Key Insights

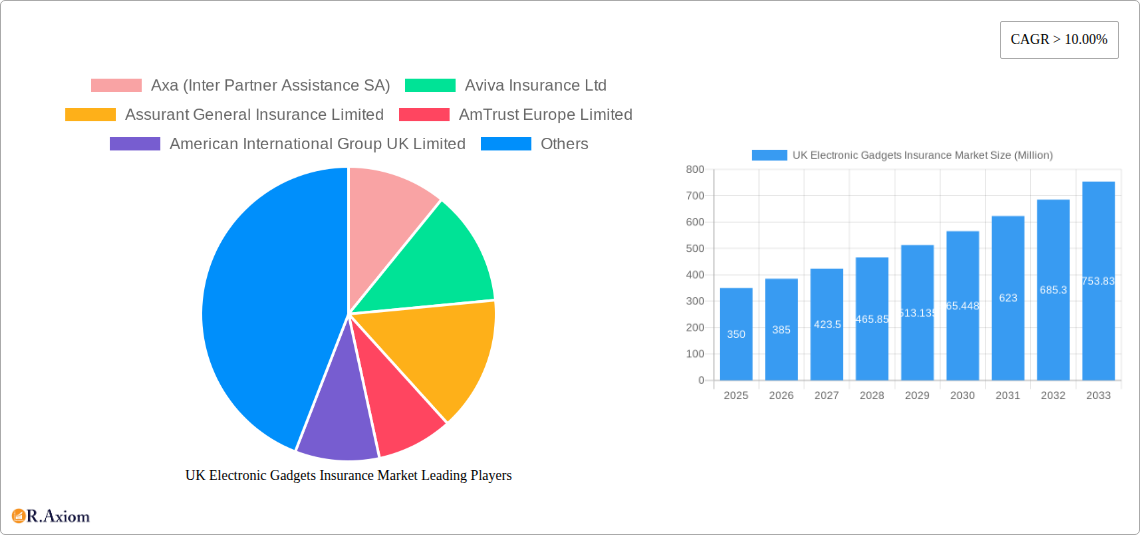

The UK electronic gadgets insurance market is projected for substantial growth, propelled by increased smartphone adoption, rising device replacement costs, and heightened consumer awareness of potential gadget damage or loss. The market demonstrates a robust Compound Annual Growth Rate (CAGR) of 9.2%, signaling a significant and expanding opportunity. This expansion is further driven by evolving consumer lifestyles, increasing dependence on technology, and the introduction of specialized insurance solutions like extended warranties and accidental damage protection. Leading providers such as AXA, Aviva, and Assurant are actively engaging in market competition through varied product portfolios, multi-channel distribution, and enhanced customer services. Market segmentation encompasses diverse coverage tiers, device categories (smartphones, tablets, laptops, wearables), and consumer profiles. With a projected market size of 74.13 billion by 2025, building upon a base year of 2025, the market is poised for considerable expansion.

UK Electronic Gadgets Insurance Market Market Size (In Billion)

Key growth drivers include technological advancements, shifts in consumer purchasing habits, and the overall economic climate. The proliferation of e-commerce and online insurance platforms further bolsters market opportunities. Potential market limitations encompass economic volatility affecting consumer expenditure and the inherent difficulty in risk assessment within a rapidly changing technological environment. Regulatory frameworks within the insurance sector may also influence market dynamics. Enhancing consumer understanding and transparency in insurance policies remains a key area for development, which can be addressed through targeted educational initiatives and simplified plan designs. Despite these challenges, the market outlook remains highly positive, presenting ample scope for continued expansion and innovation.

UK Electronic Gadgets Insurance Market Company Market Share

UK Electronic Gadgets Insurance Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the UK Electronic Gadgets Insurance Market, covering market size, segmentation, key players, growth drivers, challenges, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for industry stakeholders, investors, and businesses operating in or planning to enter this dynamic market. The report incorporates data from 2019-2024 as the historical period and projects the market from 2025-2033.

Key Highlights:

- Market Size & Growth: Discover the current market value (in Millions) and projected growth trajectory for the UK Electronic Gadgets Insurance Market from 2025 to 2033, including the Compound Annual Growth Rate (CAGR). (Specific values will be provided in the full report.)

- Detailed Segmentation: Analyze the market across key segments, including device type (smartphones, tablets, laptops, wearables, etc.), insurance coverage type ( accidental damage, theft, breakdown, etc.), and customer demographics.

- Competitive Landscape: Gain insights into the competitive landscape, including market share analysis of key players like Axa (Inter Partner Assistance SA), Aviva Insurance Ltd, Assurant General Insurance Limited, AmTrust Europe Limited, American International Group UK Limited, Better Buy Insurance, Acumen Insurance Services Ltd, Pier Insurance Managed Services Limited, EE Insurance, and ROCK Insurance Services Limited (list not exhaustive). The report will evaluate their strategies, market positioning, and competitive advantages.

- Growth Drivers & Challenges: Understand the key factors driving market growth (e.g., rising smartphone penetration, increasing consumer awareness, technological advancements) and the significant challenges hindering market expansion (e.g., competitive pricing, regulatory changes, claims processing complexities).

- Future Outlook: Explore the future opportunities and growth potential for the UK Electronic Gadgets Insurance Market, including projections for key segments, technologies, and market trends.

UK Electronic Gadgets Insurance Market Market Concentration & Innovation

The UK electronic gadgets insurance market exhibits a moderately concentrated landscape, with several large multinational insurers dominating alongside several niche players. Market share data will be provided in the full report, quantifying the dominance of leading players like Assurant and Aviva. The market is characterized by ongoing innovation, driven by:

- Technological advancements: Development of new insurance products incorporating features like AI-powered claims processing and usage-based pricing models. The introduction of blockchain technology (as demonstrated by AXA's 2019 trial) presents opportunities for improving efficiency and transparency in claims management.

- Regulatory frameworks: The UK’s regulatory environment, overseen by the Financial Conduct Authority (FCA), influences product design and compliance requirements. Changes in regulations can either stimulate or impede innovation within the market.

- Product substitutes: Alternative protection schemes, such as extended warranties offered by manufacturers, compete with insurance products, impacting market concentration and pricing strategies.

- End-user trends: Growing consumer awareness of electronic device fragility and data security are driving demand for more comprehensive insurance packages. The rising trend of purchasing refurbished devices (47% consideration, 9% adoption in 2022, per a leading business services organization) also presents opportunities for tailored insurance solutions.

- M&A activities: Consolidation through mergers and acquisitions (M&A) is a prominent feature in the market. The report will include a detailed analysis of past M&A activity, quantifying deal values where data is available.

UK Electronic Gadgets Insurance Market Industry Trends & Insights

The UK electronic gadgets insurance market is experiencing robust growth, driven by several key factors. The market is projected to witness a CAGR of xx% during the forecast period (2025-2033). Market penetration for insurance on electronic gadgets is currently at xx%, expected to increase to xx% by 2033.

Several technological disruptions are shaping the market:

- The rise of IoT: The increasing number of connected devices creates new insurance needs and opportunities for developing innovative products.

- AI and machine learning: These technologies are revolutionizing claims processing, fraud detection, and customer service within the insurance sector, driving operational efficiency and reducing costs.

- Big data analytics: Enhanced data analysis allows insurers to better understand consumer behaviour, risk profiles and pricing strategies.

Consumer preferences are shifting towards:

- Personalized insurance packages: Consumers are increasingly seeking tailored plans that address their specific device usage and risk profiles.

- Digital channels: The convenience of online purchasing and claims management is driving adoption of digital distribution channels.

Dominant Markets & Segments in UK Electronic Gadgets Insurance Market

While a detailed regional breakdown will be available in the full report, the UK market itself represents a dominant segment. The high penetration of smartphones, tablets, and laptops coupled with a relatively high level of consumer affluence contribute significantly to demand.

Key drivers for dominance within the UK market:

- High Smartphone Penetration: The UK has high smartphone ownership, creating a large pool of potential customers for gadget insurance.

- Tech-Savvy Population: The UK population's familiarity with technology and online services makes adoption of digital insurance solutions smoother.

- Robust E-commerce Infrastructure: A strong online retail sector supports efficient distribution of insurance products.

- Favorable Regulatory Environment: A relatively stable and well-defined regulatory environment for insurance companies fosters growth and investment.

UK Electronic Gadgets Insurance Market Product Developments

The market is witnessing a rapid pace of innovation in product offerings. Insurers are introducing more comprehensive plans that cover various risks, such as accidental damage, theft, liquid damage, and even data loss. Assurant's new Device Care Centre, with its focus on repair and extending device lifespan, highlights the trend towards proactive maintenance and value-added services within insurance packages. These developments enhance customer loyalty and competitiveness by improving the customer experience.

Report Scope & Segmentation Analysis

This report segments the UK Electronic Gadgets Insurance Market based on several key factors. Detailed segment-specific market sizes and growth projections will be provided in the full report.

Device Type Segmentation: This segment analyzes the market across various device types including Smartphones, Tablets, Laptops, Wearables, and Smart Home Devices, highlighting growth rates and competitive dynamics.

Coverage Type Segmentation: The report differentiates between various coverage options including accidental damage, theft, liquid damage, breakdown, and data loss.

Customer Demographics: Segmentation will analyze purchasing patterns across different age groups, income levels, and geographic locations to provide detailed insights.

Key Drivers of UK Electronic Gadgets Insurance Market Growth

The growth of the UK electronic gadgets insurance market is spurred by several factors, including:

- Increasing Smartphone Penetration: The continued rise in smartphone ownership fuels demand for insurance.

- Rising Affluence: Higher disposable incomes allow consumers to allocate budgets for insurance premiums.

- Technological Advancements: Innovations in device functionality increase the value of devices and the need for comprehensive insurance.

- Growing Awareness: Improved understanding of insurance benefits among consumers and rising awareness regarding data security risks drives sales.

Challenges in the UK Electronic Gadgets Insurance Market Sector

The market faces challenges that impact growth:

- High Claims Frequency: The high prevalence of accidental damage and theft related to electronic devices pushes up claims costs for insurers.

- Intense Competition: The market is characterized by a high level of competition from both established insurers and new market entrants.

- Fraudulent Claims: Fraudulent claims present a significant problem, affecting the profitability of insurance companies.

- Regulatory Compliance: Adherence to the FCA’s regulatory guidelines is complex and essential, requiring significant operational costs.

Emerging Opportunities in UK Electronic Gadgets Insurance Market

Several opportunities are emerging:

- Expansion into New Device Categories: Insurers are identifying opportunities to expand coverage into emerging categories like smart home devices, IoT gadgets and wearable technology.

- Bundled Insurance Packages: There is potential for growth in bundling insurance with other services, such as device repair or extended warranties.

- Personalized Insurance Solutions: Tailoring insurance policies to specific user behaviors and risk profiles can be attractive to customers and improve profitability.

Leading Players in the UK Electronic Gadgets Insurance Market Market

- Axa (Inter Partner Assistance SA)

- Aviva Insurance Ltd

- Assurant General Insurance Limited

- AmTrust Europe Limited

- American International Group UK Limited

- Better Buy Insurance

- Acumen Insurance Services Ltd

- Pier Insurance Managed Services Limited

- EE Insurance

- ROCK Insurance Services Limited

Key Developments in UK Electronic Gadgets Insurance Market Industry

- 2022: 47% of UK customers considered buying a reconditioned item, and 9% had already done so (source: large worldwide business services organization). This trend presents opportunities for insurance providers to offer specialized coverage for refurbished devices.

- Ongoing: Assurant launches its new Device Care Centre, showcasing investment in repair technology and enhancing device longevity—a key factor in the market.

- 2019: AXA Partners tests a blockchain-based solution for streamlining payment protection, demonstrating the potential of innovative technologies to transform the industry.

Strategic Outlook for UK Electronic Gadgets Insurance Market Market

The UK electronic gadgets insurance market presents significant growth opportunities. Continued technological advancements, increasing consumer demand for device protection, and the potential for tailored insurance solutions will drive future expansion. Strategic partnerships, data-driven insights, and investment in innovation will be critical for success in this competitive landscape. Insurers who can effectively adapt to evolving consumer preferences, manage risk effectively, and leverage new technologies will be well-positioned for growth.

UK Electronic Gadgets Insurance Market Segmentation

-

1. Coverage Type

- 1.1. Accidental Damage

- 1.2. Theft and Loss

-

2. Device Type

- 2.1. Laptops

- 2.2. Computers

- 2.3. Cameras

- 2.4. Mobile Devices

- 2.5. Drones

-

3. End Users

- 3.1. Corporate

- 3.2. Individual

UK Electronic Gadgets Insurance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Electronic Gadgets Insurance Market Regional Market Share

Geographic Coverage of UK Electronic Gadgets Insurance Market

UK Electronic Gadgets Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Demand for Various Gadgets is Booming

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Electronic Gadgets Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Coverage Type

- 5.1.1. Accidental Damage

- 5.1.2. Theft and Loss

- 5.2. Market Analysis, Insights and Forecast - by Device Type

- 5.2.1. Laptops

- 5.2.2. Computers

- 5.2.3. Cameras

- 5.2.4. Mobile Devices

- 5.2.5. Drones

- 5.3. Market Analysis, Insights and Forecast - by End Users

- 5.3.1. Corporate

- 5.3.2. Individual

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Coverage Type

- 6. North America UK Electronic Gadgets Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Coverage Type

- 6.1.1. Accidental Damage

- 6.1.2. Theft and Loss

- 6.2. Market Analysis, Insights and Forecast - by Device Type

- 6.2.1. Laptops

- 6.2.2. Computers

- 6.2.3. Cameras

- 6.2.4. Mobile Devices

- 6.2.5. Drones

- 6.3. Market Analysis, Insights and Forecast - by End Users

- 6.3.1. Corporate

- 6.3.2. Individual

- 6.1. Market Analysis, Insights and Forecast - by Coverage Type

- 7. South America UK Electronic Gadgets Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Coverage Type

- 7.1.1. Accidental Damage

- 7.1.2. Theft and Loss

- 7.2. Market Analysis, Insights and Forecast - by Device Type

- 7.2.1. Laptops

- 7.2.2. Computers

- 7.2.3. Cameras

- 7.2.4. Mobile Devices

- 7.2.5. Drones

- 7.3. Market Analysis, Insights and Forecast - by End Users

- 7.3.1. Corporate

- 7.3.2. Individual

- 7.1. Market Analysis, Insights and Forecast - by Coverage Type

- 8. Europe UK Electronic Gadgets Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Coverage Type

- 8.1.1. Accidental Damage

- 8.1.2. Theft and Loss

- 8.2. Market Analysis, Insights and Forecast - by Device Type

- 8.2.1. Laptops

- 8.2.2. Computers

- 8.2.3. Cameras

- 8.2.4. Mobile Devices

- 8.2.5. Drones

- 8.3. Market Analysis, Insights and Forecast - by End Users

- 8.3.1. Corporate

- 8.3.2. Individual

- 8.1. Market Analysis, Insights and Forecast - by Coverage Type

- 9. Middle East & Africa UK Electronic Gadgets Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Coverage Type

- 9.1.1. Accidental Damage

- 9.1.2. Theft and Loss

- 9.2. Market Analysis, Insights and Forecast - by Device Type

- 9.2.1. Laptops

- 9.2.2. Computers

- 9.2.3. Cameras

- 9.2.4. Mobile Devices

- 9.2.5. Drones

- 9.3. Market Analysis, Insights and Forecast - by End Users

- 9.3.1. Corporate

- 9.3.2. Individual

- 9.1. Market Analysis, Insights and Forecast - by Coverage Type

- 10. Asia Pacific UK Electronic Gadgets Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Coverage Type

- 10.1.1. Accidental Damage

- 10.1.2. Theft and Loss

- 10.2. Market Analysis, Insights and Forecast - by Device Type

- 10.2.1. Laptops

- 10.2.2. Computers

- 10.2.3. Cameras

- 10.2.4. Mobile Devices

- 10.2.5. Drones

- 10.3. Market Analysis, Insights and Forecast - by End Users

- 10.3.1. Corporate

- 10.3.2. Individual

- 10.1. Market Analysis, Insights and Forecast - by Coverage Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Axa (Inter Partner Assistance SA)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Aviva Insurance Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Assurant General Insurance Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AmTrust Europe Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 American International Group UK Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Better Buy Insurance

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Acumen Insurance Services Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pier Insurance Managed Services Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 EE Insurance

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ROCK Insurance Services Limited**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Axa (Inter Partner Assistance SA)

List of Figures

- Figure 1: Global UK Electronic Gadgets Insurance Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UK Electronic Gadgets Insurance Market Revenue (billion), by Coverage Type 2025 & 2033

- Figure 3: North America UK Electronic Gadgets Insurance Market Revenue Share (%), by Coverage Type 2025 & 2033

- Figure 4: North America UK Electronic Gadgets Insurance Market Revenue (billion), by Device Type 2025 & 2033

- Figure 5: North America UK Electronic Gadgets Insurance Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 6: North America UK Electronic Gadgets Insurance Market Revenue (billion), by End Users 2025 & 2033

- Figure 7: North America UK Electronic Gadgets Insurance Market Revenue Share (%), by End Users 2025 & 2033

- Figure 8: North America UK Electronic Gadgets Insurance Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America UK Electronic Gadgets Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America UK Electronic Gadgets Insurance Market Revenue (billion), by Coverage Type 2025 & 2033

- Figure 11: South America UK Electronic Gadgets Insurance Market Revenue Share (%), by Coverage Type 2025 & 2033

- Figure 12: South America UK Electronic Gadgets Insurance Market Revenue (billion), by Device Type 2025 & 2033

- Figure 13: South America UK Electronic Gadgets Insurance Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 14: South America UK Electronic Gadgets Insurance Market Revenue (billion), by End Users 2025 & 2033

- Figure 15: South America UK Electronic Gadgets Insurance Market Revenue Share (%), by End Users 2025 & 2033

- Figure 16: South America UK Electronic Gadgets Insurance Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America UK Electronic Gadgets Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe UK Electronic Gadgets Insurance Market Revenue (billion), by Coverage Type 2025 & 2033

- Figure 19: Europe UK Electronic Gadgets Insurance Market Revenue Share (%), by Coverage Type 2025 & 2033

- Figure 20: Europe UK Electronic Gadgets Insurance Market Revenue (billion), by Device Type 2025 & 2033

- Figure 21: Europe UK Electronic Gadgets Insurance Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 22: Europe UK Electronic Gadgets Insurance Market Revenue (billion), by End Users 2025 & 2033

- Figure 23: Europe UK Electronic Gadgets Insurance Market Revenue Share (%), by End Users 2025 & 2033

- Figure 24: Europe UK Electronic Gadgets Insurance Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe UK Electronic Gadgets Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa UK Electronic Gadgets Insurance Market Revenue (billion), by Coverage Type 2025 & 2033

- Figure 27: Middle East & Africa UK Electronic Gadgets Insurance Market Revenue Share (%), by Coverage Type 2025 & 2033

- Figure 28: Middle East & Africa UK Electronic Gadgets Insurance Market Revenue (billion), by Device Type 2025 & 2033

- Figure 29: Middle East & Africa UK Electronic Gadgets Insurance Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 30: Middle East & Africa UK Electronic Gadgets Insurance Market Revenue (billion), by End Users 2025 & 2033

- Figure 31: Middle East & Africa UK Electronic Gadgets Insurance Market Revenue Share (%), by End Users 2025 & 2033

- Figure 32: Middle East & Africa UK Electronic Gadgets Insurance Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa UK Electronic Gadgets Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific UK Electronic Gadgets Insurance Market Revenue (billion), by Coverage Type 2025 & 2033

- Figure 35: Asia Pacific UK Electronic Gadgets Insurance Market Revenue Share (%), by Coverage Type 2025 & 2033

- Figure 36: Asia Pacific UK Electronic Gadgets Insurance Market Revenue (billion), by Device Type 2025 & 2033

- Figure 37: Asia Pacific UK Electronic Gadgets Insurance Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 38: Asia Pacific UK Electronic Gadgets Insurance Market Revenue (billion), by End Users 2025 & 2033

- Figure 39: Asia Pacific UK Electronic Gadgets Insurance Market Revenue Share (%), by End Users 2025 & 2033

- Figure 40: Asia Pacific UK Electronic Gadgets Insurance Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific UK Electronic Gadgets Insurance Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Electronic Gadgets Insurance Market Revenue billion Forecast, by Coverage Type 2020 & 2033

- Table 2: Global UK Electronic Gadgets Insurance Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 3: Global UK Electronic Gadgets Insurance Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 4: Global UK Electronic Gadgets Insurance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global UK Electronic Gadgets Insurance Market Revenue billion Forecast, by Coverage Type 2020 & 2033

- Table 6: Global UK Electronic Gadgets Insurance Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 7: Global UK Electronic Gadgets Insurance Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 8: Global UK Electronic Gadgets Insurance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global UK Electronic Gadgets Insurance Market Revenue billion Forecast, by Coverage Type 2020 & 2033

- Table 13: Global UK Electronic Gadgets Insurance Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 14: Global UK Electronic Gadgets Insurance Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 15: Global UK Electronic Gadgets Insurance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global UK Electronic Gadgets Insurance Market Revenue billion Forecast, by Coverage Type 2020 & 2033

- Table 20: Global UK Electronic Gadgets Insurance Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 21: Global UK Electronic Gadgets Insurance Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 22: Global UK Electronic Gadgets Insurance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global UK Electronic Gadgets Insurance Market Revenue billion Forecast, by Coverage Type 2020 & 2033

- Table 33: Global UK Electronic Gadgets Insurance Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 34: Global UK Electronic Gadgets Insurance Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 35: Global UK Electronic Gadgets Insurance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global UK Electronic Gadgets Insurance Market Revenue billion Forecast, by Coverage Type 2020 & 2033

- Table 43: Global UK Electronic Gadgets Insurance Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 44: Global UK Electronic Gadgets Insurance Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 45: Global UK Electronic Gadgets Insurance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific UK Electronic Gadgets Insurance Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Electronic Gadgets Insurance Market?

The projected CAGR is approximately 9.2%.

2. Which companies are prominent players in the UK Electronic Gadgets Insurance Market?

Key companies in the market include Axa (Inter Partner Assistance SA), Aviva Insurance Ltd, Assurant General Insurance Limited, AmTrust Europe Limited, American International Group UK Limited, Better Buy Insurance, Acumen Insurance Services Ltd, Pier Insurance Managed Services Limited, EE Insurance, ROCK Insurance Services Limited**List Not Exhaustive.

3. What are the main segments of the UK Electronic Gadgets Insurance Market?

The market segments include Coverage Type, Device Type, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 74.13 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Demand for Various Gadgets is Booming.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In 2022, 47 % of UK customers would consider buying a reconditioned item, and 9% have already done so, according to a large worldwide business services organization that supports, protects, and connects big consumer purchases. Assurant has unveiled its new Device Care Centre, which offers state-of-the-art repair techniques and technology to guarantee that mobile devices live as long as possible and sell well secondhand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Electronic Gadgets Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Electronic Gadgets Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Electronic Gadgets Insurance Market?

To stay informed about further developments, trends, and reports in the UK Electronic Gadgets Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence