Key Insights

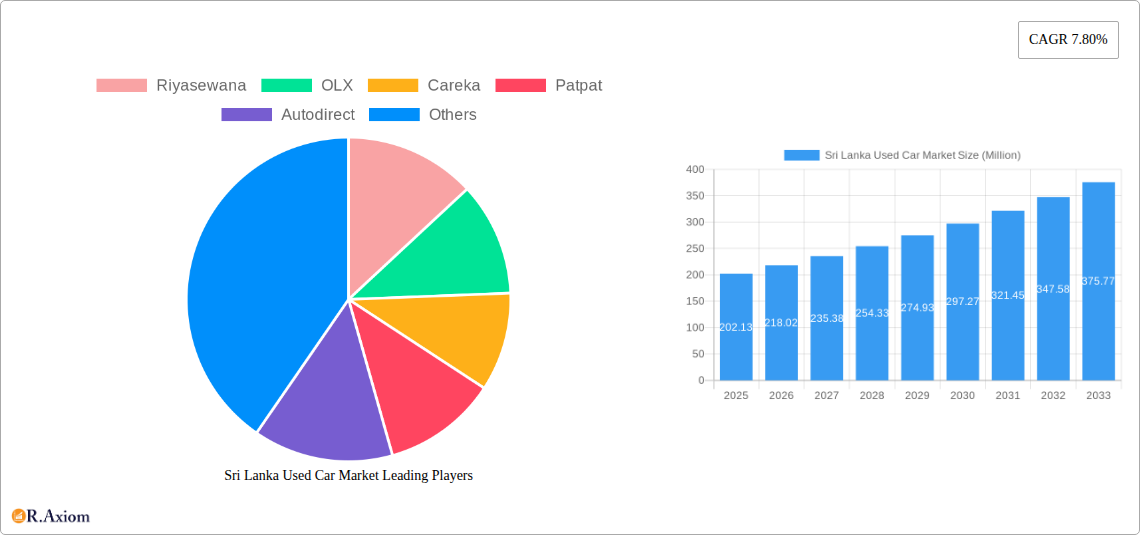

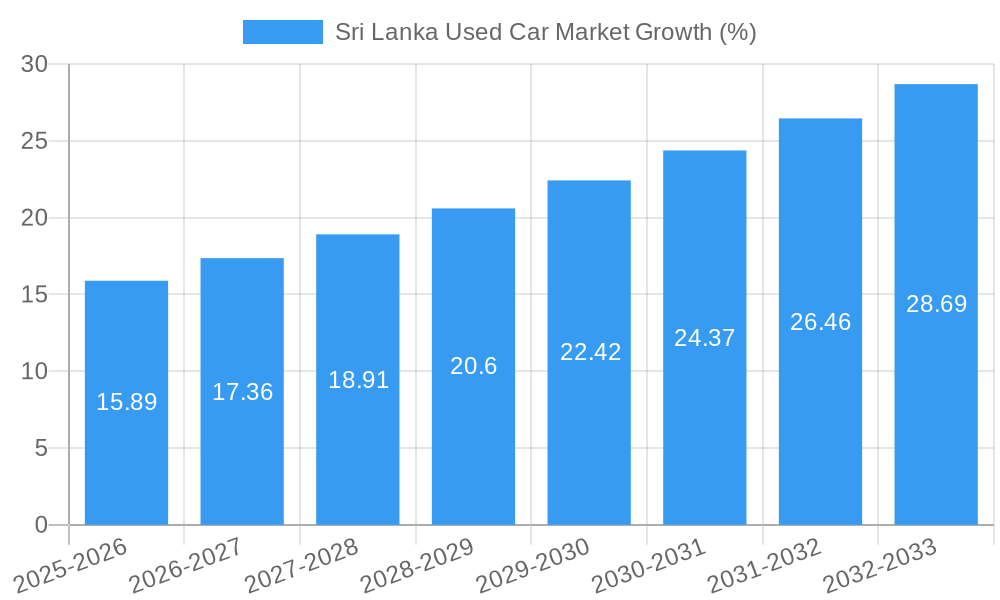

The Sri Lankan used car market, valued at $202.13 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.80% from 2025 to 2033. This expansion is driven by several factors. Firstly, the increasing affordability of used vehicles compared to new cars caters to a larger segment of the population. Secondly, a growing middle class with rising disposable incomes fuels demand for personal transportation. Thirdly, the relatively underdeveloped public transportation system in certain areas necessitates reliance on private vehicles, bolstering the used car market. Furthermore, the online platforms like Riyasewana, OLX, and others are streamlining the buying and selling process, enhancing market accessibility. However, challenges remain, including the fluctuating prices of fuel, which can impact consumer spending, and the availability of financing options which might constrain purchasing power for some buyers. The market is segmented by vehicle type (hatchbacks, sedans, SUVs/MPVs), vendor type (organized and unorganized), fuel type (petrol, diesel, electric, others), and sales channel (online and offline). The dominance of specific segments, such as SUVs, due to their perceived practicality and space, is likely to influence future growth patterns.

The competitive landscape is characterized by a mix of established online marketplaces and individual sellers. Online platforms provide convenience and reach a wider audience, while unorganized sellers cater to a price-sensitive segment. The market's future trajectory will depend on the interplay of these factors, including the government's policies on vehicle imports, fuel pricing, and initiatives promoting sustainable transportation. The increasing popularity of electric vehicles is a significant long-term trend that will progressively impact market segmentation and player dynamics in the coming years. Careful observation of economic indicators and consumer behavior will be crucial to accurately predict the market’s evolution beyond 2033.

Sri Lanka Used Car Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Sri Lanka used car market, covering market size, segmentation, key players, industry trends, and future growth prospects. The report utilizes data from 2019-2024 (historical period), with an estimated year of 2025 and a forecast period extending to 2033. The study period encompasses 2019-2033 and uses Million (M) as the unit for all value mentions.

Sri Lanka Used Car Market Market Concentration & Innovation

The Sri Lanka used car market exhibits a moderately concentrated landscape, with several dominant players competing alongside numerous smaller, unorganized vendors. Riyasewana, OLX, Ikman, and Patpat hold significant market share in the online segment, while several offline dealers dominate the unorganized sector. Precise market share figures for each player are unavailable for this report (xx%). However, analysis indicates that online platforms are rapidly gaining ground, driven by technological advancements and increased internet penetration.

Innovation in the Sri Lanka used car market is primarily focused on enhancing the online buying and selling experience. Features like high-quality images, detailed vehicle descriptions, online payment gateways, and advanced search filters are becoming standard. The introduction of premium ad services, as demonstrated by Patpat.lk, signifies a trend towards monetizing online platforms more effectively. Regulatory frameworks surrounding used car sales are currently being analyzed (xx), influencing the level of organization and transparency within the market. The emergence of online valuation tools and platforms aims to address information asymmetry, boosting buyer confidence. Mergers and acquisitions (M&A) activity within the sector remains relatively low (xx M deal value in the last five years), suggesting a landscape where organic growth strategies dominate for now. However, future consolidation is anticipated as market players adapt to the evolving digital landscape. Limited substitutes exist for used cars, mostly represented by public transportation or new car purchases, and end-user preferences are shifting towards online sales channels, driven by the convenience and transparency they provide.

Sri Lanka Used Car Market Industry Trends & Insights

The Sri Lanka used car market experienced a CAGR of xx% during the historical period (2019-2024), driven primarily by factors such as rising disposable income, increasing urbanization, and the affordability of used vehicles compared to new cars. However, economic downturns and fluctuations in fuel prices have impacted consumer demand, creating market volatility. Technological disruptions, such as the rise of online marketplaces and mobile applications, have significantly altered how vehicles are bought and sold. This has led to increased transparency and market efficiency. Consumer preferences are evolving towards safer and more fuel-efficient vehicles, and the demand for SUVs and MPVs is growing compared to hatchbacks and sedans. Competitive dynamics are characterized by fierce competition among online platforms and a relatively fragmented landscape within the offline sector. Market penetration of online platforms has increased significantly, with an estimated xx% of used car transactions now occurring online in 2025. This number is projected to increase further in the coming years, reaching an anticipated xx% by 2033.

Dominant Markets & Segments in Sri Lanka Used Car Market

- By Vehicle Type: SUVs/MPVs are currently the fastest-growing segment, driven by consumer preferences for larger vehicles and increased family sizes. Sedans maintain a significant market share, while hatchbacks are experiencing slower growth.

- By Vendor Type: The unorganized sector still constitutes a larger portion of the market, primarily due to a large number of individual sellers. However, the organized sector, comprising online platforms and established dealerships, is growing rapidly, benefiting from increased consumer trust and convenience.

- By Fuel Type: Petrol remains the dominant fuel type, owing to its widespread availability and affordability. However, the uptake of diesel vehicles is also noticeable, while electric vehicles are still in their nascent stage with limited market penetration. Other fuel types (LPG, CNG) have a small but steady presence.

- By Sales Channel: The online segment is experiencing the most significant growth, fueled by the increasing adoption of e-commerce and mobile platforms. While offline channels still have a significant presence, the shift towards online transactions is undeniable.

Key drivers for these dominant segments vary. Economic policies, including import duty regulations and taxation on used vehicles, significantly impact affordability and therefore market size. Infrastructure development, such as better road networks, also indirectly contributes to higher demand for personal vehicles. The dominance of SUVs/MPVs is fueled by evolving family size and lifestyle choices.

Sri Lanka Used Car Market Product Developments

Recent product innovations center around enhancing online platforms' functionalities, including improved search filters, vehicle history reports, and secure payment gateways. This focus on improving user experience contributes to increased consumer trust and convenience. The introduction of virtual vehicle inspections and online financing options represents a push towards a more seamless and efficient buying process. Technological advancements align with market needs, prioritizing ease of use and transparency, which are key factors in building trust within this market.

Report Scope & Segmentation Analysis

This report comprehensively segments the Sri Lanka used car market across several key dimensions:

Vehicle Type: Hatchbacks, Sedans, SUVs/MPVs. Growth projections vary by segment, with SUVs/MPVs showing the most substantial growth. Market sizes for each segment are detailed within the full report (xx M for each segment in 2025). Competitive dynamics are influenced by consumer preferences and price points.

Vendor Type: Organized (dealerships, online platforms) and Unorganized (individual sellers). Market size estimations and competitive dynamics are outlined in the complete report, focusing on the shift towards the organized sector. (xx M for organized, xx M for unorganized in 2025)

Fuel Type: Petrol, Diesel, Electric, Other. This section explores growth projections and market sizes for each fuel type, noting the potential growth of electric vehicles as infrastructure develops. (xx M for Petrol, xx M for Diesel, xx M for Electric, xx M for other in 2025)

Sales Channel: Online and Offline. This segment assesses the growth of online channels, market sizes, and the competitive dynamics between online and offline players. (xx M online, xx M offline in 2025)

Key Drivers of Sri Lanka Used Car Market Growth

The Sri Lanka used car market's growth is fueled by several interconnected factors. Increased disposable incomes among Sri Lankans are making car ownership more accessible. Expanding urbanization leads to higher demand for personal transportation. The relative affordability of used cars compared to new ones also significantly contributes. Technological improvements, especially in online marketplaces, enhance transparency and convenience, boosting consumer confidence.

Challenges in the Sri Lanka Used Car Market Sector

The Sri Lankan used car market faces numerous challenges. Fluctuating economic conditions can significantly impact consumer spending on vehicles. Supply chain disruptions, particularly concerning imported vehicles, can restrict availability. A lack of standardized vehicle inspection processes may lead to concerns regarding vehicle quality and safety. Intense competition among online and offline sellers creates price pressures. The lack of a comprehensive and effective regulatory framework also contributes to challenges in market transparency and consumer protection. The impact of these challenges on overall sales volume is significant (xx% reduction in sales during periods of economic downturn).

Emerging Opportunities in Sri Lanka Used Car Market

Several emerging opportunities exist within the Sri Lanka used car market. The expansion of financing options tailored to used car purchases could increase accessibility. The growing popularity of online valuation tools offers greater transparency for buyers and sellers. The potential for integrating blockchain technology to enhance trust and security within transactions presents a substantial opportunity. Growing consumer demand for fuel-efficient and environmentally friendly vehicles presents an opportunity for specific segments.

Leading Players in the Sri Lanka Used Car Market Market

- Riyasewana

- OLX OLX Sri Lanka

- Careka

- Patpat Patpat.lk

- Autodirect

- SaleMe

- AutoMe

- Riyahub

- Automachan

- AutoLanka

- Ikman Ikman

- Carsho

Key Developments in Sri Lanka Used Car Market Industry

April 2023: Ikman's ranking among top online brands significantly enhances its credibility and market position. This development reflects the growing importance of online platforms in the Sri Lankan used car market.

August 2022: Patpat.lk's launch of Premium Ad Services illustrates a strategy to optimize online platforms' monetization strategies and cater to the diverse needs of buyers and sellers, improving the customer experience and increasing sales.

Strategic Outlook for Sri Lanka Used Car Market Market

The Sri Lanka used car market is projected to experience continued growth over the forecast period (2025-2033), driven by the factors outlined above. The increasing penetration of online platforms will reshape the market landscape, with greater emphasis on transparency, efficiency, and enhanced customer experience. Further developments in financing options and technological innovations will unlock new opportunities for growth and market expansion. The regulatory environment will play a significant role in shaping the future of this sector, potentially impacting market transparency, consumer protection, and overall growth trajectories.

Sri Lanka Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedans

- 1.3. Sports U

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

-

3. Fuel Type

- 3.1. Petrol

- 3.2. Diesel

- 3.3. Electric

- 3.4. Other Fuel Types (LPG, CNG, etc.)

-

4. Sales Channel

- 4.1. Online

- 4.2. Offline

Sri Lanka Used Car Market Segmentation By Geography

- 1. Sri Lanka

Sri Lanka Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Digital Technologies; Others

- 3.3. Market Restrains

- 3.3.1. Increasing Used Car Prices

- 3.4. Market Trends

- 3.4.1. Rising Adoption of Digital Technologies Will Foster the Growth of the Target Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sri Lanka Used Car Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedans

- 5.1.3. Sports U

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Petrol

- 5.3.2. Diesel

- 5.3.3. Electric

- 5.3.4. Other Fuel Types (LPG, CNG, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Sri Lanka

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Riyasewana

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 OLX

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Careka

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Patpat

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Autodirect

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SaleMe

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AutoMe

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Riyahub

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Automachan

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AutoLanka

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ikman

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Carsho

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Riyasewana

List of Figures

- Figure 1: Sri Lanka Used Car Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Sri Lanka Used Car Market Share (%) by Company 2024

List of Tables

- Table 1: Sri Lanka Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Sri Lanka Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Sri Lanka Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 4: Sri Lanka Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 5: Sri Lanka Used Car Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 6: Sri Lanka Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Sri Lanka Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Sri Lanka Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 9: Sri Lanka Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 10: Sri Lanka Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 11: Sri Lanka Used Car Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 12: Sri Lanka Used Car Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sri Lanka Used Car Market?

The projected CAGR is approximately 7.80%.

2. Which companies are prominent players in the Sri Lanka Used Car Market?

Key companies in the market include Riyasewana, OLX, Careka, Patpat, Autodirect, SaleMe, AutoMe, Riyahub, Automachan, AutoLanka, Ikman, Carsho.

3. What are the main segments of the Sri Lanka Used Car Market?

The market segments include Vehicle Type, Vendor Type, Fuel Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 202.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Digital Technologies; Others.

6. What are the notable trends driving market growth?

Rising Adoption of Digital Technologies Will Foster the Growth of the Target Market.

7. Are there any restraints impacting market growth?

Increasing Used Car Prices.

8. Can you provide examples of recent developments in the market?

April 2023: Ikman, a leading online classified used car platform in Sri Lanka, was ranked as one of the "Top 25 Most Prominent Online Brands" in the Digital Outlook Sri Lanka 2023 publication. This marks an important feat for the company as it assists in establishing its position as a trusted online brand for used vehicle purchasing and selling. Further, the company also secured first place in the 'Most Popular Websites in Sri Lanka' category, second place in the 'Most Popular Online Shopping Sites in Sri Lanka - Local' category, sixth place in the 'Most Visible Brands Online - E-Commerce Marketplace Platforms' category.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sri Lanka Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sri Lanka Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sri Lanka Used Car Market?

To stay informed about further developments, trends, and reports in the Sri Lanka Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence