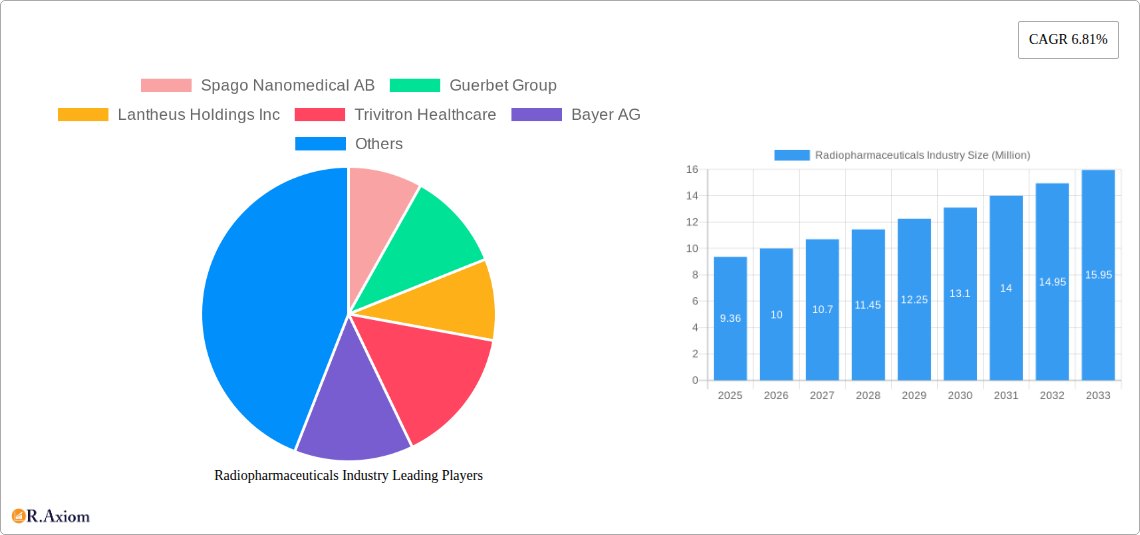

Radiopharmaceuticals Industry Company Market Share

Radiopharmaceuticals Industry Market Concentration & Innovation

The global Radiopharmaceuticals industry is characterized by a dynamic interplay of market concentration and relentless innovation. Leading players, including Siemens Healthineers, GE Company (GE Healthcare), Lantheus Holdings Inc, and Bayer AG, hold significant market share, estimated to be over $25,000 Million in the base year 2025. Their dominance stems from extensive R&D investments, robust manufacturing capabilities, and established distribution networks. Innovation is primarily driven by advancements in molecular imaging, the development of novel radiotracers for targeted therapies, and the increasing application of AI in diagnostics.

- Market Concentration Drivers:

- High capital investment for manufacturing and R&D.

- Stringent regulatory approvals and complex supply chains.

- Intellectual property protection for novel radiotracers.

- Consolidation through mergers and acquisitions (M&A) activities, with recent deal values exceeding $1,500 Million.

- Innovation Focus Areas:

- Development of theranostic agents combining diagnostic and therapeutic capabilities.

- Advancements in cyclotron technology for on-demand radiotracer production.

- Personalized medicine approaches leveraging radiopharmaceuticals.

- Regulatory Frameworks: The industry operates under strict regulations from bodies like the FDA and EMA, ensuring safety and efficacy, which also acts as a barrier to entry for smaller players.

- Product Substitutes: While nuclear imaging offers unique insights, advanced MRI and CT technologies can serve as partial substitutes in certain diagnostic scenarios, though they lack the functional imaging capabilities of radiopharmaceuticals.

- End-User Trends: Growing demand for early disease detection, precision medicine, and minimally invasive diagnostic procedures fuels end-user adoption.

- M&A Activities: Strategic acquisitions are prevalent, allowing companies to expand their product portfolios, gain access to new technologies, and consolidate market presence.

Radiopharmaceuticals Industry Industry Trends & Insights

The global Radiopharmaceuticals market is poised for substantial growth, driven by an escalating demand for advanced diagnostic and therapeutic solutions across critical medical fields. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 10% from 2025 to 2033, reaching an estimated market size of over $75,000 Million by the end of the forecast period. This robust expansion is fueled by several interconnected trends.

A significant growth driver is the increasing prevalence of chronic diseases, particularly cancer, cardiovascular diseases, and neurological disorders, which necessitates sophisticated diagnostic tools for early detection, accurate staging, and effective treatment monitoring. Radiopharmaceuticals, particularly those used in Positron Emission Tomography (PET) and Single-Photon Emission Computed Tomography (SPECT) imaging, offer unparalleled insights into cellular and molecular processes, enabling physicians to make more informed treatment decisions. The rising global population, coupled with an aging demographic, further amplifies the demand for diagnostic imaging procedures, thereby boosting the radiopharmaceutical market.

Technological advancements are another critical catalyst. The development of novel radiotracers with higher specificity and sensitivity, capable of targeting specific molecular markers associated with diseases, is revolutionizing diagnostic accuracy and therapeutic efficacy. Innovations in radiochemistry and manufacturing processes, including the wider adoption of integrated PET/CT and PET/MRI systems, enhance imaging quality and patient comfort, driving market penetration. Furthermore, the growing emphasis on personalized medicine and precision oncology is creating a substantial demand for radiopharmaceuticals that can tailor treatments to individual patient profiles. This trend is particularly evident in the oncology segment, where targeted radiotherapies are gaining traction.

Consumer preferences are also evolving, with patients and healthcare providers increasingly seeking less invasive and more effective diagnostic and therapeutic options. Radiopharmaceuticals offer a powerful tool in this regard, providing functional information that can complement or even surpass anatomical imaging techniques. The growing awareness among healthcare professionals and the public about the benefits of nuclear medicine is also contributing to market growth. Moreover, supportive government initiatives and increasing healthcare expenditure in emerging economies are creating new avenues for market expansion.

The competitive landscape is intense, with key players continuously investing in research and development to introduce innovative products and expand their market reach. Strategic partnerships and collaborations between pharmaceutical companies, diagnostic imaging manufacturers, and research institutions are common, aiming to accelerate product development and commercialization. The market penetration for advanced radiopharmaceuticals is steadily increasing, moving beyond traditional diagnostic applications to encompass therapeutic roles, further solidifying its importance in modern healthcare.

Dominant Markets & Segments in Radiopharmaceuticals Industry

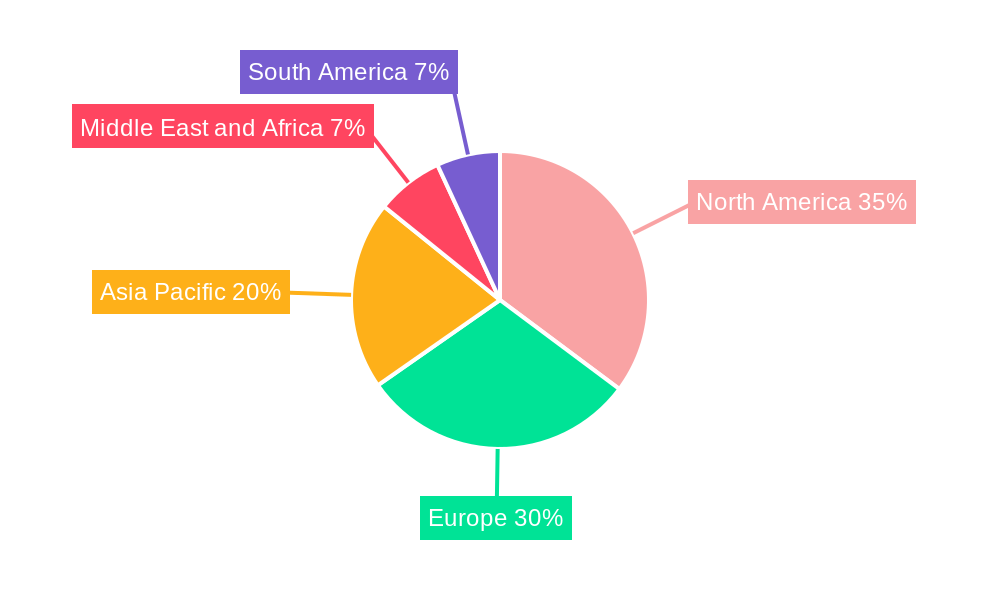

The global Radiopharmaceuticals market exhibits distinct dominance across various regions and application segments, driven by a confluence of technological advancements, healthcare infrastructure, and disease prevalence.

Dominant Region: North America, particularly the United States, currently leads the radiopharmaceutical market, accounting for an estimated market share of over 35% in 2025. This dominance is attributed to:

- High Healthcare Expenditure: Significant investment in healthcare infrastructure and advanced medical technologies.

- Prevalence of Chronic Diseases: High incidence rates of cancer, cardiovascular, and neurological disorders, driving demand for diagnostic and therapeutic radiopharmaceuticals.

- Early Adoption of Technology: A proactive approach to adopting innovative medical imaging modalities and radiotracers.

- Robust R&D Ecosystem: A strong presence of leading pharmaceutical companies, research institutions, and contract research organizations (CROs) focused on radiopharmaceutical development.

- Favorable Regulatory Environment: A well-established regulatory framework that supports the approval and commercialization of new radiopharmaceuticals.

Dominant Application Segment: Oncology represents the largest and fastest-growing application segment within the radiopharmaceuticals market, with an estimated market share exceeding 40% in 2025. The key drivers for this dominance include:

- High Cancer Burden: The pervasive and increasing incidence of various cancer types globally.

- Diagnostic Precision: The critical role of PET and SPECT imaging in early cancer detection, staging, treatment planning, and monitoring response to therapy.

- Theranostics: The emergence and growing acceptance of radioligand therapies that combine diagnostic imaging with targeted radionuclide therapy for cancers like prostate cancer and neuroendocrine tumors.

- Ongoing Research: Continuous research and development efforts focused on identifying novel cancer-specific biomarkers and developing targeted radiopharmaceuticals.

Dominant Imaging Modality: Positron Emission Tomography (PET) is the leading imaging modality, projected to capture over 50% of the market share in 2025. Its dominance is fueled by:

- Superior Sensitivity and Specificity: PET offers unparalleled functional and metabolic information, crucial for detecting diseases at their earliest stages.

- Advancements in Radiotracers: The development of a wide array of PET radiotracers for various applications, particularly in oncology and neurology.

- Integration with CT and MRI: The widespread adoption of PET/CT and PET/MRI hybrid systems enhances diagnostic accuracy and anatomical correlation.

- Growth in Therapeutic Applications: The expanding use of PET in theranostics for treatment planning and monitoring.

Dominant Type: Radiopharmaceuticals, as a distinct category, hold the primary market share, estimated at over 60% in 2025, surpassing contrast media. This is due to their unique ability to provide molecular and functional information essential for disease diagnosis and treatment.

- Key Drivers for Dominance in Segments:

- Economic Policies: Government funding for healthcare research and infrastructure development.

- Technological Infrastructure: Availability of advanced imaging equipment and radiopharmaceutical production facilities.

- Disease Demographics: Ageing populations and rising prevalence of specific diseases.

- Clinical Acceptance: Increasing evidence supporting the clinical utility and cost-effectiveness of radiopharmaceutical applications.

Radiopharmaceuticals Industry Product Developments

The radiopharmaceuticals industry is witnessing a surge in product innovations, focusing on enhanced diagnostic accuracy, targeted therapeutic delivery, and improved patient outcomes. Key developments include the creation of novel radiotracers for early detection of neurodegenerative diseases like Alzheimer's and Parkinson's, and the expansion of theranostic agents for precision oncology. Companies are leveraging advancements in radiochemistry and molecular biology to develop radiopharmaceuticals with higher specificity for tumor markers, leading to more accurate staging and treatment response assessment. The competitive advantage lies in the ability to offer integrated diagnostic and therapeutic solutions, thereby streamlining patient care pathways and improving therapeutic efficacy.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Radiopharmaceuticals industry, encompassing a detailed segmentation across key parameters. The Imaging Modality includes SPECT, PET, MRI, and Ultrasound, with PET and SPECT currently dominating due to their functional imaging capabilities. The Application segmentation covers Oncology, Cardiology, Neurology, and Gastrointestinal disorders, with Oncology being the largest segment driven by high disease prevalence and the need for precise diagnostics and therapeutics. The Type segmentation differentiates between Radiopharmaceuticals and Contrast Media, with Radiopharmaceuticals holding a larger market share due to their unique molecular imaging properties. Growth projections and market sizes are meticulously analyzed for each sub-segment, providing insights into their respective competitive dynamics and future potential.

Key Drivers of Radiopharmaceuticals Industry Growth

The Radiopharmaceuticals industry's growth is propelled by several key factors. Technologically, the continuous development of novel radiotracers with improved specificity and sensitivity for disease detection and targeted therapy is paramount. Economically, increasing global healthcare expenditure, particularly in emerging economies, and rising awareness of the benefits of advanced diagnostic imaging contribute significantly. Regulatory support through streamlined approval processes for innovative radiopharmaceuticals further bolsters growth. The escalating prevalence of chronic diseases like cancer, cardiovascular ailments, and neurological disorders necessitates accurate diagnostic tools, directly fueling demand. Furthermore, the shift towards personalized medicine and theranostics, combining diagnostics and therapeutics, opens new avenues for market expansion.

Challenges in the Radiopharmaceuticals Industry Sector

Despite robust growth, the Radiopharmaceuticals industry faces several significant challenges. Regulatory hurdles, including the stringent and time-consuming approval processes for new radiopharmaceuticals, can impede market entry and product launch timelines, impacting companies like Spago Nanomedical AB and Nano Therapeutics Pvt Ltd. Supply chain complexities, particularly the short half-life of many radioisotopes and the need for specialized infrastructure for production and distribution, pose logistical challenges. High manufacturing costs associated with specialized facilities and skilled personnel limit scalability for smaller players. Intense competition from established giants like Bayer AG and Siemens Healthineers, coupled with the threat of alternative diagnostic technologies, also presents a competitive pressure. The availability and cost of raw materials, especially critical radioisotopes, can impact market stability.

Emerging Opportunities in Radiopharmaceuticals Industry

The Radiopharmaceuticals industry is ripe with emerging opportunities. The growing demand for theranostics, particularly in oncology, presents a significant growth avenue for companies like Curium Pharma and Lantheus Holdings Inc, as it offers a dual approach to disease management. Advancements in artificial intelligence (AI) and machine learning are enabling the development of more sophisticated radiotracers and image analysis techniques, improving diagnostic accuracy and efficiency. Expansion into underserved emerging markets with increasing healthcare investments offers substantial growth potential. The development of novel radiopharmaceuticals for less-addressed therapeutic areas beyond oncology, such as infectious diseases and autoimmune disorders, represents a key frontier. Furthermore, the increasing focus on preventative medicine and early disease detection will continue to drive demand for advanced diagnostic radiopharmaceuticals.

Leading Players in the Radiopharmaceuticals Industry Market

- Siemens Healthineers

- GE Company (GE Healthcare)

- Lantheus Holdings Inc

- Bayer AG

- Guerbet Group

- Bracco Imaging SpA

- Koninklijke Philips NV

- Cardinal Health Inc

- Trivitron Healthcare

- Otsuka Pharmaceuticals Co Ltd

- Curium Pharma

- Triad Isotopes

- NTP Radioisotopes SOC Ltd

- Spago Nanomedical AB

- Nano Therapeutics Pvt Ltd

Key Developments in Radiopharmaceuticals Industry Industry

- 2023/09: Siemens Healthineers announces a new generation of PET tracers for early Alzheimer's detection, significantly impacting the neurology segment.

- 2023/07: Lantheus Holdings Inc receives FDA approval for a novel radiopharmaceutical for prostate cancer imaging, expanding its oncology portfolio.

- 2023/05: Bayer AG invests heavily in research for targeted alpha therapy radiopharmaceuticals, signaling a move towards more potent cancer treatments.

- 2023/03: Guerbet Group collaborates with a leading AI company to enhance radiopharmaceutical-based diagnostic image interpretation, improving efficiency.

- 2022/12: GE Company (GE Healthcare) launches an integrated PET/MRI system designed for advanced oncological imaging, pushing the boundaries of diagnostic capabilities.

- 2022/10: Bracco Imaging SpA expands its contrast media portfolio with new radiopharmaceuticals for cardiovascular imaging, diversifying its offerings.

- 2022/08: Curium Pharma secures regulatory approval for a new radiotracer in Europe for the diagnosis of neuroendocrine tumors, addressing a critical unmet need.

- 2022/06: Trivitron Healthcare announces strategic partnerships to expand its radiopharmaceutical manufacturing capabilities in Asia, targeting market growth.

- 2022/04: Otsuka Pharmaceuticals Co Ltd announces promising clinical trial results for a new radiopharmaceutical in treating advanced liver cancer, showcasing therapeutic potential.

Strategic Outlook for Radiopharmaceuticals Industry Market

The strategic outlook for the Radiopharmaceuticals industry is overwhelmingly positive, driven by an expanding application base and continuous technological innovation. The industry is expected to witness sustained growth, fueled by the increasing demand for advanced diagnostic and therapeutic solutions, particularly in oncology and neurology. Key growth catalysts include the ongoing development of theranostic agents, personalized medicine approaches, and the integration of AI in imaging. Companies that invest in R&D, forge strategic partnerships, and focus on expanding their global manufacturing and distribution networks are poised for significant success. The market's trajectory points towards greater precision in disease management and a more personalized approach to patient care, making radiopharmaceuticals an indispensable component of future healthcare.

Radiopharmaceuticals Industry Segmentation

-

1. Imaging Modality

- 1.1. SPECT

- 1.2. PET

- 1.3. MRI

- 1.4. Ultrasound

-

2. Application

- 2.1. Oncology

- 2.2. Cardiology

- 2.3. Neurology

- 2.4. Gastrointestinal

-

3. Type

- 3.1. Radiopharmaceuticals

- 3.2. Contrast media

Radiopharmaceuticals Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Radiopharmaceuticals Industry Regional Market Share

Geographic Coverage of Radiopharmaceuticals Industry

Radiopharmaceuticals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technology Advancements in Medical Imaging; Increasing Demand for Image-guided Procedures and Diagnostics; High Prevalence of Cancers and Cardiac Diseases

- 3.3. Market Restrains

- 3.3.1. High Costs of the Techniques; Limited Health Insurance Coverage; Short Half-life of Radiopharmaceuticals

- 3.4. Market Trends

- 3.4.1 The Cardiology Sub-segment Captured the Largest Market Share

- 3.4.2 and It is Expected to Retain its Dominance Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Radiopharmaceuticals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Imaging Modality

- 5.1.1. SPECT

- 5.1.2. PET

- 5.1.3. MRI

- 5.1.4. Ultrasound

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Oncology

- 5.2.2. Cardiology

- 5.2.3. Neurology

- 5.2.4. Gastrointestinal

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Radiopharmaceuticals

- 5.3.2. Contrast media

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Imaging Modality

- 6. North America Radiopharmaceuticals Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Imaging Modality

- 6.1.1. SPECT

- 6.1.2. PET

- 6.1.3. MRI

- 6.1.4. Ultrasound

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Oncology

- 6.2.2. Cardiology

- 6.2.3. Neurology

- 6.2.4. Gastrointestinal

- 6.3. Market Analysis, Insights and Forecast - by Type

- 6.3.1. Radiopharmaceuticals

- 6.3.2. Contrast media

- 6.1. Market Analysis, Insights and Forecast - by Imaging Modality

- 7. Europe Radiopharmaceuticals Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Imaging Modality

- 7.1.1. SPECT

- 7.1.2. PET

- 7.1.3. MRI

- 7.1.4. Ultrasound

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Oncology

- 7.2.2. Cardiology

- 7.2.3. Neurology

- 7.2.4. Gastrointestinal

- 7.3. Market Analysis, Insights and Forecast - by Type

- 7.3.1. Radiopharmaceuticals

- 7.3.2. Contrast media

- 7.1. Market Analysis, Insights and Forecast - by Imaging Modality

- 8. Asia Pacific Radiopharmaceuticals Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Imaging Modality

- 8.1.1. SPECT

- 8.1.2. PET

- 8.1.3. MRI

- 8.1.4. Ultrasound

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Oncology

- 8.2.2. Cardiology

- 8.2.3. Neurology

- 8.2.4. Gastrointestinal

- 8.3. Market Analysis, Insights and Forecast - by Type

- 8.3.1. Radiopharmaceuticals

- 8.3.2. Contrast media

- 8.1. Market Analysis, Insights and Forecast - by Imaging Modality

- 9. Middle East and Africa Radiopharmaceuticals Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Imaging Modality

- 9.1.1. SPECT

- 9.1.2. PET

- 9.1.3. MRI

- 9.1.4. Ultrasound

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Oncology

- 9.2.2. Cardiology

- 9.2.3. Neurology

- 9.2.4. Gastrointestinal

- 9.3. Market Analysis, Insights and Forecast - by Type

- 9.3.1. Radiopharmaceuticals

- 9.3.2. Contrast media

- 9.1. Market Analysis, Insights and Forecast - by Imaging Modality

- 10. South America Radiopharmaceuticals Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Imaging Modality

- 10.1.1. SPECT

- 10.1.2. PET

- 10.1.3. MRI

- 10.1.4. Ultrasound

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Oncology

- 10.2.2. Cardiology

- 10.2.3. Neurology

- 10.2.4. Gastrointestinal

- 10.3. Market Analysis, Insights and Forecast - by Type

- 10.3.1. Radiopharmaceuticals

- 10.3.2. Contrast media

- 10.1. Market Analysis, Insights and Forecast - by Imaging Modality

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Spago Nanomedical AB

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Guerbet Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lantheus Holdings Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Trivitron Healthcare

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bayer AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Siemens Healthineers

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Otsuka Pharmaceuticals Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nano Therapeutics Pvt Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 GE Company (GE Healthcare)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bracco Imaging SpA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Triad Isotopes

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Cardinal Health Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 NTP Radioisotopes SOC Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Koninklijke Philips NV

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Curium Pharma

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Spago Nanomedical AB

List of Figures

- Figure 1: Global Radiopharmaceuticals Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Radiopharmaceuticals Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Radiopharmaceuticals Industry Revenue (Million), by Imaging Modality 2025 & 2033

- Figure 4: North America Radiopharmaceuticals Industry Volume (K Unit), by Imaging Modality 2025 & 2033

- Figure 5: North America Radiopharmaceuticals Industry Revenue Share (%), by Imaging Modality 2025 & 2033

- Figure 6: North America Radiopharmaceuticals Industry Volume Share (%), by Imaging Modality 2025 & 2033

- Figure 7: North America Radiopharmaceuticals Industry Revenue (Million), by Application 2025 & 2033

- Figure 8: North America Radiopharmaceuticals Industry Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Radiopharmaceuticals Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Radiopharmaceuticals Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Radiopharmaceuticals Industry Revenue (Million), by Type 2025 & 2033

- Figure 12: North America Radiopharmaceuticals Industry Volume (K Unit), by Type 2025 & 2033

- Figure 13: North America Radiopharmaceuticals Industry Revenue Share (%), by Type 2025 & 2033

- Figure 14: North America Radiopharmaceuticals Industry Volume Share (%), by Type 2025 & 2033

- Figure 15: North America Radiopharmaceuticals Industry Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Radiopharmaceuticals Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Radiopharmaceuticals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Radiopharmaceuticals Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Radiopharmaceuticals Industry Revenue (Million), by Imaging Modality 2025 & 2033

- Figure 20: Europe Radiopharmaceuticals Industry Volume (K Unit), by Imaging Modality 2025 & 2033

- Figure 21: Europe Radiopharmaceuticals Industry Revenue Share (%), by Imaging Modality 2025 & 2033

- Figure 22: Europe Radiopharmaceuticals Industry Volume Share (%), by Imaging Modality 2025 & 2033

- Figure 23: Europe Radiopharmaceuticals Industry Revenue (Million), by Application 2025 & 2033

- Figure 24: Europe Radiopharmaceuticals Industry Volume (K Unit), by Application 2025 & 2033

- Figure 25: Europe Radiopharmaceuticals Industry Revenue Share (%), by Application 2025 & 2033

- Figure 26: Europe Radiopharmaceuticals Industry Volume Share (%), by Application 2025 & 2033

- Figure 27: Europe Radiopharmaceuticals Industry Revenue (Million), by Type 2025 & 2033

- Figure 28: Europe Radiopharmaceuticals Industry Volume (K Unit), by Type 2025 & 2033

- Figure 29: Europe Radiopharmaceuticals Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Europe Radiopharmaceuticals Industry Volume Share (%), by Type 2025 & 2033

- Figure 31: Europe Radiopharmaceuticals Industry Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Radiopharmaceuticals Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Radiopharmaceuticals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Radiopharmaceuticals Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Radiopharmaceuticals Industry Revenue (Million), by Imaging Modality 2025 & 2033

- Figure 36: Asia Pacific Radiopharmaceuticals Industry Volume (K Unit), by Imaging Modality 2025 & 2033

- Figure 37: Asia Pacific Radiopharmaceuticals Industry Revenue Share (%), by Imaging Modality 2025 & 2033

- Figure 38: Asia Pacific Radiopharmaceuticals Industry Volume Share (%), by Imaging Modality 2025 & 2033

- Figure 39: Asia Pacific Radiopharmaceuticals Industry Revenue (Million), by Application 2025 & 2033

- Figure 40: Asia Pacific Radiopharmaceuticals Industry Volume (K Unit), by Application 2025 & 2033

- Figure 41: Asia Pacific Radiopharmaceuticals Industry Revenue Share (%), by Application 2025 & 2033

- Figure 42: Asia Pacific Radiopharmaceuticals Industry Volume Share (%), by Application 2025 & 2033

- Figure 43: Asia Pacific Radiopharmaceuticals Industry Revenue (Million), by Type 2025 & 2033

- Figure 44: Asia Pacific Radiopharmaceuticals Industry Volume (K Unit), by Type 2025 & 2033

- Figure 45: Asia Pacific Radiopharmaceuticals Industry Revenue Share (%), by Type 2025 & 2033

- Figure 46: Asia Pacific Radiopharmaceuticals Industry Volume Share (%), by Type 2025 & 2033

- Figure 47: Asia Pacific Radiopharmaceuticals Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Radiopharmaceuticals Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Radiopharmaceuticals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Radiopharmaceuticals Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Radiopharmaceuticals Industry Revenue (Million), by Imaging Modality 2025 & 2033

- Figure 52: Middle East and Africa Radiopharmaceuticals Industry Volume (K Unit), by Imaging Modality 2025 & 2033

- Figure 53: Middle East and Africa Radiopharmaceuticals Industry Revenue Share (%), by Imaging Modality 2025 & 2033

- Figure 54: Middle East and Africa Radiopharmaceuticals Industry Volume Share (%), by Imaging Modality 2025 & 2033

- Figure 55: Middle East and Africa Radiopharmaceuticals Industry Revenue (Million), by Application 2025 & 2033

- Figure 56: Middle East and Africa Radiopharmaceuticals Industry Volume (K Unit), by Application 2025 & 2033

- Figure 57: Middle East and Africa Radiopharmaceuticals Industry Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa Radiopharmaceuticals Industry Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa Radiopharmaceuticals Industry Revenue (Million), by Type 2025 & 2033

- Figure 60: Middle East and Africa Radiopharmaceuticals Industry Volume (K Unit), by Type 2025 & 2033

- Figure 61: Middle East and Africa Radiopharmaceuticals Industry Revenue Share (%), by Type 2025 & 2033

- Figure 62: Middle East and Africa Radiopharmaceuticals Industry Volume Share (%), by Type 2025 & 2033

- Figure 63: Middle East and Africa Radiopharmaceuticals Industry Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East and Africa Radiopharmaceuticals Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Middle East and Africa Radiopharmaceuticals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East and Africa Radiopharmaceuticals Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: South America Radiopharmaceuticals Industry Revenue (Million), by Imaging Modality 2025 & 2033

- Figure 68: South America Radiopharmaceuticals Industry Volume (K Unit), by Imaging Modality 2025 & 2033

- Figure 69: South America Radiopharmaceuticals Industry Revenue Share (%), by Imaging Modality 2025 & 2033

- Figure 70: South America Radiopharmaceuticals Industry Volume Share (%), by Imaging Modality 2025 & 2033

- Figure 71: South America Radiopharmaceuticals Industry Revenue (Million), by Application 2025 & 2033

- Figure 72: South America Radiopharmaceuticals Industry Volume (K Unit), by Application 2025 & 2033

- Figure 73: South America Radiopharmaceuticals Industry Revenue Share (%), by Application 2025 & 2033

- Figure 74: South America Radiopharmaceuticals Industry Volume Share (%), by Application 2025 & 2033

- Figure 75: South America Radiopharmaceuticals Industry Revenue (Million), by Type 2025 & 2033

- Figure 76: South America Radiopharmaceuticals Industry Volume (K Unit), by Type 2025 & 2033

- Figure 77: South America Radiopharmaceuticals Industry Revenue Share (%), by Type 2025 & 2033

- Figure 78: South America Radiopharmaceuticals Industry Volume Share (%), by Type 2025 & 2033

- Figure 79: South America Radiopharmaceuticals Industry Revenue (Million), by Country 2025 & 2033

- Figure 80: South America Radiopharmaceuticals Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: South America Radiopharmaceuticals Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Radiopharmaceuticals Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Radiopharmaceuticals Industry Revenue Million Forecast, by Imaging Modality 2020 & 2033

- Table 2: Global Radiopharmaceuticals Industry Volume K Unit Forecast, by Imaging Modality 2020 & 2033

- Table 3: Global Radiopharmaceuticals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Radiopharmaceuticals Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Radiopharmaceuticals Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Radiopharmaceuticals Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 7: Global Radiopharmaceuticals Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Radiopharmaceuticals Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Radiopharmaceuticals Industry Revenue Million Forecast, by Imaging Modality 2020 & 2033

- Table 10: Global Radiopharmaceuticals Industry Volume K Unit Forecast, by Imaging Modality 2020 & 2033

- Table 11: Global Radiopharmaceuticals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Radiopharmaceuticals Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: Global Radiopharmaceuticals Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Radiopharmaceuticals Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 15: Global Radiopharmaceuticals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Radiopharmaceuticals Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Radiopharmaceuticals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Radiopharmaceuticals Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Radiopharmaceuticals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Radiopharmaceuticals Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Radiopharmaceuticals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Radiopharmaceuticals Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global Radiopharmaceuticals Industry Revenue Million Forecast, by Imaging Modality 2020 & 2033

- Table 24: Global Radiopharmaceuticals Industry Volume K Unit Forecast, by Imaging Modality 2020 & 2033

- Table 25: Global Radiopharmaceuticals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Global Radiopharmaceuticals Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 27: Global Radiopharmaceuticals Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 28: Global Radiopharmaceuticals Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 29: Global Radiopharmaceuticals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Radiopharmaceuticals Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Radiopharmaceuticals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: United Kingdom Radiopharmaceuticals Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Germany Radiopharmaceuticals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Germany Radiopharmaceuticals Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: France Radiopharmaceuticals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: France Radiopharmaceuticals Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Italy Radiopharmaceuticals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Italy Radiopharmaceuticals Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Spain Radiopharmaceuticals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Spain Radiopharmaceuticals Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Radiopharmaceuticals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Radiopharmaceuticals Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Global Radiopharmaceuticals Industry Revenue Million Forecast, by Imaging Modality 2020 & 2033

- Table 44: Global Radiopharmaceuticals Industry Volume K Unit Forecast, by Imaging Modality 2020 & 2033

- Table 45: Global Radiopharmaceuticals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 46: Global Radiopharmaceuticals Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 47: Global Radiopharmaceuticals Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 48: Global Radiopharmaceuticals Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 49: Global Radiopharmaceuticals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global Radiopharmaceuticals Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: China Radiopharmaceuticals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: China Radiopharmaceuticals Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Japan Radiopharmaceuticals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan Radiopharmaceuticals Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: India Radiopharmaceuticals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: India Radiopharmaceuticals Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Australia Radiopharmaceuticals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Australia Radiopharmaceuticals Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: South Korea Radiopharmaceuticals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Korea Radiopharmaceuticals Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific Radiopharmaceuticals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific Radiopharmaceuticals Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Radiopharmaceuticals Industry Revenue Million Forecast, by Imaging Modality 2020 & 2033

- Table 64: Global Radiopharmaceuticals Industry Volume K Unit Forecast, by Imaging Modality 2020 & 2033

- Table 65: Global Radiopharmaceuticals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 66: Global Radiopharmaceuticals Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 67: Global Radiopharmaceuticals Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 68: Global Radiopharmaceuticals Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 69: Global Radiopharmaceuticals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global Radiopharmaceuticals Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: GCC Radiopharmaceuticals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: GCC Radiopharmaceuticals Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: South Africa Radiopharmaceuticals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Africa Radiopharmaceuticals Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Radiopharmaceuticals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Radiopharmaceuticals Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Global Radiopharmaceuticals Industry Revenue Million Forecast, by Imaging Modality 2020 & 2033

- Table 78: Global Radiopharmaceuticals Industry Volume K Unit Forecast, by Imaging Modality 2020 & 2033

- Table 79: Global Radiopharmaceuticals Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 80: Global Radiopharmaceuticals Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 81: Global Radiopharmaceuticals Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 82: Global Radiopharmaceuticals Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 83: Global Radiopharmaceuticals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 84: Global Radiopharmaceuticals Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 85: Brazil Radiopharmaceuticals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: Brazil Radiopharmaceuticals Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: Argentina Radiopharmaceuticals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: Argentina Radiopharmaceuticals Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 89: Rest of South America Radiopharmaceuticals Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Rest of South America Radiopharmaceuticals Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Radiopharmaceuticals Industry?

The projected CAGR is approximately 6.81%.

2. Which companies are prominent players in the Radiopharmaceuticals Industry?

Key companies in the market include Spago Nanomedical AB, Guerbet Group, Lantheus Holdings Inc, Trivitron Healthcare, Bayer AG, Siemens Healthineers, Otsuka Pharmaceuticals Co Ltd, Nano Therapeutics Pvt Ltd, GE Company (GE Healthcare), Bracco Imaging SpA, Triad Isotopes, Cardinal Health Inc, NTP Radioisotopes SOC Ltd, Koninklijke Philips NV, Curium Pharma.

3. What are the main segments of the Radiopharmaceuticals Industry?

The market segments include Imaging Modality , Application , Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Technology Advancements in Medical Imaging; Increasing Demand for Image-guided Procedures and Diagnostics; High Prevalence of Cancers and Cardiac Diseases.

6. What are the notable trends driving market growth?

The Cardiology Sub-segment Captured the Largest Market Share. and It is Expected to Retain its Dominance Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Costs of the Techniques; Limited Health Insurance Coverage; Short Half-life of Radiopharmaceuticals.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Radiopharmaceuticals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Radiopharmaceuticals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Radiopharmaceuticals Industry?

To stay informed about further developments, trends, and reports in the Radiopharmaceuticals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence