Key Insights

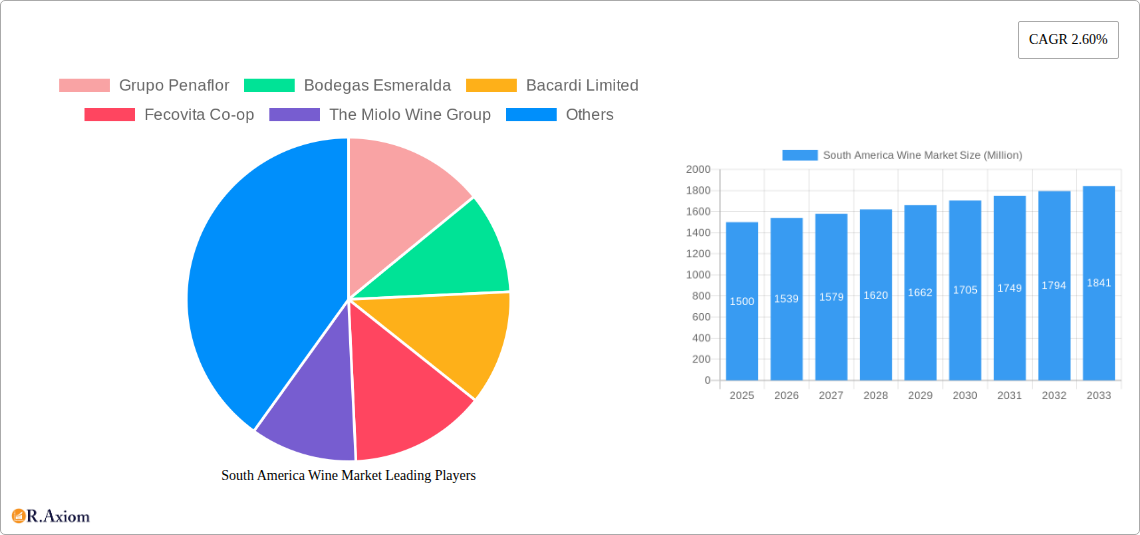

The South American wine market, valued at approximately $XX million in 2025 (assuming a logical extrapolation based on the provided CAGR and market size), is projected to experience steady growth with a compound annual growth rate (CAGR) of 2.60% from 2025 to 2033. This growth is driven by several factors. Increased disposable incomes in key markets like Brazil and Argentina, coupled with a rising appreciation for premium wine and diverse wine styles, fuel demand. A burgeoning tourism sector also contributes significantly, as wine tourism becomes increasingly popular. Furthermore, the robust production capacity of established players like Grupo Penaflor and Vina Concha Y Toro, along with the emergence of smaller boutique wineries, ensures a diverse and competitive market. While challenges remain, such as fluctuating grape harvests and competition from other alcoholic beverages, the overall market outlook is positive. The preference for red wine is likely to dominate, given regional consumption habits, although the growth of rosé and sparkling wine segments is anticipated, aligning with global trends. Strategic distribution across both on-trade (restaurants, bars) and off-trade (retail stores) channels will be critical for sustained market penetration.

South America Wine Market Market Size (In Billion)

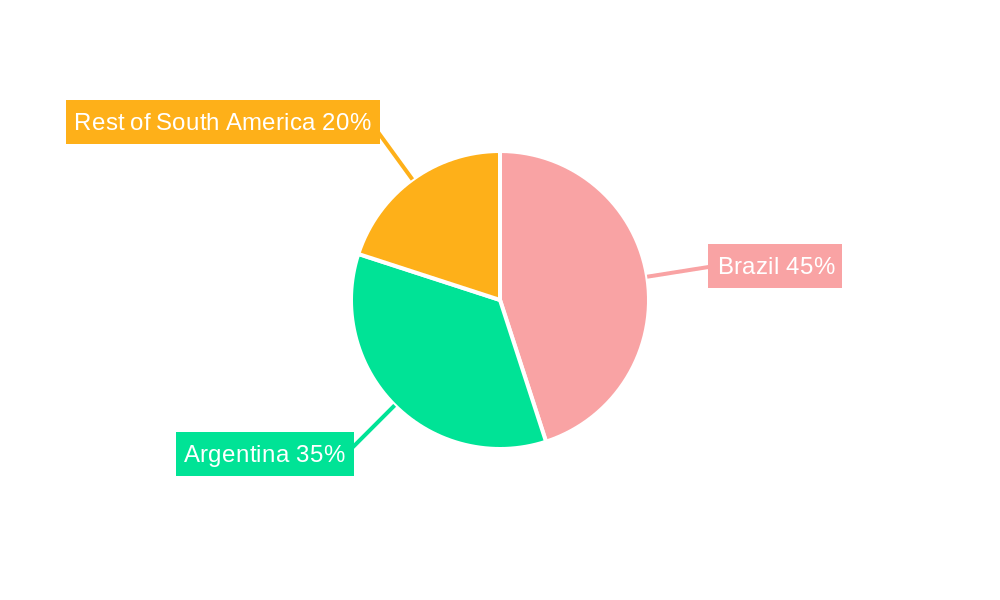

The segmentation within the South American wine market is significant. Still wine is expected to maintain the largest market share, reflecting traditional consumption patterns. However, the premiumization trend will drive growth in the sparkling wine and fortified wine segments. Distribution channels are equally important, with the off-trade segment (retail) demonstrating strong potential for growth due to increased accessibility and online sales. The market landscape is characterized by a mix of large, established players and smaller, specialized wineries. These companies are investing in brand building, innovation (such as organic and biodynamic wines), and export strategies to capitalize on the opportunities presented by a growing global appetite for South American wines. Regional variations within South America are expected, with Brazil and Argentina holding the largest market shares, but the ‘Rest of South America’ segment also offers considerable untapped potential. Growth strategies will likely focus on catering to diverse consumer preferences, tapping into the expanding middle class, and promoting the unique characteristics of South American wines on the global stage.

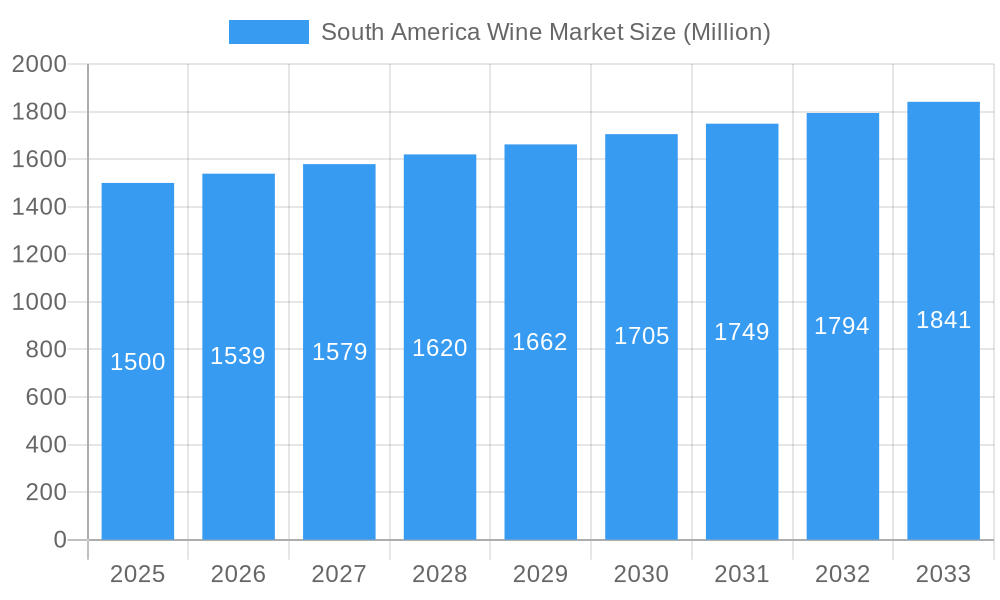

South America Wine Market Company Market Share

South America Wine Market: 2019-2033 Forecast Report

This comprehensive report provides a detailed analysis of the South America wine market, covering the period 2019-2033. It delves into market dynamics, competitive landscape, and future growth prospects, offering actionable insights for industry stakeholders. The report utilizes a robust methodology, incorporating historical data (2019-2024), a base year of 2025, and a forecast period extending to 2033. Expect detailed segmentation analysis, including market size and growth projections across various wine types, colors, distribution channels, and key regions within South America.

South America Wine Market Market Concentration & Innovation

This section analyzes the South America wine market's concentration, identifying dominant players and assessing their market share. We explore the innovation drivers shaping the industry, including technological advancements in winemaking and evolving consumer preferences. The report examines the regulatory frameworks impacting the market, analyzes the presence of product substitutes, and investigates end-user trends influencing demand. Finally, it reviews recent mergers and acquisitions (M&A) activities, including deal values and their impact on market consolidation. Key metrics such as market share percentages for leading players and total M&A deal values (in Millions) are included. For example, the xx% market share held by Grupo Penaflor in 2024 will be compared to projected figures for 2033. We will also analyze the impact of M&A activities, with an estimated xx Million in deal values recorded during the 2019-2024 period. The impact of these deals on market concentration and competition will be explored in detail.

South America Wine Market Industry Trends & Insights

This section offers a deep dive into the South America wine market's evolution. We examine market growth drivers, including shifting consumer preferences toward specific wine types and colors, the influence of tourism, and economic factors impacting purchasing power. The analysis incorporates technological disruptions, such as advancements in winemaking techniques and the growing use of e-commerce for distribution. Furthermore, the report assesses the competitive dynamics, highlighting strategies employed by key players and their impact on market share. Key metrics include the Compound Annual Growth Rate (CAGR) for the forecast period and market penetration rates for different segments, revealing the projected growth trajectory and market saturation levels.

Dominant Markets & Segments in South America Wine Market

This section pinpoints the leading regions, countries, and segments within the South America wine market. We analyze dominance across wine types (Still Wine, Sparkling Wine, Fortified Wine, Vermouth), colors (Red Wine, Rosé Wine, White Wine), and distribution channels (On-Trade, Off-Trade). Key drivers of dominance are identified, including economic policies, infrastructure development, and cultural factors.

- Key Drivers for Dominant Segments:

- Economic factors influencing consumer spending.

- Infrastructure supporting efficient distribution networks.

- Government regulations impacting production and trade.

- Cultural preferences and wine consumption habits.

The dominance analysis provides a detailed understanding of the factors driving market leadership within each segment and region. For example, Argentina's dominance in Malbec production and export will be discussed in relation to its impact on global market dynamics.

South America Wine Market Product Developments

This section summarizes recent and expected product innovations in the South American wine market, highlighting the introduction of new wine types, styles, and packaging formats. The competitive advantages associated with these new products are analyzed in relation to their market fit. Technological trends are emphasized, such as sustainable winemaking practices and the utilization of innovative packaging materials.

Report Scope & Segmentation Analysis

This report comprehensively segments the South America wine market by:

- Wine Type: Still Wine, Sparkling Wine, Fortified Wine, Vermouth (each segment will have individual growth projections, market sizes and competitive dynamics discussed)

- Wine Color: Red Wine, Rosé Wine, White Wine (each segment will have individual growth projections, market sizes and competitive dynamics discussed)

- Distribution Channel: On-Trade, Off-Trade (each segment will have individual growth projections, market sizes and competitive dynamics discussed)

Growth projections, market sizes (in Millions), and competitive dynamics are provided for each segment.

Key Drivers of South America Wine Market Growth

Several factors drive the growth of the South America wine market. These include:

- Technological advancements: Improved winemaking techniques resulting in higher quality and yields.

- Economic growth: Increased disposable incomes leading to higher wine consumption.

- Favorable regulatory environment: Policies promoting wine exports and domestic consumption.

Challenges in the South America Wine Market Sector

The South America wine market faces challenges, including:

- Regulatory hurdles: Complex import/export regulations and taxes impacting trade.

- Supply chain issues: Logistics challenges and fluctuations in raw material costs.

- Intense competition: Pressure from established players and new entrants affecting pricing strategies. For instance, the xx% increase in import tariffs in 2022 resulted in a xx Million decrease in export revenue.

Emerging Opportunities in South America Wine Market

Several opportunities exist for growth in the South America wine market. These include:

- Expansion into new markets: Increased focus on export to other regions within and outside South America.

- Adoption of new technologies: Investments in sustainable practices and digital marketing.

- Development of niche products: Catering to changing consumer tastes and preferences for organic and biodynamic wines.

Leading Players in the South America Wine Market Market

- Grupo Penaflor

- Bodegas Esmeralda

- Bacardi Limited

- Fecovita Co-op

- The Miolo Wine Group

- The Wine group

- Vina Concha Y Toro

- Bouchon Wine Limited

- Casa Valduga

- Cara Sur

Key Developments in South America Wine Market Industry

- May 2022: Concha Y Toro's Diablo brand launched its first White Wine, expanding its product portfolio.

- March 2021: Wines of Argentina launched an innovation program to enhance Argentine wineries' online presence.

- February 2020: Fecovita launched a range of Argentinian wines targeting British palates.

Strategic Outlook for South America Wine Market Market

The South America wine market is poised for continued growth, driven by factors such as increasing wine consumption, rising disposable incomes, and the ongoing efforts of wineries to innovate and improve their products. The market will continue to see consolidation through mergers and acquisitions, and an increasing focus on sustainable winemaking practices. The projected growth for the next decade presents significant opportunities for existing players and new entrants looking to capitalize on the region’s wine-producing potential.

South America Wine Market Segmentation

-

1. Type

- 1.1. Still Wine

- 1.2. Sparkling Wine

- 1.3. Fortified Wine

- 1.4. Vermouth

-

2. Color

- 2.1. Red Wine

- 2.2. Rose Wine

- 2.3. White Wine

-

3. Distriburtion Channel

- 3.1. On-Trade

-

3.2. Off-Trade

- 3.2.1. Supermarkets/Hypermarkets

- 3.2.2. Specialty Stores

- 3.2.3. Online Retailers

- 3.2.4. Other Distribution Channels

-

4. Geography

- 4.1. Argentina

- 4.2. Brazil

- 4.3. Rest of South America

South America Wine Market Segmentation By Geography

- 1. Argentina

- 2. Brazil

- 3. Rest of South America

South America Wine Market Regional Market Share

Geographic Coverage of South America Wine Market

South America Wine Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for premium and organic wines

- 3.3. Market Restrains

- 3.3.1. Economic downturns or fluctuations can impact disposable income and reduce consumer spending on luxury items like wine

- 3.4. Market Trends

- 3.4.1. Growing focus on sustainable practices in wine production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Wine Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Still Wine

- 5.1.2. Sparkling Wine

- 5.1.3. Fortified Wine

- 5.1.4. Vermouth

- 5.2. Market Analysis, Insights and Forecast - by Color

- 5.2.1. Red Wine

- 5.2.2. Rose Wine

- 5.2.3. White Wine

- 5.3. Market Analysis, Insights and Forecast - by Distriburtion Channel

- 5.3.1. On-Trade

- 5.3.2. Off-Trade

- 5.3.2.1. Supermarkets/Hypermarkets

- 5.3.2.2. Specialty Stores

- 5.3.2.3. Online Retailers

- 5.3.2.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Argentina

- 5.4.2. Brazil

- 5.4.3. Rest of South America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Argentina

- 5.5.2. Brazil

- 5.5.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Argentina South America Wine Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Still Wine

- 6.1.2. Sparkling Wine

- 6.1.3. Fortified Wine

- 6.1.4. Vermouth

- 6.2. Market Analysis, Insights and Forecast - by Color

- 6.2.1. Red Wine

- 6.2.2. Rose Wine

- 6.2.3. White Wine

- 6.3. Market Analysis, Insights and Forecast - by Distriburtion Channel

- 6.3.1. On-Trade

- 6.3.2. Off-Trade

- 6.3.2.1. Supermarkets/Hypermarkets

- 6.3.2.2. Specialty Stores

- 6.3.2.3. Online Retailers

- 6.3.2.4. Other Distribution Channels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Argentina

- 6.4.2. Brazil

- 6.4.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Brazil South America Wine Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Still Wine

- 7.1.2. Sparkling Wine

- 7.1.3. Fortified Wine

- 7.1.4. Vermouth

- 7.2. Market Analysis, Insights and Forecast - by Color

- 7.2.1. Red Wine

- 7.2.2. Rose Wine

- 7.2.3. White Wine

- 7.3. Market Analysis, Insights and Forecast - by Distriburtion Channel

- 7.3.1. On-Trade

- 7.3.2. Off-Trade

- 7.3.2.1. Supermarkets/Hypermarkets

- 7.3.2.2. Specialty Stores

- 7.3.2.3. Online Retailers

- 7.3.2.4. Other Distribution Channels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Argentina

- 7.4.2. Brazil

- 7.4.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South America Wine Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Still Wine

- 8.1.2. Sparkling Wine

- 8.1.3. Fortified Wine

- 8.1.4. Vermouth

- 8.2. Market Analysis, Insights and Forecast - by Color

- 8.2.1. Red Wine

- 8.2.2. Rose Wine

- 8.2.3. White Wine

- 8.3. Market Analysis, Insights and Forecast - by Distriburtion Channel

- 8.3.1. On-Trade

- 8.3.2. Off-Trade

- 8.3.2.1. Supermarkets/Hypermarkets

- 8.3.2.2. Specialty Stores

- 8.3.2.3. Online Retailers

- 8.3.2.4. Other Distribution Channels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Argentina

- 8.4.2. Brazil

- 8.4.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Grupo Penaflor

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Bodegas Esmeralda

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Bacardi Limited

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Fecovita Co-op

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 The Miolo Wine Group

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 The Wine group

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Vina Concha Y Toro

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Bouchon Wine Limited

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Casa Valduga

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Cara Sur

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Grupo Penaflor

List of Figures

- Figure 1: South America Wine Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Wine Market Share (%) by Company 2025

List of Tables

- Table 1: South America Wine Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: South America Wine Market Volume K Liters Forecast, by Type 2020 & 2033

- Table 3: South America Wine Market Revenue Million Forecast, by Color 2020 & 2033

- Table 4: South America Wine Market Volume K Liters Forecast, by Color 2020 & 2033

- Table 5: South America Wine Market Revenue Million Forecast, by Distriburtion Channel 2020 & 2033

- Table 6: South America Wine Market Volume K Liters Forecast, by Distriburtion Channel 2020 & 2033

- Table 7: South America Wine Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: South America Wine Market Volume K Liters Forecast, by Geography 2020 & 2033

- Table 9: South America Wine Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: South America Wine Market Volume K Liters Forecast, by Region 2020 & 2033

- Table 11: South America Wine Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: South America Wine Market Volume K Liters Forecast, by Type 2020 & 2033

- Table 13: South America Wine Market Revenue Million Forecast, by Color 2020 & 2033

- Table 14: South America Wine Market Volume K Liters Forecast, by Color 2020 & 2033

- Table 15: South America Wine Market Revenue Million Forecast, by Distriburtion Channel 2020 & 2033

- Table 16: South America Wine Market Volume K Liters Forecast, by Distriburtion Channel 2020 & 2033

- Table 17: South America Wine Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: South America Wine Market Volume K Liters Forecast, by Geography 2020 & 2033

- Table 19: South America Wine Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: South America Wine Market Volume K Liters Forecast, by Country 2020 & 2033

- Table 21: South America Wine Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: South America Wine Market Volume K Liters Forecast, by Type 2020 & 2033

- Table 23: South America Wine Market Revenue Million Forecast, by Color 2020 & 2033

- Table 24: South America Wine Market Volume K Liters Forecast, by Color 2020 & 2033

- Table 25: South America Wine Market Revenue Million Forecast, by Distriburtion Channel 2020 & 2033

- Table 26: South America Wine Market Volume K Liters Forecast, by Distriburtion Channel 2020 & 2033

- Table 27: South America Wine Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: South America Wine Market Volume K Liters Forecast, by Geography 2020 & 2033

- Table 29: South America Wine Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: South America Wine Market Volume K Liters Forecast, by Country 2020 & 2033

- Table 31: South America Wine Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: South America Wine Market Volume K Liters Forecast, by Type 2020 & 2033

- Table 33: South America Wine Market Revenue Million Forecast, by Color 2020 & 2033

- Table 34: South America Wine Market Volume K Liters Forecast, by Color 2020 & 2033

- Table 35: South America Wine Market Revenue Million Forecast, by Distriburtion Channel 2020 & 2033

- Table 36: South America Wine Market Volume K Liters Forecast, by Distriburtion Channel 2020 & 2033

- Table 37: South America Wine Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: South America Wine Market Volume K Liters Forecast, by Geography 2020 & 2033

- Table 39: South America Wine Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: South America Wine Market Volume K Liters Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Wine Market?

The projected CAGR is approximately 2.60%.

2. Which companies are prominent players in the South America Wine Market?

Key companies in the market include Grupo Penaflor, Bodegas Esmeralda, Bacardi Limited, Fecovita Co-op, The Miolo Wine Group, The Wine group, Vina Concha Y Toro, Bouchon Wine Limited, Casa Valduga, Cara Sur.

3. What are the main segments of the South America Wine Market?

The market segments include Type, Color, Distriburtion Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for premium and organic wines.

6. What are the notable trends driving market growth?

Growing focus on sustainable practices in wine production.

7. Are there any restraints impacting market growth?

Economic downturns or fluctuations can impact disposable income and reduce consumer spending on luxury items like wine.

8. Can you provide examples of recent developments in the market?

In May 2022, Concha Y Toro's brand Diablo launched its first White Wine. It is a seductive wine with notes of passion fruit and mango. This wine is versatile, especially recommended to pair with oily fish, seafood, and pasta with creamy sauces.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Liters.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Wine Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Wine Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Wine Market?

To stay informed about further developments, trends, and reports in the South America Wine Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence