Key Insights

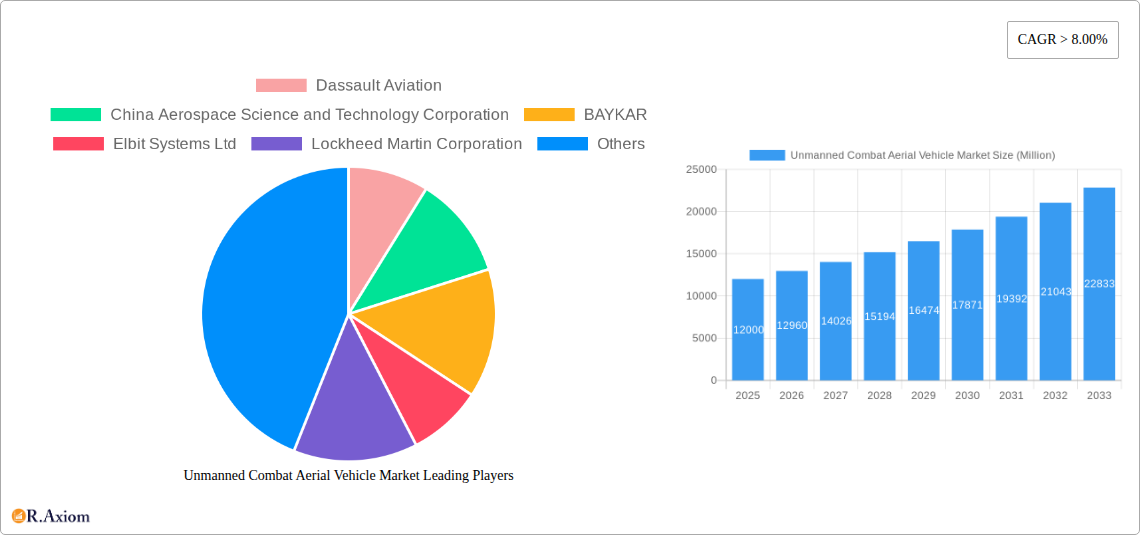

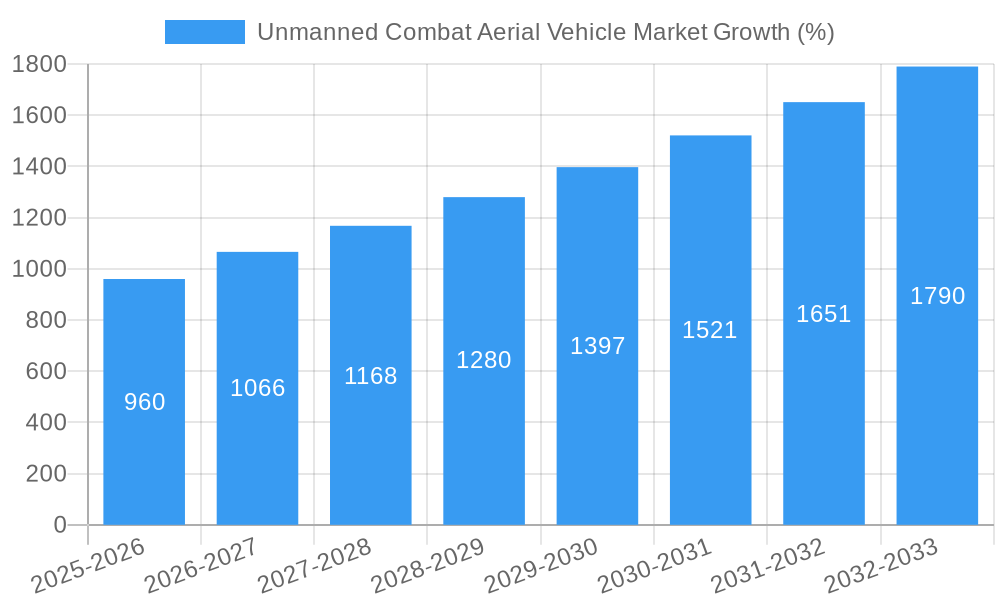

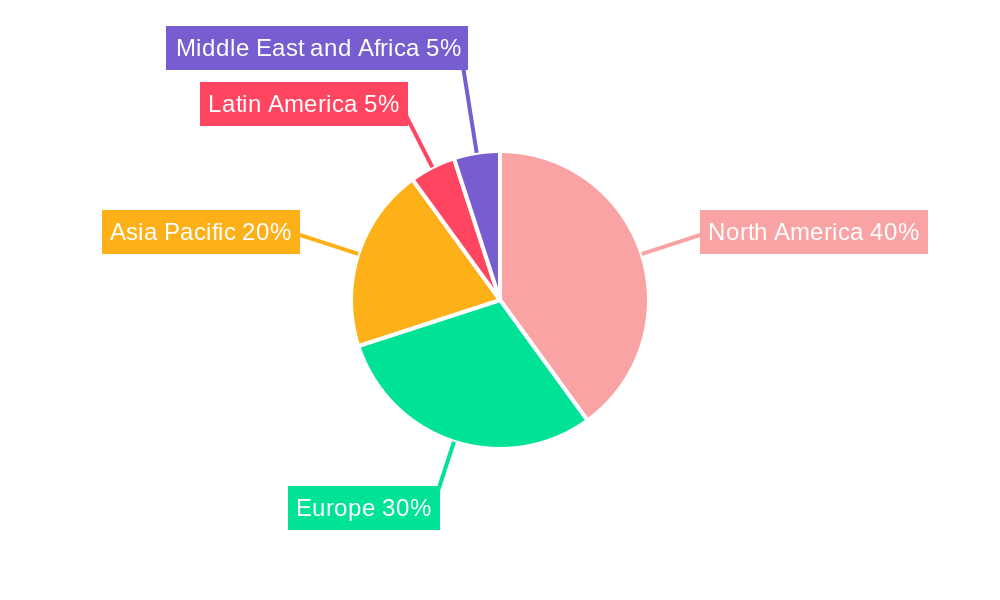

The Unmanned Combat Aerial Vehicle (UCAV) market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 8% from 2025 to 2033. This expansion is driven by several key factors. Increasing defense budgets globally, particularly among major powers and emerging economies, fuel demand for advanced, cost-effective military technologies. The inherent advantages of UCAVs—reduced pilot risk, enhanced surveillance capabilities, precise strike options, and extended operational range—make them increasingly attractive for diverse military operations. Technological advancements, such as improved autonomy, AI-powered targeting systems, and longer endurance capabilities, are further accelerating market growth. The market is segmented by altitude of operation (below and above 30,000 feet) and type (fixed-wing and rotary-wing), reflecting the diverse operational requirements and technological capabilities within the sector. North America and Europe currently hold significant market shares, driven by established defense industries and strong government investment, but the Asia-Pacific region is poised for rapid growth due to increasing military modernization efforts in countries like China and India. The competitive landscape is characterized by a mix of established aerospace giants like Boeing and Lockheed Martin, along with emerging players like Baykar and several Israeli defense companies, leading to intense innovation and competition. However, potential restraints include high initial investment costs, regulatory hurdles surrounding autonomous weapons systems, and ethical concerns surrounding the use of lethal autonomous weapons.

The market's future trajectory depends on several interacting factors. Continued technological progress, particularly in areas such as swarm technology and advanced sensor integration, will drive innovation. Geopolitical instability and regional conflicts will likely stimulate demand for UCAVs as nations seek to enhance their military capabilities. However, the pace of adoption will also be influenced by regulatory frameworks governing the use of autonomous weapons and the evolving international discussions surrounding their ethical implications. The increasing focus on cost-effectiveness and the development of smaller, more affordable UCAV platforms will also shape the market's evolution. Overall, the UCAV market is expected to witness significant expansion in the coming years, driven by a confluence of technological, geopolitical, and economic factors.

Unmanned Combat Aerial Vehicle (UCAV) Market: A Comprehensive Analysis (2019-2033)

This comprehensive report provides a detailed analysis of the Unmanned Combat Aerial Vehicle (UCAV) market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with 2025 as the base and estimated year. The report leverages extensive primary and secondary research to deliver a robust forecast for 2025-2033, providing a granular understanding of market dynamics, growth drivers, challenges, and emerging opportunities. The analysis encompasses key segments, including altitude of operation (below and above 30,000 feet) and type (fixed-wing and rotary-wing), and profiles major players shaping the market landscape.

Unmanned Combat Aerial Vehicle Market Concentration & Innovation

The UCAV market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. However, the market also witnesses considerable innovation, driven by technological advancements and the increasing demand for sophisticated unmanned systems. Market concentration is influenced by factors such as research and development capabilities, technological expertise, and established supply chains. While precise market share figures for each player are proprietary data included in the full report, we estimate that the top 5 players hold approximately xx% of the global market share in 2025.

Mergers and acquisitions (M&A) play a crucial role in shaping market dynamics. Significant M&A activity has been observed in recent years, with deal values exceeding xx Million in 2024 alone. These transactions aim to enhance technological capabilities, expand market reach, and secure a competitive edge. The regulatory framework, including export controls and national security considerations, significantly impacts market dynamics. Furthermore, the emergence of advanced technologies such as AI and autonomous navigation systems continues to drive innovation and reshape the competitive landscape. The increasing adoption of UCAVs by various end-users, including military and defense forces, further fuels market growth. Product substitutes, such as traditional manned aircraft, are facing declining market share due to the cost-effectiveness and operational advantages of UCAVs.

Unmanned Combat Aerial Vehicle Market Industry Trends & Insights

The global UCAV market is experiencing robust growth, driven by increasing defense budgets globally, advancements in drone technology, and the growing need for cost-effective and precise military operations. The compound annual growth rate (CAGR) is projected to reach xx% during the forecast period (2025-2033). Market penetration in key regions such as North America and Asia Pacific is steadily increasing due to substantial investments in military modernization and rising adoption of autonomous systems. Technological disruptions, including the integration of Artificial Intelligence (AI) and advanced sensor technologies, are revolutionizing UCAV capabilities, leading to higher accuracy, enhanced situational awareness, and improved operational efficiency. Consumer preferences are shifting towards autonomous and remotely piloted systems that offer better range, payload capacity, and improved survivability. Competitive dynamics are influenced by technological advancements, strategic partnerships, and government regulations. The market's evolution is characterized by a shift towards more advanced and specialized UCAVs, incorporating next-generation sensors, communication systems, and weapons payloads.

Dominant Markets & Segments in Unmanned Combat Aerial Vehicle Market

The North American region currently holds the largest market share in the UCAV sector, primarily due to significant defense spending and technological advancements. Within the segments, the fixed-wing UCAV segment commands a larger market share compared to rotary-wing, driven by its superior range, payload capacity, and endurance. The below 30,000 feet altitude segment dominates due to the majority of UCAV operations taking place at lower altitudes.

Key Drivers for North American Dominance:

- Substantial investments in defense modernization.

- Advanced technological capabilities and R&D.

- Strong presence of major UCAV manufacturers.

- Supportive government policies and regulations.

Key Drivers for Fixed-wing Dominance:

- Superior range and endurance compared to rotary-wing.

- Higher payload capacity for carrying weapons and sensors.

- Cost-effectiveness for long-duration missions.

Key Drivers for Below 30,000 feet Altitude Segment:

- Majority of military operations occur at lower altitudes.

- Reduced operational risks and improved situational awareness.

- Cost-effective deployment and operation.

Unmanned Combat Aerial Vehicle Market Product Developments

The Unmanned Combat Aerial Vehicle (UCAV) market is experiencing rapid innovation, with a strong emphasis on advancing autonomy through sophisticated Artificial Intelligence (AI) and machine learning algorithms. These advancements enable UCAVs to perform complex missions with minimal human intervention, including dynamic target acquisition and engagement in contested airspace. Payload capacities are being significantly increased, allowing for the integration of a wider array of sensors, electronic warfare suites, and a more diverse range of munitions. Furthermore, operational ranges are being extended through improvements in propulsion systems and aerodynamic designs, facilitating extended loiter times and deeper operational reach. Connectivity is also a critical area of development, with the integration of secure, resilient, and high-bandwidth communication networks facilitating seamless data exchange and command and control, even in degraded environments. Emerging applications are expanding beyond traditional surveillance and reconnaissance to include roles in counter-terrorism, border patrol, and even humanitarian aid delivery in high-risk zones. Competitive advantages are increasingly being carved out through the development of modular and scalable UCAV architectures that can be adapted to specific mission profiles, coupled with a focus on cost-effectiveness and lifecycle support. The overarching trend is the creation of highly integrated, networked systems that can operate collaboratively with manned platforms and other unmanned assets, forming a potent and adaptable combat force.

Report Scope & Segmentation Analysis

This comprehensive report segments the Unmanned Combat Aerial Vehicle (UCAV) market based on critical operational parameters and platform types. The primary segmentation by altitude of operation includes "below 30,000 feet" for tactical and short-range missions, and "above 30,000 feet" for strategic, high-altitude, and long-endurance (HALE) operations. Analysis within each segment covers detailed market size estimations, robust growth projections, and an in-depth examination of competitive dynamics. The "below 30,000 feet" segment is projected to experience a significant Compound Annual Growth Rate (CAGR) of approximately [Insert Specific CAGR Here]% during the forecast period. This growth is primarily propelled by the escalating demand for agile and cost-effective solutions for close air support, reconnaissance, and localized strike missions by various defense forces. Concurrently, the "above 30,000 feet" segment, while currently representing a smaller market share, is witnessing exceptionally rapid expansion. This surge is attributed to the ongoing development and deployment of advanced HALE UCAVs capable of persistent surveillance and intelligence gathering over vast areas. In terms of platform type, the fixed-wing UCAV segment is anticipated to maintain its dominant market position, owing to its inherent advantages in speed, range, and payload carriage capabilities. However, the rotary-wing UCAV segment is not to be underestimated; it is currently undergoing substantial technological advancements, including the development of vertical take-off and landing (VTOL) capabilities and enhanced maneuverability, which are significantly increasing its appeal for specialized applications requiring precise hovering and confined area operations.

Key Drivers of Unmanned Combat Aerial Vehicle Market Growth

Several factors fuel the growth of the UCAV market, including technological advancements in autonomous navigation, sensor integration, and AI-powered decision-making systems. Increased defense budgets worldwide, particularly in regions experiencing geopolitical instability, are a major driver. Furthermore, the cost-effectiveness of UCAVs compared to manned aircraft and their suitability for various missions further contribute to the growth. The increasing demand for precision-guided munitions and the desire to reduce casualties in military operations also play a critical role.

Challenges in the Unmanned Combat Aerial Vehicle Market Sector

The Unmanned Combat Aerial Vehicle (UCAV) market, despite its rapid growth and technological advancements, navigates a landscape fraught with significant challenges. Foremost among these are the stringent and evolving regulatory frameworks governing the development, testing, deployment, and operational use of unmanned systems globally. These regulations, often vary by jurisdiction, can create complexities and delays in market entry and widespread adoption. Furthermore, the global supply chain for advanced defense components is susceptible to disruptions, which can impact the timely procurement of critical parts and systems, leading to production delays and cost overruns. The competitive landscape is intensifying, with established defense giants facing increasing pressure from agile and innovative emerging companies, creating a dynamic environment that demands continuous adaptation and differentiation. A substantial hurdle for many players, particularly smaller enterprises, is the immense cost associated with research and development (R&D) for cutting-edge UCAV technologies, including advanced AI, stealth capabilities, and next-generation sensor integration. This high barrier to entry can stifle innovation and limit market participation for those without substantial financial backing.

Emerging Opportunities in Unmanned Combat Aerial Vehicle Market

Emerging opportunities include the expansion of UCAV applications beyond military use into civilian sectors, such as surveillance, search and rescue, and infrastructure monitoring. Integration of advanced technologies like AI, machine learning, and big data analytics offers significant potential. Growth in emerging markets and the increasing demand for cost-effective solutions for border security and counter-terrorism efforts present further opportunities.

Leading Players in the Unmanned Combat Aerial Vehicle Market Market

- Dassault Aviation

- China Aerospace Science and Technology Corporation

- BAYKAR

- Elbit Systems Ltd

- Lockheed Martin Corporation

- General Atomics

- BAE Systems PLC

- Kratos Defense and Security

- Northrop Grumman

- BlueBird Aero Systems Ltd

- Israel Aerospace Industries Ltd

- The Boeing Company

Key Developments in Unmanned Combat Aerial Vehicle Market Industry

- 2024 Q4: General Atomics unveiled its next-generation UCAV platform, featuring significantly enhanced AI-driven decision-making capabilities and advanced sensor fusion for superior situational awareness.

- 2023 Q3: Lockheed Martin Corporation and Elbit Systems Ltd announced a strategic partnership aimed at co-developing a novel UCAV platform designed for multi-domain operations and enhanced survivability.

- 2022 Q2: BAE Systems PLC secured a substantial multi-year contract for the supply of its advanced UCAV systems to a key international ally, highlighting increasing global demand.

- (Further significant market activities and strategic collaborations will be detailed in the complete market research report.)

Strategic Outlook for Unmanned Combat Aerial Vehicle Market Market

The UCAV market is poised for continued growth, driven by technological innovations, increasing defense spending, and the expanding applications of unmanned systems. The future will likely see greater integration of AI, enhanced autonomous capabilities, and the development of more sophisticated UCAV platforms for diverse military and civilian applications. The market will continue to be shaped by strategic alliances, acquisitions, and intense competition among major players, resulting in a dynamic and evolving landscape.

Unmanned Combat Aerial Vehicle Market Segmentation

-

1. Altitude of Operation

- 1.1. Below 30,000 feet

- 1.2. Above 30,000 feet

-

2. Type

- 2.1. Fixed-wing

- 2.2. Rotary-wing

Unmanned Combat Aerial Vehicle Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Israel

- 5.4. South Africa

- 5.5. Rest of Middle East and Africa

Unmanned Combat Aerial Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Fixed-Wing Segment is Projected to Show Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Unmanned Combat Aerial Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Altitude of Operation

- 5.1.1. Below 30,000 feet

- 5.1.2. Above 30,000 feet

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Fixed-wing

- 5.2.2. Rotary-wing

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Altitude of Operation

- 6. North America Unmanned Combat Aerial Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Altitude of Operation

- 6.1.1. Below 30,000 feet

- 6.1.2. Above 30,000 feet

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Fixed-wing

- 6.2.2. Rotary-wing

- 6.1. Market Analysis, Insights and Forecast - by Altitude of Operation

- 7. Europe Unmanned Combat Aerial Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Altitude of Operation

- 7.1.1. Below 30,000 feet

- 7.1.2. Above 30,000 feet

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Fixed-wing

- 7.2.2. Rotary-wing

- 7.1. Market Analysis, Insights and Forecast - by Altitude of Operation

- 8. Asia Pacific Unmanned Combat Aerial Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Altitude of Operation

- 8.1.1. Below 30,000 feet

- 8.1.2. Above 30,000 feet

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Fixed-wing

- 8.2.2. Rotary-wing

- 8.1. Market Analysis, Insights and Forecast - by Altitude of Operation

- 9. Latin America Unmanned Combat Aerial Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Altitude of Operation

- 9.1.1. Below 30,000 feet

- 9.1.2. Above 30,000 feet

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Fixed-wing

- 9.2.2. Rotary-wing

- 9.1. Market Analysis, Insights and Forecast - by Altitude of Operation

- 10. Middle East and Africa Unmanned Combat Aerial Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Altitude of Operation

- 10.1.1. Below 30,000 feet

- 10.1.2. Above 30,000 feet

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Fixed-wing

- 10.2.2. Rotary-wing

- 10.1. Market Analysis, Insights and Forecast - by Altitude of Operation

- 11. North America Unmanned Combat Aerial Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Unmanned Combat Aerial Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 France

- 12.1.3 Germany

- 12.1.4 Russia

- 12.1.5 Rest of Europe

- 13. Asia Pacific Unmanned Combat Aerial Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 India

- 13.1.3 Japan

- 13.1.4 South Korea

- 13.1.5 Rest of Asia Pacific

- 14. Latin America Unmanned Combat Aerial Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Rest of Latin America

- 15. Middle East and Africa Unmanned Combat Aerial Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Saudi Arabia

- 15.1.2 United Arab Emirates

- 15.1.3 Israel

- 15.1.4 South Africa

- 15.1.5 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Dassault Aviation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 China Aerospace Science and Technology Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 BAYKAR

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Elbit Systems Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Lockheed Martin Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 General Atomics

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 BAE Systems PLC

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Kratos Defense and Security

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Northrop Grumman

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 BlueBird Aero Systems Ltd*List Not Exhaustive

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Israel Aerospace Industries Ltd

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 The Boeing Company

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Dassault Aviation

List of Figures

- Figure 1: Global Unmanned Combat Aerial Vehicle Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Unmanned Combat Aerial Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Unmanned Combat Aerial Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Unmanned Combat Aerial Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Unmanned Combat Aerial Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Unmanned Combat Aerial Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Unmanned Combat Aerial Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Unmanned Combat Aerial Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Unmanned Combat Aerial Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Unmanned Combat Aerial Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Unmanned Combat Aerial Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Unmanned Combat Aerial Vehicle Market Revenue (Million), by Altitude of Operation 2024 & 2032

- Figure 13: North America Unmanned Combat Aerial Vehicle Market Revenue Share (%), by Altitude of Operation 2024 & 2032

- Figure 14: North America Unmanned Combat Aerial Vehicle Market Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Unmanned Combat Aerial Vehicle Market Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Unmanned Combat Aerial Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Unmanned Combat Aerial Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Unmanned Combat Aerial Vehicle Market Revenue (Million), by Altitude of Operation 2024 & 2032

- Figure 19: Europe Unmanned Combat Aerial Vehicle Market Revenue Share (%), by Altitude of Operation 2024 & 2032

- Figure 20: Europe Unmanned Combat Aerial Vehicle Market Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe Unmanned Combat Aerial Vehicle Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Unmanned Combat Aerial Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Unmanned Combat Aerial Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Unmanned Combat Aerial Vehicle Market Revenue (Million), by Altitude of Operation 2024 & 2032

- Figure 25: Asia Pacific Unmanned Combat Aerial Vehicle Market Revenue Share (%), by Altitude of Operation 2024 & 2032

- Figure 26: Asia Pacific Unmanned Combat Aerial Vehicle Market Revenue (Million), by Type 2024 & 2032

- Figure 27: Asia Pacific Unmanned Combat Aerial Vehicle Market Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Unmanned Combat Aerial Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Unmanned Combat Aerial Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Unmanned Combat Aerial Vehicle Market Revenue (Million), by Altitude of Operation 2024 & 2032

- Figure 31: Latin America Unmanned Combat Aerial Vehicle Market Revenue Share (%), by Altitude of Operation 2024 & 2032

- Figure 32: Latin America Unmanned Combat Aerial Vehicle Market Revenue (Million), by Type 2024 & 2032

- Figure 33: Latin America Unmanned Combat Aerial Vehicle Market Revenue Share (%), by Type 2024 & 2032

- Figure 34: Latin America Unmanned Combat Aerial Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Unmanned Combat Aerial Vehicle Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Unmanned Combat Aerial Vehicle Market Revenue (Million), by Altitude of Operation 2024 & 2032

- Figure 37: Middle East and Africa Unmanned Combat Aerial Vehicle Market Revenue Share (%), by Altitude of Operation 2024 & 2032

- Figure 38: Middle East and Africa Unmanned Combat Aerial Vehicle Market Revenue (Million), by Type 2024 & 2032

- Figure 39: Middle East and Africa Unmanned Combat Aerial Vehicle Market Revenue Share (%), by Type 2024 & 2032

- Figure 40: Middle East and Africa Unmanned Combat Aerial Vehicle Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Unmanned Combat Aerial Vehicle Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Unmanned Combat Aerial Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Unmanned Combat Aerial Vehicle Market Revenue Million Forecast, by Altitude of Operation 2019 & 2032

- Table 3: Global Unmanned Combat Aerial Vehicle Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Unmanned Combat Aerial Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Unmanned Combat Aerial Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Unmanned Combat Aerial Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Germany Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Russia Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Unmanned Combat Aerial Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: China Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Asia Pacific Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Unmanned Combat Aerial Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Latin America Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Unmanned Combat Aerial Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Saudi Arabia Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: United Arab Emirates Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Israel Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: South Africa Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Middle East and Africa Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Unmanned Combat Aerial Vehicle Market Revenue Million Forecast, by Altitude of Operation 2019 & 2032

- Table 30: Global Unmanned Combat Aerial Vehicle Market Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Global Unmanned Combat Aerial Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United States Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Canada Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Unmanned Combat Aerial Vehicle Market Revenue Million Forecast, by Altitude of Operation 2019 & 2032

- Table 35: Global Unmanned Combat Aerial Vehicle Market Revenue Million Forecast, by Type 2019 & 2032

- Table 36: Global Unmanned Combat Aerial Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: United Kingdom Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: France Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Germany Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Russia Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of Europe Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global Unmanned Combat Aerial Vehicle Market Revenue Million Forecast, by Altitude of Operation 2019 & 2032

- Table 43: Global Unmanned Combat Aerial Vehicle Market Revenue Million Forecast, by Type 2019 & 2032

- Table 44: Global Unmanned Combat Aerial Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: China Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: India Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Japan Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Korea Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Asia Pacific Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Unmanned Combat Aerial Vehicle Market Revenue Million Forecast, by Altitude of Operation 2019 & 2032

- Table 51: Global Unmanned Combat Aerial Vehicle Market Revenue Million Forecast, by Type 2019 & 2032

- Table 52: Global Unmanned Combat Aerial Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Brazil Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Latin America Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Unmanned Combat Aerial Vehicle Market Revenue Million Forecast, by Altitude of Operation 2019 & 2032

- Table 56: Global Unmanned Combat Aerial Vehicle Market Revenue Million Forecast, by Type 2019 & 2032

- Table 57: Global Unmanned Combat Aerial Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Saudi Arabia Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: United Arab Emirates Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Israel Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: South Africa Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of Middle East and Africa Unmanned Combat Aerial Vehicle Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Unmanned Combat Aerial Vehicle Market?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the Unmanned Combat Aerial Vehicle Market?

Key companies in the market include Dassault Aviation, China Aerospace Science and Technology Corporation, BAYKAR, Elbit Systems Ltd, Lockheed Martin Corporation, General Atomics, BAE Systems PLC, Kratos Defense and Security, Northrop Grumman, BlueBird Aero Systems Ltd*List Not Exhaustive, Israel Aerospace Industries Ltd, The Boeing Company.

3. What are the main segments of the Unmanned Combat Aerial Vehicle Market?

The market segments include Altitude of Operation, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Fixed-Wing Segment is Projected to Show Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Unmanned Combat Aerial Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Unmanned Combat Aerial Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Unmanned Combat Aerial Vehicle Market?

To stay informed about further developments, trends, and reports in the Unmanned Combat Aerial Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence