Key Insights

The United States cafes and bars market exhibits robust growth, driven by evolving consumer preferences and a surge in demand for diverse culinary experiences. The market's expansion is fueled by several key factors. Firstly, the increasing popularity of specialty coffee and tea, coupled with the rise of artisanal food and beverage offerings, is attracting a wider customer base. Secondly, the trend towards experiential dining, where cafes and bars become social hubs offering more than just food and drinks, is further stimulating growth. The incorporation of innovative technologies, such as mobile ordering and loyalty programs, contributes to enhanced customer engagement and repeat business. Finally, strategic partnerships and franchise models are enabling established brands to expand their reach and capture significant market share. However, challenges remain. Rising inflation and increased input costs can impact profit margins, and competition from other food service segments is intensifying. Furthermore, maintaining consistent quality and service standards across diverse locations, especially within franchise models, is crucial for long-term success.

Within this dynamic landscape, the segment breakdown reveals valuable insights. While chained outlets benefit from brand recognition and economies of scale, independent outlets offer unique concepts and personalized services that resonate with specific customer segments. Similarly, location plays a significant role. Cafes and bars thriving in leisure, lodging, and retail spaces leverage high foot traffic, while standalone locations often rely on strong brand loyalty and targeted marketing efforts. The diverse culinary offerings, including bars & pubs, cafes, juice/smoothie/dessert bars, and specialty coffee & tea shops, cater to a wide range of tastes and preferences, ensuring that the market continues to evolve and adapt to meet evolving consumer needs. Successful players are those that can successfully navigate the interplay of these factors, adapting their offerings to meet the ever-changing demands of a dynamic marketplace.

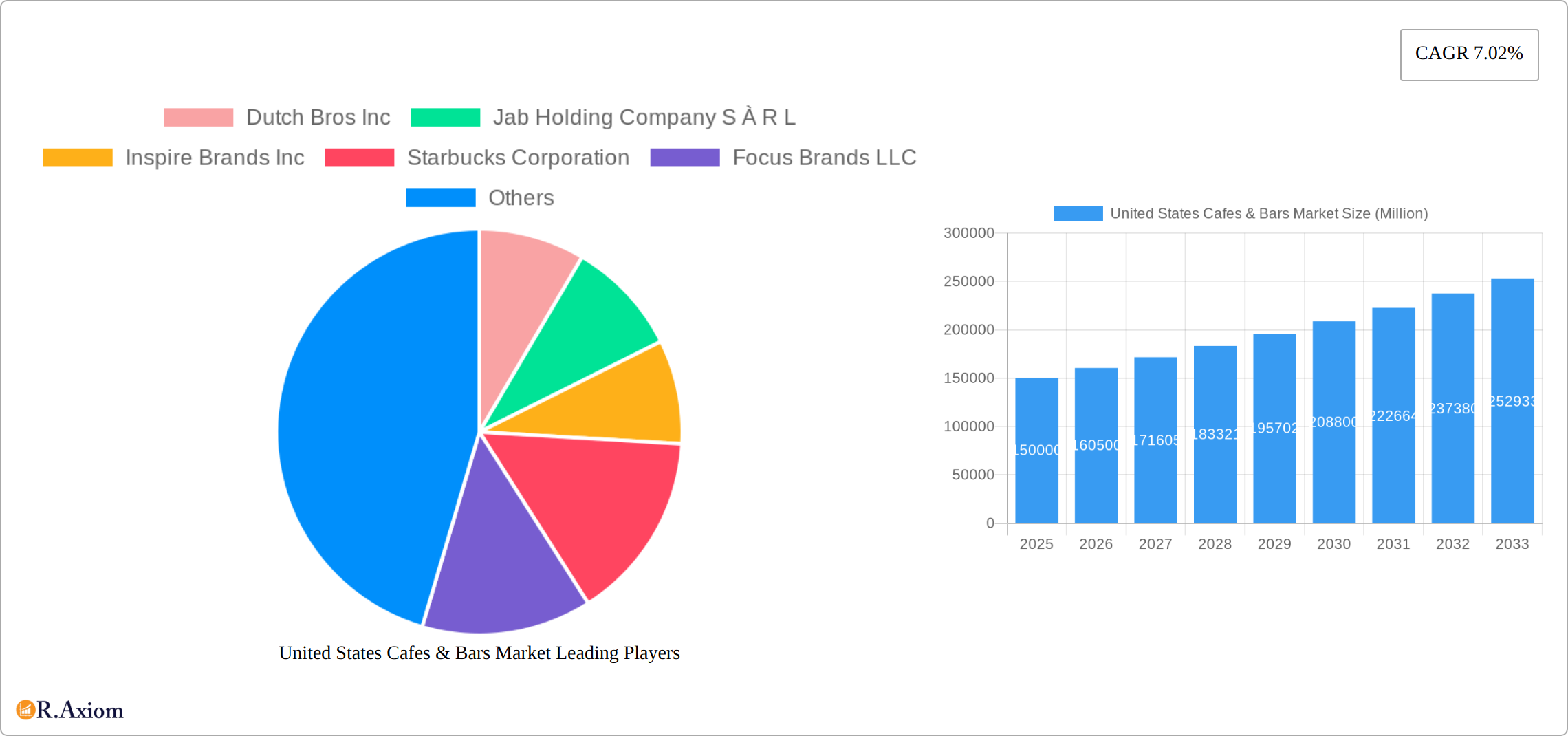

This comprehensive report provides an in-depth analysis of the United States Cafes & Bars Market, covering the period 2019-2033. It offers invaluable insights into market dynamics, competitive landscapes, and future growth potential, equipping stakeholders with actionable intelligence for strategic decision-making. The report leverages rigorous research methodologies and incorporates extensive data to provide a holistic view of this dynamic industry. The Base Year is 2025, and the Estimated Year is 2025, with a Forecast Period spanning 2025-2033 and a Historical Period encompassing 2019-2024.

United States Cafes & Bars Market Market Concentration & Innovation

The US cafes and bars market presents a moderately concentrated landscape dominated by a few major players wielding significant market influence over pricing and innovation. Key players like Starbucks Corporation, McDonald's Corporation, and Restaurant Brands International Inc. command substantial market share. However, a vibrant ecosystem of independent outlets and smaller chains also contributes significantly to overall market volume, creating a dynamic and diverse market structure. Preliminary 2024 market share estimates suggest Starbucks holds approximately xx%, McDonald's holds xx%, and Restaurant Brands International holds xx%, with the remaining share dispersed among various regional chains and independent establishments. This fragmentation creates both opportunities and challenges for market participants.

Continuous innovation is a critical driver of market growth, fueled by ongoing product diversification, the evolution of service models (such as mobile ordering, delivery, and loyalty programs), and the integration of advanced technologies. The market is also heavily influenced by regulatory frameworks governing food safety, licensing, and alcohol sales, all of which significantly impact operational costs and strategic decision-making. The competitive landscape is further shaped by the presence of product substitutes, including home-brewed coffee and various meal delivery services, which present ongoing competitive threats. Furthermore, evolving end-user trends reveal a growing preference for healthier options, sustainable practices, and personalized, immersive customer experiences. Mergers and acquisitions (M&A) activity remains moderately active, with deals primarily focused on expanding geographic reach or acquiring brands with specialized offerings or unique expertise. Recent M&A transactions, while often not publicly disclosing exact figures, have averaged approximately xx million dollars. Examples include:

- Strategic acquisitions: Large corporations utilize strategic acquisitions to bolster their product portfolios and extend their market footprint into new regions and customer segments.

- Consolidation: The trend of smaller chains being acquired by larger corporations continues, leading to increased market share consolidation and a reduction in the number of independent players.

United States Cafes & Bars Market Industry Trends & Insights

The US cafes and bars market is experiencing robust growth, driven by several factors. The rising disposable income, increasing urbanization, and the expanding preference for out-of-home dining experiences are major contributors. The market exhibited a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as online ordering platforms, mobile payment systems, and loyalty programs, are boosting efficiency and customer engagement. However, increasing competition, fluctuating raw material prices, and labor costs pose challenges. Consumer preferences lean toward premiumization, healthy options, and unique experiences, pushing businesses to innovate their offerings and service strategies. Market penetration of delivery and mobile ordering services is currently at approximately xx%, while the penetration of loyalty programs is around xx%. Competitive dynamics are intense, necessitating robust marketing, brand building, and customer retention strategies.

Dominant Markets & Segments in United States Cafes & Bars Market

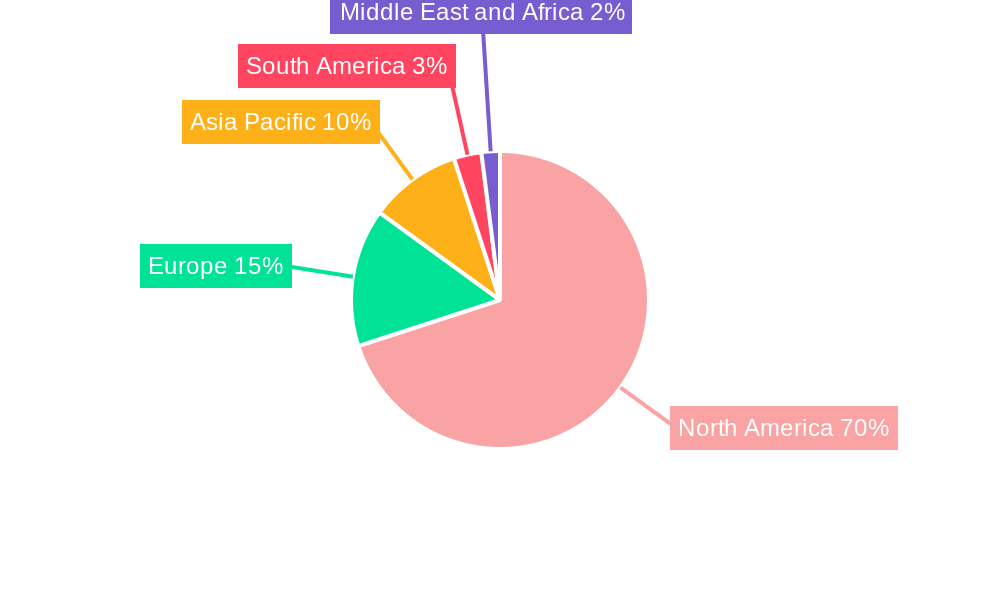

The US cafes and bars market is geographically diverse, with significant variations in consumption patterns and preferences across different regions. While precise regional dominance cannot be declared without more granular data, the following are observations:

- Cuisine: Cafes represent the largest segment, followed by Specialist Coffee & Tea Shops and Bars & Pubs. The growth of Juice/Smoothie/Desserts Bars is also notable.

- Outlet: Chained outlets dominate the market in terms of revenue, but independent outlets significantly contribute to overall volume.

- Location: Retail locations and standalone establishments represent the largest share of the market, driven by high foot traffic and accessibility. However, cafes and bars in leisure, lodging, and travel locations are experiencing substantial growth due to the increase in travel and tourism.

Key Drivers:

- Economic Growth: Rising disposable incomes fuel increased spending on leisure and dining out.

- Consumer Preferences: Demand for healthier options, customized experiences, and premium products drives innovation.

- Technological Advancements: Online ordering and mobile payment systems enhance convenience and customer engagement.

- Tourism: Increased travel and tourism boost demand, particularly in leisure and lodging locations.

United States Cafes & Bars Market Product Developments

Recent product developments focus on customization, health-conscious options, and premium offerings. This includes innovative beverage options like Dutch Bros' White Chocolate Lavender launch, sugar-free alternatives, and expanded menu offerings catering to diverse dietary needs. Technological advancements, such as improved coffee brewing equipment and automated ordering systems, are improving operational efficiency and enhancing the customer experience. These developments cater to evolving consumer preferences and provide a competitive advantage.

Report Scope & Segmentation Analysis

This report segments the US cafes and bars market across several key dimensions, including Cuisine (Bars & Pubs, Cafes, Juice/Smoothie/Desserts Bars, Specialist Coffee & Tea Shops), Outlet Type (Chained Outlets, Independent Outlets), and Location (Leisure, Lodging, Retail, Standalone, Travel). The report provides detailed growth projections and market size estimates for each segment, accompanied by a thorough analysis of the competitive dynamics within each. For instance, the Cafe segment is projected to experience a CAGR of xx%, driven by consistent consumer demand for coffee and pastries. While chained outlets generally dominate in terms of revenue generation, independent outlets offer unique and personalized experiences, fostering a diverse and dynamic market structure. Retail locations benefit from high foot traffic and accessibility, while leisure and travel locations exhibit considerable growth potential, driven by tourism and increased consumer spending in these sectors.

Key Drivers of United States Cafes & Bars Market Growth

Several factors are driving market growth, including:

- Rising disposable incomes: Increased spending power enables greater consumption of cafe and bar services.

- Changing lifestyles: Busy schedules and a preference for convenience are fueling demand for quick-service and takeaway options.

- Technological advancements: Online ordering, delivery platforms, and mobile payments enhance accessibility and convenience.

- Health and wellness trends: Growing consumer awareness of health and wellness is driving demand for healthier options.

Challenges in the United States Cafes & Bars Market Sector

The US cafes and bars market faces several challenges:

- Intense competition: The market is highly competitive, with numerous established players and new entrants.

- Fluctuating raw material prices: Increases in coffee bean, dairy, and other ingredient costs impact profitability.

- Labor shortages: Finding and retaining qualified employees poses a significant challenge.

- Regulatory compliance: Meeting food safety and alcohol licensing regulations requires significant investment.

Emerging Opportunities in United States Cafes & Bars Market

Several key emerging opportunities are shaping the future of the US cafes and bars market:

- Expansion into underserved markets: Significant untapped potential remains in various underserved regions and demographic groups, presenting opportunities for expansion and market penetration.

- Technological innovation: The adoption of advanced technologies offers significant opportunities for enhancing operational efficiency, fostering deeper customer engagement, and delivering increasingly personalized experiences tailored to individual preferences.

- Sustainability initiatives: Embracing eco-friendly practices and sustainable operations resonates strongly with the growing base of environmentally conscious consumers, providing a competitive advantage.

- Growth of niche segments: The continued growth of niche segments, such as juice bars, specialty coffee shops, and experiential cafes, caters to the diverse and evolving preferences of specific consumer groups.

- Enhanced Customer Loyalty Programs: Developing robust loyalty programs can significantly improve customer retention and drive repeat business.

- Strategic Partnerships: Collaborating with complementary businesses can open up new avenues for growth and reach wider audiences.

Leading Players in the United States Cafes & Bars Market Market

- Dutch Bros Inc

- Jab Holding Company S À R L

- Inspire Brands Inc

- Starbucks Corporation

- Focus Brands LLC

- Restaurant Brands International Inc

- McDonald's Corporation

- Smoothie King Franchises Inc

- Tropical Smoothie Cafe LL

- International Dairy Queen Inc

Key Developments in United States Cafes & Bars Market Industry

- December 2022: Dutch Bros expanded its product offerings with the launch of eight classic drinks featuring sugar-free options, directly addressing the increasing consumer demand for healthier choices.

- December 2022: Pret A Manger announced ambitious US expansion plans through a strategic franchise partnership, signaling increased competition and market dynamism.

- January 2023: Dutch Bros further broadened its portfolio with the introduction of White Chocolate Lavender across over 650 locations, driving sales growth and enhancing its brand appeal.

- [Add more recent key developments here, with specific dates and concise descriptions]

Strategic Outlook for United States Cafes & Bars Market Market

The US cafes and bars market is poised for continued growth, driven by evolving consumer preferences, technological advancements, and economic factors. Opportunities exist in expanding product offerings, enhancing customer experience through technology integration, and focusing on sustainability. Companies that effectively adapt to changing market dynamics and successfully innovate will be well-positioned for long-term success. The market is predicted to reach xx Million by 2033, demonstrating significant growth potential.

United States Cafes & Bars Market Segmentation

-

1. Cuisine

- 1.1. Bars & Pubs

- 1.2. Cafes

- 1.3. Juice/Smoothie/Desserts Bars

- 1.4. Specialist Coffee & Tea Shops

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

United States Cafes & Bars Market Segmentation By Geography

- 1. United States

United States Cafes & Bars Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

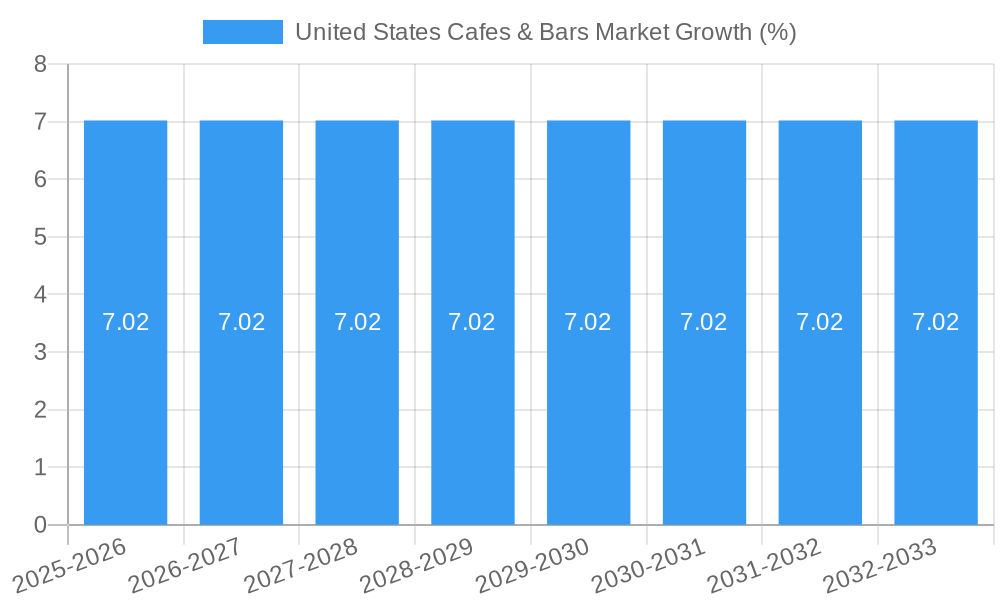

| Growth Rate | CAGR of 7.02% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Natural Food Colors

- 3.4. Market Trends

- 3.4.1. Rapid expansion of coffee chains and the increased popularity of gourmet coffee is boosting the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 5.1.1. Bars & Pubs

- 5.1.2. Cafes

- 5.1.3. Juice/Smoothie/Desserts Bars

- 5.1.4. Specialist Coffee & Tea Shops

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 6. North America United States Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 6.1.3 Mexico

- 6.1.4 Rest of North America

- 7. Europe United States Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 Spain

- 7.1.2 United Kingdom

- 7.1.3 Germany

- 7.1.4 France

- 7.1.5 Italy

- 7.1.6 Russia

- 7.1.7 Rest of Europe

- 8. Asia Pacific United States Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 China

- 8.1.2 Japan

- 8.1.3 India

- 8.1.4 Australia

- 8.1.5 Rest of Asia Pacific

- 9. South America United States Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 Brazil

- 9.1.2 Argentina

- 9.1.3 Rest of South America

- 10. Middle East and Africa United States Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 South Africa

- 10.1.2 Saudi Arabia

- 10.1.3 Rest of Middle East and Africa

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Dutch Bros Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jab Holding Company S À R L

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Inspire Brands Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Starbucks Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Focus Brands LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Restaurant Brands International Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 McDonald's Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Smoothie King Franchises Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tropical Smoothie Cafe LL

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 International Dairy Queen Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Dutch Bros Inc

List of Figures

- Figure 1: United States Cafes & Bars Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Cafes & Bars Market Share (%) by Company 2024

List of Tables

- Table 1: United States Cafes & Bars Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Cafes & Bars Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 3: United States Cafes & Bars Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: United States Cafes & Bars Market Revenue Million Forecast, by Location 2019 & 2032

- Table 5: United States Cafes & Bars Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United States Cafes & Bars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United States Cafes & Bars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Spain United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Germany United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: France United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Russia United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Europe United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: United States Cafes & Bars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Australia United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia Pacific United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: United States Cafes & Bars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Brazil United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Argentina United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of South America United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: United States Cafes & Bars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: South Africa United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Saudi Arabia United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Middle East and Africa United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: United States Cafes & Bars Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 34: United States Cafes & Bars Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 35: United States Cafes & Bars Market Revenue Million Forecast, by Location 2019 & 2032

- Table 36: United States Cafes & Bars Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Cafes & Bars Market?

The projected CAGR is approximately 7.02%.

2. Which companies are prominent players in the United States Cafes & Bars Market?

Key companies in the market include Dutch Bros Inc, Jab Holding Company S À R L, Inspire Brands Inc, Starbucks Corporation, Focus Brands LLC, Restaurant Brands International Inc, McDonald's Corporation, Smoothie King Franchises Inc, Tropical Smoothie Cafe LL, International Dairy Queen Inc.

3. What are the main segments of the United States Cafes & Bars Market?

The market segments include Cuisine, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products.

6. What are the notable trends driving market growth?

Rapid expansion of coffee chains and the increased popularity of gourmet coffee is boosting the market.

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Natural Food Colors.

8. Can you provide examples of recent developments in the market?

January 2023: Dutch Bros launched White Chocolate Lavender in over 650 locations, which can be ordered as a cold brew, breve, or Dutch Freeze.December 2022: Dutch Bros launched eight classic drinks with sugar-free options as well.December 2022: Pret A Manger announced its expansion plans in the United States through a franchise partnership with restaurant ownership and operations firm Dallas Holdings. The partnership will bring a network of new Pret locations to Southern California, as well as a location in New York City's Hudson Yards neighborhood.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Cafes & Bars Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Cafes & Bars Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Cafes & Bars Market?

To stay informed about further developments, trends, and reports in the United States Cafes & Bars Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence