Key Insights

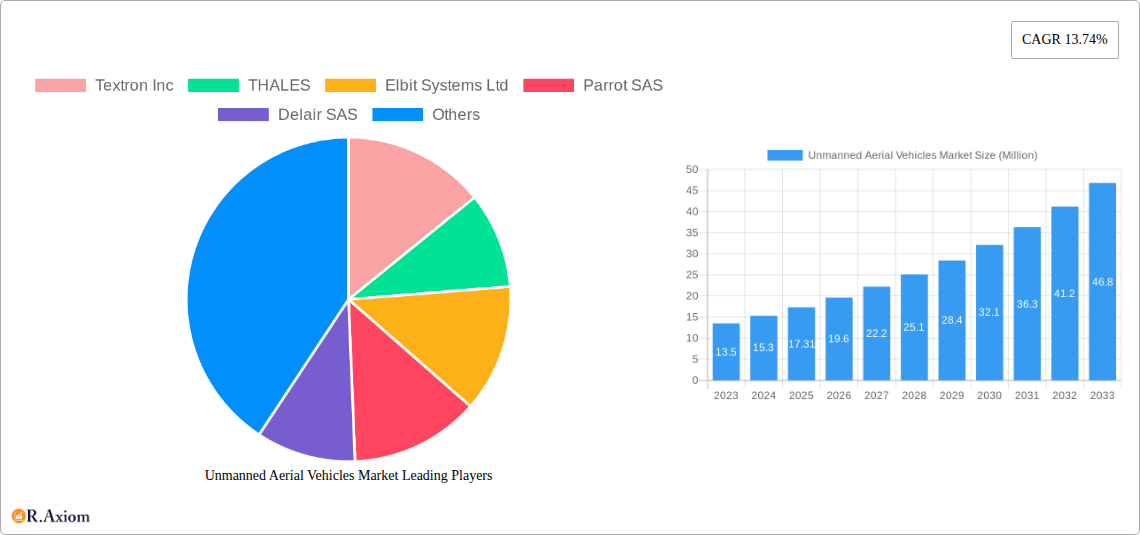

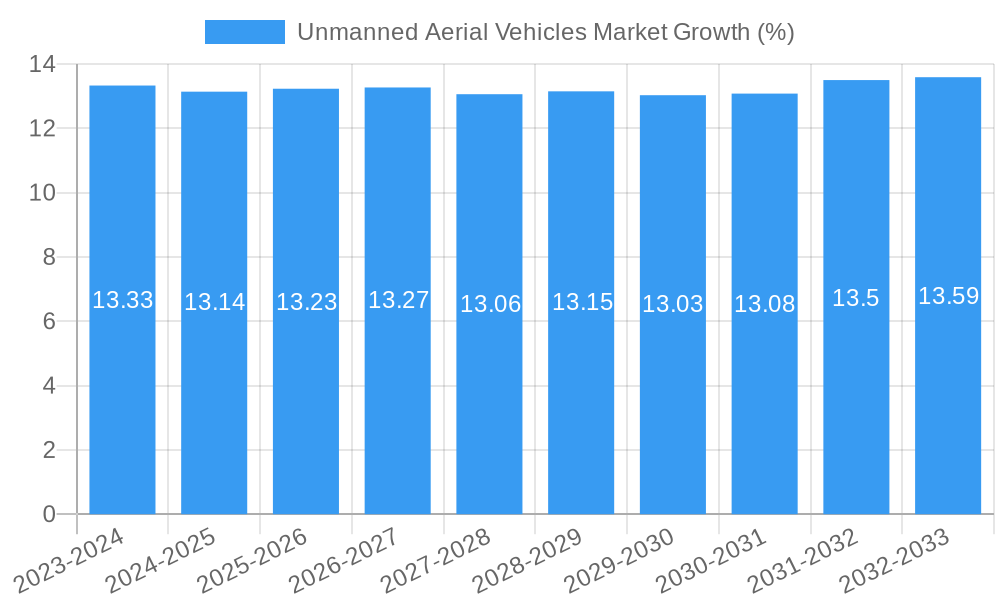

The global Unmanned Aerial Vehicles (UAVs) market is poised for substantial expansion, projected to reach a valuation of approximately $17.31 billion by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 13.74%, indicating a dynamic and rapidly evolving sector. Key drivers fueling this surge include the increasing adoption of UAVs for defense and security applications, such as surveillance, reconnaissance, and target acquisition, where their cost-effectiveness and reduced risk to personnel are highly advantageous. Furthermore, the burgeoning commercial applications across sectors like agriculture, infrastructure inspection, logistics, and media production are significantly contributing to market penetration. Advancements in drone technology, including enhanced sensor capabilities, longer flight times, improved autonomous navigation, and miniaturization, are consistently expanding the operational scope and efficiency of UAVs. The continuous innovation in AI and machine learning integration is further enabling more sophisticated data analysis and operational decision-making, making drones indispensable tools for businesses and governments alike.

Emerging trends in the UAV market highlight a clear shift towards more specialized and integrated solutions. The demand for fixed-wing and hybrid UAVs for long-endurance missions and extensive area coverage is growing, complementing the established dominance of multi-rotor drones in shorter-range, versatile operations. The increasing focus on swarm capabilities and collaborative drone operations for complex tasks like disaster response and large-scale mapping is another significant trend. While the market exhibits immense potential, certain restraints need to be addressed. Stringent regulatory frameworks in many regions, particularly concerning airspace management and operational safety, can impede widespread adoption. Concerns regarding data security and privacy also pose challenges that manufacturers and operators are actively working to mitigate. Despite these hurdles, the ongoing technological advancements, coupled with expanding application verticals and increasing investment from both public and private sectors, firmly position the UAV market for sustained and impressive growth throughout the forecast period. The competitive landscape features established aerospace and defense giants alongside innovative technology companies, fostering a dynamic environment of product development and market competition.

This detailed report provides an in-depth analysis of the global Unmanned Aerial Vehicles (UAVs) market, also known as drones. Covering a study period from 2019 to 2033, with a base and estimated year of 2025, the report offers critical insights into market dynamics, key players, technological advancements, and future growth trajectories. This analysis is crucial for stakeholders seeking to understand the burgeoning UAV industry, from military and commercial applications to emerging consumer markets. With projected market values expected to reach hundreds of billions of dollars, this report is an indispensable resource for manufacturers, investors, policymakers, and end-users navigating this rapidly evolving landscape. High-traffic keywords such as "drone market," "UAV technology," "military drones," "commercial drones," "drone industry," "autonomous systems," and "aerial surveillance" are seamlessly integrated to maximize search visibility and engagement.

Unmanned Aerial Vehicles Market Market Concentration & Innovation

The Unmanned Aerial Vehicles (UAVs) market exhibits a moderate to high level of concentration, with a few dominant players holding significant market share, particularly in the military and advanced commercial segments. Companies like Northrop Grumman Corporation, The Boeing Company, Textron Inc., General Atomics, and Israel Aerospace Industries Ltd. are key contributors to this dominance, driven by substantial defense contracts and R&D investments. Innovation is a primary growth driver, with continuous advancements in AI integration for autonomous navigation, advanced sensor technology (EO/IR, LiDAR), extended flight times, and improved payload capacities. Regulatory frameworks, while evolving, significantly influence market entry and operational scope, particularly concerning airspace management and data privacy. Product substitutes, while limited for highly specialized military applications, can emerge in the form of advanced satellite imaging or manned aircraft for certain surveillance tasks. End-user trends indicate a growing demand for UAVs in logistics, agriculture, infrastructure inspection, and public safety, alongside their continued critical role in defense. Mergers and acquisitions (M&A) activities are observed as companies seek to expand their technological capabilities, market reach, and product portfolios. M&A deal values are often in the hundreds of millions to billions of dollars, reflecting the strategic importance of acquiring innovative drone technologies and customer bases. The market share of leading players can range from 10% to 25%, underscoring the competitive yet consolidated nature of the industry.

Unmanned Aerial Vehicles Market Industry Trends & Insights

The Unmanned Aerial Vehicles (UAVs) market is experiencing robust growth, propelled by a confluence of technological advancements, increasing adoption across diverse sectors, and evolving regulatory landscapes. The global UAV market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 15% to 20% over the forecast period of 2025-2033, translating into a market value expected to surpass $200 Billion by 2030. This impressive growth is fueled by several key trends. Firstly, the escalating demand for enhanced surveillance, reconnaissance, and target acquisition capabilities in defense and homeland security sectors continues to be a primary market driver. Military UAVs, equipped with sophisticated sensors and weaponry, are becoming indispensable tools for modern warfare and border patrol. Secondly, the commercial adoption of drones is rapidly expanding. In logistics and delivery, companies are exploring drone-based solutions for last-mile delivery, promising faster and more cost-effective transportation of goods, especially in remote or challenging terrains. The agricultural sector is leveraging drones for precision farming, enabling efficient crop monitoring, spraying, and yield prediction, thereby optimizing resource utilization and increasing farm productivity. Infrastructure inspection, including bridges, power lines, and pipelines, benefits immensely from drone technology, offering safer, quicker, and more detailed assessments compared to traditional methods. The entertainment and media industries are also utilizing drones for aerial photography and videography, creating unique perspectives and enhancing visual content. Technological disruptions are at the heart of this growth. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is enabling greater autonomy in drone operations, allowing for sophisticated data analysis, object recognition, and intelligent decision-making. Advancements in battery technology are leading to extended flight times and improved operational range. Furthermore, the miniaturization of sensors and payloads is allowing for the development of smaller, more agile drones capable of performing complex tasks in confined spaces. Consumer preferences are also shifting, with a growing interest in drones for recreational photography and videography. However, challenges related to airspace management, safety regulations, public perception concerning privacy, and cybersecurity remain critical factors influencing market penetration and widespread acceptance. Competitive dynamics are intense, with both established aerospace giants and agile startups vying for market share. Strategic partnerships, acquisitions, and continuous product innovation are key strategies employed by companies to maintain a competitive edge. The increasing affordability of certain drone models is also broadening the market reach to smaller businesses and individual users.

Dominant Markets & Segments in Unmanned Aerial Vehicles Market

The Unmanned Aerial Vehicles (UAVs) market demonstrates significant regional and segmental dominance, driven by a combination of factors including defense spending, technological adoption rates, regulatory support, and economic development.

Production Analysis:

- Dominant Regions: North America, particularly the United States, and Europe, spearheaded by countries with strong defense industries like France, the UK, and Germany, are leading in UAV production. Asia-Pacific, with a rapidly growing manufacturing base and increasing defense investments from countries like China and India, is also a significant production hub.

- Key Drivers: High defense budgets, robust aerospace R&D infrastructure, government initiatives supporting domestic drone manufacturing, and the presence of leading aerospace companies are crucial drivers for production dominance in these regions.

Consumption Analysis:

- Dominant Segments: The military and defense sector remains the largest consumer of UAVs globally, accounting for over 50% of the market share. This is followed by commercial applications, with significant growth observed in logistics, agriculture, and infrastructure inspection.

- Key Drivers: Increasing geopolitical tensions, the need for advanced surveillance and reconnaissance capabilities, cost-effectiveness compared to manned aircraft for certain missions, and the expanding utility of drones in civilian sectors are major consumption drivers.

Import Market Analysis (Value & Volume):

- Dominant Regions: Countries with significant defense modernization programs and a growing appetite for advanced technology, such as the United States, various European nations, and emerging economies in the Middle East and Southeast Asia, are major importers of UAVs.

- Value: The import market is heavily influenced by the value of high-end military-grade UAVs and sophisticated commercial drones. Countries investing in advanced ISR (Intelligence, Surveillance, and Reconnaissance) capabilities contribute significantly to import value.

- Volume: While high-value imports dominate the market value, the volume of imports can also be substantial for smaller, more accessible commercial and surveillance drones used in agriculture, inspection, and mapping.

Export Market Analysis (Value & Volume):

- Dominant Countries: The United States is a leading exporter of military UAVs, followed by Israel, with its advanced drone technology. European nations like France, Germany, and the UK are also significant exporters, particularly of specialized commercial and military drones. China has emerged as a major exporter, especially in the commercial drone segment.

- Value & Volume: Exports are driven by the demand for cutting-edge UAV platforms and their associated technologies. The value of exports is often high due to the complexity and advanced features of military drones. The volume of exports is influenced by the global demand for both tactical and strategic UAV systems.

Price Trend Analysis:

- Dominant Factors: Prices for UAVs vary significantly based on payload, range, endurance, sophistication of sensors, and intended application. Military-grade UAVs can range from several hundred thousand dollars to tens of millions of dollars. Commercial drones for mapping or inspection typically range from a few thousand to tens of thousands of dollars, while high-end professional drones can cost upwards of $50,000.

- Trends: Prices for commercial drones, particularly for consumer and prosumer segments, are generally decreasing due to mass production and technological advancements. However, the prices for advanced military and specialized industrial UAVs are expected to remain high or increase due to the integration of sophisticated AI, advanced materials, and complex sensor suites.

Unmanned Aerial Vehicles Market Product Developments

The Unmanned Aerial Vehicles (UAVs) market is characterized by a relentless pace of product innovation. Recent developments showcase a strong emphasis on enhancing sensor capabilities and artificial intelligence for greater autonomy. Dual-sensor payloads, combining Electro-Optical/Infrared (EO/IR) and LiDAR technology, are becoming increasingly common, offering comprehensive data acquisition for intelligence, surveillance, and reconnaissance (ISR) missions and detailed environmental mapping. Advances in camera technology, such as improved low-light performance and higher resolution, are expanding the applicability of drones in various conditions. The integration of AI for real-time data processing and decision-making provides drones with enhanced situational awareness and operational efficiency. These product developments aim to offer competitive advantages by enabling more efficient data collection, reducing operational costs, and expanding the range of applications for UAVs across defense, public safety, and commercial sectors.

Report Scope & Segmentation Analysis

This report encompasses a comprehensive analysis of the Unmanned Aerial Vehicles (UAVs) market, segmented across key areas to provide granular insights.

- Production Analysis: Examines the geographical distribution and volume of UAV manufacturing, identifying key production hubs and their contributions to the global supply chain.

- Consumption Analysis: Delves into the end-use applications of UAVs, segmenting demand by sector, including military, commercial (logistics, agriculture, construction, energy), and consumer markets, and forecasting future adoption rates.

- Import Market Analysis (Value & Volume): Assesses the inflow of UAVs into various countries, analyzing the monetary value and quantity of imports, with a focus on identifying key importing nations and the types of drones they procure.

- Export Market Analysis (Value & Volume): Evaluates the outflow of UAVs from manufacturing nations, detailing the value and volume of exports and highlighting leading exporting countries and their market share.

- Price Trend Analysis: Investigates the pricing dynamics of different UAV categories, analyzing factors influencing price fluctuations and projecting future price trends based on technological advancements and market demand.

Key Drivers of Unmanned Aerial Vehicles Market Growth

The Unmanned Aerial Vehicles (UAVs) market growth is propelled by several interconnected factors:

- Technological Advancements: Continuous innovation in AI, sensor technology, battery life, and autonomous navigation systems enhances UAV capabilities and expands their application scope.

- Increased Defense Spending: Growing geopolitical uncertainties and the need for superior surveillance and reconnaissance capabilities are driving significant investment in military UAVs worldwide.

- Commercial Adoption Expansion: The proven cost-effectiveness, efficiency, and safety benefits of drones are spurring their adoption across diverse industries like logistics, agriculture, infrastructure inspection, and public safety.

- Regulatory Evolution: While challenges remain, the ongoing development of clearer regulatory frameworks is facilitating wider and safer integration of UAVs into commercial airspace.

- Miniaturization and Affordability: The trend towards smaller, more affordable drones is democratizing access to UAV technology for a broader range of users, from small businesses to individuals.

Challenges in the Unmanned Aerial Vehicles Market Sector

Despite the robust growth, the Unmanned Aerial Vehicles (UAVs) market faces several significant challenges:

- Regulatory Hurdles: Complex and often fragmented regulations regarding airspace access, flight operations, and data privacy can hinder widespread adoption and operational scalability. Obtaining necessary permits and certifications can be time-consuming and costly.

- Cybersecurity Threats: The increasing connectivity and data-intensive nature of UAV operations make them vulnerable to cyberattacks, posing risks to operational integrity and sensitive data.

- Public Perception and Privacy Concerns: Concerns over privacy invasion and potential misuse of drone technology can lead to public resistance and stricter regulatory scrutiny.

- Integration with Existing Air Traffic Management Systems: Seamlessly integrating a growing number of UAVs into existing air traffic control systems presents a significant technical and logistical challenge.

- Limited Endurance and Payload Capacity: For certain demanding applications, current battery technology limits flight endurance, and payload limitations can restrict the types of sensors or equipment that can be carried.

Emerging Opportunities in Unmanned Aerial Vehicles Market

The Unmanned Aerial Vehicles (UAVs) market is ripe with emerging opportunities, driven by evolving technologies and expanding use cases.

- Drone-as-a-Service (DaaS): The growth of DaaS models offers flexible and cost-effective access to drone capabilities for businesses that may not want to invest in ownership and maintenance.

- Advanced Data Analytics and AI Integration: Opportunities lie in developing sophisticated AI algorithms for real-time data processing, predictive maintenance, and automated decision-making from drone-collected information.

- Urban Air Mobility (UAM) and Delivery Networks: The potential for autonomous eVTOL (electric Vertical Take-Off and Landing) aircraft for passenger transport and advanced drone delivery networks in urban environments presents a significant future market.

- Counter-UAS Technologies: The rise of malicious drone usage is creating a growing market for anti-drone systems and detection technologies.

- Sustainable and Eco-Friendly Drones: Development of drones with improved energy efficiency, renewable power sources, and biodegradable materials will cater to growing environmental consciousness.

Leading Players in the Unmanned Aerial Vehicles Market Market

- Textron Inc.

- THALES

- Elbit Systems Ltd

- Parrot SAS

- Delair SAS

- General Atomics

- AeroVironment Inc.

- Israel Aerospace Industries Ltd.

- SZ DJI Technology Co Ltd

- BAYKAR TECH

- Leonardo S p A

- Microdrones GmbH (mdGroup Germany GmbH)

- Northrop Grumman Corporation

- The Boeing Company

Key Developments in Unmanned Aerial Vehicles Market Industry

- September 2023: Delair SAS received a contract to supply 150 DT-46 drones to Ukraine. The drone features a dual-sensor ISR payload combining EO/IR and LiDAR.

- July 2023: DJI announced the launch of the DJI Air 3 drone, equipped with an f/1.7 primary camera (24mm focal length) and an f/2.4 telephoto lens (70mm focal length).

Strategic Outlook for Unmanned Aerial Vehicles Market Market

- September 2023: Delair SAS received a contract to supply 150 DT-46 drones to Ukraine. The drone features a dual-sensor ISR payload combining EO/IR and LiDAR.

- July 2023: DJI announced the launch of the DJI Air 3 drone, equipped with an f/1.7 primary camera (24mm focal length) and an f/2.4 telephoto lens (70mm focal length).

Strategic Outlook for Unmanned Aerial Vehicles Market Market

The strategic outlook for the Unmanned Aerial Vehicles (UAVs) market is exceptionally bright, characterized by sustained growth and diversification. Continued advancements in AI and autonomy will unlock new levels of operational efficiency and expand mission capabilities across all sectors. The increasing demand for autonomous systems in defense, coupled with the burgeoning adoption of drones in commercial applications such as last-mile delivery, precision agriculture, and infrastructure inspection, will fuel market expansion. Strategic partnerships between technology developers, end-users, and regulatory bodies will be crucial for navigating the evolving legal frameworks and ensuring safe integration into the national airspace. Investment in research and development focused on enhancing endurance, payload capacity, and cybersecurity will be paramount. The emergence of drone-as-a-service (DaaS) models and the development of sophisticated data analytics platforms will create new revenue streams and business models, further solidifying the UAV market's trajectory towards becoming an indispensable component of modern infrastructure and operations.

Unmanned Aerial Vehicles Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Unmanned Aerial Vehicles Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Unmanned Aerial Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.74% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increased Seaborne Threats And Ambiguous Maritime Security Policies; Increasing Adoption Of Security Technologies In Bric Countries

- 3.3. Market Restrains

- 3.3.1. ; High Risk Rate In Ungoverned Zones; Unstructured Security Standards And Technologies

- 3.4. Market Trends

- 3.4.1. Small UAV Segment Held Highest Shares in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Unmanned Aerial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Unmanned Aerial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Unmanned Aerial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Unmanned Aerial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Unmanned Aerial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Unmanned Aerial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. North America Unmanned Aerial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Unmanned Aerial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 Germany

- 12.1.3 France

- 12.1.4 Ukraine

- 12.1.5 Rest of Europe

- 13. Asia Pacific Unmanned Aerial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 India

- 13.1.3 Japan

- 13.1.4 South Korea

- 13.1.5 Malaysia

- 13.1.6 Philippines

- 13.1.7 Indonesia

- 13.1.8 Rest of Asia Pacific

- 14. Latin America Unmanned Aerial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Mexico

- 14.1.2 Brazil

- 14.1.3 Argentina

- 14.1.4 Colombia

- 14.1.5 Rest of Latin America

- 15. Middle East and Africa Unmanned Aerial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Saudi Arabia

- 15.1.2 United Arab Emirates

- 15.1.3 Turkey

- 15.1.4 Israel

- 15.1.5 Egypt

- 15.1.6 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Textron Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 THALES

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Elbit Systems Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Parrot SAS

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Delair SAS

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 General Atomics

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 AeroVironment Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Israel Aerospace Industries Ltd

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 SZ DJI Technology Co Ltd

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 BAYKAR TECH

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Leonardo S p A

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Microdrones GmbH (mdGroup Germany GmbH)

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Northrop Grumman Corporation

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 The Boeing Company

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.1 Textron Inc

List of Figures

- Figure 1: Global Unmanned Aerial Vehicles Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Unmanned Aerial Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Unmanned Aerial Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Unmanned Aerial Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Unmanned Aerial Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Unmanned Aerial Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Unmanned Aerial Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Unmanned Aerial Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Unmanned Aerial Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Unmanned Aerial Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Unmanned Aerial Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Unmanned Aerial Vehicles Market Revenue (Million), by Production Analysis 2024 & 2032

- Figure 13: North America Unmanned Aerial Vehicles Market Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 14: North America Unmanned Aerial Vehicles Market Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 15: North America Unmanned Aerial Vehicles Market Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 16: North America Unmanned Aerial Vehicles Market Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 17: North America Unmanned Aerial Vehicles Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 18: North America Unmanned Aerial Vehicles Market Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 19: North America Unmanned Aerial Vehicles Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 20: North America Unmanned Aerial Vehicles Market Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 21: North America Unmanned Aerial Vehicles Market Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 22: North America Unmanned Aerial Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 23: North America Unmanned Aerial Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: South America Unmanned Aerial Vehicles Market Revenue (Million), by Production Analysis 2024 & 2032

- Figure 25: South America Unmanned Aerial Vehicles Market Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 26: South America Unmanned Aerial Vehicles Market Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 27: South America Unmanned Aerial Vehicles Market Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 28: South America Unmanned Aerial Vehicles Market Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 29: South America Unmanned Aerial Vehicles Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 30: South America Unmanned Aerial Vehicles Market Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 31: South America Unmanned Aerial Vehicles Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 32: South America Unmanned Aerial Vehicles Market Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 33: South America Unmanned Aerial Vehicles Market Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 34: South America Unmanned Aerial Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 35: South America Unmanned Aerial Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Europe Unmanned Aerial Vehicles Market Revenue (Million), by Production Analysis 2024 & 2032

- Figure 37: Europe Unmanned Aerial Vehicles Market Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 38: Europe Unmanned Aerial Vehicles Market Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 39: Europe Unmanned Aerial Vehicles Market Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 40: Europe Unmanned Aerial Vehicles Market Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 41: Europe Unmanned Aerial Vehicles Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 42: Europe Unmanned Aerial Vehicles Market Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 43: Europe Unmanned Aerial Vehicles Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 44: Europe Unmanned Aerial Vehicles Market Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 45: Europe Unmanned Aerial Vehicles Market Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 46: Europe Unmanned Aerial Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 47: Europe Unmanned Aerial Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 48: Middle East & Africa Unmanned Aerial Vehicles Market Revenue (Million), by Production Analysis 2024 & 2032

- Figure 49: Middle East & Africa Unmanned Aerial Vehicles Market Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 50: Middle East & Africa Unmanned Aerial Vehicles Market Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 51: Middle East & Africa Unmanned Aerial Vehicles Market Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 52: Middle East & Africa Unmanned Aerial Vehicles Market Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 53: Middle East & Africa Unmanned Aerial Vehicles Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 54: Middle East & Africa Unmanned Aerial Vehicles Market Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 55: Middle East & Africa Unmanned Aerial Vehicles Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 56: Middle East & Africa Unmanned Aerial Vehicles Market Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 57: Middle East & Africa Unmanned Aerial Vehicles Market Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 58: Middle East & Africa Unmanned Aerial Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 59: Middle East & Africa Unmanned Aerial Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 60: Asia Pacific Unmanned Aerial Vehicles Market Revenue (Million), by Production Analysis 2024 & 2032

- Figure 61: Asia Pacific Unmanned Aerial Vehicles Market Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 62: Asia Pacific Unmanned Aerial Vehicles Market Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 63: Asia Pacific Unmanned Aerial Vehicles Market Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 64: Asia Pacific Unmanned Aerial Vehicles Market Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 65: Asia Pacific Unmanned Aerial Vehicles Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 66: Asia Pacific Unmanned Aerial Vehicles Market Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 67: Asia Pacific Unmanned Aerial Vehicles Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 68: Asia Pacific Unmanned Aerial Vehicles Market Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 69: Asia Pacific Unmanned Aerial Vehicles Market Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 70: Asia Pacific Unmanned Aerial Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 71: Asia Pacific Unmanned Aerial Vehicles Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United Kingdom Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Germany Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Ukraine Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Malaysia Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Philippines Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Indonesia Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Asia Pacific Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Mexico Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Argentina Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Colombia Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Latin America Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Saudi Arabia Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: United Arab Emirates Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Turkey Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Israel Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Egypt Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East and Africa Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 40: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 41: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 42: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 43: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 44: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: United States Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Canada Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Mexico Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 49: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 50: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 51: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 52: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 53: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Brazil Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Argentina Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of South America Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 58: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 59: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 60: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 61: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 62: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 63: United Kingdom Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Germany Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: France Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Italy Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Spain Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Russia Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: Benelux Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Nordics Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Rest of Europe Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 73: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 74: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 75: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 76: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 77: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 78: Turkey Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 79: Israel Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: GCC Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 81: North Africa Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 82: South Africa Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 83: Rest of Middle East & Africa Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 85: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 86: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 87: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 88: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 89: Global Unmanned Aerial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 90: China Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 91: India Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 92: Japan Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 93: South Korea Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 94: ASEAN Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 95: Oceania Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 96: Rest of Asia Pacific Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Unmanned Aerial Vehicles Market?

The projected CAGR is approximately 13.74%.

2. Which companies are prominent players in the Unmanned Aerial Vehicles Market?

Key companies in the market include Textron Inc, THALES, Elbit Systems Ltd, Parrot SAS, Delair SAS, General Atomics, AeroVironment Inc, Israel Aerospace Industries Ltd, SZ DJI Technology Co Ltd, BAYKAR TECH, Leonardo S p A, Microdrones GmbH (mdGroup Germany GmbH), Northrop Grumman Corporation, The Boeing Company.

3. What are the main segments of the Unmanned Aerial Vehicles Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.31 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increased Seaborne Threats And Ambiguous Maritime Security Policies; Increasing Adoption Of Security Technologies In Bric Countries.

6. What are the notable trends driving market growth?

Small UAV Segment Held Highest Shares in the Market.

7. Are there any restraints impacting market growth?

; High Risk Rate In Ungoverned Zones; Unstructured Security Standards And Technologies.

8. Can you provide examples of recent developments in the market?

In September 2023, Delair SAS received a contract to supply 150 DT-46 drones to Ukraine as per the French Defense Ministry. The drone has a dual-sensor ISR payload combining EO/IR and LiDAR (Laser Detection and Ranging).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Unmanned Aerial Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Unmanned Aerial Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Unmanned Aerial Vehicles Market?

To stay informed about further developments, trends, and reports in the Unmanned Aerial Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence