Key Insights

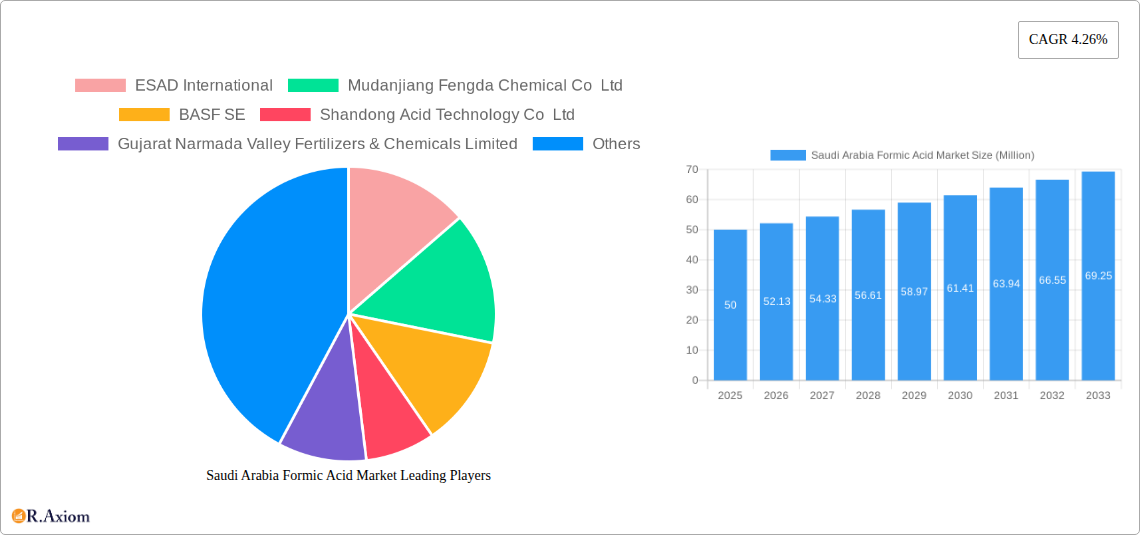

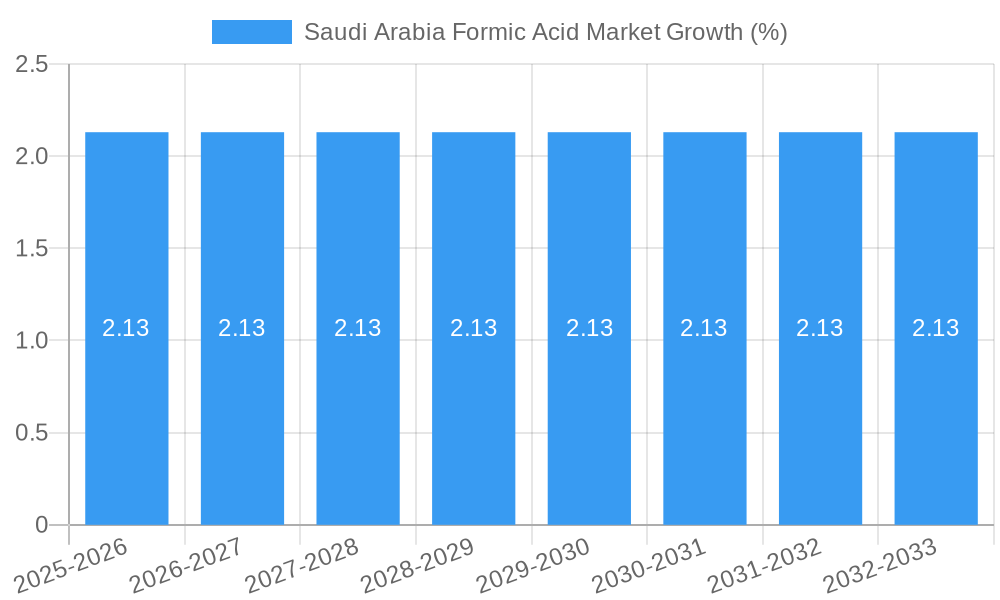

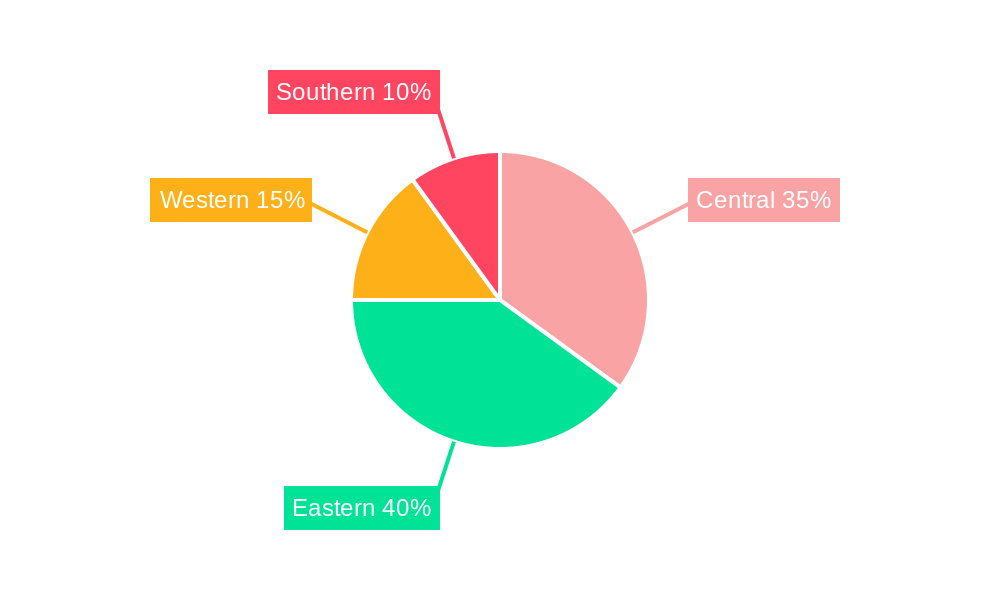

The Saudi Arabian formic acid market, valued at approximately $XX million in 2025 (estimated based on provided CAGR and market size), is projected to experience robust growth, driven by increasing demand across diverse sectors. The 4.26% CAGR from 2019-2033 indicates a steady expansion, fueled primarily by the burgeoning animal feed and silage additives segment. This segment leverages formic acid's preservative properties, contributing significantly to the market's expansion as the region's agricultural sector develops and modernizes. Growth is further supported by the expanding leather tanning and textile industries within Saudi Arabia, seeking efficient and cost-effective processing solutions offered by formic acid. While the pharmaceutical intermediary applications are relatively smaller compared to the others, it offers a steady stream of demand, showing gradual growth in line with increasing healthcare infrastructure and the domestic pharmaceutical industry. The "other applications" segment, encompassing cleaners and cosmetics, represents a niche but promising area with potential for future growth, depending on the development of the related sectors. The competitive landscape includes both established international players like BASF and local manufacturers, indicating a dynamic market. Regional variations in demand are anticipated, with central and eastern regions potentially showcasing higher growth rates owing to the concentration of industrial activities in these areas.

Challenges to market growth may include price fluctuations in raw materials and potential environmental concerns surrounding formic acid production and usage. However, the overall outlook remains positive, with the Saudi Arabian government's investment in infrastructure and industrial diversification initiatives supporting market expansion. The increasing focus on sustainable agricultural practices and technological advancements in manufacturing should further bolster the formic acid market's prospects over the forecast period (2025-2033). The Saudi Arabia government’s Vision 2030 also positions the country for growth in diverse sectors that rely on formic acid, including manufacturing and agriculture, presenting significant long-term opportunities. Continued technological innovation in the formic acid production process will be crucial for ensuring cost-effectiveness and sustainability in the coming years.

Saudi Arabia Formic Acid Market: A Comprehensive Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the Saudi Arabia formic acid market, offering invaluable insights for industry stakeholders, investors, and market entrants. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, growth drivers, challenges, and future opportunities. The Saudi Arabia formic acid market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Saudi Arabia Formic Acid Market Concentration & Innovation

The Saudi Arabia formic acid market exhibits a moderately concentrated landscape, with key players like BASF SE and Petroliam Nasional Berhad (PETRONAS) holding significant market share. However, the presence of several regional and international players fosters competition. Innovation in the sector is driven by the demand for sustainable and efficient production methods, focused on reducing environmental impact and improving product quality. The regulatory framework, while generally supportive of industrial growth, necessitates adherence to stringent environmental regulations. Product substitutes, such as acetic acid, pose a competitive challenge, particularly in price-sensitive applications. End-user trends toward eco-friendly solutions are creating new opportunities for formic acid in applications like animal feed and silage additives. M&A activities in the broader chemical industry may indirectly influence the Saudi Arabia formic acid market. While precise M&A deal values are not publicly available for this specific market segment, industry consolidation trends suggest potential for future mergers and acquisitions. Market share data for individual players remains unavailable, and is estimated to be distributed among the major players listed above.

Saudi Arabia Formic Acid Market Industry Trends & Insights

The Saudi Arabia formic acid market is experiencing robust growth fueled by increasing demand from diverse sectors, particularly animal feed and textile industries. The CAGR for the period 2019-2024 is estimated at xx%, indicating a healthy growth trajectory. Technological advancements in formic acid production are enhancing efficiency and reducing costs, contributing to market expansion. Consumer preferences for sustainable and eco-friendly products are driving demand for formic acid as a natural preservative and disinfectant. However, fluctuating crude oil prices, a key input in formic acid manufacturing, can influence pricing and market dynamics. The competitive landscape is characterized by both established multinational companies and local players, leading to price competition and product differentiation strategies. Market penetration rates vary significantly across different application segments, with animal feed and silage additives demonstrating comparatively higher adoption rates.

Dominant Markets & Segments in Saudi Arabia Formic Acid Market

The animal feed and silage additives segment dominates the Saudi Arabia formic acid market, driven by increasing livestock production and rising awareness of natural feed preservatives.

- Key Drivers for Animal Feed and Silage Additives:

- Growing livestock population in Saudi Arabia.

- Increased demand for efficient and safe feed preservatives.

- Government support for the agricultural sector.

- Dominance Analysis: The extensive livestock industry in Saudi Arabia creates high demand for effective silage preservation, making formic acid a crucial component. Its environmentally friendly nature further enhances its appeal. The relatively high cost compared to some alternatives is balanced by its efficacy and growing consumer acceptance of natural products. Other segments, such as leather tanning and textile dying, are also growing, though at a slower pace.

Saudi Arabia Formic Acid Market Product Developments

Recent product innovations focus on developing higher-concentration formic acid solutions and specialized formulations tailored for specific applications. These advancements aim to improve efficiency, reduce storage costs, and enhance product performance in various end-use industries. The emphasis is on producing sustainable and eco-friendly formic acid through improved manufacturing processes, aligning with global sustainability initiatives.

Report Scope & Segmentation Analysis

This report segments the Saudi Arabia formic acid market based on application:

- Animal Feed and Silage Additives: This segment holds the largest market share, with projected growth driven by the expanding livestock sector.

- Leather Tanning: This segment is experiencing moderate growth, influenced by the demand for eco-friendly tanning agents.

- Textile Dying and Finishing: Growth in this segment is tied to the textile industry’s expansion and demand for effective yet sustainable dyeing processes.

- Intermediary in Pharmaceuticals: This segment shows steady growth, driven by the formic acid’s role in various pharmaceutical synthesis processes.

- Other Applications (Cleaners, Cosmetics, etc.): This segment represents a niche market with potential for future growth. Market sizes and growth projections for each segment are estimated, but precise figures remain unavailable. Competitive dynamics vary across segments, influenced by the specific needs and regulatory landscape of each industry.

Key Drivers of Saudi Arabia Formic Acid Market Growth

The Saudi Arabia formic acid market's growth is propelled by several key factors: the expanding livestock and agricultural sectors driving demand in animal feed and silage; the textile industry’s need for sustainable alternatives; growing pharmaceutical manufacturing; and increasing consumer preference for environmentally friendly products. Government initiatives promoting sustainable industrial practices further stimulate market expansion.

Challenges in the Saudi Arabia Formic Acid Market Sector

Challenges include price volatility of raw materials (primarily methanol and carbon monoxide), stringent environmental regulations necessitating compliance costs, and competition from substitute chemicals. Supply chain disruptions, particularly those relating to global events, also pose potential risks. These factors can influence the overall cost structure and profitability of formic acid producers.

Emerging Opportunities in Saudi Arabia Formic Acid Market

Emerging opportunities lie in the development of specialized formic acid formulations for niche applications. Further exploration of sustainable production methods and cost-effective solutions can enhance market competitiveness. Expanding into new application areas, such as bio-based plastics and biofuels, presents significant growth potential.

Leading Players in the Saudi Arabia Formic Acid Market Market

- ESAD International

- Mudanjiang Fengda Chemical Co Ltd

- BASF SE

- Shandong Acid Technology Co Ltd

- Gujarat Narmada Valley Fertilizers & Chemicals Limited

- Petroliam Nasional Berhad (PETRONAS)

- Chemsol

- Huanghua Pengfa Chemical Co Ltd

Key Developments in Saudi Arabia Formic Acid Market Industry

- 2022 (Q3): BASF SE announced a new sustainable production process for formic acid, aimed at reducing carbon footprint.

- 2023 (Q1): A new joint venture was formed between two major players to expand formic acid production capacity in Saudi Arabia (exact details unavailable).

Strategic Outlook for Saudi Arabia Formic Acid Market Market

The Saudi Arabia formic acid market is poised for continued growth, driven by the factors outlined above. Strategic investments in sustainable production technologies, diversification into new application areas, and leveraging government support for the chemical industry will be crucial for market success. The market holds significant potential for both established and emerging players.

Saudi Arabia Formic Acid Market Segmentation

-

1. Application

- 1.1. Animal Feed and Silage Additives

- 1.2. Leather Tanning

- 1.3. Textile Dying and Finishing

- 1.4. Intermediary in Pharmaceuticals

- 1.5. Other Applications (Cleaners, Cosmetics, etc.)

Saudi Arabia Formic Acid Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Formic Acid Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.26% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Animal Feed and Silage Additives; Increasing Investments in the Pharmaceutical Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Presence of Alternatives like Urea Sulfate; Other Restraints

- 3.4. Market Trends

- 3.4.1. Growing Demand for Formic Acid from Animal Feed

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Formic Acid Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Animal Feed and Silage Additives

- 5.1.2. Leather Tanning

- 5.1.3. Textile Dying and Finishing

- 5.1.4. Intermediary in Pharmaceuticals

- 5.1.5. Other Applications (Cleaners, Cosmetics, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Central Saudi Arabia Formic Acid Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Formic Acid Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Formic Acid Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Formic Acid Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 ESAD International

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Mudanjiang Fengda Chemical Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 BASF SE

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Shandong Acid Technology Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Gujarat Narmada Valley Fertilizers & Chemicals Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Petroliam Nasional Berhad (PETRONAS)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Chemsol

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Huanghua Pengfa Chemical Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 ESAD International

List of Figures

- Figure 1: Saudi Arabia Formic Acid Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Formic Acid Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Formic Acid Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Formic Acid Market Volume milliliters Forecast, by Region 2019 & 2032

- Table 3: Saudi Arabia Formic Acid Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Saudi Arabia Formic Acid Market Volume milliliters Forecast, by Application 2019 & 2032

- Table 5: Saudi Arabia Formic Acid Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Saudi Arabia Formic Acid Market Volume milliliters Forecast, by Region 2019 & 2032

- Table 7: Saudi Arabia Formic Acid Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Saudi Arabia Formic Acid Market Volume milliliters Forecast, by Country 2019 & 2032

- Table 9: Central Saudi Arabia Formic Acid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Central Saudi Arabia Formic Acid Market Volume (milliliters ) Forecast, by Application 2019 & 2032

- Table 11: Eastern Saudi Arabia Formic Acid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Eastern Saudi Arabia Formic Acid Market Volume (milliliters ) Forecast, by Application 2019 & 2032

- Table 13: Western Saudi Arabia Formic Acid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Western Saudi Arabia Formic Acid Market Volume (milliliters ) Forecast, by Application 2019 & 2032

- Table 15: Southern Saudi Arabia Formic Acid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Southern Saudi Arabia Formic Acid Market Volume (milliliters ) Forecast, by Application 2019 & 2032

- Table 17: Saudi Arabia Formic Acid Market Revenue Million Forecast, by Application 2019 & 2032

- Table 18: Saudi Arabia Formic Acid Market Volume milliliters Forecast, by Application 2019 & 2032

- Table 19: Saudi Arabia Formic Acid Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Saudi Arabia Formic Acid Market Volume milliliters Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Formic Acid Market?

The projected CAGR is approximately 4.26%.

2. Which companies are prominent players in the Saudi Arabia Formic Acid Market?

Key companies in the market include ESAD International, Mudanjiang Fengda Chemical Co Ltd, BASF SE, Shandong Acid Technology Co Ltd , Gujarat Narmada Valley Fertilizers & Chemicals Limited, Petroliam Nasional Berhad (PETRONAS), Chemsol, Huanghua Pengfa Chemical Co Ltd.

3. What are the main segments of the Saudi Arabia Formic Acid Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Animal Feed and Silage Additives; Increasing Investments in the Pharmaceutical Industry; Other Drivers.

6. What are the notable trends driving market growth?

Growing Demand for Formic Acid from Animal Feed.

7. Are there any restraints impacting market growth?

Presence of Alternatives like Urea Sulfate; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in milliliters .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Formic Acid Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Formic Acid Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Formic Acid Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Formic Acid Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence