Key Insights

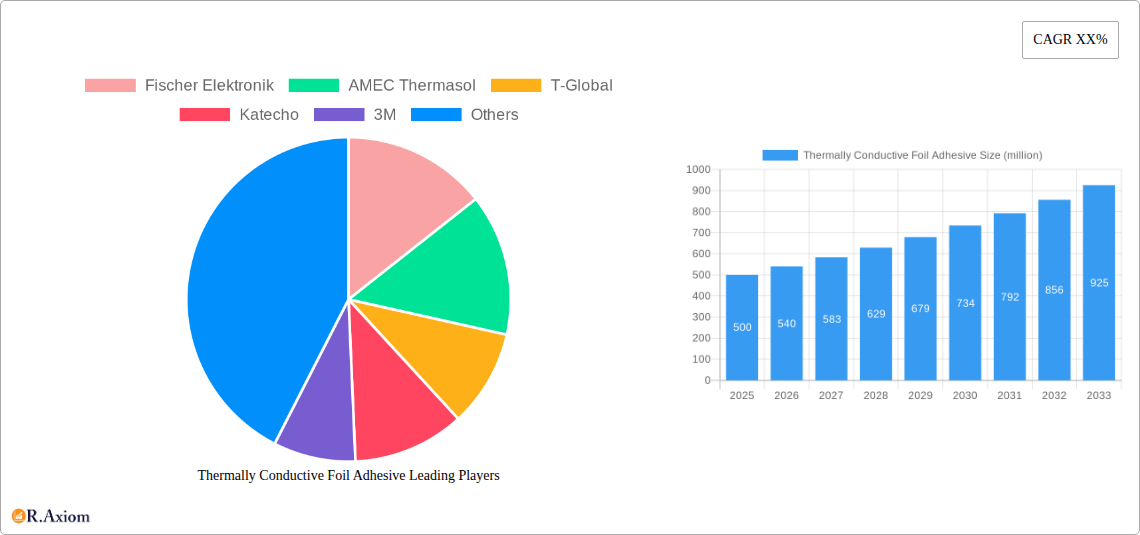

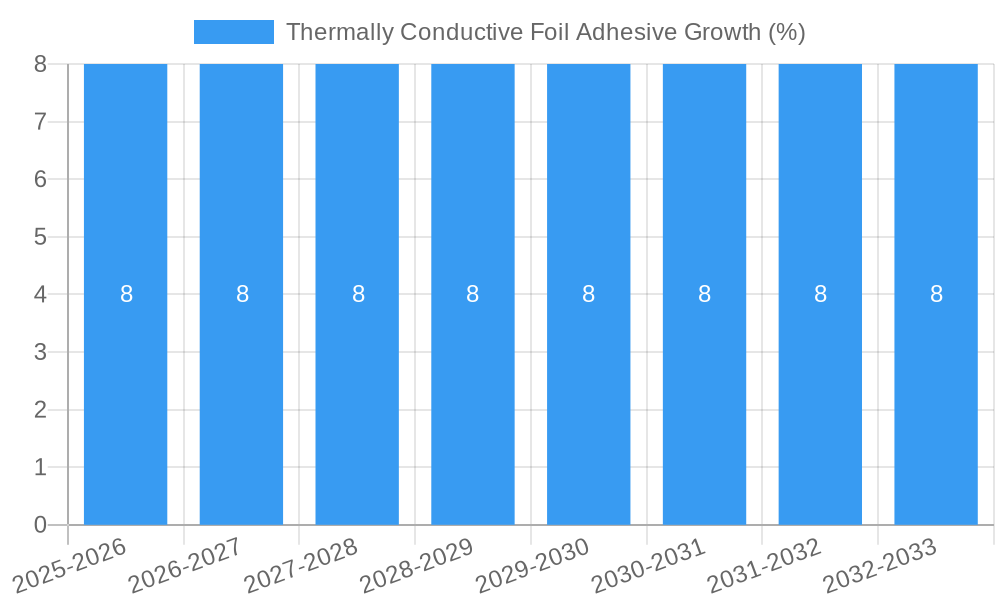

The global Thermally Conductive Foil Adhesive market is poised for significant expansion, projected to reach approximately $500 million by 2025 and exhibit a robust Compound Annual Growth Rate (CAGR) of around 8% through 2033. This impressive trajectory is primarily fueled by the burgeoning demand across key application segments such as Computer and Communication, where efficient thermal management is paramount for advanced electronics and high-performance computing. The Industry sector also contributes substantially, driven by the increasing adoption of sophisticated industrial automation and power electronics requiring reliable heat dissipation solutions. The Medical Care segment, with its continuous innovation in diagnostic and therapeutic devices, further bolsters market growth, emphasizing the critical role of these adhesives in ensuring device reliability and patient safety.

Several dynamic drivers are propelling this growth. The escalating miniaturization of electronic devices necessitates highly effective thermal management solutions, making thermally conductive foil adhesives indispensable. Furthermore, advancements in materials science are leading to the development of more advanced adhesives with superior thermal conductivity, enhanced durability, and easier application methods. The growing adoption of electric vehicles (EVs) and their complex battery management systems, which generate significant heat, presents a substantial growth avenue. Conversely, challenges such as the high cost of specialized raw materials and the need for stringent quality control during manufacturing can act as restraints. However, the ongoing technological evolution and the increasing focus on energy efficiency across various industries are expected to outweigh these challenges, ensuring sustained market expansion.

Here is a detailed, SEO-optimized report description for Thermally Conductive Foil Adhesive, incorporating the specified keywords, structure, and content.

Thermally Conductive Foil Adhesive Market Concentration & Innovation

The global thermally conductive foil adhesive market, valued at over one million dollars, exhibits a moderate concentration, with key players like Fischer Elektronik, AMEC Thermasol, T-Global, Katecho, 3M, Teraoka, Nitto, Can-Do National Tape, SEPA EUROPE, and Dexerials actively driving innovation and market share. Innovation in this sector is primarily fueled by the relentless demand for enhanced thermal management solutions across burgeoning industries such as computing, communication, and advanced industrial applications. Regulatory frameworks, while evolving to ensure safety and performance standards, also present opportunities for companies developing compliant and high-efficacy materials. The threat of product substitutes, though present in the form of thermal pastes and pads, is mitigated by the unique advantages offered by foil adhesives, including ease of application, precise dispensing, and excellent mechanical integrity. End-user trends underscore a growing preference for compact, high-performance electronic devices requiring superior heat dissipation. Mergers and acquisitions (M&A) within the industry, with recent deal values in the one million range, are strategically aimed at consolidating market presence, expanding product portfolios, and acquiring cutting-edge technologies to maintain a competitive edge in this dynamic landscape. The study period encompasses 2019–2033, with a base year of 2025 and a forecast period of 2025–2033.

Thermally Conductive Foil Adhesive Industry Trends & Insights

The thermally conductive foil adhesive market is poised for significant expansion, driven by a confluence of technological advancements and escalating demand for efficient thermal management solutions. The Compound Annual Growth Rate (CAGR) is projected to exceed xx% during the forecast period of 2025–2033. This growth is underpinned by several key industry trends. Firstly, the miniaturization of electronic components, particularly in the computer and communication sectors, necessitates the use of thinner and more effective thermal interface materials. Thermally conductive foil adhesives, with their ability to conform to intricate surfaces and provide consistent thermal conductivity, are ideally suited for these applications. The increasing adoption of 5G technology, for instance, is driving the need for advanced cooling solutions in base stations and mobile devices, thereby boosting demand for these specialized adhesives.

Secondly, the industrial sector is witnessing a surge in the deployment of sophisticated machinery and automation systems, all of which generate substantial heat. The reliability and longevity of these industrial assets are directly linked to their thermal management, making thermally conductive foil adhesives a critical component in their design and maintenance. Furthermore, the medical care industry's reliance on sensitive electronic equipment, such as imaging devices and patient monitoring systems, demands stringent temperature control to ensure accurate readings and patient safety. This has opened up a niche but high-value market for premium-grade thermally conductive foil adhesives.

Technological disruptions, including advancements in material science and manufacturing processes, are continually enhancing the performance characteristics of these adhesives. Innovations in polymer chemistry and filler integration are yielding materials with higher thermal conductivity, improved dielectric properties, and greater mechanical strength, all while maintaining flexibility and ease of application. The competitive dynamics of the market are characterized by intense R&D efforts, strategic partnerships, and a focus on product differentiation. Companies are investing heavily in developing novel formulations that cater to specific application requirements, such as extreme temperature resistance or enhanced electrical insulation. Market penetration is expected to deepen across all segments as awareness of the benefits of advanced thermal management solutions grows. The historical period of 2019–2024 has laid the groundwork for this accelerated growth, with a base year of 2025 setting the stage for the comprehensive forecast up to 2033.

Dominant Markets & Segments in Thermally Conductive Foil Adhesive

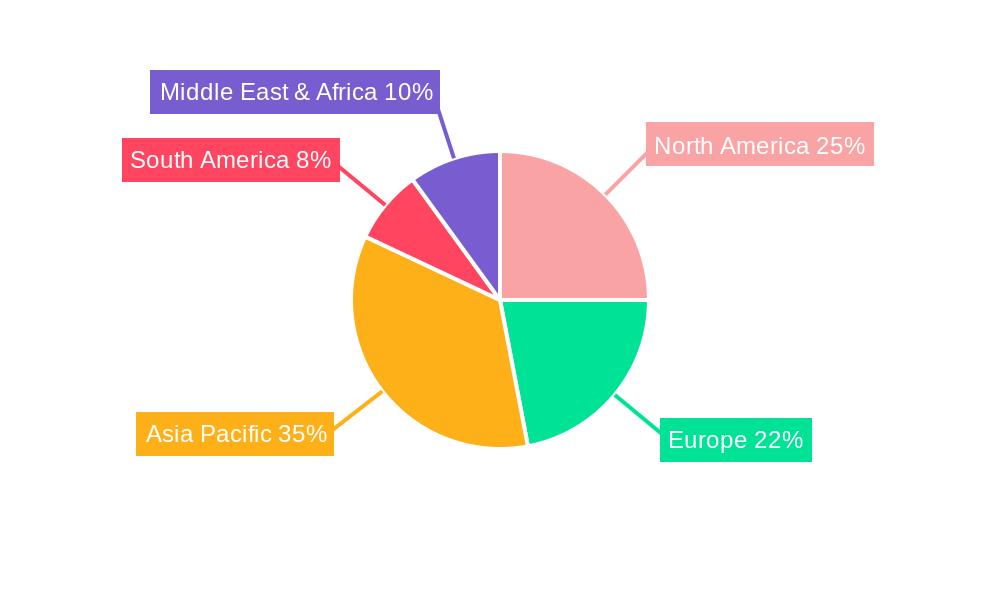

The global thermally conductive foil adhesive market is experiencing robust growth, with specific regions and application segments demonstrating exceptional dominance. North America and Asia-Pacific are identified as leading regions, driven by extensive manufacturing capabilities, high adoption rates of advanced electronics, and significant government initiatives promoting technological innovation. The United States, China, and Japan, in particular, represent key countries with substantial market shares owing to their well-established electronics industries and burgeoning demand from sectors like automotive and telecommunications.

Within the Application segment, the Computer industry stands out as a dominant force. The relentless pursuit of higher processing speeds and more compact designs in laptops, desktops, and servers necessitates sophisticated thermal management solutions. Thermally conductive foil adhesives play a crucial role in dissipating heat from critical components like CPUs, GPUs, and chipsets, ensuring optimal performance and longevity. The market size for this segment is estimated to be over one million dollars.

The Communication sector also exhibits significant dominance, fueled by the rapid expansion of 5G infrastructure, the proliferation of smartphones, and the increasing complexity of networking equipment. Efficient heat dissipation is paramount for maintaining the reliability and performance of these devices, making thermally conductive foil adhesives an indispensable material.

The Industry segment, encompassing a wide array of applications from industrial automation and power electronics to renewable energy systems, is another major contributor to market dominance. The robust performance and durability requirements of industrial equipment necessitate advanced thermal management to prevent overheating and ensure operational continuity. The market size for this segment is projected to reach one million dollars.

Regarding Types, One Side and Two Side thermally conductive foil adhesives are the most prevalent, each catering to distinct application needs. One-sided adhesives are often used for attaching heat sinks to components, while two-sided variants are employed for creating thermal pathways between two surfaces, such as a chip and a heat spreader. The market size for these two types is estimated to be in the millions.

Key drivers for this dominance include:

- Economic Policies: Favorable government policies supporting high-tech manufacturing and R&D investments.

- Infrastructure Development: Expansion of 5G networks and data centers requiring advanced cooling.

- Technological Advancements: Continuous innovation in semiconductor technology leading to higher power densities.

- Consumer Demand: Growing consumer preference for thinner, lighter, and more powerful electronic devices.

The study period is 2019–2033, with the base year and estimated year both being 2025, and the forecast period spanning 2025–2033.

Thermally Conductive Foil Adhesive Product Developments

Product developments in the thermally conductive foil adhesive market are sharply focused on enhancing thermal conductivity, improving application ease, and extending operational lifespan. Innovations include advanced ceramic and metallic filler technologies embedded within flexible polymer matrices, leading to materials with thermal conductivity exceeding xx W/mK. These advancements enable the creation of thinner yet more effective thermal interfaces, crucial for miniaturized electronic devices in the computer and communication sectors. The competitive advantage lies in offering tailor-made solutions with specific adhesion strengths, dielectric properties, and temperature resistance, catering to the stringent requirements of medical care and demanding industrial applications. The market size for these innovative products is projected to be in the one million dollar range.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global thermally conductive foil adhesive market across various segments. The market is meticulously segmented by Application into Computer, Communication, Industry, Medical Care, and Other. Each application segment is projected to exhibit distinct growth trajectories and market sizes, with the computer and communication sectors expected to lead, each contributing over one million dollars. The "Other" segment encompasses emerging applications in automotive, aerospace, and consumer electronics.

Segmentation by Type includes One Side, Two Side, and Other adhesive formats. One-sided adhesives, valued at over one million dollars, are typically used for direct heat sink attachment, while two-sided adhesives, also in the one million dollar range, facilitate thermal transfer between multiple surfaces. The "Other" type category captures specialized formulations for unique bonding and thermal management needs. Competitive dynamics within each segment are influenced by performance requirements, cost-effectiveness, and supplier capabilities, with growth projections consistently indicating an upward trend.

Key Drivers of Thermally Conductive Foil Adhesive Growth

The growth of the thermally conductive foil adhesive market is primarily propelled by several interconnected factors. Technologically, the increasing power density of electronic components across all sectors, from consumer electronics to industrial machinery, mandates more efficient heat dissipation solutions. This drives the demand for high-performance thermal interface materials. Economically, the burgeoning growth in the 5G infrastructure deployment, data centers, and electric vehicle adoption creates significant opportunities. Regulatory factors, such as stricter energy efficiency standards and product reliability requirements, also push manufacturers to adopt advanced thermal management techniques. For example, the evolution of CPUs in computers with higher core counts directly translates to a need for more effective thermal adhesives.

Challenges in the Thermally Conductive Foil Adhesive Sector

Despite strong growth prospects, the thermally conductive foil adhesive sector faces several challenges. Regulatory hurdles related to material safety and environmental compliance can impact product development timelines and costs. Supply chain issues, including the availability and pricing of critical raw materials like specialized fillers and polymers, can lead to production delays and increased costs. Furthermore, competitive pressures from established players and new entrants offering alternative thermal management solutions, such as advanced thermal pastes and gap fillers, necessitate continuous innovation and cost optimization. The market size for specialized fillers alone is estimated to be in the one million dollar range.

Emerging Opportunities in Thermally Conductive Foil Adhesive

Emerging opportunities in the thermally conductive foil adhesive market are abundant, driven by technological advancements and evolving industry demands. The rapid growth of the electric vehicle (EV) market presents a significant opportunity, as EVs require robust thermal management for batteries, power electronics, and motors. Similarly, the expansion of wearable technology and the Internet of Things (IoT) devices, which are often space-constrained and require efficient heat dissipation, offer new avenues for product development. The increasing adoption of advanced manufacturing techniques, such as 3D printing, for creating complex thermal management components, also opens doors for specialized adhesive formulations. The market size for adhesives in the EV sector is projected to exceed one million dollars.

Leading Players in the Thermally Conductive Foil Adhesive Market

- Fischer Elektronik

- AMEC Thermasol

- T-Global

- Katecho

- 3M

- Teraoka

- Nitto

- Can-Do National Tape

- SEPA EUROPE

- Dexerials

Key Developments in Thermally Conductive Foil Adhesive Industry

- 2023: 3M launched a new series of high-performance thermally conductive adhesives designed for 5G infrastructure, enhancing thermal management in demanding environments.

- 2023: Nitto introduced a flexible, high-conductivity thermal tape with improved adhesion for miniaturized consumer electronics.

- 2022: T-Global expanded its product portfolio with a new line of thermally conductive foil adhesives featuring enhanced dielectric strength for automotive applications.

- 2022: Fischer Elektronik developed a specialized thermally conductive adhesive tape for extreme temperature applications in industrial automation.

- 2021: AMEC Thermasol announced significant capacity expansion to meet the growing demand for thermally conductive materials in the communication sector.

Strategic Outlook for Thermally Conductive Foil Adhesive Market

The strategic outlook for the thermally conductive foil adhesive market remains exceptionally positive, driven by the relentless evolution of electronic technologies and the growing importance of thermal management across industries. The increasing demand for higher performance, greater energy efficiency, and enhanced reliability in devices from smartphones to industrial robots will continue to fuel market expansion. Companies that can innovate by developing materials with superior thermal conductivity, improved adhesion properties, and greater application versatility will be well-positioned for success. Strategic investments in R&D, coupled with a focus on emerging markets and applications like electric vehicles and advanced medical devices, will be crucial for capitalizing on the substantial future market potential, estimated to reach one million dollars.

Thermally Conductive Foil Adhesive Segmentation

-

1. Application

- 1.1. Computer

- 1.2. Communication

- 1.3. Industry

- 1.4. Medical Care

- 1.5. Other

-

2. Types

- 2.1. One Side

- 2.2. Two Side

- 2.3. Other

Thermally Conductive Foil Adhesive Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Thermally Conductive Foil Adhesive REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Thermally Conductive Foil Adhesive Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Computer

- 5.1.2. Communication

- 5.1.3. Industry

- 5.1.4. Medical Care

- 5.1.5. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. One Side

- 5.2.2. Two Side

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Thermally Conductive Foil Adhesive Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Computer

- 6.1.2. Communication

- 6.1.3. Industry

- 6.1.4. Medical Care

- 6.1.5. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. One Side

- 6.2.2. Two Side

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Thermally Conductive Foil Adhesive Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Computer

- 7.1.2. Communication

- 7.1.3. Industry

- 7.1.4. Medical Care

- 7.1.5. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. One Side

- 7.2.2. Two Side

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Thermally Conductive Foil Adhesive Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Computer

- 8.1.2. Communication

- 8.1.3. Industry

- 8.1.4. Medical Care

- 8.1.5. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. One Side

- 8.2.2. Two Side

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Thermally Conductive Foil Adhesive Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Computer

- 9.1.2. Communication

- 9.1.3. Industry

- 9.1.4. Medical Care

- 9.1.5. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. One Side

- 9.2.2. Two Side

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Thermally Conductive Foil Adhesive Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Computer

- 10.1.2. Communication

- 10.1.3. Industry

- 10.1.4. Medical Care

- 10.1.5. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. One Side

- 10.2.2. Two Side

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Fischer Elektronik

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AMEC Thermasol

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 T-Global

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Katecho

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 3M

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Teraoka

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nitto

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Can-Do National Tape

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SEPA EUROPE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dexerials

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Fischer Elektronik

List of Figures

- Figure 1: Global Thermally Conductive Foil Adhesive Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Thermally Conductive Foil Adhesive Revenue (million), by Application 2024 & 2032

- Figure 3: North America Thermally Conductive Foil Adhesive Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Thermally Conductive Foil Adhesive Revenue (million), by Types 2024 & 2032

- Figure 5: North America Thermally Conductive Foil Adhesive Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Thermally Conductive Foil Adhesive Revenue (million), by Country 2024 & 2032

- Figure 7: North America Thermally Conductive Foil Adhesive Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Thermally Conductive Foil Adhesive Revenue (million), by Application 2024 & 2032

- Figure 9: South America Thermally Conductive Foil Adhesive Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Thermally Conductive Foil Adhesive Revenue (million), by Types 2024 & 2032

- Figure 11: South America Thermally Conductive Foil Adhesive Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Thermally Conductive Foil Adhesive Revenue (million), by Country 2024 & 2032

- Figure 13: South America Thermally Conductive Foil Adhesive Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Thermally Conductive Foil Adhesive Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Thermally Conductive Foil Adhesive Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Thermally Conductive Foil Adhesive Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Thermally Conductive Foil Adhesive Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Thermally Conductive Foil Adhesive Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Thermally Conductive Foil Adhesive Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Thermally Conductive Foil Adhesive Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Thermally Conductive Foil Adhesive Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Thermally Conductive Foil Adhesive Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Thermally Conductive Foil Adhesive Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Thermally Conductive Foil Adhesive Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Thermally Conductive Foil Adhesive Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Thermally Conductive Foil Adhesive Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Thermally Conductive Foil Adhesive Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Thermally Conductive Foil Adhesive Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Thermally Conductive Foil Adhesive Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Thermally Conductive Foil Adhesive Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Thermally Conductive Foil Adhesive Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Thermally Conductive Foil Adhesive Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Thermally Conductive Foil Adhesive Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Thermally Conductive Foil Adhesive Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Thermally Conductive Foil Adhesive Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Thermally Conductive Foil Adhesive Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Thermally Conductive Foil Adhesive Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Thermally Conductive Foil Adhesive Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Thermally Conductive Foil Adhesive Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Thermally Conductive Foil Adhesive Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Thermally Conductive Foil Adhesive Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Thermally Conductive Foil Adhesive Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Thermally Conductive Foil Adhesive Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Thermally Conductive Foil Adhesive Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Thermally Conductive Foil Adhesive Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Thermally Conductive Foil Adhesive Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Thermally Conductive Foil Adhesive Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Thermally Conductive Foil Adhesive Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Thermally Conductive Foil Adhesive Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Thermally Conductive Foil Adhesive Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Thermally Conductive Foil Adhesive Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thermally Conductive Foil Adhesive?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Thermally Conductive Foil Adhesive?

Key companies in the market include Fischer Elektronik, AMEC Thermasol, T-Global, Katecho, 3M, Teraoka, Nitto, Can-Do National Tape, SEPA EUROPE, Dexerials.

3. What are the main segments of the Thermally Conductive Foil Adhesive?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thermally Conductive Foil Adhesive," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thermally Conductive Foil Adhesive report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thermally Conductive Foil Adhesive?

To stay informed about further developments, trends, and reports in the Thermally Conductive Foil Adhesive, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence