Key Insights

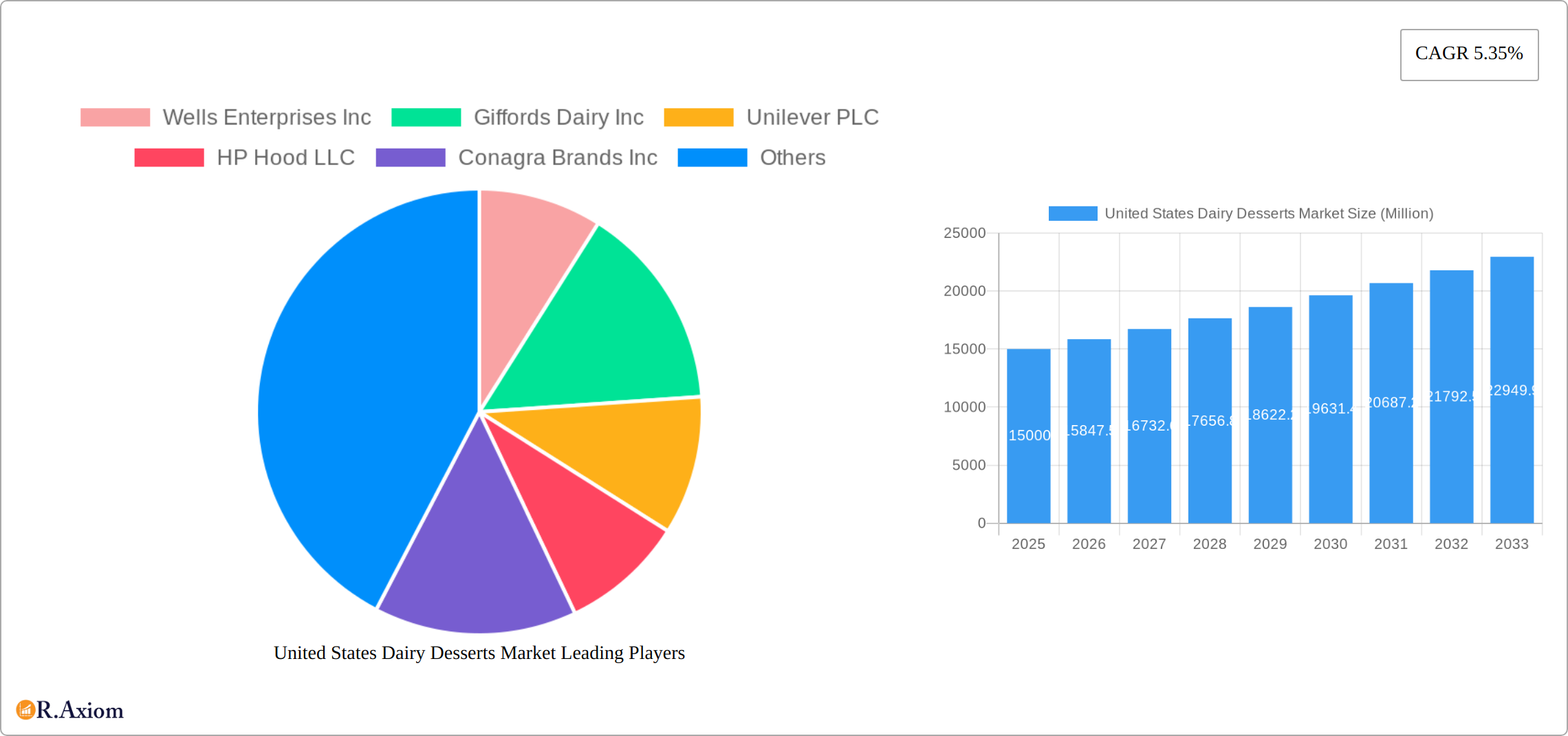

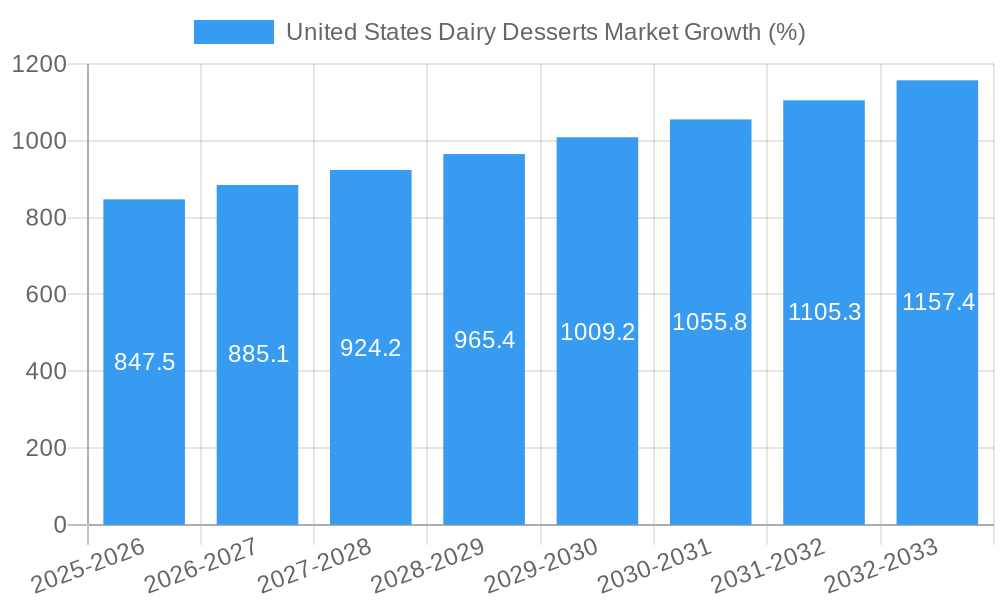

The United States dairy desserts market, valued at approximately $15 billion in 2025, is projected to experience steady growth, with a compound annual growth rate (CAGR) of 5.35% from 2025 to 2033. This expansion is driven by several key factors. The increasing consumer preference for convenient and indulgent treats fuels demand across various product types, particularly ice cream and frozen desserts. Health-conscious consumers are also influencing the market, leading to a rise in low-fat and organic options. Furthermore, the diversification of distribution channels, encompassing both off-trade (grocery stores, supermarkets) and on-trade (restaurants, cafes), broadens market reach and accessibility. Innovative product launches, featuring unique flavors and textures, further contribute to market dynamism. Major players like Wells Enterprises, Unilever, and Conagra Brands are actively involved in product development and strategic acquisitions to maintain their market share. The competitive landscape is characterized by both established giants and smaller niche players, constantly striving for innovation and market penetration.

However, certain challenges exist. Fluctuating dairy prices and increasing raw material costs can impact profitability. Growing concerns about sugar content and the prevalence of health-conscious alternatives pose a potential restraint on market growth. Successfully navigating these challenges necessitates a focus on product diversification, cost optimization, and effective marketing strategies that highlight the indulgent yet manageable aspects of dairy desserts. Companies are likely adapting by promoting portion control, highlighting natural ingredients, and developing healthier versions of classic desserts to appeal to a wider consumer base. The market's future is promising, contingent upon the industry's ability to innovate and adapt to the evolving preferences of health-conscious consumers while maintaining the appeal of indulgence.

United States Dairy Desserts Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the United States dairy desserts market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. Covering the period from 2019 to 2033, with a base year of 2025, this report delves into market size, segmentation, growth drivers, challenges, and emerging opportunities. The report incorporates data on key players, including Wells Enterprises Inc, Giffords Dairy Inc, Unilever PLC, HP Hood LLC, Conagra Brands Inc, Mondelez International Inc, Dairy Farmers of America Inc, Blue Bell Creameries LP, and Froneri International Limited, offering a holistic view of the competitive landscape. Expect detailed forecasts and actionable strategic recommendations to help you thrive in this evolving market. The projected market value in 2025 is estimated at xx Million.

United States Dairy Desserts Market Concentration & Innovation

This section analyzes the competitive landscape of the US dairy desserts market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities. The market is characterized by a mix of large multinational corporations and smaller regional players, leading to varying levels of market share concentration.

Market Concentration: The top five players collectively hold an estimated xx% market share in 2025, indicating a moderately concentrated market. Further analysis reveals significant regional variations in concentration.

Innovation Drivers: Consumer demand for healthier, premium, and innovative dairy desserts fuels product development, particularly in areas like organic, plant-based, and low-sugar options. Technological advancements in manufacturing and packaging also contribute to innovation.

Regulatory Framework: FDA regulations regarding labeling, ingredients, and safety standards significantly impact the market. Changing consumer awareness regarding health and nutrition drives the industry to adapt its offerings.

Product Substitutes: The market faces competition from non-dairy dessert alternatives, impacting the market share of traditional dairy-based products. These substitutes include plant-based ice creams and frozen desserts.

End-User Trends: Increasing demand for convenient, portable, and single-serving options is shaping product packaging and formats. Health-conscious consumers drive the growth of low-fat, low-sugar, and organic products.

M&A Activities: The recent USD 433 Million acquisition of Dean Foods properties by Dairy Farmers of America in October 2022 exemplifies significant M&A activity. This consolidation impacts market dynamics and competitive landscapes, influencing market concentration and product offerings.

United States Dairy Desserts Market Industry Trends & Insights

This section explores key market trends, including growth drivers, technological disruptions, consumer preferences, and competitive dynamics, providing a comprehensive overview of the industry's evolution.

The US dairy desserts market exhibits robust growth, driven by several factors. Rising disposable incomes and changing lifestyles contribute to increased consumption of convenient and indulgent treats. The market's CAGR during the forecast period (2025-2033) is projected at xx%. Technological advancements in manufacturing processes and packaging enhance efficiency and product quality. However, challenges persist, including increasing raw material costs and shifting consumer preferences towards healthier alternatives. Market penetration of organic and plant-based options is steadily increasing, signifying the importance of adapting to these evolving consumer demands. The competitive landscape is characterized by both intense price competition and the introduction of innovative products to attract discerning consumers.

Dominant Markets & Segments in United States Dairy Desserts Market

This section identifies the leading segments within the US dairy desserts market across different categories.

Product Type:

Ice Cream: Remains the dominant segment due to its widespread appeal and versatility. Growth is fueled by innovation in flavors, textures, and ingredients.

Frozen Desserts: This segment demonstrates significant growth, driven by increasing demand for low-fat and healthier options.

Cheesecakes: This niche segment shows consistent growth, driven by premiumization and the demand for sophisticated desserts.

Others: This category includes mousses and other specialized dairy desserts, each with its distinct growth trajectory.

Distribution Channel:

Off-Trade: This channel accounts for a significant portion of market sales through supermarkets, grocery stores, and convenience stores.

On-Trade: This includes sales through restaurants, cafes, and other foodservice establishments which shows steady growth, especially in premium and specialty dessert offerings.

Others (Warehouse clubs, gas stations, etc.): This segment showcases increasing penetration given the focus on larger packaging sizes and value-oriented offerings.

United States Dairy Desserts Market Product Developments

The United States dairy desserts market is a dynamic landscape characterized by continuous innovation and a keen focus on evolving consumer preferences. Recent product launches exemplify this trend. For instance, Blue Bell Creameries LP's introduction of Salted Caramel Brownie ice cream highlights a strategic move towards expanding product lines to cater to the increasing demand for premium and indulgent treats. Similarly, Blue Ribbon's launch of new, larger two-liter tubs featuring diverse flavor combinations directly addresses the consumer preference for family-sized options and value-oriented packaging. This proactive approach to product development reflects the industry's understanding of shifting consumer tastes and the necessity to maintain a competitive edge in a saturated market. Beyond these examples, we see a broader trend towards healthier options, including the use of organic ingredients and reduced sugar content in many new product lines.

Report Scope & Segmentation Analysis

This report offers a comprehensive analysis across various market segments, including product type (Ice Cream, Frozen Desserts, Cheesecakes, Mousses, Others), distribution channel (Off-Trade, On-Trade), and other channels (Warehouse clubs, gas stations, etc.). Each segment is analyzed individually, considering its growth projections, market size, and competitive dynamics. Specific details on market size and growth projections for each segment are available in the full report.

Key Drivers of United States Dairy Desserts Market Growth

The robust growth of the US dairy desserts market is propelled by a confluence of factors. Rising disposable incomes empower consumers to indulge in premium desserts more frequently. The parallel increase in demand for convenient and indulgent treats fuels the market's expansion, particularly within the ready-to-eat and single-serve segments. The expansion of retail channels, including online grocery platforms and specialized dessert shops, provides wider access to these products. Furthermore, technological advancements in production and packaging processes enhance efficiency, reduce costs, and improve overall product quality. The market also benefits from favorable government regulations and a supportive regulatory environment. Crucially, the industry’s responsiveness to health-conscious consumer preferences, through the development of healthier options, contributes significantly to sustained growth.

Challenges in the United States Dairy Desserts Market Sector

Despite its considerable growth, the US dairy desserts market faces significant hurdles. Volatility in raw material prices, particularly dairy products and sugar, presents a considerable challenge to profitability and long-term planning. Supply chain disruptions, exacerbated by global events, further complicate production and distribution. Intense competition, both from established industry giants and agile emerging brands, necessitates constant product innovation and aggressive marketing strategies to capture and retain market share. The increasing consumer focus on healthier alternatives necessitates adaptation and reformulation of existing products, requiring substantial investment in research and development. Moreover, evolving regulatory changes related to food safety, labeling, and ingredient sourcing demand continuous compliance and increase operational costs.

Emerging Opportunities in United States Dairy Desserts Market

Several emerging opportunities exist for growth within the US dairy desserts market. Increasing demand for organic, plant-based, and low-sugar options presents opportunities for companies to cater to health-conscious consumers. The expansion into niche markets, such as gourmet and artisanal desserts, offers higher profit margins. Moreover, leveraging online sales channels and focusing on convenient packaging formats can expand market reach and boost sales. Exploring new flavor profiles and product formats will also contribute to market growth and innovation.

Leading Players in the United States Dairy Desserts Market Market

- Wells Enterprises Inc

- Giffords Dairy Inc

- Unilever PLC

- HP Hood LLC

- Conagra Brands Inc

- Mondelez International Inc

- Dairy Farmers of America Inc

- Blue Bell Creameries LP

- Froneri International Limited

Key Developments in United States Dairy Desserts Market Industry

October 2022: Dairy Farmers of America's USD 433 million acquisition of Dean Foods properties resulted in a significant restructuring of the market. Kemps replaced Dean Foods throughout Iowa, assuming control of the Le Mars milk factory. This consolidation impacted the competitive landscape, production capabilities, and regional distribution networks.

October 2022: Blue Ribbon's strategic launch of three new two-liter tubs in its Street range, each featuring dual flavor combinations (chocolate affair, caramel hokey pokey, and velvety caramel), aimed to expand its presence in the family-sized dessert segment, catering to consumers seeking value and variety.

September 2022: Blue Bell Creameries LP's introduction of the Salted Caramel Brownie ice cream flavor exemplifies the market's focus on premium, indulgent offerings to meet evolving consumer preferences for sophisticated and decadent desserts.

Strategic Outlook for United States Dairy Desserts Market Market

The US dairy desserts market presents considerable future growth potential, fueled by ongoing innovation, evolving consumer preferences, and strategic mergers and acquisitions. Companies that successfully adapt to shifting health consciousness, embrace sustainable sourcing and packaging practices, and leverage data-driven digital marketing strategies will be best positioned for long-term success. Further growth is anticipated, particularly within premium, organic, and convenient product segments. The market's future trajectory hinges on the industry's agility in adapting to consumer demands for healthier, more sustainable, and more diverse dessert options.

United States Dairy Desserts Market Segmentation

-

1. Product Type

- 1.1. Cheesecakes

- 1.2. Frozen Desserts

- 1.3. Ice Cream

- 1.4. Mousses

- 1.5. Others

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Retail

- 2.1.3. Specialist Retailers

- 2.1.4. Supermarkets and Hypermarkets

- 2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 2.2. On-Trade

-

2.1. Off-Trade

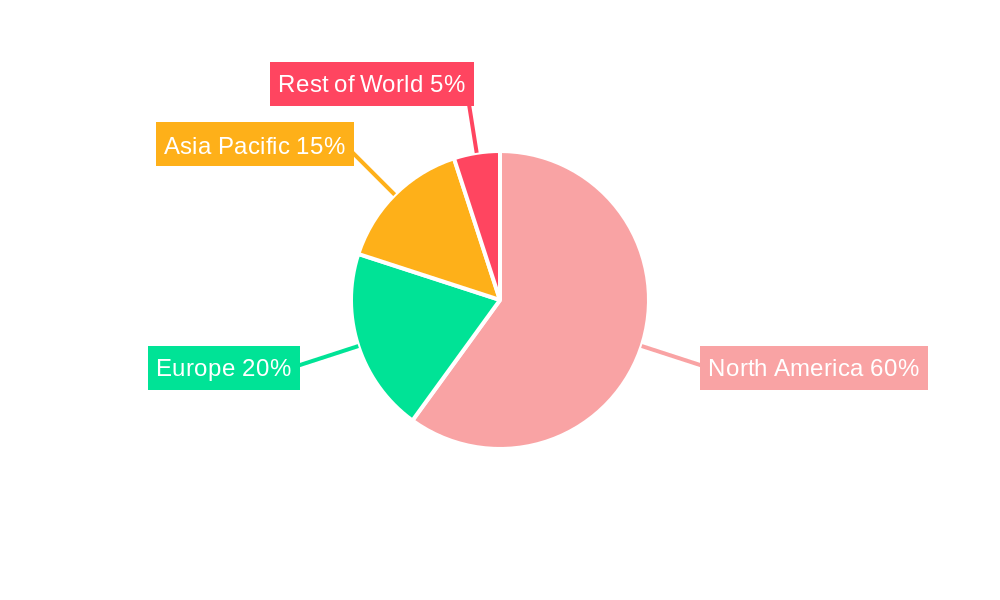

United States Dairy Desserts Market Segmentation By Geography

- 1. United States

United States Dairy Desserts Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.35% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages

- 3.3. Market Restrains

- 3.3.1. Competition from Substitute Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Dairy Desserts Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cheesecakes

- 5.1.2. Frozen Desserts

- 5.1.3. Ice Cream

- 5.1.4. Mousses

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Retail

- 5.2.1.3. Specialist Retailers

- 5.2.1.4. Supermarkets and Hypermarkets

- 5.2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China United States Dairy Desserts Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Japan United States Dairy Desserts Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. India United States Dairy Desserts Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Australia United States Dairy Desserts Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Rest of Asia Pacific United States Dairy Desserts Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Wells Enterprises Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Giffords Dairy Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Unilever PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HP Hood LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Conagra Brands Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mondelez International Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dairy Farmers of America Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Blue Bell Creameries LP

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Froneri International Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Wells Enterprises Inc

List of Figures

- Figure 1: United States Dairy Desserts Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Dairy Desserts Market Share (%) by Company 2024

List of Tables

- Table 1: United States Dairy Desserts Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Dairy Desserts Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: United States Dairy Desserts Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: United States Dairy Desserts Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United States Dairy Desserts Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Dairy Desserts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: United States Dairy Desserts Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Dairy Desserts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United States Dairy Desserts Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United States Dairy Desserts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United States Dairy Desserts Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States Dairy Desserts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United States Dairy Desserts Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Dairy Desserts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: United States Dairy Desserts Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: United States Dairy Desserts Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: United States Dairy Desserts Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Dairy Desserts Market?

The projected CAGR is approximately 5.35%.

2. Which companies are prominent players in the United States Dairy Desserts Market?

Key companies in the market include Wells Enterprises Inc, Giffords Dairy Inc, Unilever PLC, HP Hood LLC, Conagra Brands Inc, Mondelez International Inc, Dairy Farmers of America Inc, Blue Bell Creameries LP, Froneri International Limited.

3. What are the main segments of the United States Dairy Desserts Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition from Substitute Products.

8. Can you provide examples of recent developments in the market?

October 2022: Kemps replaced Dean Goods throughout Iowa as Dairy Farmers of America completed the USD 433 million acquisition of Dean Foods properties. The business took over the Le Mars milk factory, which can process numerous Kemps products, from cottage cheese to ice cream.October 2022: Blue Ribbon's Street range launched three new two-liter tubs, each featuring two flavors. The range includes chocolate affair, caramel hokey pokey, and velvety caramel.September 2022: Blue Bell Creameries LP introduced a new ice cream flavor in its product portfolio, the Salted Caramel Brownie ice cream. The strategy focused on the expansion of its business lines.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Dairy Desserts Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Dairy Desserts Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Dairy Desserts Market?

To stay informed about further developments, trends, and reports in the United States Dairy Desserts Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence