Key Insights

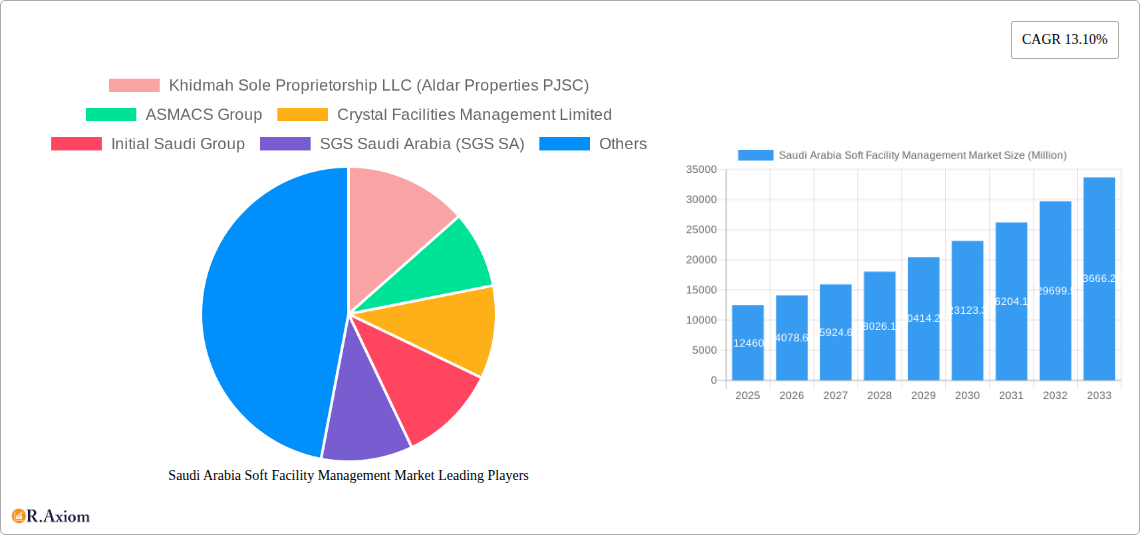

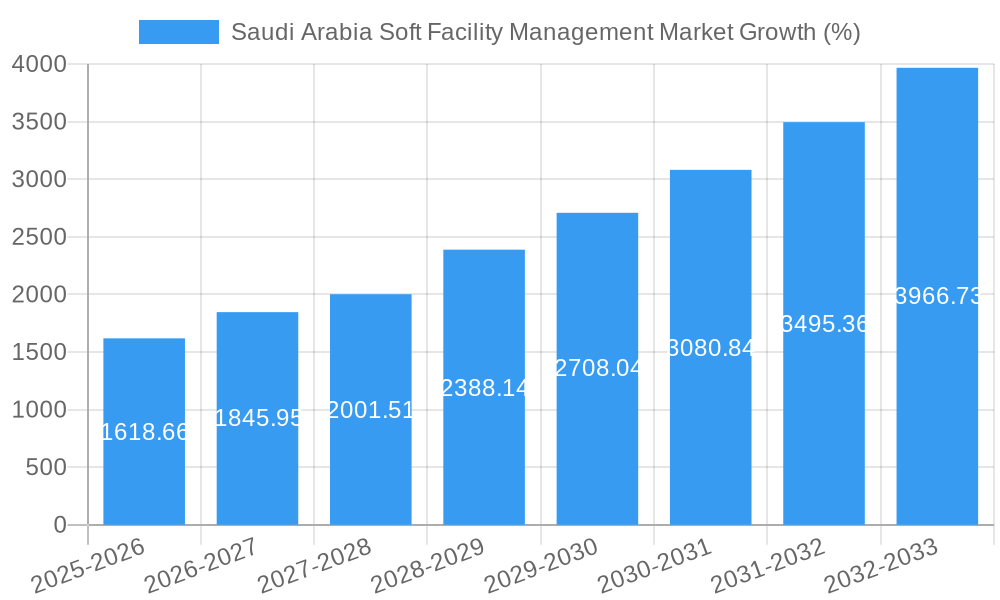

The Saudi Arabia soft facilities management (SFM) market is experiencing robust growth, driven by a burgeoning construction sector, increasing urbanization, and a rising focus on improving the quality of life within the Kingdom's cities. The market, valued at $12.46 billion in 2025, is projected to exhibit a compound annual growth rate (CAGR) of 13.10% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the government's Vision 2030 initiative is significantly investing in infrastructure development and diversification, leading to a substantial increase in the demand for SFM services across both residential and commercial properties. Secondly, a growing awareness of the importance of hygiene and safety standards, particularly post-pandemic, is driving demand for enhanced cleaning, disinfection, and pest control services. Thirdly, the rising adoption of technology in SFM, including smart building management systems and advanced cleaning technologies, is streamlining operations and increasing efficiency, further bolstering market growth. Major players are strategically focusing on expanding their service offerings, investing in technological advancements, and acquiring smaller companies to gain a larger market share.

Despite this positive outlook, certain challenges could potentially hinder market growth. These include the fluctuating oil prices that can impact overall economic activity and investment in infrastructure, and the need for skilled labor within the SFM sector. However, these restraints are expected to be offset by the long-term growth prospects fueled by sustained government investment and ongoing urbanization. The market is segmented based on service type (e.g., cleaning, security, landscaping), client type (e.g., residential, commercial, industrial), and geographic location, offering opportunities for specialized service providers to cater to niche demands. Competition is intensifying with both established international players and local companies vying for market share. The market's future trajectory strongly suggests continued growth, presenting lucrative prospects for businesses operating within the Saudi Arabia SFM sector.

This comprehensive report provides an in-depth analysis of the Saudi Arabia soft facility management market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with 2025 as the base year, this report presents a detailed overview of market trends, growth drivers, challenges, and opportunities. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Saudi Arabia Soft Facility Management Market Market Concentration & Innovation

The Saudi Arabia soft facility management market exhibits a moderately concentrated structure, with several key players holding significant market share. The top five companies, including Khidmah Sole Proprietorship LLC (Aldar Properties PJSC), ASMACS Group, Crystal Facilities Management Limited, Initial Saudi Group, and SGS Saudi Arabia (SGS SA), collectively account for an estimated xx% of the market in 2025. Market share dynamics are influenced by factors such as service offerings, technological capabilities, and strategic partnerships. Innovation is a key driver, with companies investing in advanced technologies like AI-powered cleaning solutions and smart building management systems.

- Market Concentration: Top 5 players hold approximately xx% market share in 2025.

- Innovation Drivers: AI, IoT, and automation are driving efficiency and service quality improvements.

- Regulatory Framework: Government initiatives promoting smart city development and sustainability are creating favorable conditions.

- Product Substitutes: Limited direct substitutes exist; competition is primarily based on service differentiation and pricing.

- End-User Trends: Growing demand for integrated facility management solutions and customized services is shaping market growth.

- M&A Activities: The market has witnessed xx M&A deals in the historical period (2019-2024), with deal values averaging xx Million.

Saudi Arabia Soft Facility Management Market Industry Trends & Insights

The Saudi Arabian soft facility management market is experiencing robust growth, driven by several key factors. The country's ambitious Vision 2030 initiative is stimulating significant infrastructure development and urbanization, creating a surge in demand for facility management services. Furthermore, the rising adoption of smart technologies, coupled with increasing awareness of sustainability, is transforming the industry landscape. The market penetration rate for integrated facility management (IFM) solutions is projected to increase from xx% in 2025 to xx% by 2033, fueled by cost optimization and improved operational efficiency benefits for clients. Competitive dynamics are characterized by both established players and emerging companies vying for market share, leading to innovation and service differentiation. Consumer preferences are shifting towards customized, tech-enabled, and sustainable solutions.

The market exhibits a healthy CAGR of xx% from 2025 to 2033.

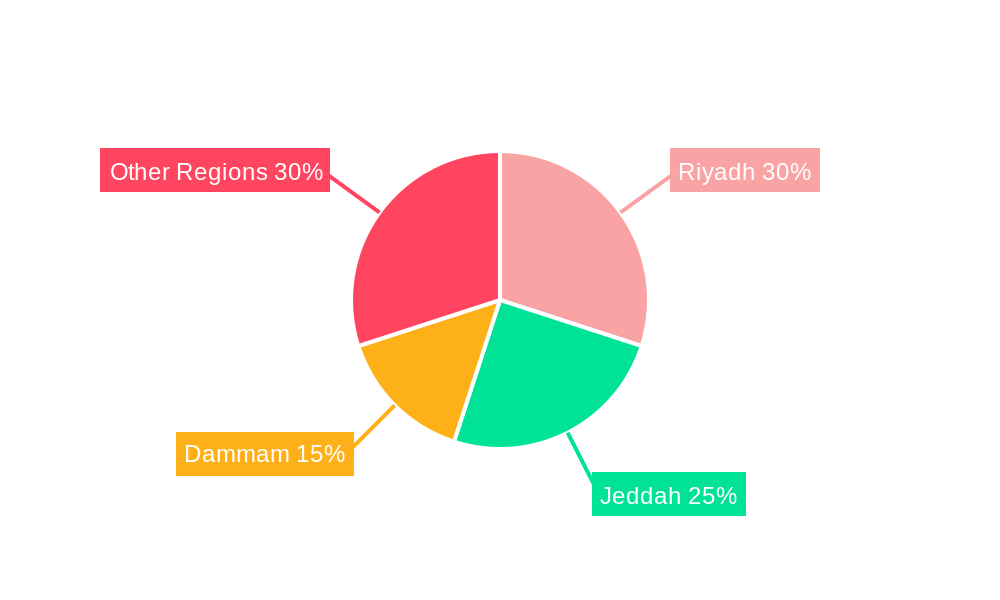

Dominant Markets & Segments in Saudi Arabia Soft Facility Management Market

The Riyadh and Jeddah metropolitan areas represent the dominant markets within the Saudi Arabia soft facility management sector, accounting for approximately xx% of the total market value in 2025. This dominance is fueled by several key factors:

- Economic Factors: These cities are the economic hubs of the country, with high concentrations of commercial and residential properties.

- Infrastructure Development: Significant investments in infrastructure projects are driving demand for facility management services.

- Government Initiatives: Government support for sustainable development and smart city initiatives contributes to the market growth in these regions.

The market is further segmented by service type (e.g., cleaning, landscaping, security), end-user (e.g., commercial, residential, industrial), and contract type (e.g., short-term, long-term). The commercial segment is projected to dominate throughout the forecast period due to increased office space, shopping malls, and hospitality facilities.

Saudi Arabia Soft Facility Management Market Product Developments

Recent product innovations have focused on incorporating advanced technologies to improve efficiency and service quality. This includes the use of AI-powered cleaning robots, smart building management systems, and drone-based inspection and cleaning services. The market is witnessing the adoption of sustainable practices such as green cleaning solutions and waste management programs, reflecting growing environmental awareness. These developments offer competitive advantages by enhancing service delivery, reducing operational costs, and improving client satisfaction.

Report Scope & Segmentation Analysis

This report segments the Saudi Arabia soft facility management market based on service type, end-user industry, and region. The service type segment includes cleaning, security, landscaping, and others. The end-user industry segment includes commercial, residential, industrial, and healthcare. The regional segment includes Riyadh, Jeddah, and other regions. Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail, providing a comprehensive market overview.

Key Drivers of Saudi Arabia Soft Facility Management Market Growth

Several key factors are driving the growth of the Saudi Arabia soft facility management market. These include:

- Government Initiatives: Vision 2030 and related infrastructure development projects are creating substantial demand.

- Economic Growth: The expanding economy and increasing urbanization are fueling the need for efficient facility management.

- Technological Advancements: The adoption of smart building technologies and automation is enhancing operational efficiency and service quality.

- Rising Awareness of Sustainability: The increasing focus on environmental responsibility is promoting sustainable facility management practices.

Challenges in the Saudi Arabia Soft Facility Management Market Sector

The market faces several challenges, including:

- Regulatory Hurdles: Navigating regulatory requirements and obtaining necessary permits can be complex.

- Supply Chain Issues: Securing skilled labor and sourcing sustainable materials can pose challenges.

- Competitive Pressures: The market is becoming increasingly competitive, requiring companies to differentiate their service offerings.

Emerging Opportunities in Saudi Arabia Soft Facility Management Market

The Saudi Arabia soft facility management market presents numerous opportunities, including:

- Expansion into Underserved Regions: Expanding services into smaller cities and towns presents significant growth potential.

- Adoption of Innovative Technologies: Implementing AI, IoT, and drone technology can create competitive advantages.

- Focus on Sustainable Practices: Providing eco-friendly services can attract environmentally conscious clients.

Leading Players in the Saudi Arabia Soft Facility Management Market Market

- Khidmah Sole Proprietorship LLC (Aldar Properties PJSC)

- ASMACS Group

- Crystal Facilities Management Limited

- Initial Saudi Group

- SGS Saudi Arabia (SGS SA)

- Jood FM

- Alhajry Overseas

- Muheel Facilities Management

- SAMAMA Holding Group

- EFS Facilities Management Services Group

- Al Yamama Group

Key Developments in Saudi Arabia Soft Facility Management Market Industry

- June 2024: Laundryheap launches on-demand laundry and dry-cleaning services in Riyadh and Jeddah, enhancing convenience and efficiency in the laundry service market.

- August 2024: KTV Working Drone secures operational permit for building facade cleaning, marking a significant milestone in the adoption of drone technology for facility management.

Strategic Outlook for Saudi Arabia Soft Facility Management Market Market

The Saudi Arabia soft facility management market presents a promising long-term outlook, driven by continued infrastructure development, economic growth, and the increasing adoption of technology. Opportunities abound for companies to capitalize on the growing demand for integrated facility management solutions, sustainable practices, and innovative service offerings. The market's evolution towards smart and sustainable facilities will require companies to adapt and invest in cutting-edge technologies to maintain a competitive edge.

Saudi Arabia Soft Facility Management Market Segmentation

-

1. Service Type

- 1.1. Janitorial Services

- 1.2. Pest Control Services

- 1.3. Waste Management Services

- 1.4. Security Services

- 1.5. Vending Services

- 1.6. Other Soft FM Services

-

2. End-user Industry

- 2.1. Commercial and Retail

- 2.2. Manufacturing and Industrial

- 2.3. Government, Infrastructure, and Public Entities

- 2.4. Institutional

- 2.5. Other End-user Industries

Saudi Arabia Soft Facility Management Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Soft Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Booming Construction Industry Due to Implementation of Saudi Vision; Growth in the Hospitality and Tourism Sector

- 3.3. Market Restrains

- 3.3.1. Booming Construction Industry Due to Implementation of Saudi Vision; Growth in the Hospitality and Tourism Sector

- 3.4. Market Trends

- 3.4.1. Janitorial Services Holds Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Soft Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Janitorial Services

- 5.1.2. Pest Control Services

- 5.1.3. Waste Management Services

- 5.1.4. Security Services

- 5.1.5. Vending Services

- 5.1.6. Other Soft FM Services

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Commercial and Retail

- 5.2.2. Manufacturing and Industrial

- 5.2.3. Government, Infrastructure, and Public Entities

- 5.2.4. Institutional

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Khidmah Sole Proprietorship LLC (Aldar Properties PJSC)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ASMACS Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Crystal Facilities Management Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Initial Saudi Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SGS Saudi Arabia (SGS SA)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jood FM

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alhajry Overseas

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Muheel Facilities Management

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SAMAMA Holding Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 EFS Facilities Management Services Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Al Yamama Grou

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Khidmah Sole Proprietorship LLC (Aldar Properties PJSC)

List of Figures

- Figure 1: Saudi Arabia Soft Facility Management Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Soft Facility Management Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Soft Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Soft Facility Management Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Saudi Arabia Soft Facility Management Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: Saudi Arabia Soft Facility Management Market Volume Billion Forecast, by Service Type 2019 & 2032

- Table 5: Saudi Arabia Soft Facility Management Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: Saudi Arabia Soft Facility Management Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 7: Saudi Arabia Soft Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Saudi Arabia Soft Facility Management Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Saudi Arabia Soft Facility Management Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 10: Saudi Arabia Soft Facility Management Market Volume Billion Forecast, by Service Type 2019 & 2032

- Table 11: Saudi Arabia Soft Facility Management Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 12: Saudi Arabia Soft Facility Management Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 13: Saudi Arabia Soft Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Saudi Arabia Soft Facility Management Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Soft Facility Management Market?

The projected CAGR is approximately 13.10%.

2. Which companies are prominent players in the Saudi Arabia Soft Facility Management Market?

Key companies in the market include Khidmah Sole Proprietorship LLC (Aldar Properties PJSC), ASMACS Group, Crystal Facilities Management Limited, Initial Saudi Group, SGS Saudi Arabia (SGS SA), Jood FM, Alhajry Overseas, Muheel Facilities Management, SAMAMA Holding Group, EFS Facilities Management Services Group, Al Yamama Grou.

3. What are the main segments of the Saudi Arabia Soft Facility Management Market?

The market segments include Service Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.46 Million as of 2022.

5. What are some drivers contributing to market growth?

Booming Construction Industry Due to Implementation of Saudi Vision; Growth in the Hospitality and Tourism Sector.

6. What are the notable trends driving market growth?

Janitorial Services Holds Major Share.

7. Are there any restraints impacting market growth?

Booming Construction Industry Due to Implementation of Saudi Vision; Growth in the Hospitality and Tourism Sector.

8. Can you provide examples of recent developments in the market?

August 2024: KTV Working Drone, based in Saudi Arabia, obtained its first operational permit from the General Authority of Civil Aviation. This permit authorizes it to clean building facades, marking a significant milestone as it prepares to launch its services in Saudi Arabia. This licensing initiative reflects the authority's dedication to promoting advanced drone applications, enabling beneficiaries to implement modern operational methods and keep pace with global developments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Soft Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Soft Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Soft Facility Management Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Soft Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence