Key Insights

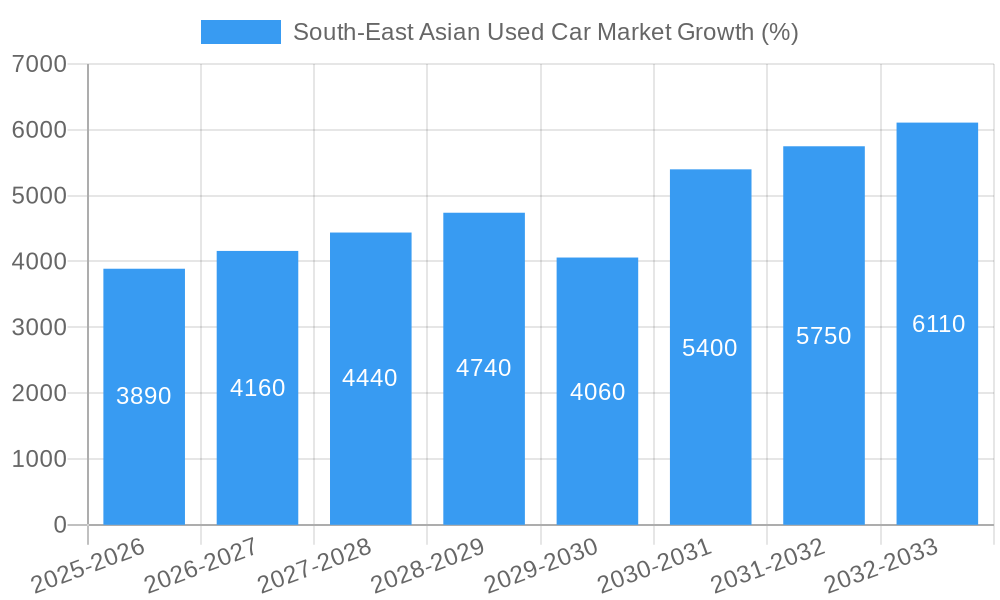

The South-East Asian used car market, valued at $62.31 billion in 2025, is projected to experience robust growth, driven by factors such as rising disposable incomes, increasing urbanization, and a preference for more affordable transportation options compared to new vehicles. The market's Compound Annual Growth Rate (CAGR) of 6.23% from 2025 to 2033 indicates a significant expansion, with SUVs experiencing particularly strong demand due to their versatility and suitability for diverse road conditions in the region. Online platforms are rapidly gaining traction, disrupting the traditional offline model and offering greater transparency and convenience to buyers and sellers. This shift towards online channels is further fueled by increased internet penetration and smartphone adoption across Southeast Asia. While the organized sector is currently dominant, the unorganized sector continues to play a significant role, especially in rural areas. Market segmentation by vehicle type (hatchback, sedan, SUV), fuel type (diesel, gasoline/petrol, others), booking type (offline, online), vendor type (organized, unorganized), and country (Vietnam, Indonesia, Malaysia, Thailand, Singapore, Rest of South-East Asia) provides granular insights for strategic planning. Competition is intensifying with both established players like Cars24 and Honda Certified, and emerging online marketplaces like Carousell and Carsome vying for market share.

The continued economic growth in key Southeast Asian nations will likely fuel further expansion of the used car market. However, challenges such as fluctuating fuel prices, evolving government regulations regarding vehicle emissions and safety standards, and the availability of financing options will influence the market's trajectory. The market's growth potential is especially significant in countries like Vietnam and Indonesia, characterized by burgeoning middle classes and expanding car ownership. Understanding the specific dynamics of each country within the region is crucial for effective market entry and penetration strategies. Furthermore, investment in improved vehicle inspection and certification processes could help boost consumer confidence and accelerate market growth, contributing to a more formalized and transparent used car industry in Southeast Asia.

South-East Asian Used Car Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South-East Asian used car market, covering the period from 2019 to 2033. It offers valuable insights into market dynamics, key players, growth drivers, and future opportunities, equipping industry stakeholders with actionable intelligence for strategic decision-making. The report leverages extensive data analysis, including market sizing, segmentation, and competitive landscape assessments, to deliver a holistic view of this dynamic market. With a focus on key countries like Indonesia, Malaysia, Thailand, Singapore, Vietnam, and the Rest of South-East Asia, this report is an essential resource for businesses looking to navigate and capitalize on the growth potential within the region.

South-East Asian Used Car Market Concentration & Innovation

The South-East Asian used car market exhibits a complex interplay of organized and unorganized players, resulting in a fragmented yet rapidly evolving landscape. Market concentration is moderate, with several dominant players vying for market share, alongside numerous smaller, independent vendors. The market share of top players like Carsome and Carro is growing, but the unorganized sector still holds a significant portion.

- Market Share (Estimated 2025): Organized sector: 40%; Unorganized sector: 60%

- M&A Activity: The past five years have witnessed significant M&A activity, with deal values exceeding xx Million USD. Key acquisitions have focused on consolidating market share and expanding geographical reach. For example, Carsome's acquisitions have significantly boosted its market share.

- Innovation Drivers: Technological advancements, particularly in online platforms and digital marketing, are key innovation drivers. The rise of online marketplaces like Carousell and OLX Indonesia has democratized access to used cars, creating new opportunities for both buyers and sellers.

- Regulatory Frameworks: Varying regulatory environments across the region impact market dynamics, with some countries having stricter regulations concerning vehicle inspections and emissions standards than others. These regulatory differences can influence the growth trajectories of specific segments and companies operating within those regions.

- Product Substitutes: Public transportation and ride-hailing services pose a degree of competition, especially in densely populated urban areas. However, the preference for personal vehicle ownership, particularly in emerging markets, continues to fuel market growth.

- End-User Trends: Increasing urbanization, rising disposable incomes, and a preference for fuel-efficient vehicles are key end-user trends shaping market demand.

South-East Asian Used Car Market Industry Trends & Insights

The South-East Asian used car market is experiencing robust growth, driven by factors such as a burgeoning middle class, increasing vehicle ownership, and the affordability of used cars compared to new ones. The market is witnessing a technological disruption, with online platforms significantly altering the buying and selling processes. This digital shift is improving transparency and efficiency, attracting a broader customer base.

Consumer preferences are evolving, with a clear inclination towards fuel-efficient vehicles, especially SUVs and hatchbacks. The competitive landscape is dynamic, with established players like Carsome and Carro facing increasing competition from emerging online platforms and international expansion of companies. The compound annual growth rate (CAGR) for the market during the forecast period (2025-2033) is projected to be xx%. Market penetration of online platforms is expected to reach xx% by 2033.

Dominant Markets & Segments in South-East Asian Used Car Market

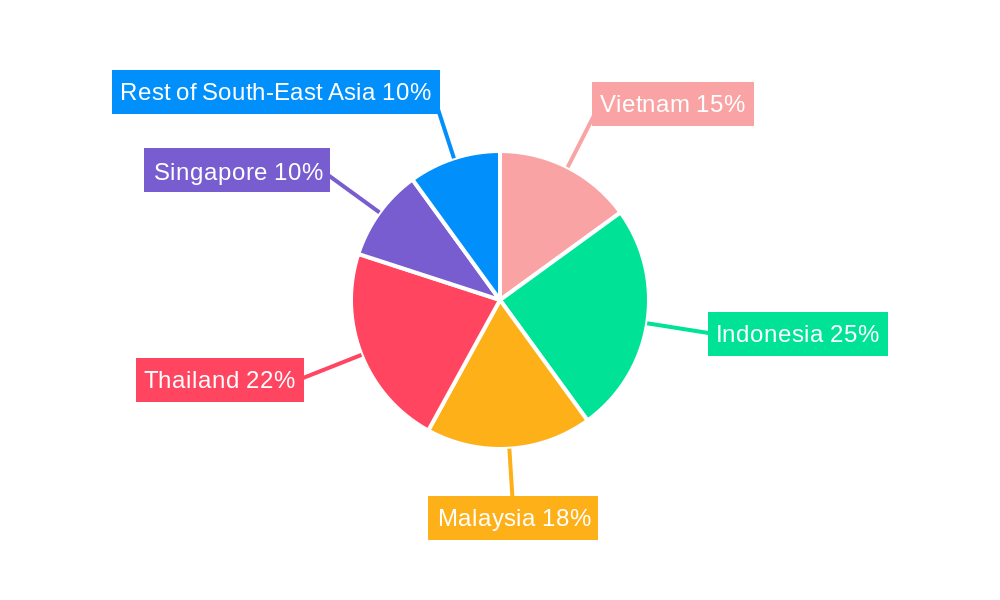

Indonesia and Thailand dominate the South-East Asian used car market, driven by large populations, expanding middle classes, and supportive government policies that incentivize vehicle ownership. However, other countries such as Vietnam and Malaysia are also experiencing significant growth.

Dominant Segments:

- By Country: Indonesia and Thailand represent the largest markets.

- By Vehicle Type: SUVs and hatchbacks are the most popular vehicle types.

- By Fuel Type: Gasoline/Petrol remains the dominant fuel type.

- By Booking Type: While offline transactions still prevail, the online segment is experiencing rapid growth.

- By Vendor Type: The unorganized sector is currently larger but the organized sector is growing quickly.

Key Drivers:

- Economic factors: Rising disposable incomes, increasing urbanization, and government initiatives supporting vehicle ownership.

- Infrastructure: Improved road networks and expanding urban infrastructure.

South-East Asian Used Car Market Product Developments

The used car market is witnessing significant product innovation driven by technological advancements. Online platforms offer features like virtual inspections, detailed vehicle history reports, and secure online payment gateways. These innovations enhance transparency, trust, and convenience for buyers and sellers. The integration of AI-powered valuation tools and personalized recommendations further improves the customer experience. This convergence of technology and the traditional used car market leads to increased market reach and a streamlined customer journey.

Report Scope & Segmentation Analysis

This report segments the South-East Asian used car market across various parameters:

By Vehicle Type: Hatchback, Sedan, SUV, other. Growth projections vary across segments, with SUVs expected to show robust growth, given changing consumer preferences.

By Fuel Type: Gasoline/Petrol, Diesel, Other Fuel Types. Gasoline/Petrol holds the largest market share, but the demand for alternative fuels is emerging.

By Booking Type: Online, Offline. The online segment is exhibiting faster growth compared to offline, driven by the increased adoption of e-commerce and online platforms.

By Vendor Type: Organized, Unorganized. The organized sector is expected to increase its market share in the coming years.

By Country: Vietnam, Indonesia, Malaysia, Thailand, Singapore, Rest of South-East Asia. Each country's market dynamics and growth trajectories are analyzed individually, considering specific regional factors and regulatory frameworks.

Key Drivers of South-East Asian Used Car Market Growth

Several key factors are driving the expansion of the South-East Asian used car market. The increasing affordability of used vehicles compared to new ones is a significant driver, particularly for first-time buyers. Technological advancements facilitating online transactions, improved vehicle inspections, and convenient financing options are enhancing market accessibility. Moreover, supportive government policies in certain countries and economic growth are fostering consumer confidence and increasing purchasing power.

Challenges in the South-East Asian Used Car Market Sector

The South-East Asian used car market faces several challenges. These include the prevalence of the unorganized sector, which can lead to issues of transparency and trust. Varying regulations across different countries create operational complexities for companies operating in multiple markets. Supply chain disruptions, especially concerning vehicle parts and logistics, can also impact market stability. Finally, intense competition among both organized and unorganized players creates price pressures.

Emerging Opportunities in South-East Asian Used Car Market

The market presents significant opportunities for growth. The expansion of the organized sector, with its emphasis on quality assurance, transparency, and convenient services, creates a significant growth opportunity. The increasing adoption of fintech solutions for financing and online payment processing is further boosting the market. The emergence of subscription models for used cars is another area with high potential. Additionally, exploring alternative fuel vehicle segments (e.g., electric and hybrid) offers significant future growth potential.

Leading Players in the South-East Asian Used Car Market Market

- Cars24 Services Private Limited

- Honda Certified (Honda Motor Corporation)

- OLX Indonesia

- Carousell

- Carsome Sdn Bhd

- PT Moladin Digita

- Toyota Trust (Toyota Motor Corporation)

- Nissan Intelligent Mobility (Nissan Motor Corporation)

- ICar Asia Limited

- Carro (Trusty Cars Pte Ltd)

Key Developments in South-East Asian Used Car Market Industry

- January 2022: Moladin, an Indonesian used car platform, raised USD 42 Million in Series A funding. This investment signifies the growing interest in the Indonesian used car market and the potential for online platforms to scale rapidly.

- April 2022: Spinny launched its Spinnymax brand in Vietnam, targeting the luxury used car segment. This expansion reflects the increasing demand for pre-owned luxury vehicles in the region.

Strategic Outlook for South-East Asian Used Car Market Market

The South-East Asian used car market is poised for sustained growth, driven by factors such as rising disposable incomes, increasing urbanization, and a growing preference for affordable and convenient transportation options. The continued adoption of technology, coupled with the expansion of organized players and supportive regulatory frameworks in several key markets, is expected to fuel market expansion. The focus on enhancing transparency, quality assurance, and customer experience will be crucial for success in this competitive landscape. The market presents lucrative opportunities for both established players and new entrants who can adapt to changing consumer preferences and leverage technological advancements to their advantage.

South-East Asian Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. Sports Utility Vehicle (SUV)

- 1.4. Multi-Purpose Utility Vehicle (MPV)

-

2. Fuel Type

- 2.1. Gasoline

- 2.2. Diesel

- 2.3. Electric

- 2.4. Other Fuel Types (LPG, CNG, Etc.)

-

3. Sales Channel

- 3.1. Online

- 3.2. Offline

-

4. Vendor Type

- 4.1. Organized

- 4.2. Unorganized

-

5. Purchase Method

- 5.1. Outright Purchase

-

5.2. Financed Purchase

- 5.2.1. Captive Financing

- 5.2.2. Bank Financing

- 5.2.3. Non-banking Financial Corporations (NBFC)

South-East Asian Used Car Market Segmentation By Geography

-

1. South East Asia

- 1.1. Indonesia

- 1.2. Malaysia

- 1.3. Singapore

- 1.4. Thailand

- 1.5. Vietnam

- 1.6. Philippines

- 1.7. Myanmar

- 1.8. Cambodia

- 1.9. Laos

South-East Asian Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.23% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Distribution Channels; Others

- 3.3. Market Restrains

- 3.3.1. Lack Of Trust And Transparency; Others

- 3.4. Market Trends

- 3.4.1. Strengthening of Digital Platforms is Driving the Online Booking Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South-East Asian Used Car Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. Sports Utility Vehicle (SUV)

- 5.1.4. Multi-Purpose Utility Vehicle (MPV)

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Gasoline

- 5.2.2. Diesel

- 5.2.3. Electric

- 5.2.4. Other Fuel Types (LPG, CNG, Etc.)

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Vendor Type

- 5.4.1. Organized

- 5.4.2. Unorganized

- 5.5. Market Analysis, Insights and Forecast - by Purchase Method

- 5.5.1. Outright Purchase

- 5.5.2. Financed Purchase

- 5.5.2.1. Captive Financing

- 5.5.2.2. Bank Financing

- 5.5.2.3. Non-banking Financial Corporations (NBFC)

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South East Asia

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. China South-East Asian Used Car Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan South-East Asian Used Car Market Analysis, Insights and Forecast, 2019-2031

- 8. India South-East Asian Used Car Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea South-East Asian Used Car Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan South-East Asian Used Car Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia South-East Asian Used Car Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific South-East Asian Used Car Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Cars24 Services Private Limited

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Honda Certified (Honda Motor Corporation)

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 OLX Indonesia

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Carousell

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Carsome Sdn Bhd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 PT Moladin Digita

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Toyota Trust (Toyota Motor Corporation)

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Nissan Intelligent Mobility (Nissan Motor Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 ICar Asia Limited

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Carro (Trusty Cars Pte Ltd)

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Cars24 Services Private Limited

List of Figures

- Figure 1: South-East Asian Used Car Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South-East Asian Used Car Market Share (%) by Company 2024

List of Tables

- Table 1: South-East Asian Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South-East Asian Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: South-East Asian Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: South-East Asian Used Car Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 5: South-East Asian Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 6: South-East Asian Used Car Market Revenue Million Forecast, by Purchase Method 2019 & 2032

- Table 7: South-East Asian Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: South-East Asian Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: China South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Japan South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Korea South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Taiwan South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Australia South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Asia-Pacific South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South-East Asian Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 17: South-East Asian Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 18: South-East Asian Used Car Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 19: South-East Asian Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 20: South-East Asian Used Car Market Revenue Million Forecast, by Purchase Method 2019 & 2032

- Table 21: South-East Asian Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Indonesia South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Malaysia South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Singapore South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Thailand South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Vietnam South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Philippines South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Myanmar South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Cambodia South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Laos South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South-East Asian Used Car Market?

The projected CAGR is approximately 6.23%.

2. Which companies are prominent players in the South-East Asian Used Car Market?

Key companies in the market include Cars24 Services Private Limited, Honda Certified (Honda Motor Corporation), OLX Indonesia, Carousell, Carsome Sdn Bhd, PT Moladin Digita, Toyota Trust (Toyota Motor Corporation), Nissan Intelligent Mobility (Nissan Motor Corporation, ICar Asia Limited, Carro (Trusty Cars Pte Ltd).

3. What are the main segments of the South-East Asian Used Car Market?

The market segments include Vehicle Type, Fuel Type, Sales Channel, Vendor Type, Purchase Method.

4. Can you provide details about the market size?

The market size is estimated to be USD 62.31 Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Distribution Channels; Others.

6. What are the notable trends driving market growth?

Strengthening of Digital Platforms is Driving the Online Booking Segment.

7. Are there any restraints impacting market growth?

Lack Of Trust And Transparency; Others.

8. Can you provide examples of recent developments in the market?

April 2022: Spinny, a used car buying and selling platform, entered the luxury car used vehicle segment under the Spinnymax brand in the Vietnamese market. The platform will operate at a national scale and offers over 500 cars from various brands, including Mercedes-Benz, BMW, Audi, Jaguar, and Land Rover, with an all-India delivery service through 250 cities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South-East Asian Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South-East Asian Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South-East Asian Used Car Market?

To stay informed about further developments, trends, and reports in the South-East Asian Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence