Key Insights

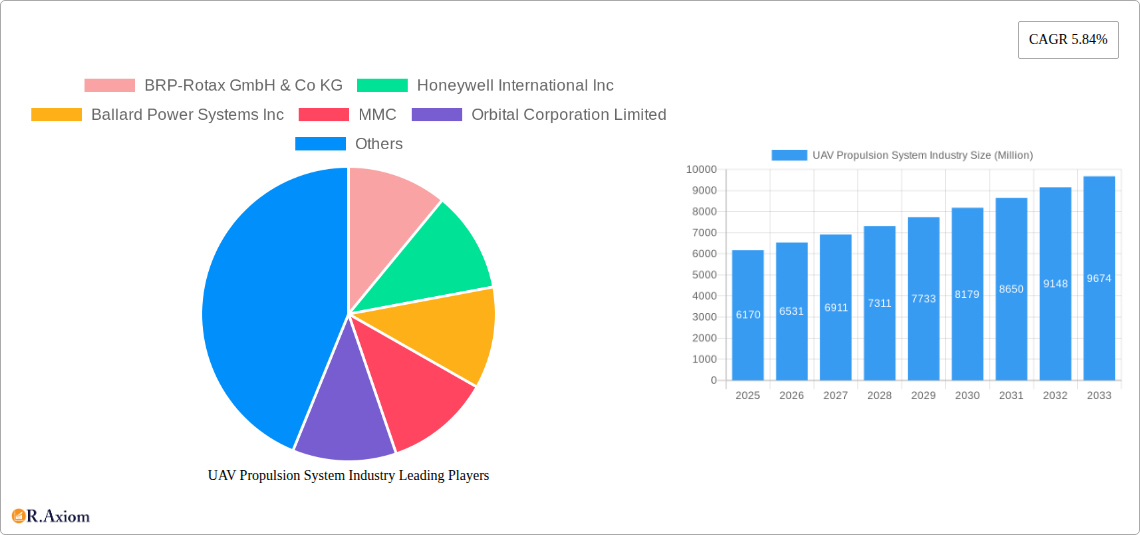

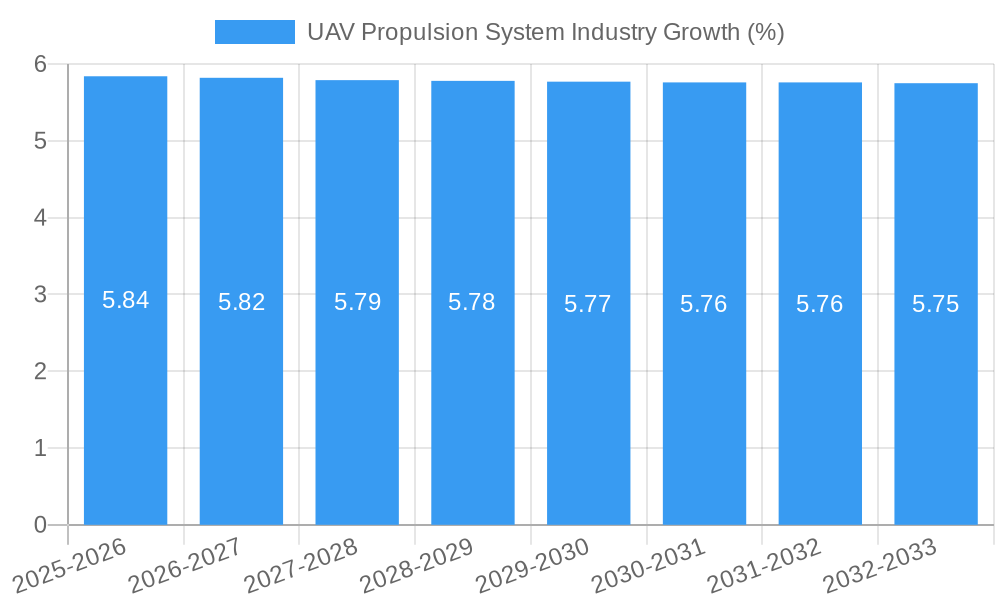

The global UAV Propulsion System Industry is poised for substantial growth, projected to reach $6.17 billion by 2025 and expand at a robust Compound Annual Growth Rate (CAGR) of 5.84% through 2033. This expansion is fundamentally driven by the escalating demand for advanced drone technology across diverse sectors, including civil and commercial applications for surveillance, logistics, agriculture, and infrastructure inspection. The military sector continues to be a significant contributor, with nations investing heavily in unmanned aerial vehicles for reconnaissance, defense, and tactical operations. The increasing miniaturization and sophistication of UAVs, spanning micro, mini, tactical, MALE, and HALE categories, necessitate innovative and efficient propulsion solutions. Advancements in engine technologies, particularly the shift towards hybrid and full-electric powertrains, are key drivers, offering improved flight endurance, reduced noise pollution, and enhanced environmental sustainability. These trends are further propelled by significant investments in research and development by leading global players such as Honeywell International Inc., Pratt & Whitney, and General Electric Company, alongside specialized manufacturers like Ballard Power Systems Inc. and BRP-Rotax GmbH & Co KG.

The industry's trajectory is also shaped by emerging trends like the integration of AI and autonomous capabilities, which demand propulsion systems that can reliably support longer and more complex missions. The growing adoption of UAVs for package delivery, emergency response, and mapping services in urban and remote areas is creating new market opportunities. However, certain restraints may influence the pace of growth, including stringent regulatory frameworks for airspace management, high initial investment costs for advanced propulsion systems, and ongoing challenges in battery technology for electric variants concerning energy density and charging times. Despite these challenges, the market is characterized by a strong competitive landscape with established aerospace giants and emerging specialists actively innovating to meet the evolving needs of the UAV ecosystem. The anticipated market expansion underscores the critical role of efficient and reliable propulsion in unlocking the full potential of unmanned aerial systems across the globe.

UAV Propulsion System Industry Market Concentration & Innovation

The UAV Propulsion System Industry is characterized by a moderate market concentration, with key players like Honeywell International Inc., Pratt & Whitney (RTX Corporation), and Rolls-Royce plc holding significant market shares. Innovation is a primary driver, fueled by advancements in electric and hybrid propulsion technologies aimed at increasing flight endurance, reducing noise pollution, and enhancing operational efficiency for various UAV types, from Micro UAVs to HALE UAVs. Regulatory frameworks are evolving, with an increasing focus on safety standards and airspace integration, impacting research and development priorities. Product substitutes, such as advanced battery chemistries and alternative fuel sources, are continuously being explored. End-user trends are leaning towards greater autonomy, longer flight times, and reduced operational costs, driving demand for more sophisticated and sustainable propulsion solutions. Merger and acquisition activities are present, with strategic collaborations and acquisitions valued in the hundreds of millions to billions of dollars, aimed at consolidating expertise, expanding product portfolios, and gaining a competitive edge. For instance, acquisitions of specialized component manufacturers or R&D firms are common to accelerate innovation cycles.

UAV Propulsion System Industry Industry Trends & Insights

The UAV Propulsion System Industry is poised for substantial growth, driven by an accelerating Compound Annual Growth Rate (CAGR) of xx%, projected to reach several tens of billions by the forecast period's end. This expansion is propelled by escalating demand across both Civil and Commercial and Military applications. In the Civil and Commercial sector, the proliferation of UAVs for logistics, agriculture, infrastructure inspection, and surveillance is creating a robust market for advanced propulsion systems. Key technological disruptions include the significant advancements in full-electric propulsion, offering quieter operations and zero emissions, making them ideal for urban environments and sensitive ecological areas. Hybrid systems are also gaining traction, combining the benefits of internal combustion engines and electric motors to achieve extended flight ranges and improved payload capacities, particularly for Tactical and MALE UAVs. Consumer preferences are increasingly shifting towards sustainability, demanding greener propulsion solutions that align with global environmental initiatives. This shift is directly impacting R&D investments, pushing companies like BRP-Rotax GmbH & Co KG and Orbital Corporation Limited to explore alternative fuel sources and more efficient engine designs. The competitive dynamics are intensifying, with established aerospace giants like General Electric Company and Diamond Aircraft Industries GmbH competing alongside specialized players such as Ballard Power Systems Inc. and Intelligent Energy Limited. Market penetration for full-electric systems is expected to grow significantly, especially within the Micro and Mini UAV segments, while hybrid and conventional systems will continue to dominate for longer-endurance applications like MALE and HALE UAVs. The industry is also witnessing a growing interest in hydrogen fuel cell technology, presenting a significant long-term opportunity for companies like H3 Dynamics Holdings Pte Ltd.

Dominant Markets & Segments in UAV Propulsion System Industry

The Military application segment is currently the dominant market within the UAV Propulsion System Industry, driven by extensive investments in defense modernization programs and the increasing use of UAVs for reconnaissance, surveillance, and combat operations. This dominance is further amplified by the demand for robust, high-performance propulsion systems capable of operating in challenging environments and supporting a wide range of UAV types, from tactical unmanned aerial vehicles to larger MALE and HALE UAVs. In terms of Engine Type, conventional internal combustion engines still hold a significant market share due to their established reliability and power output, particularly for longer-endurance military applications. However, the Full-electric segment is experiencing rapid growth, driven by technological advancements in battery technology and electric motor efficiency, making it increasingly viable for various military roles, including intelligence, surveillance, and reconnaissance (ISR) missions where stealth and reduced thermal signatures are paramount.

Within the UAV Type segmentation, Tactical UAVs and MALE UAVs are commanding substantial market share, necessitating propulsion systems that offer a balance of power, endurance, and payload capacity. The growing operational tempo in defense sectors globally directly fuels the demand for these UAV classes and their associated propulsion systems. Economic policies supporting defense spending and the strategic imperative to maintain air superiority are key drivers. For instance, ongoing geopolitical tensions necessitate advanced aerial capabilities, directly impacting the demand for advanced propulsion systems for military UAVs.

In the Civil and Commercial sphere, while not yet surpassing the military segment, its growth trajectory is exceptionally steep. This is propelled by a confluence of factors including government initiatives promoting drone integration for public services, increasing adoption by private enterprises for logistics and agricultural applications, and advancements in safety regulations that facilitate broader commercial use. The "economic policies" supporting drone delivery networks and remote sensing technologies are significantly contributing to this growth. Infrastructure development for drone ports and charging stations will further accelerate this trend.

The Full-electric engine type is witnessing particularly impressive growth in the Civil and Commercial sector, especially for Micro and Mini UAVs used in urban delivery and aerial photography. The inherent advantages of quiet operation and zero emissions make them ideal for these applications. Hybrid systems are also finding increasing adoption for longer-range commercial applications such as pipeline inspection and agricultural spraying, where extended flight times are crucial. The "consumer preferences" for eco-friendly solutions are a powerful underlying trend.

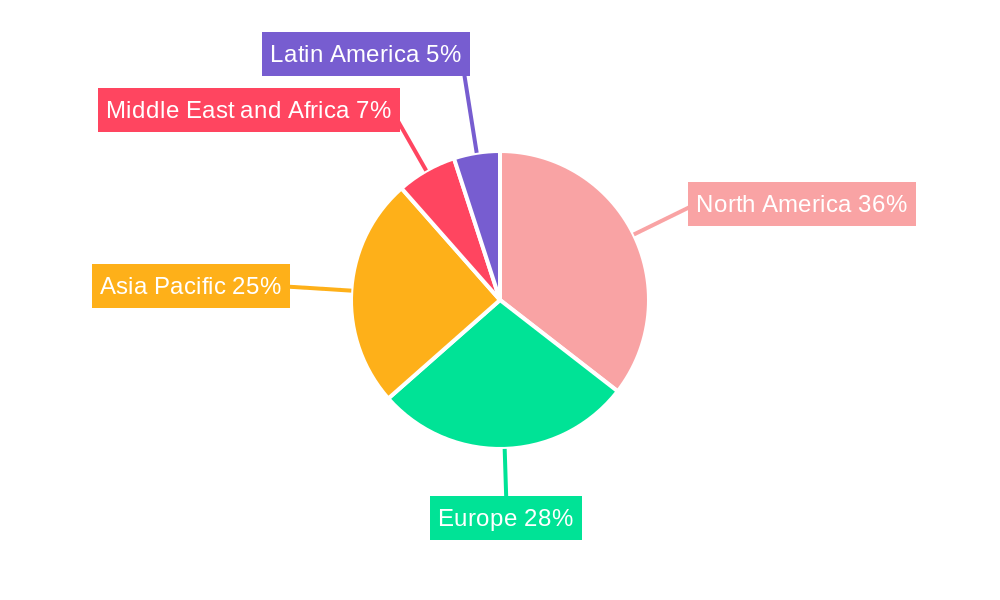

Geographically, North America and Europe are leading markets due to strong government investment in defense, robust aerospace industries, and a proactive approach to regulatory frameworks for UAV integration. The presence of key industry players like Honeywell International Inc. and Rolls-Royce plc in these regions further solidifies their dominance. The "infrastructure" for supporting advanced UAV operations, including testing facilities and research institutions, is also more developed in these regions.

UAV Propulsion System Industry Product Developments

The UAV Propulsion System Industry is witnessing a surge in product innovations focusing on enhanced power density, reduced weight, and improved fuel efficiency across all engine types. Full-electric propulsion systems are seeing advancements in battery technology, offering longer flight durations and faster charging capabilities, making them increasingly competitive for Micro and Mini UAVs. Hybrid propulsion solutions are emerging with integrated power management systems, optimizing fuel consumption for Tactical and MALE UAVs. Conventional engines are also benefiting from lighter materials and advanced combustion techniques, enhancing performance and reliability for all UAV classes. Companies are actively developing propulsion systems with modular designs for easier maintenance and upgrades, a key competitive advantage in a rapidly evolving market.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the UAV Propulsion System Industry, segmented by Engine Type (Conventional, Hybrid, Full-electric), Application (Civil and Commercial, Military), and UAV Type (Micro UAV, Mini UAV, Tactical UAV, MALE UAV, HALE UAV). The Conventional engine segment is projected to hold a substantial market share throughout the forecast period, particularly in military applications requiring high power and endurance. The Hybrid segment is expected to witness robust growth as it offers a compelling balance of range and efficiency for diverse applications. The Full-electric segment is anticipated to experience the highest CAGR, driven by technological advancements and increasing demand for sustainable solutions in civil and commercial sectors. The Civil and Commercial application segment is forecast to grow significantly, propelled by emerging use cases in logistics and infrastructure. The Military segment will remain a dominant force, supported by ongoing defense modernization efforts. Within UAV types, Tactical UAVs and MALE UAVs are expected to drive significant market demand.

Key Drivers of UAV Propulsion System Industry Growth

The primary growth drivers for the UAV Propulsion System Industry include the escalating demand for advanced reconnaissance and surveillance capabilities in military operations, fueling the need for reliable and high-performance propulsion systems. In the civil and commercial sectors, the burgeoning adoption of UAVs for logistics, agriculture, and infrastructure inspection is creating substantial market opportunities. Technological advancements, particularly in electric and hybrid propulsion, are enabling longer flight endurance, reduced noise, and improved operational efficiency. Furthermore, supportive government initiatives and evolving regulatory frameworks that facilitate broader UAV integration are crucial growth catalysts. The increasing focus on sustainable aviation and reducing carbon footprints is also driving innovation in cleaner propulsion technologies.

Challenges in the UAV Propulsion System Industry Sector

Despite robust growth prospects, the UAV Propulsion System Industry faces several challenges. Stringent and evolving regulatory frameworks across different regions can create complexities and delays in product development and market entry. Supply chain disruptions and the sourcing of specialized components, particularly for advanced electric and hybrid systems, can impact production timelines and costs. High research and development costs associated with innovative propulsion technologies can pose a barrier for smaller players. Furthermore, the limited availability of trained personnel for the manufacturing and maintenance of advanced propulsion systems presents a human capital challenge. Intense competition among established players and emerging startups also puts pressure on pricing and profit margins.

Emerging Opportunities in UAV Propulsion System Industry

Emerging opportunities in the UAV Propulsion System Industry are abundant. The development of next-generation battery technologies and hydrogen fuel cells offers immense potential for significantly extending UAV flight endurance and reducing reliance on fossil fuels. The expansion of UAVs into new application areas like urban air mobility and cargo delivery presents a substantial market for specialized propulsion systems. Partnerships and collaborations between propulsion manufacturers, UAV OEMs, and technology providers are creating synergistic growth opportunities. Furthermore, the increasing demand for autonomous operations necessitates propulsion systems with advanced control and monitoring capabilities. The growing focus on cybersecurity for UAV operations also opens avenues for integrated propulsion and control system solutions.

Leading Players in the UAV Propulsion System Industry Market

- BRP-Rotax GmbH & Co KG

- Honeywell International Inc.

- Ballard Power Systems Inc.

- MMC

- Orbital Corporation Limited

- Pratt & Whitney (RTX Corporation)

- Diamond Aircraft Industries GmbH

- Intelligent Energy Limited

- Rolls-Royce plc

- H3 Dynamics Holdings Pte Ltd

- 3W International GmbH

- General Electric Company

- UAV Engines Limited

- Hirth Engines GmbH

Key Developments in UAV Propulsion System Industry Industry

- 2023/04: Rolls-Royce plc announces successful testing of a new hydrogen-electric hybrid propulsion system for a regional aircraft demonstrator, potentially applicable to larger UAVs.

- 2023/02: Ballard Power Systems Inc. partners with a leading UAV manufacturer to integrate its fuel cell technology for extended-endurance surveillance drones.

- 2022/11: Honeywell International Inc. unveils a new lightweight, high-efficiency turbogenerator for MALE UAV applications, enhancing power output and fuel efficiency.

- 2022/08: H3 Dynamics Holdings Pte Ltd secures significant funding to accelerate the development and commercialization of its hydrogen-electric propulsion solutions for long-range UAVs.

- 2022/05: Pratt & Whitney (RTX Corporation) expands its portfolio with advanced hybrid-electric propulsion concepts aimed at future military UAV platforms.

- 2021/12: Diamond Aircraft Industries GmbH announces advancements in its electric propulsion systems for lighter UAV categories, focusing on urban air mobility applications.

- 2021/09: Orbital Corporation Limited introduces an enhanced piston engine designed for increased reliability and fuel efficiency in tactical UAVs.

Strategic Outlook for UAV Propulsion System Industry Market

The strategic outlook for the UAV Propulsion System Industry is exceptionally positive, driven by sustained innovation and expanding market applications. The industry is set to witness a significant shift towards electrification and hybridization, catering to the growing demand for sustainable and efficient operations. Companies that can leverage advancements in battery technology, fuel cells, and advanced control systems will be well-positioned for future success. Strategic partnerships and a focus on offering integrated propulsion solutions will be crucial for navigating the competitive landscape. The increasing integration of UAVs into both military and civilian infrastructure presents long-term growth catalysts, supported by ongoing investment in research and development and a favorable regulatory environment for emerging technologies.

UAV Propulsion System Industry Segmentation

-

1. Engine Type

- 1.1. Conventional

- 1.2. Hybrid

- 1.3. Full-electric

-

2. Application

- 2.1. Civil and Commercial

- 2.2. Military

-

3. UAV Type

- 3.1. Micro UAV

- 3.2. Mini UAV

- 3.3. Tactical UAV

- 3.4. MALE UAV

- 3.5. HALE UAV

UAV Propulsion System Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Qatar

- 5.4. South Africa

- 5.5. Rest of Middle East and Africa

UAV Propulsion System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.84% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Commercial Segment is Expected to Lead the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAV Propulsion System Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Engine Type

- 5.1.1. Conventional

- 5.1.2. Hybrid

- 5.1.3. Full-electric

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Civil and Commercial

- 5.2.2. Military

- 5.3. Market Analysis, Insights and Forecast - by UAV Type

- 5.3.1. Micro UAV

- 5.3.2. Mini UAV

- 5.3.3. Tactical UAV

- 5.3.4. MALE UAV

- 5.3.5. HALE UAV

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Engine Type

- 6. North America UAV Propulsion System Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Engine Type

- 6.1.1. Conventional

- 6.1.2. Hybrid

- 6.1.3. Full-electric

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Civil and Commercial

- 6.2.2. Military

- 6.3. Market Analysis, Insights and Forecast - by UAV Type

- 6.3.1. Micro UAV

- 6.3.2. Mini UAV

- 6.3.3. Tactical UAV

- 6.3.4. MALE UAV

- 6.3.5. HALE UAV

- 6.1. Market Analysis, Insights and Forecast - by Engine Type

- 7. Europe UAV Propulsion System Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Engine Type

- 7.1.1. Conventional

- 7.1.2. Hybrid

- 7.1.3. Full-electric

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Civil and Commercial

- 7.2.2. Military

- 7.3. Market Analysis, Insights and Forecast - by UAV Type

- 7.3.1. Micro UAV

- 7.3.2. Mini UAV

- 7.3.3. Tactical UAV

- 7.3.4. MALE UAV

- 7.3.5. HALE UAV

- 7.1. Market Analysis, Insights and Forecast - by Engine Type

- 8. Asia Pacific UAV Propulsion System Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Engine Type

- 8.1.1. Conventional

- 8.1.2. Hybrid

- 8.1.3. Full-electric

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Civil and Commercial

- 8.2.2. Military

- 8.3. Market Analysis, Insights and Forecast - by UAV Type

- 8.3.1. Micro UAV

- 8.3.2. Mini UAV

- 8.3.3. Tactical UAV

- 8.3.4. MALE UAV

- 8.3.5. HALE UAV

- 8.1. Market Analysis, Insights and Forecast - by Engine Type

- 9. Latin America UAV Propulsion System Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Engine Type

- 9.1.1. Conventional

- 9.1.2. Hybrid

- 9.1.3. Full-electric

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Civil and Commercial

- 9.2.2. Military

- 9.3. Market Analysis, Insights and Forecast - by UAV Type

- 9.3.1. Micro UAV

- 9.3.2. Mini UAV

- 9.3.3. Tactical UAV

- 9.3.4. MALE UAV

- 9.3.5. HALE UAV

- 9.1. Market Analysis, Insights and Forecast - by Engine Type

- 10. Middle East and Africa UAV Propulsion System Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Engine Type

- 10.1.1. Conventional

- 10.1.2. Hybrid

- 10.1.3. Full-electric

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Civil and Commercial

- 10.2.2. Military

- 10.3. Market Analysis, Insights and Forecast - by UAV Type

- 10.3.1. Micro UAV

- 10.3.2. Mini UAV

- 10.3.3. Tactical UAV

- 10.3.4. MALE UAV

- 10.3.5. HALE UAV

- 10.1. Market Analysis, Insights and Forecast - by Engine Type

- 11. North America UAV Propulsion System Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe UAV Propulsion System Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 France

- 12.1.3 Germany

- 12.1.4 Rest of Europe

- 13. Asia Pacific UAV Propulsion System Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 India

- 13.1.3 Japan

- 13.1.4 South Korea

- 13.1.5 Rest of Asia Pacific

- 14. Latin America UAV Propulsion System Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Mexico

- 14.1.3 Rest of Latin America

- 15. Middle East and Africa UAV Propulsion System Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 Qatar

- 15.1.4 South Africa

- 15.1.5 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 BRP-Rotax GmbH & Co KG

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Honeywell International Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Ballard Power Systems Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 MMC

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Orbital Corporation Limited

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Pratt & Whitney (RTX Corporation)

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Diamond Aircraft Industries GmbH

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Intelligent Energy Limite

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Rolls-Royce plc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 H3 Dynamics Holdings Pte Ltd

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 3W International GmbH

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 General Electric Company

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 UAV Engines Limited

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Hirth Engines GmbH

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.1 BRP-Rotax GmbH & Co KG

List of Figures

- Figure 1: Global UAV Propulsion System Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America UAV Propulsion System Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America UAV Propulsion System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe UAV Propulsion System Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe UAV Propulsion System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific UAV Propulsion System Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific UAV Propulsion System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America UAV Propulsion System Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America UAV Propulsion System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa UAV Propulsion System Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa UAV Propulsion System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America UAV Propulsion System Industry Revenue (Million), by Engine Type 2024 & 2032

- Figure 13: North America UAV Propulsion System Industry Revenue Share (%), by Engine Type 2024 & 2032

- Figure 14: North America UAV Propulsion System Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: North America UAV Propulsion System Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America UAV Propulsion System Industry Revenue (Million), by UAV Type 2024 & 2032

- Figure 17: North America UAV Propulsion System Industry Revenue Share (%), by UAV Type 2024 & 2032

- Figure 18: North America UAV Propulsion System Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America UAV Propulsion System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe UAV Propulsion System Industry Revenue (Million), by Engine Type 2024 & 2032

- Figure 21: Europe UAV Propulsion System Industry Revenue Share (%), by Engine Type 2024 & 2032

- Figure 22: Europe UAV Propulsion System Industry Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe UAV Propulsion System Industry Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe UAV Propulsion System Industry Revenue (Million), by UAV Type 2024 & 2032

- Figure 25: Europe UAV Propulsion System Industry Revenue Share (%), by UAV Type 2024 & 2032

- Figure 26: Europe UAV Propulsion System Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe UAV Propulsion System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific UAV Propulsion System Industry Revenue (Million), by Engine Type 2024 & 2032

- Figure 29: Asia Pacific UAV Propulsion System Industry Revenue Share (%), by Engine Type 2024 & 2032

- Figure 30: Asia Pacific UAV Propulsion System Industry Revenue (Million), by Application 2024 & 2032

- Figure 31: Asia Pacific UAV Propulsion System Industry Revenue Share (%), by Application 2024 & 2032

- Figure 32: Asia Pacific UAV Propulsion System Industry Revenue (Million), by UAV Type 2024 & 2032

- Figure 33: Asia Pacific UAV Propulsion System Industry Revenue Share (%), by UAV Type 2024 & 2032

- Figure 34: Asia Pacific UAV Propulsion System Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific UAV Propulsion System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America UAV Propulsion System Industry Revenue (Million), by Engine Type 2024 & 2032

- Figure 37: Latin America UAV Propulsion System Industry Revenue Share (%), by Engine Type 2024 & 2032

- Figure 38: Latin America UAV Propulsion System Industry Revenue (Million), by Application 2024 & 2032

- Figure 39: Latin America UAV Propulsion System Industry Revenue Share (%), by Application 2024 & 2032

- Figure 40: Latin America UAV Propulsion System Industry Revenue (Million), by UAV Type 2024 & 2032

- Figure 41: Latin America UAV Propulsion System Industry Revenue Share (%), by UAV Type 2024 & 2032

- Figure 42: Latin America UAV Propulsion System Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America UAV Propulsion System Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa UAV Propulsion System Industry Revenue (Million), by Engine Type 2024 & 2032

- Figure 45: Middle East and Africa UAV Propulsion System Industry Revenue Share (%), by Engine Type 2024 & 2032

- Figure 46: Middle East and Africa UAV Propulsion System Industry Revenue (Million), by Application 2024 & 2032

- Figure 47: Middle East and Africa UAV Propulsion System Industry Revenue Share (%), by Application 2024 & 2032

- Figure 48: Middle East and Africa UAV Propulsion System Industry Revenue (Million), by UAV Type 2024 & 2032

- Figure 49: Middle East and Africa UAV Propulsion System Industry Revenue Share (%), by UAV Type 2024 & 2032

- Figure 50: Middle East and Africa UAV Propulsion System Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa UAV Propulsion System Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UAV Propulsion System Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UAV Propulsion System Industry Revenue Million Forecast, by Engine Type 2019 & 2032

- Table 3: Global UAV Propulsion System Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global UAV Propulsion System Industry Revenue Million Forecast, by UAV Type 2019 & 2032

- Table 5: Global UAV Propulsion System Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global UAV Propulsion System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global UAV Propulsion System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United Kingdom UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global UAV Propulsion System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: China UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Asia Pacific UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global UAV Propulsion System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Latin America UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global UAV Propulsion System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United Arab Emirates UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Saudi Arabia UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Qatar UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: South Africa UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Middle East and Africa UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global UAV Propulsion System Industry Revenue Million Forecast, by Engine Type 2019 & 2032

- Table 31: Global UAV Propulsion System Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Global UAV Propulsion System Industry Revenue Million Forecast, by UAV Type 2019 & 2032

- Table 33: Global UAV Propulsion System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Canada UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Global UAV Propulsion System Industry Revenue Million Forecast, by Engine Type 2019 & 2032

- Table 37: Global UAV Propulsion System Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 38: Global UAV Propulsion System Industry Revenue Million Forecast, by UAV Type 2019 & 2032

- Table 39: Global UAV Propulsion System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: United Kingdom UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: France UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Germany UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Europe UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global UAV Propulsion System Industry Revenue Million Forecast, by Engine Type 2019 & 2032

- Table 45: Global UAV Propulsion System Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 46: Global UAV Propulsion System Industry Revenue Million Forecast, by UAV Type 2019 & 2032

- Table 47: Global UAV Propulsion System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 48: China UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: India UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: South Korea UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Asia Pacific UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Global UAV Propulsion System Industry Revenue Million Forecast, by Engine Type 2019 & 2032

- Table 54: Global UAV Propulsion System Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 55: Global UAV Propulsion System Industry Revenue Million Forecast, by UAV Type 2019 & 2032

- Table 56: Global UAV Propulsion System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 57: Brazil UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Mexico UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Rest of Latin America UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Global UAV Propulsion System Industry Revenue Million Forecast, by Engine Type 2019 & 2032

- Table 61: Global UAV Propulsion System Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 62: Global UAV Propulsion System Industry Revenue Million Forecast, by UAV Type 2019 & 2032

- Table 63: Global UAV Propulsion System Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 64: United Arab Emirates UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Saudi Arabia UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Qatar UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: South Africa UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Rest of Middle East and Africa UAV Propulsion System Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAV Propulsion System Industry?

The projected CAGR is approximately 5.84%.

2. Which companies are prominent players in the UAV Propulsion System Industry?

Key companies in the market include BRP-Rotax GmbH & Co KG, Honeywell International Inc, Ballard Power Systems Inc, MMC, Orbital Corporation Limited, Pratt & Whitney (RTX Corporation), Diamond Aircraft Industries GmbH, Intelligent Energy Limite, Rolls-Royce plc, H3 Dynamics Holdings Pte Ltd, 3W International GmbH, General Electric Company, UAV Engines Limited, Hirth Engines GmbH.

3. What are the main segments of the UAV Propulsion System Industry?

The market segments include Engine Type, Application, UAV Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.17 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Commercial Segment is Expected to Lead the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAV Propulsion System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAV Propulsion System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAV Propulsion System Industry?

To stay informed about further developments, trends, and reports in the UAV Propulsion System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence