Key Insights

The United States Banking-as-a-Service (BaaS) market is poised for significant expansion, driven by the escalating adoption of embedded finance solutions and the dynamic growth of fintech innovators. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 13.1%, expanding from a market size of 30.26 billion in the base year 2025 to reach substantial future valuations. This robust trajectory is underpinned by several pivotal factors. Primarily, businesses across diverse industries are prioritizing the seamless integration of financial services into their existing customer journeys, thereby minimizing friction and elevating user experiences. This encompasses the provision of embedded payments, lending, and a spectrum of financial products directly within their native platforms. Concurrently, the evolving regulatory landscape is increasingly supportive of BaaS innovation, fostering greater participation from both agile fintechs and established financial institutions. Furthermore, technological advancements, including sophisticated API integrations and stringent security frameworks, are simplifying the deployment of BaaS solutions and accelerating their widespread acceptance.

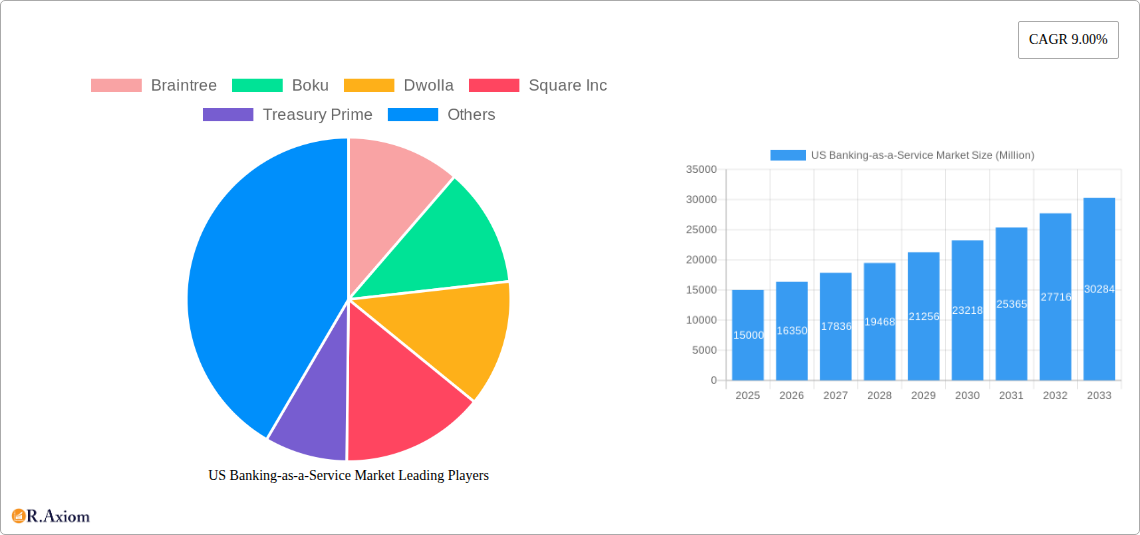

US Banking-as-a-Service Market Market Size (In Billion)

Sustained market ascendancy in the US BaaS sector is contingent upon continued strategic investments in technology to ensure the security, scalability, and reliability of BaaS offerings. Enhanced regulatory clarity and consistent oversight will be instrumental in cultivating market confidence and driving broader adoption. BaaS providers that adeptly adapt to evolving consumer demands and embrace emerging technological paradigms, such as open banking and real-time payment ecosystems, will secure a distinct competitive advantage. As the market matures, an intensified focus on value-added services, including personalized financial management tools and advanced analytics, is anticipated to fuel further expansion. This growth is expected to be particularly pronounced within key sectors such as e-commerce, digital marketplaces, and the rapidly expanding gig economy, where the need for integrated financial solutions is paramount.

US Banking-as-a-Service Market Company Market Share

US Banking-as-a-Service Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the US Banking-as-a-Service (BaaS) market, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report delves into market dynamics, growth drivers, challenges, and emerging opportunities. The report leverages extensive primary and secondary research, including detailed financial data and expert interviews to provide accurate market sizing and forecasting. Expect detailed analysis of key players like Braintree, Boku, Dwolla, Square Inc (Block), Treasury Prime, Moven, Green Dot, Synapse, Galileo, and Marqeta – though this list is not exhaustive.

US Banking-as-a-Service Market Market Concentration & Innovation

The US BaaS market exhibits a moderately concentrated landscape with several key players holding significant market share. While precise market share data for each company is proprietary information and not publicly available in sufficient detail to give precise figures, the market is characterized by a blend of established financial technology (FinTech) companies and emerging players. Innovation is a major driving force, fueled by advancements in APIs, cloud computing, and AI. The regulatory environment, while evolving, poses both challenges and opportunities, requiring adherence to stringent compliance standards (like those under the Dodd-Frank Act). The emergence of open banking initiatives further stimulates innovation by fostering interoperability and data sharing. Significant M&A activity is observed, with deal values ranging from xx Million to xx Million USD in recent years, primarily driven by efforts to expand capabilities, enhance market reach, and secure a stronger competitive foothold. End-user trends, like increased demand for personalized financial products and seamless digital experiences, propel BaaS adoption.

US Banking-as-a-Service Market Industry Trends & Insights

The US BaaS market is experiencing robust growth, driven by the increasing demand for embedded finance solutions and the rapid digital transformation within the financial sector. The compound annual growth rate (CAGR) during the forecast period (2025-2033) is estimated at xx%. Technological disruptions, such as the rise of cloud-native platforms and advanced analytics, are reshaping the competitive landscape. Consumer preferences are shifting towards convenient, personalized, and secure financial services, driving the adoption of BaaS solutions. Market penetration is gradually increasing across diverse sectors, including fintech, e-commerce, and traditional financial institutions. Competitive dynamics are intensifying, as both established players and new entrants strive to gain market share through innovative product offerings and strategic partnerships.

Dominant Markets & Segments in US Banking-as-a-Service Market

Dominant Region/Segment: The report indicates that the [Specify Dominant Region/Segment, e.g., Northeast Region/ Payments Segment] is currently the dominant segment/region in the US BaaS market.

Key Drivers:

- Stronger technological infrastructure.

- Favorable regulatory environment fostering innovation.

- High concentration of FinTech companies and early adopters.

- Increased consumer demand for digital banking services.

This dominance is attributed to a confluence of factors, including a highly developed technological infrastructure, a favorable regulatory climate promoting innovation, and a concentrated presence of both established financial institutions and nimble FinTech companies. The region's robust digital economy and high adoption rate of digital banking contribute significantly to the segment's outsized contribution to the overall market.

US Banking-as-a-Service Market Product Developments

Recent product innovations within the US BaaS market focus on enhancing functionality, security, and scalability. This includes the development of advanced APIs, enhanced fraud prevention tools, and improved customer onboarding processes. New applications are emerging across various industries, such as embedded lending, buy-now-pay-later (BNPL) solutions, and personalized financial management tools. Companies are emphasizing competitive advantages through superior technological capabilities, seamless integration with existing systems, and robust customer support.

Report Scope & Segmentation Analysis

This report segments the US BaaS market based on several key factors including deployment type (cloud-based, on-premise), service type (payment processing, account aggregation, lending), and end-user industry (FinTech, e-commerce, healthcare). Each segment is analyzed individually, providing detailed information on market size, growth projections, and competitive dynamics. For example, the cloud-based segment is projected to experience significant growth driven by its scalability and cost-effectiveness. The payment processing segment holds a considerable market share due to the high demand for streamlined payment solutions.

Key Drivers of US Banking-as-a-Service Market Growth

The growth of the US BaaS market is driven by several factors. Technological advancements, like cloud computing and AI, enable faster deployment and more efficient operations. Increased regulatory compliance pressures encourage financial institutions to adopt BaaS solutions to meet stringent requirements. The rising demand for embedded finance solutions from non-financial companies, like e-commerce platforms and marketplaces, further fuels market growth. Lastly, the growing preference for digital banking solutions among consumers drives adoption.

Challenges in the US Banking-as-a-Service Market Sector

Despite its growth potential, the US BaaS market faces significant challenges. Strict regulatory compliance requirements necessitate substantial investments in compliance infrastructure and expertise. Concerns about data security and privacy remain a major hurdle, requiring robust security measures to protect sensitive customer information. Maintaining the security of complex integrated systems poses operational difficulties that can be difficult and costly to resolve. Intense competition among BaaS providers creates pressure on pricing and margins.

Emerging Opportunities in US Banking-as-a-Service Market

Emerging opportunities in the US BaaS market include the expansion into under-served markets, such as small and medium-sized enterprises (SMEs). The integration of emerging technologies, like blockchain and decentralized finance (DeFi), holds significant potential. The increasing demand for personalized financial products and services presents substantial opportunities for companies offering customized BaaS solutions. Furthermore, expansion into international markets can unlock significant growth potential.

Leading Players in the US Banking-as-a-Service Market Market

- Braintree

- Boku

- Dwolla

- Square Inc (Block)

- Treasury Prime

- Moven

- Green Dot

- Synapse

- Galileo

- Marqeta

- List Not Exhaustive

Key Developments in US Banking-as-a-Service Market Industry

July 2021: Dwolla secured USD 21 Million in funding to expand its service functionality, particularly for card payments, hire talent, and expand into Canada, the UK, and Australia. This signifies a significant investment in the BaaS sector and reflects the growing market demand.

December 2021: Square officially changed its corporate name to Block, reflecting its expansion beyond credit card readers into new technologies like blockchain. This signals a strategic shift toward a broader financial technology landscape and an increased focus on innovation within the BaaS space.

Strategic Outlook for US Banking-as-a-Service Market Market

The future of the US BaaS market looks exceptionally promising. Continued technological advancements, increased regulatory clarity, and rising consumer demand for digital financial services will drive substantial growth. Opportunities exist for innovative players to capitalize on emerging trends like embedded finance, open banking, and the integration of AI and machine learning. The market is poised for significant expansion, presenting substantial opportunities for growth and investment.

US Banking-as-a-Service Market Segmentation

-

1. Component

- 1.1. Platform

-

1.2. Services

- 1.2.1. Professional Service

- 1.2.2. Managed Service

-

2. Type

- 2.1. API Based BaaS

- 2.2. Cloud Based BaaS

-

3. Enterprise

- 3.1. Large Enterprise

- 3.2. Small and Medium Enterprise

-

4. End User

- 4.1. Banks

- 4.2. Fintechs Corporations/NBFC

- 4.3. Others

US Banking-as-a-Service Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Banking-as-a-Service Market Regional Market Share

Geographic Coverage of US Banking-as-a-Service Market

US Banking-as-a-Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Increasing Digital Banking Adoption in US is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Banking-as-a-Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Platform

- 5.1.2. Services

- 5.1.2.1. Professional Service

- 5.1.2.2. Managed Service

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. API Based BaaS

- 5.2.2. Cloud Based BaaS

- 5.3. Market Analysis, Insights and Forecast - by Enterprise

- 5.3.1. Large Enterprise

- 5.3.2. Small and Medium Enterprise

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Banks

- 5.4.2. Fintechs Corporations/NBFC

- 5.4.3. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America US Banking-as-a-Service Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Platform

- 6.1.2. Services

- 6.1.2.1. Professional Service

- 6.1.2.2. Managed Service

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. API Based BaaS

- 6.2.2. Cloud Based BaaS

- 6.3. Market Analysis, Insights and Forecast - by Enterprise

- 6.3.1. Large Enterprise

- 6.3.2. Small and Medium Enterprise

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Banks

- 6.4.2. Fintechs Corporations/NBFC

- 6.4.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. South America US Banking-as-a-Service Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Platform

- 7.1.2. Services

- 7.1.2.1. Professional Service

- 7.1.2.2. Managed Service

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. API Based BaaS

- 7.2.2. Cloud Based BaaS

- 7.3. Market Analysis, Insights and Forecast - by Enterprise

- 7.3.1. Large Enterprise

- 7.3.2. Small and Medium Enterprise

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Banks

- 7.4.2. Fintechs Corporations/NBFC

- 7.4.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Europe US Banking-as-a-Service Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Platform

- 8.1.2. Services

- 8.1.2.1. Professional Service

- 8.1.2.2. Managed Service

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. API Based BaaS

- 8.2.2. Cloud Based BaaS

- 8.3. Market Analysis, Insights and Forecast - by Enterprise

- 8.3.1. Large Enterprise

- 8.3.2. Small and Medium Enterprise

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Banks

- 8.4.2. Fintechs Corporations/NBFC

- 8.4.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Middle East & Africa US Banking-as-a-Service Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Platform

- 9.1.2. Services

- 9.1.2.1. Professional Service

- 9.1.2.2. Managed Service

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. API Based BaaS

- 9.2.2. Cloud Based BaaS

- 9.3. Market Analysis, Insights and Forecast - by Enterprise

- 9.3.1. Large Enterprise

- 9.3.2. Small and Medium Enterprise

- 9.4. Market Analysis, Insights and Forecast - by End User

- 9.4.1. Banks

- 9.4.2. Fintechs Corporations/NBFC

- 9.4.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Asia Pacific US Banking-as-a-Service Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Platform

- 10.1.2. Services

- 10.1.2.1. Professional Service

- 10.1.2.2. Managed Service

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. API Based BaaS

- 10.2.2. Cloud Based BaaS

- 10.3. Market Analysis, Insights and Forecast - by Enterprise

- 10.3.1. Large Enterprise

- 10.3.2. Small and Medium Enterprise

- 10.4. Market Analysis, Insights and Forecast - by End User

- 10.4.1. Banks

- 10.4.2. Fintechs Corporations/NBFC

- 10.4.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Braintree

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Boku

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dwolla

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Square Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Treasury Prime

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Moven

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Green Dot

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Synapse

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Galileo

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Marqeta**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Braintree

List of Figures

- Figure 1: Global US Banking-as-a-Service Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America US Banking-as-a-Service Market Revenue (billion), by Component 2025 & 2033

- Figure 3: North America US Banking-as-a-Service Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America US Banking-as-a-Service Market Revenue (billion), by Type 2025 & 2033

- Figure 5: North America US Banking-as-a-Service Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America US Banking-as-a-Service Market Revenue (billion), by Enterprise 2025 & 2033

- Figure 7: North America US Banking-as-a-Service Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 8: North America US Banking-as-a-Service Market Revenue (billion), by End User 2025 & 2033

- Figure 9: North America US Banking-as-a-Service Market Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America US Banking-as-a-Service Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America US Banking-as-a-Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America US Banking-as-a-Service Market Revenue (billion), by Component 2025 & 2033

- Figure 13: South America US Banking-as-a-Service Market Revenue Share (%), by Component 2025 & 2033

- Figure 14: South America US Banking-as-a-Service Market Revenue (billion), by Type 2025 & 2033

- Figure 15: South America US Banking-as-a-Service Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: South America US Banking-as-a-Service Market Revenue (billion), by Enterprise 2025 & 2033

- Figure 17: South America US Banking-as-a-Service Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 18: South America US Banking-as-a-Service Market Revenue (billion), by End User 2025 & 2033

- Figure 19: South America US Banking-as-a-Service Market Revenue Share (%), by End User 2025 & 2033

- Figure 20: South America US Banking-as-a-Service Market Revenue (billion), by Country 2025 & 2033

- Figure 21: South America US Banking-as-a-Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe US Banking-as-a-Service Market Revenue (billion), by Component 2025 & 2033

- Figure 23: Europe US Banking-as-a-Service Market Revenue Share (%), by Component 2025 & 2033

- Figure 24: Europe US Banking-as-a-Service Market Revenue (billion), by Type 2025 & 2033

- Figure 25: Europe US Banking-as-a-Service Market Revenue Share (%), by Type 2025 & 2033

- Figure 26: Europe US Banking-as-a-Service Market Revenue (billion), by Enterprise 2025 & 2033

- Figure 27: Europe US Banking-as-a-Service Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 28: Europe US Banking-as-a-Service Market Revenue (billion), by End User 2025 & 2033

- Figure 29: Europe US Banking-as-a-Service Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe US Banking-as-a-Service Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Europe US Banking-as-a-Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa US Banking-as-a-Service Market Revenue (billion), by Component 2025 & 2033

- Figure 33: Middle East & Africa US Banking-as-a-Service Market Revenue Share (%), by Component 2025 & 2033

- Figure 34: Middle East & Africa US Banking-as-a-Service Market Revenue (billion), by Type 2025 & 2033

- Figure 35: Middle East & Africa US Banking-as-a-Service Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East & Africa US Banking-as-a-Service Market Revenue (billion), by Enterprise 2025 & 2033

- Figure 37: Middle East & Africa US Banking-as-a-Service Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 38: Middle East & Africa US Banking-as-a-Service Market Revenue (billion), by End User 2025 & 2033

- Figure 39: Middle East & Africa US Banking-as-a-Service Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: Middle East & Africa US Banking-as-a-Service Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East & Africa US Banking-as-a-Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific US Banking-as-a-Service Market Revenue (billion), by Component 2025 & 2033

- Figure 43: Asia Pacific US Banking-as-a-Service Market Revenue Share (%), by Component 2025 & 2033

- Figure 44: Asia Pacific US Banking-as-a-Service Market Revenue (billion), by Type 2025 & 2033

- Figure 45: Asia Pacific US Banking-as-a-Service Market Revenue Share (%), by Type 2025 & 2033

- Figure 46: Asia Pacific US Banking-as-a-Service Market Revenue (billion), by Enterprise 2025 & 2033

- Figure 47: Asia Pacific US Banking-as-a-Service Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 48: Asia Pacific US Banking-as-a-Service Market Revenue (billion), by End User 2025 & 2033

- Figure 49: Asia Pacific US Banking-as-a-Service Market Revenue Share (%), by End User 2025 & 2033

- Figure 50: Asia Pacific US Banking-as-a-Service Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Asia Pacific US Banking-as-a-Service Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Banking-as-a-Service Market Revenue billion Forecast, by Component 2020 & 2033

- Table 2: Global US Banking-as-a-Service Market Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Global US Banking-as-a-Service Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 4: Global US Banking-as-a-Service Market Revenue billion Forecast, by End User 2020 & 2033

- Table 5: Global US Banking-as-a-Service Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global US Banking-as-a-Service Market Revenue billion Forecast, by Component 2020 & 2033

- Table 7: Global US Banking-as-a-Service Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global US Banking-as-a-Service Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 9: Global US Banking-as-a-Service Market Revenue billion Forecast, by End User 2020 & 2033

- Table 10: Global US Banking-as-a-Service Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global US Banking-as-a-Service Market Revenue billion Forecast, by Component 2020 & 2033

- Table 15: Global US Banking-as-a-Service Market Revenue billion Forecast, by Type 2020 & 2033

- Table 16: Global US Banking-as-a-Service Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 17: Global US Banking-as-a-Service Market Revenue billion Forecast, by End User 2020 & 2033

- Table 18: Global US Banking-as-a-Service Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Brazil US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global US Banking-as-a-Service Market Revenue billion Forecast, by Component 2020 & 2033

- Table 23: Global US Banking-as-a-Service Market Revenue billion Forecast, by Type 2020 & 2033

- Table 24: Global US Banking-as-a-Service Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 25: Global US Banking-as-a-Service Market Revenue billion Forecast, by End User 2020 & 2033

- Table 26: Global US Banking-as-a-Service Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: United Kingdom US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Germany US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: France US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Italy US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Spain US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Benelux US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Nordics US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global US Banking-as-a-Service Market Revenue billion Forecast, by Component 2020 & 2033

- Table 37: Global US Banking-as-a-Service Market Revenue billion Forecast, by Type 2020 & 2033

- Table 38: Global US Banking-as-a-Service Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 39: Global US Banking-as-a-Service Market Revenue billion Forecast, by End User 2020 & 2033

- Table 40: Global US Banking-as-a-Service Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Turkey US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Israel US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: GCC US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: North Africa US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: South Africa US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Global US Banking-as-a-Service Market Revenue billion Forecast, by Component 2020 & 2033

- Table 48: Global US Banking-as-a-Service Market Revenue billion Forecast, by Type 2020 & 2033

- Table 49: Global US Banking-as-a-Service Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 50: Global US Banking-as-a-Service Market Revenue billion Forecast, by End User 2020 & 2033

- Table 51: Global US Banking-as-a-Service Market Revenue billion Forecast, by Country 2020 & 2033

- Table 52: China US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: India US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Korea US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: ASEAN US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Oceania US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific US Banking-as-a-Service Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Banking-as-a-Service Market?

The projected CAGR is approximately 13.1%.

2. Which companies are prominent players in the US Banking-as-a-Service Market?

Key companies in the market include Braintree, Boku, Dwolla, Square Inc, Treasury Prime, Moven, Green Dot, Synapse, Galileo, Marqeta**List Not Exhaustive.

3. What are the main segments of the US Banking-as-a-Service Market?

The market segments include Component, Type, Enterprise, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.26 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Increasing Digital Banking Adoption in US is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In July 2021, Dwolla has raised USD 21 million in funding, which it will use to expand the functionality of its service, particularly in terms of how it integrates and provides more responsiveness to card payments; hire more talent; and begin the process of expanding its rails to more markets outside of the United States, with a focus on Canada, the United Kingdom, and Australia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Banking-as-a-Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Banking-as-a-Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Banking-as-a-Service Market?

To stay informed about further developments, trends, and reports in the US Banking-as-a-Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence