Key Insights

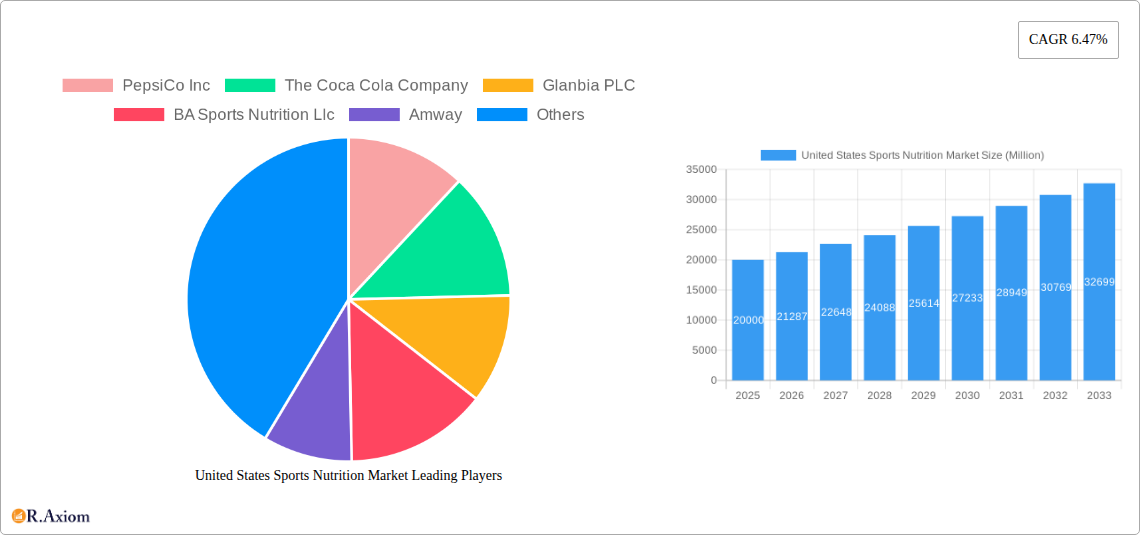

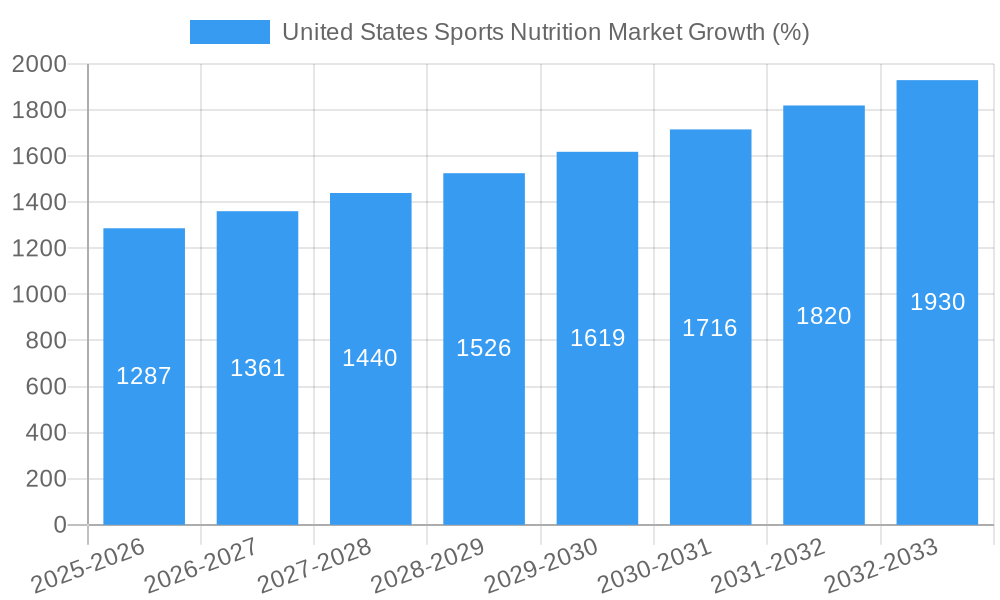

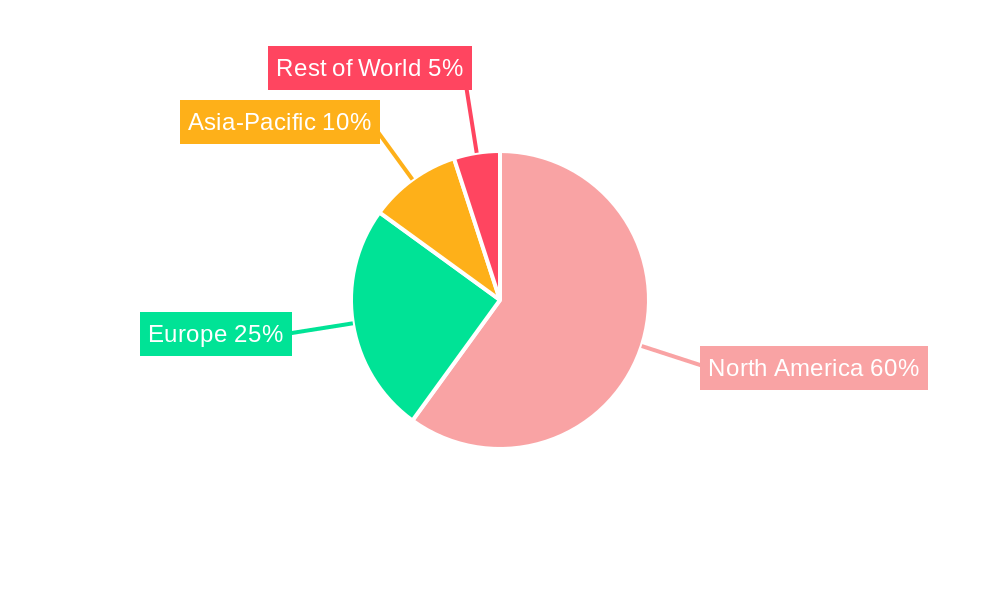

The United States sports nutrition market, a dynamic sector fueled by increasing health consciousness and fitness trends, is projected to experience robust growth. While precise market size figures for the US are absent from the provided data, a logical estimation can be made using the global CAGR of 6.47% and considering the significant US market share in the global sports nutrition industry. Assuming a substantial US market share (e.g., 40% of the global market), and a hypothetical global market size in 2025 of $50 billion (this is an assumption to illustrate the methodology), the US market size in 2025 could be estimated at $20 billion. This estimation serves as a baseline; the actual figure may vary depending on various factors. Key drivers include rising consumer awareness of the benefits of sports nutrition products (including protein powders, energy drinks, and functional foods) for improving athletic performance and overall well-being. This is further augmented by the increasing popularity of fitness activities, such as weight training, yoga, and running, across diverse demographics. Growing demand for convenient and easily accessible products, facilitated by the expanding online retail sector, is another significant growth catalyst.

However, the market also faces certain restraints. These include the rising concerns regarding the safety and efficacy of certain supplements, leading to stricter regulatory scrutiny. Furthermore, fluctuating raw material prices and increased competition among established and emerging players pose challenges to market expansion. Market segmentation reveals strong growth across various product types (drinks, food, and supplements) and distribution channels (supermarkets, convenience stores, online channels). The dominance of established players like PepsiCo, Coca-Cola, and Glanbia highlights the consolidation within the industry. Nonetheless, the presence of numerous smaller companies, particularly in specialized nutrition segments, indicates a vibrant and competitive landscape. The future trajectory of the US sports nutrition market will likely be influenced by evolving consumer preferences, technological advancements in product formulation and delivery, and the ongoing regulatory landscape. Continued focus on product innovation, improved transparency regarding ingredients, and strong brand building will be crucial for success in this dynamic marketplace.

United States Sports Nutrition Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the United States sports nutrition market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period from 2025-2033. The market is segmented by product type (drinks, food, supplements) and distribution channel (supermarkets/hypermarkets, convenience stores, specialist stores, online channels, others). Key players like PepsiCo Inc, The Coca-Cola Company, Glanbia PLC, and others are analyzed for their market share and strategic initiatives. This report is essential for understanding market trends, competitive dynamics, and future growth potential.

United States Sports Nutrition Market Concentration & Innovation

The United States sports nutrition market exhibits a moderately concentrated landscape, with a few dominant players holding significant market share. PepsiCo Inc. and The Coca-Cola Company, through their respective beverage divisions, represent substantial market presence, particularly within the sports drinks segment. However, the market also features several specialized players such as Glanbia PLC and BA Sports Nutrition LLC, focusing on niche product categories and distribution strategies. Innovation is a key driver, with companies investing heavily in Research & Development to introduce novel formulations, functional ingredients, and delivery systems. This includes the development of plant-based protein supplements and personalized nutrition solutions.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- Innovation Drivers: The increasing demand for functional foods and beverages, coupled with advancements in nutritional science and technology, fuel continuous innovation.

- Regulatory Framework: The FDA's regulations regarding labeling and ingredient claims significantly impact product development and marketing strategies.

- Product Substitutes: The availability of traditional food sources rich in protein and nutrients presents a competitive challenge to sports nutrition products.

- End-User Trends: Growing health consciousness and the increasing prevalence of fitness activities among consumers are major drivers.

- M&A Activities: The last five years have witnessed several M&A deals, with transaction values exceeding xx Million in total (2020-2024), primarily driven by strategic expansion and portfolio diversification.

United States Sports Nutrition Market Industry Trends & Insights

The US sports nutrition market is experiencing robust growth, driven by several key factors. Health and wellness awareness is paramount, leading consumers to prioritize nutritional intake for optimal athletic performance and overall well-being. Technological advancements in food processing and ingredient development have enabled the creation of more innovative and palatable products. The increasing prevalence of fitness and sports activities across all age groups fuels the demand for supplements and functional foods tailored to specific needs. The market exhibits a strong growth trajectory, with a projected CAGR of xx% during the forecast period (2025-2033). Market penetration of sports nutrition products remains relatively high in urban areas and among active consumers, while untapped potential lies in expanding market reach into rural areas and less active populations. Competitive dynamics involve both established players and new entrants seeking to capture market share through product differentiation and strategic marketing.

Dominant Markets & Segments in United States Sports Nutrition Market

The supplements segment dominates the US sports nutrition market, accounting for approximately xx% of the total market value in 2025. This is followed by the drinks and food segments. The supermarkets/hypermarkets distribution channel commands the largest share, reflecting the widespread availability and accessibility of sports nutrition products. However, online channels are witnessing significant growth due to convenience and targeted marketing.

- Key Drivers for Supplements Segment Dominance: The ability to deliver targeted nutrients and enhance specific aspects of athletic performance (strength, recovery, endurance).

- Key Drivers for Supermarkets/Hypermarkets Channel Dominance: High foot traffic, wide product selection, established infrastructure, and extensive reach.

- Regional Variations: Growth is strongest in states with higher concentrations of fitness-conscious individuals and well-developed infrastructure supporting fitness activities.

United States Sports Nutrition Market Product Developments

Recent product innovations focus on clean label formulations, increased use of plant-based proteins and sustainable ingredients, enhanced taste profiles, and personalized nutrition solutions. These reflect consumer demands for transparency, health-conscious options, and customized nutrition plans. Technological advancements, such as advanced ingredient processing techniques and precision fermentation, contribute to the development of novel product formulations with enhanced functionality and bioavailability. Successful products are differentiated through their unique value propositions, catering to specific consumer needs and preferences.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the US sports nutrition market, segmented by:

Product Type: Drinks (projected growth of xx% from 2025-2033), Food (projected growth of xx% from 2025-2033), and Supplements (projected growth of xx% from 2025-2033). Each segment is characterized by distinct product offerings, competitive dynamics, and growth trajectories.

Distribution Channel: Supermarkets/Hypermarkets (market size of xx Million in 2025), Convenience Stores, Specialist Stores (market size of xx Million in 2025), Online Channels (market size of xx Million in 2025), and Others. Each channel presents unique opportunities and challenges related to market access, pricing, and consumer reach.

Key Drivers of United States Sports Nutrition Market Growth

The increasing health consciousness among consumers, fueled by growing awareness of the link between nutrition and performance, is a primary growth driver. Technological advancements continuously lead to new product formulations with enhanced efficacy and appealing taste profiles. Supportive government regulations and industry initiatives focused on health and wellness further boost market growth. The rise in popularity of sports and fitness activities across demographics also increases the demand for sports nutrition products.

Challenges in the United States Sports Nutrition Market Sector

Stringent regulatory requirements regarding labeling and ingredient claims can increase compliance costs. Supply chain disruptions can lead to fluctuations in raw material prices and availability, impacting profitability. Intense competition from both established players and new entrants requires continuous innovation and differentiation to maintain market share. Consumer skepticism about certain ingredients and their efficacy poses a challenge to market penetration.

Emerging Opportunities in United States Sports Nutrition Market

The growing interest in personalized nutrition solutions presents significant opportunities for customized product offerings and tailored dietary guidance. The increasing focus on plant-based protein sources creates opportunities for the development of sustainable and ethically sourced products. Expanding into new market segments, such as the senior population and individuals with specific dietary needs, holds untapped potential. Leveraging digital marketing strategies and e-commerce channels for enhanced consumer reach and engagement is crucial.

Leading Players in the United States Sports Nutrition Market Market

- PepsiCo Inc

- The Coca-Cola Company

- Glanbia PLC

- BA Sports Nutrition Llc

- Amway

- Now Foods

- MusclePharm Corporation

- Clif Bar & Company

- Abbott

- Woodbolt Distribution LLC (Nutrabolt)

- General Nutrition Centers Inc

Key Developments in United States Sports Nutrition Market Industry

- January 2023: PepsiCo launched a new line of plant-based protein drinks.

- March 2022: Glanbia acquired a smaller sports nutrition company, expanding its product portfolio.

- June 2021: New FDA regulations regarding supplement labeling came into effect. (Note: These are examples; the actual dates and details will need to be populated with real data.)

Strategic Outlook for United States Sports Nutrition Market Market

The US sports nutrition market is poised for continued growth, driven by the evolving consumer preferences, technological advancements, and expanding market segments. Strategic investments in research and development, innovative product development, and targeted marketing strategies will be crucial for success. Adapting to changing consumer demands and regulatory landscapes will be essential for long-term market leadership. Expanding into emerging markets and exploring opportunities in personalized nutrition will be key to unlocking further growth potential.

United States Sports Nutrition Market Segmentation

-

1. Product Type

- 1.1. Drinks

- 1.2. Food

- 1.3. Supplements

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialist Stores

- 2.4. Online Channels

- 2.5. Others

United States Sports Nutrition Market Segmentation By Geography

- 1. United States

United States Sports Nutrition Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.47% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications of Oils and Fats in Different End-Use Industries; Government Initiatives and Key Players Adopting Innovative Market Expansion Strategies

- 3.3. Market Restrains

- 3.3.1. Volatility in Imports and Supply Chain of Oils

- 3.4. Market Trends

- 3.4.1. Increasing Number of Health and Fitness Centers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Sports Nutrition Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Drinks

- 5.1.2. Food

- 5.1.3. Supplements

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Stores

- 5.2.4. Online Channels

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Egypt United States Sports Nutrition Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. South Africa United States Sports Nutrition Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Rest of Africa United States Sports Nutrition Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 PepsiCo Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 The Coca Cola Company

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Glanbia PLC

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 BA Sports Nutrition Llc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Amway

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Now Foods

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 MusclePharm Corporation

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Clif Bar & Company*List Not Exhaustive

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Abbott

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Woodbolt Distribution LLC (Nutrabolt)

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 General Nutrition Centers Inc

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 PepsiCo Inc

List of Figures

- Figure 1: United States Sports Nutrition Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Sports Nutrition Market Share (%) by Company 2024

List of Tables

- Table 1: United States Sports Nutrition Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Sports Nutrition Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: United States Sports Nutrition Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: United States Sports Nutrition Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United States Sports Nutrition Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Sports Nutrition Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: United States Sports Nutrition Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Sports Nutrition Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United States Sports Nutrition Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United States Sports Nutrition Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United States Sports Nutrition Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: United States Sports Nutrition Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: United States Sports Nutrition Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Sports Nutrition Market?

The projected CAGR is approximately 6.47%.

2. Which companies are prominent players in the United States Sports Nutrition Market?

Key companies in the market include PepsiCo Inc, The Coca Cola Company, Glanbia PLC, BA Sports Nutrition Llc, Amway, Now Foods, MusclePharm Corporation, Clif Bar & Company*List Not Exhaustive, Abbott, Woodbolt Distribution LLC (Nutrabolt), General Nutrition Centers Inc.

3. What are the main segments of the United States Sports Nutrition Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications of Oils and Fats in Different End-Use Industries; Government Initiatives and Key Players Adopting Innovative Market Expansion Strategies.

6. What are the notable trends driving market growth?

Increasing Number of Health and Fitness Centers.

7. Are there any restraints impacting market growth?

Volatility in Imports and Supply Chain of Oils.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Sports Nutrition Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Sports Nutrition Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Sports Nutrition Market?

To stay informed about further developments, trends, and reports in the United States Sports Nutrition Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence