Key Insights

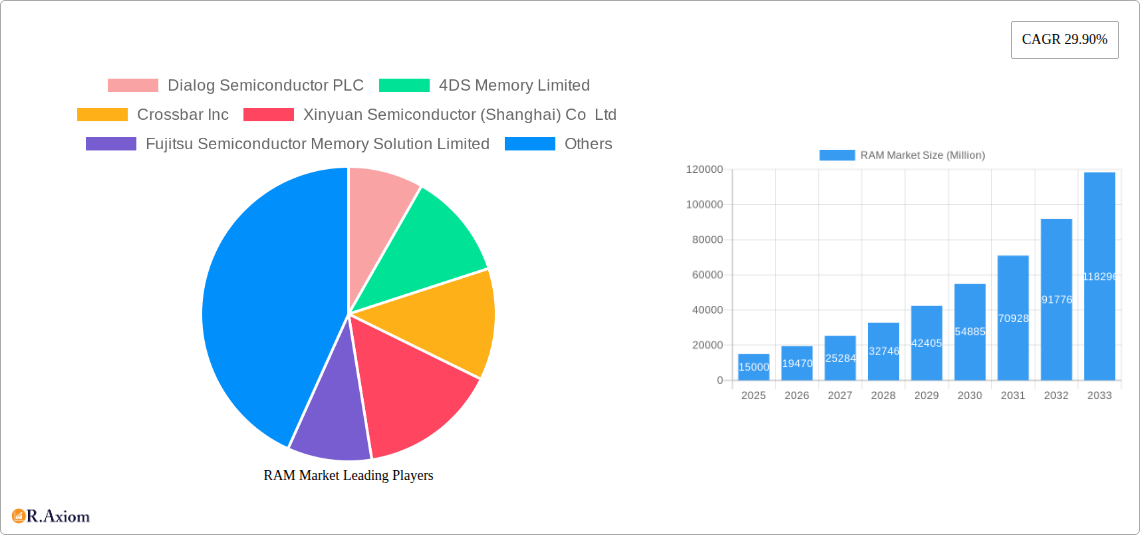

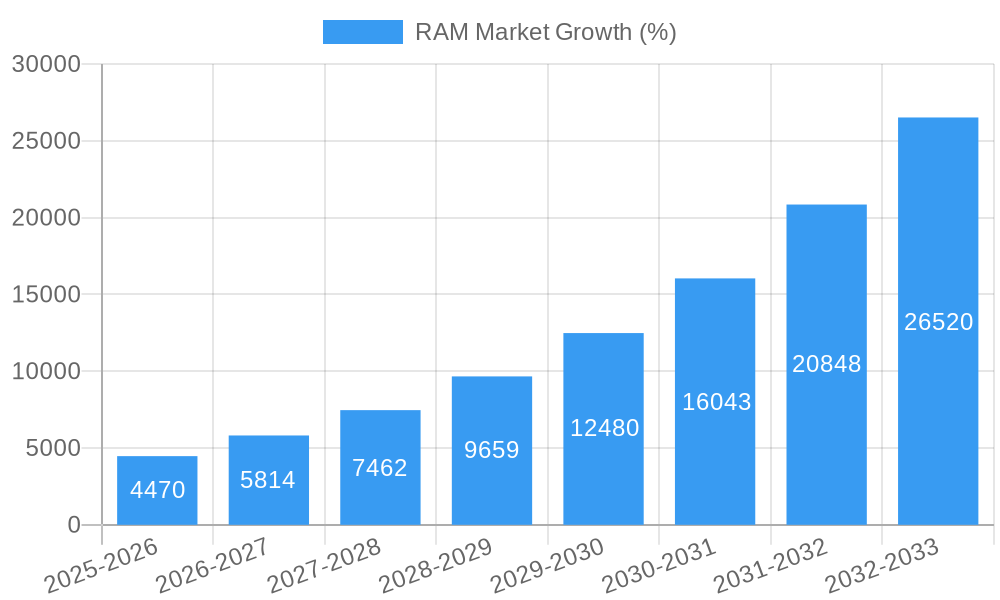

The RAM market is experiencing robust growth, driven by the increasing demand for high-performance computing across diverse sectors. The market's Compound Annual Growth Rate (CAGR) of 29.90% from 2019-2024 indicates a significant expansion, projected to continue through 2033. This growth is fueled by several key factors. The proliferation of IoT devices, autonomous vehicles, and advanced industrial automation systems necessitates faster and more efficient memory solutions. Furthermore, the rise of data centers and cloud computing, demanding massive data storage and processing capabilities, significantly boosts RAM demand. Embedded applications, including analog ICs, MCUs, and SoCs, also contribute significantly to market growth, driven by the miniaturization and enhanced processing power of modern electronics. Standalone RAM applications in areas like fast memory, code storage, and persistent memory further broaden the market. Competition among key players like Dialog Semiconductor, 4DS Memory, and Crossbar is intensifying, leading to innovation and cost optimization, ultimately benefitting consumers. While potential restraints such as supply chain disruptions and fluctuating raw material prices exist, the overall market outlook remains optimistic, reflecting the ongoing technological advancements and the insatiable need for faster and larger memory capacities.

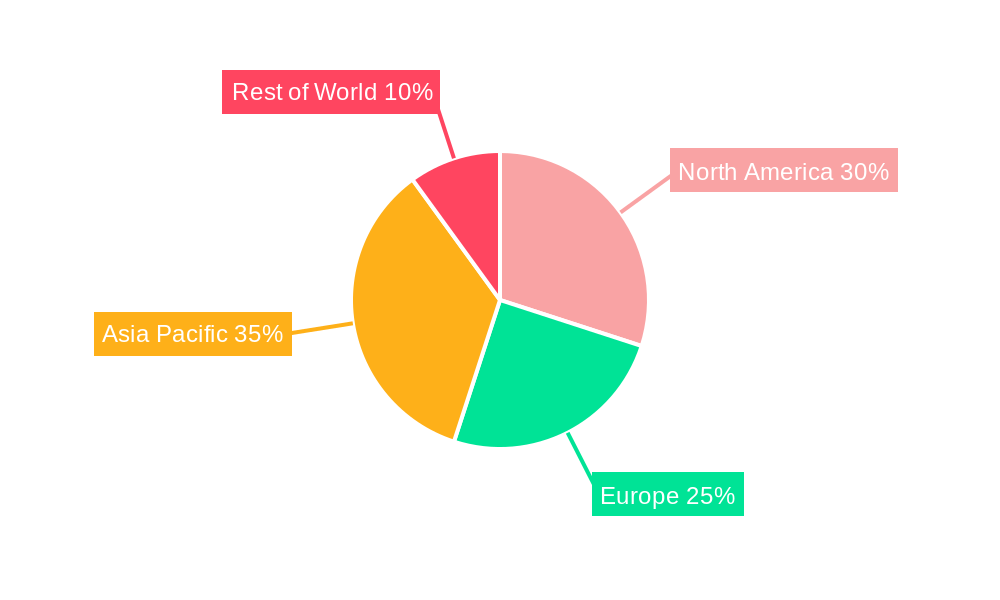

The market segmentation reveals a dynamic landscape. The embedded RAM segment, particularly in advanced applications like In-Memory Computing, is poised for significant growth, driven by the increasing integration of computing power within devices. Standalone RAM solutions, encompassing high-speed and persistent memory technologies, are witnessing strong adoption across data centers, workstations, and SSD storage solutions. Regionally, the Asia-Pacific region, particularly China, is expected to experience rapid growth due to the expanding electronics manufacturing base and surging demand for consumer electronics and industrial applications. North America and Europe maintain robust market positions, driven by strong technological innovation and high adoption rates in diverse industries. While precise regional market share figures are unavailable, a reasonable estimation based on market trends suggests a significant share for Asia Pacific, followed by North America and Europe, with other regions contributing proportionally. The forecast period (2025-2033) anticipates sustained growth, albeit possibly at a slightly moderated rate compared to the historical period, as the market matures.

RAM Market: A Comprehensive Market Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the RAM market, encompassing market size, segmentation, growth drivers, challenges, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report utilizes data from the historical period (2019-2024) to forecast market trends from 2025 to 2033. This report is designed to provide actionable insights for industry stakeholders, investors, and market entrants.

RAM Market Concentration & Innovation

This section analyzes the competitive landscape of the RAM market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is characterized by a mix of established players and emerging innovators, leading to dynamic competition and significant innovation. Market share data reveals a moderately concentrated market, with the top five players accounting for approximately xx% of the total market revenue in 2024. However, the emergence of novel technologies and startups is increasing competition.

- Market Concentration: The top 5 players hold approximately xx% market share in 2024 (estimated).

- Innovation Drivers: Miniaturization, increased speed, lower power consumption, and improved data retention are key innovation drivers. The development of new memory technologies such as RRAM is also a significant factor.

- Regulatory Frameworks: Government regulations regarding data security and environmental standards impact market dynamics. Compliance requirements drive innovation in secure and energy-efficient RAM technologies.

- Product Substitutes: Other non-volatile memory types (e.g., flash memory) pose a competitive threat, but RAM’s speed advantage sustains its demand in specific applications.

- End-User Trends: The growing demand for data storage and processing across various end-user segments, including data centers, IoT devices, and automotive applications, fuels market growth.

- M&A Activities: M&A activity in the RAM market is moderate. Deal values over the past five years have totaled approximately xx Million, primarily focused on acquiring smaller companies with specialized technologies. Examples include (but are not limited to) acquisitions related to expanding product portfolios and strengthening technological capabilities.

RAM Market Industry Trends & Insights

The global RAM market exhibits strong growth prospects, driven by several key factors. The increasing adoption of cloud computing and big data analytics significantly fuels demand for high-performance memory solutions. Technological advancements, such as the development of 3D stacked RAM and new memory materials, are improving RAM performance and efficiency. Consumer preferences are shifting towards faster, more reliable, and energy-efficient devices, stimulating the demand for advanced RAM technologies. The market's competitive landscape is dynamic, with ongoing innovation and strategic partnerships shaping market dynamics. The CAGR for the RAM market is projected to be xx% during the forecast period (2025-2033). Market penetration is expected to reach xx% by 2033, driven largely by the adoption of RAM in emerging applications like artificial intelligence and autonomous vehicles.

Dominant Markets & Segments in RAM Market

The RAM market is segmented by application (Embedded and Standalone) and end-user (Industrial/IoT/Wearables/Automotive and SSD/Datacenters/Workstations). The dominant segment is the standalone RAM market, particularly within the SSD/Datacenters/Workstations end-user segment, driven by the escalating demand for high-performance computing resources in these sectors.

- Dominant Region/Country: North America and Asia-Pacific are the leading regions, with significant contributions from countries like the U.S., China, Japan, and South Korea.

Key Drivers (per segment):

- Embedded (Analog ICs, MCU/SoC/ASIC/ASSPs, In-Memory Computing): Growth is fueled by the increasing adoption of embedded systems across various industries, including automotive, industrial automation, and consumer electronics. Demand for enhanced processing capabilities in embedded applications drives the market.

- Standalone (Fast/Reliable Memory, Code/Data Storage, Low-latency Storage and Persistent Memory): This segment thrives on the high demand for fast and reliable memory in servers, PCs, and other high-performance computing devices. The ongoing need for faster data processing across data centers and high-performance computing fuels this segment's dominance.

- Industrial/IoT/Wearables/Automotive: The substantial growth in the Internet of Things (IoT) and the rising adoption of advanced driver-assistance systems (ADAS) in automobiles are significant drivers in this segment. Miniaturization and low-power consumption requirements drive innovation in this sector.

- SSD/Datacenters/Workstations: This segment benefits significantly from the growing demand for large-scale data storage and processing capabilities in data centers and high-performance computing environments. The continued growth of cloud computing and big data analytics significantly impacts this segment.

RAM Market Product Developments

Recent innovations in RAM technology include advancements in 3D stacking, the introduction of new memory materials, and the development of novel memory architectures designed to improve speed, density, and energy efficiency. These advancements address the increasing need for higher performance and lower power consumption in various applications, giving manufacturers a competitive edge by offering superior products. The focus on improving data retention and reliability also drives product development.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the RAM market, segmented by application (Embedded and Standalone) and end-user (Industrial/IoT/Wearables/Automotive and SSD/Datacenters/Workstations). Each segment's growth projections, market sizes, and competitive dynamics are thoroughly evaluated. The report also incorporates detailed analyses of the leading market players and their strategies. Market size estimates for each segment are provided for the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033).

Key Drivers of RAM Market Growth

Several factors contribute to the RAM market's growth. The increasing adoption of cloud computing, big data analytics, and artificial intelligence generates significant demand for high-performance memory solutions. Technological advancements, such as 3D stacked RAM and new materials, improve speed, density, and power efficiency. The rise of IoT devices and the automotive industry's adoption of advanced driver-assistance systems (ADAS) fuel demand for specialized RAM solutions.

Challenges in the RAM Market Sector

The RAM market faces challenges such as stringent regulatory requirements related to data security and environmental standards, impacting production costs and innovation. Supply chain disruptions can cause component shortages, impacting production capacity and delivery times. Intense competition among established players and emerging companies exerts pressure on profit margins. These factors collectively hinder market growth and present hurdles to industry participants.

Emerging Opportunities in RAM Market

Emerging opportunities exist in specialized RAM applications, such as in-memory computing and neuromorphic computing. The development of new memory technologies, such as resistive RAM (RRAM), offers potential for significant performance improvements and cost reductions. Growing demand for high-bandwidth memory (HBM) in data centers and high-performance computing presents substantial market expansion opportunities. Furthermore, the increasing adoption of RAM in various sectors, including automotive and industrial IoT, creates new market avenues.

Leading Players in the RAM Market Market

- Dialog Semiconductor PLC

- 4DS Memory Limited

- Crossbar Inc

- Xinyuan Semiconductor (Shanghai) Co Ltd

- Fujitsu Semiconductor Memory Solution Limited

- Weebit-Nano Ltd

Key Developments in RAM Market Industry

- January 2022: Fujitsu Semiconductor Memory Solution Limited launched the 8Mbit FRAM MB85RQ8MLX with a Quad SPI interface, marking the highest density in their SPI connection FRAM product line. This increased density addresses the growing demand for higher capacity and improved performance in embedded systems.

- February 2022: Intrinsic Semiconductor Technologies successfully scaled its silicon oxide-based RRAM devices to 50 nm, demonstrating potential for high-performance, low-cost embedded non-volatile memory in advanced logic devices. This development signifies a significant step towards the wider adoption of RRAM technology.

Strategic Outlook for RAM Market Market

The RAM market is poised for substantial growth, driven by the ongoing need for faster, more efficient, and higher-capacity memory solutions. Technological advancements and the expanding adoption of RAM in diverse applications across various industries ensure continued market expansion. Strategic partnerships and mergers and acquisitions will play a crucial role in shaping the future of the RAM market. The focus on energy efficiency, enhanced data security, and the development of new materials and architectures will define the competitive landscape in the coming years.

RAM Market Segmentation

-

1. Application

- 1.1. Embedded

- 1.2. Standalo

-

2. End-user

- 2.1. Industrial/IoT/Wearables/Automotive

- 2.2. SSD/Datacenters/Workstations

RAM Market Segmentation By Geography

- 1. Americas

- 2. Europe

- 3. China

- 4. Japan

- 5. Asia Pacific

RAM Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 29.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Demand for IoT

- 3.2.2 Cloud Computing

- 3.2.3 and Big Data; Surging Demand for Application of Automation Robots

- 3.3. Market Restrains

- 3.3.1. Complexity in Technological Applications

- 3.4. Market Trends

- 3.4.1. Increasing Demand of Connected Devices Under Consumer Electronics Segment is Fueling the Demand for ReRAM

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global RAM Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Embedded

- 5.1.2. Standalo

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Industrial/IoT/Wearables/Automotive

- 5.2.2. SSD/Datacenters/Workstations

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Americas

- 5.3.2. Europe

- 5.3.3. China

- 5.3.4. Japan

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Americas RAM Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Embedded

- 6.1.2. Standalo

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Industrial/IoT/Wearables/Automotive

- 6.2.2. SSD/Datacenters/Workstations

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe RAM Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Embedded

- 7.1.2. Standalo

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Industrial/IoT/Wearables/Automotive

- 7.2.2. SSD/Datacenters/Workstations

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. China RAM Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Embedded

- 8.1.2. Standalo

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Industrial/IoT/Wearables/Automotive

- 8.2.2. SSD/Datacenters/Workstations

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Japan RAM Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Embedded

- 9.1.2. Standalo

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Industrial/IoT/Wearables/Automotive

- 9.2.2. SSD/Datacenters/Workstations

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific RAM Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Embedded

- 10.1.2. Standalo

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Industrial/IoT/Wearables/Automotive

- 10.2.2. SSD/Datacenters/Workstations

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Americas RAM Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe RAM Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. China RAM Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Japan RAM Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Asia Pacific RAM Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Dialog Semiconductor PLC

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 4DS Memory Limited

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Crossbar Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Xinyuan Semiconductor (Shanghai) Co Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Fujitsu Semiconductor Memory Solution Limited

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Weebit-Nano Ltd

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.1 Dialog Semiconductor PLC

List of Figures

- Figure 1: Global RAM Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Americas RAM Market Revenue (Million), by Country 2024 & 2032

- Figure 3: Americas RAM Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe RAM Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe RAM Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: China RAM Market Revenue (Million), by Country 2024 & 2032

- Figure 7: China RAM Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Japan RAM Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Japan RAM Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Asia Pacific RAM Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Asia Pacific RAM Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Americas RAM Market Revenue (Million), by Application 2024 & 2032

- Figure 13: Americas RAM Market Revenue Share (%), by Application 2024 & 2032

- Figure 14: Americas RAM Market Revenue (Million), by End-user 2024 & 2032

- Figure 15: Americas RAM Market Revenue Share (%), by End-user 2024 & 2032

- Figure 16: Americas RAM Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Americas RAM Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe RAM Market Revenue (Million), by Application 2024 & 2032

- Figure 19: Europe RAM Market Revenue Share (%), by Application 2024 & 2032

- Figure 20: Europe RAM Market Revenue (Million), by End-user 2024 & 2032

- Figure 21: Europe RAM Market Revenue Share (%), by End-user 2024 & 2032

- Figure 22: Europe RAM Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe RAM Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: China RAM Market Revenue (Million), by Application 2024 & 2032

- Figure 25: China RAM Market Revenue Share (%), by Application 2024 & 2032

- Figure 26: China RAM Market Revenue (Million), by End-user 2024 & 2032

- Figure 27: China RAM Market Revenue Share (%), by End-user 2024 & 2032

- Figure 28: China RAM Market Revenue (Million), by Country 2024 & 2032

- Figure 29: China RAM Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Japan RAM Market Revenue (Million), by Application 2024 & 2032

- Figure 31: Japan RAM Market Revenue Share (%), by Application 2024 & 2032

- Figure 32: Japan RAM Market Revenue (Million), by End-user 2024 & 2032

- Figure 33: Japan RAM Market Revenue Share (%), by End-user 2024 & 2032

- Figure 34: Japan RAM Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Japan RAM Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific RAM Market Revenue (Million), by Application 2024 & 2032

- Figure 37: Asia Pacific RAM Market Revenue Share (%), by Application 2024 & 2032

- Figure 38: Asia Pacific RAM Market Revenue (Million), by End-user 2024 & 2032

- Figure 39: Asia Pacific RAM Market Revenue Share (%), by End-user 2024 & 2032

- Figure 40: Asia Pacific RAM Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Asia Pacific RAM Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global RAM Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global RAM Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global RAM Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 4: Global RAM Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global RAM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: RAM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global RAM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: RAM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global RAM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: RAM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global RAM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: RAM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global RAM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: RAM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global RAM Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Global RAM Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 17: Global RAM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global RAM Market Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Global RAM Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 20: Global RAM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global RAM Market Revenue Million Forecast, by Application 2019 & 2032

- Table 22: Global RAM Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 23: Global RAM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global RAM Market Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global RAM Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 26: Global RAM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global RAM Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Global RAM Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 29: Global RAM Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the RAM Market?

The projected CAGR is approximately 29.90%.

2. Which companies are prominent players in the RAM Market?

Key companies in the market include Dialog Semiconductor PLC, 4DS Memory Limited, Crossbar Inc, Xinyuan Semiconductor (Shanghai) Co Ltd , Fujitsu Semiconductor Memory Solution Limited, Weebit-Nano Ltd.

3. What are the main segments of the RAM Market?

The market segments include Application, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for IoT. Cloud Computing. and Big Data; Surging Demand for Application of Automation Robots.

6. What are the notable trends driving market growth?

Increasing Demand of Connected Devices Under Consumer Electronics Segment is Fueling the Demand for ReRAM.

7. Are there any restraints impacting market growth?

Complexity in Technological Applications.

8. Can you provide examples of recent developments in the market?

February 2022: Intrinsic Semiconductor Technologies stated that it had successfully scaled its silicon oxide-based resistive random access memory devices (RRAM). They demonstrated electrical performance characteristics, which may enable their use as high-performance, low-cost, embedded, non-volatile memory in logic devices at advanced processing nodes. The company's RRAM devices have been scaled to dimensions of 50 nm. The company said the devices had demonstrated excellent switching behavior, which is key to their use as the next generation of non-volatile, solid-state memory.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "RAM Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the RAM Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the RAM Market?

To stay informed about further developments, trends, and reports in the RAM Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence