Key Insights

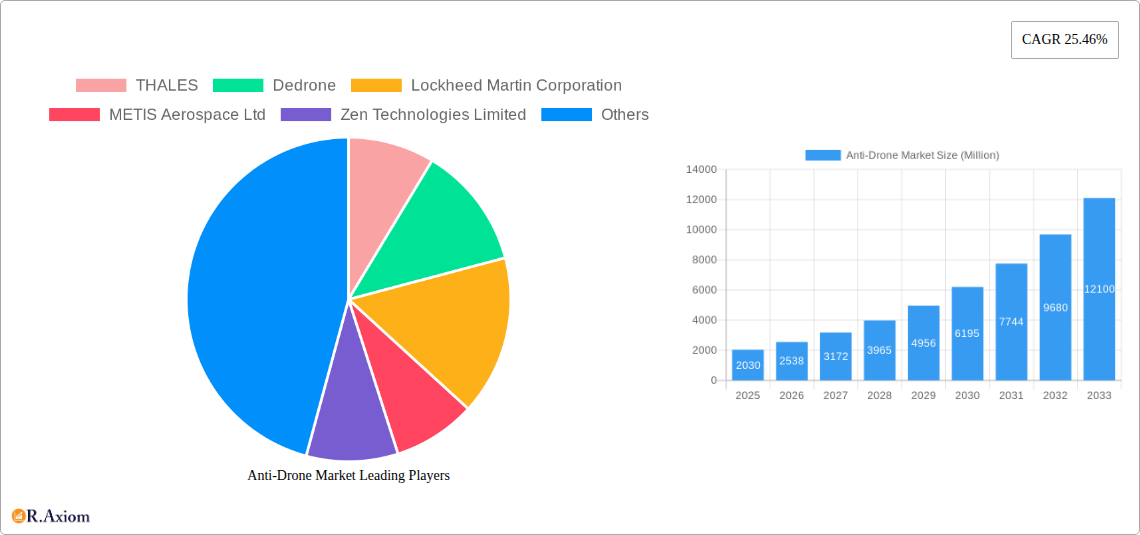

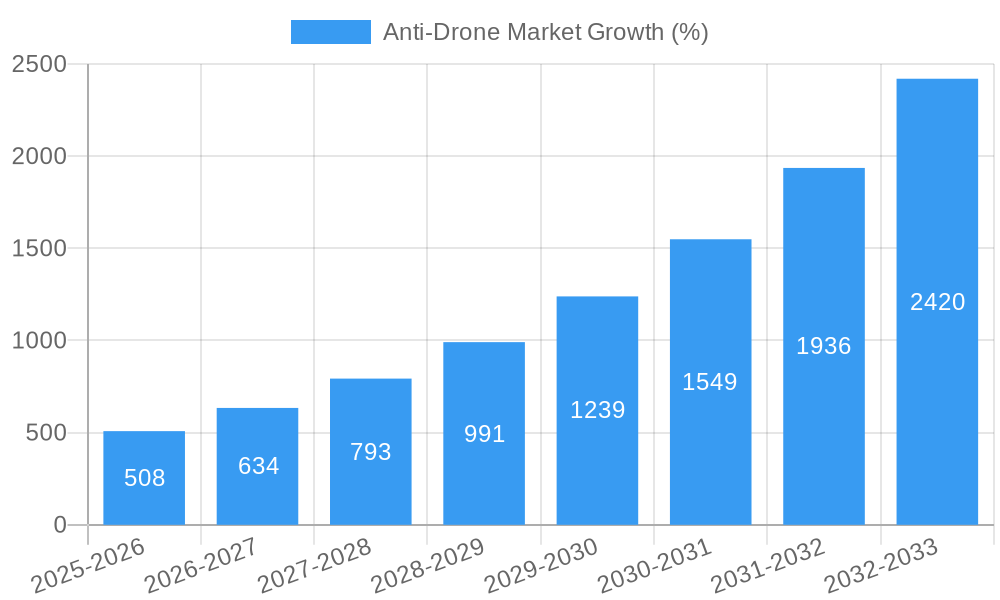

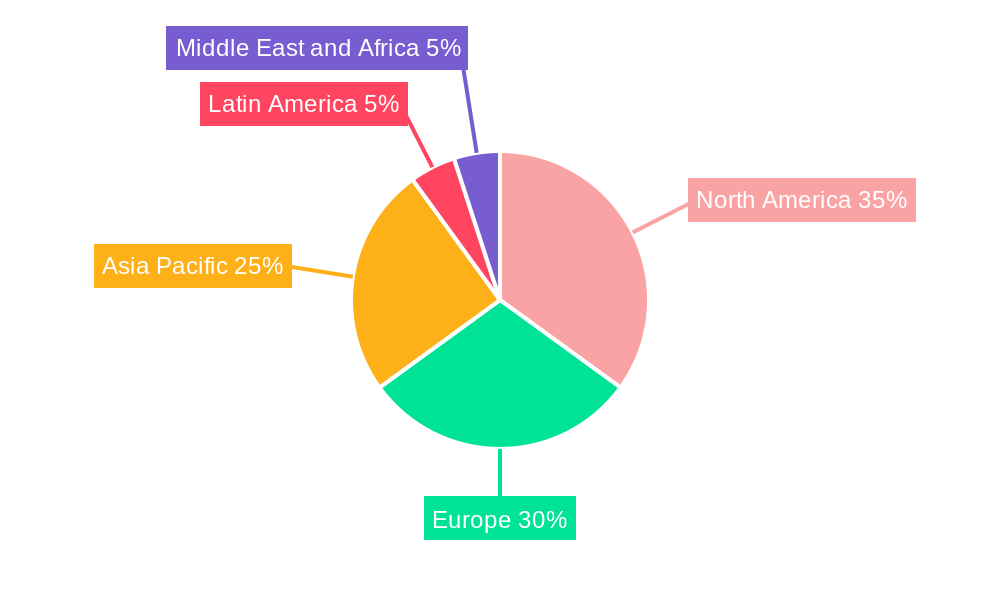

The anti-drone market is experiencing rapid growth, driven by escalating security concerns across various sectors. The market, valued at $2.03 billion in 2025, is projected to expand significantly, exhibiting a Compound Annual Growth Rate (CAGR) of 25.46% from 2025 to 2033. This robust growth is fueled by several key factors. Increased drone proliferation, particularly for malicious purposes, necessitates robust countermeasures. Government initiatives focused on national security and critical infrastructure protection are significantly contributing to market expansion. Furthermore, technological advancements in anti-drone systems, such as AI-powered detection and jamming technologies, are improving effectiveness and driving adoption. The Defense sector currently dominates the market, but growing adoption in airports and other critical infrastructure sectors, such as power grids and industrial facilities, promises substantial future growth. Regional variations exist, with North America and Europe leading in terms of adoption and technological innovation, followed by the Asia-Pacific region, which is showing a rapid increase in demand.

The segmentation of the anti-drone market reveals key opportunities. Detection systems, which encompass radar, optical, and acoustic technologies, constitute a significant portion of the market. However, the segment focusing on jamming and disruption technologies is also witnessing impressive growth as sophisticated countermeasures become necessary to neutralize advanced drone threats. The major players in this market, including Thales, Dedrone, and Lockheed Martin, are investing heavily in research and development, fostering innovation and competitiveness. The market faces certain restraints, including regulatory challenges surrounding the deployment of anti-drone technologies and the potential for unintended consequences, however the overall trajectory indicates a sustained and significant period of market growth driven by the need to protect against increasingly sophisticated drone threats.

This in-depth report provides a comprehensive analysis of the Anti-Drone Market, encompassing market size, segmentation, growth drivers, challenges, and key players. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. It offers invaluable insights for stakeholders, including manufacturers, investors, and government agencies, seeking to understand and capitalize on the opportunities within this rapidly evolving market. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Anti-Drone Market Market Concentration & Innovation

The Anti-Drone Market is characterized by a moderately concentrated landscape, with several key players holding significant market share. However, the market also witnesses considerable innovation, driven by advancements in sensor technology, AI-powered detection systems, and counter-drone strategies. Market leaders such as Thales, Lockheed Martin Corporation, and DroneShield Ltd. are actively involved in research and development, expanding their product portfolios to cater to evolving needs.

- Market Concentration: The top five players account for approximately xx% of the global market share (2024 data). This concentration is influenced by factors such as high R&D investment, strong brand reputation, and established distribution networks.

- Innovation Drivers: The increasing sophistication of drone technology and its potential misuse are key drivers of innovation. Advancements in radar, radio frequency (RF) sensing, and AI-based detection systems are improving the accuracy and effectiveness of anti-drone solutions.

- Regulatory Frameworks: Government regulations concerning drone usage and security are significantly shaping the market. Stringent regulations in key regions are pushing the demand for effective anti-drone measures, thereby stimulating market growth.

- Product Substitutes: While dedicated anti-drone systems dominate the market, alternative solutions, such as physical barriers and stricter airspace management protocols, also play a role. The emergence of new technological solutions continues to reshape the competitive landscape.

- End-User Trends: Growing concerns about national security, critical infrastructure protection, and public safety are fueling demand across various sectors, including defense, airports, and other critical infrastructure facilities.

- M&A Activities: The market has seen a moderate level of M&A activity in recent years, primarily focused on consolidating technology and expanding market reach. The total value of M&A deals during the historical period (2019-2024) is estimated to be around xx Million.

Anti-Drone Market Industry Trends & Insights

The Anti-Drone Market is experiencing robust growth, driven by a multitude of factors. The increasing adoption of drones across diverse sectors has consequently amplified concerns regarding their potential misuse for malicious purposes, such as espionage, attacks, and smuggling. This has resulted in a heightened demand for sophisticated anti-drone technologies. Technological advancements, particularly in AI, machine learning, and sensor technology, have led to the development of more effective and user-friendly counter-drone systems. This has subsequently increased market penetration across various applications, notably defense, airports, and critical infrastructure. The rise of autonomous anti-drone systems is also enhancing the capabilities and efficiency of counter-drone measures.

The market growth is further fueled by favorable government regulations and policies supporting the deployment of anti-drone technologies. However, significant challenges remain, including high initial investment costs for advanced systems, ongoing maintenance requirements, and the need for skilled personnel to operate these systems. The competitive landscape is dynamic, featuring both established players and emerging companies that are actively investing in new technologies and solutions, leading to a continuously evolving market.

Dominant Markets & Segments in Anti-Drone Market

The Anti-Drone Market exhibits varied growth across different segments. The defense segment currently holds the largest market share, primarily driven by substantial government spending on defense modernization and heightened security concerns. The airports segment is witnessing significant growth due to rising air traffic and increasing vulnerability to drone attacks. Other critical infrastructure sectors, such as power plants and government buildings, are also experiencing increased demand for anti-drone systems.

Dominant Region: North America is currently the leading region, followed by Europe and Asia-Pacific. This dominance stems from high technological advancements, robust defense spending, and well-established security infrastructure.

Dominant Application: The detection segment represents the largest application area, encompassing a wide range of technologies such as radar, optical, and RF sensors.

Dominant Sensor Type: Jamming and disruption systems are gaining traction, offering effective countermeasures against hostile drones.

Key Drivers (by segment):

- Defense: Government investments in national security, increasing geopolitical tensions, and the need for advanced surveillance systems.

- Airports: Stringent aviation security regulations, rising air traffic, and concerns about drone intrusions into airspace.

- Other Critical Infrastructures: The need to protect essential facilities from potential drone-related threats, including physical attacks and data breaches.

Anti-Drone Market Product Developments

Recent product developments highlight advancements in AI-powered detection, improved jamming and disruption capabilities, and the integration of multiple sensor technologies for enhanced accuracy and effectiveness. The market is moving toward more autonomous and integrated systems, offering improved situational awareness and faster response times. This trend is driven by the need for efficient and adaptable solutions capable of addressing the diverse threats posed by increasingly sophisticated drones. Furthermore, miniaturization and cost reduction efforts are making anti-drone technologies more accessible to a wider range of users.

Report Scope & Segmentation Analysis

This report segments the Anti-Drone Market by application (Detection, Jamming and Disruption), and vertical (Defense, Airports, Other Critical Infrastructures). Each segment is analyzed based on its market size, growth rate, and competitive landscape. The detection segment is projected to witness substantial growth, driven by increasing demand for advanced sensor systems, while the jamming and disruption segment is expected to experience strong growth due to the effectiveness of these technologies in neutralizing hostile drones. The defense vertical currently holds the largest share, owing to the critical need for anti-drone solutions within the military and national security sectors. However, the airports and other critical infrastructure verticals are expected to exhibit significant growth in the forecast period. The market dynamics vary by region, with North America and Europe currently leading in terms of adoption and innovation.

Key Drivers of Anti-Drone Market Growth

The Anti-Drone Market is primarily driven by several key factors:

- Increased Drone Usage: The widespread adoption of drones across various sectors has heightened concerns about their potential misuse, fueling demand for counter-drone measures.

- Technological Advancements: Innovations in sensor technology, AI, and machine learning are improving the accuracy, reliability, and effectiveness of anti-drone systems.

- Stringent Regulations: Government regulations related to drone operation and security are driving the demand for effective anti-drone solutions.

- Growing Security Concerns: Rising concerns about national security, critical infrastructure protection, and public safety are contributing to increased investment in anti-drone technologies.

Challenges in the Anti-Drone Market Sector

Despite significant growth potential, the Anti-Drone Market faces several challenges:

- High Initial Investment Costs: Advanced anti-drone systems can be expensive, creating a barrier to entry for some organizations.

- Regulatory Hurdles: Navigating varied and evolving regulations across different jurisdictions can be complex and time-consuming.

- Technological Limitations: Current technologies may struggle to effectively counter highly advanced or sophisticated drone designs.

- Supply Chain Disruptions: Global supply chain disruptions can affect the availability and cost of critical components for anti-drone systems.

Emerging Opportunities in Anti-Drone Market

The Anti-Drone Market offers several promising opportunities:

- Development of AI-powered systems: AI and machine learning can significantly enhance the accuracy and effectiveness of anti-drone solutions.

- Integration of multiple sensor technologies: Combining various sensor types can improve overall system performance and situational awareness.

- Expansion into new markets: Growing demand from sectors such as law enforcement, prisons, and private security is creating new market opportunities.

- Development of portable and user-friendly systems: Making anti-drone technologies more accessible and user-friendly can expand the market further.

Leading Players in the Anti-Drone Market Market

- THALES

- Dedrone

- Lockheed Martin Corporation

- METIS Aerospace Ltd

- Zen Technologies Limited

- Robin Radar System

- Drone Defence

- Citadel Defense

- SRC Inc

- DroneShield Ltd

- RTX Corporation

- Israel Aerospace Industries Ltd

- SAAB AB

- QinetiQ Group plc

- DeTect Inc

Key Developments in Anti-Drone Market Industry

- August 2023: DroneShield Ltd. introduced satellite denial systems for specific target areas, incorporating intelligent defeat capabilities for various GNSS (GPS, BeiDou, GLONASS, Galileo). This signifies a significant advancement in countering drone navigation capabilities.

- July 2023: Thales partnered with the Swedish Defence Materiel Administration (FMV) to deliver SMART-L Multi-Mission Fixed (MM/F) long-range radars utilizing AESA technology for air and surface surveillance. This highlights the continued investment in advanced radar technology for broader anti-drone applications.

Strategic Outlook for Anti-Drone Market Market

The Anti-Drone Market is poised for continued strong growth, driven by ongoing technological advancements, heightened security concerns, and increasing regulatory oversight. Emerging technologies such as AI and advanced sensor integration will further enhance the capabilities of anti-drone systems, creating new opportunities for market participants. Expansion into new applications and geographical markets will also contribute to the overall growth trajectory, presenting significant potential for both established players and emerging companies.

Anti-Drone Market Segmentation

-

1. Application

-

1.1. Detection

- 1.1.1. RADARs

- 1.1.2. Other Sensors

- 1.2. Jamming and Disruption

-

1.1. Detection

-

2. Vertical

- 2.1. Defense

- 2.2. Airports

- 2.3. Other Critical Infrastructures

Anti-Drone Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Anti-Drone Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 25.46% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Defense Segment Dominates the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Anti-Drone Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Detection

- 5.1.1.1. RADARs

- 5.1.1.2. Other Sensors

- 5.1.2. Jamming and Disruption

- 5.1.1. Detection

- 5.2. Market Analysis, Insights and Forecast - by Vertical

- 5.2.1. Defense

- 5.2.2. Airports

- 5.2.3. Other Critical Infrastructures

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Anti-Drone Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Detection

- 6.1.1.1. RADARs

- 6.1.1.2. Other Sensors

- 6.1.2. Jamming and Disruption

- 6.1.1. Detection

- 6.2. Market Analysis, Insights and Forecast - by Vertical

- 6.2.1. Defense

- 6.2.2. Airports

- 6.2.3. Other Critical Infrastructures

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Anti-Drone Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Detection

- 7.1.1.1. RADARs

- 7.1.1.2. Other Sensors

- 7.1.2. Jamming and Disruption

- 7.1.1. Detection

- 7.2. Market Analysis, Insights and Forecast - by Vertical

- 7.2.1. Defense

- 7.2.2. Airports

- 7.2.3. Other Critical Infrastructures

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Anti-Drone Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Detection

- 8.1.1.1. RADARs

- 8.1.1.2. Other Sensors

- 8.1.2. Jamming and Disruption

- 8.1.1. Detection

- 8.2. Market Analysis, Insights and Forecast - by Vertical

- 8.2.1. Defense

- 8.2.2. Airports

- 8.2.3. Other Critical Infrastructures

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Anti-Drone Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Detection

- 9.1.1.1. RADARs

- 9.1.1.2. Other Sensors

- 9.1.2. Jamming and Disruption

- 9.1.1. Detection

- 9.2. Market Analysis, Insights and Forecast - by Vertical

- 9.2.1. Defense

- 9.2.2. Airports

- 9.2.3. Other Critical Infrastructures

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Anti-Drone Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Detection

- 10.1.1.1. RADARs

- 10.1.1.2. Other Sensors

- 10.1.2. Jamming and Disruption

- 10.1.1. Detection

- 10.2. Market Analysis, Insights and Forecast - by Vertical

- 10.2.1. Defense

- 10.2.2. Airports

- 10.2.3. Other Critical Infrastructures

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. North America Anti-Drone Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Anti-Drone Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 France

- 12.1.3 Germany

- 12.1.4 Rest of Europe

- 13. Asia Pacific Anti-Drone Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 India

- 13.1.3 Japan

- 13.1.4 South Korea

- 13.1.5 Rest of Asia Pacific

- 14. Latin America Anti-Drone Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Mexico

- 14.1.2 Brazil

- 14.1.3 Rest of Latin America

- 15. Middle East and Africa Anti-Drone Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Saudi Arabia

- 15.1.2 United Arab Emirates

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 THALES

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Dedrone

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Lockheed Martin Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 METIS Aerospace Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Zen Technologies Limited

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Robin Radar System

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Drone Defence

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Citadel Defense

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 SRC Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 DroneShield Ltd

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 RTX Corporation

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Israel Aerospace Industries Ltd

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 SAAB AB

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 QinetiQ Group plc

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 DeTect Inc

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.1 THALES

List of Figures

- Figure 1: Global Anti-Drone Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Anti-Drone Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Anti-Drone Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Anti-Drone Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Anti-Drone Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Anti-Drone Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Anti-Drone Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Anti-Drone Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Anti-Drone Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Anti-Drone Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Anti-Drone Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Anti-Drone Market Revenue (Million), by Application 2024 & 2032

- Figure 13: North America Anti-Drone Market Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Anti-Drone Market Revenue (Million), by Vertical 2024 & 2032

- Figure 15: North America Anti-Drone Market Revenue Share (%), by Vertical 2024 & 2032

- Figure 16: North America Anti-Drone Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Anti-Drone Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Anti-Drone Market Revenue (Million), by Application 2024 & 2032

- Figure 19: Europe Anti-Drone Market Revenue Share (%), by Application 2024 & 2032

- Figure 20: Europe Anti-Drone Market Revenue (Million), by Vertical 2024 & 2032

- Figure 21: Europe Anti-Drone Market Revenue Share (%), by Vertical 2024 & 2032

- Figure 22: Europe Anti-Drone Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Anti-Drone Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Anti-Drone Market Revenue (Million), by Application 2024 & 2032

- Figure 25: Asia Pacific Anti-Drone Market Revenue Share (%), by Application 2024 & 2032

- Figure 26: Asia Pacific Anti-Drone Market Revenue (Million), by Vertical 2024 & 2032

- Figure 27: Asia Pacific Anti-Drone Market Revenue Share (%), by Vertical 2024 & 2032

- Figure 28: Asia Pacific Anti-Drone Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Anti-Drone Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Anti-Drone Market Revenue (Million), by Application 2024 & 2032

- Figure 31: Latin America Anti-Drone Market Revenue Share (%), by Application 2024 & 2032

- Figure 32: Latin America Anti-Drone Market Revenue (Million), by Vertical 2024 & 2032

- Figure 33: Latin America Anti-Drone Market Revenue Share (%), by Vertical 2024 & 2032

- Figure 34: Latin America Anti-Drone Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Anti-Drone Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Anti-Drone Market Revenue (Million), by Application 2024 & 2032

- Figure 37: Middle East and Africa Anti-Drone Market Revenue Share (%), by Application 2024 & 2032

- Figure 38: Middle East and Africa Anti-Drone Market Revenue (Million), by Vertical 2024 & 2032

- Figure 39: Middle East and Africa Anti-Drone Market Revenue Share (%), by Vertical 2024 & 2032

- Figure 40: Middle East and Africa Anti-Drone Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Anti-Drone Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Anti-Drone Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Anti-Drone Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Anti-Drone Market Revenue Million Forecast, by Vertical 2019 & 2032

- Table 4: Global Anti-Drone Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Anti-Drone Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Anti-Drone Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Germany Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Anti-Drone Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: India Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: South Korea Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Asia Pacific Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Anti-Drone Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Mexico Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Brazil Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Latin America Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Anti-Drone Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Saudi Arabia Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: United Arab Emirates Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Anti-Drone Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Global Anti-Drone Market Revenue Million Forecast, by Vertical 2019 & 2032

- Table 29: Global Anti-Drone Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United States Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Canada Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Anti-Drone Market Revenue Million Forecast, by Application 2019 & 2032

- Table 33: Global Anti-Drone Market Revenue Million Forecast, by Vertical 2019 & 2032

- Table 34: Global Anti-Drone Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: United Kingdom Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Germany Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Europe Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Anti-Drone Market Revenue Million Forecast, by Application 2019 & 2032

- Table 40: Global Anti-Drone Market Revenue Million Forecast, by Vertical 2019 & 2032

- Table 41: Global Anti-Drone Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Asia Pacific Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global Anti-Drone Market Revenue Million Forecast, by Application 2019 & 2032

- Table 48: Global Anti-Drone Market Revenue Million Forecast, by Vertical 2019 & 2032

- Table 49: Global Anti-Drone Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Mexico Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Brazil Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Latin America Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Global Anti-Drone Market Revenue Million Forecast, by Application 2019 & 2032

- Table 54: Global Anti-Drone Market Revenue Million Forecast, by Vertical 2019 & 2032

- Table 55: Global Anti-Drone Market Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Saudi Arabia Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: United Arab Emirates Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Middle East and Africa Anti-Drone Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Anti-Drone Market?

The projected CAGR is approximately 25.46%.

2. Which companies are prominent players in the Anti-Drone Market?

Key companies in the market include THALES, Dedrone, Lockheed Martin Corporation, METIS Aerospace Ltd, Zen Technologies Limited, Robin Radar System, Drone Defence, Citadel Defense, SRC Inc, DroneShield Ltd, RTX Corporation, Israel Aerospace Industries Ltd, SAAB AB, QinetiQ Group plc, DeTect Inc.

3. What are the main segments of the Anti-Drone Market?

The market segments include Application, Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.03 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Defense Segment Dominates the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

August 2023: DroneShield Ltd. introduced satellite denial systems for specific target areas. Various Global Navigation Satellite Systems (GNSS) are used worldwide, including the well-known US GPS, the Chinese BeiDou, the Russian GLONASS, and the European Galileo system. DroneShield’s GNSS disruption solutions for drones and UAVs incorporate intelligent defeat capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Anti-Drone Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Anti-Drone Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Anti-Drone Market?

To stay informed about further developments, trends, and reports in the Anti-Drone Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence