Key Insights

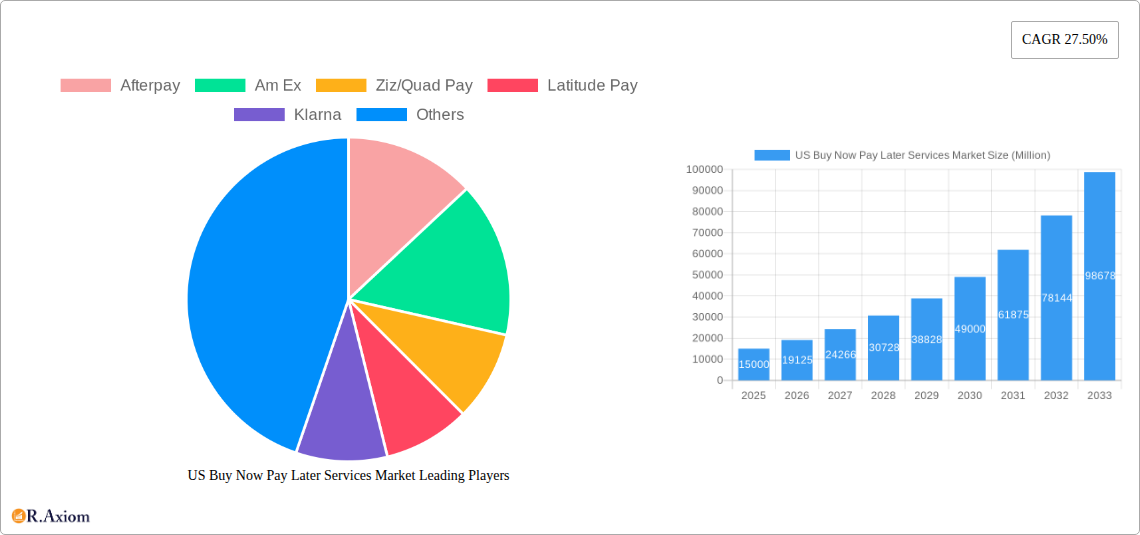

The United States Buy Now, Pay Later (BNPL) market is undergoing significant expansion, propelled by escalating consumer demand for flexible payment solutions and the pervasive growth of e-commerce. This dynamic sector is projected to reach a market size of 122.26 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 12.2% from the base year of 2025. Key growth drivers include the widespread adoption across online and Point-of-Sale (POS) channels, and substantial contributions from product categories such as kitchen appliances, electronics, fashion, and healthcare. Leading industry players, including Afterpay, Affirm, Klarna, and PayPal, are actively innovating and expanding their market presence.

US Buy Now Pay Later Services Market Market Size (In Billion)

While the BNPL market demonstrates robust growth, potential restraints such as consumer debt accumulation, regulatory oversight, and fraud risks are present. However, the industry is actively mitigating these challenges through enhanced risk management, transparent fee structures, and strategic financial partnerships. The North American region, with the U.S. at its forefront, benefits from high e-commerce penetration and a tech-savvy consumer base. Continued e-commerce growth and the increasing acceptance of BNPL by both merchants and consumers are expected to fuel substantial market expansion throughout the forecast period. Advanced BNPL features, including personalized credit limits and loyalty programs, are anticipated to further accelerate market growth.

US Buy Now Pay Later Services Market Company Market Share

US Buy Now Pay Later Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the US Buy Now Pay Later (BNPL) services market, encompassing market size, segmentation, growth drivers, challenges, and key players. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. This report is invaluable for industry stakeholders, investors, and businesses seeking to understand and capitalize on the opportunities within this rapidly evolving market.

US Buy Now Pay Later Services Market Market Concentration & Innovation

This section analyzes the competitive landscape of the US BNPL market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. The market is characterized by a moderately concentrated structure with several key players holding significant market share. However, the entry of new players and technological innovations continuously shape the competitive dynamics.

Market Share: Affirm Inc. and Klarna hold a combined xx% market share in 2025, followed by Afterpay with xx% and PayPal with xx%. Other players such as Sezzle, Splitit, and Zip/QuadPay hold smaller but significant shares.

Innovation Drivers: The key drivers of innovation are advancements in fintech, the increasing adoption of mobile payments, and the growing demand for flexible payment options among consumers. The development of AI-powered risk assessment tools and personalized financial solutions are also major factors.

Regulatory Framework: The evolving regulatory landscape, particularly concerning consumer protection and data privacy, significantly impacts market growth. Compliance requirements and potential changes in regulations pose both challenges and opportunities for players in this sector.

Product Substitutes: Credit cards and traditional installment loans remain primary substitutes for BNPL services. However, BNPL services differentiate themselves through their convenience, ease of use, and accessibility, particularly for younger demographics.

End-User Trends: The increasing preference for online shopping and omnichannel experiences fuels the adoption of BNPL services across various product categories. The growing popularity of BNPL among younger consumers also contributes significantly to market growth.

M&A Activities: The BNPL sector has witnessed substantial M&A activity in recent years, driven by strategic expansion and the consolidation of market players. While precise deal values are proprietary, significant transactions exceeding xx Million have been recorded. These mergers and acquisitions have led to increased market concentration and expansion of service offerings.

US Buy Now Pay Later Services Market Industry Trends & Insights

This section delves into the key trends and insights shaping the US BNPL market, including market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The market exhibits a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by the factors detailed below. Market penetration, as measured by the percentage of online transactions utilizing BNPL, is projected to reach xx% by 2033, up from xx% in 2025.

The increasing adoption of e-commerce and the preference for flexible payment options are primary drivers of market expansion. Technological advancements, such as embedded finance and the integration of BNPL into existing payment platforms, are reshaping the industry. Consumer preference for seamless checkout experiences and transparent pricing also influences market trends. The intensified competition among providers necessitates ongoing innovation and differentiation strategies.

Dominant Markets & Segments in US Buy Now Pay Later Services Market

This section identifies the leading segments within the US BNPL market based on application (online vs. POS) and product category.

By Application: The online segment dominates the market, driven by the exponential growth of e-commerce. POS (Point of Sale) BNPL is also growing rapidly, especially in sectors like fashion and electronics. This growth is fueled by the convenience of integrating BNPL directly into retail transactions.

By Product Category: The fashion and personal care sector leads in BNPL adoption, followed by other electronic appliances (TVs, mobiles, laptops, tablets), and kitchen appliances. These sectors exhibit high average order values and benefit from the affordability provided by BNPL. The healthcare segment shows promising but moderate growth as BNPL is adopted for high-value medical procedures.

Key Drivers:

- Economic Policies: Favorable lending regulations and consumer-friendly financial policies promote BNPL adoption.

- Infrastructure: Robust digital infrastructure and widespread internet penetration facilitate the seamless use of BNPL services.

The dominance of online BNPL is attributed to its seamless integration with e-commerce platforms and broader reach, while the strong performance of certain product categories highlights the specific consumer preferences and purchasing behaviors influencing BNPL adoption.

US Buy Now Pay Later Services Market Product Developments

Recent product innovations include improved risk assessment algorithms, personalized repayment plans, and the integration of BNPL with loyalty programs. These developments enhance the user experience and improve the overall market fit by addressing consumer needs for flexibility and affordability. The integration of BNPL with other financial services, such as budgeting tools and financial management apps, is another significant trend. These innovations aim to increase customer loyalty and responsible spending.

Report Scope & Segmentation Analysis

This report segments the US BNPL market by application (online and POS) and product category (kitchen appliances, other electronic appliances, fashion and personal care, healthcare, and other product categories). Each segment's growth projection, market size (in Millions), and competitive dynamics are analyzed.

Online BNPL: This segment is characterized by high growth potential, driven by the expansion of e-commerce.

POS BNPL: This segment is exhibiting rapid growth as retailers integrate BNPL into their in-store checkout processes.

Product Category Segmentation: Each product category presents unique growth opportunities, with market sizes varying based on factors like average transaction value and consumer demand.

Key Drivers of US Buy Now Pay Later Services Market Growth

The growth of the US BNPL market is propelled by several factors:

Increased e-commerce adoption: The rapid growth of online shopping provides fertile ground for BNPL services.

Rising consumer demand for flexible payment options: Consumers increasingly prefer flexible payment options that align with their budgeting needs.

Technological advancements: Improved risk assessment technologies and seamless payment integrations facilitate broader market access.

Favorable regulatory environment (relative to other markets): The US regulatory environment, while evolving, remains relatively conducive to BNPL growth compared to some other countries.

Challenges in the US Buy Now Pay Later Services Market Sector

The US BNPL market faces several challenges:

Regulatory uncertainty: Changes in regulations concerning consumer protection and data privacy could negatively impact market growth. Uncertainty around future regulatory changes can create hesitancy for investors and expansion.

Credit risk: The inherent risk of consumer defaults needs to be carefully managed. Increasing defaults could negatively impact the profitability of BNPL providers.

Intense competition: The market's high competitive intensity necessitates continuous innovation and differentiation to remain competitive. Profit margins can be compressed due to competitive pricing strategies.

Emerging Opportunities in US Buy Now Pay Later Services Market

Significant opportunities exist within the US BNPL market:

Expansion into new market segments: BNPL services can be expanded into new sectors, such as healthcare and education.

Integration with other financial products: Bundling BNPL with other financial services can increase customer loyalty.

International expansion: Successful US-based BNPL providers can expand their operations to other global markets.

Leading Players in the US Buy Now Pay Later Services Market Market

- Afterpay

- Am Ex

- Zip/Quad Pay

- Latitude Pay

- Klarna

- Pay Pal

- Splitit

- Open Pay

- Sezzle

- Affirm Inc

Key Developments in US Buy Now Pay Later Services Market Industry

May 2022: Affirm and Fiserv partnered, integrating Affirm into Fiserv's Carat operating system, expanding Affirm's merchant reach.

May 2022: Afterpay partnered with Rite Aid, offering BNPL options to Rite Aid's online customers, expanding Afterpay's retail presence and customer base.

Strategic Outlook for US Buy Now Pay Later Services Market Market

The US BNPL market exhibits strong growth potential driven by sustained e-commerce growth, evolving consumer preferences, and technological innovation. Opportunities for strategic expansion through partnerships, product diversification, and international expansion will continue to shape the market landscape. Addressing regulatory challenges and managing credit risk effectively will be crucial for long-term success in this dynamic sector. The market is poised for further consolidation and evolution, requiring continuous adaptation and innovation to thrive.

US Buy Now Pay Later Services Market Segmentation

-

1. Application

- 1.1. Online

- 1.2. POS

-

2. Product Category

- 2.1. Kitchen Appliance

- 2.2. Other El

- 2.3. Fashion and Personal Care

- 2.4. Healthcare

- 2.5. Other Product Categories

US Buy Now Pay Later Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Buy Now Pay Later Services Market Regional Market Share

Geographic Coverage of US Buy Now Pay Later Services Market

US Buy Now Pay Later Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Efficient and Cost-Effective Healthcare Services

- 3.3. Market Restrains

- 3.3.1. Increasing Regulatory Scrutiny and Compliance Requirements

- 3.4. Market Trends

- 3.4.1. Income of US Households Affecting the BNPL Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Buy Now Pay Later Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online

- 5.1.2. POS

- 5.2. Market Analysis, Insights and Forecast - by Product Category

- 5.2.1. Kitchen Appliance

- 5.2.2. Other El

- 5.2.3. Fashion and Personal Care

- 5.2.4. Healthcare

- 5.2.5. Other Product Categories

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America US Buy Now Pay Later Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online

- 6.1.2. POS

- 6.2. Market Analysis, Insights and Forecast - by Product Category

- 6.2.1. Kitchen Appliance

- 6.2.2. Other El

- 6.2.3. Fashion and Personal Care

- 6.2.4. Healthcare

- 6.2.5. Other Product Categories

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America US Buy Now Pay Later Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online

- 7.1.2. POS

- 7.2. Market Analysis, Insights and Forecast - by Product Category

- 7.2.1. Kitchen Appliance

- 7.2.2. Other El

- 7.2.3. Fashion and Personal Care

- 7.2.4. Healthcare

- 7.2.5. Other Product Categories

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe US Buy Now Pay Later Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online

- 8.1.2. POS

- 8.2. Market Analysis, Insights and Forecast - by Product Category

- 8.2.1. Kitchen Appliance

- 8.2.2. Other El

- 8.2.3. Fashion and Personal Care

- 8.2.4. Healthcare

- 8.2.5. Other Product Categories

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa US Buy Now Pay Later Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online

- 9.1.2. POS

- 9.2. Market Analysis, Insights and Forecast - by Product Category

- 9.2.1. Kitchen Appliance

- 9.2.2. Other El

- 9.2.3. Fashion and Personal Care

- 9.2.4. Healthcare

- 9.2.5. Other Product Categories

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific US Buy Now Pay Later Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online

- 10.1.2. POS

- 10.2. Market Analysis, Insights and Forecast - by Product Category

- 10.2.1. Kitchen Appliance

- 10.2.2. Other El

- 10.2.3. Fashion and Personal Care

- 10.2.4. Healthcare

- 10.2.5. Other Product Categories

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Afterpay

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Am Ex

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ziz/Quad Pay

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Latitude Pay

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Klarna

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Pay Pal

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Splitit**List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Open Pay

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sezzle

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Affirm Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Afterpay

List of Figures

- Figure 1: Global US Buy Now Pay Later Services Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America US Buy Now Pay Later Services Market Revenue (billion), by Application 2025 & 2033

- Figure 3: North America US Buy Now Pay Later Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America US Buy Now Pay Later Services Market Revenue (billion), by Product Category 2025 & 2033

- Figure 5: North America US Buy Now Pay Later Services Market Revenue Share (%), by Product Category 2025 & 2033

- Figure 6: North America US Buy Now Pay Later Services Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America US Buy Now Pay Later Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America US Buy Now Pay Later Services Market Revenue (billion), by Application 2025 & 2033

- Figure 9: South America US Buy Now Pay Later Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America US Buy Now Pay Later Services Market Revenue (billion), by Product Category 2025 & 2033

- Figure 11: South America US Buy Now Pay Later Services Market Revenue Share (%), by Product Category 2025 & 2033

- Figure 12: South America US Buy Now Pay Later Services Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America US Buy Now Pay Later Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe US Buy Now Pay Later Services Market Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe US Buy Now Pay Later Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe US Buy Now Pay Later Services Market Revenue (billion), by Product Category 2025 & 2033

- Figure 17: Europe US Buy Now Pay Later Services Market Revenue Share (%), by Product Category 2025 & 2033

- Figure 18: Europe US Buy Now Pay Later Services Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe US Buy Now Pay Later Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa US Buy Now Pay Later Services Market Revenue (billion), by Application 2025 & 2033

- Figure 21: Middle East & Africa US Buy Now Pay Later Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa US Buy Now Pay Later Services Market Revenue (billion), by Product Category 2025 & 2033

- Figure 23: Middle East & Africa US Buy Now Pay Later Services Market Revenue Share (%), by Product Category 2025 & 2033

- Figure 24: Middle East & Africa US Buy Now Pay Later Services Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa US Buy Now Pay Later Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific US Buy Now Pay Later Services Market Revenue (billion), by Application 2025 & 2033

- Figure 27: Asia Pacific US Buy Now Pay Later Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific US Buy Now Pay Later Services Market Revenue (billion), by Product Category 2025 & 2033

- Figure 29: Asia Pacific US Buy Now Pay Later Services Market Revenue Share (%), by Product Category 2025 & 2033

- Figure 30: Asia Pacific US Buy Now Pay Later Services Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific US Buy Now Pay Later Services Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Buy Now Pay Later Services Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global US Buy Now Pay Later Services Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 3: Global US Buy Now Pay Later Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global US Buy Now Pay Later Services Market Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global US Buy Now Pay Later Services Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 6: Global US Buy Now Pay Later Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global US Buy Now Pay Later Services Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global US Buy Now Pay Later Services Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 12: Global US Buy Now Pay Later Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global US Buy Now Pay Later Services Market Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global US Buy Now Pay Later Services Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 18: Global US Buy Now Pay Later Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global US Buy Now Pay Later Services Market Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global US Buy Now Pay Later Services Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 30: Global US Buy Now Pay Later Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global US Buy Now Pay Later Services Market Revenue billion Forecast, by Application 2020 & 2033

- Table 38: Global US Buy Now Pay Later Services Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 39: Global US Buy Now Pay Later Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific US Buy Now Pay Later Services Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Buy Now Pay Later Services Market?

The projected CAGR is approximately 12.2%.

2. Which companies are prominent players in the US Buy Now Pay Later Services Market?

Key companies in the market include Afterpay, Am Ex, Ziz/Quad Pay, Latitude Pay, Klarna, Pay Pal, Splitit**List Not Exhaustive, Open Pay, Sezzle, Affirm Inc.

3. What are the main segments of the US Buy Now Pay Later Services Market?

The market segments include Application, Product Category.

4. Can you provide details about the market size?

The market size is estimated to be USD 122.26 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Efficient and Cost-Effective Healthcare Services.

6. What are the notable trends driving market growth?

Income of US Households Affecting the BNPL Market.

7. Are there any restraints impacting market growth?

Increasing Regulatory Scrutiny and Compliance Requirements.

8. Can you provide examples of recent developments in the market?

In May 2022, Affirm and Fiserv announced a partnership to make Affirm available to Fiserv enterprise merchant clients by the end of the year. With this partnership, Affirm will become the first buy now pay later provider fully integrated into the Carat operating system from Fiserv.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Buy Now Pay Later Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Buy Now Pay Later Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Buy Now Pay Later Services Market?

To stay informed about further developments, trends, and reports in the US Buy Now Pay Later Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence