Key Insights

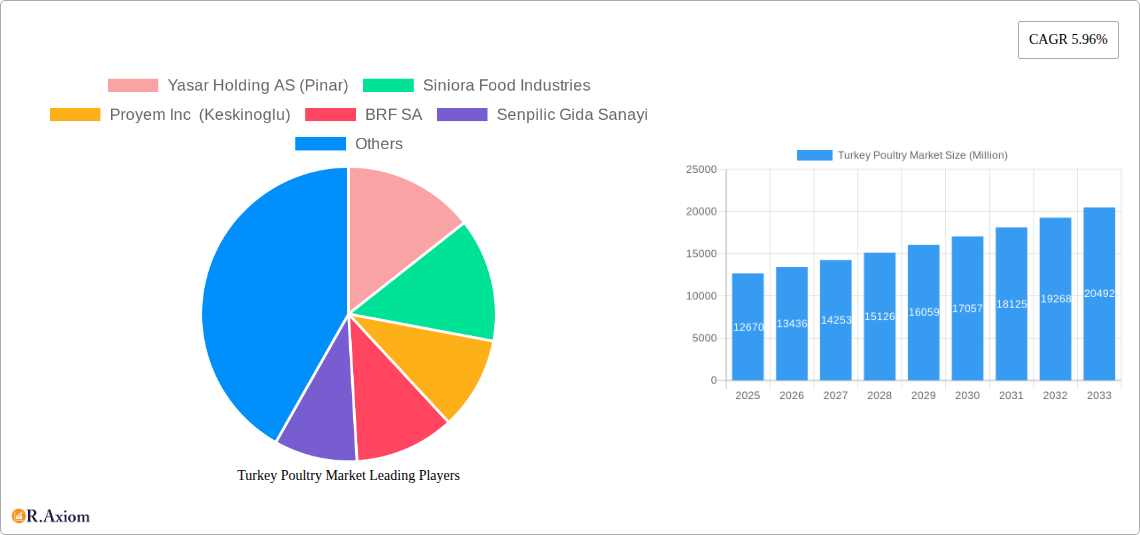

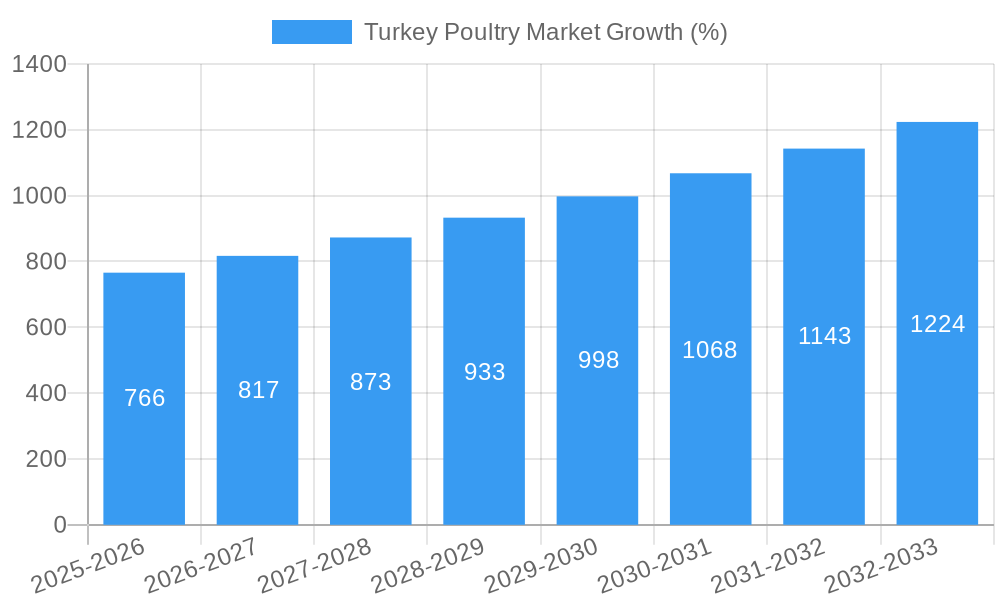

The Turkey poultry market, valued at $12.67 billion in 2025, is projected to experience robust growth, driven by rising domestic consumption fueled by a growing population and increasing disposable incomes. Turkey's strong agricultural sector, coupled with government support for the poultry industry, further contributes to this expansion. Key trends include increasing demand for processed poultry products, a growing preference for value-added and convenient food options, and a rising focus on food safety and traceability. While challenges exist, such as fluctuations in feed prices and potential outbreaks of avian influenza, the overall market outlook remains positive. The competitive landscape is characterized by a mix of large, established players like Yasar Holding AS (Pinar) and Siniora Food Industries, and smaller regional producers. These companies are actively investing in technological advancements and expanding their product portfolios to cater to evolving consumer preferences. The market segmentation likely includes broiler, layer, and turkey segments, with further subdivisions based on product type (whole birds, cuts, processed meats) and distribution channels (retail, food service). The forecast period (2025-2033) anticipates a continued expansion, with the CAGR of 5.96% suggesting a significant market opportunity for both domestic and international players. Further analysis of regional data (currently unavailable) would provide more granular insights into market dynamics within Turkey.

The strong growth trajectory is expected to continue throughout the forecast period, driven by several factors. These include government initiatives promoting agricultural development, increasing urbanization leading to higher demand for convenient protein sources, and a burgeoning export market as Turkey seeks to establish itself as a major player in the global poultry trade. However, potential challenges such as climate change impacting feed production and the need to continuously improve biosecurity measures to prevent disease outbreaks, will influence the market’s growth trajectory. Understanding consumer preferences toward organic and free-range poultry will also be crucial for companies to maintain a competitive edge. Market research focusing on consumer behavior and dietary trends will provide a more nuanced understanding of the opportunities and challenges that lie ahead.

This detailed report provides a comprehensive analysis of the Turkey poultry market, covering market size, segmentation, key players, industry trends, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is essential for industry stakeholders, investors, and market researchers seeking actionable insights into this dynamic market.

Turkey Poultry Market Market Concentration & Innovation

This section analyzes the competitive landscape of the Turkish poultry market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities. The market is moderately concentrated, with several major players holding significant market share. However, the presence of numerous smaller players creates a dynamic and competitive environment.

Market Concentration: While precise market share figures for each company are unavailable, Yasar Holding AS (Pinar), Siniora Food Industries, and Proyem Inc (Keskinoglu) are considered among the leading players. The combined market share of the top five players is estimated to be around xx%.

Innovation Drivers: Innovation in the Turkish poultry sector is driven by increasing consumer demand for high-quality, value-added products, rising health consciousness leading to demand for healthier poultry options, and the adoption of advanced technologies in poultry farming and processing.

Regulatory Framework: Turkish government regulations concerning animal welfare, food safety, and environmental standards significantly influence the market. These regulations are constantly evolving, presenting both challenges and opportunities for businesses.

Product Substitutes: Competition exists from alternative protein sources, such as red meat, fish, and plant-based alternatives. However, poultry remains a relatively affordable and widely consumed protein source in Turkey.

End-User Trends: Growing urban populations and changing dietary habits are driving demand for processed and convenience poultry products. Consumers are also increasingly aware of the nutritional benefits and health implications of their food choices.

M&A Activities: Recent M&A activities, such as the Matlı Companies Group's acquisition of Keskinoglu in April 2023, showcase the ongoing consolidation within the industry. These deals highlight strategic moves to increase market share, optimize operations, and enhance product offerings. The total value of M&A deals in the observed period is estimated to be around xx Million.

Turkey Poultry Market Industry Trends & Insights

This section delves into the key trends shaping the Turkish poultry market, including market growth drivers, technological advancements, evolving consumer preferences, and competitive dynamics. The Turkish poultry market exhibits a significant growth trajectory, driven by several factors.

Turkey's poultry market is characterized by a Compound Annual Growth Rate (CAGR) of approximately xx% during the historical period (2019-2024), with projections indicating continued growth during the forecast period (2025-2033). This growth is primarily fueled by rising consumer demand, supported by increasing disposable incomes and a growing population. Technological advancements, such as automated feeding systems and improved breeding techniques, enhance efficiency and productivity within the sector. Consumer preferences are shifting towards healthier and more convenient poultry products, creating opportunities for value-added products and innovative processing techniques. The competitive landscape is characterized by both intense rivalry among established players and the emergence of new entrants, driving innovation and pricing pressures. Market penetration of processed poultry products continues to increase, reflecting changing lifestyles and consumer demand.

Dominant Markets & Segments in Turkey Poultry Market

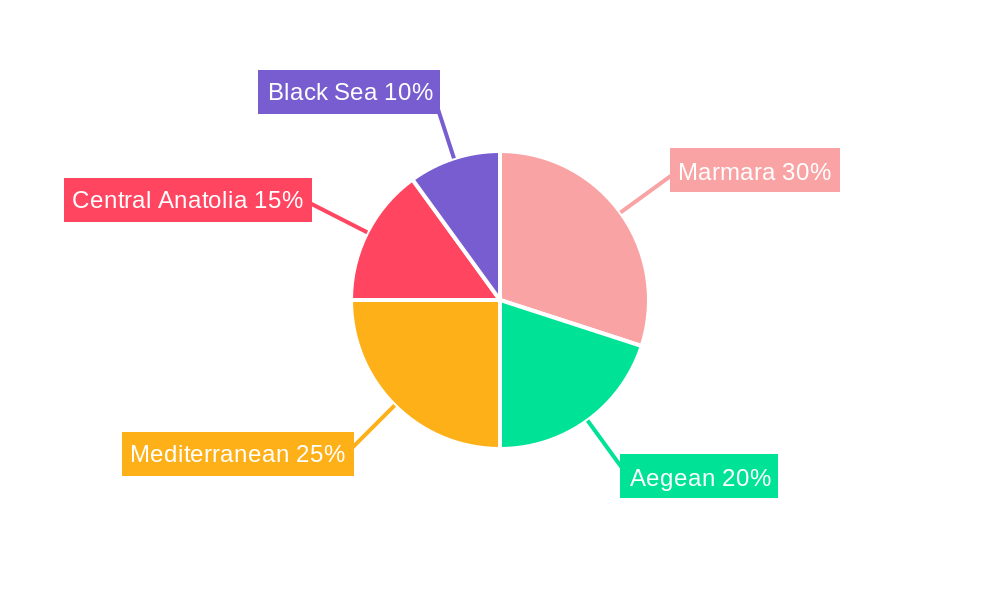

This section identifies the leading regions, countries, or segments within the Turkey poultry market. While detailed regional breakdown is beyond the scope of this overview, the overall market is geographically diverse, with significant consumption across various regions of the country. Demand is particularly high in densely populated urban areas.

- Key Drivers of Market Dominance:

- Strong domestic consumption driven by population growth and rising disposable incomes.

- Government support for agricultural development, including poultry farming.

- Favorable climatic conditions suitable for poultry production.

- Efficient supply chains and distribution networks.

- Relatively lower prices compared to other protein sources.

The analysis indicates that the dominant segment within the market is the fresh poultry segment, followed by processed poultry products. The dominance of fresh poultry is attributed to traditional consumption habits and affordability, although the processed segment is showing robust growth.

Turkey Poultry Market Product Developments

Recent years have witnessed a surge in product innovation within the Turkish poultry market. Companies are focusing on developing value-added products, such as ready-to-cook meals, marinated poultry, and organic poultry options, to cater to evolving consumer preferences. Technological advancements in processing and packaging are enhancing product quality, shelf life, and convenience. These innovations are aimed at improving market fit and achieving a competitive edge.

Report Scope & Segmentation Analysis

This report segments the Turkey poultry market based on product type (fresh, processed), distribution channel (retail, food service), and region. Each segment's growth projections, market sizes, and competitive dynamics are analyzed. The fresh poultry segment is expected to maintain a significant market share, while the processed segment is projected to experience faster growth, driven by changing consumer preferences and urbanization. The retail channel currently dominates the distribution landscape but the food service sector is expected to show robust growth.

Key Drivers of Turkey Poultry Market Growth

Several factors contribute to the growth of the Turkey poultry market. These include rising disposable incomes driving higher consumer spending on protein sources, population growth leading to increased demand, and favorable government policies supporting the agricultural sector. Technological advancements in poultry farming and processing enhance efficiency and productivity.

Challenges in the Turkey Poultry Market Sector

The Turkish poultry market faces certain challenges including fluctuations in feed prices impacting production costs, competition from imports and alternative protein sources, and maintaining consistent product quality and food safety standards across the industry. These factors can potentially impact profitability and market stability. Regulatory changes and environmental concerns also pose challenges.

Emerging Opportunities in Turkey Poultry Market

Opportunities exist in value-added poultry products, such as organic poultry and ready-to-eat meals, catering to evolving consumer preferences. The growth of e-commerce and online food delivery platforms presents opportunities for improved market reach and distribution. Investing in sustainable and efficient farming practices can also lead to improved profitability and environmental sustainability.

Leading Players in the Turkey Poultry Market Market

- Yasar Holding AS (Pinar)

- Siniora Food Industries

- Proyem Inc (Keskinoglu)

- BRF SA

- Senpilic Gida Sanayi

- Erpilic

- Beypi Beypazari Tarimsal Üretim Pazarlama Sanayi Ve Ticaret AŞ

- Abalioglu Yem Soya Ve Tekstil Sanayi AS

- Charoen Pokphand Foods PCL

- Bupilic Entegre AS

- Kula Yag ve Emek Yem San Tic Inc

- Akdeniz Toros

Key Developments in Turkey Poultry Market Industry

- October 2022: Abalioglu Lezita Gida invested approximately TRY 1.35 Billion to expand its white meat production capacity, establishing a new 200,000 sq.m facility in Kahramanmaraş. This significantly boosted the company's production capabilities and market share.

- April 2023: Matlı Companies Group acquired Keskinoglu, consolidating its position as a leading player in the Turkish poultry market. This merger created synergies, leading to optimized resource utilization and enhanced market competitiveness.

- July 2023: Şenpiliç integrated Yemsel Tavukçuluk AŞ, strengthening its operational efficiency and value chain. This strategic move facilitated better coordination in contract cutting services within the Samsun region, boosting their regional footprint.

Strategic Outlook for Turkey Poultry Market Market

The Turkey poultry market is poised for continued growth, driven by favorable demographic trends, rising disposable incomes, and evolving consumer preferences. Strategic investments in value-added products, technological advancements, and sustainable farming practices will be crucial for companies seeking to capitalize on emerging opportunities and remain competitive in this dynamic market. The focus on processed foods and convenient options will further boost this growth.

Turkey Poultry Market Segmentation

-

1. Product Type

- 1.1. Table Eggs

- 1.2. Broiler Meat

-

1.3. Processed Meat

- 1.3.1. Nuggets

- 1.3.2. Sausages

- 1.3.3. Burgers

- 1.3.4. Marinated Poultry Products

- 1.3.5. Other Processed Meat Products

-

2. Distribution Channel

- 2.1. Hotels

- 2.2. Restaurants

- 2.3. Catering

- 2.4. Modern Trade (Supermarkets/Hypermarkets)

- 2.5. Other Distribution Channels

Turkey Poultry Market Segmentation By Geography

- 1. Turkey

Turkey Poultry Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.96% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Enhanced Consumption of Chicken Meat and Eggs Fueling Market Demand; Rising Penetration of Hotels and Fast-food Restaurants Augmenting Market Demand

- 3.3. Market Restrains

- 3.3.1. Enhanced Consumption of Chicken Meat and Eggs Fueling Market Demand; Rising Penetration of Hotels and Fast-food Restaurants Augmenting Market Demand

- 3.4. Market Trends

- 3.4.1. Rising Demand for Broiler Meat Fueling the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Turkey Poultry Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Table Eggs

- 5.1.2. Broiler Meat

- 5.1.3. Processed Meat

- 5.1.3.1. Nuggets

- 5.1.3.2. Sausages

- 5.1.3.3. Burgers

- 5.1.3.4. Marinated Poultry Products

- 5.1.3.5. Other Processed Meat Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hotels

- 5.2.2. Restaurants

- 5.2.3. Catering

- 5.2.4. Modern Trade (Supermarkets/Hypermarkets)

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Turkey

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Yasar Holding AS (Pinar)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Siniora Food Industries

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Proyem Inc (Keskinoglu)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BRF SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Senpilic Gida Sanayi

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Erpilic

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Beypi Beypazari Tarimsal Üretim Pazarlama Sanayi Ve Ticaret AŞ

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Abalioglu Yem Soya Ve Tekstil Sanayi AS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Charoen Pokphand Foods PCL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bupilic Entegre AS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Kula Yag ve Emek Yem San Tic Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Akdeniz Toros*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Yasar Holding AS (Pinar)

List of Figures

- Figure 1: Turkey Poultry Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Turkey Poultry Market Share (%) by Company 2024

List of Tables

- Table 1: Turkey Poultry Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Turkey Poultry Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Turkey Poultry Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Turkey Poultry Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 5: Turkey Poultry Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Turkey Poultry Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 7: Turkey Poultry Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Turkey Poultry Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Turkey Poultry Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 10: Turkey Poultry Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 11: Turkey Poultry Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: Turkey Poultry Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 13: Turkey Poultry Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Turkey Poultry Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turkey Poultry Market?

The projected CAGR is approximately 5.96%.

2. Which companies are prominent players in the Turkey Poultry Market?

Key companies in the market include Yasar Holding AS (Pinar), Siniora Food Industries, Proyem Inc (Keskinoglu), BRF SA, Senpilic Gida Sanayi, Erpilic, Beypi Beypazari Tarimsal Üretim Pazarlama Sanayi Ve Ticaret AŞ, Abalioglu Yem Soya Ve Tekstil Sanayi AS, Charoen Pokphand Foods PCL, Bupilic Entegre AS, Kula Yag ve Emek Yem San Tic Inc, Akdeniz Toros*List Not Exhaustive.

3. What are the main segments of the Turkey Poultry Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Enhanced Consumption of Chicken Meat and Eggs Fueling Market Demand; Rising Penetration of Hotels and Fast-food Restaurants Augmenting Market Demand.

6. What are the notable trends driving market growth?

Rising Demand for Broiler Meat Fueling the Market.

7. Are there any restraints impacting market growth?

Enhanced Consumption of Chicken Meat and Eggs Fueling Market Demand; Rising Penetration of Hotels and Fast-food Restaurants Augmenting Market Demand.

8. Can you provide examples of recent developments in the market?

July 2023: As a part of the company's vision of strategically growing and developing smart integration methods, Şenpiliç added to its investments and incorporated Yemsel Tavukçuluk AŞ, with which it has been cooperating on contract cutting services in the Samsun region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turkey Poultry Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turkey Poultry Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turkey Poultry Market?

To stay informed about further developments, trends, and reports in the Turkey Poultry Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence