Key Insights

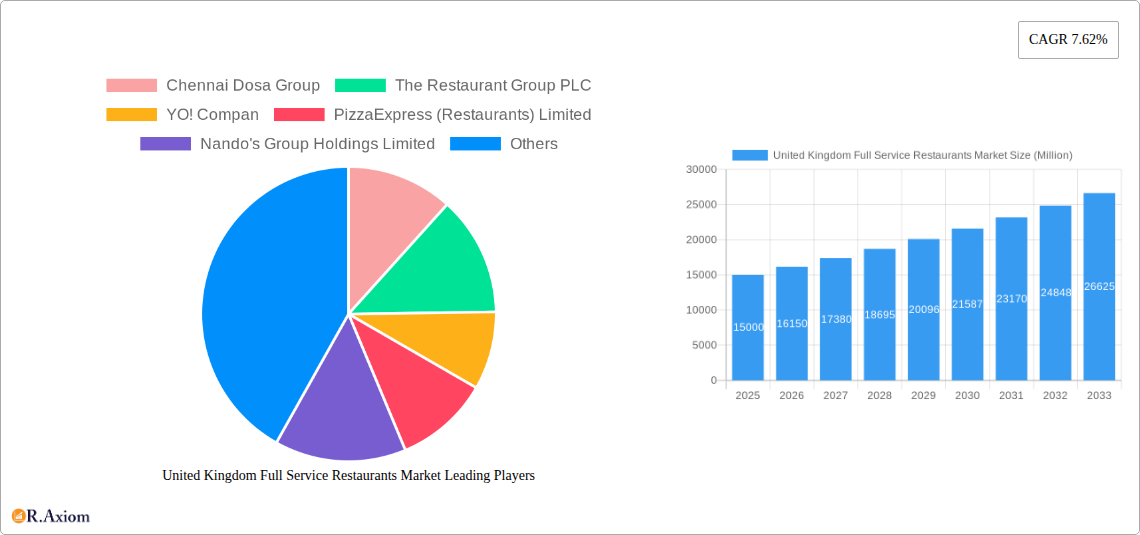

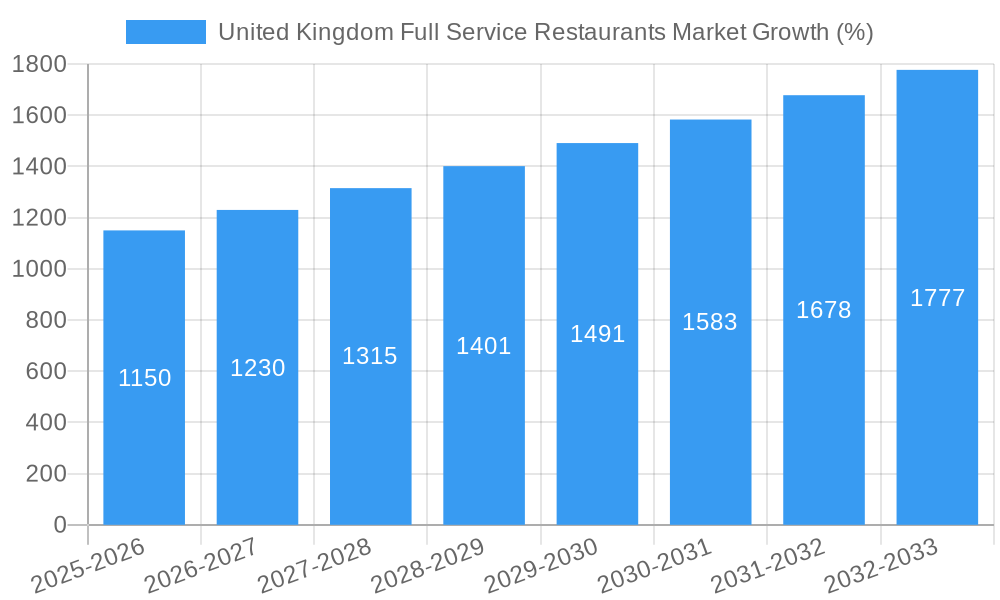

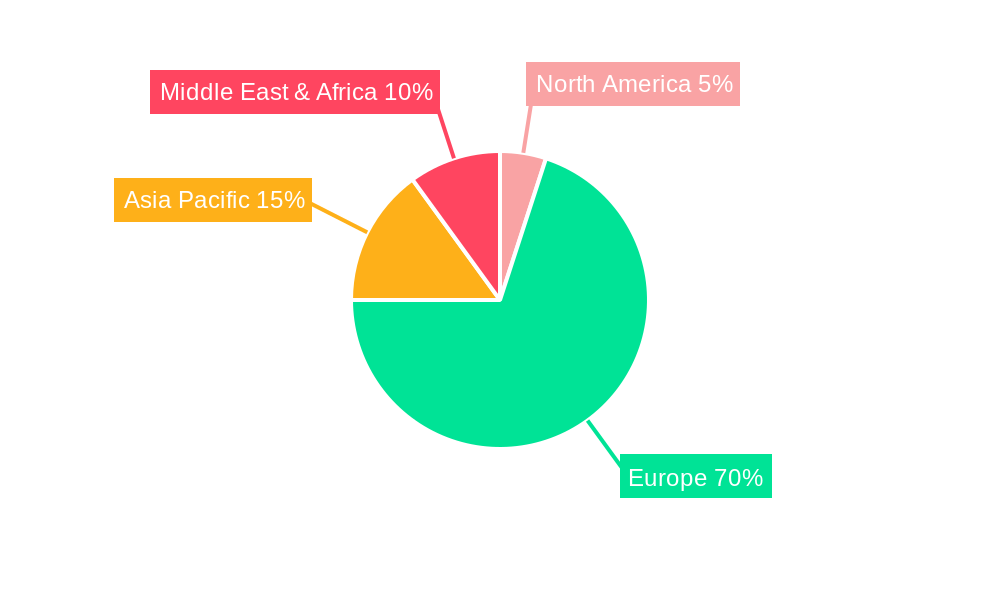

The United Kingdom Full Service Restaurant (FSR) market, exhibiting a robust CAGR of 7.62%, presents a compelling investment landscape. Driven by evolving consumer preferences towards diverse culinary experiences and the increasing popularity of casual dining, the market is segmented across various cuisines (Asian, European, Latin American, Middle Eastern, North American, and others), outlet types (chained and independent), and locations (leisure, lodging, retail, standalone, and travel). The presence of established players like PizzaExpress, Nando's, and Mitchells & Butlers, alongside emerging independent restaurants, indicates a dynamic competitive environment. While the market enjoys significant growth, potential restraints include fluctuating food costs, labor shortages, and economic uncertainty. However, innovative menu offerings, technology adoption for enhanced customer experience (e.g., online ordering and delivery), and strategic partnerships are mitigating these challenges. The market's strong performance is further fueled by the UK's vibrant tourism sector and a growing middle class with increased disposable income. Growth is expected to be particularly strong in the chained outlet segment, leveraging economies of scale and branding power, while independent outlets contribute significantly to culinary diversity and innovation. Geographic variations in market size are anticipated, with London and other major cities potentially exhibiting higher growth rates compared to rural areas.

Further analysis reveals that the UK FSR market is experiencing a shift towards experiential dining. Consumers are increasingly seeking unique dining experiences beyond simply satisfying hunger. This trend is driving innovation in restaurant concepts, menu offerings, and ambiance. The rising popularity of fusion cuisine and personalized dining options further exemplifies this shift. While the established players continue to maintain market share, the emergence of smaller, niche restaurants focusing on specific dietary needs or culinary traditions adds dynamism and competition. The impact of external factors like Brexit and global economic conditions requires ongoing monitoring; however, the overall outlook for the UK FSR market remains positive, with consistent growth projected throughout the forecast period (2025-2033). The market’s ability to adapt to changing consumer preferences and address operational challenges will be key to sustaining its growth trajectory.

United Kingdom Full Service Restaurants Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the United Kingdom's full-service restaurant (FSR) market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. It segments the market by cuisine type (Asian, European, Latin American, Middle Eastern, North American, Other FSR Cuisines), outlet type (Chained Outlets, Independent Outlets), and location (Leisure, Lodging, Retail, Standalone, Travel). Key players analyzed include Chennai Dosa Group, The Restaurant Group PLC, YO! Compan, PizzaExpress (Restaurants) Limited, Nando's Group Holdings Limited, The Big Table Group Limited, TGI Fridays Franchisor LLC, Mitchells & Butlers PLC, Prezzo Holdings Limited, The Azzuri Group, and Pizza Hut (U K ) Limited. The report utilizes data from 2019-2024 as its historical period, with 2025 serving as both the base year and estimated year.

United Kingdom Full Service Restaurants Market Market Concentration & Innovation

The UK FSR market exhibits a moderate level of concentration, with a few large chains dominating alongside numerous independent restaurants. Market share data reveals that the top five players account for approximately xx% of the market in 2025, indicating room for both expansion and competition. Innovation is driven by evolving consumer preferences, technological advancements, and a focus on enhancing the customer experience. Regulatory frameworks, including food safety regulations and minimum wage legislation, significantly impact market dynamics. Product substitutes, such as meal delivery services and home-cooked meals, exert competitive pressure. Mergers and acquisitions (M&A) activities play a vital role in shaping market consolidation, with deal values fluctuating depending on market conditions. Recent M&A activity has been characterized by a focus on strategic expansion and diversification, with deal values in 2024 reaching an estimated £xx Million.

- Market Concentration: Top 5 players hold approximately xx% market share in 2025.

- Innovation Drivers: Consumer preferences, technological advancements, enhanced customer experience.

- Regulatory Framework: Food safety, minimum wage legislation.

- M&A Activity: Strategic expansion and diversification driving deal activity; 2024 deal value estimated at £xx Million.

United Kingdom Full Service Restaurants Market Industry Trends & Insights

The UK FSR market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, driven primarily by rising disposable incomes, increasing urbanization, and changing consumer lifestyles. Technological disruptions, such as online ordering and delivery platforms, are transforming the industry, impacting both business models and customer expectations. Consumer preferences are shifting towards healthier options, personalized experiences, and sustainable practices. Intense competition among established players and emerging concepts is shaping the market landscape. Market penetration of online ordering is estimated at xx% in 2025 and is projected to grow to xx% by 2033. The increasing popularity of quick-service restaurants presents a challenge to full-service establishments.

Dominant Markets & Segments in United Kingdom Full Service Restaurants Market

The European cuisine segment dominates the UK FSR market, accounting for approximately xx% of the total revenue in 2025. Key drivers for this dominance include established culinary traditions and consumer familiarity. Chained outlets represent a larger share of the market compared to independent outlets due to their economies of scale and branding. Standalone locations are the most prevalent outlet type, although growth is observed in leisure and retail locations.

- Cuisine: European cuisine dominates due to established traditions and familiarity (xx% of market revenue in 2025).

- Outlet Type: Chained outlets hold a larger market share due to economies of scale.

- Location: Standalone locations are most common; growth seen in leisure and retail segments.

United Kingdom Full Service Restaurants Market Product Developments

Recent product innovations have focused on enhancing the customer experience through technology integration, personalized menu options, and unique dining concepts. The introduction of innovative ingredients, globally-inspired cuisines, and personalized meal customization cater to evolving consumer preferences. These advancements aim to increase customer loyalty and attract new customers in a competitive market.

Report Scope & Segmentation Analysis

This report segments the UK FSR market across various parameters:

Cuisine: Asian, European, Latin American, Middle Eastern, North American, Other FSR Cuisines. Each cuisine segment demonstrates unique growth trajectories, influenced by evolving consumer tastes and cultural influences. Market size and competitive dynamics vary significantly across segments.

Outlet: Chained Outlets and Independent Outlets. The chained segment is characterized by established brands and economies of scale, while the independent segment showcases variety and unique offerings. Growth projections differ due to differing competitive pressures and operating models.

Location: Leisure, Lodging, Retail, Standalone, Travel. Each location offers unique market opportunities based on customer demographics and consumption patterns. The market size and competitive landscape varies across location types.

Key Drivers of United Kingdom Full Service Restaurants Market Growth

Several factors are propelling the growth of the UK FSR market: rising disposable incomes allowing consumers to spend more on dining out; the increasing popularity of social dining experiences; expansion of delivery services; and the trend towards healthier, more sustainable food options. Technological advancements are facilitating operational efficiencies and enhancing the customer experience. Favorable government policies supporting the hospitality sector also contribute to market expansion.

Challenges in the United Kingdom Full Service Restaurants Market Sector

The UK FSR market faces several challenges including rising operating costs, including food and labor expenses; intense competition from both established and emerging players; fluctuating consumer confidence impacting spending patterns; and supply chain disruptions affecting the availability of ingredients. These factors can impact profitability and market share for businesses operating in this sector. Further challenges include stringent regulatory compliance and labor shortages.

Emerging Opportunities in United Kingdom Full Service Restaurants Market

Emerging opportunities include the growing demand for experiential dining, personalized menu options, and customized food experiences. The increasing adoption of technology for online ordering, table reservations, and personalized recommendations presents significant opportunities for businesses. There is also a growing interest in sustainable and ethically sourced ingredients, offering opportunities for businesses that prioritize these values.

Leading Players in the United Kingdom Full Service Restaurants Market Market

- Chennai Dosa Group

- The Restaurant Group PLC

- YO! Compan

- PizzaExpress (Restaurants) Limited

- Nando's Group Holdings Limited

- The Big Table Group Limited

- TGI Fridays Franchisor LLC

- Mitchells & Butlers PLC

- Prezzo Holdings Limited

- The Azzuri Group

- Pizza Hut (U K ) Limited

Key Developments in United Kingdom Full Service Restaurants Market Industry

- October 2022: Pizza Hut launched "Melts," a new product category, impacting product innovation and consumer preferences.

- November 2022: Just Eat and Uber Eats partnered with PizzaExpress, expanding delivery options and catering to increased demand.

- February 2023: The Big Table Group implemented PolyAI's customer service assistant, improving customer service and operational efficiency.

Strategic Outlook for United Kingdom Full Service Restaurants Market Market

The UK FSR market presents significant growth potential, driven by evolving consumer preferences, technological advancements, and strategic initiatives by market players. Businesses that focus on innovation, operational efficiency, and a strong customer experience are well-positioned to capitalize on these opportunities. The market's future growth will depend on the ability of companies to adapt to evolving consumer demands and navigate the challenges facing the industry.

United Kingdom Full Service Restaurants Market Segmentation

-

1. Cuisine

- 1.1. Asian

- 1.2. European

- 1.3. Latin American

- 1.4. Middle Eastern

- 1.5. North American

- 1.6. Other FSR Cuisines

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

United Kingdom Full Service Restaurants Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Full Service Restaurants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.62% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Application and Benefits of Collagen Across End-User Industry; Implementation of Business Strategies by Market Players

- 3.3. Market Restrains

- 3.3.1. Intolerance of Vegetarian/Vegan Population Towards Animal Sourced Protein

- 3.4. Market Trends

- 3.4.1 A significant rise in tourist arrivals is driving substantial growth in the market

- 3.4.2 and new trends in dining contributing the market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 5.1.1. Asian

- 5.1.2. European

- 5.1.3. Latin American

- 5.1.4. Middle Eastern

- 5.1.5. North American

- 5.1.6. Other FSR Cuisines

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 6. North America United Kingdom Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 6.1.3 Mexico

- 7. South America United Kingdom Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 Brazil

- 7.1.2 Argentina

- 7.1.3 Rest of South America

- 8. Europe United Kingdom Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 Germany

- 8.1.2 France

- 8.1.3 Italy

- 8.1.4 United Kingdom

- 8.1.5 Netherlands

- 8.1.6 Rest of Europe

- 9. Asia Pacific United Kingdom Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 China

- 9.1.2 Japan

- 9.1.3 India

- 9.1.4 South Korea

- 9.1.5 Taiwan

- 9.1.6 Australia

- 9.1.7 Rest of Asia-Pacific

- 10. Middle East & Africa United Kingdom Full Service Restaurants Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 UAE

- 10.1.2 South Africa

- 10.1.3 Saudi Arabia

- 10.1.4 Rest of MEA

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Chennai Dosa Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Restaurant Group PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 YO! Compan

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PizzaExpress (Restaurants) Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nando's Group Holdings Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Big Table Group Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TGI Fridays Franchisor LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mitchells & Butlers PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Prezzo Holdings Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Azzuri Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Pizza Hut (U K ) Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Chennai Dosa Group

List of Figures

- Figure 1: United Kingdom Full Service Restaurants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Full Service Restaurants Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 3: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Location 2019 & 2032

- Table 5: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Brazil United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Argentina United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of South America United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Germany United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Netherlands United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: China United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Japan United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: India United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Korea United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Taiwan United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Australia United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Asia-Pacific United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: UAE United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: South Africa United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Saudi Arabia United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of MEA United Kingdom Full Service Restaurants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 35: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 36: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Location 2019 & 2032

- Table 37: United Kingdom Full Service Restaurants Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Full Service Restaurants Market?

The projected CAGR is approximately 7.62%.

2. Which companies are prominent players in the United Kingdom Full Service Restaurants Market?

Key companies in the market include Chennai Dosa Group, The Restaurant Group PLC, YO! Compan, PizzaExpress (Restaurants) Limited, Nando's Group Holdings Limited, The Big Table Group Limited, TGI Fridays Franchisor LLC, Mitchells & Butlers PLC, Prezzo Holdings Limited, The Azzuri Group, Pizza Hut (U K ) Limited.

3. What are the main segments of the United Kingdom Full Service Restaurants Market?

The market segments include Cuisine, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Application and Benefits of Collagen Across End-User Industry; Implementation of Business Strategies by Market Players.

6. What are the notable trends driving market growth?

A significant rise in tourist arrivals is driving substantial growth in the market. and new trends in dining contributing the market growth.

7. Are there any restraints impacting market growth?

Intolerance of Vegetarian/Vegan Population Towards Animal Sourced Protein.

8. Can you provide examples of recent developments in the market?

February 2023: The Big Table Group announced that it would use PolyAI's customer-led conversational assistant to enhance customer service and foster its expansion. The Big Table Group added that it had accomplished its goal of answering 100% of customer calls at its Bella Italia and Café Rouge restaurants owing to PolyAI.November 2022: Just Eat and Uber Eats collaborated with PizzaExpress. To address the increased demand for delivery before the first-ever Winter World Cup, expected to be a popular time for American Hots and Peronis to be delivered straight to consumers' doors, PizzaExpress engaged in these new collaborations.October 2022: Pizza Hut introduced "Melts," a new product category with a wide range of offerings, including Pizza Hut MeltsTM. Pizza Hut MeltsTM are cheesy, crunchy, stuffed with toppings, and served with a perfectly matched dip.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Full Service Restaurants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Full Service Restaurants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Full Service Restaurants Market?

To stay informed about further developments, trends, and reports in the United Kingdom Full Service Restaurants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence