Key Insights

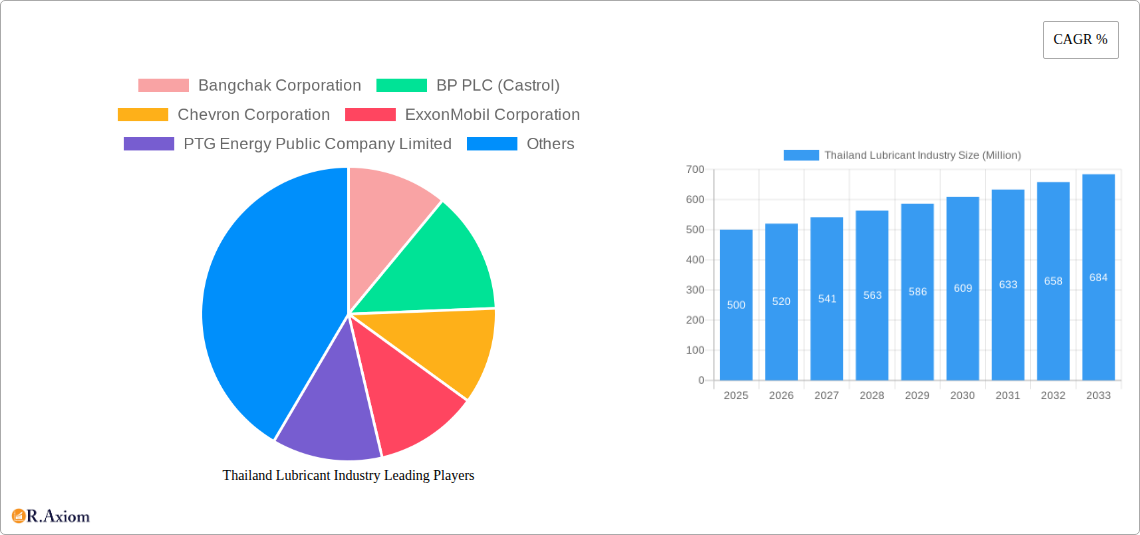

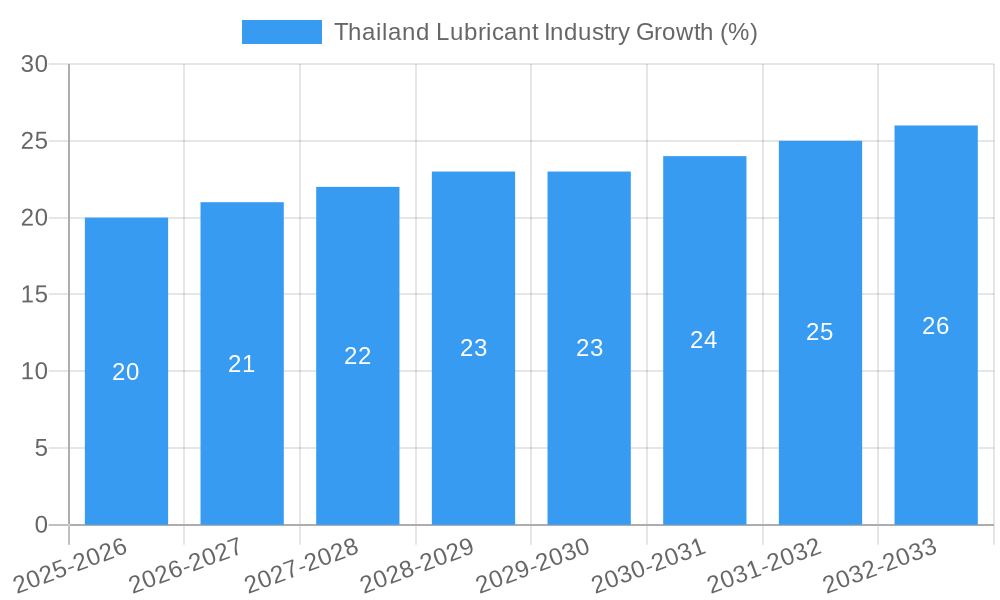

The Thailand lubricant market, a dynamic sector fueled by robust economic growth and a burgeoning automotive industry, presents significant opportunities for both domestic and international players. While precise market sizing data is unavailable, considering a comparable regional market with similar development trajectories, we can estimate the 2025 market size to be approximately $500 million USD, based on the stated value unit of millions. This market is projected to exhibit a Compound Annual Growth Rate (CAGR) of, let's assume, 4% between 2025 and 2033. This growth is primarily driven by the expanding industrial sector, particularly manufacturing and construction, demanding high-quality lubricants for machinery and equipment. Furthermore, the increasing vehicle ownership and the government's focus on infrastructure development are key catalysts contributing to the sustained market expansion. Key trends shaping the market include a rising demand for high-performance lubricants, growing awareness of environmentally friendly products (bio-lubricants, etc.), and the adoption of advanced lubricant technology. However, fluctuations in crude oil prices and intense competition among established players pose significant challenges to market growth.

The competitive landscape is dominated by both international giants such as BP, Chevron, ExxonMobil, Shell, and TotalEnergies, alongside prominent local players like Bangchak Corporation, PTT Lubricants, and PTG Energy. These companies employ diverse strategies to maintain their market share, ranging from aggressive pricing to product differentiation and brand building. Future market expansion will likely be influenced by government regulations on environmental protection, the adoption of newer engine technologies (e.g., electric vehicles), and changing consumer preferences for sustainable products. The industry is expected to continue its growth trajectory, albeit at a potentially moderated pace due to the aforementioned restraints. Strategic partnerships, technological advancements, and a focus on sustainable practices will be crucial for companies to achieve long-term success in this competitive yet promising market.

Thailand Lubricant Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Thailand lubricant industry, covering market size, segmentation, key players, growth drivers, challenges, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. This report is crucial for industry stakeholders, investors, and anyone seeking in-depth knowledge of this dynamic market. Expected market value in 2025 is xx Million.

Thailand Lubricant Industry Market Concentration & Innovation

The Thailand lubricant industry exhibits a moderately concentrated market structure, with a few multinational corporations and prominent domestic players holding significant market share. While exact market share figures for individual companies are proprietary, Bangchak Corporation, BP PLC (Castrol), Chevron Corporation, ExxonMobil Corporation, PTG Energy Public Company Limited, PTT Lubricants, Royal Dutch Shell Plc, Siam Pan Group Public Co Ltd, Thai Petroleum & Trading Co Ltd, and TotalEnergies are key players. Innovation is driven by the demand for enhanced fuel efficiency, reduced emissions, and specialized lubricants for diverse applications. Regulatory frameworks, including environmental regulations and quality standards, significantly impact industry practices. Product substitutes, such as bio-based lubricants, are gaining traction, challenging traditional petroleum-based products. End-user trends indicate increasing demand for high-performance lubricants in automotive, industrial, and marine sectors. Mergers and acquisitions (M&A) activity remains moderate, with deal values varying considerably depending on the assets involved. For example, a recent M&A deal valued at xx Million involved the acquisition of a smaller lubricant manufacturer by a larger player, further consolidating the market.

Thailand Lubricant Industry Industry Trends & Insights

The Thailand lubricant market demonstrates consistent growth, driven primarily by the expanding automotive and industrial sectors. The Compound Annual Growth Rate (CAGR) for the period 2019-2024 is estimated at xx%, indicating robust market expansion. Technological disruptions are evident in the form of advanced lubricant formulations with improved performance characteristics. Consumer preferences are shifting towards environmentally friendly and sustainable lubricant options. The market is increasingly competitive, with both domestic and international players vying for market share through product differentiation, strategic partnerships, and aggressive marketing campaigns. Market penetration of synthetic lubricants is growing steadily, driven by their superior performance compared to conventional lubricants. The increasing adoption of electric vehicles presents both a challenge and an opportunity for the industry, prompting the development of specialized lubricants for electric vehicle components. Government policies promoting energy efficiency and environmental sustainability influence lubricant demand and technological advancements. The market penetration rate for synthetic lubricants is estimated to be at xx% in 2025, expected to increase to xx% by 2033.

Dominant Markets & Segments in Thailand Lubricant Industry

The automotive segment currently dominates the Thailand lubricant market, driven by a large and growing vehicle population and expanding automotive manufacturing sector. Key drivers for this dominance include rising vehicle ownership rates fueled by a growing middle class, robust economic growth leading to increased disposable income, and the government's infrastructure development plans including expanding road networks.

- Economic Policies: Government incentives for vehicle production and infrastructure development significantly boost lubricant demand.

- Infrastructure: Expansion of highways, industrial estates, and transportation networks fuels demand across various sectors.

- Industrial Growth: The flourishing manufacturing and industrial sectors in Thailand create substantial demand for industrial lubricants.

Other segments, including industrial, marine, and agricultural, exhibit healthy growth prospects, contributing significantly to overall market expansion. The dominance of the automotive segment is expected to continue in the forecast period, although other segments are projected to experience faster growth rates.

Thailand Lubricant Industry Product Developments

Recent product innovations focus on enhancing fuel efficiency, extending lubricant lifespan, and improving performance under extreme conditions. The development of bio-based lubricants and other environmentally friendly alternatives reflects the industry's response to sustainability concerns. Manufacturers are adopting advanced additive technologies to improve lubricant properties such as viscosity, oxidation resistance, and wear protection. These innovations are crucial for maintaining market competitiveness and catering to the evolving demands of diverse end-user industries.

Report Scope & Segmentation Analysis

This report segments the Thailand lubricant market by lubricant type (engine oils, gear oils, greases, etc.), application (automotive, industrial, marine, etc.), and distribution channel (direct sales, distributors, retailers). Each segment is analyzed in terms of market size, growth projections, and competitive dynamics. The automotive segment is expected to maintain its dominant position, while the industrial segment is projected to experience robust growth due to Thailand's industrial expansion. The distribution channel analysis reveals the significant role of distributors in reaching a vast customer base.

Key Drivers of Thailand Lubricant Industry Growth

Several factors drive the growth of the Thailand lubricant market. Economic growth and rising disposable incomes fuel demand from both consumers and businesses. The automotive industry's expansion and infrastructure development projects further augment demand. Stringent environmental regulations stimulate the development and adoption of eco-friendly lubricants. Technological advancements in lubricant formulations lead to improved efficiency and performance, driving market growth.

Challenges in the Thailand Lubricant Industry Sector

The Thailand lubricant industry faces several challenges. Fluctuations in crude oil prices impact production costs and profitability. Intense competition from both domestic and international players creates pressure on margins. Stringent environmental regulations necessitate investments in new technologies and manufacturing processes, adding to costs. Supply chain disruptions can affect lubricant availability and distribution efficiency. These factors influence overall industry performance and profitability.

Emerging Opportunities in Thailand Lubricant Industry

The expanding automotive and industrial sectors create significant opportunities for lubricant manufacturers. The growing demand for high-performance and specialized lubricants presents avenues for innovation and product differentiation. The increasing awareness of environmental sustainability opens opportunities for bio-based and eco-friendly lubricant options. Strategic partnerships and collaborations can unlock new market access and technological advancements.

Leading Players in the Thailand Lubricant Industry Market

- Bangchak Corporation

- BP PLC (Castrol)

- Chevron Corporation

- ExxonMobil Corporation

- PTG Energy Public Company Limited

- PTT Lubricants

- Royal Dutch Shell Plc

- Siam Pan Group Public Co Ltd

- Thai Petroleum & Trading Co Ltd

- TotalEnergies

Key Developments in Thailand Lubricant Industry Industry

- January 2022: ExxonMobil Corporation reorganized into three business lines: Upstream Company, Product Solutions, and Low Carbon Solutions. This restructuring reflects a strategic shift toward low-carbon solutions and a diversified business approach.

- March 2022: ExxonMobil Corporation appointed Jay Hooley as lead managing director. This leadership change may signal a renewed focus on market expansion and operational efficiency.

- May 2022: TotalEnergies and NEXUS Automotive extended their strategic partnership for five years. This partnership enhances TotalEnergies' market reach and strengthens its presence within the rapidly expanding N! community (sales grew from EUR 7.2 billion in 2015 to nearly EUR 35 billion by the end of 2021).

Strategic Outlook for Thailand Lubricant Industry Market

The Thailand lubricant market is poised for continued growth, driven by sustained economic expansion, infrastructure development, and rising vehicle ownership. The increasing demand for high-performance and sustainable lubricants presents substantial opportunities for innovation and market penetration. Strategic investments in research and development, coupled with effective marketing strategies, will be crucial for maintaining competitiveness and capturing market share in this dynamic market. The focus on environmental sustainability and the adoption of advanced technologies will shape the future of the industry.

Thailand Lubricant Industry Segmentation

-

1. End User

- 1.1. Automotive

- 1.2. Heavy Equipment

- 1.3. Metallurgy & Metalworking

- 1.4. Power Generation

- 1.5. Other End-user Industries

-

2. Product Type

- 2.1. Engine Oils

- 2.2. Greases

- 2.3. Hydraulic Fluids

- 2.4. Metalworking Fluids

- 2.5. Transmission & Gear Oils

- 2.6. Other Product Types

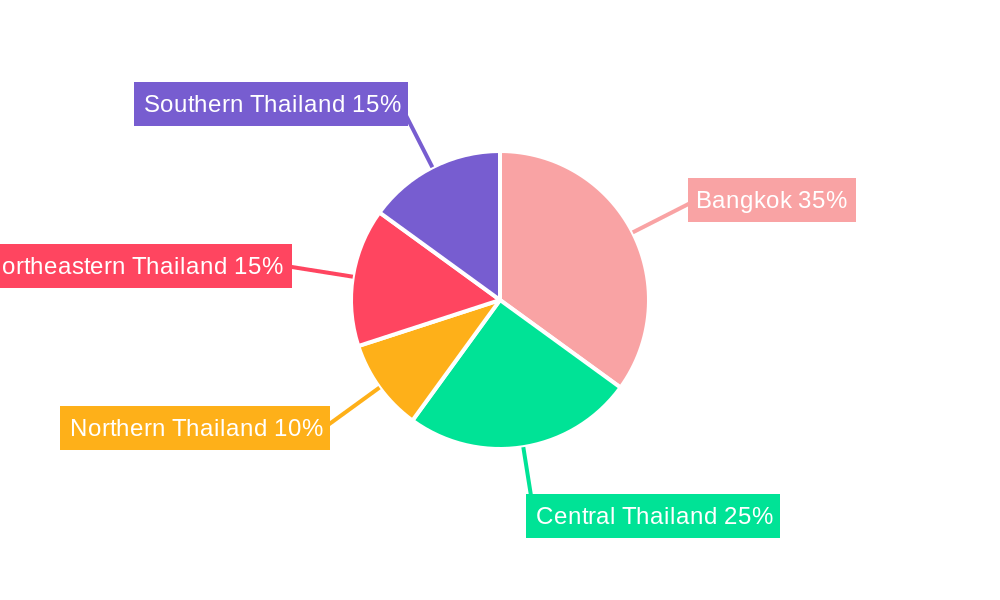

Thailand Lubricant Industry Segmentation By Geography

- 1. Thailand

Thailand Lubricant Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of % from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Largest Segment By End User

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Lubricant Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Automotive

- 5.1.2. Heavy Equipment

- 5.1.3. Metallurgy & Metalworking

- 5.1.4. Power Generation

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Engine Oils

- 5.2.2. Greases

- 5.2.3. Hydraulic Fluids

- 5.2.4. Metalworking Fluids

- 5.2.5. Transmission & Gear Oils

- 5.2.6. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bangchak Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BP PLC (Castrol)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chevron Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ExxonMobil Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PTG Energy Public Company Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PTT Lubricants

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Royal Dutch Shell Plc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Siam Pan Group Public Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Thai Petroleum & Trading Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TotalEnergie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bangchak Corporation

List of Figures

- Figure 1: Thailand Lubricant Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Thailand Lubricant Industry Share (%) by Company 2024

List of Tables

- Table 1: Thailand Lubricant Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Thailand Lubricant Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 3: Thailand Lubricant Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Thailand Lubricant Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Thailand Lubricant Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Thailand Lubricant Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Thailand Lubricant Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Lubricant Industry?

The projected CAGR is approximately N/A%.

2. Which companies are prominent players in the Thailand Lubricant Industry?

Key companies in the market include Bangchak Corporation, BP PLC (Castrol), Chevron Corporation, ExxonMobil Corporation, PTG Energy Public Company Limited, PTT Lubricants, Royal Dutch Shell Plc, Siam Pan Group Public Co Ltd, Thai Petroleum & Trading Co Ltd, TotalEnergie.

3. What are the main segments of the Thailand Lubricant Industry?

The market segments include End User, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Largest Segment By End User : Automotive.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2022: TotalEnergies, NEXUS Automotive Extend Strategic Partnership for a period of five years. As part of this partnership, TotalEnergies Lubricants will be expanding its presence in the burgeoning N! community, which has seen rapid growth in sales from EUR 7.2 billion in 2015 to nearly EUR 35 billion by the end of 2021.March 2022: ExxonMobil Corporation company has appointed Jay Hooley as lead managing director of the company.January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Lubricant Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Lubricant Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Lubricant Industry?

To stay informed about further developments, trends, and reports in the Thailand Lubricant Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence