Key Insights

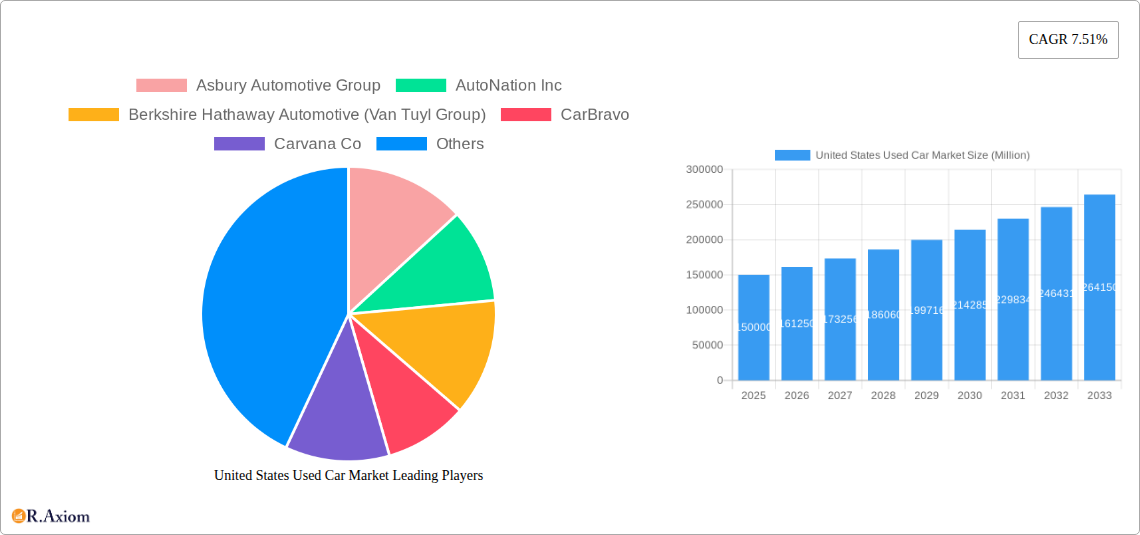

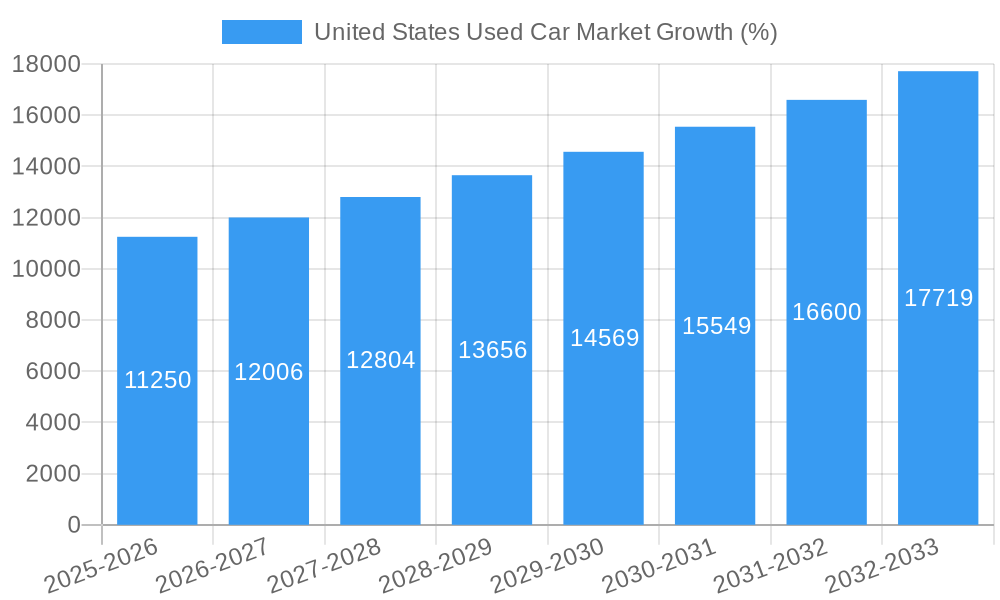

The United States used car market, a significant segment of the broader automotive industry, is experiencing robust growth, driven by several key factors. The market's substantial size, coupled with a Compound Annual Growth Rate (CAGR) of 7.51%, indicates a consistently expanding market. Several factors fuel this expansion, including the increasing preference for pre-owned vehicles due to affordability compared to new cars, the rising popularity of online car buying platforms offering convenience and transparency, and the fluctuating new car prices influenced by supply chain issues and economic conditions. The market is segmented by vendor type (organized vs. unorganized dealerships), fuel type (petrol, diesel, electric, and others), body type (hatchback, sedan, SUV, and MPV), and sales channels (online and offline). The presence of major players like CarMax, AutoNation, and Asbury Automotive Group indicates a competitive landscape with both established and emerging businesses vying for market share. The growth in the electric vehicle segment within the used car market is anticipated to further fuel market expansion in the coming years, driven by increased adoption of EVs and government incentives.

Despite the positive growth trajectory, certain challenges remain. One key restraint is the fluctuating used car prices influenced by economic factors and the overall availability of inventory. Additionally, maintaining consistent quality control and addressing concerns about vehicle history and maintenance are critical factors for continued market expansion. The increasing competition among dealers necessitates innovation and investment in customer service, technology, and inventory management to secure a competitive edge. Looking ahead, the US used car market presents strong growth potential, particularly in the online sales channel and the electric vehicle segment. Market participants will need to adapt to changing consumer preferences and address the challenges effectively to fully capitalize on this expanding market opportunity. The forecast period of 2025-2033 promises further growth, based on the current trajectory and projected market dynamics.

This comprehensive report provides a detailed analysis of the United States used car market, covering the period 2019-2033. It offers in-depth insights into market dynamics, key players, emerging trends, and future growth opportunities. The report is essential for industry stakeholders, investors, and anyone seeking a thorough understanding of this dynamic sector. With a base year of 2025 and an estimated year of 2025, the forecast period spans from 2025 to 2033, building upon historical data from 2019 to 2024. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

United States Used Car Market Concentration & Innovation

The United States used car market exhibits a moderately concentrated landscape, with a few major players commanding significant market share. However, the presence of numerous smaller, independent dealers contributes to a dynamic competitive environment. Market share data for key players such as CarMax Inc., AutoNation Inc., and Asbury Automotive Group show varying degrees of dominance across different segments. For instance, CarMax holds approximately xx% of the organized retail market share in 2025. The market is witnessing significant innovation, driven by technological advancements in online sales platforms, automated valuation tools, and data analytics. Regulatory frameworks, including those concerning emissions standards and vehicle safety, influence market dynamics. The rise of electric vehicles presents a substitute for traditional petrol and diesel cars, altering the market's landscape and creating opportunities for new players. Consumer preferences are shifting towards online transactions and flexible financing options.

Mergers and Acquisitions (M&A): The used car market has seen significant M&A activity, with deal values totaling xx Million in 2024. These activities are largely driven by a desire for market consolidation, expansion into new geographical areas, and diversification of product offerings. Key transactions included the acquisition of xx by xx in 2023.

Innovation Drivers: Technological advancements, changing consumer preferences, and increasing regulatory scrutiny are driving market innovation.

Regulatory Frameworks: Environmental regulations impacting emissions and fuel efficiency are shaping the market, favoring electric vehicles and influencing consumer choice.

United States Used Car Market Industry Trends & Insights

The US used car market is experiencing robust growth, primarily driven by rising demand, technological advancements, and evolving consumer preferences. The market's growth is fueled by several factors including increasing vehicle ownership rates, particularly amongst younger demographics, rising disposable incomes, and a growing preference for pre-owned vehicles due to their affordability. The increasing penetration of online sales channels is revolutionizing the industry, offering consumers greater convenience and transparency. Technological disruptions, such as AI-powered valuation tools and online marketplaces, are streamlining the buying process and improving customer experience. The average transaction price for used vehicles is increasing, reflecting higher demand and limited supply in certain segments. The market is witnessing a shift towards SUVs and electric vehicles, reflecting changing consumer preferences and environmental concerns. Competitive dynamics are characterized by both fierce competition among established players and the emergence of new online-focused businesses. This is leading to price wars, innovative marketing strategies, and improved customer service offerings. The CAGR for the used car market from 2025 to 2033 is estimated to be xx%, reaching a market value of xx Million by 2033. Market penetration of online sales is projected to reach xx% by 2033.

Dominant Markets & Segments in United States Used Car Market

The largest segment in the US used car market is the organized retail segment, comprising dealerships and large used car retailers. This dominance is attributable to consumer trust, established infrastructure, and access to diverse inventory. The SUV body type is also a leading segment, driven by consumer preferences for space and versatility. Petrol remains the dominant fuel type, but electric vehicles are witnessing increasing adoption and are poised for strong growth. Online sales channels are experiencing rapid growth, but offline sales remain significant, highlighting the importance of physical showrooms and test drives.

Key Drivers for Organized Retail Segment Dominance:

- Strong brand recognition and consumer trust

- Established infrastructure and network of dealerships

- Wide range of inventory and financing options

- Professional service and warranty offerings.

Key Drivers for SUV Segment Dominance:

- Growing family sizes and preference for larger vehicles

- Increased affordability of SUVs compared to new vehicles

- Enhanced safety features and technological advancements

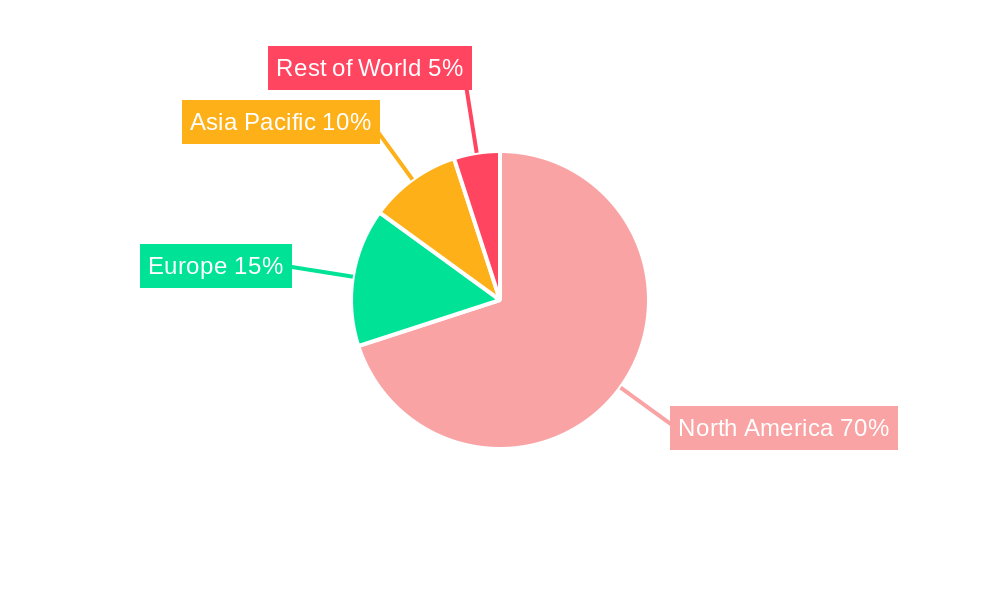

Geographic Dominance: California, Texas, and Florida represent the largest regional markets due to high population density, strong economies, and favorable demographics.

United States Used Car Market Product Developments

Recent product developments include the integration of online platforms with AI-powered valuation tools and digital retail experiences enhancing transparency and convenience for buyers. Furthermore, there's a growing focus on certified pre-owned vehicles offering warranties and additional services, increasing consumer confidence and driving higher prices. Technological trends indicate a move toward greater integration of data analytics for personalized marketing and inventory management. The market fit for these developments is strong as they address consumer needs for efficiency, transparency, and reliable used vehicles.

Report Scope & Segmentation Analysis

This report segments the US used car market across various parameters:

Vendor Type: Organized (Dealerships, large retailers) and Unorganized (Individual sellers). The organized sector is expected to exhibit faster growth due to its scale and infrastructure.

Fuel Type: Petrol, Diesel, Electric, and Others (Hybrid, etc.). Electric vehicles are anticipated to gain significant market share due to environmental concerns and technological advancements.

Body Type: Hatchback, Sedan, Sports Utility Vehicle (SUV), and Multi-Purpose Vehicle (MPV). SUVs are projected to maintain dominance due to their popularity and functionality.

Sales Channel: Online and Offline. Online channels are rapidly growing, but offline sales remain substantial.

Key Drivers of United States Used Car Market Growth

Several factors fuel the growth of the US used car market: increasing affordability compared to new vehicles, evolving consumer preferences toward used vehicles due to environmental concerns and budget limitations, the growth of online marketplaces offering convenience and transparency, and the continued rise in vehicle ownership rates.

Challenges in the United States Used Car Market Sector

The used car market faces challenges like fluctuating used car prices due to supply chain disruptions impacting new vehicle production. Additionally, regulatory uncertainties surrounding emissions standards and technological advancements can impact market dynamics. Competition from both established players and new entrants keeps pressure on margins.

Emerging Opportunities in United States Used Car Market

Emerging opportunities include expanding into the subscription-based vehicle model, the growing adoption of electric vehicles and increased focus on sustainable practices, and the advancement of AI-driven valuation tools and inspection technologies to improve transparency and efficiency.

Leading Players in the United States Used Car Market Market

- Asbury Automotive Group

- AutoNation Inc

- Berkshire Hathaway Automotive (Van Tuyl Group)

- CarBravo

- Carvana Co

- Sonic Automotive

- CarMax Inc

- Lithia Motors Inc

- Hendrick Automotive Group

- Group 1 Automotive Inc

Key Developments in United States Used Car Market Industry

- May 2022: Topmarq launched its online platform for automated bidding and seller appointment scheduling, initially focusing on the Texas market. This development enhances the efficiency of acquiring used vehicle inventory for dealers.

Strategic Outlook for United States Used Car Market Market

The US used car market is poised for continued growth, driven by technological advancements, shifting consumer preferences, and the ongoing evolution of the retail landscape. Opportunities exist for players who can effectively leverage technology to improve efficiency, enhance transparency, and personalize the customer experience. The increasing adoption of electric vehicles presents a significant opportunity for market expansion and diversification. Companies that can adapt to these trends and effectively cater to evolving consumer needs will be best positioned for success in the coming years.

United States Used Car Market Segmentation

-

1. Vendor Type

- 1.1. Organized

- 1.2. Unorganized

-

2. Fuel Type

- 2.1. Petrol

- 2.2. Diesel

- 2.3. Electric

- 2.4. Others

-

3. Body Type

- 3.1. Hatchback

- 3.2. Sedan

- 3.3. Sports Utility Vehicle and Multi-Purpose Vehicle

-

4. Sales Channel

- 4.1. Online

- 4.2. Offline

United States Used Car Market Segmentation By Geography

- 1. United States

United States Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.51% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Diverse Selection Among Car Models is Anticipated to Drive the Market Growth

- 3.3. Market Restrains

- 3.3.1. Counterfeit and Illegally Imported Vehicles are Restraining the Market Growth

- 3.4. Market Trends

- 3.4.1. TECHNOLOGICAL ADVANCEMENT IN THE ONLINE MODE SEGEMENT IS EXPECTED TO FOSTER THE DEMAND OF TARGET MARKET

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Used Car Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vendor Type

- 5.1.1. Organized

- 5.1.2. Unorganized

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Petrol

- 5.2.2. Diesel

- 5.2.3. Electric

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Body Type

- 5.3.1. Hatchback

- 5.3.2. Sedan

- 5.3.3. Sports Utility Vehicle and Multi-Purpose Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Vendor Type

- 6. United States United States Used Car Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Canada United States Used Car Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Rest of North America United States Used Car Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Germany United States Used Car Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. United Kingdom United States Used Car Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. France United States Used Car Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Italy United States Used Car Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of Europe United States Used Car Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. China United States Used Car Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. India United States Used Car Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Japan United States Used Car Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. South Korea United States Used Car Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Rest of Asia Pacific United States Used Car Market Analysis, Insights and Forecast, 2019-2031

- 18.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 18.1.1.

- 19. Mexico United States Used Car Market Analysis, Insights and Forecast, 2019-2031

- 19.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 19.1.1.

- 20. Brazil United States Used Car Market Analysis, Insights and Forecast, 2019-2031

- 20.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 20.1.1.

- 21. United Arab Emirates United States Used Car Market Analysis, Insights and Forecast, 2019-2031

- 21.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 21.1.1.

- 22. Other Countries United States Used Car Market Analysis, Insights and Forecast, 2019-2031

- 22.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 22.1.1.

- 23. Competitive Analysis

- 23.1. Market Share Analysis 2024

- 23.2. Company Profiles

- 23.2.1 Asbury Automotive Group

- 23.2.1.1. Overview

- 23.2.1.2. Products

- 23.2.1.3. SWOT Analysis

- 23.2.1.4. Recent Developments

- 23.2.1.5. Financials (Based on Availability)

- 23.2.2 AutoNation Inc

- 23.2.2.1. Overview

- 23.2.2.2. Products

- 23.2.2.3. SWOT Analysis

- 23.2.2.4. Recent Developments

- 23.2.2.5. Financials (Based on Availability)

- 23.2.3 Berkshire Hathaway Automotive (Van Tuyl Group)

- 23.2.3.1. Overview

- 23.2.3.2. Products

- 23.2.3.3. SWOT Analysis

- 23.2.3.4. Recent Developments

- 23.2.3.5. Financials (Based on Availability)

- 23.2.4 CarBravo

- 23.2.4.1. Overview

- 23.2.4.2. Products

- 23.2.4.3. SWOT Analysis

- 23.2.4.4. Recent Developments

- 23.2.4.5. Financials (Based on Availability)

- 23.2.5 Carvana Co

- 23.2.5.1. Overview

- 23.2.5.2. Products

- 23.2.5.3. SWOT Analysis

- 23.2.5.4. Recent Developments

- 23.2.5.5. Financials (Based on Availability)

- 23.2.6 Sonic Automotive

- 23.2.6.1. Overview

- 23.2.6.2. Products

- 23.2.6.3. SWOT Analysis

- 23.2.6.4. Recent Developments

- 23.2.6.5. Financials (Based on Availability)

- 23.2.7 CarMax Inc

- 23.2.7.1. Overview

- 23.2.7.2. Products

- 23.2.7.3. SWOT Analysis

- 23.2.7.4. Recent Developments

- 23.2.7.5. Financials (Based on Availability)

- 23.2.8 Lithia Motors Inc *List Not Exhaustive

- 23.2.8.1. Overview

- 23.2.8.2. Products

- 23.2.8.3. SWOT Analysis

- 23.2.8.4. Recent Developments

- 23.2.8.5. Financials (Based on Availability)

- 23.2.9 Hendrick Automotive Group

- 23.2.9.1. Overview

- 23.2.9.2. Products

- 23.2.9.3. SWOT Analysis

- 23.2.9.4. Recent Developments

- 23.2.9.5. Financials (Based on Availability)

- 23.2.10 Group 1 Automotive Inc

- 23.2.10.1. Overview

- 23.2.10.2. Products

- 23.2.10.3. SWOT Analysis

- 23.2.10.4. Recent Developments

- 23.2.10.5. Financials (Based on Availability)

- 23.2.1 Asbury Automotive Group

List of Figures

- Figure 1: United States Used Car Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Used Car Market Share (%) by Company 2024

List of Tables

- Table 1: United States Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 3: United States Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: United States Used Car Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 5: United States Used Car Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 6: United States Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: United States Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United States Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United States Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United States Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United States Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: United States Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: United States Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: United States Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United States Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: United States Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United States Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: United States Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United States Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: United States Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United States Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: United States Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United States Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: United States Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United States Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: United States Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United States Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: United States Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: United States Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United States Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: United States Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: United States Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: United States Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: United States Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: United States Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 42: United States Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 43: United States Used Car Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 44: United States Used Car Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 45: United States Used Car Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Used Car Market?

The projected CAGR is approximately 7.51%.

2. Which companies are prominent players in the United States Used Car Market?

Key companies in the market include Asbury Automotive Group, AutoNation Inc, Berkshire Hathaway Automotive (Van Tuyl Group), CarBravo, Carvana Co, Sonic Automotive, CarMax Inc, Lithia Motors Inc *List Not Exhaustive, Hendrick Automotive Group, Group 1 Automotive Inc.

3. What are the main segments of the United States Used Car Market?

The market segments include Vendor Type, Fuel Type, Body Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Diverse Selection Among Car Models is Anticipated to Drive the Market Growth.

6. What are the notable trends driving market growth?

TECHNOLOGICAL ADVANCEMENT IN THE ONLINE MODE SEGEMENT IS EXPECTED TO FOSTER THE DEMAND OF TARGET MARKET.

7. Are there any restraints impacting market growth?

Counterfeit and Illegally Imported Vehicles are Restraining the Market Growth.

8. Can you provide examples of recent developments in the market?

In May 2022, Topmarq debuted its solution, which is intended to be an online service with automatic bidding and seller appointment arranging. The platform is being introduced as a limited public beta, according to a press release. Topmarq stated that it is now focusing on the Texas market, with intentions to expand to other large metros in the near future. This technology tool was released to assist dealers in acquiring used inventory from vehicles sold by individual owners.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Used Car Market?

To stay informed about further developments, trends, and reports in the United States Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence