Key Insights

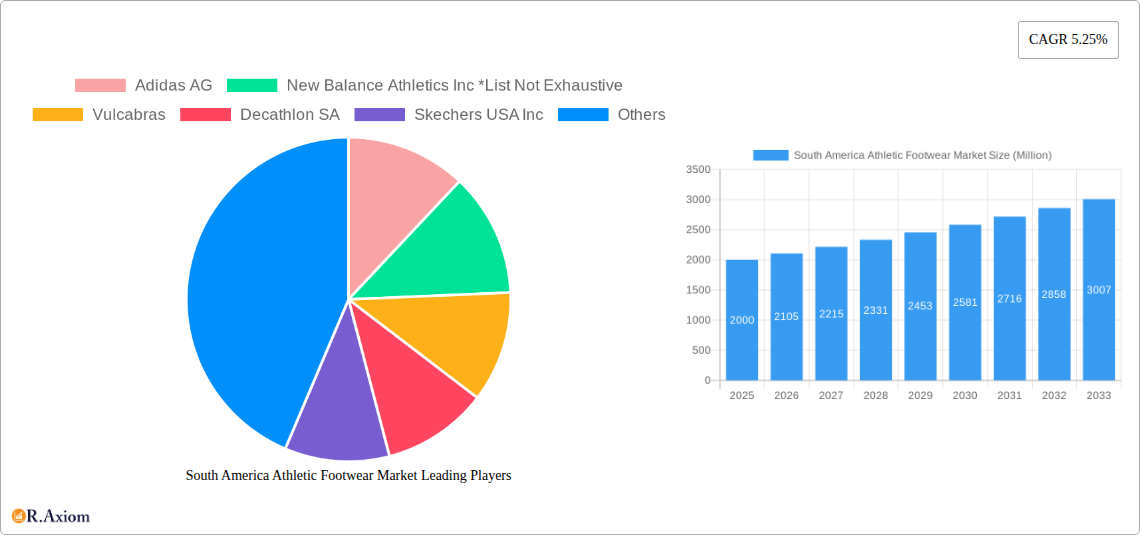

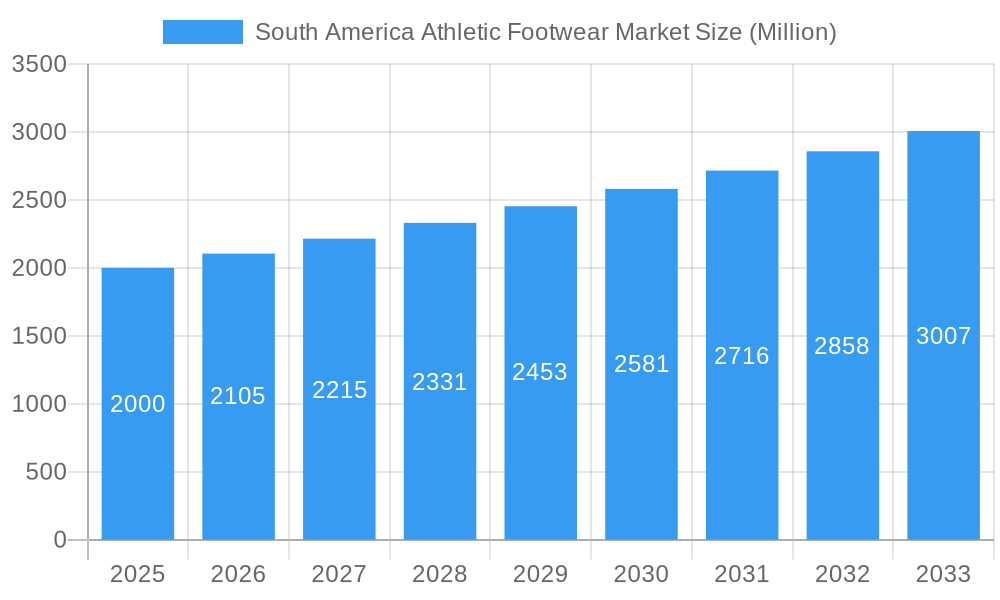

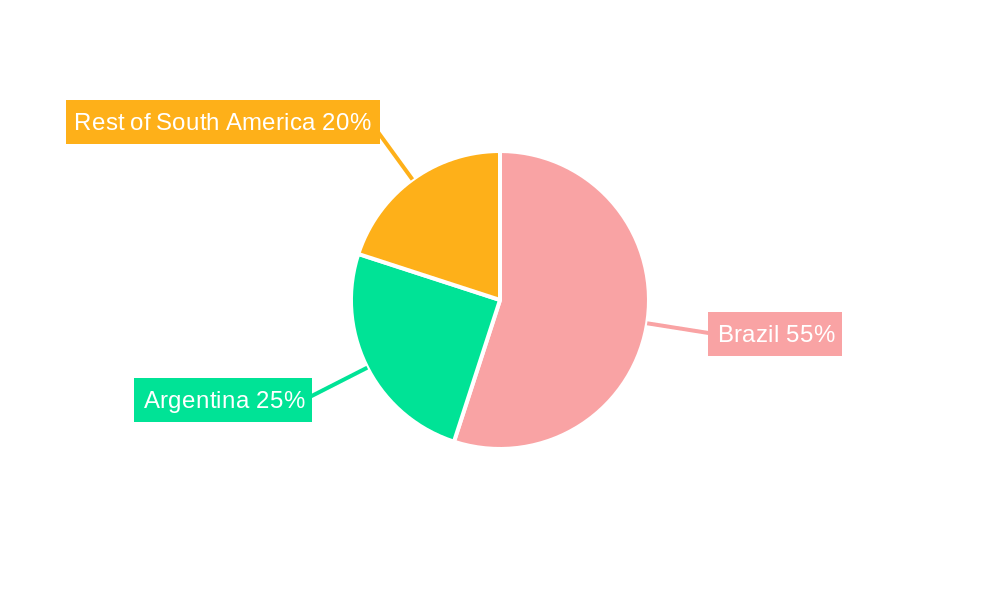

The South American athletic footwear market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.25% from 2025 to 2033. This expansion is fueled by several key factors. Rising disposable incomes across major South American economies like Brazil and Argentina are driving increased consumer spending on athletic apparel and footwear. The growing popularity of fitness activities, including running, hiking, and team sports, further boosts demand. Furthermore, the increasing adoption of e-commerce platforms provides convenient access to a wider range of products and brands, stimulating market growth. The market is segmented by distribution channel (supermarkets/hypermarkets, online retail stores, others), product type (running shoes, sport shoes, trekking/hiking shoes, others), and end-user (men, women, children). Brazil and Argentina represent the largest segments within the South American market, reflecting their larger populations and higher levels of economic activity. While the market faces certain restraints, such as economic volatility in some regions and competition from cheaper, locally produced alternatives, the overall growth trajectory remains positive. Key players such as Adidas, Nike, Puma, and Under Armour are vying for market share through strategic marketing campaigns, product innovation, and partnerships with local distributors.

South America Athletic Footwear Market Market Size (In Billion)

The success of major international brands in South America hinges on their ability to adapt to local preferences and consumer purchasing habits. This includes offering a diverse range of styles and sizes to cater to different body types and preferences, utilizing effective marketing strategies that resonate with South American consumers, and establishing strong distribution networks to reach wider audiences. The growing middle class in the region is a significant driver of demand, with consumers increasingly prioritizing health and wellness and seeking quality athletic footwear that improves performance and comfort. The continued growth of online retail channels is expected to significantly contribute to market expansion in the coming years, particularly in regions with limited physical retail infrastructure. This presents opportunities for brands to expand their reach and engage with a broader range of consumers. The future of the South American athletic footwear market is promising, with substantial potential for growth driven by a confluence of economic, social, and technological factors.

South America Athletic Footwear Market Company Market Share

This detailed report provides a comprehensive analysis of the South America athletic footwear market, offering actionable insights for stakeholders across the value chain. The study covers the period from 2019 to 2033, with 2025 serving as the base year and the forecast period extending from 2025 to 2033. The report leverages extensive primary and secondary research to deliver a granular understanding of market dynamics, including key segments, leading players, growth drivers, and challenges. The total market size is projected to reach xx Million by 2033.

South America Athletic Footwear Market Concentration & Innovation

This section analyzes the competitive landscape of the South America athletic footwear market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The market is characterized by a moderately concentrated structure with key players like Nike, Adidas, and Puma holding significant market share. However, the presence of several regional and smaller players ensures competitive intensity.

- Market Share: Nike and Adidas are estimated to collectively hold approximately 45% of the market share in 2025, while other major players such as Puma, ASICS and Under Armour combined account for another 30%. Smaller regional brands comprise the remaining 25%.

- Innovation Drivers: Technological advancements in materials (e.g., sustainable fabrics), design (e.g., enhanced cushioning and support), and manufacturing processes are driving innovation. Consumer demand for performance enhancement and personalized experiences further fuels innovation.

- Regulatory Framework: Varying regulations across South American countries regarding product safety, labeling, and import/export procedures influence market dynamics.

- Product Substitutes: The market faces competition from other forms of footwear, including casual shoes and sandals. However, the increasing popularity of fitness activities and sports continues to support market growth.

- End-User Trends: A rising middle class, increasing health consciousness, and a growing preference for athletic apparel are driving market growth.

- M&A Activities: The report documents significant M&A activities in the historical period (2019-2024), with deal values ranging from xx Million to xx Million, primarily focused on expanding distribution networks and acquiring smaller brands.

South America Athletic Footwear Market Industry Trends & Insights

This section delves into the market's growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The South American athletic footwear market is expected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily driven by increasing disposable incomes, rising health awareness, and expanding sporting activities across the region.

The increasing penetration of e-commerce platforms is reshaping distribution channels, offering new opportunities for brands to reach consumers. Consumer preferences are shifting towards sustainable and ethically sourced products, prompting manufacturers to adopt eco-friendly materials and manufacturing practices. Competitive dynamics are characterized by intense rivalry among global and regional players, focusing on brand building, product innovation, and strategic partnerships. Market penetration for athletic footwear in major urban centers is high, while expansion into rural areas presents significant potential.

Dominant Markets & Segments in South America Athletic Footwear Market

This section identifies the leading regions, countries, and segments within the South American athletic footwear market based on distribution channel, product type, and end-user.

By Distribution Channel:

- Online Retail Stores: This segment is experiencing the fastest growth due to increasing internet penetration and consumer preference for online shopping. Key drivers include easy access, wider product variety, and competitive pricing.

- Supermarkets/Hypermarkets: This channel remains significant, particularly in smaller towns and cities, providing convenience to consumers.

- Others: This includes specialized sporting goods stores and independent retailers, which play a crucial role in the market.

By Product Type:

- Running Shoes: This segment enjoys high demand due to the popularity of running and marathons across the region.

- Sport Shoes: This broad category covers a wide variety of sports and is a major contributor to overall market revenue.

- Trekking/Hiking Shoes: The growing interest in outdoor activities contributes to the increasing demand in this segment.

- Other Product Types: This segment encompasses specialized footwear for various sports and activities.

By End-user:

- Men: This segment is the largest, reflecting higher participation in sports and fitness activities among men.

- Women: The women's segment is growing at a significant rate, influenced by the rising interest in fitness and wellness among women.

- Children: The children's segment offers significant growth opportunities with the increasing participation of children in sports and extra-curricular activities.

Key drivers for dominance include favorable demographics, rising disposable incomes, supportive government policies promoting sports and physical activity, and increasing investment in sports infrastructure.

South America Athletic Footwear Market Product Developments

The athletic footwear market in South America witnesses continuous product innovation. Technological advancements are leading to lighter, more durable, and more comfortable footwear. The integration of smart technologies, such as embedded sensors for performance tracking, is gaining traction. Brands are emphasizing sustainable manufacturing practices, using recycled materials and reducing their environmental footprint. These innovations cater to consumer demand for both performance and ethical considerations, aligning with broader market trends towards sustainability and technological integration.

Report Scope & Segmentation Analysis

This report comprehensively segments the South America athletic footwear market by distribution channel (supermarkets/hypermarkets, online retail stores, others), product type (running shoes, sport shoes, trekking/hiking shoes, other product types), and end-user (men, women, children). Each segment is analyzed in terms of its market size, growth projections, and competitive dynamics. Growth rates vary significantly across segments, with online retail stores and specialized footwear experiencing the fastest growth.

Key Drivers of South America Athletic Footwear Market Growth

Several factors fuel the growth of the South American athletic footwear market. Rising disposable incomes across the region are empowering consumers to spend more on sporting goods, including footwear. Growing awareness of health and fitness is motivating people to participate in various sports and activities, boosting demand for athletic footwear. Government initiatives promoting sports and physical activity further contribute to market expansion. Technological advancements and the subsequent innovations in footwear design and manufacturing are also key growth drivers.

Challenges in the South America Athletic Footwear Market Sector

Despite positive growth prospects, the South American athletic footwear market faces challenges. Fluctuating currency exchange rates can impact import costs and profitability. Supply chain disruptions can lead to delays and shortages. The prevalence of counterfeit products poses a threat to both legitimate brands and consumer trust. Intense competition from established global brands and emerging local players necessitates continuous innovation and effective marketing strategies.

Emerging Opportunities in South America Athletic Footwear Market

The South American athletic footwear market presents promising opportunities. Expanding e-commerce channels create avenues for reaching new consumer segments and increasing market penetration. Demand for specialized and high-performance footwear is growing, providing scope for innovation and premium-priced products. The increasing adoption of sustainable materials and manufacturing practices aligns with global environmental concerns, creating new market niches for eco-friendly products.

Leading Players in the South America Athletic Footwear Market Market

Key Developments in South America Athletic Footwear Market Industry

- 2022: PUMA SE partnered with the Brazilian Confederation of Athletics to sponsor national teams, including 24 adult and youth teams.

- 2021: Nike Inc. transitioned its Nike Brand business in Brazil, Argentina, Chile, and Uruguay to strategic distributor partnerships.

- 2019: Iconix Brand Group extended Umbro's licensing agreement with Grupo Dass in Brazil, Argentina, and Paraguay.

Strategic Outlook for South America Athletic Footwear Market Market

The South American athletic footwear market is poised for continued growth driven by rising disposable incomes, health consciousness, and technological advancements. Brands that effectively leverage e-commerce, adopt sustainable practices, and cater to evolving consumer preferences will be well-positioned to capitalize on the market's potential. Innovation in product design, materials, and manufacturing will be crucial for maintaining competitiveness. Strategic partnerships and collaborations will play an essential role in market expansion.

South America Athletic Footwear Market Segmentation

-

1. Product Type

- 1.1. Running Shoes

- 1.2. Sport Shoes

- 1.3. Trekking/Hiking Shoes

- 1.4. Other Product Types

-

2. End user

- 2.1. Men

- 2.2. Women

- 2.3. Children

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Online Retail Stores

- 3.3. Others

-

4. Geography

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

South America Athletic Footwear Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Athletic Footwear Market Regional Market Share

Geographic Coverage of South America Athletic Footwear Market

South America Athletic Footwear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Social Media Influence and Aggressive Marketing Fueling Market Demand; Augmented Expenditure on Advertisement and Promotional Activities by Key players

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfiet Products

- 3.4. Market Trends

- 3.4.1. Expanding Sports Sector with Strong Support from Governing Bodies

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Athletic Footwear Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Running Shoes

- 5.1.2. Sport Shoes

- 5.1.3. Trekking/Hiking Shoes

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End user

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Children

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Online Retail Stores

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.5.2. Argentina

- 5.5.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Athletic Footwear Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Running Shoes

- 6.1.2. Sport Shoes

- 6.1.3. Trekking/Hiking Shoes

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End user

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Children

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets/Hypermarkets

- 6.3.2. Online Retail Stores

- 6.3.3. Others

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Argentina

- 6.4.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America Athletic Footwear Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Running Shoes

- 7.1.2. Sport Shoes

- 7.1.3. Trekking/Hiking Shoes

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End user

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Children

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets/Hypermarkets

- 7.3.2. Online Retail Stores

- 7.3.3. Others

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Argentina

- 7.4.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of South America South America Athletic Footwear Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Running Shoes

- 8.1.2. Sport Shoes

- 8.1.3. Trekking/Hiking Shoes

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End user

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Children

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets/Hypermarkets

- 8.3.2. Online Retail Stores

- 8.3.3. Others

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Argentina

- 8.4.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Adidas AG

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 New Balance Athletics Inc *List Not Exhaustive

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Vulcabras

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Decathlon SA

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Skechers USA Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Puma SE

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Under Armour Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Mizuno Corporation

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Nike Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 ASICS Corporation

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Adidas AG

List of Figures

- Figure 1: South America Athletic Footwear Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Athletic Footwear Market Share (%) by Company 2025

List of Tables

- Table 1: South America Athletic Footwear Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: South America Athletic Footwear Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: South America Athletic Footwear Market Revenue undefined Forecast, by End user 2020 & 2033

- Table 4: South America Athletic Footwear Market Volume K Units Forecast, by End user 2020 & 2033

- Table 5: South America Athletic Footwear Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: South America Athletic Footwear Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 7: South America Athletic Footwear Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: South America Athletic Footwear Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 9: South America Athletic Footwear Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 10: South America Athletic Footwear Market Volume K Units Forecast, by Region 2020 & 2033

- Table 11: South America Athletic Footwear Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 12: South America Athletic Footwear Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 13: South America Athletic Footwear Market Revenue undefined Forecast, by End user 2020 & 2033

- Table 14: South America Athletic Footwear Market Volume K Units Forecast, by End user 2020 & 2033

- Table 15: South America Athletic Footwear Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 16: South America Athletic Footwear Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 17: South America Athletic Footwear Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 18: South America Athletic Footwear Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 19: South America Athletic Footwear Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: South America Athletic Footwear Market Volume K Units Forecast, by Country 2020 & 2033

- Table 21: South America Athletic Footwear Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 22: South America Athletic Footwear Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 23: South America Athletic Footwear Market Revenue undefined Forecast, by End user 2020 & 2033

- Table 24: South America Athletic Footwear Market Volume K Units Forecast, by End user 2020 & 2033

- Table 25: South America Athletic Footwear Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 26: South America Athletic Footwear Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 27: South America Athletic Footwear Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: South America Athletic Footwear Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 29: South America Athletic Footwear Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: South America Athletic Footwear Market Volume K Units Forecast, by Country 2020 & 2033

- Table 31: South America Athletic Footwear Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 32: South America Athletic Footwear Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 33: South America Athletic Footwear Market Revenue undefined Forecast, by End user 2020 & 2033

- Table 34: South America Athletic Footwear Market Volume K Units Forecast, by End user 2020 & 2033

- Table 35: South America Athletic Footwear Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 36: South America Athletic Footwear Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 37: South America Athletic Footwear Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 38: South America Athletic Footwear Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 39: South America Athletic Footwear Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: South America Athletic Footwear Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Athletic Footwear Market?

The projected CAGR is approximately 2.43%.

2. Which companies are prominent players in the South America Athletic Footwear Market?

Key companies in the market include Adidas AG, New Balance Athletics Inc *List Not Exhaustive, Vulcabras, Decathlon SA, Skechers USA Inc, Puma SE, Under Armour Inc, Mizuno Corporation, Nike Inc, ASICS Corporation.

3. What are the main segments of the South America Athletic Footwear Market?

The market segments include Product Type, End user, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Social Media Influence and Aggressive Marketing Fueling Market Demand; Augmented Expenditure on Advertisement and Promotional Activities by Key players.

6. What are the notable trends driving market growth?

Expanding Sports Sector with Strong Support from Governing Bodies.

7. Are there any restraints impacting market growth?

Availability of Counterfiet Products.

8. Can you provide examples of recent developments in the market?

In 2022, PUMA Se partnered up with the Brazilian Confederation of Athletics to sponsor their national teams. This partnership also includes sponsoring 24 adult and youth teams.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Athletic Footwear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Athletic Footwear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Athletic Footwear Market?

To stay informed about further developments, trends, and reports in the South America Athletic Footwear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence