Key Insights

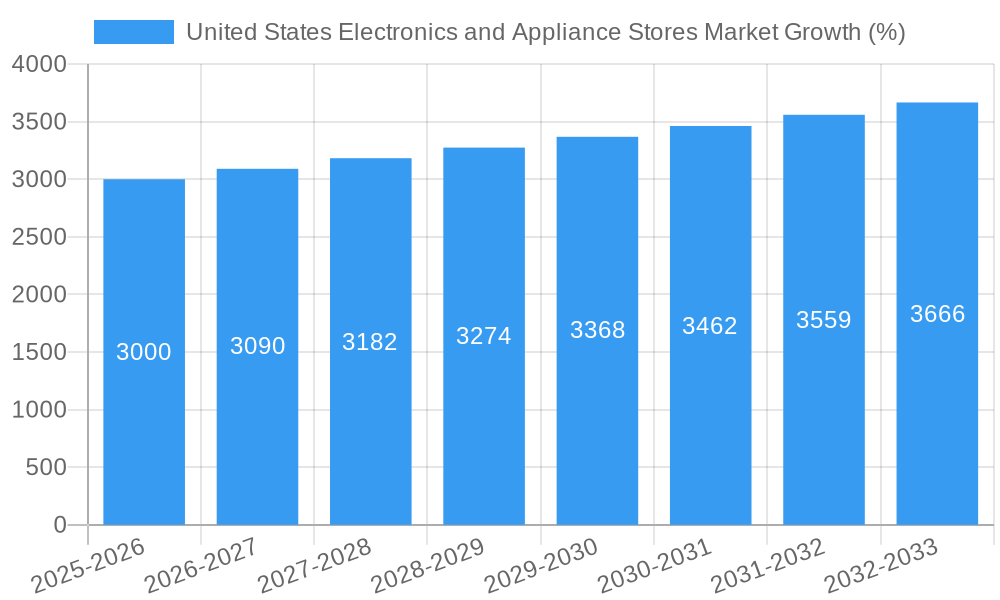

The United States electronics and appliance stores market is a dynamic sector characterized by robust growth and evolving consumer preferences. With a market size exceeding $XX million in 2025 (a figure requiring further market research to ascertain a precise value, but estimated to be significant considering the scale of the US consumer market and CAGR of over 2%), this sector is projected to experience consistent expansion throughout the forecast period (2025-2033). Key drivers include increasing disposable incomes, the growing adoption of smart home technology, and a continuous demand for updated appliances. Trends such as the rise of e-commerce, the increasing popularity of subscription services for appliance maintenance, and the growing focus on energy-efficient products are further shaping the market landscape. While challenges exist, such as supply chain disruptions and economic fluctuations, these are counterbalanced by consumer preference for premium appliances, leading to opportunities for both established brands like Whirlpool, Panasonic, and Samsung, and emerging players focusing on niche markets. The market segmentation reveals a diversified structure with hardware suppliers, security stores, and consumer electronics stores all playing crucial roles. Retail formats include retail chains, independent retailers, exclusive showrooms, and inclusive dealer stores, alongside the significant and rapidly expanding online retail segment.

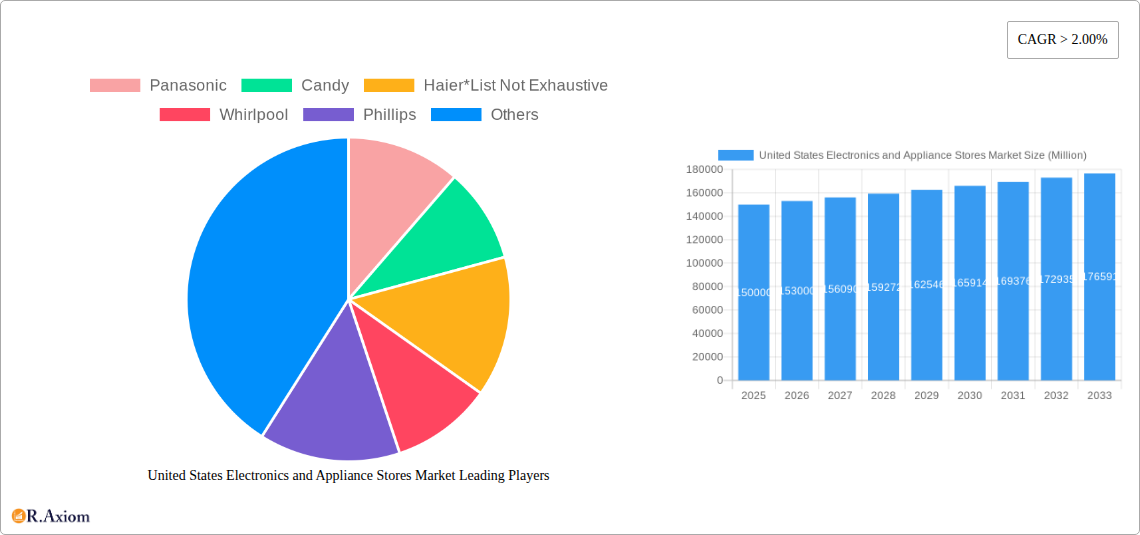

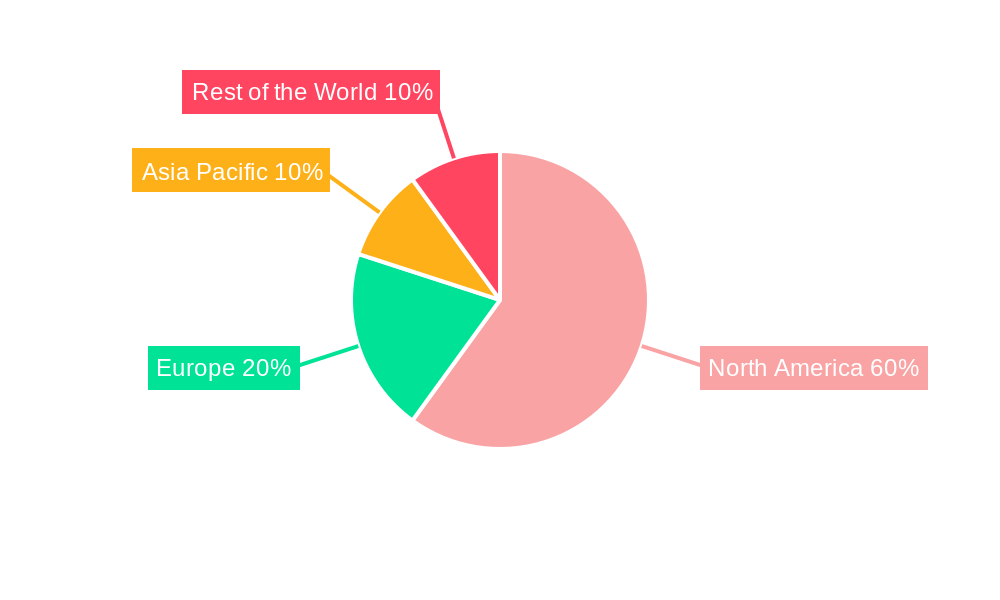

The competitive landscape features established players like Panasonic, Candy, Haier, Whirlpool, Philips, Bosch, Toshiba, Hitachi Limited, and GE Appliances, alongside numerous smaller, specialized retailers. The growth trajectory suggests substantial investment opportunities for businesses capitalizing on the expansion of e-commerce, the growing preference for sustainable and smart appliances, and the ongoing need for professional installation and maintenance services. Understanding evolving consumer preferences, incorporating innovative technologies, and developing robust omnichannel strategies are key to success within this competitive but lucrative market. The regional distribution likely reflects a concentration of market share in densely populated areas, with North America representing a significant portion, and potential for growth in other regions as markets mature and access to technology improves.

This in-depth report provides a comprehensive analysis of the United States Electronics and Appliance Stores Market, covering the period from 2019 to 2033. It offers invaluable insights into market size, segmentation, growth drivers, challenges, and emerging opportunities, empowering stakeholders to make informed strategic decisions. The report leverages extensive data analysis, incorporating key industry developments and competitive landscapes to present a holistic view of this dynamic market. The base year for this report is 2025, with estimations provided for the same year and forecasts extending to 2033. The historical period covered is 2019-2024.

United States Electronics and Appliance Stores Market Market Concentration & Innovation

The United States electronics and appliance stores market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous independent retailers and online marketplaces contributes to a competitive environment. Market share data for key players like Whirlpool, Panasonic, and LG is being assessed and will be included in the final report. The market is driven by innovation in smart home technology, energy-efficient appliances, and enhanced customer experiences. Regulatory frameworks, including energy efficiency standards and consumer protection laws, significantly influence market dynamics. Product substitution is a notable factor, with consumers increasingly choosing alternatives like smart speakers and streaming services to traditional electronics. Mergers and acquisitions (M&A) activity has been robust, with notable deals including Whirlpool's acquisition of InSinkErator in November 2022 for an estimated value of xx Million. This trend reflects industry consolidation and a pursuit of economies of scale. Consumer trends towards sustainable and technologically advanced products further shape the market.

- Market Concentration: Moderately concentrated with significant presence of large retailers and online players.

- Innovation Drivers: Smart home technology, energy efficiency, and personalized consumer experiences.

- Regulatory Frameworks: Energy efficiency standards and consumer protection laws are key influencers.

- M&A Activity: High activity, exemplified by Whirlpool's acquisition of InSinkErator. Estimated value for this deal and others will be detailed in the report.

United States Electronics and Appliance Stores Market Industry Trends & Insights

The US electronics and appliance stores market is experiencing robust growth, driven primarily by rising disposable incomes, increasing urbanization, and a shift towards technologically advanced household appliances. The market’s Compound Annual Growth Rate (CAGR) from 2019-2024 is estimated to be xx%, and is projected to reach xx Million by 2033. Technological advancements like AI integration, as demonstrated by GE Appliances' partnership with Google Cloud, and the Internet of Things (IoT) are reshaping the market. Consumer preferences are leaning towards energy-efficient, smart, and sustainable products, leading to increased demand for appliances with advanced features. Intense competition among established players and the emergence of new online retailers are shaping market dynamics. Market penetration of smart appliances is steadily increasing, with projected penetration rates detailed in the report for each segment.

Dominant Markets & Segments in United States Electronics and Appliance Stores Market

The report identifies the leading segments and regions within the United States electronics and appliance stores market. Key findings include a strong dominance of online sales channels and a significant presence of retail chains in terms of market share.

- By Type: Consumer Electronic Stores represent the largest segment, driven by demand for smart TVs, audio devices, and gaming consoles.

- By Ownership: Retail chains dominate, benefiting from economies of scale and broad market reach.

- By Type of Store: Online retailers are experiencing rapid growth due to convenience and competitive pricing.

Detailed analysis of regional performance, economic policies, and infrastructural factors contributing to dominance is presented in the full report.

United States Electronics and Appliance Stores Market Product Developments

The market witnesses continuous product innovation, with a focus on enhancing energy efficiency, connectivity, and user experience. Smart appliances with integrated AI capabilities, as showcased by GE Appliances’ Flavorly™ AI, are gaining popularity. Manufacturers are focusing on developing sustainable and eco-friendly products to appeal to environmentally conscious consumers. The integration of IoT allows for remote control and monitoring of appliances, enhancing user convenience and energy management. These advancements are creating competitive advantages for companies at the forefront of technological trends.

Report Scope & Segmentation Analysis

This report segments the US electronics and appliance stores market across several key parameters:

By Type: Hardware Supplier, Security Stores, Consumer Electronic Store. Each segment's growth projection, market size, and competitive landscape are detailed.

By Ownership: Retail Chain, Independent Retailer. The report assesses the respective growth trajectories and market dynamics of each ownership structure.

By Type of Store: Exclusive Retailers/showroom, Inclusive Retailers/Dealers Store, Online. Detailed competitive analyses are included for each channel type, highlighting their specific challenges and opportunities.

Key Drivers of United States Electronics and Appliance Stores Market Growth

Several factors contribute to the growth of the US electronics and appliance stores market. Technological advancements, particularly in smart home technology and energy efficiency, are significant drivers. Economic factors, such as rising disposable incomes and increased consumer spending on home improvement, also play a major role. Favorable government policies promoting energy conservation and technological innovation are providing further impetus to market growth.

Challenges in the United States Electronics and Appliance Stores Market Sector

The market faces several challenges, including supply chain disruptions that lead to increased costs and product shortages. Intense competition from both established and new players creates pricing pressures and necessitates continuous innovation. Fluctuations in raw material prices and rising labor costs also impact profitability. Regulatory compliance requirements can add complexity to operations.

Emerging Opportunities in United States Electronics and Appliance Stores Market

The market presents significant growth opportunities. The expansion of smart home technology and the rising demand for energy-efficient appliances offer substantial potential. The growing adoption of online retail channels presents new avenues for market penetration and improved consumer reach. Focus on sustainable products and personalized customer experiences represents a substantial emerging market segment.

Leading Players in the United States Electronics and Appliance Stores Market Market

Key Developments in United States Electronics and Appliance Stores Market Industry

- August 2023: GE Appliances and Google Cloud partnered to enhance consumer experiences using generative AI.

- November 2022: Whirlpool acquired InSinkErator, expanding its kitchen and laundry product portfolio.

- February 2022: Mitsubishi Electric Corporation acquired CPT, strengthening its UPS business in North America.

Strategic Outlook for United States Electronics and Appliance Stores Market Market

The US electronics and appliance stores market is poised for continued growth, driven by innovation, technological advancements, and changing consumer preferences. Opportunities exist in expanding smart home integration, promoting sustainable products, and leveraging online channels. Companies that successfully adapt to evolving consumer demands and technological disruptions will be best positioned for future success. The market's potential for expansion is substantial, particularly in areas such as energy efficiency and sustainable appliances.

United States Electronics and Appliance Stores Market Segmentation

-

1. Type

- 1.1. Hardware Supplier

- 1.2. Security Stores

- 1.3. Consumer Electronic Store

-

2. Ownership

- 2.1. Retail Chain

- 2.2. Independent Retailer

-

3. Type of Store

- 3.1. Exclusive Retailers/showroom

- 3.2. Inclusive Retailers/Dealers Store

- 3.3. Online

United States Electronics and Appliance Stores Market Segmentation By Geography

- 1. United States

United States Electronics and Appliance Stores Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Innovation in LED Display; Increased Applications for Digital Signage

- 3.3. Market Restrains

- 3.3.1. Shorter Operating Range of WiGig Products

- 3.4. Market Trends

- 3.4.1. AI And IOT Enabled Electronic Appliance DrivingUS Electronics and Appliance Stores Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Electronics and Appliance Stores Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware Supplier

- 5.1.2. Security Stores

- 5.1.3. Consumer Electronic Store

- 5.2. Market Analysis, Insights and Forecast - by Ownership

- 5.2.1. Retail Chain

- 5.2.2. Independent Retailer

- 5.3. Market Analysis, Insights and Forecast - by Type of Store

- 5.3.1. Exclusive Retailers/showroom

- 5.3.2. Inclusive Retailers/Dealers Store

- 5.3.3. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America United States Electronics and Appliance Stores Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United States Electronics and Appliance Stores Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific United States Electronics and Appliance Stores Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Rest of the World United States Electronics and Appliance Stores Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Panasonic

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Candy

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Haier*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Whirlpool

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Phillips

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Bosch

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Toshiba

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hitachi Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 GE Appliance

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Panasonic

List of Figures

- Figure 1: United States Electronics and Appliance Stores Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Electronics and Appliance Stores Market Share (%) by Company 2024

List of Tables

- Table 1: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 4: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Type of Store 2019 & 2032

- Table 5: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Electronics and Appliance Stores Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Electronics and Appliance Stores Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States Electronics and Appliance Stores Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Electronics and Appliance Stores Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 16: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Type of Store 2019 & 2032

- Table 17: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Electronics and Appliance Stores Market?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the United States Electronics and Appliance Stores Market?

Key companies in the market include Panasonic, Candy, Haier*List Not Exhaustive, Whirlpool, Phillips, Bosch, Toshiba, Hitachi Limited, GE Appliance.

3. What are the main segments of the United States Electronics and Appliance Stores Market?

The market segments include Type, Ownership, Type of Store.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Innovation in LED Display; Increased Applications for Digital Signage.

6. What are the notable trends driving market growth?

AI And IOT Enabled Electronic Appliance DrivingUS Electronics and Appliance Stores Market.

7. Are there any restraints impacting market growth?

Shorter Operating Range of WiGig Products.

8. Can you provide examples of recent developments in the market?

In August 2023, GE Appliances, a Haier company, and Google Cloud expanded their partnership to enhance and personalize consumer experiences with generative AI. GE Appliances’ SmartHQ consumer app will use Google Cloud’s generative AI platform, Vertex AI, to offer users the ability to generate custom recipes based on the food in their kitchen with its new feature called Flavorly™ AI.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Electronics and Appliance Stores Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Electronics and Appliance Stores Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Electronics and Appliance Stores Market?

To stay informed about further developments, trends, and reports in the United States Electronics and Appliance Stores Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence