Key Insights

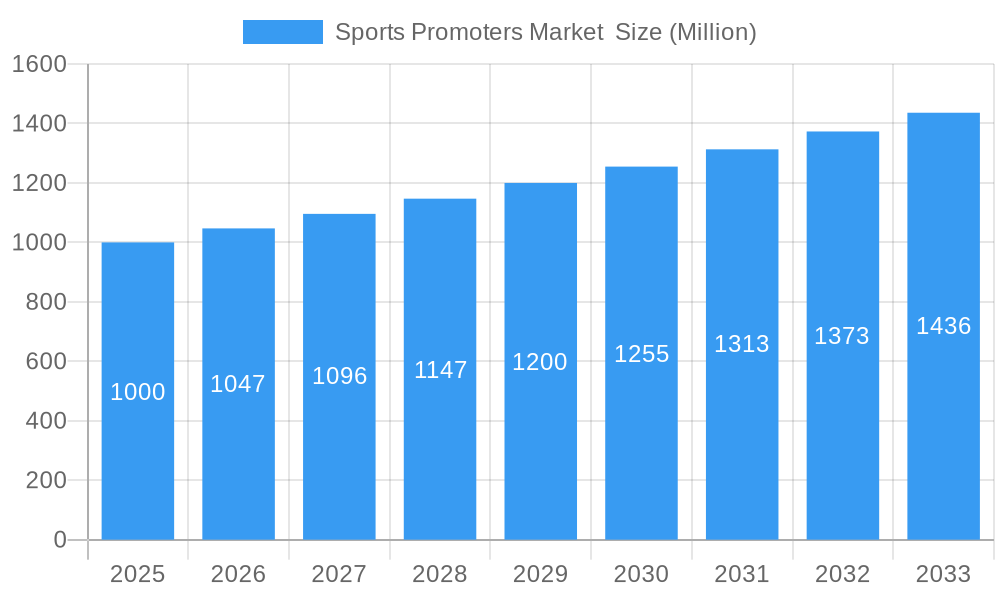

The global Sports Promoters Market is poised for significant expansion, estimated to reach a substantial XX Million by 2025 and projected to grow at a compound annual growth rate (CAGR) of 4.65% through 2033. This robust growth is primarily propelled by escalating consumer interest in live sporting events, the increasing commercialization of sports, and the continuous evolution of sports merchandising. The surge in popularity of sports like Basketball, Football, Cricket, and Badminton, coupled with their expanding global fan bases, creates substantial opportunities for promoters to capitalize on ticket sales, sponsorships, and ancillary revenue streams. The demand for unique fan experiences, including premium seating, interactive activations, and exclusive merchandise, further fuels the market's upward trajectory. Moreover, advancements in digital platforms and social media are enabling promoters to reach wider audiences, enhance engagement, and create innovative promotional campaigns that drive attendance and merchandise sales.

Sports Promoters Market Market Size (In Billion)

However, the market is not without its challenges. Intense competition among promoters, rising operational costs associated with staging large-scale events, and the impact of unforeseen global events that can disrupt event schedules present significant restraints. Furthermore, evolving fan preferences and the need for constant innovation in event formats and engagement strategies require promoters to remain agile and adaptable. Despite these hurdles, the market's resilience and the inherent appeal of live sports events are expected to drive sustained growth. Emerging markets in the Asia Pacific and Latin America, with their burgeoning young populations and increasing disposable incomes, represent significant untapped potential for sports promotion. The integration of technology, such as augmented reality and virtual reality, in fan experiences and the growing trend of esports promotion are also shaping the future landscape of the sports promotion industry, offering new avenues for revenue generation and audience engagement.

Sports Promoters Market Company Market Share

This comprehensive report delves into the dynamic Sports Promoters Market, offering critical insights into market dynamics, growth drivers, challenges, and future projections. Analyzing the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report leverages high-traffic keywords such as "sports promotion," "event management," "live sports," "sports marketing," "fan engagement," and "sports industry growth" to enhance search visibility for industry stakeholders. We explore market concentration, innovation, key trends, dominant segments, product developments, and strategic outlooks, providing actionable intelligence for investors, promoters, and sports organizations navigating this evolving landscape. The estimated market size for the Sports Promoters Market is expected to reach approximately XX Million by 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period.

Sports Promoters Market Market Concentration & Innovation

The Sports Promoters Market exhibits a moderate level of concentration, with a few large players dominating significant portions of the global market. However, the landscape is also characterized by a healthy presence of regional and niche promoters, fostering a competitive environment. Innovation is a key driver, fueled by the increasing demand for enhanced fan experiences. Technological advancements in ticketing, digital media, augmented reality (AR), and virtual reality (VR) are revolutionizing how sports events are promoted and consumed. Regulatory frameworks, while generally supportive of the industry, can vary significantly across regions, impacting operational strategies for promoters. Product substitutes, such as home entertainment and other leisure activities, pose a constant challenge, necessitating continuous innovation to maintain audience engagement. End-user trends are shifting towards personalized experiences, social sharing, and seamless digital integration, pushing promoters to adapt their strategies. Mergers and Acquisitions (M&A) activity is notable, with strategic partnerships and consolidations aimed at expanding market reach and capabilities. For instance, the total value of M&A deals in the past year is estimated to be around XX Million. The market share of the top five players is estimated to be around XX%.

- Innovation Drivers:

- Digital transformation in event management.

- Personalized fan engagement platforms.

- Emerging technologies like AR/VR for immersive experiences.

- Data analytics for targeted marketing and audience segmentation.

- Regulatory Frameworks:

- Licensing and permits for event organization.

- Broadcasting rights regulations.

- Sponsorship and advertising guidelines.

- Product Substitutes:

- Home streaming services for live sports.

- Esports and online gaming.

- Other entertainment options (concerts, theater).

- End-User Trends:

- Demand for interactive and social fan experiences.

- Growth of mobile-first consumption patterns.

- Increased preference for personalized content and offers.

- M&A Activities:

- Consolidation to achieve economies of scale.

- Acquisition of innovative technology providers.

- Strategic partnerships for market expansion.

Sports Promoters Market Industry Trends & Insights

The Sports Promoters Market is on a robust growth trajectory, propelled by a confluence of factors that are reshaping the global sports and entertainment landscape. The increasing popularity of various sports, coupled with rising disposable incomes in emerging economies, is a primary growth driver. Fans are increasingly willing to spend on live event experiences, driving demand for ticketing, merchandise, and associated services. Technological disruptions are playing a pivotal role, with the integration of digital platforms transforming event promotion, fan engagement, and broadcasting. The advent of sophisticated event management software, AI-powered analytics for audience insights, and immersive technologies like augmented reality (AR) and virtual reality (VR) are enabling promoters to create more engaging and personalized experiences. These innovations not only enhance the live event atmosphere but also extend the fan experience beyond the stadium or arena, fostering year-round engagement. Consumer preferences are evolving rapidly, with a growing emphasis on convenience, accessibility, and unique experiences. Fans are seeking more than just the game; they desire a holistic entertainment package, including pre- and post-event activities, interactive fan zones, and seamless digital integration. This shift necessitates promoters to adopt a more holistic approach to event planning and execution. The competitive dynamics within the market are intense, with established players constantly innovating to retain market share and new entrants leveraging technology to carve out specific niches. Strategic partnerships and collaborations are becoming increasingly common as companies seek to leverage each other's strengths, expand their service offerings, and reach wider audiences. The market penetration for digital ticketing solutions is expected to exceed XX% by 2028, reflecting the growing adoption of technology. The overall market CAGR is projected to be XX% during the forecast period. The trend towards experiential marketing is also significantly influencing the market, with brands and organizations investing heavily in creating memorable sports events to build brand loyalty and awareness. Furthermore, the rise of influencer marketing within the sports domain is creating new avenues for promotion and fan engagement. The focus is shifting from traditional advertising to more authentic and engaging content delivery, often through social media platforms. The integration of sustainable practices in event management is also gaining traction, with a growing awareness among consumers and stakeholders about the environmental impact of large-scale events. Promoters who adopt eco-friendly strategies are likely to gain a competitive advantage. The global sports promotion market is also being influenced by the increasing investment in grassroots sports development, which in turn creates a larger pool of potential fans and participants for professional events. The ongoing efforts to enhance spectator safety and security at live events are also a critical aspect of the industry's evolution, ensuring a positive and secure experience for all attendees.

Dominant Markets & Segments in Sports Promoters Market

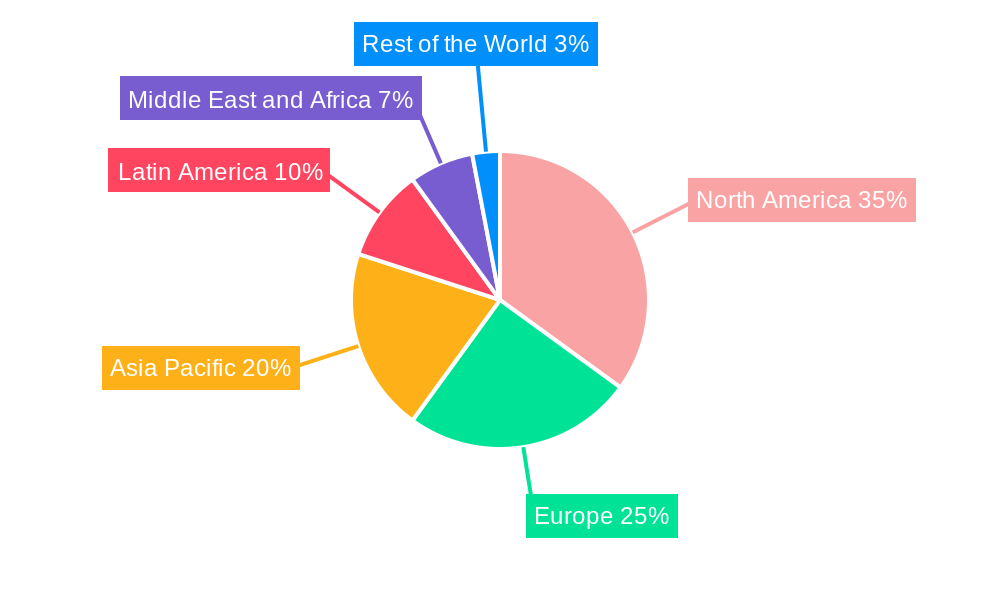

The Sports Promoters Market showcases distinct regional dominance and segment strength, driven by a complex interplay of economic policies, infrastructure development, cultural preferences, and marketing investments. North America, particularly the United States, stands as a leading region due to its well-established sports leagues, high consumer spending on entertainment, and advanced sports marketing infrastructure. The robust economic policies that support the sports industry, including favorable tax incentives for stadium development and event hosting, further bolster its position. Key countries within this region, like the USA and Canada, consistently lead in terms of event attendance, sponsorship revenue, and overall market value. The dominance is further amplified by significant investments in world-class sporting venues and transportation networks, facilitating smooth event operations and fan accessibility.

In terms of sports segments, Football (American football) commands a substantial share in North America, with leagues like the NFL generating immense revenue through broadcasting rights, sponsorships, and ticket sales. However, Basketball is also a rapidly growing segment, especially in terms of global appeal and the increasing popularity of leagues like the NBA, which has a strong international marketing presence. Cricket, while dominant in South Asia and parts of the Commonwealth, is also witnessing significant growth in new markets, with promoters capitalizing on its massive fan base to organize large-scale events and tournaments. The economic policies in countries like India and Australia are highly supportive of cricket, with substantial government and private investment in infrastructure and development. The infrastructure development in these regions, including the construction of modern stadiums and training facilities, plays a crucial role in the sport's continued dominance.

Merchandising represents a highly lucrative revenue stream within the Sports Promoters Market, transcending individual sports. The ability to translate fan loyalty into tangible product sales—ranging from team jerseys and apparel to collectibles and memorabilia—is a critical component of a promoter's financial success. The economic policies that encourage consumer spending on branded goods and the growth of e-commerce platforms have significantly amplified revenue generation from merchandising. Promoters are increasingly leveraging digital channels to offer personalized merchandise options and direct-to-consumer sales, further enhancing this revenue segment. The market penetration of licensed sports merchandise is substantial, contributing significantly to the overall market value.

- Leading Region: North America (especially the USA)

- Key Drivers:

- Strong economic policies supporting sports investment.

- Advanced infrastructure for event hosting and fan access.

- High consumer disposable income and spending on entertainment.

- Well-established professional sports leagues and strong fan loyalty.

- Significant investments in sports marketing and broadcasting.

- Key Drivers:

- Dominant Sports Segments:

- Football: High revenue generation through broadcast rights, sponsorships, and ticket sales; strong fan engagement.

- Basketball: Growing global appeal, with leagues like the NBA expanding their international reach; increasing popularity among younger demographics.

- Cricket: Massive fan base in South Asia and Commonwealth countries; significant growth potential in emerging markets; major tournaments drive substantial revenue.

- Other Sports: Including motorsports, combat sports, and individual sports, which attract dedicated fan bases and niche sponsorship opportunities.

- Key Revenue Segment:

- Merchandising:

- Significant contribution to overall revenue through apparel, collectibles, and licensed products.

- Growing reliance on e-commerce and personalized offerings.

- Strong connection to fan loyalty and brand building.

- Economic policies encouraging consumer spending on branded goods.

- Merchandising:

Sports Promoters Market Product Developments

Product developments in the Sports Promoters Market are increasingly focused on enhancing the fan experience and operational efficiency. Innovations include the deployment of advanced ticketing platforms with integrated mobile payment options and dynamic pricing strategies. Digital fan engagement tools, such as interactive mobile apps offering real-time stats, AR overlays for stadium navigation, and gamified experiences, are becoming standard. Furthermore, promoters are investing in sustainable event solutions, from waste management to energy-efficient venue operations, aligning with growing environmental consciousness. The competitive advantage lies in seamless integration of these technologies, offering personalized fan journeys and efficient event management, ultimately driving higher attendance and increased revenue streams.

Report Scope & Segmentation Analysis

The Sports Promoters Market report provides a comprehensive segmentation analysis across key areas, offering detailed insights into market dynamics and growth projections. The market is segmented by Sports into Basketball, Football, Badminton, Cricket, and Other Sports. Each sport segment is analyzed for its unique market size, growth rate, and competitive landscape, considering factors such as fan base, league popularity, and investment trends. The Revenue segmentation primarily focuses on Merchandising, detailing its contribution to the overall market value and exploring growth strategies within this segment.

- Sports Segmentation:

- Basketball: Expected to witness robust growth driven by the global popularity of leagues like the NBA and increasing participation rates.

- Football: Continues to be a dominant segment, especially in North America, with consistent demand for live events and associated merchandise.

- Badminton: A growing segment, particularly in Asia, with increasing investments in professional leagues and tournaments.

- Cricket: Dominant in specific regions with a massive fan following, expected to see sustained growth through major tournaments and expansion into new territories.

- Other Sports: Encompasses a diverse range of sports like motorsports, tennis, and combat sports, each with unique market dynamics and growth potential.

- Revenue Segmentation:

- Merchandising: A crucial revenue stream, projected to grow steadily with the increasing demand for branded sports memorabilia and apparel. The segment's growth is linked to successful fan engagement strategies and effective e-commerce integration.

Key Drivers of Sports Promoters Market Growth

The Sports Promoters Market is propelled by several interconnected drivers that fuel its expansion and evolution. A primary driver is the unwavering global passion for sports, translating into consistent demand for live events. Technological advancements, particularly in digital engagement and broadcasting, are transforming how fans interact with sports, creating new revenue opportunities and enhancing spectator experiences. The increasing disposable income in many regions allows for greater discretionary spending on entertainment, including sports events. Furthermore, strategic investments in sports infrastructure and the growing professionalization of sports leagues worldwide are creating a more organized and appealing market for promoters. The increasing emphasis on experiential marketing by brands also contributes significantly, as sports events offer unparalleled platforms for engagement and visibility.

- Technological Advancements: AI, AR/VR, digital ticketing, and enhanced broadcasting capabilities.

- Economic Growth: Rising disposable incomes and increased consumer spending on entertainment.

- Growing Sports Popularity: Global appeal of major sports and emerging sports gaining traction.

- Infrastructure Development: Investment in modern stadiums, arenas, and associated facilities.

- Brand Sponsorships & Experiential Marketing: Companies leveraging sports for brand visibility and engagement.

Challenges in the Sports Promoters Market Sector

Despite its robust growth, the Sports Promoters Market faces several significant challenges that can impede its progress. Intense competition from other entertainment options, including digital streaming services and gaming, requires continuous innovation to capture and retain audience attention. The ever-increasing costs associated with hosting major sporting events, from venue rentals and player salaries to security and marketing, can put a strain on profitability. Regulatory hurdles and varying legal frameworks across different jurisdictions can add complexity to international event management. Furthermore, unforeseen disruptions, such as global health crises or economic downturns, can lead to event cancellations and significant financial losses. The constant need to adapt to evolving fan expectations and digital trends also presents an ongoing operational challenge.

- Intense Competition: From other entertainment forms and digital platforms.

- Rising Operational Costs: Venue hire, player compensation, security, and marketing expenses.

- Regulatory Complexity: Navigating diverse legal and licensing frameworks.

- Economic Volatility: Susceptibility to economic downturns and unforeseen disruptions.

- Evolving Fan Expectations: The need for continuous adaptation to new technologies and experiences.

Emerging Opportunities in Sports Promoters Market

The Sports Promoters Market is ripe with emerging opportunities, driven by new technologies, evolving consumer behaviors, and untapped markets. The continued growth of esports presents a significant opportunity for promoters to diversify their offerings and tap into a new, digitally native audience. The expansion of sports into emerging economies offers substantial potential for market growth, requiring promoters to develop region-specific strategies. The increasing demand for sustainable and eco-friendly events aligns with growing global consciousness, creating opportunities for promoters to lead in this area. Furthermore, the application of advanced data analytics and AI can unlock personalized fan experiences and highly targeted marketing campaigns, leading to increased engagement and revenue. The development of hybrid events, combining physical and virtual elements, also offers a pathway to reach a broader audience and enhance accessibility.

- Esports Growth: Expanding into the booming esports market.

- Emerging Markets: Tapping into the potential of developing economies.

- Sustainable Event Practices: Leveraging eco-friendly initiatives for brand differentiation.

- Data Analytics & AI: Personalized fan experiences and targeted marketing.

- Hybrid Events: Combining physical and virtual elements for wider reach.

Leading Players in the Sports Promoters Market Market

- Live Nation Entertainment Inc

- EXOR Group

- Madison Square Garden Company

- Lincoln Center

- San Francisco Symphony

- Townsquare Media Inc

- GMM Grammy Public Company Limited

- Tivoli A/S

- Factory Theatre

- Denver Center For The Performing Arts

Key Developments in Sports Promoters Market Industry

- August 2023: Live Nation partnered with FUZE Technology, a consumer technology start-up, to introduce its convenient mobile charging solution, chargeFUZE, for fans at concerts and festivals across the US. With innovations like digital tickets, payments, AR festival maps, social sharing, and more, smartphones have become an increasingly important part of the live music experience. The partnership ensures concert and festival-goers can be fully powered at events and capture and share their experiences with friends on social media.

- April 2023: Madison Square Garden Entertainment Corp. announced that it has completed its spin-off from Sphere Entertainment Co. and will begin trading on the NYSE under the ticker symbol 'MSGE.' Sphere Entertainment owns the remaining approximately 33% of MSG Entertainment's outstanding shares.

Strategic Outlook for Sports Promoters Market Market

The strategic outlook for the Sports Promoters Market is one of continued innovation and adaptation. Promoters must prioritize leveraging technology to create seamless, personalized, and engaging fan experiences, both at live events and through digital platforms. Strategic partnerships and collaborations will be crucial for expanding reach, diversifying offerings, and mitigating risks. A focus on sustainability and corporate social responsibility will not only enhance brand reputation but also cater to evolving consumer preferences. Furthermore, a deep understanding of regional market nuances and a willingness to invest in emerging economies will be vital for long-term growth. By embracing these strategies, sports promoters can navigate the dynamic landscape and capitalize on the significant opportunities for expansion and increased profitability. The estimated market size of XX Million in 2025 is projected to grow substantially through strategic initiatives and a commitment to fan-centric experiences.

Sports Promoters Market Segmentation

-

1. Sports

- 1.1. Basketball

- 1.2. Football

- 1.3. Badminton

- 1.4. Cricket

- 1.5. Other Sports

-

2. Reven

- 2.1. Merchandising

Sports Promoters Market Segmentation By Geography

- 1. Asia Pacific

- 2. North America

- 3. Latin America

- 4. Europe

- 5. Middle East and Africa

- 6. Rest of the World

Sports Promoters Market Regional Market Share

Geographic Coverage of Sports Promoters Market

Sports Promoters Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Asia Pacific is driving the growth of the market; Growing number of new sporting events across the globe

- 3.3. Market Restrains

- 3.3.1. Asia Pacific is driving the growth of the market; Growing number of new sporting events across the globe

- 3.4. Market Trends

- 3.4.1. Athletes influencers is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sports Promoters Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sports

- 5.1.1. Basketball

- 5.1.2. Football

- 5.1.3. Badminton

- 5.1.4. Cricket

- 5.1.5. Other Sports

- 5.2. Market Analysis, Insights and Forecast - by Reven

- 5.2.1. Merchandising

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Latin America

- 5.3.4. Europe

- 5.3.5. Middle East and Africa

- 5.3.6. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Sports

- 6. Asia Pacific Sports Promoters Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sports

- 6.1.1. Basketball

- 6.1.2. Football

- 6.1.3. Badminton

- 6.1.4. Cricket

- 6.1.5. Other Sports

- 6.2. Market Analysis, Insights and Forecast - by Reven

- 6.2.1. Merchandising

- 6.1. Market Analysis, Insights and Forecast - by Sports

- 7. North America Sports Promoters Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sports

- 7.1.1. Basketball

- 7.1.2. Football

- 7.1.3. Badminton

- 7.1.4. Cricket

- 7.1.5. Other Sports

- 7.2. Market Analysis, Insights and Forecast - by Reven

- 7.2.1. Merchandising

- 7.1. Market Analysis, Insights and Forecast - by Sports

- 8. Latin America Sports Promoters Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sports

- 8.1.1. Basketball

- 8.1.2. Football

- 8.1.3. Badminton

- 8.1.4. Cricket

- 8.1.5. Other Sports

- 8.2. Market Analysis, Insights and Forecast - by Reven

- 8.2.1. Merchandising

- 8.1. Market Analysis, Insights and Forecast - by Sports

- 9. Europe Sports Promoters Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sports

- 9.1.1. Basketball

- 9.1.2. Football

- 9.1.3. Badminton

- 9.1.4. Cricket

- 9.1.5. Other Sports

- 9.2. Market Analysis, Insights and Forecast - by Reven

- 9.2.1. Merchandising

- 9.1. Market Analysis, Insights and Forecast - by Sports

- 10. Middle East and Africa Sports Promoters Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sports

- 10.1.1. Basketball

- 10.1.2. Football

- 10.1.3. Badminton

- 10.1.4. Cricket

- 10.1.5. Other Sports

- 10.2. Market Analysis, Insights and Forecast - by Reven

- 10.2.1. Merchandising

- 10.1. Market Analysis, Insights and Forecast - by Sports

- 11. Rest of the World Sports Promoters Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Sports

- 11.1.1. Basketball

- 11.1.2. Football

- 11.1.3. Badminton

- 11.1.4. Cricket

- 11.1.5. Other Sports

- 11.2. Market Analysis, Insights and Forecast - by Reven

- 11.2.1. Merchandising

- 11.1. Market Analysis, Insights and Forecast - by Sports

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Live Nation Entertainment Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 EXOR Group

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Madison Square Garden Company

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Lincoln Center

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 San Francisco Symphony

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Townsquare Media Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 GMM Grammy Public Company Limited

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Tivoli A/S

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Factory Theatre

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Denver Center For The Performing Arts**List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Live Nation Entertainment Inc

List of Figures

- Figure 1: Global Sports Promoters Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Sports Promoters Market Revenue (Million), by Sports 2025 & 2033

- Figure 3: Asia Pacific Sports Promoters Market Revenue Share (%), by Sports 2025 & 2033

- Figure 4: Asia Pacific Sports Promoters Market Revenue (Million), by Reven 2025 & 2033

- Figure 5: Asia Pacific Sports Promoters Market Revenue Share (%), by Reven 2025 & 2033

- Figure 6: Asia Pacific Sports Promoters Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Sports Promoters Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Sports Promoters Market Revenue (Million), by Sports 2025 & 2033

- Figure 9: North America Sports Promoters Market Revenue Share (%), by Sports 2025 & 2033

- Figure 10: North America Sports Promoters Market Revenue (Million), by Reven 2025 & 2033

- Figure 11: North America Sports Promoters Market Revenue Share (%), by Reven 2025 & 2033

- Figure 12: North America Sports Promoters Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Sports Promoters Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Sports Promoters Market Revenue (Million), by Sports 2025 & 2033

- Figure 15: Latin America Sports Promoters Market Revenue Share (%), by Sports 2025 & 2033

- Figure 16: Latin America Sports Promoters Market Revenue (Million), by Reven 2025 & 2033

- Figure 17: Latin America Sports Promoters Market Revenue Share (%), by Reven 2025 & 2033

- Figure 18: Latin America Sports Promoters Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Latin America Sports Promoters Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Europe Sports Promoters Market Revenue (Million), by Sports 2025 & 2033

- Figure 21: Europe Sports Promoters Market Revenue Share (%), by Sports 2025 & 2033

- Figure 22: Europe Sports Promoters Market Revenue (Million), by Reven 2025 & 2033

- Figure 23: Europe Sports Promoters Market Revenue Share (%), by Reven 2025 & 2033

- Figure 24: Europe Sports Promoters Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Sports Promoters Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Sports Promoters Market Revenue (Million), by Sports 2025 & 2033

- Figure 27: Middle East and Africa Sports Promoters Market Revenue Share (%), by Sports 2025 & 2033

- Figure 28: Middle East and Africa Sports Promoters Market Revenue (Million), by Reven 2025 & 2033

- Figure 29: Middle East and Africa Sports Promoters Market Revenue Share (%), by Reven 2025 & 2033

- Figure 30: Middle East and Africa Sports Promoters Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Sports Promoters Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World Sports Promoters Market Revenue (Million), by Sports 2025 & 2033

- Figure 33: Rest of the World Sports Promoters Market Revenue Share (%), by Sports 2025 & 2033

- Figure 34: Rest of the World Sports Promoters Market Revenue (Million), by Reven 2025 & 2033

- Figure 35: Rest of the World Sports Promoters Market Revenue Share (%), by Reven 2025 & 2033

- Figure 36: Rest of the World Sports Promoters Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Rest of the World Sports Promoters Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Sports Promoters Market Revenue Million Forecast, by Sports 2020 & 2033

- Table 2: Global Sports Promoters Market Revenue Million Forecast, by Reven 2020 & 2033

- Table 3: Global Sports Promoters Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Sports Promoters Market Revenue Million Forecast, by Sports 2020 & 2033

- Table 5: Global Sports Promoters Market Revenue Million Forecast, by Reven 2020 & 2033

- Table 6: Global Sports Promoters Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Sports Promoters Market Revenue Million Forecast, by Sports 2020 & 2033

- Table 8: Global Sports Promoters Market Revenue Million Forecast, by Reven 2020 & 2033

- Table 9: Global Sports Promoters Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Sports Promoters Market Revenue Million Forecast, by Sports 2020 & 2033

- Table 11: Global Sports Promoters Market Revenue Million Forecast, by Reven 2020 & 2033

- Table 12: Global Sports Promoters Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Sports Promoters Market Revenue Million Forecast, by Sports 2020 & 2033

- Table 14: Global Sports Promoters Market Revenue Million Forecast, by Reven 2020 & 2033

- Table 15: Global Sports Promoters Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Sports Promoters Market Revenue Million Forecast, by Sports 2020 & 2033

- Table 17: Global Sports Promoters Market Revenue Million Forecast, by Reven 2020 & 2033

- Table 18: Global Sports Promoters Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Sports Promoters Market Revenue Million Forecast, by Sports 2020 & 2033

- Table 20: Global Sports Promoters Market Revenue Million Forecast, by Reven 2020 & 2033

- Table 21: Global Sports Promoters Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sports Promoters Market ?

The projected CAGR is approximately 4.65%.

2. Which companies are prominent players in the Sports Promoters Market ?

Key companies in the market include Live Nation Entertainment Inc, EXOR Group, Madison Square Garden Company, Lincoln Center, San Francisco Symphony, Townsquare Media Inc, GMM Grammy Public Company Limited, Tivoli A/S, Factory Theatre, Denver Center For The Performing Arts**List Not Exhaustive.

3. What are the main segments of the Sports Promoters Market ?

The market segments include Sports, Reven.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Asia Pacific is driving the growth of the market; Growing number of new sporting events across the globe.

6. What are the notable trends driving market growth?

Athletes influencers is driving the market.

7. Are there any restraints impacting market growth?

Asia Pacific is driving the growth of the market; Growing number of new sporting events across the globe.

8. Can you provide examples of recent developments in the market?

August 2023: Live Nation partnered with FUZE Technology, a consumer technology start-up, to introduce its convenient mobile charging solution, chargeFUZE, for fans at concerts and festivals across the US. With innovations like digital tickets, payments, AR festival maps, social sharing, and more, smartphones have become an increasingly important part of the live music experience. The partnership ensures concert and festival-goers can be fully powered at events and capture and share their experiences with friends on social media.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sports Promoters Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sports Promoters Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sports Promoters Market ?

To stay informed about further developments, trends, and reports in the Sports Promoters Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence