Key Insights

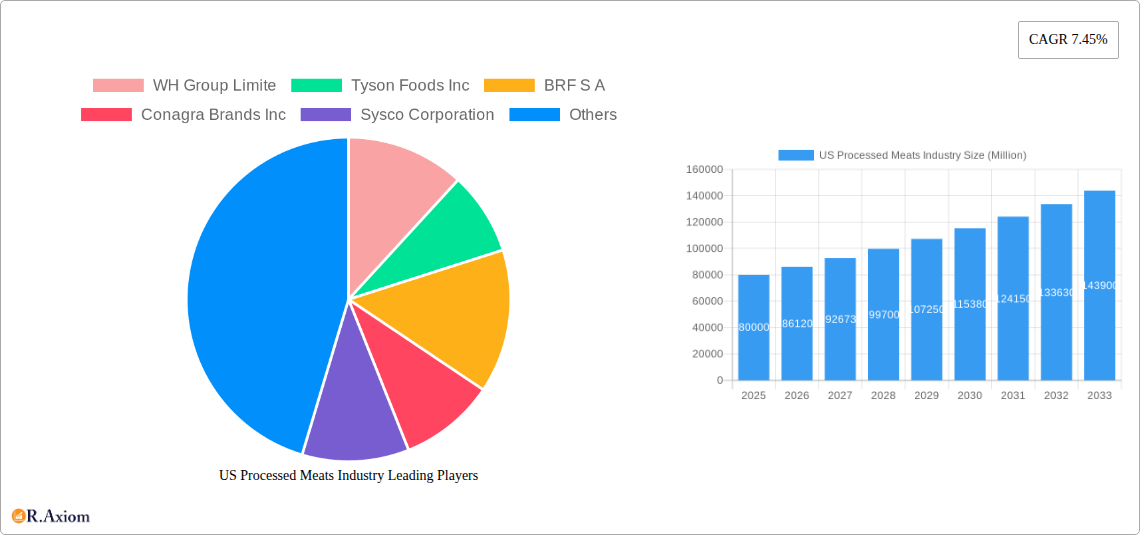

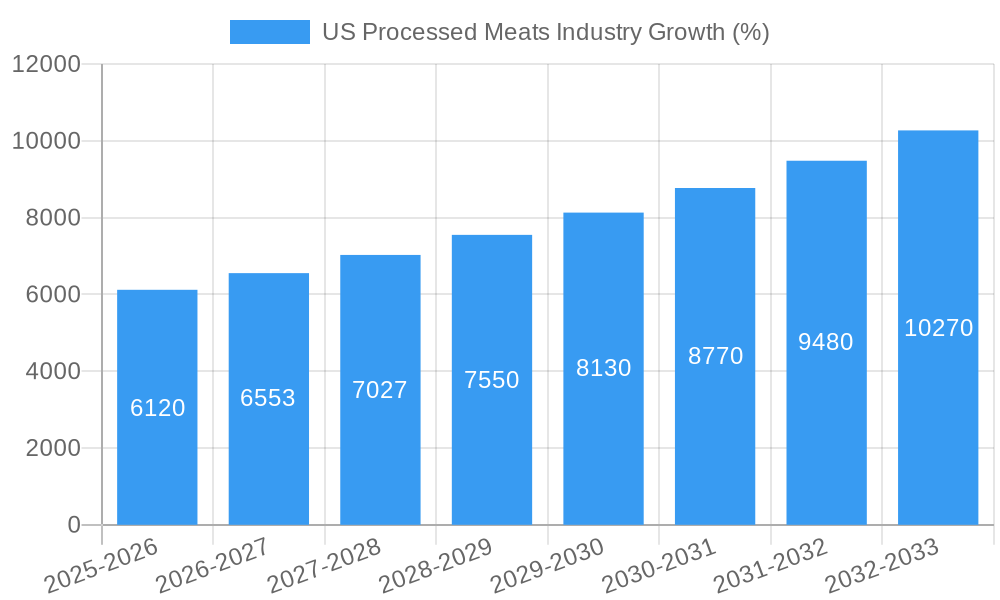

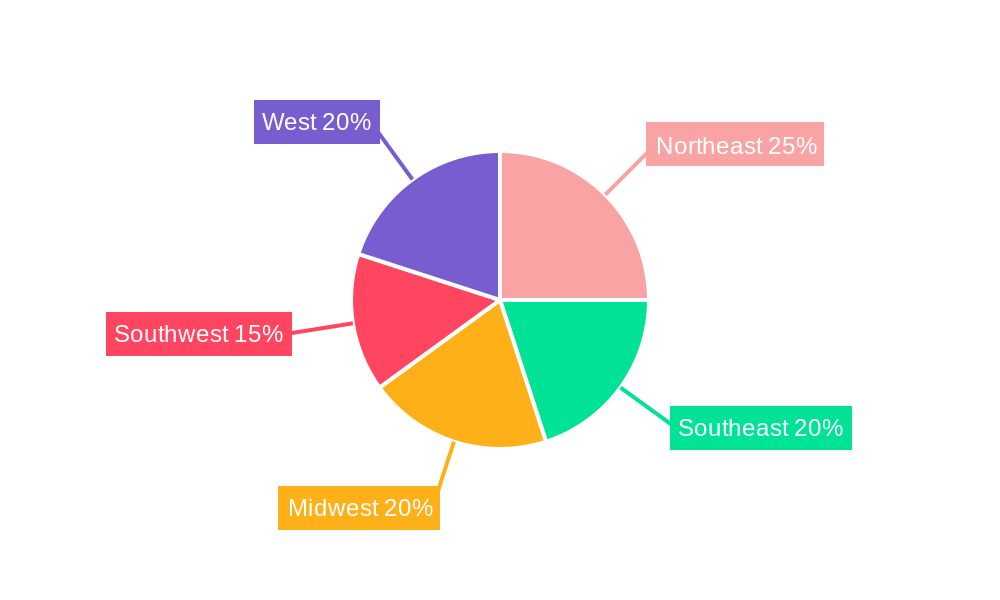

The US processed meats industry, valued at approximately $80 billion in 2025, is projected to experience robust growth, with a compound annual growth rate (CAGR) of 7.45% from 2025 to 2033. This expansion is driven by several key factors. Increasing consumer demand for convenient and ready-to-eat meal options fuels the growth of processed meats, particularly in categories like pre-packaged lunch meats, sausages, and bacon. Furthermore, the rising popularity of processed meat-based snacks and the growing food service sector contribute significantly to market expansion. Innovation in product offerings, such as healthier alternatives with reduced sodium and fat content, also plays a role in attracting health-conscious consumers. Geographic variations in consumption patterns exist, with the Northeast and West regions exhibiting higher per capita consumption compared to the South and Midwest. However, changing dietary preferences and increasing awareness of the health implications associated with high processed meat consumption pose potential restraints to market growth. The industry is segmented by meat type (beef, pork, poultry, mutton, and others), with poultry and pork likely dominating the market share due to affordability and versatility. Distribution channels include off-trade (grocery stores, supermarkets) and on-trade (restaurants, food service). Major players, including JBS SA, Tyson Foods, and Hormel Foods, are constantly striving for market dominance through strategic acquisitions, brand expansion, and innovation in product development.

The competitive landscape is characterized by both large multinational corporations and regional players. The industry's future trajectory will be significantly shaped by factors such as evolving consumer preferences (demand for sustainable and ethically sourced products), government regulations regarding food safety and labeling, and the impact of economic fluctuations on consumer spending. Successfully navigating these factors will require companies to implement adaptable strategies that prioritize innovation, sustainability, and consumer health consciousness. Continued investment in research and development of healthier and more sustainable processing techniques will be crucial for sustained growth in the processed meats market. The forecast period of 2025-2033 presents significant opportunities for growth, but requires a keen understanding of market dynamics and consumer behavior.

US Processed Meats Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the US processed meats industry, covering market size, growth drivers, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base year and a forecast period from 2025 to 2033. The report utilizes a wealth of data from the historical period (2019-2024) to project future trends and opportunities. This report is crucial for industry stakeholders, investors, and businesses looking to navigate this dynamic market.

US Processed Meats Industry Market Concentration & Innovation

The US processed meats industry is characterized by a concentrated market structure, with a few major players controlling a significant portion of the market share. Key players such as Tyson Foods Inc., JBS SA, and Hormel Foods Corporation, along with others including WH Group Limited, BRF S.A., Conagra Brands Inc., Sysco Corporation, The Kraft Heinz Company, Cargill Inc., Marfrig Global Foods S.A., and Maple Leaf Foods, dominate the landscape. Market share analysis reveals that the top 5 players collectively hold approximately xx% of the market, indicating high industry concentration. This concentration stems from economies of scale, extensive distribution networks, and strong brand recognition.

Innovation in the industry focuses on enhancing product quality, extending shelf life, and catering to evolving consumer preferences for healthier and convenient options. This includes the development of reduced-sodium, organic, and antibiotic-free products. Regulatory frameworks, such as food safety regulations (e.g., the Food Safety Modernization Act), play a crucial role in shaping industry practices. The industry faces competitive pressure from product substitutes like plant-based meat alternatives, requiring continuous innovation to maintain market share. Furthermore, mergers and acquisitions (M&A) activity is prevalent, as larger companies seek to expand their market reach and product portfolios. Recent M&A deal values have averaged approximately USD xx Million, driven by strategic consolidation and expansion into new segments.

US Processed Meats Industry Industry Trends & Insights

The US processed meats industry exhibits a complex interplay of factors impacting its growth trajectory. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected to be xx%, driven by several key trends. Increasing consumer demand for convenient and ready-to-eat meals fuels significant market growth, with a xx% market penetration for convenience foods within the processed meats sector. Technological advancements in processing and packaging enhance efficiency and product quality. Shifting consumer preferences towards healthier options, such as leaner meats and organic products, are reshaping the product landscape. The industry is experiencing technological disruptions, with the adoption of automation and data analytics enhancing operational efficiency and product traceability. Competitive dynamics remain intense, with established players and emerging brands vying for market share. Price fluctuations in raw materials, alongside evolving consumer preferences, impact the competitive dynamics, with strategic pricing and product differentiation influencing market share gains.

Dominant Markets & Segments in US Processed Meats Industry

The US processed meats market is dominated by the Off-Trade distribution channel, accounting for approximately xx% of total sales in 2025. This dominance reflects the high volume of processed meat products sold through grocery stores, supermarkets, and other retail outlets. In terms of product type, Poultry holds a leading position, accounting for approximately xx% of market share in 2025, driven by its affordability and versatility. Within geographical segmentation, the Midwest region remains the most significant market, due to factors such as a large population base and a strong agricultural sector. Key drivers for this regional dominance include robust infrastructure supporting efficient processing and distribution, coupled with favorable economic conditions that stimulate consumer spending.

- Key Drivers for Off-Trade Dominance: Extensive retail network, established distribution channels, and consumer preference for purchasing groceries at retail outlets.

- Key Drivers for Poultry Segment Dominance: Affordability, versatility in culinary applications, and growing consumer awareness of its relatively healthier profile compared to other meats.

- Key Drivers for Midwest Region Dominance: Established agricultural base, efficient infrastructure, and strong consumer demand.

US Processed Meats Industry Product Developments

Recent product innovations highlight the industry's focus on convenience, health, and taste. The introduction of ready-to-eat meals, including microwaveable options, caters to busy lifestyles. Companies are increasingly offering products with reduced sodium, lower fat content, and organic certifications to meet changing consumer preferences. Technological advancements are also evident in the use of advanced packaging technologies that extend shelf life and maintain product freshness. The focus is on developing products that meet consumer demands for convenience, health, and enhanced flavor, thereby gaining a significant competitive edge.

Report Scope & Segmentation Analysis

This report segments the US processed meats market based on product type (Beef, Mutton, Pork, Poultry, Other Meat) and distribution channel (Off-Trade, On-Trade). Each segment is analyzed in detail, providing insights into market size, growth projections, and competitive dynamics.

Beef: This segment is expected to grow at a CAGR of xx% during the forecast period. The market is characterized by intense competition amongst established brands.

Mutton: This segment represents a smaller portion of the overall market and exhibits a relatively slower growth rate, with a CAGR of xx%.

Pork: Similar to beef, this is a significant segment with a projected CAGR of xx%, facing competition from other meat types.

Poultry: The fastest-growing segment, with a projected CAGR of xx%, driven by consumer preference for its affordability and health perceptions.

Other Meat: This segment encompasses processed meats not categorized above and is anticipated to grow at a CAGR of xx%.

Off-Trade: This distribution channel dominates the market, exhibiting a projected CAGR of xx% during the forecast period.

On-Trade: This segment, encompassing restaurants and food service establishments, is expected to grow at a CAGR of xx%.

Key Drivers of US Processed Meats Industry Growth

Several key factors contribute to the growth of the US processed meats industry. Firstly, rising disposable incomes and changing lifestyles are driving demand for convenient ready-to-eat and ready-to-cook meals. Secondly, technological advancements in food processing and preservation technologies enhance efficiency and product quality. Finally, government policies supporting the agricultural sector and facilitating trade are further boosting industry growth.

Challenges in the US Processed Meats Industry Sector

The industry faces challenges including stringent food safety regulations that increase compliance costs. Supply chain disruptions and fluctuations in raw material prices impact profitability. Intense competition from both established players and new entrants, along with the rise of plant-based alternatives, creates significant competitive pressure. These challenges, if not addressed effectively, could limit market growth by approximately xx% in the coming years.

Emerging Opportunities in US Processed Meats Industry

Emerging opportunities exist in the growing demand for organic and sustainably sourced products, along with specialized products catering to specific dietary needs and preferences. Technological advancements in alternative protein sources and customized packaging provide opportunities for growth. Expanding into new markets and focusing on product innovation will be crucial to capture market share and accelerate revenue growth.

Leading Players in the US Processed Meats Industry Market

- WH Group Limited

- Tyson Foods Inc

- BRF S A

- Conagra Brands Inc

- Sysco Corporation

- The Kraft Heinz Company

- Hormel Foods Corporation

- Cargill Inc

- Marfrig Global Foods S A

- Maple Leaf Foods

- JBS SA

Key Developments in US Processed Meats Industry Industry

May 2023: Tyson Foods Claryville's USD 83 Million expansion increases cocktail sausage production by 50%, boosting Hillshire Farm brand capacity and meeting high customer demand. This signals a strong commitment to serving the growing demand for processed meats.

April 2023: Launch of HERDEZ™ Mexican Refrigerated Entrées line expands product offerings in the convenient ready-to-eat segment. This demonstrates a focus on consumer preferences for flavorful and convenient meals.

March 2023: Tyson® brand introduces chicken sandwiches and sliders, a move catering to consumers’ desires for restaurant-quality convenience foods at home. This expands market reach in the frozen snacks category.

Strategic Outlook for US Processed Meats Industry Market

The US processed meats industry is poised for continued growth, driven by rising consumer demand for convenient and ready-to-eat options. Technological innovation, sustainable practices, and strategic product development will shape future market potential. The focus on health-conscious products, combined with efficient production and distribution, will be crucial for companies to maintain a competitive edge and capture increasing market share in the years to come.

US Processed Meats Industry Segmentation

-

1. Type

- 1.1. Beef

- 1.2. Mutton

- 1.3. Pork

- 1.4. Poultry

- 1.5. Other Meat

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Channel

- 2.1.3. Supermarkets and Hypermarkets

- 2.1.4. Others

- 2.2. On-Trade

-

2.1. Off-Trade

US Processed Meats Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Processed Meats Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Processed Meats Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Beef

- 5.1.2. Mutton

- 5.1.3. Pork

- 5.1.4. Poultry

- 5.1.5. Other Meat

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Channel

- 5.2.1.3. Supermarkets and Hypermarkets

- 5.2.1.4. Others

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America US Processed Meats Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Beef

- 6.1.2. Mutton

- 6.1.3. Pork

- 6.1.4. Poultry

- 6.1.5. Other Meat

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Off-Trade

- 6.2.1.1. Convenience Stores

- 6.2.1.2. Online Channel

- 6.2.1.3. Supermarkets and Hypermarkets

- 6.2.1.4. Others

- 6.2.2. On-Trade

- 6.2.1. Off-Trade

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America US Processed Meats Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Beef

- 7.1.2. Mutton

- 7.1.3. Pork

- 7.1.4. Poultry

- 7.1.5. Other Meat

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Off-Trade

- 7.2.1.1. Convenience Stores

- 7.2.1.2. Online Channel

- 7.2.1.3. Supermarkets and Hypermarkets

- 7.2.1.4. Others

- 7.2.2. On-Trade

- 7.2.1. Off-Trade

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe US Processed Meats Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Beef

- 8.1.2. Mutton

- 8.1.3. Pork

- 8.1.4. Poultry

- 8.1.5. Other Meat

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Off-Trade

- 8.2.1.1. Convenience Stores

- 8.2.1.2. Online Channel

- 8.2.1.3. Supermarkets and Hypermarkets

- 8.2.1.4. Others

- 8.2.2. On-Trade

- 8.2.1. Off-Trade

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa US Processed Meats Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Beef

- 9.1.2. Mutton

- 9.1.3. Pork

- 9.1.4. Poultry

- 9.1.5. Other Meat

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Off-Trade

- 9.2.1.1. Convenience Stores

- 9.2.1.2. Online Channel

- 9.2.1.3. Supermarkets and Hypermarkets

- 9.2.1.4. Others

- 9.2.2. On-Trade

- 9.2.1. Off-Trade

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific US Processed Meats Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Beef

- 10.1.2. Mutton

- 10.1.3. Pork

- 10.1.4. Poultry

- 10.1.5. Other Meat

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Off-Trade

- 10.2.1.1. Convenience Stores

- 10.2.1.2. Online Channel

- 10.2.1.3. Supermarkets and Hypermarkets

- 10.2.1.4. Others

- 10.2.2. On-Trade

- 10.2.1. Off-Trade

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Northeast US Processed Meats Industry Analysis, Insights and Forecast, 2019-2031

- 12. Southeast US Processed Meats Industry Analysis, Insights and Forecast, 2019-2031

- 13. Midwest US Processed Meats Industry Analysis, Insights and Forecast, 2019-2031

- 14. Southwest US Processed Meats Industry Analysis, Insights and Forecast, 2019-2031

- 15. West US Processed Meats Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 WH Group Limite

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Tyson Foods Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 BRF S A

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Conagra Brands Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Sysco Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 The Kraft Heinz Company

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Hormel Foods Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Cargill Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Marfrig Global Foods S A

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Maple Leaf Foods

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 JBS SA

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 WH Group Limite

List of Figures

- Figure 1: Global US Processed Meats Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United states US Processed Meats Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: United states US Processed Meats Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America US Processed Meats Industry Revenue (Million), by Type 2024 & 2032

- Figure 5: North America US Processed Meats Industry Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America US Processed Meats Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 7: North America US Processed Meats Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 8: North America US Processed Meats Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: North America US Processed Meats Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America US Processed Meats Industry Revenue (Million), by Type 2024 & 2032

- Figure 11: South America US Processed Meats Industry Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America US Processed Meats Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 13: South America US Processed Meats Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 14: South America US Processed Meats Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: South America US Processed Meats Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe US Processed Meats Industry Revenue (Million), by Type 2024 & 2032

- Figure 17: Europe US Processed Meats Industry Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe US Processed Meats Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 19: Europe US Processed Meats Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 20: Europe US Processed Meats Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe US Processed Meats Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa US Processed Meats Industry Revenue (Million), by Type 2024 & 2032

- Figure 23: Middle East & Africa US Processed Meats Industry Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa US Processed Meats Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: Middle East & Africa US Processed Meats Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: Middle East & Africa US Processed Meats Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa US Processed Meats Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific US Processed Meats Industry Revenue (Million), by Type 2024 & 2032

- Figure 29: Asia Pacific US Processed Meats Industry Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific US Processed Meats Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 31: Asia Pacific US Processed Meats Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 32: Asia Pacific US Processed Meats Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific US Processed Meats Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global US Processed Meats Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global US Processed Meats Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global US Processed Meats Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global US Processed Meats Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global US Processed Meats Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Northeast US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Southeast US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Midwest US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Southwest US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global US Processed Meats Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Global US Processed Meats Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: Global US Processed Meats Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global US Processed Meats Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Global US Processed Meats Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 19: Global US Processed Meats Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Argentina US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of South America US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global US Processed Meats Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Global US Processed Meats Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 25: Global US Processed Meats Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United Kingdom US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Germany US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: France US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Italy US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Spain US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Russia US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Benelux US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Nordics US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Europe US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global US Processed Meats Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 36: Global US Processed Meats Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 37: Global US Processed Meats Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Turkey US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Israel US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: GCC US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: North Africa US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Africa US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Middle East & Africa US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global US Processed Meats Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 45: Global US Processed Meats Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 46: Global US Processed Meats Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 47: China US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: ASEAN US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Oceania US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Asia Pacific US Processed Meats Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Processed Meats Industry?

The projected CAGR is approximately 7.45%.

2. Which companies are prominent players in the US Processed Meats Industry?

Key companies in the market include WH Group Limite, Tyson Foods Inc, BRF S A, Conagra Brands Inc, Sysco Corporation, The Kraft Heinz Company, Hormel Foods Corporation, Cargill Inc, Marfrig Global Foods S A, Maple Leaf Foods, JBS SA.

3. What are the main segments of the US Processed Meats Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

May 2023: Tyson Foods Claryville announced its newly expanded cocktail sausage manufacturing capacity, allowing the company to meet high customer demand for its Hillshire Farm brand products. This USD 83 million expansion will add 15,000 square feet to its 342,000 square foot facility and state-of-the-art equipment to increase production by 50% to better serve customers.April 2023: The makers of the HERDEZ® brand announced the launch of its HERDEZ™ Mexican Refrigerated Entrées line with two delicious varieties, including HERDEZ™ Chicken Shredded in Mild Chipotle Sauce and HERDEZ™ Carnitas Slow Cooked Pork.March 2023: Tyson® brand introduces chicken sandwiches and sliders, bringing restaurant-quality taste to home. The new Tyson Chicken Breast Sandwiches and Sliders are available in Original and Spicy. The new product is available in the frozen snacks section at retailers nationwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Processed Meats Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Processed Meats Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Processed Meats Industry?

To stay informed about further developments, trends, and reports in the US Processed Meats Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence