Key Insights

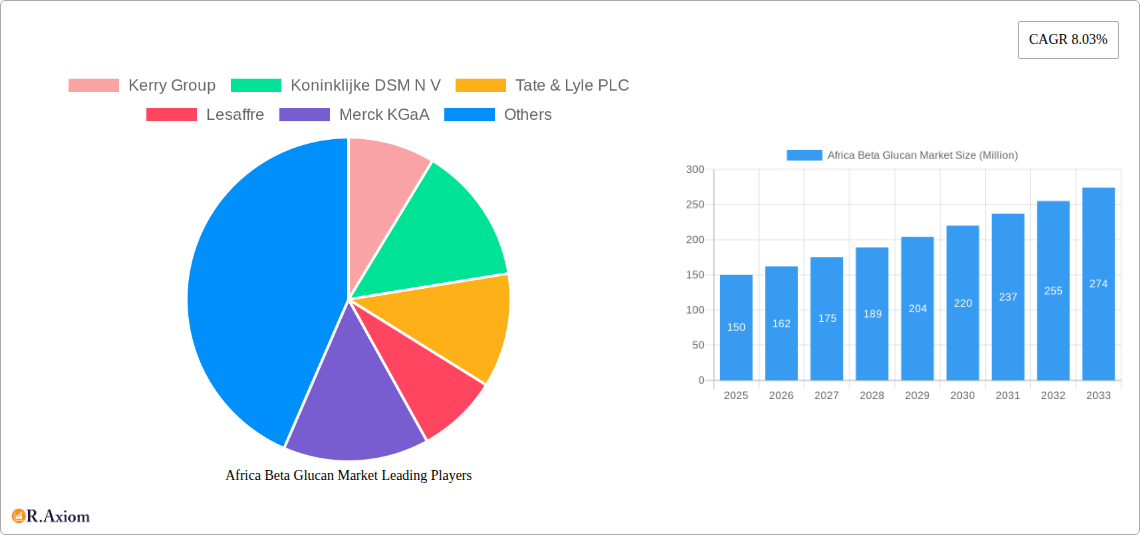

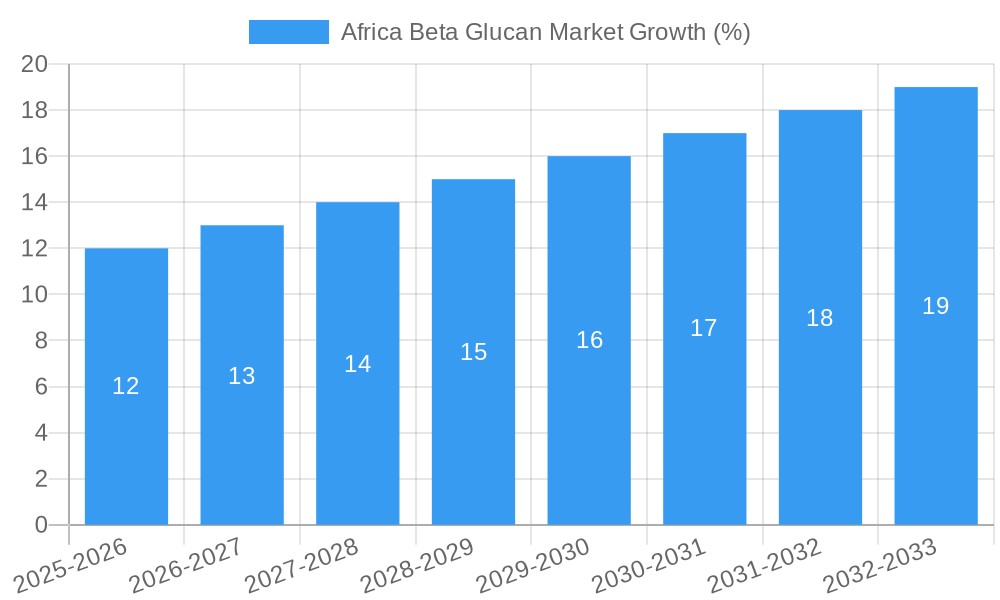

The Africa beta-glucan market, while currently exhibiting moderate size, is poised for significant growth over the next decade. Driven by increasing awareness of the health benefits associated with beta-glucans – notably their immune-boosting properties and potential role in preventing chronic diseases – demand is steadily rising across the continent. This growth is further fueled by a burgeoning functional food and beverage sector, incorporating beta-glucans into products targeting health-conscious consumers. Expanding research into the applications of beta-glucans in areas like animal feed and pharmaceuticals also contributes to market expansion. While challenges remain, such as limited infrastructure in some regions and variable consumer awareness levels, the overall market outlook is optimistic. The estimated market value in 2025 is $150 million, projected to reach $250 million by 2030, reflecting an 8.03% CAGR. This growth trajectory is primarily driven by the increasing prevalence of chronic diseases like diabetes and cardiovascular issues, which fuels the demand for functional foods and nutraceuticals containing beta-glucans. Major players like Kerry Group, DSM, and Tate & Lyle are strategically positioning themselves within the African market, indicating strong future potential. Further segment-specific analysis will need to incorporate specific product types and applications to obtain a clearer understanding of market dynamics within each niche.

The growth trajectory is expected to be influenced by several factors. Firstly, increasing investment in healthcare infrastructure and improved access to information will boost consumer understanding of beta-glucan benefits. Secondly, the development of innovative beta-glucan-based products tailored to specific African health needs will drive market penetration. Finally, partnerships between international companies and local producers are key to overcoming logistical challenges and ensuring accessibility in diverse regions across Africa. The sustained CAGR points towards a continuous rise in market value.

Africa Beta Glucan Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Africa Beta Glucan Market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The study utilizes a robust methodology, incorporating both historical data (2019-2024) and future projections to deliver an accurate and reliable market overview. Key segments are analyzed, providing a granular understanding of market dynamics and growth potential. Leading players such as Kerry Group, Koninklijke DSM N V, Tate & Lyle PLC, Lesaffre, Merck KGaA, and Kemin Industries (list not exhaustive) are profiled, highlighting their strategies and market positions. This report is essential for navigating the complexities of the Africa Beta Glucan Market and capitalizing on emerging opportunities.

Africa Beta Glucan Market Market Concentration & Innovation

The Africa Beta Glucan market exhibits a moderately concentrated landscape, with a few major players holding significant market share. While precise market share figures for individual companies remain proprietary, industry estimations suggest the top five players account for approximately xx% of the total market value in 2025. This concentration is driven by the significant investments these companies have made in research and development, leading to innovative product formulations and superior production capabilities.

Innovation in the sector is largely focused on enhancing the functional properties of beta glucan, such as improved solubility, stability, and bioavailability. This is fueled by the growing demand for natural and functional food ingredients across the continent. Regulatory frameworks, while varying across African nations, are generally supportive of the use of beta glucan in food and beverage applications, provided they comply with safety and labeling regulations. The absence of stringent regulations in certain regions presents both opportunities and challenges. Substitute products, such as other dietary fibers, pose a level of competition, though beta glucan's unique health benefits provide a strong competitive advantage. End-user trends reveal a rising preference for health-conscious products, further bolstering market growth. Mergers and acquisitions (M&A) activity has been relatively low in recent years, with deal values remaining below xx Million, primarily due to the market's still-emerging nature; however, future consolidation is anticipated as the market matures.

Africa Beta Glucan Market Industry Trends & Insights

The Africa Beta Glucan market is experiencing robust growth, driven by several key factors. The rising prevalence of health-conscious consumers who seek natural and functional food ingredients is a major driver. This trend is mirrored by the increasing awareness of the immune-boosting and cholesterol-lowering benefits of beta glucan. Technological advancements in beta glucan extraction and purification methods are leading to higher-quality products with improved functionalities, expanding application possibilities. The market is witnessing a CAGR of xx% during the forecast period (2025-2033). This growth is further fueled by the increasing penetration of beta glucan in various food and beverage applications, including functional foods, dietary supplements, and animal feed. However, challenges remain such as inconsistent raw material supply, fluctuating prices, and the need for greater consumer education regarding beta glucan's benefits. This growth is also influenced by the evolving competitive landscape. New market entrants are gradually increasing, though the larger players maintain a significant market share. Market penetration varies significantly across different African regions, with more developed nations showing higher adoption rates.

Dominant Markets & Segments in Africa Beta Glucan Market

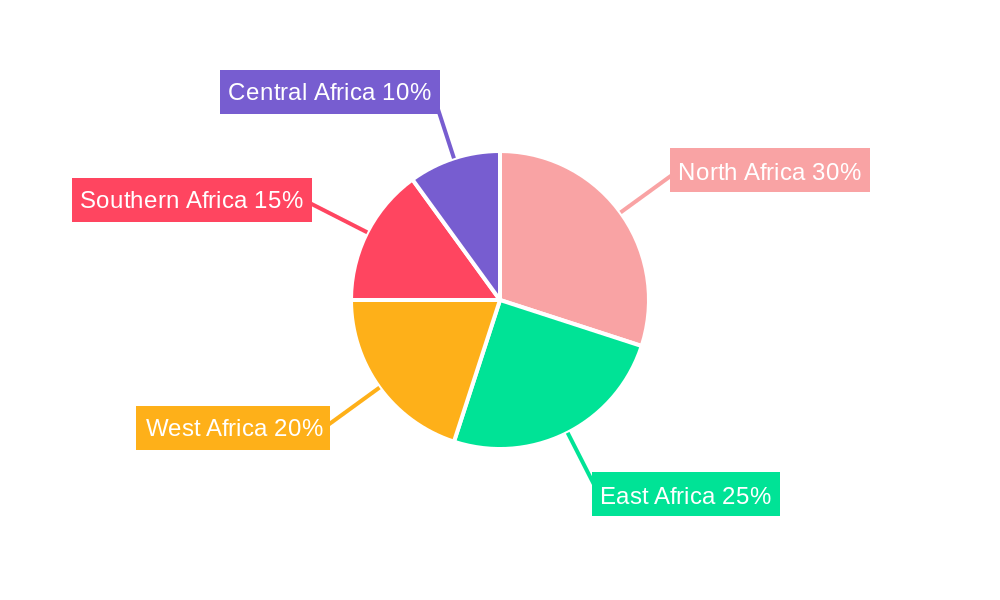

Leading Region: The [Region Name - e.g., Southern Africa] region is currently the dominant market for beta glucan in Africa, accounting for approximately xx% of the overall market value in 2025.

Key Drivers for Dominance in [Region Name]:

- Stronger regulatory framework supportive of functional food ingredients.

- Higher disposable income and increasing health awareness amongst consumers.

- Established distribution networks for food and beverage products.

Dominant Country: [Country Name - e.g., South Africa] is leading the market within the [Region Name] region due to its well-developed food processing sector and a large consumer base with a growing interest in health and wellness.

The dominance of this region and country is a result of several factors, including a higher level of economic development compared to other African nations, leading to increased disposable incomes and consumer spending on health-conscious products. The established infrastructure and food processing capabilities in the region also contribute to the higher market penetration of beta glucan. Further analysis reveals that the [specific segment - e.g., food and beverage] segment is the largest within this region, primarily driven by increasing demand for fortified foods and beverages with added health benefits.

Africa Beta Glucan Market Product Developments

Recent product innovations focus on enhancing beta glucan's solubility, stability, and bioavailability, enabling its incorporation into a wider range of food and beverage products. New applications are emerging in areas like animal feed, where beta glucan is used to enhance animal health and immunity. The competitive advantage lies in offering high-quality, standardized beta glucan products with superior functional properties and consistent supply. This is achieved through investments in advanced extraction and purification technologies, ensuring product quality and efficacy. The industry is also focusing on developing innovative delivery systems, like encapsulation technologies, to improve the effectiveness of beta glucan and its integration into various food and beverage formats.

Report Scope & Segmentation Analysis

The report segments the Africa Beta Glucan market based on several key factors, including:

By Source: This segment includes various sources of beta glucan, such as yeast, oats, barley, and mushrooms, each exhibiting varying market sizes and growth projections. Competitive dynamics vary depending on the source, with yeast-derived beta glucan currently holding a significant market share.

By Application: This segment covers the diverse applications of beta glucan, including food and beverages, dietary supplements, animal feed, and pharmaceuticals. Market sizes and growth projections vary greatly amongst these applications.

By Region: The report provides a detailed regional breakdown of the market, covering key countries and regions across Africa, enabling region-specific analysis.

Key Drivers of Africa Beta Glucan Market Growth

Several factors are driving the growth of the Africa Beta Glucan market. The increasing prevalence of chronic diseases, such as diabetes and cardiovascular diseases, is fueling the demand for health-promoting ingredients like beta glucan. Rising consumer awareness of the health benefits associated with beta glucan, fueled by increased marketing and educational initiatives, contributes significantly to market expansion. Furthermore, technological advancements in beta glucan extraction and processing are leading to more efficient and cost-effective production methods, making the product more accessible to consumers and manufacturers. Supportive government regulations and policies promoting the use of functional foods and dietary supplements also enhance market growth.

Challenges in the Africa Beta Glucan Market Sector

Despite the considerable growth potential, several challenges hinder the Africa Beta Glucan market's development. Inconsistencies in the quality and supply of raw materials, coupled with fluctuating prices, pose significant challenges for manufacturers. Limited consumer awareness and understanding of beta glucan's benefits in certain regions necessitate targeted educational campaigns. The lack of standardized quality control measures and a fragmented regulatory landscape across various African countries present additional challenges. These factors contribute to overall market volatility and hinder sustainable growth. Finally, competition from other dietary fibers and functional ingredients requires strategic product differentiation and effective marketing strategies.

Emerging Opportunities in Africa Beta Glucan Market

The Africa Beta Glucan market presents numerous emerging opportunities. The rising demand for fortified foods and beverages presents a significant avenue for market expansion. Growing interest in natural and functional ingredients opens avenues for innovative product development. The untapped potential in several African countries offers immense growth opportunities for companies willing to invest in market development and education initiatives. Moreover, technological advancements in beta glucan extraction and production processes could lead to more affordable and accessible products, boosting overall market accessibility and consumption.

Leading Players in the Africa Beta Glucan Market Market

- Kerry Group

- Koninklijke DSM N V

- Tate & Lyle PLC

- Lesaffre

- Merck KGaA

- Kemin Industries

- List Not Exhaustive

Key Developments in Africa Beta Glucan Market Industry

- January 2023: [Company Name] launched a new line of beta-glucan-enriched beverages in [Country].

- June 2022: A significant investment was made in a new beta-glucan production facility in [Country].

- October 2021: [Company Name] and [Company Name] announced a strategic partnership to expand their beta glucan product portfolio in Africa.

(Note: Further specific details require access to market intelligence databases and news sources.)

Strategic Outlook for Africa Beta Glucan Market Market

The Africa Beta Glucan market holds significant growth potential, driven by increasing health awareness, technological advancements, and supportive regulatory environments. The focus on innovation, particularly in enhancing beta glucan’s functionalities and exploring new applications, will be key to future success. Companies that can effectively address the challenges related to raw material sourcing, quality control, and consumer education are best positioned to capitalize on the market's considerable growth opportunities. Strategic partnerships and investments in research and development will play a crucial role in shaping the future of this dynamic market.

Africa Beta Glucan Market Segmentation

-

1. Source

- 1.1. Cereal

- 1.2. Yeast

- 1.3. Mushroom

- 1.4. Others

-

2. Category

- 2.1. Soluble

- 2.2. Insoluble

-

3. Application

- 3.1. Food and Beverage

- 3.2. Healthcare and Dietary Supplements

- 3.3. Other Applications

-

4. Geography

-

4.1. Africa

- 4.1.1. South Africa

- 4.1.2. Nigeria

- 4.1.3. Kenya

- 4.1.4. Rest of Africa

-

4.1. Africa

Africa Beta Glucan Market Segmentation By Geography

-

1. Africa

- 1.1. South Africa

- 1.2. Nigeria

- 1.3. Kenya

- 1.4. Rest of Africa

Africa Beta Glucan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.03% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increased Demand of Soluble Beta-Glucan

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Africa Beta Glucan Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Cereal

- 5.1.2. Yeast

- 5.1.3. Mushroom

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Soluble

- 5.2.2. Insoluble

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Food and Beverage

- 5.3.2. Healthcare and Dietary Supplements

- 5.3.3. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Africa

- 5.4.1.1. South Africa

- 5.4.1.2. Nigeria

- 5.4.1.3. Kenya

- 5.4.1.4. Rest of Africa

- 5.4.1. Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Kerry Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Koninklijke DSM N V

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tate & Lyle PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lesaffre

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Merck KGaA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kemin Industries*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Kerry Group

List of Figures

- Figure 1: Global Africa Beta Glucan Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Africa Africa Beta Glucan Market Revenue (Million), by Source 2024 & 2032

- Figure 3: Africa Africa Beta Glucan Market Revenue Share (%), by Source 2024 & 2032

- Figure 4: Africa Africa Beta Glucan Market Revenue (Million), by Category 2024 & 2032

- Figure 5: Africa Africa Beta Glucan Market Revenue Share (%), by Category 2024 & 2032

- Figure 6: Africa Africa Beta Glucan Market Revenue (Million), by Application 2024 & 2032

- Figure 7: Africa Africa Beta Glucan Market Revenue Share (%), by Application 2024 & 2032

- Figure 8: Africa Africa Beta Glucan Market Revenue (Million), by Geography 2024 & 2032

- Figure 9: Africa Africa Beta Glucan Market Revenue Share (%), by Geography 2024 & 2032

- Figure 10: Africa Africa Beta Glucan Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Africa Africa Beta Glucan Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Africa Beta Glucan Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Africa Beta Glucan Market Revenue Million Forecast, by Source 2019 & 2032

- Table 3: Global Africa Beta Glucan Market Revenue Million Forecast, by Category 2019 & 2032

- Table 4: Global Africa Beta Glucan Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Africa Beta Glucan Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Global Africa Beta Glucan Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Africa Beta Glucan Market Revenue Million Forecast, by Source 2019 & 2032

- Table 8: Global Africa Beta Glucan Market Revenue Million Forecast, by Category 2019 & 2032

- Table 9: Global Africa Beta Glucan Market Revenue Million Forecast, by Application 2019 & 2032

- Table 10: Global Africa Beta Glucan Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 11: Global Africa Beta Glucan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: South Africa Africa Beta Glucan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Nigeria Africa Beta Glucan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Kenya Africa Beta Glucan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Africa Africa Beta Glucan Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Beta Glucan Market?

The projected CAGR is approximately 8.03%.

2. Which companies are prominent players in the Africa Beta Glucan Market?

Key companies in the market include Kerry Group, Koninklijke DSM N V, Tate & Lyle PLC, Lesaffre, Merck KGaA, Kemin Industries*List Not Exhaustive.

3. What are the main segments of the Africa Beta Glucan Market?

The market segments include Source, Category, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increased Demand of Soluble Beta-Glucan.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Beta Glucan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Beta Glucan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Beta Glucan Market?

To stay informed about further developments, trends, and reports in the Africa Beta Glucan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence