Key Insights

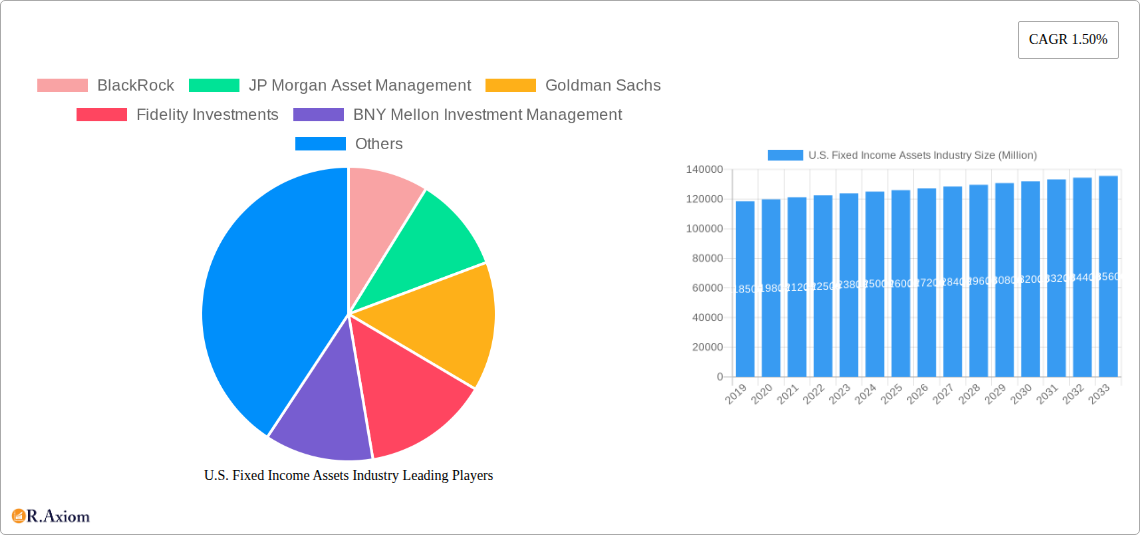

The U.S. Fixed Income Assets Industry is poised for steady, albeit modest, growth, with an estimated market size of approximately $125 trillion in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 1.50% through 2033. This sustained expansion is primarily driven by the persistent demand for capital preservation and predictable income streams from a diverse investor base, including retail investors, substantial pension funds, insurance companies, and conservative banking institutions. In an environment characterized by evolving economic conditions and a continuous search for stable returns, fixed income assets offer a crucial diversification tool and a hedge against market volatility. The increasing sophistication of financial products and the ongoing integration of technology within asset management are also contributing factors, enabling more efficient access and management of these assets.

U.S. Fixed Income Assets Industry Market Size (In Billion)

However, the industry faces notable restraints, including prevailing low-interest rate environments that can cap yield potential and the growing allure of alternative investments promising higher returns, albeit with increased risk. Regulatory changes and evolving compliance landscapes also present ongoing challenges for asset managers. Despite these headwinds, key trends such as the increasing prominence of Exchange Traded Funds (ETFs) for fixed income exposure, the growing allocation towards corporate bonds driven by their higher yields, and the continued importance of money market instruments for liquidity management are shaping the market. The dominance of the U.S. market within this sector is a significant characteristic, reflecting its deep and liquid financial markets. Asset managers like BlackRock, JP Morgan Asset Management, and Vanguard are expected to continue their leadership positions, leveraging their scale and expertise to navigate market dynamics and capitalize on investor needs.

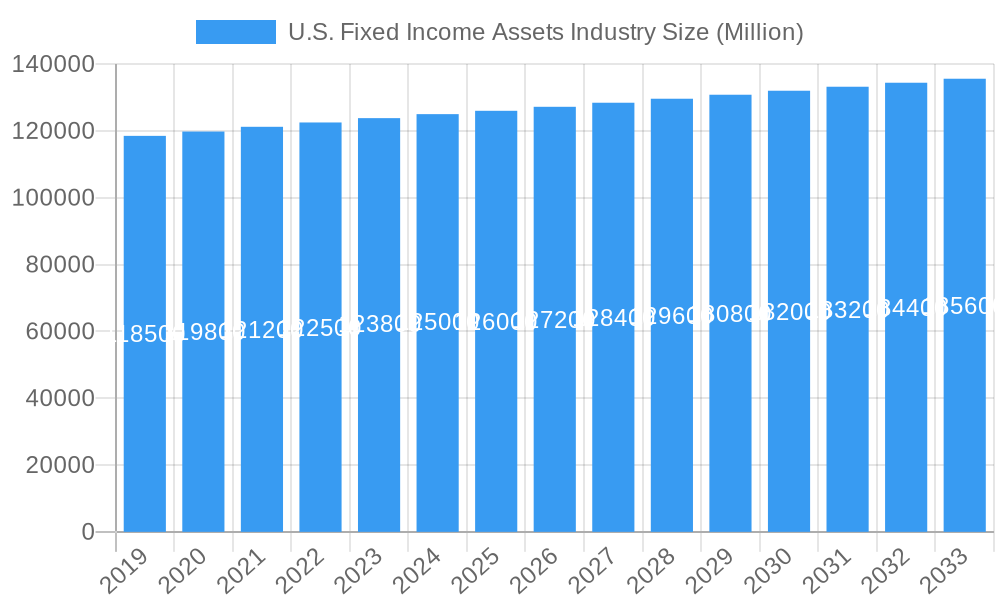

U.S. Fixed Income Assets Industry Company Market Share

U.S. Fixed Income Assets Industry Market Concentration & Innovation

The U.S. Fixed Income Assets Industry is characterized by a high degree of market concentration, with a few dominant players managing substantial assets under management (AUM). Leading firms like BlackRock (managing over $9 Million in fixed income AUM), JP Morgan Asset Management ($7 Million), Fidelity Investments ($6 Million), and The Vanguard Group ($8 Million) command significant market share. Innovation in this sector is primarily driven by the development of sophisticated financial instruments, enhanced data analytics for risk management, and the integration of technology to streamline trading and reporting. Regulatory frameworks, such as those overseen by the Securities and Exchange Commission (SEC) and the Federal Reserve, play a crucial role in shaping market operations and investor protection, ensuring market stability. Product substitutes, including equities and alternative investments, offer investors diversification options, influencing demand for fixed income products. End-user trends indicate a growing demand for stable, income-generating assets, particularly from pension funds and insurance companies seeking to meet long-term liabilities. Mergers and acquisitions (M&A) activity is robust, with significant deal values, such as BlackRock's reported $XX Million acquisition of Global Infrastructure Partners (GIP), underscoring the industry's consolidation and strategic expansion efforts. This ongoing consolidation suggests a future landscape where fewer, larger entities will manage a greater proportion of fixed income assets.

U.S. Fixed Income Assets Industry Industry Trends & Insights

The U.S. Fixed Income Assets Industry is poised for substantial growth, projected to experience a Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2025 to 2033, reaching an estimated market size of $XX Trillion by 2033. This growth is propelled by several key factors. Firstly, a persistent low-interest-rate environment, despite recent hikes, continues to drive demand for yield-seeking investments, making fixed income an attractive option for investors looking to preserve capital and generate steady income. The demographic shift towards an aging population also fuels demand for retirement-focused products, where fixed income plays a vital role in wealth preservation and income generation for retirees. Technological disruptions are fundamentally reshaping the industry. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is enhancing algorithmic trading, portfolio optimization, and risk assessment, leading to more efficient and sophisticated investment strategies. Blockchain technology is emerging as a potential disrupter, promising to improve the transparency, security, and efficiency of bond issuance, trading, and settlement processes. Consumer preferences are evolving, with a growing emphasis on Environmental, Social, and Governance (ESG) investing. Investors are increasingly seeking fixed income products that align with their values, leading to a surge in demand for green bonds, social bonds, and sustainability-linked bonds. This trend is compelling asset managers to integrate ESG factors into their investment decisions and product offerings. Competitive dynamics are intensifying, with established players investing heavily in technology and talent to maintain their market positions. New entrants, particularly fintech companies, are challenging traditional models with innovative digital platforms and user-centric solutions. This competitive pressure is driving down fees and improving the accessibility of fixed income investments for a broader range of investors. The market penetration of exchange-traded funds (ETFs) in the fixed income space continues to expand, offering retail investors a cost-effective and diversified way to access various bond segments. The industry is also witnessing increased interest in private credit, as institutional investors seek higher yields and diversification beyond traditional public markets. The ongoing evolution of regulatory landscapes, both domestically and internationally, will continue to shape investment strategies and product development, with a focus on enhancing transparency and investor protection. The resilience of the U.S. economy, coupled with the dollar's status as a global reserve currency, provides a stable foundation for the continued growth and appeal of U.S. fixed income assets.

Dominant Markets & Segments in U.S. Fixed Income Assets Industry

The U.S. Fixed Income Assets Industry exhibits significant dominance across various client types and asset classes, driven by a confluence of economic policies, infrastructure development, and evolving investor needs.

Dominant Client Types:

- Pension Funds: These entities are consistently the largest institutional investors in U.S. fixed income. Their long-term liabilities and need for predictable income streams make bonds a core component of their portfolios. Economic policies that encourage long-term investment and the stability of the U.S. market make it an attractive destination. The sheer scale of pension fund assets, estimated to be over $XX Trillion, translates to substantial demand for fixed income instruments.

- Insurance Companies: Similar to pension funds, insurance companies require stable, income-generating assets to meet their policyholder obligations. The predictable cash flows from fixed income securities align perfectly with their long-term financial planning. Regulatory requirements often mandate a significant allocation to conservative assets like bonds, further solidifying their dominance in this segment. Their AUM in fixed income is estimated to be in the range of $XX Trillion.

- Banks: Banks invest heavily in fixed income for liquidity management, regulatory capital requirements, and as a counterparty in various financial transactions. The demand from the banking sector for Treasury bonds and other highly liquid instruments is a constant. Their AUM in this sector is estimated to be around $XX Trillion.

- Retail Investors: While individual retail investors may manage smaller individual portfolios, their collective investment through mutual funds and ETFs contributes significantly to the market. The accessibility and perceived safety of fixed income products appeal to a broad range of retail investors, especially those nearing or in retirement. The overall retail AUM in fixed income is estimated to be $XX Trillion.

- Other Client Types: This broad category includes endowments, foundations, sovereign wealth funds, and hedge funds, all of which allocate a portion of their capital to fixed income for diversification, yield enhancement, and risk mitigation. Their collective investment is estimated to be in the range of $XX Trillion.

Dominant Asset Classes:

- Bonds: This overarching category, encompassing government bonds (Treasuries), corporate bonds, municipal bonds, and mortgage-backed securities, represents the largest segment. The U.S. Treasury market, in particular, is the deepest and most liquid bond market globally, attracting immense interest. The total market value of outstanding U.S. bonds is estimated to exceed $XX Trillion.

- Money Market Instruments (includes Mutual Funds): These short-term, highly liquid debt instruments are crucial for cash management and capital preservation. Money market mutual funds, popular among both institutional and retail investors, represent a significant portion of this segment. Their market size is estimated to be in the range of $XX Trillion.

- ETFs: Fixed Income Exchange-Traded Funds (ETFs) have experienced explosive growth, offering investors diversified exposure to various bond markets at low costs. They have become a primary vehicle for retail and increasingly institutional investors to access fixed income. The AUM in fixed income ETFs is estimated to be $XX Trillion.

- Other Asset Class: This can include specialized fixed income products, structured products, and emerging market debt. While smaller in overall size compared to core bond categories, these segments offer diversification and higher yield potential, attracting specific investor profiles.

The dominance of these segments is driven by the fundamental role of fixed income in wealth preservation, income generation, and portfolio diversification within the U.S. financial system.

U.S. Fixed Income Assets Industry Product Developments

Product development in the U.S. Fixed Income Assets Industry is increasingly focused on meeting investor demand for yield, customization, and ESG integration. Innovations include the proliferation of fixed income ETFs offering targeted exposure to specific sectors, durations, and credit qualities, enhancing accessibility and diversification. The rise of sustainable finance has spurred the development of green bonds, social bonds, and sustainability-linked bonds, allowing investors to align their financial goals with environmental and social impact. Additionally, advancements in data analytics and AI are enabling the creation of more sophisticated structured products and actively managed strategies designed to optimize risk-adjusted returns in dynamic market conditions.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the U.S. Fixed Income Assets Industry, segmented by Client Type and Asset Class. The Client Type segments include Retail, Pension Funds, Insurance Companies, Banks, and Other Client Types, each with unique investment objectives and risk appetites. The Asset Class segmentation covers Bonds, Money Market Instruments (including Mutual Funds), ETFs, and Other Asset Classes, reflecting the diverse instruments available. Growth projections for each segment indicate varying rates of expansion, influenced by prevailing economic conditions and investor preferences. Market sizes within each segment are estimated based on current AUM and projected inflows, with competitive dynamics analyzed for each.

Key Drivers of U.S. Fixed Income Assets Industry Growth

Several key drivers are fueling the growth of the U.S. Fixed Income Assets Industry. Economic Stability and Policy: The U.S. economy's relative stability and the dollar's global reserve status create a consistent demand for U.S. debt. Demographic Shifts: An aging population is increasing demand for stable, income-producing assets for retirement planning. Monetary Policy: While interest rates have risen, periods of low rates previously spurred search for yield, and current rates offer attractive income opportunities. Technological Advancements: Fintech innovations are enhancing accessibility, efficiency, and product development. Investor Demand for Diversification: Fixed income remains a crucial tool for diversifying investment portfolios across asset classes.

Challenges in the U.S. Fixed Income Assets Industry Sector

The U.S. Fixed Income Assets Industry faces several challenges. Interest Rate Volatility: Rising interest rates can devalue existing bond holdings, impacting portfolio performance and investor sentiment. Inflationary Pressures: Persistent inflation erodes the real return of fixed income investments, especially for those with lower yields. Regulatory Complexity: Evolving regulations, while aimed at investor protection, can increase compliance costs and operational burdens for asset managers. Competition from Other Asset Classes: Equities and alternative investments can offer higher potential returns, drawing capital away from fixed income. Cybersecurity Risks: The increasing reliance on digital platforms exposes the industry to potential cyber threats and data breaches.

Emerging Opportunities in U.S. Fixed Income Assets Industry

Emerging opportunities in the U.S. Fixed Income Assets Industry include the burgeoning market for ESG-aligned fixed income products, such as green and social bonds. The growth of private credit markets offers alternative yield opportunities for institutional investors seeking diversification beyond traditional public markets. Tokenization of fixed income assets on blockchain technology presents a future opportunity for increased efficiency, liquidity, and accessibility. Furthermore, the ongoing demand for income-generating products from a growing retiree population and the increasing sophistication of fixed income ETFs and structured products present significant avenues for growth and innovation.

Leading Players in the U.S. Fixed Income Assets Industry Market

- BlackRock

- JP Morgan Asset Management

- Goldman Sachs

- Fidelity Investments

- BNY Mellon Investment Management

- The Vanguard Group

- State Street Global Advisors

- Pacific Investment Management Company LLC

- Prudential Financial

- Capital Research & Management Company

- Franklin Templeton Investments

- Northern Trust Global Investments

Key Developments in U.S. Fixed Income Assets Industry Industry

- January 2024: BlackRock finalized an agreement to acquire Global Infrastructure Partners (GIP), a significant move positioning it as a dominant player in the global infrastructure private markets investment landscape, potentially impacting fixed income allocation strategies for infrastructure projects.

- October 2023: pvest, a Berlin-based fintech company, partnered with BlackRock to enhance investing accessibility for millions of Europeans through its all-in-one API for digital wealth management. This collaboration highlights the trend of fintech integration and expanded reach for asset managers in the fixed income space. pvest also secured €30 million in investments, underscoring confidence in the digital wealth management sector.

Strategic Outlook for U.S. Fixed Income Assets Industry Market

The strategic outlook for the U.S. Fixed Income Assets Industry is one of continued resilience and adaptation. The industry will focus on leveraging technological advancements to enhance operational efficiency and product innovation, particularly in areas like AI-driven analytics and blockchain applications. The increasing demand for ESG-compliant investments will drive the development and marketing of sustainable fixed income products. Furthermore, asset managers will strategically expand their offerings in private credit and alternative fixed income strategies to cater to the evolving needs of institutional and sophisticated retail investors seeking diversification and enhanced yields. Navigating interest rate sensitivity and inflationary pressures will require sophisticated risk management and active portfolio construction.

U.S. Fixed Income Assets Industry Segmentation

-

1. Client Type

- 1.1. Retail

- 1.2. Pension Funds

- 1.3. Insurance Companies

- 1.4. Banks

- 1.5. Other Client Types

-

2. Asset Class

- 2.1. Bonds

- 2.2. Money Market Instruments (includes Mutual Funds)

- 2.3. ETF

- 2.4. Other Asset Class

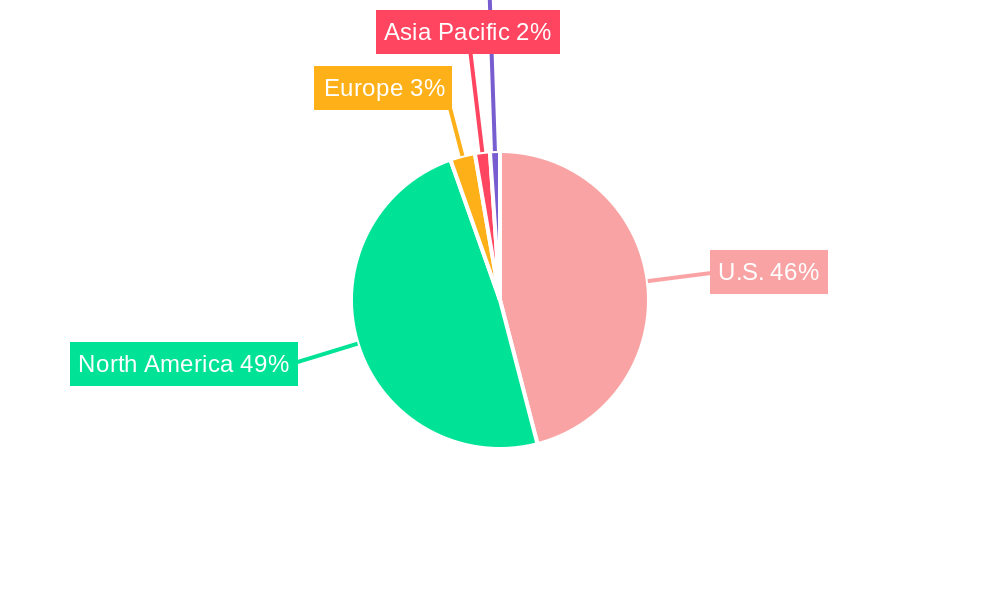

U.S. Fixed Income Assets Industry Segmentation By Geography

- 1. U.S.

U.S. Fixed Income Assets Industry Regional Market Share

Geographic Coverage of U.S. Fixed Income Assets Industry

U.S. Fixed Income Assets Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Distribution of US Fixed Income Assets - By Investment Style

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. U.S. Fixed Income Assets Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 5.1.1. Retail

- 5.1.2. Pension Funds

- 5.1.3. Insurance Companies

- 5.1.4. Banks

- 5.1.5. Other Client Types

- 5.2. Market Analysis, Insights and Forecast - by Asset Class

- 5.2.1. Bonds

- 5.2.2. Money Market Instruments (includes Mutual Funds)

- 5.2.3. ETF

- 5.2.4. Other Asset Class

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. U.S.

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BlackRock

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JP Morgan Asset Management

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Goldman Sachs

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fidelity Investments

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BNY Mellon Investment Management

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Vanguard Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 State Street Global Advisors

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pacific Investment Management Company LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Prudential Financial

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Capital Research & Management Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Franklin Templeton Investments

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Northern Trust Global Investments

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 BlackRock

List of Figures

- Figure 1: U.S. Fixed Income Assets Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: U.S. Fixed Income Assets Industry Share (%) by Company 2025

List of Tables

- Table 1: U.S. Fixed Income Assets Industry Revenue undefined Forecast, by Client Type 2020 & 2033

- Table 2: U.S. Fixed Income Assets Industry Revenue undefined Forecast, by Asset Class 2020 & 2033

- Table 3: U.S. Fixed Income Assets Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: U.S. Fixed Income Assets Industry Revenue undefined Forecast, by Client Type 2020 & 2033

- Table 5: U.S. Fixed Income Assets Industry Revenue undefined Forecast, by Asset Class 2020 & 2033

- Table 6: U.S. Fixed Income Assets Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the U.S. Fixed Income Assets Industry?

The projected CAGR is approximately 1.5%.

2. Which companies are prominent players in the U.S. Fixed Income Assets Industry?

Key companies in the market include BlackRock, JP Morgan Asset Management, Goldman Sachs, Fidelity Investments, BNY Mellon Investment Management, The Vanguard Group, State Street Global Advisors, Pacific Investment Management Company LLC, Prudential Financial, Capital Research & Management Company, Franklin Templeton Investments, Northern Trust Global Investments.

3. What are the main segments of the U.S. Fixed Income Assets Industry?

The market segments include Client Type, Asset Class.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Distribution of US Fixed Income Assets - By Investment Style.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2024, BlackRock has finalized an agreement to acquire Global Infrastructure Partners (GIP), a move that positions it as a dominant player in the global infrastructure private markets investment landscape.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "U.S. Fixed Income Assets Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the U.S. Fixed Income Assets Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the U.S. Fixed Income Assets Industry?

To stay informed about further developments, trends, and reports in the U.S. Fixed Income Assets Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence