Key Insights

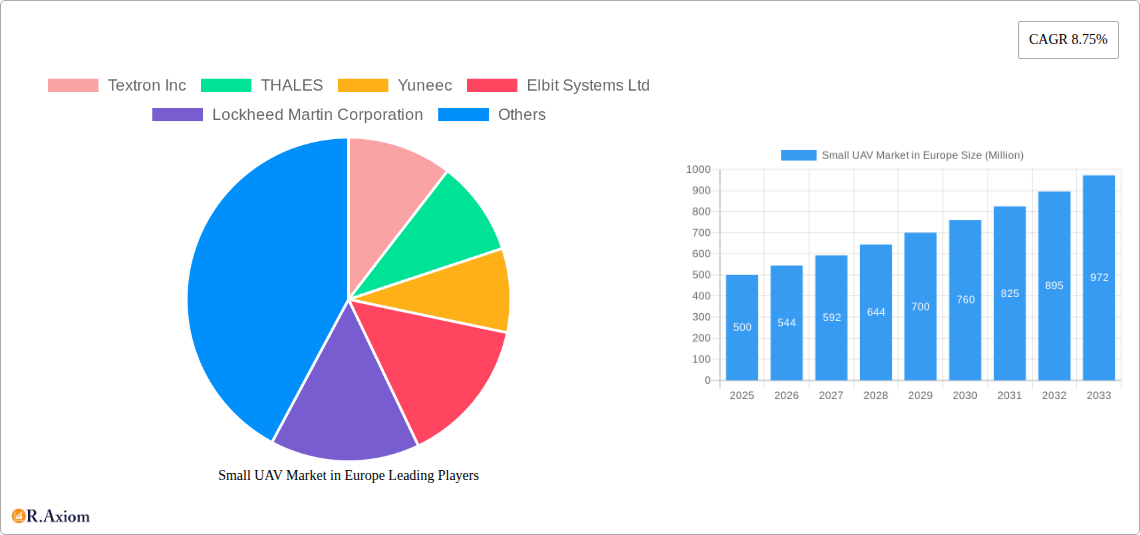

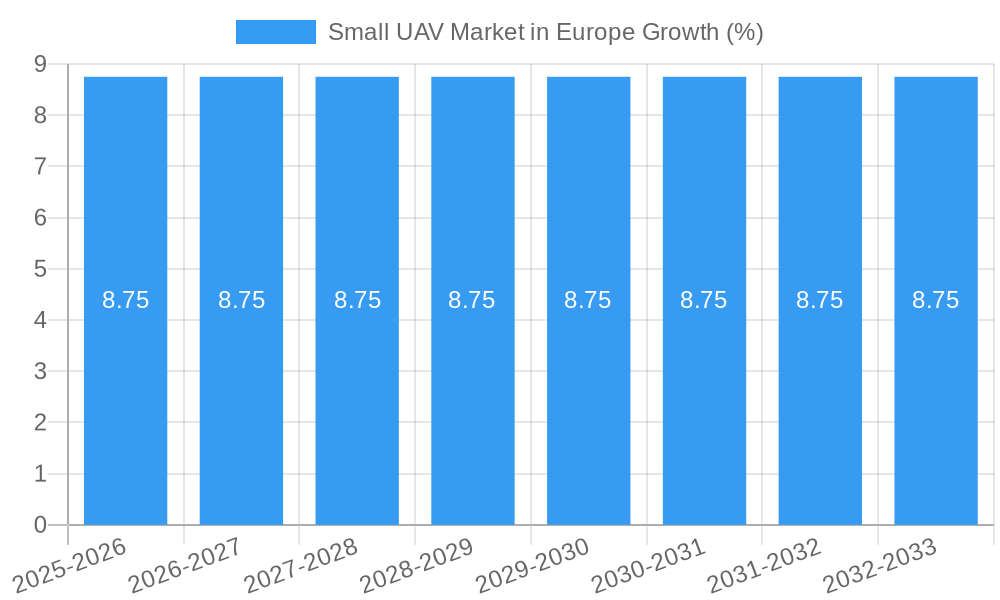

The European Small Unmanned Aerial Vehicle (UAV) market is poised for significant expansion, projecting a market size of approximately $500 million in 2025 and a robust Compound Annual Growth Rate (CAGR) of 8.75% through 2033. This growth is fueled by escalating demand across diverse sectors, from enhanced military and law enforcement surveillance capabilities to burgeoning civil and commercial applications. In military and law enforcement, small UAVs are increasingly vital for intelligence gathering, reconnaissance, and operational support, offering a cost-effective and agile alternative to traditional aerial assets. The civil sector is witnessing an explosion in drone adoption for aerial photography and videography, infrastructure inspection, precision agriculture, and last-mile delivery services. Technological advancements, including miniaturization, improved battery life, enhanced sensor payloads, and autonomous navigation, are key drivers propelling this market forward. The increasing availability of advanced features at competitive price points is further democratizing access to UAV technology, broadening its adoption across small and medium-sized enterprises.

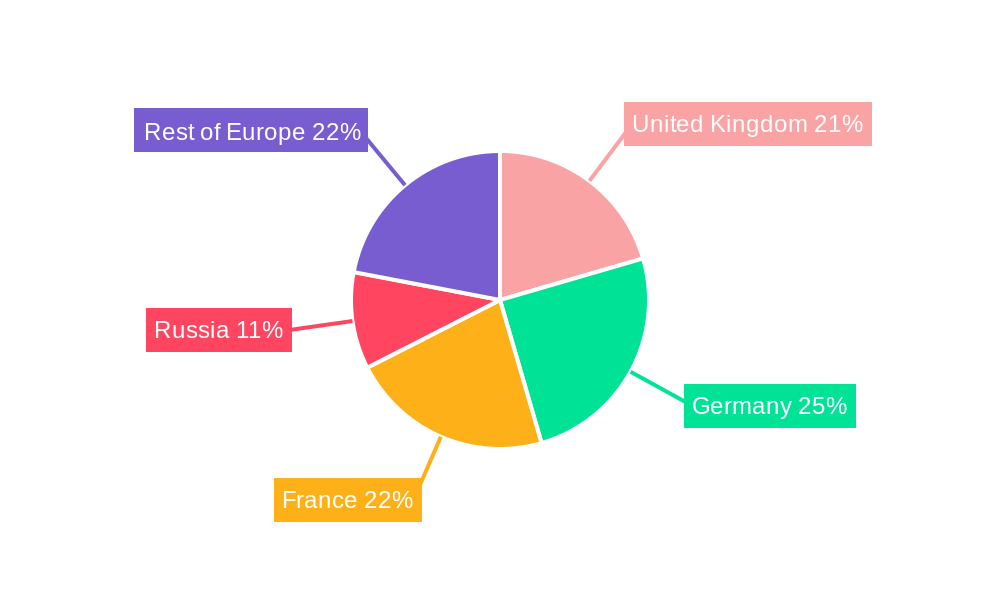

The market is segmented by wing type, with fixed-wing UAVs dominating due to their extended flight endurance and speed, making them ideal for long-range surveillance and mapping. However, rotary-wing drones are gaining traction for their vertical take-off and landing (VTOL) capabilities and agility in confined spaces, proving invaluable for close-range inspection and urban operations. In terms of size, micro and mini UAVs are experiencing the most rapid growth, driven by their portability, ease of deployment, and suitability for a wide array of tactical and commercial uses. Key restraints in the European market include evolving regulatory frameworks that can sometimes slow down adoption, concerns around data security and privacy, and the need for skilled operators. Despite these challenges, strategic investments in research and development by leading companies and a growing ecosystem of drone service providers are expected to mitigate these limitations and ensure sustained market expansion across the United Kingdom, Germany, France, Russia, and the rest of Europe.

Here is a detailed, SEO-optimized report description for the "Small UAV Market in Europe," structured as requested, with no placeholders and ready for immediate use.

This in-depth report delivers a thorough analysis of the European Small Unmanned Aerial Vehicle (UAV) market, providing critical insights into market dynamics, growth drivers, challenges, and future opportunities. Covering the historical period from 2019 to 2024, a base year of 2025, and a comprehensive forecast period from 2025 to 2033, this study is an essential resource for industry stakeholders, investors, and decision-makers looking to capitalize on the burgeoning European drone sector.

Small UAV Market in Europe Market Concentration & Innovation

The European Small UAV market exhibits a moderate level of concentration, with a few key players dominating specific application segments. Innovation is a critical driver, fueled by advancements in AI, sensor technology, and miniaturization. Regulatory frameworks, while evolving, are becoming more conducive to broader adoption.

- Market Concentration: Dominated by a mix of established defense contractors and agile commercial drone manufacturers. Key players include Textron Inc, THALES, Yuneec, Elbit Systems Ltd., Lockheed Martin Corporation, Shield AI, AeroVironment Inc, Parrot Drones SAS, SZ DJI Technology Co Ltd, UAS Europe AB, DELAIR SAS, Microdrones GmbH, Northrop Grumman Corporation, and Teledyne FLIR LLC.

- Innovation Drivers:

- Increased demand for advanced surveillance and reconnaissance capabilities.

- Development of autonomous flight and AI-powered data processing.

- Improvements in battery technology for extended flight times.

- Integration of sophisticated sensor payloads (e.g., thermal imaging, LiDAR).

- Regulatory Frameworks: Ongoing efforts by the European Union Aviation Safety Agency (EASA) to standardize drone operations, including UTM (UAV Traffic Management) systems, are crucial for market expansion.

- Product Substitutes: While traditional manned aircraft and ground-based surveillance methods exist, small UAVs offer unparalleled cost-effectiveness, flexibility, and access to previously inaccessible areas.

- End-User Trends: Growing adoption in logistics, agriculture, infrastructure inspection, public safety, and defense.

- M&A Activities: Strategic acquisitions and partnerships are observed as companies aim to expand their technological capabilities and market reach. For instance, Teledyne FLIR LLC’s acquisition by Teledyne Technologies in 2021 significantly strengthened its position in the advanced sensor and imaging market for UAVs. Deal values are expected to rise as market consolidation continues.

Small UAV Market in Europe Industry Trends & Insights

The European Small UAV market is poised for significant expansion, driven by escalating demand across both military and civil sectors. Technological advancements are continuously redefining the capabilities and applications of these unmanned systems. The market is characterized by a dynamic competitive landscape where innovation, strategic partnerships, and regulatory compliance are paramount for sustained growth. The increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) into UAVs is a transformative trend, enabling enhanced autonomy, intelligent data analysis, and sophisticated mission execution. This is particularly evident in applications like predictive maintenance for infrastructure, precision agriculture, and advanced battlefield awareness.

Furthermore, the growing emphasis on sustainability and environmental monitoring is opening new avenues for drone deployment, from tracking deforestation to monitoring wildlife populations. The development of swarming capabilities, where multiple UAVs coordinate autonomously, represents another cutting-edge trend, promising to revolutionize complex surveillance and mapping operations. Consumer preferences are also evolving, with a rising demand for user-friendly, high-performance drones for aerial photography, videography, and recreational use.

In the defense sector, the urgency to counter emerging threats and enhance situational awareness is a primary growth catalyst. European nations are increasingly investing in small UAVs for reconnaissance, surveillance, target acquisition, and force protection. This includes the development and deployment of specialized drones for urban warfare and asymmetric conflict scenarios. The ongoing geopolitical landscape further accentuates the need for robust and versatile unmanned systems.

The competitive dynamics are intense, with established aerospace and defense giants competing alongside innovative startups. Companies are focusing on developing lighter, more durable, and more intelligent UAV platforms equipped with advanced payloads. Strategic alliances and collaborations between technology providers, manufacturers, and end-users are becoming increasingly common to accelerate product development and market penetration. The overall Compound Annual Growth Rate (CAGR) for the European Small UAV market is projected to be substantial, indicating a robust growth trajectory over the forecast period. Market penetration is expected to deepen significantly as regulatory clarity improves and the cost-effectiveness of drone solutions becomes more widely recognized across various industries. The drive towards digitalization and the Industry 4.0 revolution further underpins the market's upward momentum.

Dominant Markets & Segments in Small UAV Market in Europe

The European Small UAV market's dominance is multifaceted, with specific regions, countries, and segments showcasing remarkable growth and adoption rates.

Leading Regions and Countries:

- Western Europe: This region consistently leads the market due to robust economies, strong defense spending, and advanced technological infrastructure. Countries like the United Kingdom, Germany, France, and Italy are at the forefront of adopting small UAVs for both military and civil applications.

- Key Drivers: High defense budgets, government initiatives to modernize military capabilities, significant investment in research and development, and a burgeoning commercial drone industry for various applications. The UK's focus on human-machine teaming, as highlighted by Elbit Systems' contract, exemplifies this trend.

- Nordic Countries: These nations are increasingly investing in advanced drone technology for surveillance, environmental monitoring, and maritime security.

- Key Drivers: Geopolitical considerations, extensive coastlines requiring advanced surveillance, and a strong commitment to environmental sustainability.

Dominant Segments:

- Application: Military and Law Enforcement: This segment is a primary driver of the European Small UAV market.

- Key Drivers:

- Enhanced Situational Awareness: Providing real-time intelligence for troop deployment and threat assessment.

- Force Protection: Offering persistent surveillance of operational areas to prevent ambushes and protect personnel.

- Target Acquisition: Precisely identifying and tracking enemy assets for effective engagement.

- Cost-Effectiveness: Significantly cheaper to operate and deploy than manned aircraft for similar missions.

- Risk Mitigation: Performing dangerous missions in contested or hazardous environments, reducing risk to human personnel.

- The French defense innovation agency's (AID) interest in low-cost small attack drones (Larinae and Colibri projects) underscores the strategic importance of this segment.

- Key Drivers:

- Application: Civil and Commercial: This segment is experiencing rapid growth, driven by diverse industrial needs.

- Key Drivers:

- Inspection and Monitoring: Infrastructure (bridges, power lines, wind turbines), pipelines, and agricultural fields.

- Logistics and Delivery: Emerging applications for last-mile delivery of goods and medical supplies.

- Mapping and Surveying: Creating detailed 3D models and topographical maps for construction and land management.

- Public Safety and Emergency Services: Search and rescue operations, disaster response, and law enforcement surveillance.

- Media and Entertainment: Aerial photography and videography for films, events, and real estate.

- Key Drivers:

- Wing Type: Rotary-wing: Currently holds a significant market share due to its vertical take-off and landing (VTOL) capabilities, hovering, and maneuverability in confined spaces.

- Key Drivers: Suitability for urban environments, precise hovering for inspection and surveillance, and ease of deployment.

- Size: Mini and Micro: These smaller UAVs are gaining traction due to their portability, stealth, and ability to operate in restricted airspace.

- Key Drivers: Ease of transport and deployment by individual soldiers or first responders, lower operational costs, and reduced detectability.

Small UAV Market in Europe Product Developments

Product development in the European Small UAV market is characterized by a relentless pursuit of enhanced performance, extended endurance, and greater intelligence. Innovations are focused on miniaturization of sophisticated sensors, improved battery technology for longer flight times, and advanced AI for autonomous operations. Companies are developing modular payloads to adapt drones for diverse missions, from high-resolution aerial imaging to specialized gas detection. The emphasis is on creating cost-effective, user-friendly systems that can be rapidly deployed and integrated into existing operational workflows, offering a competitive edge through superior data acquisition and analytical capabilities.

Report Scope & Segmentation Analysis

This report segments the European Small UAV market by Wing Type, Size, and Application. The analysis provides in-depth insights into the market size, growth projections, and competitive dynamics within each segment.

- Wing Type:

- Fixed-wing: Characterized by higher endurance and speed, suitable for large-area surveillance and mapping. Projected to see steady growth driven by mapping and long-range reconnaissance needs.

- Rotary-wing: Dominant due to VTOL capabilities, ideal for urban surveillance, inspection, and tactical operations. Expected to maintain a strong market share.

- Size:

- Micro: Highly portable, used for tactical reconnaissance and indoor operations. Significant growth anticipated due to ease of deployment.

- Mini: Versatile size, balancing portability with payload capacity, suitable for a wide range of commercial and military applications. Expected to capture substantial market share.

- Nano: Extremely small, primarily for specialized niche applications. Lower market share but with potential for future growth.

- Application:

- Military and Law Enforcement: The largest segment, driven by defense modernization and internal security needs. Forecasted to experience robust growth.

- Civil and Commercial: Experiencing rapid expansion across industries like logistics, agriculture, and infrastructure. Expected to show the highest growth rate over the forecast period.

Key Drivers of Small UAV Market in Europe Growth

The growth of the European Small UAV market is propelled by several interconnected factors.

- Technological Advancements: Continuous innovation in AI, sensor technology, battery life, and miniaturization makes UAVs more capable, affordable, and versatile.

- Increasing Demand from Military and Law Enforcement: Heightened security concerns and the need for enhanced situational awareness drive significant procurement of small UAVs for surveillance, reconnaissance, and border patrol.

- Growing Adoption in Civil and Commercial Sectors: Industries like agriculture, construction, logistics, and environmental monitoring are increasingly recognizing the cost-efficiency and operational benefits of drones for inspection, mapping, and delivery.

- Favorable Regulatory Environment: Harmonization of drone regulations across Europe by bodies like EASA is facilitating broader adoption and enabling complex operations.

- Government Initiatives and Investments: National defense strategies and civilian innovation programs often include substantial funding for drone research, development, and procurement.

Challenges in the Small UAV Market in Europe Sector

Despite the promising growth trajectory, the European Small UAV market faces several significant challenges.

- Regulatory Hurdles: While improving, evolving regulations concerning airspace management, data privacy, and operational limitations can still hinder widespread deployment, especially for complex BVLOS (Beyond Visual Line of Sight) operations.

- Cybersecurity Concerns: The increasing connectivity of UAVs raises concerns about potential cyber threats, data breaches, and system hacking, requiring robust security measures.

- Public Perception and Privacy Issues: Concerns about noise, privacy invasion, and the potential misuse of drones can lead to public resistance and impact market acceptance in certain areas.

- Skilled Workforce Shortage: A lack of adequately trained pilots, maintenance technicians, and data analysts can constrain the efficient utilization of advanced UAV systems.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact the availability of critical components and manufacturing capacity, potentially leading to delays and increased costs.

Emerging Opportunities in Small UAV Market in Europe

The European Small UAV market is ripe with emerging opportunities driven by new technologies and evolving market needs.

- Urban Air Mobility (UAM): The development of drone-based passenger transport and advanced logistics networks in urban areas presents a significant long-term opportunity.

- AI-Powered Autonomous Operations: Advancements in AI are enabling fully autonomous missions, reducing the need for human operators and expanding capabilities for complex tasks like swarm operations and real-time adaptive decision-making.

- Integration with 5G Networks: The deployment of 5G technology will facilitate real-time data transmission and control, enabling more sophisticated and responsive drone operations.

- Sustainable Applications: Growing demand for drones in environmental monitoring, renewable energy inspection (e.g., wind turbines, solar farms), and precision agriculture for resource optimization.

- Counter-UAV Technologies: The increasing proliferation of drones also fuels demand for effective counter-UAS systems, creating a symbiotic market opportunity.

Leading Players in the Small UAV Market in Europe Market

- Textron Inc

- THALES

- Yuneec

- Elbit Systems Ltd.

- Lockheed Martin Corporation

- Shield AI

- AeroVironment Inc

- Parrot Drones SAS

- SZ DJI Technology Co Ltd

- UAS Europe AB

- DELAIR SAS

- Microdrones GmbH

- Northrop Grumman Corporation

- Teledyne FLIR LLC

Key Developments in Small UAV Market in Europe Industry

- January 2023: Elbit Systems Ltd. secured a significant contract with the UK to equip the British Army with Magni-X drones, underscoring the growing importance of micro-unmanned aerial systems for defense modernization and human-machine teaming initiatives.

- May 2022: The French defense innovation agency, L'Agence de l'Innovation de Défense (AID), launched two crucial proposals for the development of low-cost small attack drones. The Larinae project aims to develop a system capable of neutralizing targets beyond 50 kilometers, while the Colibri project focuses on systems for neutralizing targets within a 5-kilometer contact zone. These initiatives highlight the strategic push for advanced autonomous combat capabilities.

Strategic Outlook for Small UAV Market in Europe Market

- January 2023: Elbit Systems Ltd. secured a significant contract with the UK to equip the British Army with Magni-X drones, underscoring the growing importance of micro-unmanned aerial systems for defense modernization and human-machine teaming initiatives.

- May 2022: The French defense innovation agency, L'Agence de l'Innovation de Défense (AID), launched two crucial proposals for the development of low-cost small attack drones. The Larinae project aims to develop a system capable of neutralizing targets beyond 50 kilometers, while the Colibri project focuses on systems for neutralizing targets within a 5-kilometer contact zone. These initiatives highlight the strategic push for advanced autonomous combat capabilities.

Strategic Outlook for Small UAV Market in Europe Market

The strategic outlook for the European Small UAV market remains exceptionally strong, fueled by an ongoing wave of technological innovation and increasing adoption across diverse sectors. The continued investment in AI and autonomous systems will unlock new capabilities, transforming operational efficiency and mission effectiveness in both defense and civil domains. The push towards standardized regulations and improved airspace management will pave the way for more complex and widespread operations, including Beyond Visual Line of Sight (BVLOS) flights. Emerging opportunities in urban air mobility, sustainable applications, and integrated defense systems present substantial avenues for growth. Companies that focus on developing robust, secure, and adaptable drone solutions, while strategically navigating regulatory landscapes and fostering key partnerships, are best positioned to capitalize on the immense potential of this dynamic market.

Small UAV Market in Europe Segmentation

-

1. Wing Type

- 1.1. Fixed-wing

- 1.2. Rotary-wing

-

2. Size

- 2.1. Micro

- 2.2. Mini

- 2.3. Nano

-

3. Application

- 3.1. Military and Law Enforcement

- 3.2. Civil and Commercial

Small UAV Market in Europe Segmentation By Geography

-

1. Country

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Russia

- 1.5. Rest of Europe

Small UAV Market in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.75% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increased Seaborne Threats And Ambiguous Maritime Security Policies; Increasing Adoption Of Security Technologies In Bric Countries

- 3.3. Market Restrains

- 3.3.1. ; High Risk Rate In Ungoverned Zones; Unstructured Security Standards And Technologies

- 3.4. Market Trends

- 3.4.1. The Rotary-wing Segment is Projected to Show Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Small UAV Market in Europe Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Wing Type

- 5.1.1. Fixed-wing

- 5.1.2. Rotary-wing

- 5.2. Market Analysis, Insights and Forecast - by Size

- 5.2.1. Micro

- 5.2.2. Mini

- 5.2.3. Nano

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Military and Law Enforcement

- 5.3.2. Civil and Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Country

- 5.1. Market Analysis, Insights and Forecast - by Wing Type

- 6. Germany Small UAV Market in Europe Analysis, Insights and Forecast, 2019-2031

- 7. France Small UAV Market in Europe Analysis, Insights and Forecast, 2019-2031

- 8. Italy Small UAV Market in Europe Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Small UAV Market in Europe Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Small UAV Market in Europe Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Small UAV Market in Europe Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Small UAV Market in Europe Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Textron Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 THALES

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Yuneec

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Elbit Systems Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Lockheed Martin Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Shield AI

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 AeroVironment Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Parrot Drones SAS

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 SZ DJI Technology Co Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 UAS Europe AB

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 DELAIR SAS

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Microdrones GmbH

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Northrop Grumman Corporation

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Teledyne FLIR LLC

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.1 Textron Inc

List of Figures

- Figure 1: Small UAV Market in Europe Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Small UAV Market in Europe Share (%) by Company 2024

List of Tables

- Table 1: Small UAV Market in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Small UAV Market in Europe Revenue Million Forecast, by Wing Type 2019 & 2032

- Table 3: Small UAV Market in Europe Revenue Million Forecast, by Size 2019 & 2032

- Table 4: Small UAV Market in Europe Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Small UAV Market in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Small UAV Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Small UAV Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Small UAV Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Small UAV Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Small UAV Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Small UAV Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Small UAV Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Small UAV Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Small UAV Market in Europe Revenue Million Forecast, by Wing Type 2019 & 2032

- Table 15: Small UAV Market in Europe Revenue Million Forecast, by Size 2019 & 2032

- Table 16: Small UAV Market in Europe Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Small UAV Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Small UAV Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Small UAV Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Small UAV Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Russia Small UAV Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Europe Small UAV Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Small UAV Market in Europe?

The projected CAGR is approximately 8.75%.

2. Which companies are prominent players in the Small UAV Market in Europe?

Key companies in the market include Textron Inc, THALES, Yuneec, Elbit Systems Ltd, Lockheed Martin Corporation, Shield AI, AeroVironment Inc, Parrot Drones SAS, SZ DJI Technology Co Ltd, UAS Europe AB, DELAIR SAS, Microdrones GmbH, Northrop Grumman Corporation, Teledyne FLIR LLC.

3. What are the main segments of the Small UAV Market in Europe?

The market segments include Wing Type, Size, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increased Seaborne Threats And Ambiguous Maritime Security Policies; Increasing Adoption Of Security Technologies In Bric Countries.

6. What are the notable trends driving market growth?

The Rotary-wing Segment is Projected to Show Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

; High Risk Rate In Ungoverned Zones; Unstructured Security Standards And Technologies.

8. Can you provide examples of recent developments in the market?

In January 2023, Elbit Systems Ltd. announced a contract with the UK to equip the British Army with Magni-X drones. The Defence Ministry will receive the micro-unmanned aerial system as part of a transaction with the subordinate Defence Equipment and Support agency's Future Capability Group. The deal is part of the United Kingdom's efforts to expand the use of drones in the Army's Human Machine Teaming initiative.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Small UAV Market in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Small UAV Market in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Small UAV Market in Europe?

To stay informed about further developments, trends, and reports in the Small UAV Market in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence