Key Insights

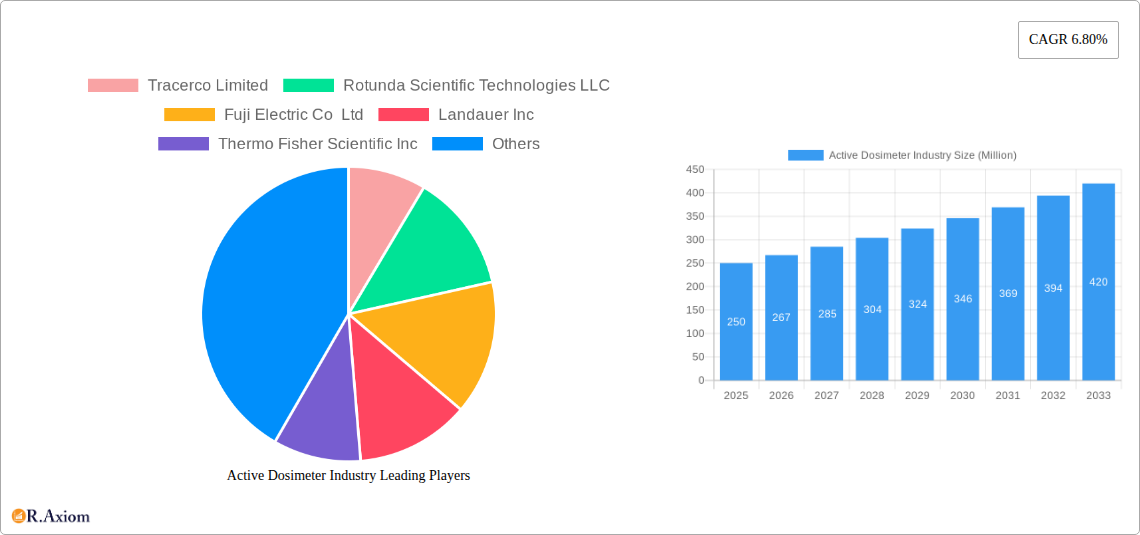

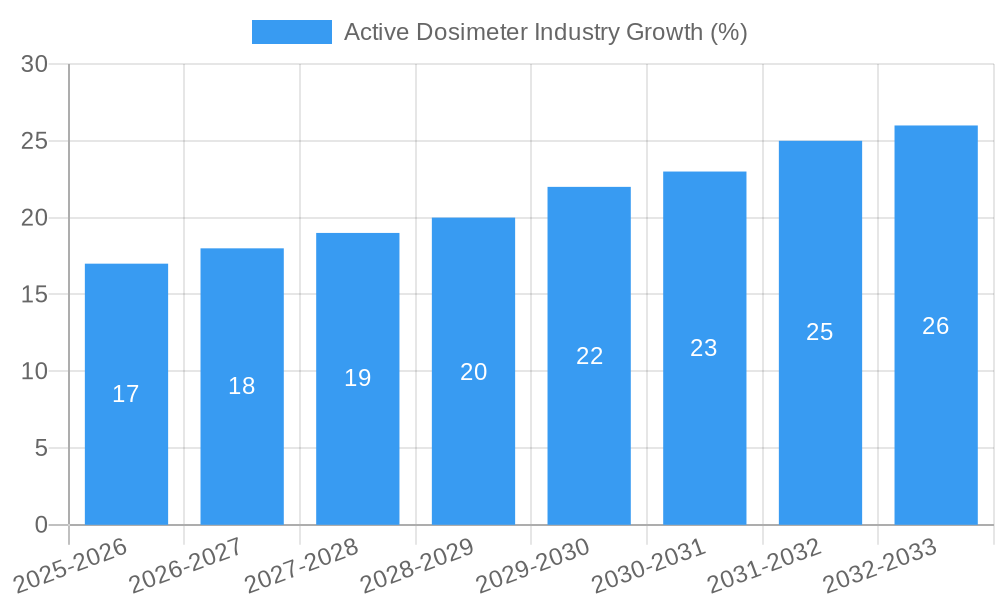

The active dosimeter market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.80% from 2025 to 2033. This expansion is driven by several key factors. The increasing prevalence of radiation-related applications across diverse sectors, including healthcare (medical imaging, radiation therapy), industrial settings (oil & gas exploration, mining operations), and military/homeland security (nuclear threat detection), fuels demand for accurate and reliable personal radiation monitoring. Stringent safety regulations and growing awareness of radiation hazards further incentivize the adoption of advanced active dosimeters. Technological advancements, including the development of miniaturized and more sensitive detectors, along with improved data management and connectivity features, are also contributing to market growth. The market is segmented by application, with medical, industrial, and military/homeland security sectors representing significant revenue streams. Companies like Tracerco Limited, Mirion Technologies Inc., and Thermo Fisher Scientific Inc. are key players, leveraging their technological expertise and established distribution networks to gain market share. While initial investment costs for advanced dosimeter systems can be a restraint, the long-term benefits in terms of enhanced safety and regulatory compliance outweigh the initial expense, driving market expansion.

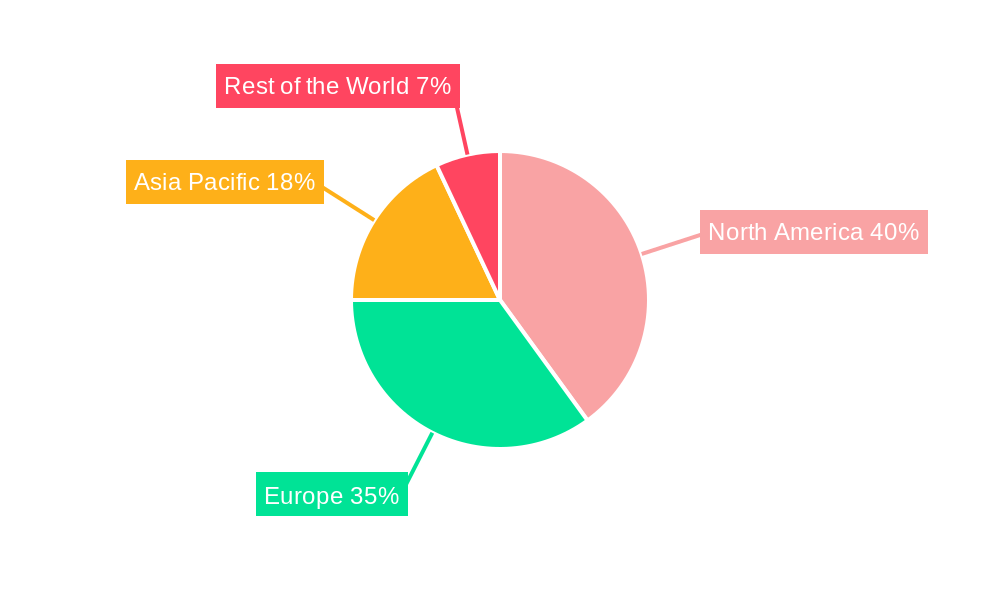

Geographic distribution reveals a significant market presence across North America and Europe, attributable to the established regulatory frameworks and higher adoption rates within these regions. However, the Asia-Pacific region is expected to show significant growth potential, driven by rapid industrialization and rising awareness of radiation safety. This will likely result in a shift in regional market shares over the forecast period. Competition within the active dosimeter market is anticipated to intensify as new players emerge and existing companies expand their product portfolios to cater to the diverse application segments and evolving technological landscape. Continuous innovation in detector technology, data analytics capabilities, and user-friendly interfaces will play a crucial role in determining future market leaders.

This comprehensive report provides an in-depth analysis of the Active Dosimeter industry, offering valuable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report analyzes market trends, competitive landscapes, and future growth potential. The report incorporates data from key players such as Tracerco Limited, Rotunda Scientific Technologies LLC, Fuji Electric Co Ltd, Landauer Inc, Thermo Fisher Scientific Inc, Raeco Rents LLC, Mirion Technologies Inc, Far West Technology Inc, Polimaster Inc, ATOMTEX SPE, and Unfors RaySafe AB. The market is segmented by application, including Medical, Industrial (Oil & Gas, Mining), Military and Homeland Security, Power & Energy, and Other Applications.

Active Dosimeter Industry Market Concentration & Innovation

The active dosimeter market exhibits a moderately concentrated landscape, with a few major players holding significant market share. While precise market share figures for individual companies are proprietary data, analysis suggests a top 5 market share of approximately xx%. Innovation is driven by the increasing demand for accurate, reliable, and user-friendly dosimetry solutions across various applications. Regulatory frameworks, such as those from the IAEA and national regulatory bodies, heavily influence product development and market access. The market also witnesses continuous advancements in sensor technology, data processing capabilities, and wireless communication protocols. Product substitutes, such as passive dosimeters, exist but often lack the real-time feedback and enhanced data analysis offered by active dosimeters. End-user trends are moving towards miniaturized, wearable devices with improved data logging and remote monitoring capabilities. M&A activity in this sector is relatively modest, with deal values averaging around xx Million annually over the past five years, driven primarily by the need for expanding product portfolios and geographic reach.

Active Dosimeter Industry Industry Trends & Insights

The active dosimeter market is experiencing robust growth, projected to achieve a CAGR of xx% during the forecast period (2025-2033). This growth is primarily fueled by increasing awareness of radiation safety concerns across various sectors, stringent regulatory compliance requirements, and advancements in sensor and communication technologies. Technological disruptions are evident in the development of sophisticated algorithms for data analysis and the integration of cloud-based platforms for data management and remote monitoring. Consumer preferences lean towards devices offering improved accuracy, portability, and ease of use. Competitive dynamics are characterized by product differentiation, technological innovation, and strategic partnerships. Market penetration is highest in the medical and industrial sectors, with significant growth potential in emerging markets and applications.

Dominant Markets & Segments in Active Dosimeter Industry

The active dosimeter market is geographically diverse, with strong growth observed across North America, Europe, and Asia-Pacific. While precise market dominance data are not openly available, North America currently holds a significant market share, driven by its well-established healthcare infrastructure and stringent safety regulations.

- Key Drivers for North American Dominance:

- Strong regulatory environment emphasizing radiation safety.

- High adoption rates in healthcare and industrial settings.

- Significant investments in research and development.

The medical segment constitutes the largest application area, driven by increasing demand for advanced radiation therapy, nuclear medicine, and diagnostic imaging procedures. The industrial sector, particularly oil and gas, and mining, also shows significant growth due to stringent safety regulations and the increasing use of radiation sources in these industries.

Active Dosimeter Industry Product Developments

Recent advancements focus on miniaturization, improved data accuracy and processing, and wireless connectivity. New products incorporate sophisticated algorithms for real-time dose assessment and incorporate advanced data analysis features, enhancing risk management capabilities. This allows for better integration with existing safety management systems. The key competitive advantage lies in providing superior accuracy, user-friendliness, and cost-effectiveness compared to traditional dosimetry methods.

Report Scope & Segmentation Analysis

This report comprehensively segments the active dosimeter market by application:

Medical: This segment is characterized by high growth due to increasing use in radiation therapy, nuclear medicine, and diagnostic imaging. The market size is estimated at xx Million in 2025, with a projected CAGR of xx% during the forecast period. Competitive dynamics are intense, with major players focusing on product differentiation and technological advancements.

Industrial (Oil & Gas, Mining): This segment benefits from stringent safety regulations and the increasing use of radiation sources in these industries. The market size is estimated at xx Million in 2025, with a projected CAGR of xx%. Competitive dynamics are focused on durability, reliability, and ease of use in challenging environments.

Military and Homeland Security: This segment is driven by the need for robust and reliable radiation detection and monitoring in security applications. The market size is estimated at xx Million in 2025, with a projected CAGR of xx%. Competitive dynamics are shaped by government contracts and stringent performance requirements.

Power & Energy: This segment is growing due to the use of radiation sources in nuclear power plants and other energy-related applications. The market size is estimated at xx Million in 2025, with a projected CAGR of xx%. Competitive dynamics are driven by the need for high reliability and safety in critical infrastructure.

Other Applications: This segment encompasses various niche applications, including research, education, and environmental monitoring. The market size is estimated at xx Million in 2025, with a projected CAGR of xx%. Competitive dynamics are shaped by the specific needs and requirements of each application.

Key Drivers of Active Dosimeter Industry Growth

The active dosimeter market is fueled by a combination of factors. Stringent radiation safety regulations across various sectors mandate the use of accurate dosimetry solutions. Technological advancements lead to more compact, user-friendly, and precise devices. The growing adoption of advanced radiation therapies in healthcare drives demand for sophisticated dosimeters. Increasing awareness of radiation risks among healthcare professionals and industrial workers promotes wider adoption.

Challenges in the Active Dosimeter Industry Sector

The industry faces challenges, including high initial investment costs for advanced devices and the need for regular calibration and maintenance. Supply chain disruptions can impact production and availability. Intense competition from established players and new entrants puts pressure on pricing and profitability. Regulatory hurdles in different countries can create market access barriers.

Emerging Opportunities in Active Dosimeter Industry

Emerging opportunities lie in the development of more compact and wearable dosimeters, and the integration of wireless connectivity and cloud-based data platforms for real-time monitoring. Expansion into developing economies with growing healthcare infrastructure and industrial sectors creates significant growth potential. Advances in artificial intelligence and machine learning offer opportunities to improve data analysis and risk assessment capabilities.

Leading Players in the Active Dosimeter Industry Market

- Tracerco Limited

- Rotunda Scientific Technologies LLC

- Fuji Electric Co Ltd

- Landauer Inc

- Thermo Fisher Scientific Inc

- Raeco Rents LLC

- Mirion Technologies Inc

- Far West Technology Inc

- Polimaster Inc

- ATOMTEX SPE

- Unfors RaySafe AB

Key Developments in Active Dosimeter Industry Industry

September 2022: Thermo Fisher Scientific announced a $160 Million investment to expand bioproduction capacity, indirectly impacting the demand for radiation safety equipment in this sector.

April 2022: Mirion Technologies introduced a new SaaS option for its Sun Check Quality Management platform, enhancing radiation therapy QA and potentially influencing the adoption of active dosimeters in radiation oncology.

Strategic Outlook for Active Dosimeter Industry Market

The active dosimeter market is poised for continued growth, driven by technological advancements, increasing regulatory scrutiny, and rising awareness of radiation safety. Expansion into new applications, particularly in emerging markets, offers significant potential. Companies focusing on innovation, strategic partnerships, and efficient supply chain management are well-positioned to capture a larger market share.

Active Dosimeter Industry Segmentation

-

1. Application

- 1.1. Medical

- 1.2. Industrial (Oil & Gas, Mining)

- 1.3. Military and Homeland Security

- 1.4. Power & Energy

- 1.5. Other Applications

Active Dosimeter Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Active Dosimeter Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Construction of Nuclear Reactors; Growing Application Across Medical & Lifescience Sector

- 3.3. Market Restrains

- 3.3.1. High cost of device; Sensitivity toward Mechanical Instability

- 3.4. Market Trends

- 3.4.1. Medical Application is Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Active Dosimeter Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Medical

- 5.1.2. Industrial (Oil & Gas, Mining)

- 5.1.3. Military and Homeland Security

- 5.1.4. Power & Energy

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Active Dosimeter Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Medical

- 6.1.2. Industrial (Oil & Gas, Mining)

- 6.1.3. Military and Homeland Security

- 6.1.4. Power & Energy

- 6.1.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Active Dosimeter Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Medical

- 7.1.2. Industrial (Oil & Gas, Mining)

- 7.1.3. Military and Homeland Security

- 7.1.4. Power & Energy

- 7.1.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Active Dosimeter Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Medical

- 8.1.2. Industrial (Oil & Gas, Mining)

- 8.1.3. Military and Homeland Security

- 8.1.4. Power & Energy

- 8.1.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Active Dosimeter Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Medical

- 9.1.2. Industrial (Oil & Gas, Mining)

- 9.1.3. Military and Homeland Security

- 9.1.4. Power & Energy

- 9.1.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. North America Active Dosimeter Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Active Dosimeter Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Active Dosimeter Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Active Dosimeter Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Tracerco Limited

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Rotunda Scientific Technologies LLC

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Fuji Electric Co Ltd

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Landauer Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Thermo Fisher Scientific Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Raeco Rents LLC *List Not Exhaustive

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Mirion Technologies Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Far West Technology Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Polimaster Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 ATOMTEX SPE

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Unfors RaySafe AB

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Tracerco Limited

List of Figures

- Figure 1: Global Active Dosimeter Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Active Dosimeter Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Active Dosimeter Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Active Dosimeter Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Active Dosimeter Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Active Dosimeter Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Active Dosimeter Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Active Dosimeter Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Active Dosimeter Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Active Dosimeter Industry Revenue (Million), by Application 2024 & 2032

- Figure 11: North America Active Dosimeter Industry Revenue Share (%), by Application 2024 & 2032

- Figure 12: North America Active Dosimeter Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Active Dosimeter Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Active Dosimeter Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: Europe Active Dosimeter Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Active Dosimeter Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Active Dosimeter Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Active Dosimeter Industry Revenue (Million), by Application 2024 & 2032

- Figure 19: Asia Pacific Active Dosimeter Industry Revenue Share (%), by Application 2024 & 2032

- Figure 20: Asia Pacific Active Dosimeter Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Active Dosimeter Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Rest of the World Active Dosimeter Industry Revenue (Million), by Application 2024 & 2032

- Figure 23: Rest of the World Active Dosimeter Industry Revenue Share (%), by Application 2024 & 2032

- Figure 24: Rest of the World Active Dosimeter Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Rest of the World Active Dosimeter Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Active Dosimeter Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Active Dosimeter Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Active Dosimeter Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Active Dosimeter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Active Dosimeter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Active Dosimeter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Active Dosimeter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Active Dosimeter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Active Dosimeter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Active Dosimeter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Active Dosimeter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Active Dosimeter Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 13: Global Active Dosimeter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Active Dosimeter Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Global Active Dosimeter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Active Dosimeter Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global Active Dosimeter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Active Dosimeter Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Global Active Dosimeter Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Active Dosimeter Industry?

The projected CAGR is approximately 6.80%.

2. Which companies are prominent players in the Active Dosimeter Industry?

Key companies in the market include Tracerco Limited, Rotunda Scientific Technologies LLC, Fuji Electric Co Ltd, Landauer Inc, Thermo Fisher Scientific Inc, Raeco Rents LLC *List Not Exhaustive, Mirion Technologies Inc, Far West Technology Inc, Polimaster Inc, ATOMTEX SPE, Unfors RaySafe AB.

3. What are the main segments of the Active Dosimeter Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Construction of Nuclear Reactors; Growing Application Across Medical & Lifescience Sector.

6. What are the notable trends driving market growth?

Medical Application is Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

High cost of device; Sensitivity toward Mechanical Instability.

8. Can you provide examples of recent developments in the market?

September 2022 - Thermo Fisher Scientific has announced its Investment of $160 Million to Expand the Bioproduction Capacity in Greater Boston; the 85,000-square-foot facility will help meet the growing demand for the biological materials needed to produce vaccines and breakthrough therapies for cancer and other diseases.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Active Dosimeter Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Active Dosimeter Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Active Dosimeter Industry?

To stay informed about further developments, trends, and reports in the Active Dosimeter Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence