Key Insights

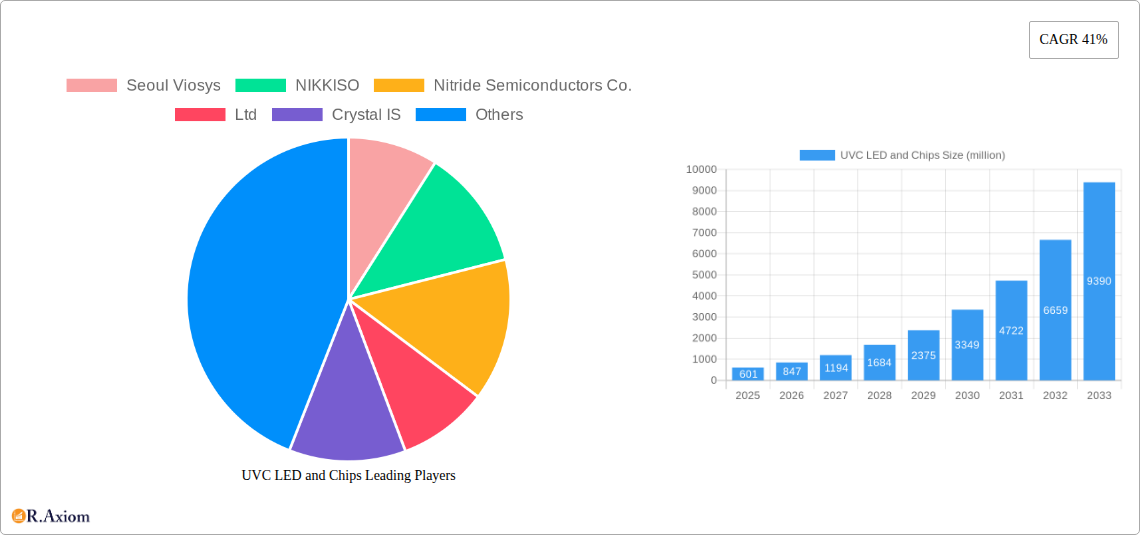

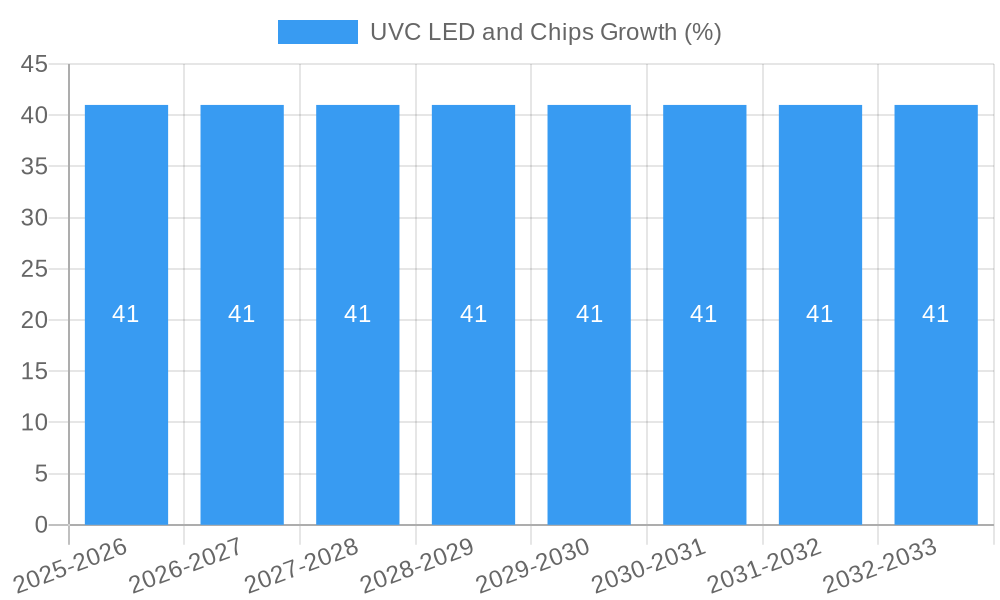

The UVC LED and Chips market is poised for explosive growth, projected to reach a significant market size of $601 million by 2025, driven by an unprecedented Compound Annual Growth Rate (CAGR) of 41%. This surge is underpinned by the escalating global demand for effective disinfection and sterilization solutions across a myriad of applications. The Water/Air Disinfection segment is a primary catalyst, propelled by heightened public health awareness and stricter regulatory mandates for clean environments, particularly in the wake of recent global health events. Furthermore, the increasing adoption of UVC LEDs in biosensing for rapid diagnostic tools and in advanced medical device sterilization is contributing significantly to market expansion. The prevalence of applications requiring compact and energy-efficient disinfection, such as portable devices and inline water treatment systems, is fueling the demand for UVC LEDs with power outputs below 10 mW and in the 10-30 mW range, though higher power segments are also showing robust growth for industrial applications.

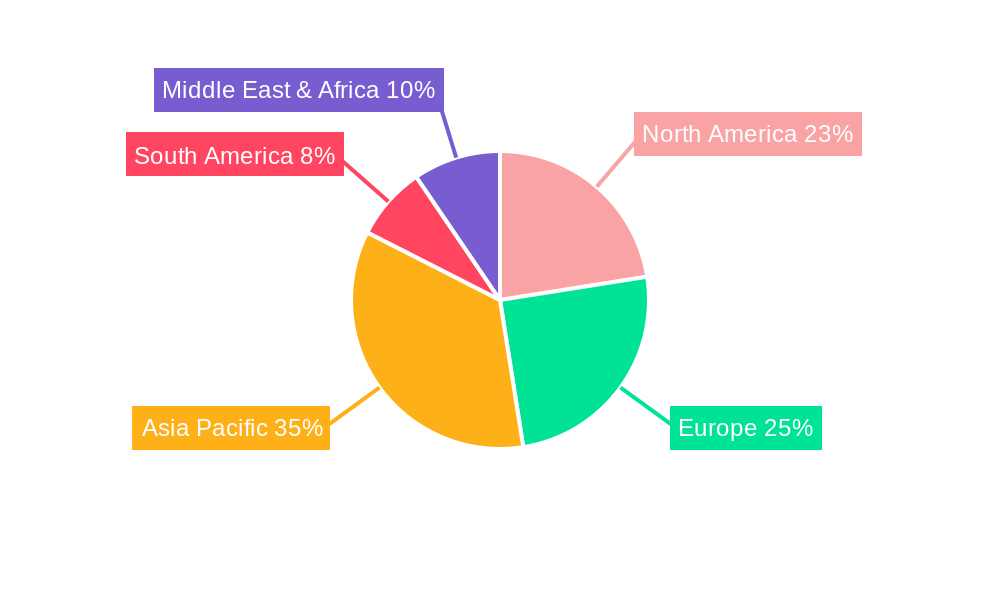

The market dynamics are further shaped by continuous technological advancements in UVC LED chip efficiency and manufacturing processes, leading to more cost-effective and higher-performance solutions. Companies like Seoul Viosys, NIKKISO, and Nitride Semiconductors Co., Ltd. are at the forefront of innovation, introducing novel UVC LED technologies that enhance germicidal efficacy and operational lifespan. While the market is characterized by rapid innovation and substantial investment, potential restraints include the high initial cost of UVC LED integration compared to traditional methods, although this is steadily decreasing. Environmental concerns regarding mercury-based UV lamps also act as a significant driver for UVC LED adoption. Geographically, Asia Pacific, particularly China and South Korea, is emerging as a dominant manufacturing hub and a significant consumer due to its extensive electronics industry and growing awareness of hygiene. North America and Europe are also crucial markets, driven by advanced healthcare systems and stringent environmental regulations. The forecast period from 2025 to 2033 is expected to witness sustained and robust market expansion as UVC LED technology becomes more accessible and integrated into mainstream consumer and industrial products.

UVC LED and Chips Market Concentration & Innovation

The UVC LED and chips market exhibits a moderately concentrated structure, with key players like Seoul Viosys, NIKKISO, and Nichia holding significant market share in the range of over 20 million units and 15 million units respectively. Innovation is a primary driver, fueled by advancements in semiconductor technology, improved quantum efficiency, and enhanced germicidal efficacy. The development of novel UVC LED chips with higher power outputs (above 30 mw), particularly for applications like water and air disinfection, is transforming the market. Regulatory frameworks, such as those governing disinfection standards and product safety, are becoming increasingly influential. Product substitutes, while present in the form of traditional mercury lamps, are gradually being supplanted by the more energy-efficient and mercury-free UVC LEDs. End-user trends are leaning towards demand for portable and integrated disinfection solutions, particularly in the medical and consumer electronics sectors. Mergers and acquisitions (M&A) are expected to play a crucial role in consolidating market share and expanding technological capabilities, with estimated M&A deal values potentially reaching hundreds of millions of dollars.

UVC LED and Chips Industry Trends & Insights

The UVC LED and chips market is experiencing robust growth, driven by an escalating global emphasis on public health and hygiene. The Compound Annual Growth Rate (CAGR) for this sector is projected to be a significant XX% from 2025 to 2033, reflecting its expanding market penetration. Technological disruptions, including breakthroughs in material science and chip packaging, are leading to more efficient, durable, and cost-effective UVC LED solutions. Consumer preferences are increasingly shifting towards safe, chemical-free disinfection methods, making UVC LED technology highly attractive for a wide array of applications. Competitive dynamics are intensifying, with established players investing heavily in R&D to maintain their market leadership and new entrants striving to capture market share with innovative product offerings. The COVID-19 pandemic significantly accelerated the adoption of UVC disinfection technologies, creating a sustained demand surge that is expected to continue through the forecast period. Furthermore, the development of specialized UVC LED chips below 10 mw for precise biosensing applications is opening new avenues for growth. The continuous innovation in power output, ranging from below 10 mw to above 30 mw, caters to diverse market needs, from delicate laboratory applications to high-volume industrial disinfection. The integration of UVC LEDs into everyday products, such as air purifiers, water bottles, and smart devices, is also contributing to market expansion, further solidifying the position of UVC LEDs as a critical technology for a healthier future. The market is also witnessing a rise in UV-C germicidal irradiation (UVGI) systems, which are increasingly being deployed in public spaces and healthcare facilities to combat the spread of infectious diseases. The demand for UVC LEDs in medical applications, including sterilization of medical equipment and surface disinfection, remains strong, further bolstering market growth. The increasing awareness about the harmful effects of certain chemicals used in traditional disinfection methods is also pushing consumers and industries towards the adoption of UV-C LED technology. The overall market penetration of UVC LEDs is expected to rise substantially as these trends continue to shape consumer and industrial demand.

Dominant Markets & Segments in UVC LED and Chips

The UVC LED and chips market is currently dominated by the Water/Air Disinfection application segment. This dominance is propelled by several key drivers:

- Public Health Initiatives and Regulations: Governments worldwide are implementing stricter regulations and investing in public health infrastructure, which includes advanced disinfection technologies for water treatment plants, municipal water supplies, and air quality control in public spaces. The aftermath of global health crises has further amplified the importance of effective germicidal solutions.

- Consumer Awareness and Demand: There is a palpable surge in consumer awareness regarding the health risks associated with contaminated water and air. This has led to a significant demand for home-use water purifiers, air purifiers, and portable disinfection devices that leverage UVC LED technology. The convenience and effectiveness of these solutions are key selling points.

- Technological Advancements in Power Output: The availability of UVC LED chips with power outputs above 30 mw has enabled more efficient and faster disinfection processes, making them ideal for high-volume applications like industrial water treatment and large-scale air purification systems. Companies like Seoul Viosys and Nichia are at the forefront of these high-power UVC LED developments.

- Environmental and Sustainability Concerns: UVC LEDs offer an eco-friendly alternative to chemical disinfectants and mercury-based UV lamps, which pose disposal challenges. This aligns with growing global sustainability initiatives and corporate social responsibility mandates.

- Growth in the Asia-Pacific Region: The Asia-Pacific region, particularly China and South Korea, is emerging as a dominant geographical market due to robust manufacturing capabilities, increasing disposable incomes, and a growing focus on environmental and public health standards. Countries like Japan, with companies like NIKKISO, also contribute significantly.

Within the Types segmentation, Above 30 mw power output UVC LEDs are experiencing the most rapid growth, directly supporting the dominance of the Water/Air Disinfection segment. These high-power chips are essential for achieving sufficient germicidal doses in a shorter time, making them suitable for industrial-scale applications. The 10-30 mw segment is also witnessing steady growth, catering to mid-range applications and more advanced consumer products. The Below 10 mw segment, while smaller in volume for disinfection, plays a crucial role in niche applications such as biosensing and medical diagnostics where precise and localized UV exposure is required.

The Medical application segment is another significant growth area, driven by the need for sterilization and disinfection in hospitals, clinics, and laboratories. Companies like Crystal IS and Stanley are contributing to advancements in this segment. Biosensing is an emerging but rapidly expanding segment, leveraging the specific germicidal properties of UVC light for various analytical and diagnostic purposes. The "Others" segment encompasses a diverse range of applications, including curing of coatings and resins, and specialized industrial processes, all of which contribute to the overall market expansion.

UVC LED and Chips Product Developments

Product development in the UVC LED and chips market is characterized by a relentless pursuit of higher efficacy, improved reliability, and enhanced power output. Innovations are focused on increasing germicidal effectiveness at lower energy consumption, particularly for UVC-254nm and UVC-265nm wavelengths. Companies are developing compact and integrated UVC LED modules for a wider range of applications, from portable water purifiers to smart home appliances. Competitive advantages are being built through enhanced chip architectures that offer longer operational lifespans and reduced heat generation, making them ideal for continuous use in various environments. The trend towards mercury-free and ozone-free disinfection solutions continues to drive product innovation.

Report Scope & Segmentation Analysis

This report offers a comprehensive analysis of the UVC LED and chips market, segmented by application and power type. The Water/Air Disinfection segment is projected for substantial growth, driven by increasing global health concerns and demand for advanced purification solutions. The Biosensing segment, while currently smaller, is expected to see significant expansion as UVC LED technology finds more applications in diagnostics and scientific research. The Medical segment will continue its steady growth, fueled by the persistent need for effective sterilization and disinfection in healthcare settings. The Others segment, encompassing diverse industrial and consumer applications, will contribute to overall market expansion. In terms of power output, the Above 30 mw segment is anticipated to dominate in terms of volume for disinfection applications, while Below 10 mw and 10-30 mw segments will cater to specialized and general-purpose needs, respectively. Growth projections for each segment are based on current market trends and anticipated technological advancements.

Key Drivers of UVC LED and Chips Growth

Several key drivers are propelling the growth of the UVC LED and chips market. The escalating global awareness and concern for public health and hygiene, exacerbated by recent pandemics, is a paramount driver, creating sustained demand for effective disinfection solutions. Technological advancements in UVC LED efficiency and power output, exemplified by companies like Seoul Viosys and NIKKISO, are making these solutions more viable and cost-effective for a wider range of applications. The increasing adoption of UVC LEDs as a mercury-free and environmentally friendly alternative to traditional UV lamps is another significant factor, aligning with global sustainability efforts. Furthermore, supportive government initiatives and regulations promoting public health and clean technologies are indirectly boosting market expansion. The expanding application landscape, from water and air purification to medical sterilization and biosensing, is continuously opening new avenues for growth.

Challenges in the UVC LED and Chips Sector

Despite the robust growth, the UVC LED and chips sector faces several challenges. High initial manufacturing costs for UVC LED chips and modules can still be a barrier to widespread adoption in price-sensitive markets. Regulatory hurdles and standardization issues for UVC disinfection efficacy and safety need to be addressed to ensure consumer confidence and facilitate market growth. Supply chain disruptions and raw material availability, particularly for specialized semiconductor materials, can impact production volumes and lead times. Intense competition and price pressures from established and emerging players necessitate continuous innovation and cost optimization. Finally, educating end-users about the proper and safe use of UVC disinfection technology remains crucial to prevent misuse and ensure effectiveness.

Emerging Opportunities in UVC LED and Chips

Emerging opportunities in the UVC LED and chips market are abundant. The development of highly integrated and miniaturized UVC LED disinfection systems for consumer electronics and portable devices presents a significant market opportunity. The expansion of UVC LED applications in the food and beverage industry for surface and product disinfection is another promising area. Advances in wearable health monitoring devices incorporating UVC sterilization capabilities offer new consumer-centric markets. The growing demand for advanced biosensing and analytical instrumentation utilizing specific UVC wavelengths is creating niche but high-value opportunities. Furthermore, the potential for smart city infrastructure incorporating UVC disinfection for public spaces and transportation networks represents a long-term growth avenue.

Leading Players in the UVC LED and Chips Market

- Seoul Viosys

- NIKKISO

- Nitride Semiconductors Co.,Ltd

- Crystal IS

- Stanley

- Qingdao Jason Electric

- Rayvio

- Advanced Optoelectronic Technology Inc

- NATIONSTAR

- LITE-ON

- San'an Optoelectronics

- Lextar

- HPL

- DUVTek

- Nichia

- Photon Wave Co

Key Developments in UVC LED and Chips Industry

- 2023/05: Seoul Viosys launches a new generation of high-power UVC LEDs with enhanced germicidal efficacy, targeting industrial water purification.

- 2023/02: NIKKISO announces strategic partnerships to expand its UVC LED chip manufacturing capacity, addressing growing market demand.

- 2022/11: Crystal IS introduces innovative UVC LED solutions for medical device sterilization, emphasizing superior reliability and performance.

- 2022/07: Nichia unveils advancements in UVC LED chip design, achieving higher energy efficiency for air disinfection applications.

- 2021/10: A significant M&A deal is rumored in the sector, with Advanced Optoelectronic Technology Inc reportedly in acquisition talks with a smaller UVC LED component manufacturer.

Strategic Outlook for UVC LED and Chips Market

The strategic outlook for the UVC LED and chips market remains exceptionally positive. Continued investment in research and development for higher power, more efficient, and longer-lasting UVC LEDs will be crucial for sustained growth. Strategic collaborations and partnerships between chip manufacturers and system integrators will foster innovation and accelerate market penetration across diverse applications. The increasing emphasis on public health and the growing demand for sustainable and chemical-free disinfection solutions will act as powerful growth catalysts. Companies that can effectively address manufacturing cost challenges, navigate evolving regulatory landscapes, and leverage emerging application areas will be well-positioned to capture significant market share in the coming years. The expansion into new geographical markets and the development of intelligent UVC disinfection systems will further shape the future trajectory of this dynamic industry.

UVC LED and Chips Segmentation

-

1. Application

- 1.1. Water/Air Disinfection

- 1.2. Biosensing

- 1.3. Medical

- 1.4. Others

-

2. Types

- 2.1. Below 10 mw

- 2.2. 10-30 mw

- 2.3. Above 30 mw

UVC LED and Chips Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UVC LED and Chips REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 41% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UVC LED and Chips Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Water/Air Disinfection

- 5.1.2. Biosensing

- 5.1.3. Medical

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Below 10 mw

- 5.2.2. 10-30 mw

- 5.2.3. Above 30 mw

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America UVC LED and Chips Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Water/Air Disinfection

- 6.1.2. Biosensing

- 6.1.3. Medical

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Below 10 mw

- 6.2.2. 10-30 mw

- 6.2.3. Above 30 mw

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America UVC LED and Chips Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Water/Air Disinfection

- 7.1.2. Biosensing

- 7.1.3. Medical

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Below 10 mw

- 7.2.2. 10-30 mw

- 7.2.3. Above 30 mw

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe UVC LED and Chips Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Water/Air Disinfection

- 8.1.2. Biosensing

- 8.1.3. Medical

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Below 10 mw

- 8.2.2. 10-30 mw

- 8.2.3. Above 30 mw

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa UVC LED and Chips Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Water/Air Disinfection

- 9.1.2. Biosensing

- 9.1.3. Medical

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Below 10 mw

- 9.2.2. 10-30 mw

- 9.2.3. Above 30 mw

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific UVC LED and Chips Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Water/Air Disinfection

- 10.1.2. Biosensing

- 10.1.3. Medical

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Below 10 mw

- 10.2.2. 10-30 mw

- 10.2.3. Above 30 mw

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Seoul Viosys

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NIKKISO

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nitride Semiconductors Co.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Crystal IS

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Stanley

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Qingdao Jason Electric

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rayvio

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Advanced Optoelectronic Technology Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 NATIONSTAR

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 LITE-ON

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 San'an Optoelectronics

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Lextar

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 HPL

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 DUVTek

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Nichia

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Photon Wave Co

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Seoul Viosys

List of Figures

- Figure 1: Global UVC LED and Chips Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America UVC LED and Chips Revenue (million), by Application 2024 & 2032

- Figure 3: North America UVC LED and Chips Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America UVC LED and Chips Revenue (million), by Types 2024 & 2032

- Figure 5: North America UVC LED and Chips Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America UVC LED and Chips Revenue (million), by Country 2024 & 2032

- Figure 7: North America UVC LED and Chips Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America UVC LED and Chips Revenue (million), by Application 2024 & 2032

- Figure 9: South America UVC LED and Chips Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America UVC LED and Chips Revenue (million), by Types 2024 & 2032

- Figure 11: South America UVC LED and Chips Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America UVC LED and Chips Revenue (million), by Country 2024 & 2032

- Figure 13: South America UVC LED and Chips Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe UVC LED and Chips Revenue (million), by Application 2024 & 2032

- Figure 15: Europe UVC LED and Chips Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe UVC LED and Chips Revenue (million), by Types 2024 & 2032

- Figure 17: Europe UVC LED and Chips Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe UVC LED and Chips Revenue (million), by Country 2024 & 2032

- Figure 19: Europe UVC LED and Chips Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa UVC LED and Chips Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa UVC LED and Chips Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa UVC LED and Chips Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa UVC LED and Chips Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa UVC LED and Chips Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa UVC LED and Chips Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific UVC LED and Chips Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific UVC LED and Chips Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific UVC LED and Chips Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific UVC LED and Chips Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific UVC LED and Chips Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific UVC LED and Chips Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UVC LED and Chips Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global UVC LED and Chips Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global UVC LED and Chips Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global UVC LED and Chips Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global UVC LED and Chips Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global UVC LED and Chips Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global UVC LED and Chips Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global UVC LED and Chips Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global UVC LED and Chips Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global UVC LED and Chips Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global UVC LED and Chips Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global UVC LED and Chips Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global UVC LED and Chips Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global UVC LED and Chips Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global UVC LED and Chips Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global UVC LED and Chips Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global UVC LED and Chips Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global UVC LED and Chips Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global UVC LED and Chips Revenue million Forecast, by Country 2019 & 2032

- Table 41: China UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific UVC LED and Chips Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UVC LED and Chips?

The projected CAGR is approximately 41%.

2. Which companies are prominent players in the UVC LED and Chips?

Key companies in the market include Seoul Viosys, NIKKISO, Nitride Semiconductors Co., Ltd, Crystal IS, Stanley, Qingdao Jason Electric, Rayvio, Advanced Optoelectronic Technology Inc, NATIONSTAR, LITE-ON, San'an Optoelectronics, Lextar, HPL, DUVTek, Nichia, Photon Wave Co.

3. What are the main segments of the UVC LED and Chips?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 601 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 5900.00, USD 8850.00, and USD 11800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UVC LED and Chips," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UVC LED and Chips report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UVC LED and Chips?

To stay informed about further developments, trends, and reports in the UVC LED and Chips, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence