Key Insights

The UAV Flight Training and Simulation market is experiencing robust growth, projected to reach a significant value by 2033. Driven by increasing demand for unmanned aerial vehicles (UAVs) across military, law enforcement, and civilian sectors, the market is witnessing a surge in investment in sophisticated training and simulation technologies. The rising complexity of UAV operations, coupled with the need for cost-effective and safe training solutions, fuels the adoption of realistic simulations. Key trends include the integration of artificial intelligence (AI) and virtual reality (VR) to enhance training effectiveness and the development of cloud-based simulation platforms for improved accessibility and scalability. While high initial investment costs for advanced simulation systems might pose a restraint, the long-term cost savings achieved through reduced operational risks and improved pilot proficiency outweigh the initial expenses. The market is segmented by application (military & law enforcement, civil & commercial) and geographically diversified, with North America and Europe currently holding substantial market shares, followed by the rapidly growing Asia-Pacific region. Leading players like Textron, L3Harris, and CAE are strategically investing in research and development, acquisitions, and partnerships to solidify their market positions and capitalize on the expanding market opportunities.

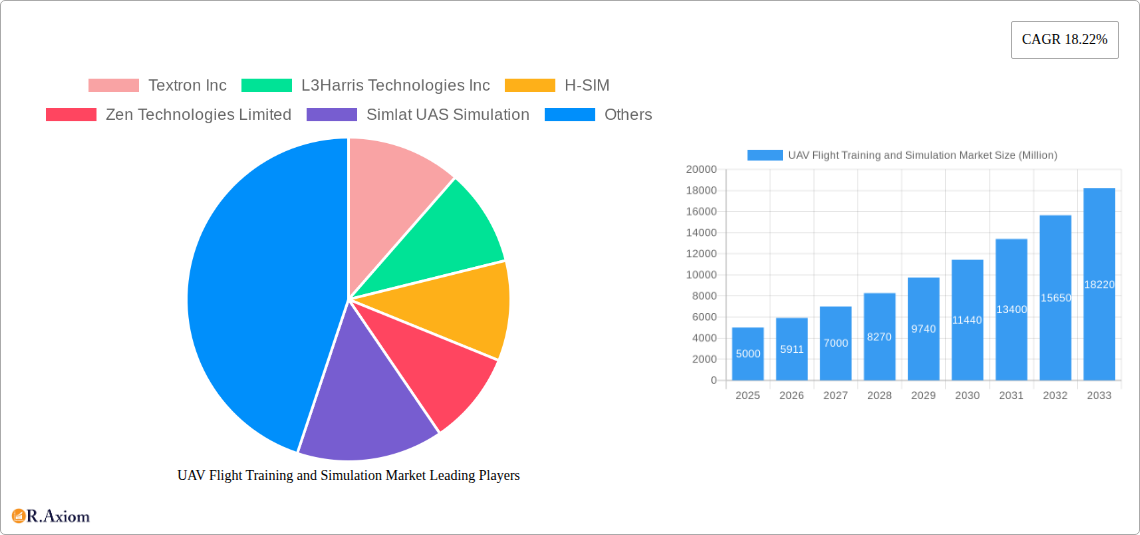

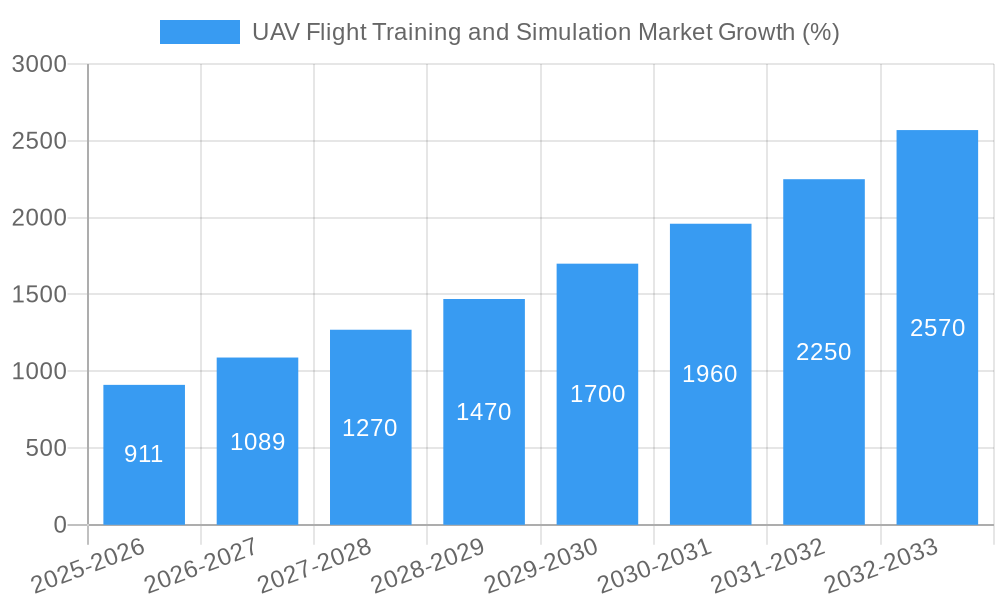

The 18.22% CAGR indicates a consistently expanding market. Given the market size in millions (XX) is unavailable, a reasonable estimation based on the CAGR and industry reports suggests a substantial market value in 2025 (e.g., let's assume $5 Billion for illustrative purposes, keeping in mind this is an educated estimate). This implies significant growth potential in the forecast period (2025-2033), particularly fueled by increasing UAV adoption in emerging economies and advancements in simulation technology. Companies are focusing on developing modular and scalable training solutions to cater to diverse client needs and budget considerations. The increasing integration of UAVs into various sectors, including agriculture, logistics, and infrastructure inspection, further drives the demand for effective training programs. The market's future growth hinges on the continuous innovation in simulation technologies, coupled with supportive government regulations and investments in advanced training infrastructure.

UAV Flight Training and Simulation Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the UAV Flight Training and Simulation market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. It explores market dynamics, key players, technological advancements, and future growth projections, providing a holistic understanding of this rapidly evolving sector. The market size is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

UAV Flight Training and Simulation Market Market Concentration & Innovation

This section analyzes the level of market concentration, key innovation drivers, regulatory landscape, presence of substitute products, prevailing end-user trends, and significant mergers and acquisitions (M&A) activities within the UAV Flight Training and Simulation market.

The market exhibits a moderately concentrated structure, with key players like Textron Inc, L3Harris Technologies Inc, and CAE Inc holding significant market share. However, the entry of new players and the increasing adoption of innovative technologies are likely to challenge this concentration in the coming years. Market share data for 2024 indicates that the top three players collectively hold approximately xx% of the market. M&A activity in the sector has been relatively modest, with deal values averaging xx Million per transaction in the historical period (2019-2024). However, the increasing demand for advanced training solutions and the strategic need for technology integration are anticipated to fuel future M&A activity.

- Innovation Drivers: Advancements in simulation technology (e.g., VR/AR integration, AI-powered training scenarios), the rise of autonomous UAVs, and the increasing demand for standardized training programs are driving innovation.

- Regulatory Frameworks: Stringent safety regulations and certification requirements for UAV operators are influencing the development and adoption of simulation-based training solutions.

- Product Substitutes: While full-scale flight training remains irreplaceable for certain aspects of pilot training, the cost-effectiveness and safety benefits of simulation are increasingly making it a preferred training method.

- End-User Trends: The rising adoption of UAVs across various sectors (military, civil, commercial) is directly correlated to a surging demand for efficient and effective training solutions. A strong preference towards immersive and realistic simulation experiences is also observed.

- M&A Activity: The pace of M&A activity is expected to increase, driven by the need for technology integration and expansion into new market segments. Strategic partnerships and collaborations are likely to become more prevalent.

UAV Flight Training and Simulation Market Industry Trends & Insights

The UAV Flight Training and Simulation market is experiencing robust growth, fueled by several key factors. The increasing adoption of UAVs across various applications, notably in military and commercial sectors, is a primary driver. Technological advancements such as the integration of VR/AR technologies, AI-powered training modules, and the development of more realistic simulations are also contributing to market expansion. Consumer preferences are shifting towards more interactive and personalized training programs, stimulating innovation in the development of simulation software and hardware. The competitive landscape is becoming increasingly dynamic, with both established players and new entrants competing to provide cutting-edge training solutions. This competition fosters innovation and drives down prices, making UAV training more accessible. The market is expected to grow at a CAGR of xx% from 2025 to 2033, with market penetration rates increasing significantly across various segments.

Dominant Markets & Segments in UAV Flight Training and Simulation Market

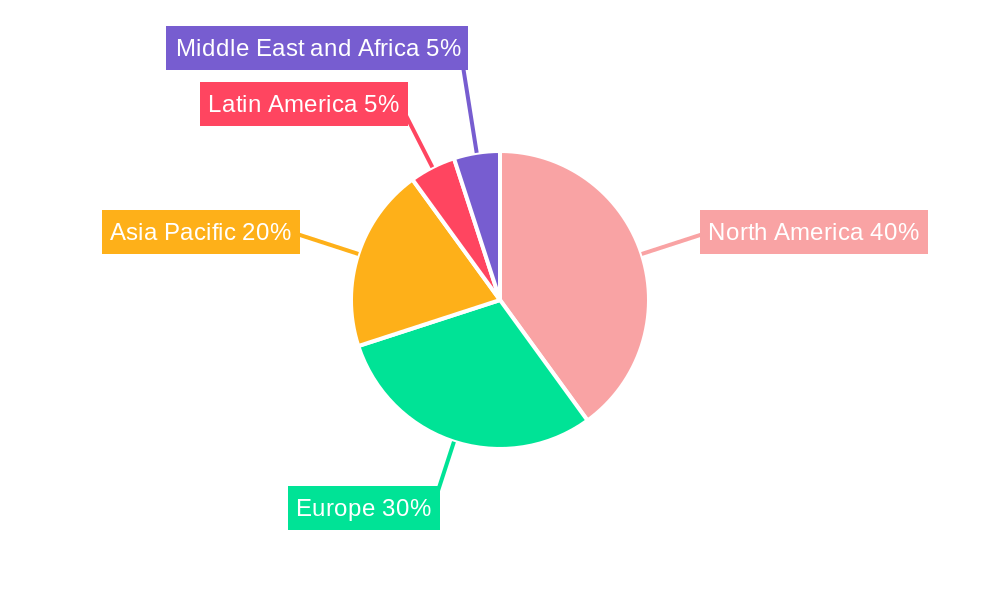

The North American region currently dominates the UAV Flight Training and Simulation market. The strong presence of major UAV manufacturers, a well-established defense sector, and robust government funding for defense and security programs are key drivers of this dominance. Within applications, the military and law enforcement segment holds a significant share, followed by the civil and commercial segment. The latter is expected to experience faster growth in the forecast period due to the expanding commercial drone market.

Key Drivers for North American Dominance:

- Robust Defense Budget: Significant government investments in defense and security initiatives stimulate demand for advanced UAV training.

- Presence of Major Players: Many leading UAV manufacturers and simulation technology providers are headquartered in North America.

- Strong Regulatory Framework: A defined regulatory environment for UAV operations encourages the use of robust training programs.

- Technological Advancement: North America is a hub for technological innovation in the UAV and simulation sectors.

Dominance Analysis: North America's dominance is primarily due to its mature UAV market and strong government support for defense initiatives, driving demand for sophisticated training systems. However, the Asia-Pacific region is expected to witness significant growth in the coming years due to rapid technological advancements and increasing UAV adoption in various sectors.

UAV Flight Training and Simulation Market Product Developments

Recent product innovations focus on enhancing realism and immersion in UAV simulations. This includes the integration of advanced graphics, realistic physics engines, and AI-powered adversaries. New applications are emerging beyond basic pilot training, encompassing mission planning, maintenance training, and regulatory compliance programs. The competitive advantage lies in providing highly realistic, customizable, and cost-effective training solutions that address the specific needs of various user groups. A key technological trend is the move towards cloud-based simulations, offering greater scalability and accessibility. Market fit is determined by the ability to deliver training that meets stringent safety standards, reduces operational costs, and improves overall pilot proficiency.

Report Scope & Segmentation Analysis

The report segments the UAV Flight Training and Simulation market based on application:

Military and Law Enforcement: This segment is characterized by high demand for advanced, highly realistic simulations for training pilots in complex scenarios. Growth is driven by increasing military spending and the expanding adoption of UAVs for surveillance, reconnaissance, and combat operations. The market is highly competitive, with major players focusing on offering specialized training solutions for specific military applications. Market size is estimated at xx Million in 2025, projected to reach xx Million by 2033.

Civil and Commercial: This segment shows significant growth potential, driven by the expanding commercial drone market and increasing regulations around drone operations. Simulations are used to train pilots in safe and controlled environments, covering various applications such as delivery, inspection, and photography. Competitive pressures are high, with new entrants offering innovative and cost-effective solutions. Market size is projected to grow from xx Million in 2025 to xx Million by 2033.

Key Drivers of UAV Flight Training and Simulation Market Growth

Several factors drive the growth of the UAV Flight Training and Simulation market. Technological advancements in simulation technology (VR/AR, AI) enhance training realism and effectiveness. The increasing adoption of UAVs across various sectors, particularly in military and commercial applications, boosts the demand for training solutions. Favorable government policies and regulations supporting the use of UAVs are also positive drivers. Furthermore, cost savings associated with simulation-based training over traditional methods make it attractive for various organizations.

Challenges in the UAV Flight Training and Simulation Market Sector

The UAV Flight Training and Simulation market faces several challenges. Stringent regulatory requirements for UAV operations and training programs present compliance hurdles for providers. Supply chain disruptions and the availability of advanced components for simulation systems can impact production. Intense competition from established players and new market entrants puts pressure on pricing and profitability. The market also needs to address issues related to the standardization of training programs and the interoperability of different simulation platforms. These factors could potentially hinder the market’s growth by xx% by 2033 if not properly addressed.

Emerging Opportunities in UAV Flight Training and Simulation Market

Several emerging opportunities exist in the UAV Flight Training and Simulation market. The increasing use of UAVs in new applications like autonomous delivery and precision agriculture will open up new training segments. The development of cloud-based simulation platforms will enhance accessibility and scalability. Integration of advanced AI and machine learning algorithms in simulations allows for adaptive and personalized training experiences. The emergence of new simulation technologies, such as haptic feedback systems, further enhances the realism and effectiveness of training. These trends collectively create significant growth potential for the market.

Leading Players in the UAV Flight Training and Simulation Market Market

- Textron Inc

- L3Harris Technologies Inc

- H-SIM

- Zen Technologies Limited

- Simlat UAS Simulation

- General Atomics

- CAE Inc

- Presagis USA Inc

- Israel Aerospace Industries (IAI) Ltd

- Northrop Grumman Corporation

- Quantum3D

Key Developments in UAV Flight Training and Simulation Market Industry

- July 2022: CAE signed a Memorandum of Understanding (MoU) with Boeing to expand collaboration and explore further teaming opportunities in defense aerospace training, focusing on innovation and competition through potential joint offerings.

- September 2022: MORAI launched MORAI SIM Air, a new simulation platform for UAVs and UAMs at the Commercial UAV Expo 2022, designed for verifying aircraft system safety in realistic virtual spaces.

Strategic Outlook for UAV Flight Training and Simulation Market Market

The future of the UAV Flight Training and Simulation market looks promising. Continued advancements in simulation technologies, the expanding use of UAVs across various sectors, and supportive government policies will fuel significant growth. The increasing demand for advanced training solutions to meet stringent safety standards and the growing need for cost-effective training options will further drive market expansion. The strategic focus should be on developing highly realistic, customizable, and scalable simulation platforms that cater to the diverse needs of different user groups. This will ensure the market’s continued expansion and competitiveness, and contribute to safety advancements within the wider UAV sector.

UAV Flight Training and Simulation Market Segmentation

-

1. Application

- 1.1. Military and Law Enforcement

- 1.2. Civil and Commercial

UAV Flight Training and Simulation Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

UAV Flight Training and Simulation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.22% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Civil and Commercial Segment is Projected to Show Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAV Flight Training and Simulation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Military and Law Enforcement

- 5.1.2. Civil and Commercial

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America UAV Flight Training and Simulation Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Military and Law Enforcement

- 6.1.2. Civil and Commercial

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe UAV Flight Training and Simulation Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Military and Law Enforcement

- 7.1.2. Civil and Commercial

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific UAV Flight Training and Simulation Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Military and Law Enforcement

- 8.1.2. Civil and Commercial

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America UAV Flight Training and Simulation Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Military and Law Enforcement

- 9.1.2. Civil and Commercial

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa UAV Flight Training and Simulation Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Military and Law Enforcement

- 10.1.2. Civil and Commercial

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. North America UAV Flight Training and Simulation Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe UAV Flight Training and Simulation Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific UAV Flight Training and Simulation Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America UAV Flight Training and Simulation Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa UAV Flight Training and Simulation Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Textron Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 L3Harris Technologies Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 H-SIM

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Zen Technologies Limited

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Simlat UAS Simulation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 General Atomics

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 CAE Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Presagis USA Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Israel Aerospace Industries (IAI) Ltd

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Northrop Grumman Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Quantum3D

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Textron Inc

List of Figures

- Figure 1: Global UAV Flight Training and Simulation Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America UAV Flight Training and Simulation Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America UAV Flight Training and Simulation Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe UAV Flight Training and Simulation Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe UAV Flight Training and Simulation Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific UAV Flight Training and Simulation Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific UAV Flight Training and Simulation Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America UAV Flight Training and Simulation Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America UAV Flight Training and Simulation Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa UAV Flight Training and Simulation Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa UAV Flight Training and Simulation Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America UAV Flight Training and Simulation Market Revenue (Million), by Application 2024 & 2032

- Figure 13: North America UAV Flight Training and Simulation Market Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America UAV Flight Training and Simulation Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America UAV Flight Training and Simulation Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe UAV Flight Training and Simulation Market Revenue (Million), by Application 2024 & 2032

- Figure 17: Europe UAV Flight Training and Simulation Market Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe UAV Flight Training and Simulation Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe UAV Flight Training and Simulation Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific UAV Flight Training and Simulation Market Revenue (Million), by Application 2024 & 2032

- Figure 21: Asia Pacific UAV Flight Training and Simulation Market Revenue Share (%), by Application 2024 & 2032

- Figure 22: Asia Pacific UAV Flight Training and Simulation Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific UAV Flight Training and Simulation Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Latin America UAV Flight Training and Simulation Market Revenue (Million), by Application 2024 & 2032

- Figure 25: Latin America UAV Flight Training and Simulation Market Revenue Share (%), by Application 2024 & 2032

- Figure 26: Latin America UAV Flight Training and Simulation Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Latin America UAV Flight Training and Simulation Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East and Africa UAV Flight Training and Simulation Market Revenue (Million), by Application 2024 & 2032

- Figure 29: Middle East and Africa UAV Flight Training and Simulation Market Revenue Share (%), by Application 2024 & 2032

- Figure 30: Middle East and Africa UAV Flight Training and Simulation Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East and Africa UAV Flight Training and Simulation Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UAV Flight Training and Simulation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UAV Flight Training and Simulation Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global UAV Flight Training and Simulation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global UAV Flight Training and Simulation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: UAV Flight Training and Simulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global UAV Flight Training and Simulation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: UAV Flight Training and Simulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global UAV Flight Training and Simulation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: UAV Flight Training and Simulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global UAV Flight Training and Simulation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: UAV Flight Training and Simulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global UAV Flight Training and Simulation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: UAV Flight Training and Simulation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global UAV Flight Training and Simulation Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Global UAV Flight Training and Simulation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global UAV Flight Training and Simulation Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global UAV Flight Training and Simulation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global UAV Flight Training and Simulation Market Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Global UAV Flight Training and Simulation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global UAV Flight Training and Simulation Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Global UAV Flight Training and Simulation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global UAV Flight Training and Simulation Market Revenue Million Forecast, by Application 2019 & 2032

- Table 23: Global UAV Flight Training and Simulation Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAV Flight Training and Simulation Market?

The projected CAGR is approximately 18.22%.

2. Which companies are prominent players in the UAV Flight Training and Simulation Market?

Key companies in the market include Textron Inc, L3Harris Technologies Inc, H-SIM, Zen Technologies Limited, Simlat UAS Simulation, General Atomics, CAE Inc, Presagis USA Inc, Israel Aerospace Industries (IAI) Ltd, Northrop Grumman Corporation, Quantum3D.

3. What are the main segments of the UAV Flight Training and Simulation Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Civil and Commercial Segment is Projected to Show Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In July 2022, CAE signed a Memorandum of Understanding (MoU) to expand their collaboration and explore further teaming opportunities in defense aerospace training. The memorandum leverages the strengths, skills, and advanced technologies of Boeing and CAE with the intent to further enhance innovation and competition through the potential joint offering.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAV Flight Training and Simulation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAV Flight Training and Simulation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAV Flight Training and Simulation Market?

To stay informed about further developments, trends, and reports in the UAV Flight Training and Simulation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence