Key Insights

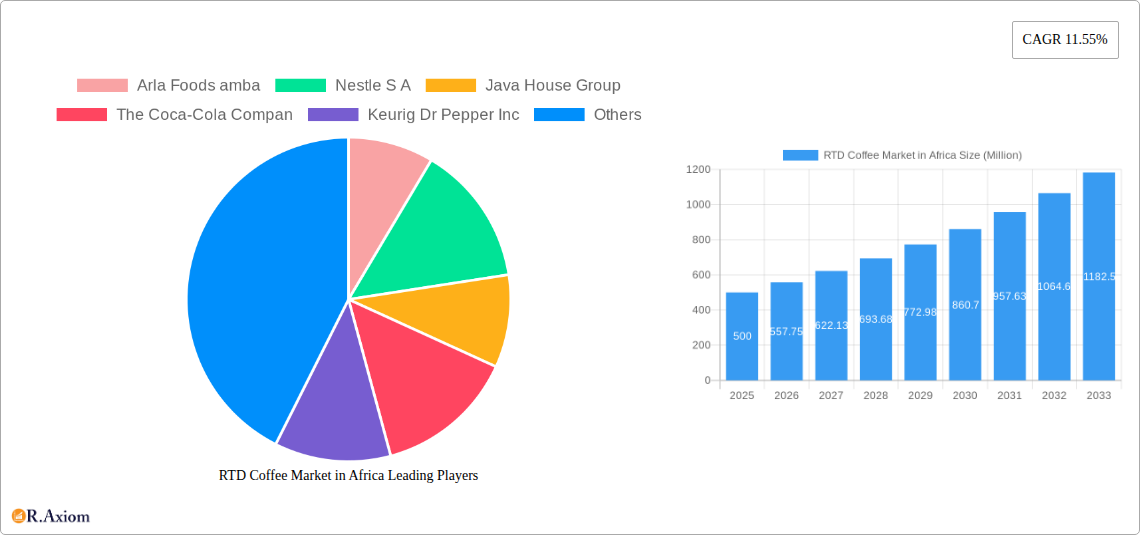

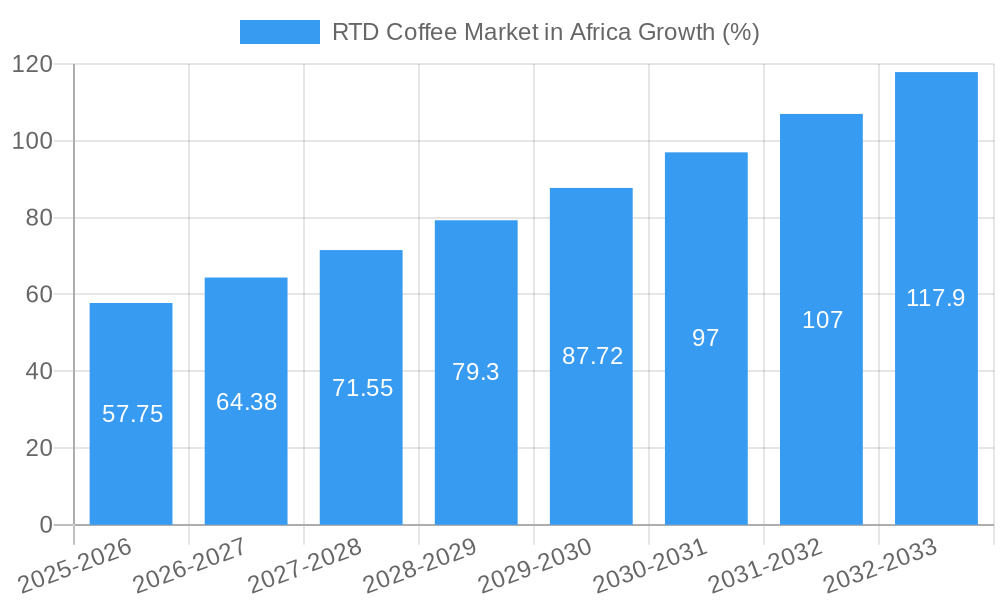

The Ready-to-Drink (RTD) coffee market in Africa is experiencing robust growth, projected to expand significantly over the forecast period (2025-2033). Driven by increasing urbanization, rising disposable incomes, and a growing preference for convenient and on-the-go beverage options, the market is poised for considerable expansion. The strong CAGR of 11.55% indicates a high level of consumer adoption of RTD coffee, particularly amongst younger demographics. Key segments driving this growth include cold brew coffee and iced coffee, reflecting the region's warm climate and preference for refreshing beverages. The packaging type segment is witnessing a shift towards convenient and sustainable options like PET bottles, reflecting evolving consumer preferences and environmental concerns. Major players like Nestle S.A., The Coca-Cola Company, and regional brands are actively investing in product innovation and distribution networks to capitalize on this burgeoning market. The on-trade channel (cafes, restaurants) plays a significant role, though the off-trade channel (supermarkets, convenience stores) is expanding rapidly due to increased accessibility. While challenges such as fluctuating raw material prices and competition from traditional coffee consumption methods exist, the overall growth trajectory remains positive.

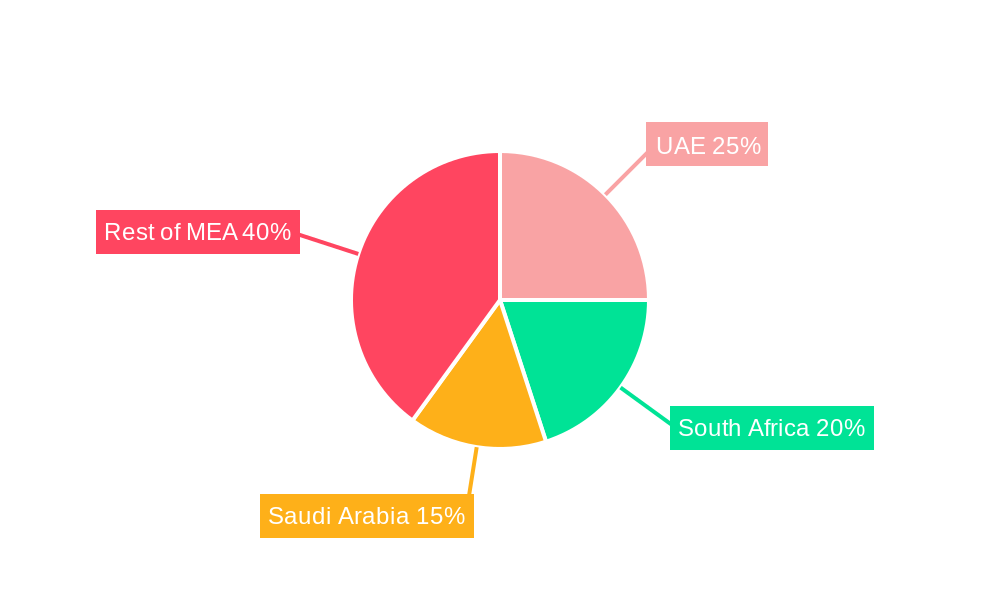

The Middle East and Africa region, particularly countries like the UAE, South Africa, and Saudi Arabia, are key contributors to the RTD coffee market's expansion. These countries exhibit characteristics that align with the market's drivers, namely high population density in urban areas, strong consumer spending power, and a burgeoning cafe culture. The competitive landscape involves both international giants and local players, leading to a dynamic market with a focus on product differentiation and targeted marketing strategies. The future growth is likely to be influenced by factors like further infrastructure development improving distribution reach, increasing health consciousness impacting product formulations, and the adoption of innovative packaging solutions to enhance shelf life and reduce environmental impact. The market's ongoing evolution presents lucrative opportunities for both established players and new entrants, making it a compelling area for investment and growth.

RTD Coffee Market in Africa: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Ready-to-Drink (RTD) Coffee market in Africa, covering the period 2019-2033. It offers invaluable insights for industry stakeholders, including manufacturers, distributors, investors, and market entrants, seeking to navigate this dynamic and rapidly growing market. The report leverages extensive data analysis, incorporating historical trends (2019-2024), current market estimations (2025), and future forecasts (2025-2033) to provide a 360-degree view of the RTD coffee landscape in Africa. Key players such as Arla Foods amba, Nestlé S.A., Java House Group, The Coca-Cola Company, Keurig Dr Pepper Inc., and King Car Group are analyzed in detail.

RTD Coffee Market in Africa: Market Concentration & Innovation

This section analyzes the competitive landscape of the African RTD coffee market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The market exhibits a moderate level of concentration, with a few major players holding significant market share, although numerous smaller, regional players also contribute significantly. Market share data for key players will be presented, based on revenue figures for the base year (2025). xx% of the market is currently held by the top 5 players, indicating room for both growth and increased competition.

- Innovation Drivers: The increasing demand for convenient and high-quality coffee options is driving innovation in RTD coffee formats, flavors, and packaging. Sustainable sourcing practices and functional coffee drinks enriched with health benefits are also becoming increasingly important drivers.

- Regulatory Frameworks: Variations in regulations across African nations influence market entry and operational costs. The report analyzes the impact of these regulations on market dynamics.

- Product Substitutes: Other beverages, such as tea, juice, and energy drinks, represent key substitutes for RTD coffee. The report assesses the competitive threat posed by these substitutes.

- End-User Trends: The growing urban population and rising disposable incomes are boosting demand for premium and convenient RTD coffee options. This section will incorporate data on consumer preferences, including flavor profiles and preferred packaging types.

- M&A Activities: The report analyzes recent merger and acquisition activities within the African RTD coffee market, assessing their impact on market consolidation and competitiveness. While precise M&A deal values are difficult to obtain for all transactions, the report will attempt to include available data and estimates where possible.

RTD Coffee Market in Africa: Industry Trends & Insights

This section delves into the key trends shaping the African RTD coffee market. The market demonstrates a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by several factors. Market penetration of RTD coffee is currently at xx%, indicating significant untapped potential for growth.

The rising popularity of cold brew coffee and the increasing adoption of innovative packaging solutions are key growth catalysts. Consumer preferences are evolving towards healthier and more sustainable options, creating opportunities for RTD coffee producers. Competition is intensifying as both established players and new entrants vie for market share. The report will analyze the competitive dynamics through a Porter's Five Forces analysis, providing an in-depth perspective on the current market landscape and predicting future market behavior.

Dominant Markets & Segments in RTD Coffee Market in Africa

This section identifies the leading regions, countries, and segments within the African RTD coffee market. While precise market dominance may shift year to year, initial analysis indicates that [Country Name] is currently the leading market, driven by high per capita consumption and robust economic growth.

- Distribution Channel:

- Off-trade: Supermarkets, convenience stores, and online retailers dominate the off-trade channel. Growth is fueled by expanding retail infrastructure and the increasing preference for at-home consumption.

- On-trade: Cafes, restaurants, and hotels are significant players in the on-trade channel. The growth here will depend on tourism numbers and economic trends.

- Soft Drink Type:

- Cold Brew Coffee: This segment is experiencing rapid growth due to its perceived health benefits and unique taste profile.

- Iced Coffee: This established segment maintains a strong presence, with continuing growth predicted.

- Other RTD Coffee: This category encompasses a variety of options, including flavored coffee and functional coffee drinks.

- Packaging Type:

- PET Bottles: PET bottles are highly popular due to their affordability and recyclability.

- Metal Cans: Metal cans offer excellent product protection and shelf life.

- Aseptic Packages: Aseptic packaging is increasingly adopted for its extended shelf life and ability to preserve freshness.

- Key Drivers: The growth of these segments is primarily driven by factors such as urbanization, rising disposable incomes, increasing preference for convenience, and improved cold chain infrastructure.

RTD Coffee Market in Africa: Product Developments

Recent innovations in the African RTD coffee market include the introduction of cold brew coffee, plant-based options, and functional coffee drinks fortified with vitamins and minerals. This reflects growing consumer demand for healthier, more sustainable, and flavorful beverage options. Technological advancements in packaging, such as the adoption of sustainable materials and improved preservation techniques, are also playing a crucial role in product development. The market is witnessing a shift towards premiumization, with the launch of specialty coffee products catering to discerning consumers.

Report Scope & Segmentation Analysis

This report segments the African RTD coffee market based on distribution channel (off-trade and on-trade), soft drink type (cold brew coffee, iced coffee, and other RTD coffee), and packaging type (aseptic packages, glass bottles, metal cans, PET bottles, and others). Each segment's growth trajectory, market size, and competitive dynamics are analyzed, providing a granular understanding of the market's structure. Growth projections are provided for each segment for the forecast period (2025-2033), outlining their expected contribution to overall market expansion. The report quantifies the market size of each segment in Million USD for both the base year and the forecast period.

Key Drivers of RTD Coffee Market in Africa Growth

Several factors contribute to the growth of the African RTD coffee market. These include:

- Rising Disposable Incomes: Increased disposable incomes in urban areas fuel demand for premium beverage options.

- Urbanization: Rapid urbanization leads to a larger target market for convenient ready-to-drink products.

- Changing Lifestyle: Busy lifestyles increase demand for convenient coffee alternatives.

- Technological Advancements: Improvements in packaging and processing technology enhance product quality and shelf life.

- Favorable Government Policies: Policies promoting domestic industries and supporting investments in agriculture and food processing can have positive effects.

Challenges in the RTD Coffee Market in Africa Sector

Despite significant growth potential, the African RTD coffee market faces several challenges:

- Infrastructure Limitations: Inadequate cold chain infrastructure poses significant challenges for product preservation and distribution. This results in an estimated xx Million USD loss annually.

- Supply Chain Disruptions: Volatility in raw material prices and supply chain disruptions can impact production costs and availability.

- Regulatory Hurdles: Navigating varied regulatory frameworks across African nations adds complexity for market entry.

- Competition: Intense competition from established beverage players and new entrants requires continuous innovation and strategic adjustments.

Emerging Opportunities in RTD Coffee Market in Africa

Despite challenges, promising opportunities exist within the RTD coffee market in Africa:

- Expansion into Rural Markets: Significant growth potential exists in expanding reach beyond urban centers.

- E-commerce Growth: Online channels provide new avenues for product distribution and brand building.

- Premiumization: There is significant demand for premium and specialized RTD coffee products.

- Sustainable Sourcing and Production: Consumers are increasingly conscious of sustainability.

Leading Players in the RTD Coffee Market in Africa Market

- Arla Foods amba

- Nestle S.A.

- Java House Group

- The Coca-Cola Company

- Keurig Dr Pepper Inc.

- King Car Group

Key Developments in RTD Coffee Market in Africa Industry

- December 2023: Costa Coffee plans to launch five new outlets in Morocco (USD xx Million investment).

- August 2023: Java House launched its cold brew coffee, a collaboration with KEVIAN and Bio Food Products Ltd.

- January 2023: Goldex Morocco opened a second Costa Coffee store in Casablanca, with plans for further expansion in 2024 and beyond.

Strategic Outlook for RTD Coffee Market in Africa Market

The RTD coffee market in Africa holds significant growth potential fueled by rising incomes, urbanization, and evolving consumer preferences. Strategic partnerships, innovative product development, and effective distribution strategies will be crucial for success. Focusing on sustainable sourcing, premiumization, and addressing infrastructural challenges will unlock even greater opportunities for market expansion and capture of market share in this dynamic sector. The projected CAGR of xx% over the forecast period underscores this market's exceptional growth prospects.

RTD Coffee Market in Africa Segmentation

-

1. Soft Drink Type

- 1.1. Cold Brew Coffee

- 1.2. Iced coffee

- 1.3. Other RTD Coffee

-

2. Packaging Type

- 2.1. Aseptic packages

- 2.2. Glass Bottles

- 2.3. Metal Can

- 2.4. PET Bottles

-

3. Distribution Channel

-

3.1. Off-trade

- 3.1.1. Convenience Stores

- 3.1.2. Online Retail

- 3.1.3. Specialty Stores

- 3.1.4. Supermarket/Hypermarket

- 3.1.5. Others

- 3.2. On-trade

-

3.1. Off-trade

RTD Coffee Market in Africa Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

RTD Coffee Market in Africa REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global RTD Coffee Market in Africa Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 5.1.1. Cold Brew Coffee

- 5.1.2. Iced coffee

- 5.1.3. Other RTD Coffee

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Aseptic packages

- 5.2.2. Glass Bottles

- 5.2.3. Metal Can

- 5.2.4. PET Bottles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Off-trade

- 5.3.1.1. Convenience Stores

- 5.3.1.2. Online Retail

- 5.3.1.3. Specialty Stores

- 5.3.1.4. Supermarket/Hypermarket

- 5.3.1.5. Others

- 5.3.2. On-trade

- 5.3.1. Off-trade

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6. North America RTD Coffee Market in Africa Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6.1.1. Cold Brew Coffee

- 6.1.2. Iced coffee

- 6.1.3. Other RTD Coffee

- 6.2. Market Analysis, Insights and Forecast - by Packaging Type

- 6.2.1. Aseptic packages

- 6.2.2. Glass Bottles

- 6.2.3. Metal Can

- 6.2.4. PET Bottles

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Off-trade

- 6.3.1.1. Convenience Stores

- 6.3.1.2. Online Retail

- 6.3.1.3. Specialty Stores

- 6.3.1.4. Supermarket/Hypermarket

- 6.3.1.5. Others

- 6.3.2. On-trade

- 6.3.1. Off-trade

- 6.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 7. South America RTD Coffee Market in Africa Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 7.1.1. Cold Brew Coffee

- 7.1.2. Iced coffee

- 7.1.3. Other RTD Coffee

- 7.2. Market Analysis, Insights and Forecast - by Packaging Type

- 7.2.1. Aseptic packages

- 7.2.2. Glass Bottles

- 7.2.3. Metal Can

- 7.2.4. PET Bottles

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Off-trade

- 7.3.1.1. Convenience Stores

- 7.3.1.2. Online Retail

- 7.3.1.3. Specialty Stores

- 7.3.1.4. Supermarket/Hypermarket

- 7.3.1.5. Others

- 7.3.2. On-trade

- 7.3.1. Off-trade

- 7.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 8. Europe RTD Coffee Market in Africa Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 8.1.1. Cold Brew Coffee

- 8.1.2. Iced coffee

- 8.1.3. Other RTD Coffee

- 8.2. Market Analysis, Insights and Forecast - by Packaging Type

- 8.2.1. Aseptic packages

- 8.2.2. Glass Bottles

- 8.2.3. Metal Can

- 8.2.4. PET Bottles

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Off-trade

- 8.3.1.1. Convenience Stores

- 8.3.1.2. Online Retail

- 8.3.1.3. Specialty Stores

- 8.3.1.4. Supermarket/Hypermarket

- 8.3.1.5. Others

- 8.3.2. On-trade

- 8.3.1. Off-trade

- 8.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 9. Middle East & Africa RTD Coffee Market in Africa Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 9.1.1. Cold Brew Coffee

- 9.1.2. Iced coffee

- 9.1.3. Other RTD Coffee

- 9.2. Market Analysis, Insights and Forecast - by Packaging Type

- 9.2.1. Aseptic packages

- 9.2.2. Glass Bottles

- 9.2.3. Metal Can

- 9.2.4. PET Bottles

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Off-trade

- 9.3.1.1. Convenience Stores

- 9.3.1.2. Online Retail

- 9.3.1.3. Specialty Stores

- 9.3.1.4. Supermarket/Hypermarket

- 9.3.1.5. Others

- 9.3.2. On-trade

- 9.3.1. Off-trade

- 9.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 10. Asia Pacific RTD Coffee Market in Africa Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 10.1.1. Cold Brew Coffee

- 10.1.2. Iced coffee

- 10.1.3. Other RTD Coffee

- 10.2. Market Analysis, Insights and Forecast - by Packaging Type

- 10.2.1. Aseptic packages

- 10.2.2. Glass Bottles

- 10.2.3. Metal Can

- 10.2.4. PET Bottles

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Off-trade

- 10.3.1.1. Convenience Stores

- 10.3.1.2. Online Retail

- 10.3.1.3. Specialty Stores

- 10.3.1.4. Supermarket/Hypermarket

- 10.3.1.5. Others

- 10.3.2. On-trade

- 10.3.1. Off-trade

- 10.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 11. UAE RTD Coffee Market in Africa Analysis, Insights and Forecast, 2019-2031

- 12. South Africa RTD Coffee Market in Africa Analysis, Insights and Forecast, 2019-2031

- 13. Saudi Arabia RTD Coffee Market in Africa Analysis, Insights and Forecast, 2019-2031

- 14. Rest of MEA RTD Coffee Market in Africa Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Arla Foods amba

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Nestle S A

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Java House Group

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 The Coca-Cola Compan

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Keurig Dr Pepper Inc

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 King Car Group

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.1 Arla Foods amba

List of Figures

- Figure 1: Global RTD Coffee Market in Africa Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Middle East & Africa RTD Coffee Market in Africa Revenue (Million), by Country 2024 & 2032

- Figure 3: Middle East & Africa RTD Coffee Market in Africa Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America RTD Coffee Market in Africa Revenue (Million), by Soft Drink Type 2024 & 2032

- Figure 5: North America RTD Coffee Market in Africa Revenue Share (%), by Soft Drink Type 2024 & 2032

- Figure 6: North America RTD Coffee Market in Africa Revenue (Million), by Packaging Type 2024 & 2032

- Figure 7: North America RTD Coffee Market in Africa Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 8: North America RTD Coffee Market in Africa Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 9: North America RTD Coffee Market in Africa Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 10: North America RTD Coffee Market in Africa Revenue (Million), by Country 2024 & 2032

- Figure 11: North America RTD Coffee Market in Africa Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America RTD Coffee Market in Africa Revenue (Million), by Soft Drink Type 2024 & 2032

- Figure 13: South America RTD Coffee Market in Africa Revenue Share (%), by Soft Drink Type 2024 & 2032

- Figure 14: South America RTD Coffee Market in Africa Revenue (Million), by Packaging Type 2024 & 2032

- Figure 15: South America RTD Coffee Market in Africa Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 16: South America RTD Coffee Market in Africa Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 17: South America RTD Coffee Market in Africa Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 18: South America RTD Coffee Market in Africa Revenue (Million), by Country 2024 & 2032

- Figure 19: South America RTD Coffee Market in Africa Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe RTD Coffee Market in Africa Revenue (Million), by Soft Drink Type 2024 & 2032

- Figure 21: Europe RTD Coffee Market in Africa Revenue Share (%), by Soft Drink Type 2024 & 2032

- Figure 22: Europe RTD Coffee Market in Africa Revenue (Million), by Packaging Type 2024 & 2032

- Figure 23: Europe RTD Coffee Market in Africa Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 24: Europe RTD Coffee Market in Africa Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: Europe RTD Coffee Market in Africa Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: Europe RTD Coffee Market in Africa Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe RTD Coffee Market in Africa Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa RTD Coffee Market in Africa Revenue (Million), by Soft Drink Type 2024 & 2032

- Figure 29: Middle East & Africa RTD Coffee Market in Africa Revenue Share (%), by Soft Drink Type 2024 & 2032

- Figure 30: Middle East & Africa RTD Coffee Market in Africa Revenue (Million), by Packaging Type 2024 & 2032

- Figure 31: Middle East & Africa RTD Coffee Market in Africa Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 32: Middle East & Africa RTD Coffee Market in Africa Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 33: Middle East & Africa RTD Coffee Market in Africa Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 34: Middle East & Africa RTD Coffee Market in Africa Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa RTD Coffee Market in Africa Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific RTD Coffee Market in Africa Revenue (Million), by Soft Drink Type 2024 & 2032

- Figure 37: Asia Pacific RTD Coffee Market in Africa Revenue Share (%), by Soft Drink Type 2024 & 2032

- Figure 38: Asia Pacific RTD Coffee Market in Africa Revenue (Million), by Packaging Type 2024 & 2032

- Figure 39: Asia Pacific RTD Coffee Market in Africa Revenue Share (%), by Packaging Type 2024 & 2032

- Figure 40: Asia Pacific RTD Coffee Market in Africa Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 41: Asia Pacific RTD Coffee Market in Africa Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 42: Asia Pacific RTD Coffee Market in Africa Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific RTD Coffee Market in Africa Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global RTD Coffee Market in Africa Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global RTD Coffee Market in Africa Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 3: Global RTD Coffee Market in Africa Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 4: Global RTD Coffee Market in Africa Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Global RTD Coffee Market in Africa Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global RTD Coffee Market in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 7: UAE RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Africa RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Saudi Arabia RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of MEA RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global RTD Coffee Market in Africa Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 12: Global RTD Coffee Market in Africa Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 13: Global RTD Coffee Market in Africa Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: Global RTD Coffee Market in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global RTD Coffee Market in Africa Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 19: Global RTD Coffee Market in Africa Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 20: Global RTD Coffee Market in Africa Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 21: Global RTD Coffee Market in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Brazil RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Argentina RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of South America RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global RTD Coffee Market in Africa Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 26: Global RTD Coffee Market in Africa Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 27: Global RTD Coffee Market in Africa Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: Global RTD Coffee Market in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United Kingdom RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Germany RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: France RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Italy RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Spain RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Russia RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Benelux RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Nordics RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Europe RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global RTD Coffee Market in Africa Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 39: Global RTD Coffee Market in Africa Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 40: Global RTD Coffee Market in Africa Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 41: Global RTD Coffee Market in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Turkey RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Israel RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: GCC RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: North Africa RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: South Africa RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Middle East & Africa RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global RTD Coffee Market in Africa Revenue Million Forecast, by Soft Drink Type 2019 & 2032

- Table 49: Global RTD Coffee Market in Africa Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 50: Global RTD Coffee Market in Africa Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 51: Global RTD Coffee Market in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 52: China RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: India RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Japan RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: South Korea RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: ASEAN RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Oceania RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Asia Pacific RTD Coffee Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the RTD Coffee Market in Africa?

The projected CAGR is approximately 11.55%.

2. Which companies are prominent players in the RTD Coffee Market in Africa?

Key companies in the market include Arla Foods amba, Nestle S A, Java House Group, The Coca-Cola Compan, Keurig Dr Pepper Inc, King Car Group.

3. What are the main segments of the RTD Coffee Market in Africa?

The market segments include Soft Drink Type, Packaging Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

December 2023: Costa Coffee’s Moroccan franchisee Goldex Morocco has planned to launch five new outlets in Morocco by the end of Q3 2023 at a cost of USD m. Two will be in Casablanca, two in Rabat and the final outlet will be opened in Bouskoura.August 2023: Java House has launched its latest innovation, cold brew coffee, a ready-to-drink made from 100% Kenyan Arabica coffee beans.The innovation was a collaboration between Java House; KEVIAN, manufacturer of Afia and Pick n Peel fruit juices, and dairy processor Bio Food Products Ltd.January 2023: Goldex Morocco, part of UK-based Goldex Investments Group, opened a second Costa Coffee store in Casablanca in May 2023. Goldex Investments Group further plans to open six or seven more outlets in 2024, probably in Casablanca, Rabat, Tangier, and Agadir. It aims to have opened 30 to 40 cafes within the next five years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "RTD Coffee Market in Africa," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the RTD Coffee Market in Africa report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the RTD Coffee Market in Africa?

To stay informed about further developments, trends, and reports in the RTD Coffee Market in Africa, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence