Key Insights

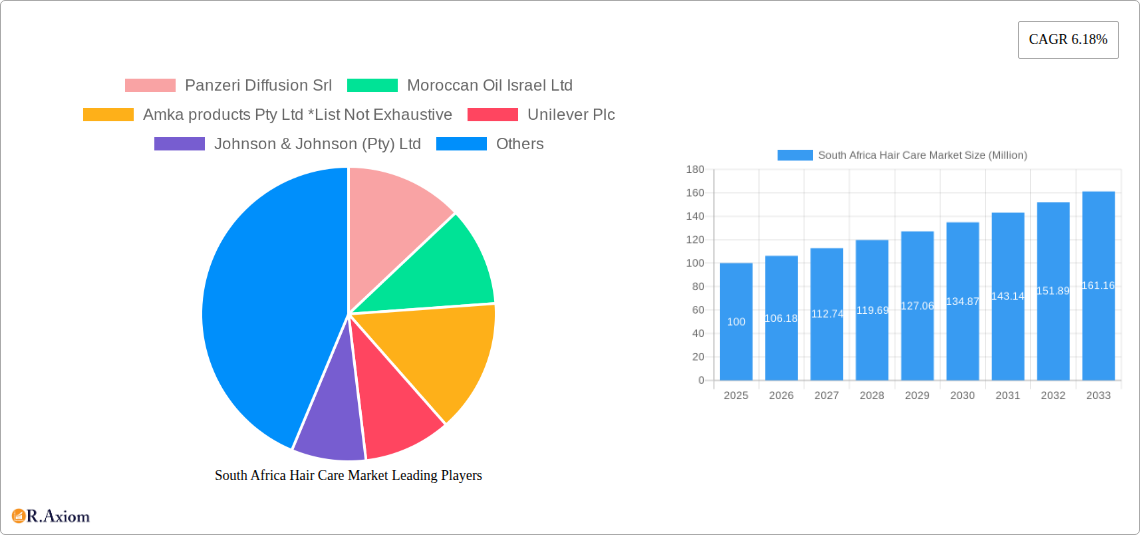

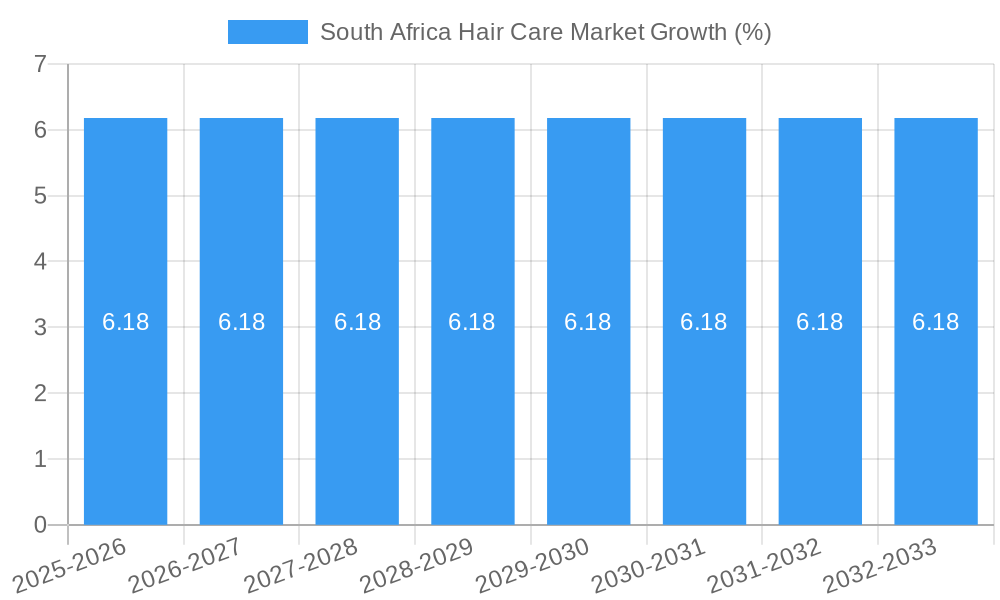

The South African hair care market, valued at approximately $100 million in 2025 (estimated based on the provided MEA market size and assuming South Africa represents a significant portion), is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) of 6.18% from 2025 to 2033. This growth is fueled by several key factors. Rising disposable incomes, particularly within the middle class, are driving increased spending on personal care products, including premium hair care lines. A growing awareness of hair health and the increasing popularity of natural and organic hair care options are also contributing to market expansion. The strong presence of both international and local brands further fuels competition and innovation, ultimately benefiting consumers with a diverse range of choices across various price points. Distribution channels are diversifying, with online retail experiencing significant growth alongside traditional channels like supermarkets and specialty stores. This shift caters to the changing consumer preferences and shopping habits, making hair care products more accessible.

However, the market also faces some challenges. Economic instability and fluctuating exchange rates can impact consumer spending and potentially slow down growth. Furthermore, competition from both established international brands and emerging local players is intense. Maintaining brand loyalty and innovating to meet evolving consumer demands remains crucial for market success. The market segmentation, encompassing product types (shampoos, conditioners, hair colorants, styling products) and distribution channels, offers opportunities for targeted marketing and product development tailored to specific consumer segments and their preferences. Understanding these nuances is essential for companies aiming to capture market share in this dynamic and competitive landscape. Focus on sustainability and ethical sourcing of ingredients will also become increasingly important as consumer awareness grows.

South Africa Hair Care Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South Africa hair care market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to capitalize on growth opportunities within this dynamic sector. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period. Market size is expressed in Millions.

South Africa Hair Care Market Concentration & Innovation

The South Africa hair care market exhibits a moderately concentrated structure, dominated by multinational corporations like Unilever Plc, Johnson & Johnson (Pty) Ltd, and L'Oréal S A. However, smaller, specialized brands catering to niche segments, such as Amka products Pty Ltd and 'Curls in Bloom', are also gaining traction. The market share of these key players fluctuates yearly, with Unilever and L'Oréal consistently holding significant positions (xx% and xx% respectively, estimated for 2025). Innovation is driven by consumer demand for natural, ethically sourced products, as evidenced by the success of brands like Bhuman. Furthermore, regulatory frameworks concerning ingredient safety and sustainability are influencing product formulations. The market has witnessed several mergers and acquisitions (M&A) in recent years, though specific deal values remain undisclosed for many transactions (xx Million estimated total M&A value for the period 2019-2024). Substitutes, such as homemade hair care solutions, pose a minor threat, while end-user trends toward personalized care and sustainable practices present substantial growth opportunities.

South Africa Hair Care Market Industry Trends & Insights

The South African hair care market is experiencing robust growth, driven by increasing disposable incomes, rising consumer awareness of hair health, and the expanding popularity of natural and organic products. The market is projected to register a CAGR of xx% during the forecast period (2025-2033), exceeding the global average. This growth is fueled by several factors, including the increasing adoption of sophisticated hair care routines, the rise in demand for specialized hair care products tailored to specific hair types (e.g., ethnic hair), and the proliferation of online retail channels. Technological disruptions, such as the use of AI in personalized hair care recommendations and the development of innovative formulations, are also shaping the market landscape. Consumer preferences are shifting towards products that offer natural ingredients, environmentally friendly packaging, and address specific hair concerns, leading to higher market penetration of premium and specialized segments. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new, innovative brands. Market penetration for natural hair care products is estimated at xx% in 2025, expected to reach xx% by 2033.

Dominant Markets & Segments in South Africa Hair Care Market

- Dominant Product Type: Shampoo maintains its position as the dominant product type, owing to its widespread usage and relatively lower price point. Conditioner follows closely, with significant growth potential within premium segments. Hair colorants are witnessing increased adoption amongst younger consumers.

- Dominant Distribution Channel: Supermarkets/hypermarkets remain the primary distribution channel, providing wide accessibility and convenience. However, online retail stores are rapidly gaining popularity, driven by increasing internet penetration and the convenience of online shopping.

Key drivers for the dominance of supermarkets/hypermarkets include their extensive reach across various socioeconomic groups and well-established distribution networks. The rise of online retail is facilitated by increasing internet and smartphone penetration, particularly amongst younger demographics. Growth in specialty stores catering to specific hair types (e.g., natural hair) is also notable.

South Africa Hair Care Market Product Developments

Recent product innovations focus on natural and organic ingredients, tailored solutions for specific hair types (particularly ethnic hair), and sustainable packaging. Brands are leveraging technological advancements in formulation and ingredient sourcing to offer superior product performance and cater to evolving consumer preferences. The market is witnessing the emergence of personalized hair care solutions, leveraging AI and data analytics to provide customized product recommendations and treatment plans. These developments are strongly aligned with market demands for efficacy, ethical sourcing, and environmental consciousness.

Report Scope & Segmentation Analysis

This report segments the South Africa hair care market based on product type (Shampoo, Conditioner, Hair Colorant, Hair Styling Products, Other Product Types) and distribution channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail Stores, Other Distribution Channels). Each segment's growth projections, market sizes (in Millions), and competitive dynamics are thoroughly analyzed. For instance, the shampoo segment is expected to reach xx Million in 2025 and xx Million in 2033. The online retail segment is anticipated to register a higher CAGR compared to traditional channels. Competitive dynamics vary across segments, with established players and new entrants vying for market share.

Key Drivers of South Africa Hair Care Market Growth

Several factors contribute to the growth of the South Africa hair care market. These include: rising disposable incomes enabling greater spending on personal care; increasing awareness of hair health and the importance of proper hair care; a growing preference for natural and organic products; the rise of e-commerce platforms improving accessibility to diverse product offerings; and government regulations promoting safe and sustainable practices within the industry.

Challenges in the South Africa Hair Care Market Sector

The market faces challenges including fluctuating raw material prices impacting production costs; counterfeiting of popular brands eroding consumer trust; competition from international and local players putting pressure on profit margins; and stringent regulations concerning ingredient safety and environmental impact requiring significant investment. These factors collectively reduce market profitability and necessitate robust risk mitigation strategies.

Emerging Opportunities in South Africa Hair Care Market

Significant opportunities exist within the natural and organic segment; the growing demand for personalized hair care solutions; the expansion into untapped rural markets; and the development of sustainable and eco-friendly products aligned with increasing environmental consciousness. These opportunities are expected to shape the market’s future trajectory and reward innovative businesses.

Leading Players in the South Africa Hair Care Market Market

- Panzeri Diffusion Srl

- Moroccan Oil Israel Ltd

- Amka products Pty Ltd

- Unilever Plc

- Johnson & Johnson (Pty) Ltd

- L'Oreal S A

- Coty Inc

- Canviiy LLC

- The Este Lauder Companies

- Procter & Gamble Company

Key Developments in South Africa Hair Care Market Industry

- October 2021: South African natural hair care brand 'Curls in Bloom' launched a new range, boosting the natural hair care segment.

- November 2021: Bhuman's water-activated powdered hair wash entered the South African market, signifying a shift towards eco-friendly products.

- May 2022: Nubian Crown Hair Studio's partnership with L'Oréal Professionals expanded access to specialized ethnic hair care products.

Strategic Outlook for South Africa Hair Care Market Market

The South Africa hair care market presents substantial growth potential, driven by evolving consumer preferences, technological advancements, and the increasing demand for specialized and sustainable products. Companies focusing on innovation, natural ingredients, and effective marketing strategies are well-positioned to capitalize on this dynamic market and achieve significant market share. The focus on personalization and sustainable practices will be crucial for future success in this sector.

South Africa Hair Care Market Segmentation

-

1. Product Type

- 1.1. Shampoo

- 1.2. Conditioner

- 1.3. Hair Colorant

- 1.4. Hair Styling Products

- 1.5. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialty Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

South Africa Hair Care Market Segmentation By Geography

- 1. South Africa

South Africa Hair Care Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.18% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Innovative Launches; Hair Concerns Among Consumers

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Hair-Related Issues and Innovative Launches

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Hair Care Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Shampoo

- 5.1.2. Conditioner

- 5.1.3. Hair Colorant

- 5.1.4. Hair Styling Products

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. UAE South Africa Hair Care Market Analysis, Insights and Forecast, 2019-2031

- 7. South Africa South Africa Hair Care Market Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia South Africa Hair Care Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA South Africa Hair Care Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Panzeri Diffusion Srl

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Moroccan Oil Israel Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Amka products Pty Ltd *List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Unilever Plc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Johnson & Johnson (Pty) Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 L'Oreal S A

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Coty Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Canviiy LLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 The Este Lauder Companies

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Procter & Gamble Company

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Panzeri Diffusion Srl

List of Figures

- Figure 1: South Africa Hair Care Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Hair Care Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa Hair Care Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Hair Care Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: South Africa Hair Care Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: South Africa Hair Care Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South Africa Hair Care Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: UAE South Africa Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South Africa South Africa Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Saudi Arabia South Africa Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of MEA South Africa Hair Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Africa Hair Care Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 11: South Africa Hair Care Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: South Africa Hair Care Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Hair Care Market?

The projected CAGR is approximately 6.18%.

2. Which companies are prominent players in the South Africa Hair Care Market?

Key companies in the market include Panzeri Diffusion Srl, Moroccan Oil Israel Ltd, Amka products Pty Ltd *List Not Exhaustive, Unilever Plc, Johnson & Johnson (Pty) Ltd, L'Oreal S A, Coty Inc, Canviiy LLC, The Este Lauder Companies, Procter & Gamble Company.

3. What are the main segments of the South Africa Hair Care Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 496.19 Million as of 2022.

5. What are some drivers contributing to market growth?

Innovative Launches; Hair Concerns Among Consumers.

6. What are the notable trends driving market growth?

Hair-Related Issues and Innovative Launches.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

May 2022: Nubian Crown Hair Studio partnered with L'Oréal Professionals to launch DIA Light and DIA Richesse safe colors for type 3 and 4 ethnic hair at their salon in Hyde Park, Johannesburg.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Hair Care Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Hair Care Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Hair Care Market?

To stay informed about further developments, trends, and reports in the South Africa Hair Care Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence