Key Insights

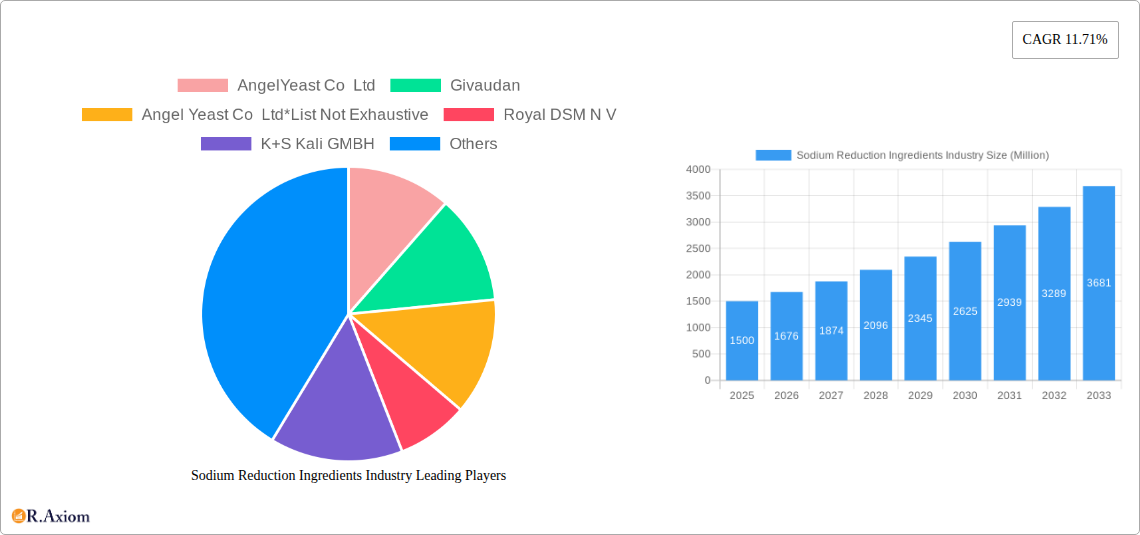

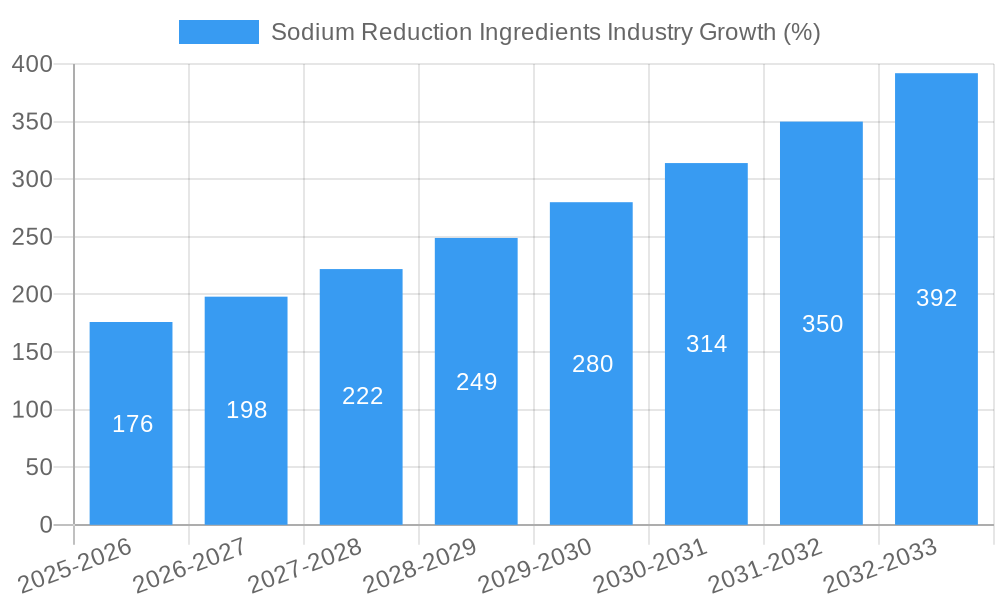

The Sodium Reduction Ingredients market, currently valued at approximately $XX million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 11.71% from 2025 to 2033. This expansion is driven by a confluence of factors. Increasing consumer awareness of the health risks associated with high sodium intake, coupled with stricter government regulations on sodium content in processed foods, are major catalysts. The rising prevalence of hypertension and cardiovascular diseases globally further fuels demand for effective sodium reduction solutions. Key market trends include the growing preference for clean-label ingredients and the innovation of novel sodium reduction technologies, such as the development of more effective mineral salts and protein-based alternatives. While the market faces restraints such as potential challenges in maintaining taste and texture in low-sodium products, the overall market outlook remains positive, supported by ongoing research and development in this crucial area of food technology.

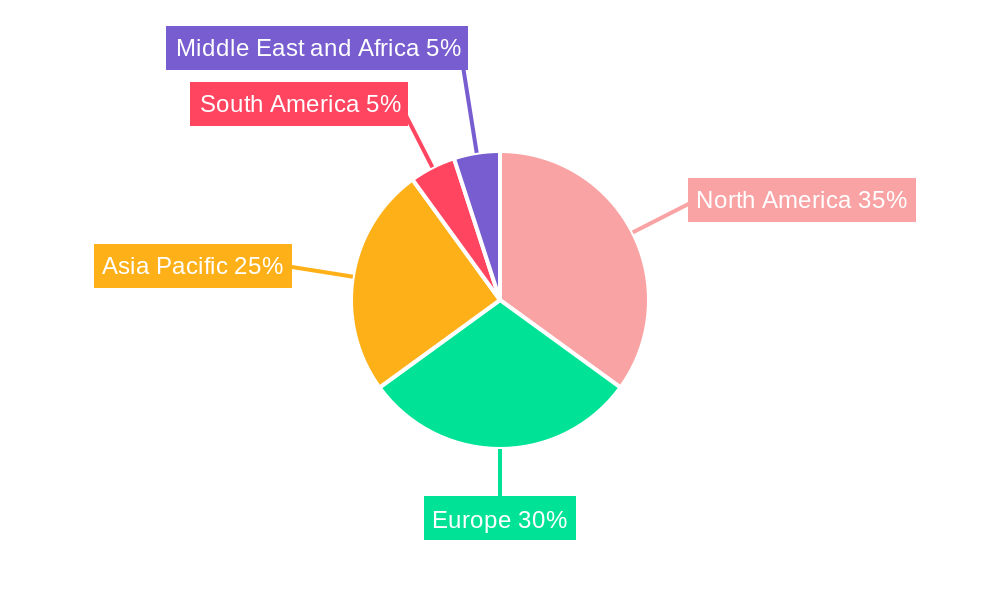

The market segmentation reveals significant opportunities. Amino acids and glutamates, along with mineral salts such as potassium chloride, are key product types, each catering to specific applications. The bakery & confectionery, condiments & sauces, and dairy & frozen foods segments are substantial consumers of these ingredients, reflecting the broad applicability of sodium reduction solutions across diverse food categories. Leading companies like Angel Yeast Co Ltd, Givaudan, Royal DSM, and Cargill are actively involved in innovation and market expansion, driving competitive dynamics. Regional analysis suggests robust growth across North America, Europe, and the Asia-Pacific region, mirroring the global trend of increased health consciousness and regulatory pressure. The market's future trajectory is promising, predicated on sustained innovation, consumer demand for healthier food choices, and continued supportive government policies.

This detailed report provides a comprehensive analysis of the Sodium Reduction Ingredients industry, covering market size, growth projections, key players, and emerging trends from 2019 to 2033. The report incorporates data from the historical period (2019-2024), base year (2025), and estimated year (2025), offering a robust forecast for 2025-2033. It is an essential resource for industry stakeholders, investors, and researchers seeking actionable insights into this dynamic market.

Sodium Reduction Ingredients Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the sodium reduction ingredients market, examining market concentration, innovation drivers, regulatory influences, and M&A activity. The market is characterized by a mix of large multinational corporations and specialized ingredient suppliers. While precise market share data for each company requires further detailed analysis, the industry displays moderate concentration, with several key players holding significant market positions. The xx Million market value is driven by the increasing consumer demand for healthier food options and stringent government regulations aimed at reducing sodium intake. Innovation is a key driver, with companies continuously developing new and improved sodium reduction solutions.

- Market Concentration: Moderate, with several key players holding significant shares. Further research will quantify these shares precisely.

- Innovation Drivers: Growing health consciousness, stringent regulations, and technological advancements in ingredient development.

- Regulatory Frameworks: Varying regulations across different regions are influencing product development and market penetration.

- Product Substitutes: The availability of substitutes like potassium chloride and other mineral salts influences market competition.

- End-User Trends: Increasing demand for healthier and lower-sodium food products across various application segments.

- M&A Activities: The report will include details on past and potential M&A activities affecting the market landscape and their impact on market dynamics. xx Million in M&A deal values are projected over the forecast period.

Sodium Reduction Ingredients Industry Industry Trends & Insights

The sodium reduction ingredients market is experiencing significant growth, driven by factors such as increasing health awareness among consumers, rising prevalence of diet-related diseases, and stricter government regulations on sodium content in food products. The market is expected to witness a CAGR of xx% during the forecast period (2025-2033). Technological advancements, such as the development of novel sodium reduction ingredients and improved processing technologies, are further contributing to market expansion. Consumer preferences are shifting towards healthier food choices, creating a strong demand for low-sodium food products. Competitive dynamics are shaping the market, with companies focusing on innovation, product differentiation, and strategic partnerships to enhance their market presence. Market penetration for sodium reduction ingredients is projected to reach xx% by 2033.

Dominant Markets & Segments in Sodium Reduction Ingredients Industry

The global sodium reduction ingredients market is segmented by product type (Amino Acids & Glutamates, Mineral Salts, Calcium Chloride, Yeast Extracts, Others) and application (Bakery & Confectionery, Condiments, Seasonings & Sauces, Dairy & Frozen Foods, Meat & Meat Products, Snacks, Others). While a definitive "dominant" region/country requires further analysis, North America and Europe are expected to hold significant market shares due to high consumer awareness and established regulatory frameworks. Within product types, yeast extracts and mineral salts are expected to dominate based on current market trends. The Bakery & Confectionery and Condiments, Seasonings & Sauces application segments are anticipated to be the largest.

Key Drivers for Leading Regions/Countries:

- North America: High consumer awareness of health and well-being, robust regulatory environment.

- Europe: Stringent food safety regulations, strong focus on healthy eating.

- Asia-Pacific: Growing health consciousness, rising disposable incomes.

Key Drivers for Leading Segments:

- Yeast Extracts: Functional properties and broad application potential.

- Mineral Salts (e.g., Potassium Chloride): Effective sodium replacement and cost-effectiveness.

- Bakery & Confectionery: High consumption of baked goods and snacks.

- Condiments, Seasonings & Sauces: Significant sodium content in these product categories.

Sodium Reduction Ingredients Industry Product Developments

Recent product innovations focus on developing effective and palatable sodium reduction solutions. New technologies enhance the functionality and sensory properties of these ingredients, minimizing taste compromises. For example, the development of ultra-fine salt flour allows for better incorporation into various food products, expanding the application range. These advancements are improving the market fit of sodium reduction ingredients, leading to increased adoption across various food categories.

Report Scope & Segmentation Analysis

This report segments the sodium reduction ingredients market by product type (Amino Acids & Glutamates, Mineral Salts, Calcium Chloride, Yeast Extracts, Others) and application (Bakery & Confectionery, Condiments, Seasonings & Sauces, Dairy & Frozen Foods, Meat & Meat Products, Snacks, Others). Each segment's growth trajectory, market size, and competitive landscape are analyzed, providing a detailed breakdown of the market's structure and dynamics. Growth projections vary across segments depending on factors like consumer demand, technological advancements, and regulatory changes. The competitive dynamics within each segment are analyzed, highlighting key players and their market strategies.

Key Drivers of Sodium Reduction Ingredients Industry Growth

The growth of the sodium reduction ingredients industry is driven by several factors. The increasing prevalence of diet-related diseases linked to high sodium intake is pushing consumers towards healthier food options. Government regulations mandating sodium reduction in processed foods are creating significant demand for these ingredients. Technological advancements in ingredient development are improving their functionality and taste, making them more appealing to food manufacturers.

Challenges in the Sodium Reduction Ingredients Industry Sector

Despite strong growth drivers, the industry faces challenges. The cost of some sodium reduction ingredients can be higher than traditional salt, posing a barrier to adoption for cost-sensitive manufacturers. Maintaining the sensory qualities of food products after sodium reduction can be challenging, requiring careful ingredient selection and formulation. Furthermore, inconsistent regulations across different regions create complexities for manufacturers operating internationally. These issues may contribute to a xx Million slowdown in market growth in certain segments.

Emerging Opportunities in Sodium Reduction Ingredients Industry

The industry presents exciting opportunities. The growing demand for clean-label and natural food products offers opportunities for manufacturers to develop sodium reduction solutions derived from natural sources. The expansion of the global food processing industry, especially in developing economies, presents significant market potential for sodium reduction ingredients. Furthermore, innovations in taste masking technologies could further enhance consumer acceptance of low-sodium food products. These factors could contribute to a xx Million surge in market value in specific niche applications.

Leading Players in the Sodium Reduction Ingredients Industry Market

- AngelYeast Co Ltd

- Givaudan

- Royal DSM N V

- K+S Kali GMBH

- Advanced Food Systems Inc

- Kerry Group Plc

- DuPont

- Dr Paul Lohmann GmbH & Co KGaA

- Cargill Inc

Key Developments in Sodium Reduction Ingredients Industry Industry

- 2021: Cargill Salt launched purified sea salt flour, expanding applications in dry soups, cereals, and snack foods.

- 2021: Tata Salt introduced India's first 30% low-sodium salt, Tata Salt SuperLite.

- 2021: Food For Life launched three low-sodium products (English muffins, cereal, tortillas) with 0mg sodium per serving.

Strategic Outlook for Sodium Reduction Ingredients Industry Market

The sodium reduction ingredients market is poised for continued growth, driven by persistent health concerns, evolving consumer preferences, and supportive government policies. Innovation in taste masking and the development of sustainable and natural solutions will be critical for sustained market expansion. The focus on improving the functionality and sensory attributes of these ingredients will be key to enhancing their adoption and driving future market growth, potentially leading to a xx Million increase in market value by 2033.

Sodium Reduction Ingredients Industry Segmentation

-

1. Product Type

- 1.1. Amino Acids & Glutamates

-

1.2. Mineral Salts

- 1.2.1. Potassium Chloride

- 1.2.2. Magnesium Sulphate

- 1.2.3. Potassium Lactate

- 1.2.4. Calcium Chloride

- 1.3. Yeast Extracts

- 1.4. Others

-

2. Application

- 2.1. Bakery & Confectionery

- 2.2. Condiments, Seasonings & Sauces

- 2.3. Dairy & Frozen Foods

- 2.4. Meat & Meat Products

- 2.5. Snacks

- 2.6. Others

Sodium Reduction Ingredients Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Sodium Reduction Ingredients Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.71% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population

- 3.3. Market Restrains

- 3.3.1. Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products

- 3.4. Market Trends

- 3.4.1. Growing Consumer Awareness Toward High Sodium Intake

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sodium Reduction Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Amino Acids & Glutamates

- 5.1.2. Mineral Salts

- 5.1.2.1. Potassium Chloride

- 5.1.2.2. Magnesium Sulphate

- 5.1.2.3. Potassium Lactate

- 5.1.2.4. Calcium Chloride

- 5.1.3. Yeast Extracts

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery & Confectionery

- 5.2.2. Condiments, Seasonings & Sauces

- 5.2.3. Dairy & Frozen Foods

- 5.2.4. Meat & Meat Products

- 5.2.5. Snacks

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Sodium Reduction Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Amino Acids & Glutamates

- 6.1.2. Mineral Salts

- 6.1.2.1. Potassium Chloride

- 6.1.2.2. Magnesium Sulphate

- 6.1.2.3. Potassium Lactate

- 6.1.2.4. Calcium Chloride

- 6.1.3. Yeast Extracts

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bakery & Confectionery

- 6.2.2. Condiments, Seasonings & Sauces

- 6.2.3. Dairy & Frozen Foods

- 6.2.4. Meat & Meat Products

- 6.2.5. Snacks

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Sodium Reduction Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Amino Acids & Glutamates

- 7.1.2. Mineral Salts

- 7.1.2.1. Potassium Chloride

- 7.1.2.2. Magnesium Sulphate

- 7.1.2.3. Potassium Lactate

- 7.1.2.4. Calcium Chloride

- 7.1.3. Yeast Extracts

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bakery & Confectionery

- 7.2.2. Condiments, Seasonings & Sauces

- 7.2.3. Dairy & Frozen Foods

- 7.2.4. Meat & Meat Products

- 7.2.5. Snacks

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Sodium Reduction Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Amino Acids & Glutamates

- 8.1.2. Mineral Salts

- 8.1.2.1. Potassium Chloride

- 8.1.2.2. Magnesium Sulphate

- 8.1.2.3. Potassium Lactate

- 8.1.2.4. Calcium Chloride

- 8.1.3. Yeast Extracts

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bakery & Confectionery

- 8.2.2. Condiments, Seasonings & Sauces

- 8.2.3. Dairy & Frozen Foods

- 8.2.4. Meat & Meat Products

- 8.2.5. Snacks

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Sodium Reduction Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Amino Acids & Glutamates

- 9.1.2. Mineral Salts

- 9.1.2.1. Potassium Chloride

- 9.1.2.2. Magnesium Sulphate

- 9.1.2.3. Potassium Lactate

- 9.1.2.4. Calcium Chloride

- 9.1.3. Yeast Extracts

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Bakery & Confectionery

- 9.2.2. Condiments, Seasonings & Sauces

- 9.2.3. Dairy & Frozen Foods

- 9.2.4. Meat & Meat Products

- 9.2.5. Snacks

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Sodium Reduction Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Amino Acids & Glutamates

- 10.1.2. Mineral Salts

- 10.1.2.1. Potassium Chloride

- 10.1.2.2. Magnesium Sulphate

- 10.1.2.3. Potassium Lactate

- 10.1.2.4. Calcium Chloride

- 10.1.3. Yeast Extracts

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Bakery & Confectionery

- 10.2.2. Condiments, Seasonings & Sauces

- 10.2.3. Dairy & Frozen Foods

- 10.2.4. Meat & Meat Products

- 10.2.5. Snacks

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. North America Sodium Reduction Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 11.1.4 Rest of North America

- 12. Europe Sodium Reduction Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 Germany

- 12.1.3 France

- 12.1.4 Russia

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Rest of Europe

- 13. Asia Pacific Sodium Reduction Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 India

- 13.1.2 China

- 13.1.3 Japan

- 13.1.4 Australia

- 13.1.5 Rest of Asia Pacific

- 14. South America Sodium Reduction Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Middle East and Africa Sodium Reduction Ingredients Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 South Africa

- 15.1.2 Saudi Arabia

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 AngelYeast Co Ltd

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Givaudan

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Angel Yeast Co Ltd*List Not Exhaustive

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Royal DSM N V

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 K+S Kali GMBH

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Advanced Food Systems Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Kerry Group Plc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 DuPont

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Dr Paul Lohmann GmbH & Co KGaA

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Cargill Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 AngelYeast Co Ltd

List of Figures

- Figure 1: Global Sodium Reduction Ingredients Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Sodium Reduction Ingredients Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Sodium Reduction Ingredients Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Sodium Reduction Ingredients Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Sodium Reduction Ingredients Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Sodium Reduction Ingredients Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Sodium Reduction Ingredients Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Sodium Reduction Ingredients Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Sodium Reduction Ingredients Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Sodium Reduction Ingredients Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Sodium Reduction Ingredients Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Sodium Reduction Ingredients Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 13: North America Sodium Reduction Ingredients Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: North America Sodium Reduction Ingredients Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Sodium Reduction Ingredients Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Sodium Reduction Ingredients Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Sodium Reduction Ingredients Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Sodium Reduction Ingredients Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 19: Europe Sodium Reduction Ingredients Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 20: Europe Sodium Reduction Ingredients Industry Revenue (Million), by Application 2024 & 2032

- Figure 21: Europe Sodium Reduction Ingredients Industry Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe Sodium Reduction Ingredients Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Sodium Reduction Ingredients Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Sodium Reduction Ingredients Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 25: Asia Pacific Sodium Reduction Ingredients Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 26: Asia Pacific Sodium Reduction Ingredients Industry Revenue (Million), by Application 2024 & 2032

- Figure 27: Asia Pacific Sodium Reduction Ingredients Industry Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Sodium Reduction Ingredients Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Sodium Reduction Ingredients Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: South America Sodium Reduction Ingredients Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 31: South America Sodium Reduction Ingredients Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 32: South America Sodium Reduction Ingredients Industry Revenue (Million), by Application 2024 & 2032

- Figure 33: South America Sodium Reduction Ingredients Industry Revenue Share (%), by Application 2024 & 2032

- Figure 34: South America Sodium Reduction Ingredients Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: South America Sodium Reduction Ingredients Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Sodium Reduction Ingredients Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 37: Middle East and Africa Sodium Reduction Ingredients Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Middle East and Africa Sodium Reduction Ingredients Industry Revenue (Million), by Application 2024 & 2032

- Figure 39: Middle East and Africa Sodium Reduction Ingredients Industry Revenue Share (%), by Application 2024 & 2032

- Figure 40: Middle East and Africa Sodium Reduction Ingredients Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Sodium Reduction Ingredients Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Sodium Reduction Ingredients Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Sodium Reduction Ingredients Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Sodium Reduction Ingredients Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Sodium Reduction Ingredients Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Sodium Reduction Ingredients Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Sodium Reduction Ingredients Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United Kingdom Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Russia Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Europe Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Sodium Reduction Ingredients Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: India Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: China Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Sodium Reduction Ingredients Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Brazil Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Argentina Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of South America Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Sodium Reduction Ingredients Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: South Africa Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Saudi Arabia Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Middle East and Africa Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Sodium Reduction Ingredients Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 33: Global Sodium Reduction Ingredients Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 34: Global Sodium Reduction Ingredients Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 35: United States Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Canada Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Mexico Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of North America Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Sodium Reduction Ingredients Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 40: Global Sodium Reduction Ingredients Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 41: Global Sodium Reduction Ingredients Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: United Kingdom Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Germany Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: France Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Russia Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Spain Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Sodium Reduction Ingredients Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 50: Global Sodium Reduction Ingredients Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 51: Global Sodium Reduction Ingredients Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 52: India Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: China Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Japan Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Australia Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Asia Pacific Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Global Sodium Reduction Ingredients Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 58: Global Sodium Reduction Ingredients Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 59: Global Sodium Reduction Ingredients Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 60: Brazil Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Argentina Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of South America Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Global Sodium Reduction Ingredients Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 64: Global Sodium Reduction Ingredients Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 65: Global Sodium Reduction Ingredients Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 66: South Africa Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Saudi Arabia Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Rest of Middle East and Africa Sodium Reduction Ingredients Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sodium Reduction Ingredients Industry?

The projected CAGR is approximately 11.71%.

2. Which companies are prominent players in the Sodium Reduction Ingredients Industry?

Key companies in the market include AngelYeast Co Ltd, Givaudan, Angel Yeast Co Ltd*List Not Exhaustive, Royal DSM N V, K+S Kali GMBH, Advanced Food Systems Inc, Kerry Group Plc, DuPont, Dr Paul Lohmann GmbH & Co KGaA, Cargill Inc.

3. What are the main segments of the Sodium Reduction Ingredients Industry?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population.

6. What are the notable trends driving market growth?

Growing Consumer Awareness Toward High Sodium Intake.

7. Are there any restraints impacting market growth?

Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products.

8. Can you provide examples of recent developments in the market?

In 2021, Cargill Salt launched a new purified sea salt flour. The ingredient is a unique type of ultra-fine cut, powder-like sodium chloride. It is suitable for blending applications that require perfect sizing, including dry soup, cereal, flour, spice mixes, and topping snack foods.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sodium Reduction Ingredients Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sodium Reduction Ingredients Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sodium Reduction Ingredients Industry?

To stay informed about further developments, trends, and reports in the Sodium Reduction Ingredients Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence