Key Insights

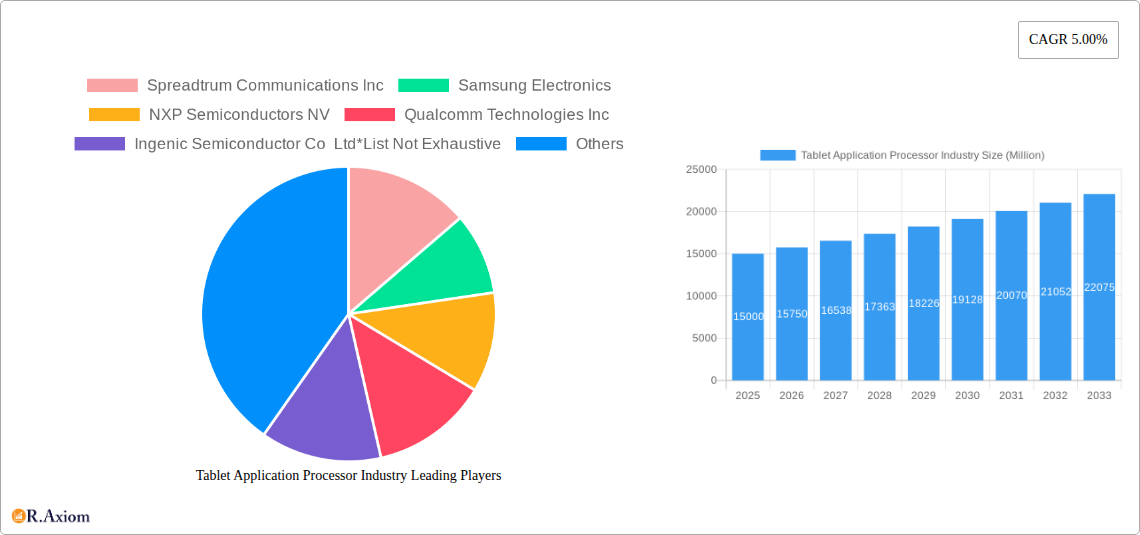

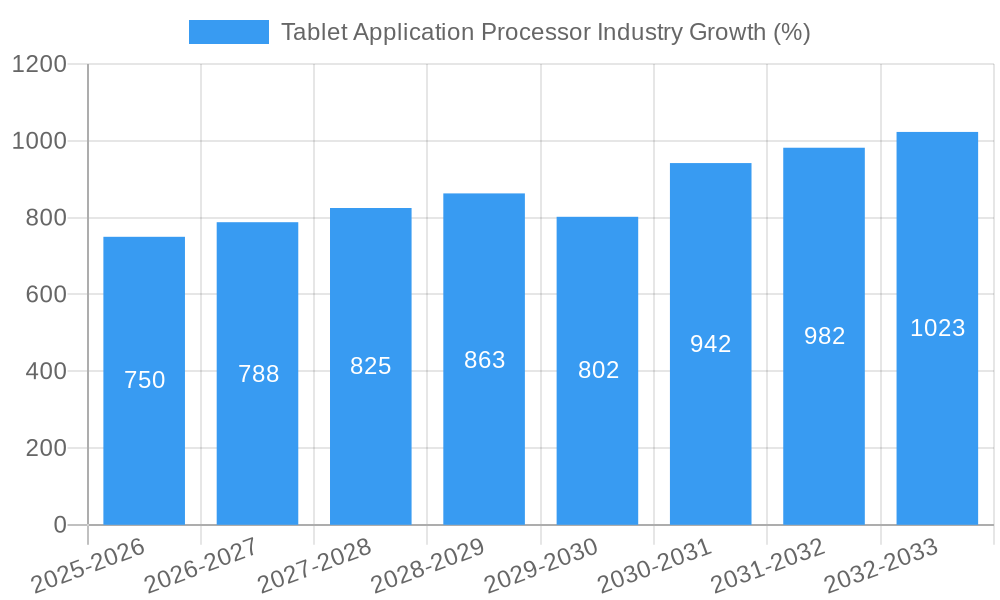

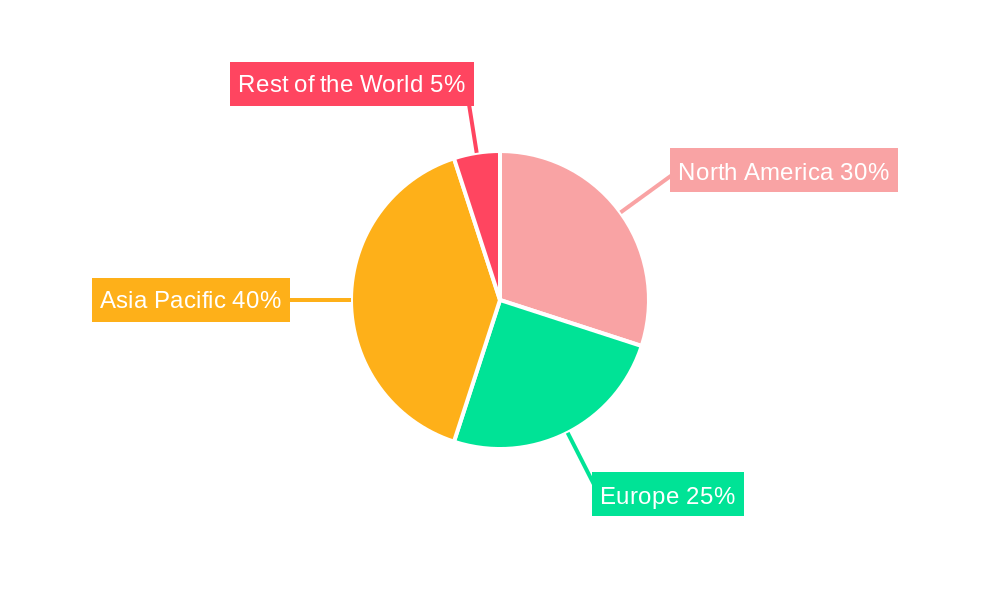

The global tablet application processor (AP) market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by several key factors. The increasing demand for high-performance tablets across various sectors, including household and commercial applications, fuels market expansion. The ongoing shift towards more powerful processors, particularly multi-core 64-bit architectures, is a significant trend. This is further complemented by advancements in operating systems like Android and iOS, constantly pushing the boundaries of tablet functionality and user experience. While the market faces restraints such as intense competition among established players like Qualcomm, MediaTek, and Apple, as well as the emergence of new contenders, the overall growth trajectory remains positive. The market segmentation reveals a strong preference for Android and iOS-based tablets, signifying the dominance of these operating systems in the consumer landscape. Geographical distribution indicates that North America and Asia Pacific, especially regions like China and India, represent significant market shares, fueled by high consumer electronics adoption rates and growing disposable incomes. The 5% CAGR projected for the forecast period (2025-2033) suggests a steady and sustainable growth path for the tablet application processor industry.

The competitive landscape is marked by a mix of established giants and emerging players. Companies like Qualcomm and MediaTek hold significant market share due to their strong technological capabilities and established distribution networks. However, newer entrants and innovative technologies continually challenge this dominance. The future growth will likely be shaped by technological advancements such as improved power efficiency, enhanced graphics processing capabilities, and the integration of artificial intelligence (AI) features into tablet APs. Furthermore, the evolving needs of specific end-user segments, such as the increasing demand for high-performance processors in commercial tablets used for enterprise applications, will influence the market trajectory. Regional variations in growth will be determined by factors such as economic development, technological infrastructure, and consumer spending patterns.

Tablet Application Processor Industry: A Comprehensive Market Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the global Tablet Application Processor industry, offering crucial insights for stakeholders, investors, and industry professionals. The report covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period extends from 2025 to 2033, and the historical period encompasses 2019-2024. The market is segmented by operating system (Android, Apple iOS, Windows), end-user (Household, Commercial, Other), type (32-bit, 64-bit, Other), and core type (Single-core, Multi-core). Key players analyzed include Spreadtrum Communications Inc, Samsung Electronics, NXP Semiconductors NV, Qualcomm Technologies Inc, Ingenic Semiconductor Co Ltd, Texas Instruments Incorporated, MediaTek Inc, Nvidia Corporation, Apple Inc, and HiSilicon Technologies Co Ltd. The report's total market value in 2025 is estimated at xx Million.

Tablet Application Processor Industry Market Concentration & Innovation

The Tablet Application Processor market exhibits a moderately concentrated landscape, with a few dominant players commanding significant market share. Qualcomm Technologies Inc and Apple Inc hold substantial market power, leveraging their strong brand recognition and technological advancements. However, the market also features several other prominent players like Samsung Electronics and MediaTek Inc, contributing to a competitive environment. Market share data for 2025 estimates Qualcomm at approximately 35%, Apple at 25%, and the remaining players sharing the balance.

Innovation is a key driver in this sector, with continuous improvements in processing power, energy efficiency, and graphics capabilities. The development of advanced technologies like AI processing units and 5G modem integration are crucial factors shaping the competitive landscape. Regulatory frameworks, particularly concerning data privacy and security, play a significant role in shaping product development and market access. The prevalence of smartphones and other mobile devices acts as a product substitute, putting pressure on the market. Furthermore, mergers and acquisitions (M&A) are prevalent, with recent deals totaling an estimated xx Million in value, primarily driven by the consolidation of smaller players and the expansion of technology portfolios.

- Market Concentration: Moderately concentrated, with Qualcomm and Apple holding leading positions.

- Innovation Drivers: AI processing, 5G integration, improved energy efficiency.

- M&A Activity: Total deal value estimated at xx Million in recent years.

Tablet Application Processor Industry Industry Trends & Insights

The Tablet Application Processor market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily fueled by increasing demand for high-performance tablets across various sectors, including education, entertainment, and business. Technological advancements, particularly in areas like Artificial Intelligence (AI) and Machine Learning (ML), are driving the development of more powerful and energy-efficient processors. Consumer preference is shifting towards devices with enhanced multimedia capabilities and longer battery life, directly influencing processor design. Competitive dynamics are marked by intense innovation and strategic partnerships, with companies focusing on differentiation through unique features and optimized performance. Market penetration of advanced processors in tablets is expected to reach xx% by 2033.

Dominant Markets & Segments in Tablet Application Processor Industry

The Android operating system holds the dominant market share among tablets, owing to its widespread adoption and open-source nature. Within end-users, the household segment demonstrates significant growth, driven by increased tablet ownership for entertainment and education. The 64-bit processor type dominates the market due to its enhanced processing capabilities and ability to handle larger datasets. Multi-core processors represent the prevailing technology, offering significant performance advantages.

- Key Drivers for Android Dominance: Wide device compatibility, extensive developer ecosystem, affordability.

- Key Drivers for Household Segment Dominance: Rising disposable income, increased preference for digital content consumption.

- Key Drivers for 64-bit Type Dominance: Enhanced performance, support for large applications.

- Key Drivers for Multi-core Processors: Improved processing speed, ability to handle multitasking.

Regional dominance: North America and Asia Pacific are the largest markets, driven by strong technological adoption and manufacturing capacity, respectively.

Tablet Application Processor Industry Product Developments

Recent product developments focus on integrating advanced AI processing units, enhancing graphics capabilities, and optimizing power consumption. The integration of 5G modems is also a major trend, aiming to improve connectivity speeds and capabilities. These advancements are designed to meet the evolving demands of both consumers and commercial users, leading to an improved user experience and device performance across various applications.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Tablet Application Processor market across various segments:

- Operating System: Android, Apple iOS, and Windows segments are analyzed based on market size, growth projections, and competitive landscapes.

- End User: The household, commercial, and other end-user segments are assessed based on their respective growth drivers and application-specific needs.

- Type: 32-bit, 64-bit, and other types are analyzed for their market share, future potential, and technological advantages.

- Core Type: Single-core and multi-core processors are analyzed based on their performance capabilities, target applications, and market adoption rates.

Key Drivers of Tablet Application Processor Industry Growth

Growth is propelled by several key factors: the increasing demand for high-performance mobile computing, technological advancements in processing power and energy efficiency, the rising adoption of tablets across various sectors (education, business, and entertainment), and the growing availability of high-speed internet access globally. Government initiatives to promote digital literacy and infrastructure development further accelerate market expansion.

Challenges in the Tablet Application Processor Industry Sector

The industry faces challenges such as intense competition, the high cost of research and development, supply chain disruptions that lead to increased manufacturing costs, and fluctuations in raw material prices. These factors collectively impact profitability and market growth, necessitating strategic planning and resource management. Furthermore, regulatory changes related to data privacy and security compliance add further complexity.

Emerging Opportunities in Tablet Application Processor Industry

Emerging opportunities exist in the development of specialized processors for augmented reality (AR) and virtual reality (VR) applications, as well as the expansion into emerging markets with growing tablet adoption rates. The integration of advanced security features and the focus on energy-efficient designs are also significant areas for growth.

Leading Players in the Tablet Application Processor Industry Market

- Spreadtrum Communications Inc

- Samsung Electronics

- NXP Semiconductors NV

- Qualcomm Technologies Inc

- Ingenic Semiconductor Co Ltd

- Texas Instruments Incorporated

- MediaTek Inc

- Nvidia Corporation

- Apple Inc

- HiSilicon Technologies Co Ltd

Key Developments in Tablet Application Processor Industry Industry

- 2022-Q4: Qualcomm announces its new Snapdragon processor with enhanced AI capabilities.

- 2023-Q1: MediaTek launches a new energy-efficient processor for budget tablets.

- 2023-Q3: Samsung integrates a next-generation graphics processing unit into its latest tablet processor. (Further developments will be detailed in the full report)

Strategic Outlook for Tablet Application Processor Industry Market

The Tablet Application Processor market is poised for continued growth, driven by technological advancements, increasing demand for high-performance mobile devices, and the expansion of the tablet market into new applications and geographical regions. Strategic investments in R&D, strategic partnerships, and a focus on delivering innovative, energy-efficient processors are crucial for success in this dynamic market.

Tablet Application Processor Industry Segmentation

-

1. Type

- 1.1. 32 Bit

- 1.2. 64 Bit

- 1.3. Other Types

-

2. Core Type

- 2.1. Single Core

- 2.2. Multi-core

-

3. Operating System

- 3.1. Android

- 3.2. Apple iOS

- 3.3. Windows

-

4. End User

- 4.1. Household

- 4.2. Commercial

- 4.3. Other End Users

Tablet Application Processor Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East and Africa

Tablet Application Processor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Adoption of Octa-Core Application Processors; Increasing Adoption of Navigation Application in Automotive

- 3.3. Market Restrains

- 3.3.1. Concerns Regarding the Impact of COVID-19 On Supply Chain

- 3.4. Market Trends

- 3.4.1. Apple iOS to Witness Significant Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tablet Application Processor Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. 32 Bit

- 5.1.2. 64 Bit

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Core Type

- 5.2.1. Single Core

- 5.2.2. Multi-core

- 5.3. Market Analysis, Insights and Forecast - by Operating System

- 5.3.1. Android

- 5.3.2. Apple iOS

- 5.3.3. Windows

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Household

- 5.4.2. Commercial

- 5.4.3. Other End Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Tablet Application Processor Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. 32 Bit

- 6.1.2. 64 Bit

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Core Type

- 6.2.1. Single Core

- 6.2.2. Multi-core

- 6.3. Market Analysis, Insights and Forecast - by Operating System

- 6.3.1. Android

- 6.3.2. Apple iOS

- 6.3.3. Windows

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Household

- 6.4.2. Commercial

- 6.4.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Tablet Application Processor Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. 32 Bit

- 7.1.2. 64 Bit

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Core Type

- 7.2.1. Single Core

- 7.2.2. Multi-core

- 7.3. Market Analysis, Insights and Forecast - by Operating System

- 7.3.1. Android

- 7.3.2. Apple iOS

- 7.3.3. Windows

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Household

- 7.4.2. Commercial

- 7.4.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Tablet Application Processor Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. 32 Bit

- 8.1.2. 64 Bit

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Core Type

- 8.2.1. Single Core

- 8.2.2. Multi-core

- 8.3. Market Analysis, Insights and Forecast - by Operating System

- 8.3.1. Android

- 8.3.2. Apple iOS

- 8.3.3. Windows

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Household

- 8.4.2. Commercial

- 8.4.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Tablet Application Processor Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. 32 Bit

- 9.1.2. 64 Bit

- 9.1.3. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Core Type

- 9.2.1. Single Core

- 9.2.2. Multi-core

- 9.3. Market Analysis, Insights and Forecast - by Operating System

- 9.3.1. Android

- 9.3.2. Apple iOS

- 9.3.3. Windows

- 9.4. Market Analysis, Insights and Forecast - by End User

- 9.4.1. Household

- 9.4.2. Commercial

- 9.4.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Tablet Application Processor Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 11. Europe Tablet Application Processor Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Italy

- 11.1.5 Rest of Europe

- 12. Asia Pacific Tablet Application Processor Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 India

- 12.1.2 China

- 12.1.3 Japan

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Tablet Application Processor Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Latin America

- 13.1.2 Middle East and Africa

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Spreadtrum Communications Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Samsung Electronics

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 NXP Semiconductors NV

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Qualcomm Technologies Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Ingenic Semiconductor Co Ltd*List Not Exhaustive

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Texas Instruments Incorporated

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 MediaTek Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Nvidia Corporation

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Apple Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 HiSilicon Technologies Co Ltd

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Spreadtrum Communications Inc

List of Figures

- Figure 1: Global Tablet Application Processor Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Tablet Application Processor Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Tablet Application Processor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Tablet Application Processor Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Tablet Application Processor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Tablet Application Processor Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Tablet Application Processor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Tablet Application Processor Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Tablet Application Processor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Tablet Application Processor Industry Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Tablet Application Processor Industry Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Tablet Application Processor Industry Revenue (Million), by Core Type 2024 & 2032

- Figure 13: North America Tablet Application Processor Industry Revenue Share (%), by Core Type 2024 & 2032

- Figure 14: North America Tablet Application Processor Industry Revenue (Million), by Operating System 2024 & 2032

- Figure 15: North America Tablet Application Processor Industry Revenue Share (%), by Operating System 2024 & 2032

- Figure 16: North America Tablet Application Processor Industry Revenue (Million), by End User 2024 & 2032

- Figure 17: North America Tablet Application Processor Industry Revenue Share (%), by End User 2024 & 2032

- Figure 18: North America Tablet Application Processor Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Tablet Application Processor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Tablet Application Processor Industry Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe Tablet Application Processor Industry Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Tablet Application Processor Industry Revenue (Million), by Core Type 2024 & 2032

- Figure 23: Europe Tablet Application Processor Industry Revenue Share (%), by Core Type 2024 & 2032

- Figure 24: Europe Tablet Application Processor Industry Revenue (Million), by Operating System 2024 & 2032

- Figure 25: Europe Tablet Application Processor Industry Revenue Share (%), by Operating System 2024 & 2032

- Figure 26: Europe Tablet Application Processor Industry Revenue (Million), by End User 2024 & 2032

- Figure 27: Europe Tablet Application Processor Industry Revenue Share (%), by End User 2024 & 2032

- Figure 28: Europe Tablet Application Processor Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe Tablet Application Processor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Asia Pacific Tablet Application Processor Industry Revenue (Million), by Type 2024 & 2032

- Figure 31: Asia Pacific Tablet Application Processor Industry Revenue Share (%), by Type 2024 & 2032

- Figure 32: Asia Pacific Tablet Application Processor Industry Revenue (Million), by Core Type 2024 & 2032

- Figure 33: Asia Pacific Tablet Application Processor Industry Revenue Share (%), by Core Type 2024 & 2032

- Figure 34: Asia Pacific Tablet Application Processor Industry Revenue (Million), by Operating System 2024 & 2032

- Figure 35: Asia Pacific Tablet Application Processor Industry Revenue Share (%), by Operating System 2024 & 2032

- Figure 36: Asia Pacific Tablet Application Processor Industry Revenue (Million), by End User 2024 & 2032

- Figure 37: Asia Pacific Tablet Application Processor Industry Revenue Share (%), by End User 2024 & 2032

- Figure 38: Asia Pacific Tablet Application Processor Industry Revenue (Million), by Country 2024 & 2032

- Figure 39: Asia Pacific Tablet Application Processor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 40: Rest of the World Tablet Application Processor Industry Revenue (Million), by Type 2024 & 2032

- Figure 41: Rest of the World Tablet Application Processor Industry Revenue Share (%), by Type 2024 & 2032

- Figure 42: Rest of the World Tablet Application Processor Industry Revenue (Million), by Core Type 2024 & 2032

- Figure 43: Rest of the World Tablet Application Processor Industry Revenue Share (%), by Core Type 2024 & 2032

- Figure 44: Rest of the World Tablet Application Processor Industry Revenue (Million), by Operating System 2024 & 2032

- Figure 45: Rest of the World Tablet Application Processor Industry Revenue Share (%), by Operating System 2024 & 2032

- Figure 46: Rest of the World Tablet Application Processor Industry Revenue (Million), by End User 2024 & 2032

- Figure 47: Rest of the World Tablet Application Processor Industry Revenue Share (%), by End User 2024 & 2032

- Figure 48: Rest of the World Tablet Application Processor Industry Revenue (Million), by Country 2024 & 2032

- Figure 49: Rest of the World Tablet Application Processor Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Tablet Application Processor Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Tablet Application Processor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Tablet Application Processor Industry Revenue Million Forecast, by Core Type 2019 & 2032

- Table 4: Global Tablet Application Processor Industry Revenue Million Forecast, by Operating System 2019 & 2032

- Table 5: Global Tablet Application Processor Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Global Tablet Application Processor Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Tablet Application Processor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Tablet Application Processor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Tablet Application Processor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: India Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: China Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia Pacific Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Tablet Application Processor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Latin America Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Middle East and Africa Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Tablet Application Processor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Global Tablet Application Processor Industry Revenue Million Forecast, by Core Type 2019 & 2032

- Table 27: Global Tablet Application Processor Industry Revenue Million Forecast, by Operating System 2019 & 2032

- Table 28: Global Tablet Application Processor Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 29: Global Tablet Application Processor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United States Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Canada Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Tablet Application Processor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 33: Global Tablet Application Processor Industry Revenue Million Forecast, by Core Type 2019 & 2032

- Table 34: Global Tablet Application Processor Industry Revenue Million Forecast, by Operating System 2019 & 2032

- Table 35: Global Tablet Application Processor Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 36: Global Tablet Application Processor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Germany Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: United Kingdom Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Italy Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of Europe Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global Tablet Application Processor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 43: Global Tablet Application Processor Industry Revenue Million Forecast, by Core Type 2019 & 2032

- Table 44: Global Tablet Application Processor Industry Revenue Million Forecast, by Operating System 2019 & 2032

- Table 45: Global Tablet Application Processor Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 46: Global Tablet Application Processor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 47: India Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: China Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Asia Pacific Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Global Tablet Application Processor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 53: Global Tablet Application Processor Industry Revenue Million Forecast, by Core Type 2019 & 2032

- Table 54: Global Tablet Application Processor Industry Revenue Million Forecast, by Operating System 2019 & 2032

- Table 55: Global Tablet Application Processor Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 56: Global Tablet Application Processor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 57: Latin America Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Middle East and Africa Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tablet Application Processor Industry?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Tablet Application Processor Industry?

Key companies in the market include Spreadtrum Communications Inc, Samsung Electronics, NXP Semiconductors NV, Qualcomm Technologies Inc, Ingenic Semiconductor Co Ltd*List Not Exhaustive, Texas Instruments Incorporated, MediaTek Inc, Nvidia Corporation, Apple Inc, HiSilicon Technologies Co Ltd.

3. What are the main segments of the Tablet Application Processor Industry?

The market segments include Type, Core Type, Operating System, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High Adoption of Octa-Core Application Processors; Increasing Adoption of Navigation Application in Automotive.

6. What are the notable trends driving market growth?

Apple iOS to Witness Significant Growth Rate.

7. Are there any restraints impacting market growth?

Concerns Regarding the Impact of COVID-19 On Supply Chain.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tablet Application Processor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tablet Application Processor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tablet Application Processor Industry?

To stay informed about further developments, trends, and reports in the Tablet Application Processor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence