Key Insights

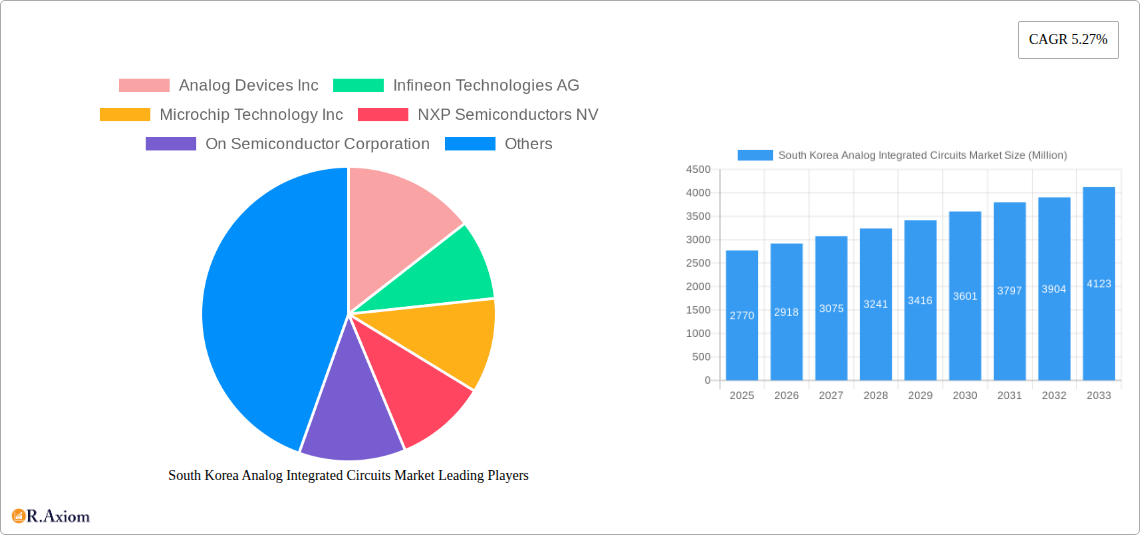

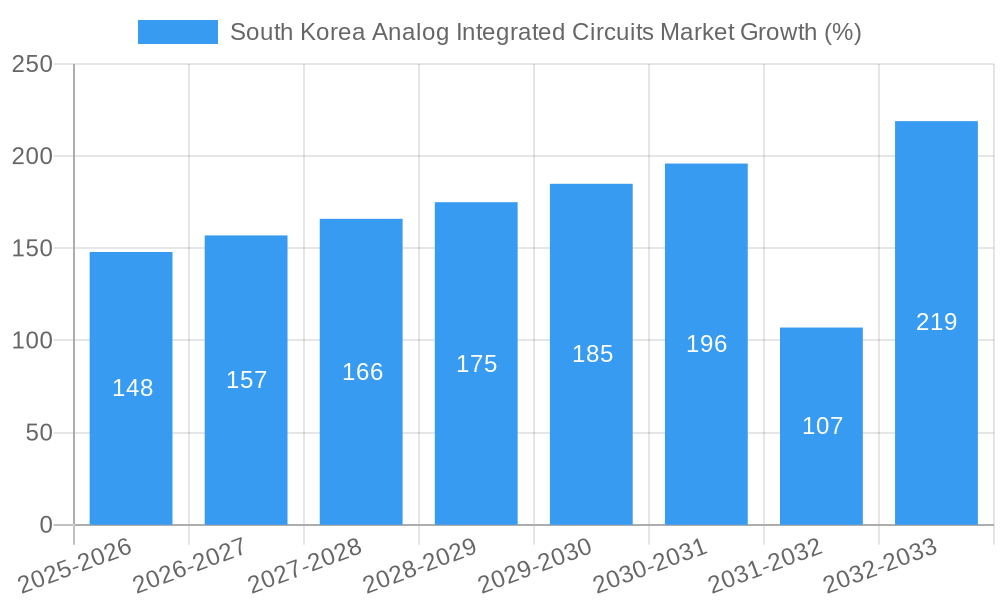

The South Korean analog integrated circuits (AIC) market exhibits robust growth, projected to reach \$2.77 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 5.27% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing demand for high-performance electronics across various sectors, such as consumer electronics, automotive, and industrial automation within South Korea, is a significant catalyst. Advancements in 5G technology and the burgeoning Internet of Things (IoT) ecosystem are further stimulating demand for sophisticated AICs capable of handling high-speed data transmission and low-power consumption. Furthermore, government initiatives promoting technological innovation and domestic semiconductor manufacturing contribute to the market's positive trajectory. While supply chain disruptions and global economic uncertainties pose potential restraints, the long-term outlook remains optimistic, driven by consistent technological advancements and increasing integration of AICs in diverse applications. The market's segmentation likely reflects various AIC types (operational amplifiers, data converters, etc.) and application areas. Leading players like Analog Devices, Infineon, and Texas Instruments are likely to maintain significant market share, leveraging their technological expertise and established distribution networks within South Korea. The competitive landscape is intense, however, with regional and global players vying for market dominance through strategic partnerships, acquisitions, and product innovations.

The forecast period (2025-2033) suggests a steady rise in market value, exceeding \$4 billion by 2033. This growth is expected to be relatively consistent, given the continuous technological advancements and the country's strong focus on technological development and industrial modernization. The historical period (2019-2024) likely saw similar growth, albeit potentially impacted by short-term economic fluctuations. Continued innovation in automotive electronics, particularly in electric vehicles and advanced driver-assistance systems (ADAS), will significantly drive demand for specific AIC types within South Korea. The strong presence of global electronics manufacturers and a robust domestic electronics industry ensure continuous growth for the foreseeable future. While specific regional data is absent, the national market size suggests a significant concentration within South Korea, likely influenced by its position as a major global player in the electronics manufacturing industry.

South Korea Analog Integrated Circuits Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the South Korea Analog Integrated Circuits market, covering the historical period (2019-2024), the base year (2025), and offering detailed forecasts until 2033. It delves into market dynamics, competitive landscapes, technological advancements, and key growth drivers, providing actionable insights for industry stakeholders. The report leverages extensive data analysis to offer a precise outlook for investors, manufacturers, and market participants. Market values are expressed in Millions (USD).

South Korea Analog Integrated Circuits Market Concentration & Innovation

This section analyzes the competitive intensity within the South Korea Analog Integrated Circuits market, examining market concentration, innovation drivers, regulatory frameworks, the impact of product substitutes, evolving end-user trends, and merger & acquisition (M&A) activities. The market is moderately concentrated, with a few major players holding significant market share. However, the presence of numerous smaller, specialized firms fosters a dynamic competitive landscape.

- Market Share: Texas Instruments Inc. and Analog Devices Inc. currently hold the largest market share, estimated at xx% and xx% respectively in 2025. Other key players, including STMicroelectronics NV, Infineon Technologies AG, and NXP Semiconductors NV, collectively account for approximately xx% of the market.

- Innovation Drivers: The continuous demand for miniaturization, enhanced performance, and lower power consumption in various applications drives innovation in analog IC technology. Advancements in process technologies like STMicroelectronics' 18nm FD-SOI process fuel this progress.

- Regulatory Framework: Government initiatives promoting technological advancement and the electronics industry influence market dynamics. Stringent regulatory requirements related to product safety and environmental standards also impact manufacturers' strategies.

- Product Substitutes: The emergence of digital signal processing (DSP) and software-defined radio (SDR) technologies presents some level of substitution but their capabilities often complement, rather than completely replace, analog ICs.

- End-User Trends: The increasing demand for advanced features in consumer electronics, automotive applications, and industrial automation significantly impacts market growth. The preference for smaller, more energy-efficient devices pushes technological innovation.

- M&A Activities: The South Korean Analog Integrated Circuits market has seen xx M&A deals in the past five years, with an average deal value of xx Million. These activities contribute to market consolidation and enhance technological capabilities.

South Korea Analog Integrated Circuits Market Industry Trends & Insights

This section provides in-depth analysis of the market's growth trajectory, highlighting key trends and drivers influencing its development. The market is projected to experience substantial growth, driven by factors such as increasing demand for advanced electronics, technological advancements, and government support for the semiconductor industry.

The South Korea Analog Integrated Circuits market is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including the robust growth in the consumer electronics and automotive sectors, increasing demand for high-performance analog ICs in industrial applications, and government support for the semiconductor industry in South Korea. The market penetration of high-performance analog ICs is steadily increasing, and is further boosted by the adoption of advanced technologies in various end-use sectors. The competitive landscape is highly dynamic, with both established and emerging players constantly striving to innovate and differentiate their offerings. The strong focus on technological advancements, especially in areas like power management and sensor technology, is driving the growth of this market. However, challenges like supply chain disruptions and global economic uncertainties could potentially impede growth to a certain extent.

Dominant Markets & Segments in South Korea Analog Integrated Circuits Market

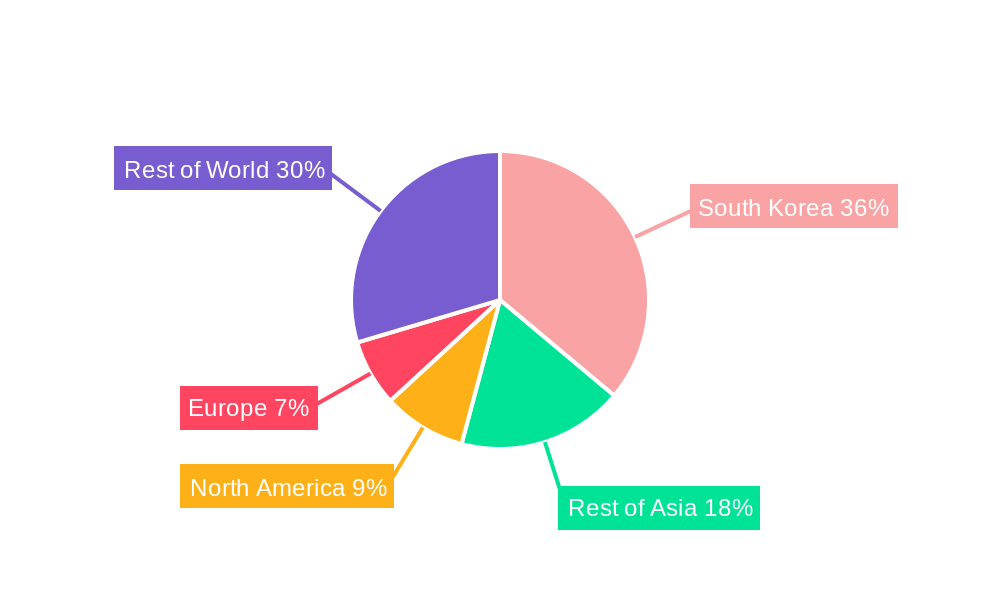

This section identifies the leading segments and regions within the South Korea Analog Integrated Circuits market, providing a detailed analysis of the factors contributing to their dominance. While data on specific regional breakdowns within South Korea are limited, the analysis focuses on the key application sectors driving market demand.

Key Drivers:

- Robust Consumer Electronics Sector: South Korea's highly developed consumer electronics sector fuels demand for sophisticated analog ICs in smartphones, televisions, and other consumer devices.

- Automotive Industry Growth: The expanding automotive sector, with a focus on electric and autonomous vehicles, drives demand for advanced analog ICs in power management, sensor systems, and infotainment systems.

- Government Support: Government policies supporting the semiconductor industry and investments in research and development boost technological advancements and market growth.

Dominance Analysis: The consumer electronics sector is currently the most dominant segment, accounting for an estimated xx% of the total market value in 2025. This is followed by the automotive sector and industrial automation. The strong growth potential of the automotive and industrial sectors positions them for increased market share in the coming years.

South Korea Analog Integrated Circuits Market Product Developments

Recent product innovations have focused on enhancing performance, reducing power consumption, and miniaturization. The development of advanced process technologies like STMicroelectronics' 18nm FD-SOI process, as showcased in their April 2024 announcement, signifies a significant step towards improved efficiency and reliability. These advancements cater to the growing need for high-performance analog ICs in various applications, driving increased market demand and bolstering the competitiveness of leading players. The focus on integrating advanced features like embedded phase-change memory (PCM) further improves performance and enables diverse functionalities.

Report Scope & Segmentation Analysis

This report segments the South Korea Analog Integrated Circuits market based on several key parameters:

By Product Type: This segment includes operational amplifiers, voltage regulators, data converters, and others. Each segment demonstrates varied growth projections reflecting differing end-user demands and technological advancements. For example, the data converter segment is projected to experience faster growth due to the rising demand for high-speed data transmission in various applications. The competitive dynamics are also analyzed within each product type segment, focusing on the specific strengths of individual manufacturers.

By Application: This segment categorizes the market based on applications like consumer electronics, automotive, industrial, and others. Each application segment exhibits specific growth patterns influenced by factors such as technological advancements and industry-specific trends. For instance, the automotive segment is expected to show rapid growth fueled by the increasing adoption of advanced driver-assistance systems (ADAS) and electric vehicles. Competitive dynamics within application segments reflect the specialized capabilities of various manufacturers to meet the application-specific needs.

By Technology: This segment analyzes the market based on different technologies used in analog IC manufacturing. The advancements in process technologies are expected to impact the market significantly.

Key Drivers of South Korea Analog Integrated Circuits Market Growth

Several factors contribute to the growth of the South Korea Analog Integrated Circuits market:

- Technological Advancements: Continuous innovation in process technologies, leading to higher performance, lower power consumption, and miniaturization, drives market growth.

- Strong Consumer Electronics Sector: South Korea’s robust consumer electronics industry fosters a high demand for sophisticated analog ICs.

- Automotive Industry Expansion: The rapid growth of the automotive sector, particularly in electric and autonomous vehicles, drives significant demand.

- Government Support for Semiconductor Industry: Initiatives promoting technology development and investment in R&D further accelerate market growth.

Challenges in the South Korea Analog Integrated Circuits Market Sector

Despite the growth potential, the market faces several challenges:

- Global Economic Uncertainty: Fluctuations in the global economy can impact investment and demand.

- Supply Chain Disruptions: Dependence on global supply chains introduces vulnerability to disruptions.

- Intense Competition: A large number of players create a competitive environment affecting pricing and profitability.

Emerging Opportunities in South Korea Analog Integrated Circuits Market

Several emerging opportunities exist for growth:

- Growth in Internet of Things (IoT): The increasing adoption of IoT devices creates a demand for energy-efficient and highly integrated analog ICs.

- Advancements in 5G Technology: 5G infrastructure development fuels the demand for high-performance analog ICs for base stations and mobile devices.

- Expansion of Industrial Automation: The growing adoption of automation in industrial settings creates demand for robust and reliable analog ICs.

Leading Players in the South Korea Analog Integrated Circuits Market Market

- Analog Devices Inc

- Infineon Technologies AG

- Microchip Technology Inc

- NXP Semiconductors NV

- On Semiconductor Corporation

- Richtek Technology Corporation (MediaTek Inc)

- Skyworks Solutions Inc

- STMicroelectronics NV

- Texas Instruments Inc

- Renesas Electronics Corporation

- Qorvo Inc

- *List Not Exhaustive

Key Developments in South Korea Analog Integrated Circuits Market Industry

- April 2024: STMicroelectronics announced a new 18nm FD-SOI process technology with embedded phase change memory (PCM) for next-generation embedded processing devices. This advancement enhances performance and reliability for demanding industrial applications.

- January 2024: Damon Motors Inc. collaborated with NXP Semiconductors to integrate NXP's technology into Damon's electronic control units (ECUs) and other electronic systems. This highlights the growing demand for advanced analog ICs in the electric vehicle sector.

Strategic Outlook for South Korea Analog Integrated Circuits Market Market

The South Korea Analog Integrated Circuits market presents a significant growth opportunity for companies leveraging technological advancements and catering to the increasing demand across various application sectors. The continued expansion of the consumer electronics, automotive, and industrial automation industries, coupled with government support, ensures a positive outlook for the future. The strategic focus should be on innovation, enhancing supply chain resilience, and expanding into emerging applications to capture market share and achieve sustainable growth.

South Korea Analog Integrated Circuits Market Segmentation

-

1. Type

-

1.1. General-purpose IC

- 1.1.1. Interface

- 1.1.2. Power Management

- 1.1.3. Signal Conversion

- 1.1.4. Amplifiers/Comparators (Signal Conditioning)

-

1.2. Application-specific IC

-

1.2.1. Consumer

- 1.2.1.1. Audio/Video

- 1.2.1.2. Digital Still Camera and Camcorder

- 1.2.1.3. Other Consumers

-

1.2.2. Automotive

- 1.2.2.1. Infotainment

- 1.2.2.2. Other Infotainment

-

1.2.3. Communication

- 1.2.3.1. Cell Phone

- 1.2.3.2. Infrastructure

- 1.2.3.3. Wired Communication

- 1.2.3.4. Short Range

- 1.2.3.5. Other Wireless

-

1.2.4. Computer

- 1.2.4.1. Computer System and Display

- 1.2.4.2. Computer Periphery

- 1.2.4.3. Storage

- 1.2.4.4. Other Computers

- 1.2.5. Industrial and Others

-

1.2.1. Consumer

-

1.1. General-purpose IC

South Korea Analog Integrated Circuits Market Segmentation By Geography

- 1. South Korea

South Korea Analog Integrated Circuits Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.27% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Penetration of Smartphones

- 3.2.2 Feature Phones

- 3.2.3 and Tablets; Increasing Adoption of Industrial Automation; The Growing Emphasis on Energy Efficiency Across Various Sectors

- 3.3. Market Restrains

- 3.3.1 Rising Penetration of Smartphones

- 3.3.2 Feature Phones

- 3.3.3 and Tablets; Increasing Adoption of Industrial Automation; The Growing Emphasis on Energy Efficiency Across Various Sectors

- 3.4. Market Trends

- 3.4.1. The Power Management Segment is Anticipated to Drive the Demand for the Market Studied

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Analog Integrated Circuits Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. General-purpose IC

- 5.1.1.1. Interface

- 5.1.1.2. Power Management

- 5.1.1.3. Signal Conversion

- 5.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 5.1.2. Application-specific IC

- 5.1.2.1. Consumer

- 5.1.2.1.1. Audio/Video

- 5.1.2.1.2. Digital Still Camera and Camcorder

- 5.1.2.1.3. Other Consumers

- 5.1.2.2. Automotive

- 5.1.2.2.1. Infotainment

- 5.1.2.2.2. Other Infotainment

- 5.1.2.3. Communication

- 5.1.2.3.1. Cell Phone

- 5.1.2.3.2. Infrastructure

- 5.1.2.3.3. Wired Communication

- 5.1.2.3.4. Short Range

- 5.1.2.3.5. Other Wireless

- 5.1.2.4. Computer

- 5.1.2.4.1. Computer System and Display

- 5.1.2.4.2. Computer Periphery

- 5.1.2.4.3. Storage

- 5.1.2.4.4. Other Computers

- 5.1.2.5. Industrial and Others

- 5.1.2.1. Consumer

- 5.1.1. General-purpose IC

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Analog Devices Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Infineon Technologies AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Microchip Technology Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NXP Semiconductors NV

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 On Semiconductor Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Richtek Technology Corporation (MediaTek Inc )

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Skyworks Solutions Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 STMicroelectronics NV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Texas Instruments Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Renesas Electronics Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Qorvo Inc *List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Analog Devices Inc

List of Figures

- Figure 1: South Korea Analog Integrated Circuits Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Korea Analog Integrated Circuits Market Share (%) by Company 2024

List of Tables

- Table 1: South Korea Analog Integrated Circuits Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Korea Analog Integrated Circuits Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: South Korea Analog Integrated Circuits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: South Korea Analog Integrated Circuits Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: South Korea Analog Integrated Circuits Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South Korea Analog Integrated Circuits Market Volume Billion Forecast, by Region 2019 & 2032

- Table 7: South Korea Analog Integrated Circuits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: South Korea Analog Integrated Circuits Market Volume Billion Forecast, by Type 2019 & 2032

- Table 9: South Korea Analog Integrated Circuits Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: South Korea Analog Integrated Circuits Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Analog Integrated Circuits Market?

The projected CAGR is approximately 5.27%.

2. Which companies are prominent players in the South Korea Analog Integrated Circuits Market?

Key companies in the market include Analog Devices Inc, Infineon Technologies AG, Microchip Technology Inc, NXP Semiconductors NV, On Semiconductor Corporation, Richtek Technology Corporation (MediaTek Inc ), Skyworks Solutions Inc, STMicroelectronics NV, Texas Instruments Inc, Renesas Electronics Corporation, Qorvo Inc *List Not Exhaustive.

3. What are the main segments of the South Korea Analog Integrated Circuits Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Penetration of Smartphones. Feature Phones. and Tablets; Increasing Adoption of Industrial Automation; The Growing Emphasis on Energy Efficiency Across Various Sectors.

6. What are the notable trends driving market growth?

The Power Management Segment is Anticipated to Drive the Demand for the Market Studied.

7. Are there any restraints impacting market growth?

Rising Penetration of Smartphones. Feature Phones. and Tablets; Increasing Adoption of Industrial Automation; The Growing Emphasis on Energy Efficiency Across Various Sectors.

8. Can you provide examples of recent developments in the market?

April 2024: STMicroelectronics announced a new process technology to design and build transistors for next-generation embedded processing devices. The advanced technology was based on an 18nm fully depleted silicon on insulator (FD-SOI) process with embedded phase change memory. This is claimed to have reduced the feature size to 18nm from 20nm. PCMtechnology uses changes in the material phase to store data. It also supports 3V operation for analog features and delivers the reliability required for demanding industrial applications like high-temperature operation, radiation hardening, and data retention capabilities.January 2024: Damon Motors Inc. announced a collaboration with NXP Semiconductors, a prominent company in automotive processing and a renowned provider of vehicle electrical/electronic (E/E) architecture and electrification solutions. Through this collaboration, NXP's advanced technology has been integrated into Damon's electronic control units (ECU) and other electronic systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Analog Integrated Circuits Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Analog Integrated Circuits Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Analog Integrated Circuits Market?

To stay informed about further developments, trends, and reports in the South Korea Analog Integrated Circuits Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence