Key Insights

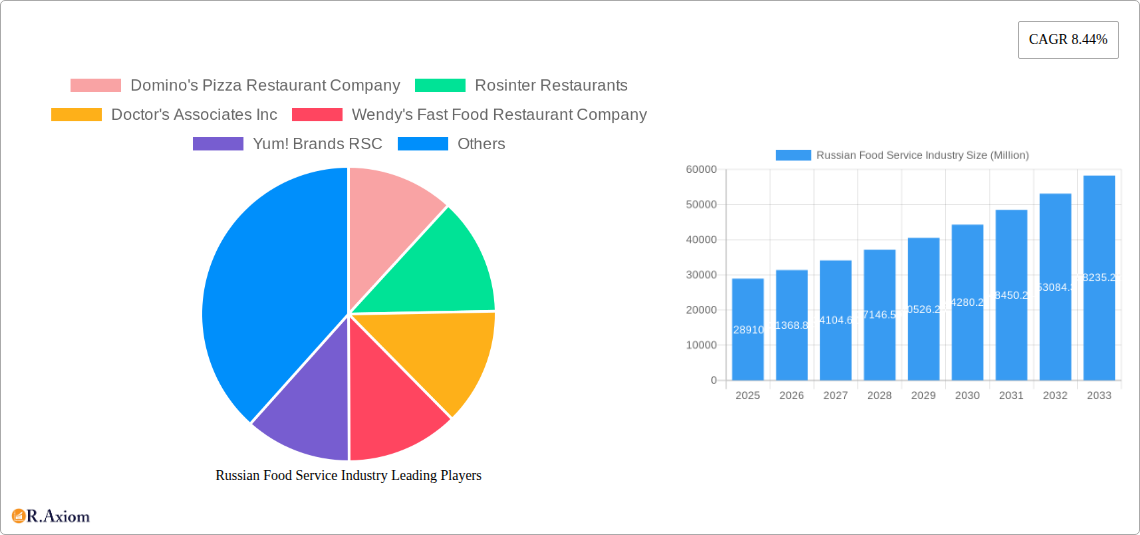

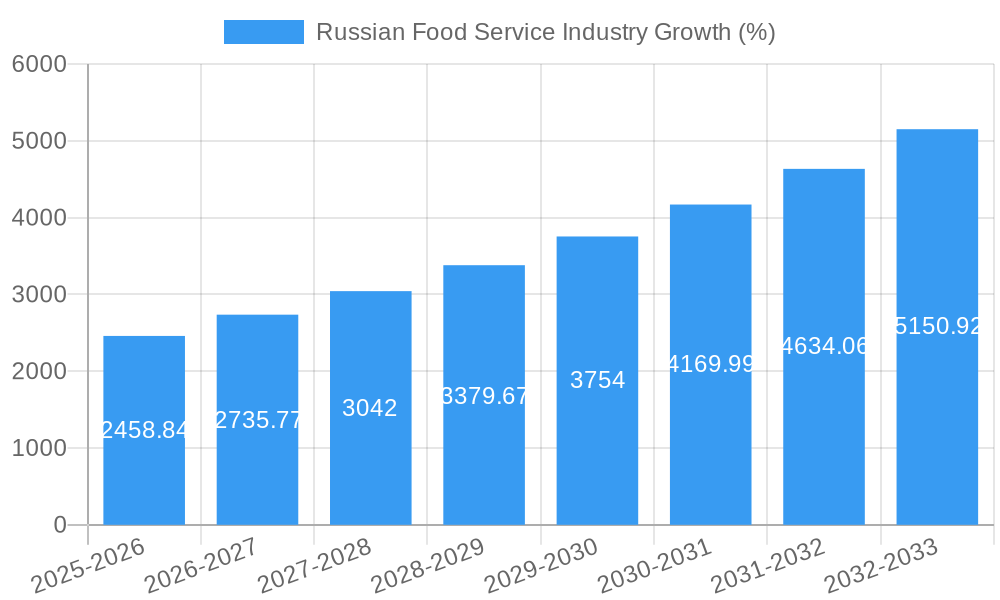

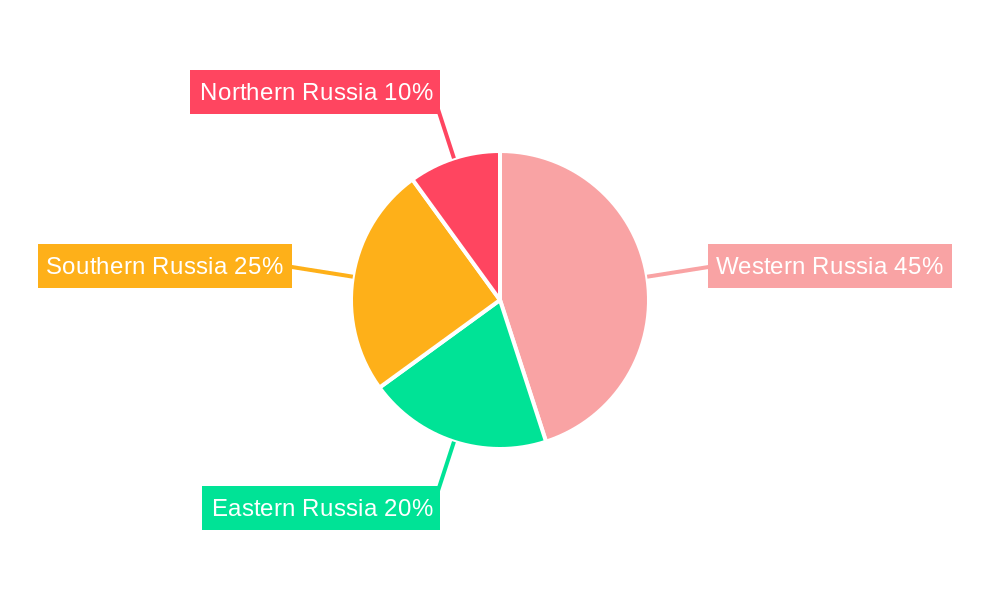

The Russian food service industry, valued at $28.91 billion in 2025, is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of 8.44% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes, particularly within urban centers, are empowering consumers to spend more on dining out. The burgeoning popularity of quick-service restaurants (QSRs) and delivery services caters to increasingly busy lifestyles and evolving consumer preferences for convenience. Furthermore, the diversification of culinary offerings, incorporating both traditional Russian cuisine and international trends, is attracting a wider customer base. However, the industry faces challenges including economic volatility, fluctuating food prices, and intense competition among established chains and independent players. Successful operators are adapting by enhancing their digital presence, leveraging technology for efficient operations (e.g., online ordering systems, delivery apps), and focusing on value-for-money propositions to navigate economic uncertainties. The market segmentation reveals a diverse landscape. Chained consumer foodservice establishments, like Domino's and Rosinter, hold significant market share, competing alongside independent restaurants and smaller food vendors, including street stalls and cafes. Regional variations exist, with Western Russia potentially exhibiting higher growth rates due to higher population density and purchasing power. The forecast period suggests a continuous expansion, with increasing market penetration of delivery-only services and a potential shift towards healthier, more sustainable food choices influencing menu development and marketing strategies.

The industry's success will hinge on adaptability and innovation. Companies are prioritizing customer experience, loyalty programs, and brand building to gain a competitive edge. Expansion into smaller cities and towns, coupled with the development of specialized foodservice segments, such as gourmet food halls or ethnic cuisine establishments, present lucrative opportunities. The ongoing geopolitical situation and potential sanctions may create uncertainty, but the fundamental drivers of growth – rising incomes and changing consumer preferences – remain robust. Understanding regional nuances and consumer preferences is crucial for success within this dynamic market. The continued adoption of technology and a focus on efficiency will be vital for operators to achieve profitability and sustained growth throughout the forecast period.

Russian Food Service Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Russian food service industry, covering market size, segmentation, key players, and future growth prospects from 2019 to 2033. The report leverages robust data and insightful analysis to offer actionable intelligence for stakeholders across the industry. With a base year of 2025 and an estimated year of 2025, this report forecasts market trends through 2033, using historical data from 2019-2024. The report explores the impact of significant events, including the rebranding of McDonald's to Vkusno & Tochka and Starbucks to Stars Coffee. The total market size is estimated at XX Million for 2025.

Russian Food Service Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the Russian food service industry, focusing on market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. The Russian food service market exhibits a blend of both established international chains and burgeoning domestic players. Market share is concentrated among the largest chains, especially in the Quick-Service Restaurant (QSR) segment. However, the independent segment remains a significant contributor to the overall market volume.

- Market Concentration: The top 5 players account for approximately XX% of the market share in 2025. This concentration is higher in the chained consumer foodservice segment compared to the independent segment.

- Innovation Drivers: Consumer demand for diverse cuisines, healthier options, and convenient delivery services are driving innovation. Technological advancements in food preparation, ordering, and delivery systems also play a vital role.

- Regulatory Framework: Government regulations concerning food safety, hygiene, and labor standards significantly impact industry operations. Changes in import/export regulations and taxation also affect pricing and profitability.

- Product Substitutes: The rise of home-cooking and meal kit delivery services presents a growing substitute to the traditional food service industry. The increasing affordability of groceries also competes with lower-priced food service options.

- End-User Trends: The younger generation demonstrates a preference for convenient and diverse food options, including international cuisines and healthier choices. This trend drives innovation in menu offerings and service models.

- M&A Activities: The past five years have witnessed significant M&A activity, with deal values exceeding XX Million. These transactions reflect consolidation in the market and a push for expansion by larger players.

Russian Food Service Industry Industry Trends & Insights

This section delves into the overarching trends shaping the Russian food service industry, examining market growth drivers, technological disruptions, evolving consumer preferences, and competitive dynamics. The industry experienced a period of significant disruption following the geopolitical changes in 2022.

The market demonstrates a compound annual growth rate (CAGR) of XX% during the forecast period (2025-2033). Market penetration of various segments is showing varied growth trajectories. Quick-service restaurants, for example, are expected to experience higher market penetration compared to full-service restaurants due to their affordability and convenience. Technological disruptions, like online ordering and delivery platforms, have significantly altered consumer behavior, increasing the demand for convenience. Consumer preferences have shifted towards healthier options, international cuisines, and personalized experiences. This necessitates ongoing menu innovation and personalized service offerings. Intense competition among established and new entrants, including the rise of local brands post-2022, creates a dynamic market landscape characterized by constant innovation and adaptation.

Dominant Markets & Segments in Russian Food Service Industry

This section identifies the leading regions and segments within the Russian food service industry, analyzing their dominance based on various factors.

Leading Region: Moscow and St. Petersburg represent the most dominant markets due to higher population density, disposable income, and developed infrastructure. However, other major cities are also showing significant growth.

Dominant Segments:

- Chained Consumer Foodservice: This segment holds a larger market share compared to the independent segment, largely driven by established international and domestic chains offering economies of scale and brand recognition.

- Quick-Service Restaurants (QSRs): QSRs are the most dominant type due to affordability, convenience, and widespread presence.

- Cafés and Bars: Cafés and bars contribute significantly to the market, particularly in urban areas, catering to specific consumer needs for social interaction and beverage consumption.

Key Drivers of Dominance:

- Economic policies: Government initiatives supporting the food service sector, including tax incentives and infrastructure development, contribute to the industry's growth.

- Infrastructure: Developed transportation networks and communication infrastructure facilitate efficient food delivery and logistics, supporting growth.

- Consumer preferences: Changing tastes and increasing demand for convenient dining options influence segment dominance.

Russian Food Service Industry Product Developments

Recent product innovations include the introduction of healthier menu options, personalized meal customization, and the expansion of delivery services. Technological advancements like AI-powered ordering systems and automated kitchens are improving efficiency and customer experience. These innovations enhance the competitiveness of food service providers by catering to the evolving needs and preferences of consumers. The successful integration of these innovations significantly impacts market penetration and customer loyalty.

Report Scope & Segmentation Analysis

This report segments the Russian food service market by structure (Independent Consumer Foodservice, Chained Consumer Foodservice) and type (Full-Service Restaurants, Quick-Service Restaurants, Street Stalls and Kiosks, Cafés and Bars, 100% Home Delivery Restaurants). Each segment shows varying growth trajectories based on factors such as economic conditions, consumer preferences, and technological advancements. Market size estimates and competitive dynamics are analyzed for each segment. For example, the QSR segment is projected to experience faster growth than full-service restaurants. The independent segment, while significant in volume, faces challenges in competing with the economies of scale offered by larger chains.

Key Drivers of Russian Food Service Industry Growth

Several factors contribute to the growth of the Russian food service industry. These include technological advancements in food preparation, order management, and delivery systems; rising disposable incomes and changing consumer preferences favoring convenience and diverse cuisines; and government initiatives to support the sector through infrastructure development and tax incentives. The increasing popularity of online food ordering and delivery platforms has also been a crucial growth driver.

Challenges in the Russian Food Service Industry Sector

The Russian food service industry faces challenges such as volatile economic conditions influencing consumer spending; supply chain disruptions affecting ingredient availability and costs; and intense competition among both established and new entrants. Import restrictions and fluctuations in the ruble's exchange rate add further complexity. These challenges impact profitability and operational efficiency. The estimated impact of these factors on market growth is approximately XX% in 2025.

Emerging Opportunities in Russian Food Service Industry

Emerging opportunities lie in the expansion of delivery services to underserved areas; the growing demand for healthier and customizable menu options; and the adoption of innovative technologies to enhance efficiency and customer experience. The increasing popularity of cloud kitchens also presents a significant opportunity for growth. Furthermore, the rise of ghost kitchens and dark stores is expected to change the landscape of the industry.

Leading Players in the Russian Food Service Industry Market

- Domino's Pizza Restaurant Company

- Rosinter Restaurants

- Doctor's Associates Inc

- Wendy's Fast Food Restaurant Company

- Yum! Brands RSC

- Papa John's Pizza

- Restaurant Brands International Inc

- Vkusno & Tochka

- Teremok

- Stars Coffee

Key Developments in Russian Food Service Industry Industry

- February 2022: Shell Cafe opened a new café in Moscow, expanding its coffee and snack offerings.

- June 2022: Vkusno & Tochka launched, rebranding former McDonald's locations nationwide. This significantly altered the QSR market landscape.

- August 2022: Stars Coffee launched, replacing Starbucks in Russia. This change altered the coffee shop market share.

Strategic Outlook for Russian Food Service Industry Market

The Russian food service industry is poised for continued growth, driven by evolving consumer preferences, technological advancements, and government initiatives. The market's resilience in the face of recent geopolitical challenges demonstrates its potential for long-term growth. The focus on innovation, customer experience, and efficient operations will be crucial for success in this dynamic market. The forecast indicates a positive outlook, with potential for further market expansion and increased investor interest.

Russian Food Service Industry Segmentation

-

1. Type

- 1.1. Full-Service Restaurants

- 1.2. Quick-Service Restaurants

- 1.3. Street Stalls and Kiosks

- 1.4. Cafés and Bars

- 1.5. 100% Home Delivery Restaurants

-

2. Structure

- 2.1. Independent Consumer Foodservice

- 2.2. Chained Consumer Foodservice

Russian Food Service Industry Segmentation By Geography

- 1. Russia

Russian Food Service Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.44% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The expansion of the middle class in Russia has led to increased disposable incomes

- 3.2.2 which in turn fuels spending on dining out

- 3.2.3 especially in casual and premium dining segments

- 3.3. Market Restrains

- 3.3.1 The Russian food service industry is subject to strict regulations

- 3.3.2 particularly concerning food safety

- 3.3.3 labor laws

- 3.3.4 and taxation

- 3.3.5 which can be burdensome for operators.

- 3.4. Market Trends

- 3.4.1 Increasing health consciousness among Russian consumers is driving demand for healthier menu options

- 3.4.2 including vegetarian

- 3.4.3 vegan

- 3.4.4 and organic foods.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russian Food Service Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Full-Service Restaurants

- 5.1.2. Quick-Service Restaurants

- 5.1.3. Street Stalls and Kiosks

- 5.1.4. Cafés and Bars

- 5.1.5. 100% Home Delivery Restaurants

- 5.2. Market Analysis, Insights and Forecast - by Structure

- 5.2.1. Independent Consumer Foodservice

- 5.2.2. Chained Consumer Foodservice

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Western Russia Russian Food Service Industry Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Russia Russian Food Service Industry Analysis, Insights and Forecast, 2019-2031

- 8. Southern Russia Russian Food Service Industry Analysis, Insights and Forecast, 2019-2031

- 9. Northern Russia Russian Food Service Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Domino's Pizza Restaurant Company

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Rosinter Restaurants

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Doctor's Associates Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Wendy's Fast Food Restaurant Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Yum! Brands RSC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Papa John's Pizza

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Restaurant Brands International Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Vkusno & Tochka

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Teremok

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Stars Coffee

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Domino's Pizza Restaurant Company

List of Figures

- Figure 1: Russian Food Service Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russian Food Service Industry Share (%) by Company 2024

List of Tables

- Table 1: Russian Food Service Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russian Food Service Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Russian Food Service Industry Revenue Million Forecast, by Structure 2019 & 2032

- Table 4: Russian Food Service Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Russian Food Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Western Russia Russian Food Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Eastern Russia Russian Food Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southern Russia Russian Food Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Northern Russia Russian Food Service Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Russian Food Service Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 11: Russian Food Service Industry Revenue Million Forecast, by Structure 2019 & 2032

- Table 12: Russian Food Service Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russian Food Service Industry?

The projected CAGR is approximately 8.44%.

2. Which companies are prominent players in the Russian Food Service Industry?

Key companies in the market include Domino's Pizza Restaurant Company, Rosinter Restaurants, Doctor's Associates Inc, Wendy's Fast Food Restaurant Company, Yum! Brands RSC, Papa John's Pizza, Restaurant Brands International Inc, Vkusno & Tochka, Teremok, Stars Coffee.

3. What are the main segments of the Russian Food Service Industry?

The market segments include Type, Structure.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.91 Million as of 2022.

5. What are some drivers contributing to market growth?

The expansion of the middle class in Russia has led to increased disposable incomes. which in turn fuels spending on dining out. especially in casual and premium dining segments.

6. What are the notable trends driving market growth?

Increasing health consciousness among Russian consumers is driving demand for healthier menu options. including vegetarian. vegan. and organic foods..

7. Are there any restraints impacting market growth?

The Russian food service industry is subject to strict regulations. particularly concerning food safety. labor laws. and taxation. which can be burdensome for operators..

8. Can you provide examples of recent developments in the market?

June 2022: Vkusno & Tochka (Tasty and that's it) launched its operations in Russia, post McDonald's exit in Russia. The firm rebranded the McDonald's stores nationwide and aimed to expand its presence nationwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russian Food Service Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russian Food Service Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russian Food Service Industry?

To stay informed about further developments, trends, and reports in the Russian Food Service Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence