Key Insights

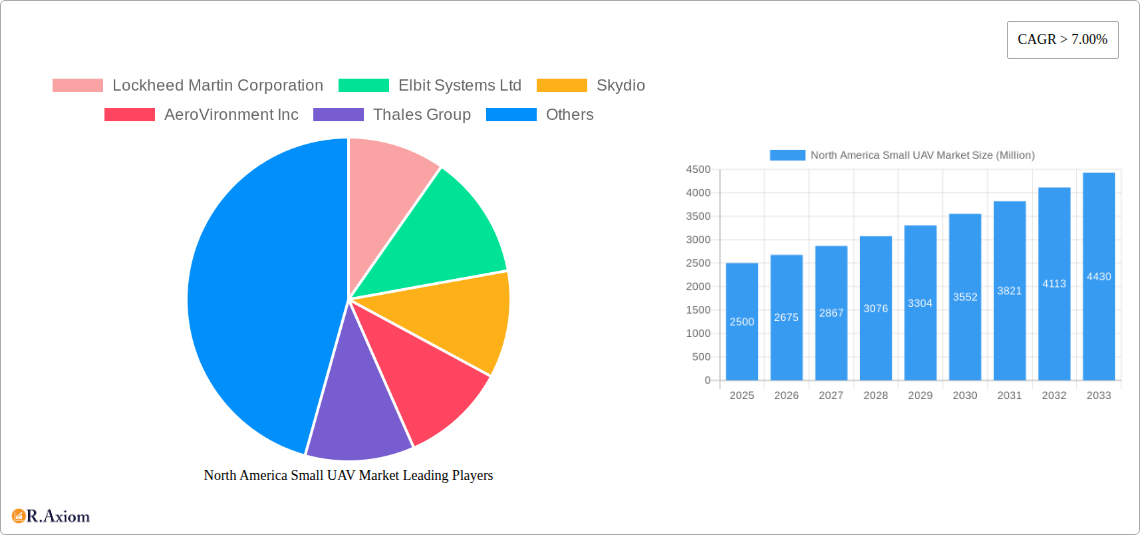

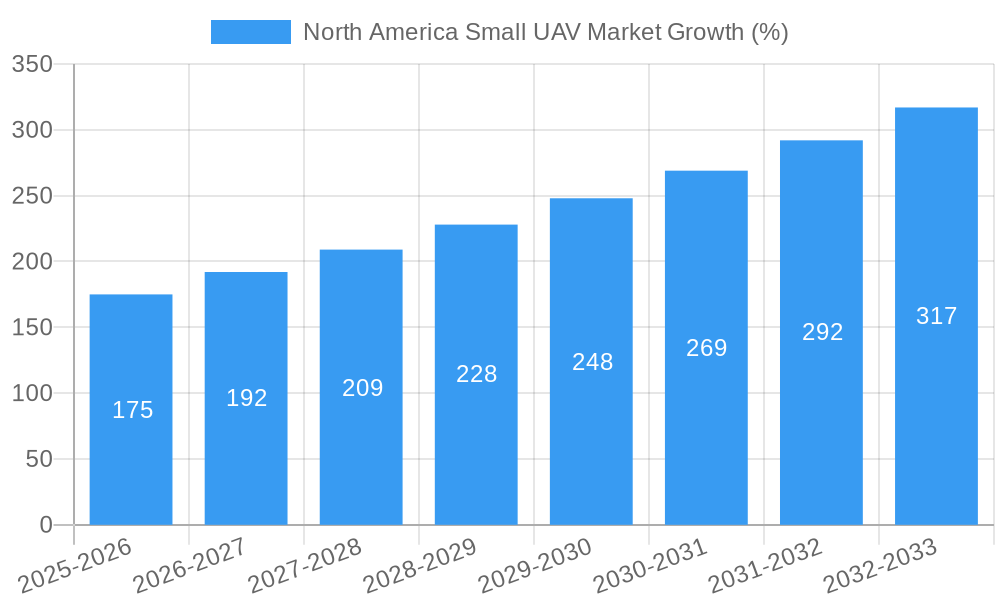

The North American small unmanned aerial vehicle (UAV) market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 7% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of UAVs across diverse sectors, including construction (for site surveying and progress monitoring), agriculture (for precision farming and crop monitoring), and energy (for infrastructure inspection and maintenance), is a significant catalyst. Furthermore, advancements in propulsion technology, particularly the development of more efficient and longer-lasting lithium-ion batteries and the emergence of hybrid and hydrogen cell options, are extending flight times and operational capabilities, thereby increasing market appeal. Regulatory streamlining and increased government investment in drone technology are also contributing factors. The market is segmented by UAV type (fixed-wing and rotary-wing), propulsion technology (hydrogen cell, hybrid, solar, and lithium-ion), and end-user industry (construction, agriculture, energy, entertainment, defense and law enforcement). The United States currently dominates the North American market, driven by a strong technological base and significant defense spending. However, Canada is also experiencing notable growth, particularly in the agricultural and energy sectors. While challenges such as stringent regulations in certain applications and concerns about data privacy and security exist, the overall market outlook remains positive, indicating substantial growth opportunities for established players and new entrants alike.

The competitive landscape is characterized by a mix of large, established defense contractors like Lockheed Martin and BAE Systems, alongside innovative technology companies such as Skydio and DJI. These companies are engaged in intense competition, focusing on technological innovation, cost reduction, and strategic partnerships to gain market share. Future growth will likely be driven by the development of advanced autonomous flight capabilities, improved sensor integration, and the emergence of new applications, such as package delivery and urban air mobility. The market's continued growth will depend on addressing regulatory hurdles, ensuring data security, and fostering public trust in the safe and responsible operation of small UAVs. This will require collaboration among industry stakeholders, government agencies, and research institutions. The integration of AI and machine learning capabilities into UAV systems is also expected to unlock significant value in the years to come, providing enhanced data analytics and autonomous decision-making capabilities.

North America Small UAV Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America small unmanned aerial vehicle (UAV) market, covering the period from 2019 to 2033. It offers actionable insights for stakeholders, including manufacturers, investors, and government agencies, by examining market size, segmentation, growth drivers, challenges, and key players. The report leverages rigorous data analysis and expert insights to provide a clear picture of this dynamic market. The market is segmented by UAV type (fixed-wing, rotary-wing), propulsion technology (hydrogen cell, hybrid, solar, lithium-ion), end-user industry (construction, agriculture, energy, entertainment, defense and law enforcement, other), and country (United States, Canada).

North America Small UAV Market Concentration & Innovation

The North America small UAV market exhibits a moderately concentrated landscape, with several major players holding significant market share. However, the presence of numerous smaller, innovative companies signifies a dynamic competitive environment. Market share data for 2024 reveals that the top five players (Lockheed Martin Corporation, Elbit Systems Ltd, AeroVironment Inc, DJI Technology Co Ltd, and Thales Group) collectively account for approximately xx% of the market. This indicates a degree of consolidation, but also leaves room for growth and diversification. Innovation is driven by advancements in propulsion technology, particularly the emergence of hybrid and hydrogen cell systems seeking to extend flight times and operational capabilities. The regulatory landscape, while evolving, presents both opportunities and challenges. Stricter regulations in certain airspace areas necessitate technological innovations to ensure safe and compliant operations. Substitutes for small UAVs are limited, with alternatives such as manned aircraft or satellite imagery often being less cost-effective or flexible. End-user trends favor increased automation, improved data analytics capabilities, and greater ease of use. Mergers and acquisitions (M&A) activity has been notable, with deal values exceeding xx Million in the last five years. Specific deals include:

- February 2022: Skydio's USD 99.8 Million contract with the US Army.

- May 2022: Teledyne FLIR Defense's USD 14 Million contract with the US Army.

These transactions reflect the strategic importance of the small UAV sector and the consolidation efforts among market players.

North America Small UAV Market Industry Trends & Insights

The North America small UAV market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors. Increasing adoption across various end-user industries, driven by the cost-effectiveness and efficiency of UAVs compared to traditional methods, is a major driver. Technological advancements, including improved battery technology, autonomous flight capabilities, and advanced sensor integration, are enhancing the versatility and applications of small UAVs. Consumer preferences are shifting toward user-friendly systems with robust data analytics capabilities. The market penetration of small UAVs in the agriculture sector, for instance, is projected to increase from xx% in 2024 to xx% by 2033. The competitive dynamics are characterized by both intense rivalry among established players and the emergence of innovative startups. This leads to continuous product improvements, price reductions, and an expanding range of applications. Furthermore, government initiatives promoting the use of UAVs for various purposes, coupled with investment in research and development, are further boosting market growth. The increasing demand for efficient infrastructure monitoring and management is also creating new growth opportunities.

Dominant Markets & Segments in North America Small UAV Market

The United States dominates the North America small UAV market, accounting for the largest share due to its large defense budget, significant investment in technology, and well-established aerospace industry. Key drivers for dominance include:

- Strong government support for defense and security applications.

- Extensive investment in R&D in the aerospace and defense sectors.

- A favorable regulatory environment promoting innovation and adoption.

Within the segments, the rotary-wing UAV type holds a larger market share compared to fixed-wing UAVs, due to its maneuverability and suitability for various applications such as aerial photography and surveillance. Lithium-ion batteries currently dominate the propulsion technology segment, but there’s growing interest in hybrid and hydrogen-cell technologies for extended flight durations. The defense and law enforcement end-user sector is a major driver, but significant growth is also witnessed in the agriculture, construction, and energy sectors. Canada, while smaller than the U.S. market, also shows promising growth due to increased adoption in resource management, infrastructure inspection, and other critical industries.

North America Small UAV Market Product Developments

Recent product developments have focused on enhancing autonomy, payload capacity, flight time, and data analytics capabilities. Miniaturization of components, enabling the creation of smaller and more portable drones, is a significant trend. The market is witnessing a shift towards software-defined UAVs that can be adapted to different applications through software updates. These improvements provide competitive advantages such as increased operational efficiency, cost savings, and expanded applications across diverse industries. The market fit for new products is assessed based on factors like cost-effectiveness, ease of use, and compliance with regulatory standards.

Report Scope & Segmentation Analysis

This report segments the North America small UAV market across several dimensions:

UAV Type: Fixed-wing and rotary-wing UAVs, with growth projections for each based on market size and competitive dynamics.

Propulsion Technology: Hydrogen cell, hybrid, solar, and lithium-ion, analyzing the market share and future outlook of each technology based on efficiency and cost-effectiveness.

End-user Industry: Construction, agriculture, energy, entertainment, defense and law enforcement, and other industries, with individual market size and growth projections based on adoption rates and specific applications.

Country: United States and Canada, focusing on market size, growth drivers, and key differences between the two countries’ markets. Competitive dynamics are analyzed within each segment, identifying key players and their market positions.

Key Drivers of North America Small UAV Market Growth

Several factors contribute to the growth of the North America small UAV market:

- Technological advancements in UAV technology, enabling increased autonomy, longer flight times, and improved data analytics.

- Growing demand from various end-user industries, including construction, agriculture, and energy, seeking cost-effective solutions for inspection, surveillance, and data acquisition.

- Favorable regulatory frameworks in several regions, facilitating wider adoption of small UAVs while ensuring safety and security.

- Increased government spending on defense and security applications, creating substantial demand for military-grade UAVs.

Challenges in the North America Small UAV Market Sector

The North America small UAV market faces several challenges:

- Stringent regulatory requirements and airspace restrictions in certain regions, impacting operational flexibility and cost.

- Concerns about data security and privacy, especially in relation to surveillance applications.

- Supply chain disruptions, affecting the availability and cost of components.

- Intense competition among established and emerging players, leading to price pressures.

Emerging Opportunities in North America Small UAV Market

Several emerging opportunities exist:

- Expanding applications of small UAVs in new markets like logistics and delivery.

- Advancements in autonomous flight and AI-powered data analytics capabilities.

- Growing adoption of Beyond Visual Line of Sight (BVLOS) operations, enabling wider operational ranges.

- Increased demand for drone-as-a-service (DaaS) solutions, offering accessible and cost-effective solutions to various industries.

Leading Players in the North America Small UAV Market Market

- Lockheed Martin Corporation

- Elbit Systems Ltd

- Skydio

- AeroVironment Inc

- Thales Group

- BAE Systems PLC

- Parrot Drone SA

- Israel Aerospace Industries Ltd

- SZ DJI Technology Co Ltd

- Aeronautics Ltd

Key Developments in North America Small UAV Market Industry

- May 2022: Teledyne FLIR Defense secured a USD 14 Million contract to supply Black Hornet 3 drones to the US Army, bolstering the market for nano UAVs.

- February 2022: Skydio received a USD 99.8 Million contract from the US Army for X2D UAVs, signifying strong demand for advanced reconnaissance drones. These key developments highlight the increasing importance of small UAVs in defense and security applications.

Strategic Outlook for North America Small UAV Market Market

The North America small UAV market is poised for continued growth, driven by technological advancements, increasing adoption across various industries, and supportive government policies. Opportunities lie in developing advanced autonomous systems, improving data analytics capabilities, and expanding into new applications. The market will likely witness further consolidation through M&A activity, and the emergence of new players offering innovative solutions will shape the competitive landscape. The focus on improving safety, security, and regulatory compliance will be crucial for long-term growth and market sustainability.

North America Small UAV Market Segmentation

-

1. UAV Type

- 1.1. Fixed-wing

- 1.2. Rotary-wing

-

2. Propulsion Technology

- 2.1. Hydrogen Cell

- 2.2. Hybrid

- 2.3. Solar

- 2.4. Lithium-ion

-

3. End-user Industry

- 3.1. Construction

- 3.2. Agriculture

- 3.3. Energy

- 3.4. Entertainment

- 3.5. Defense and Law Enforcement

- 3.6. Other End-user Industries

North America Small UAV Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Small UAV Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Agriculture Industry to Witness Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Small UAV Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by UAV Type

- 5.1.1. Fixed-wing

- 5.1.2. Rotary-wing

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Technology

- 5.2.1. Hydrogen Cell

- 5.2.2. Hybrid

- 5.2.3. Solar

- 5.2.4. Lithium-ion

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Construction

- 5.3.2. Agriculture

- 5.3.3. Energy

- 5.3.4. Entertainment

- 5.3.5. Defense and Law Enforcement

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by UAV Type

- 6. United States North America Small UAV Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Small UAV Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Small UAV Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Small UAV Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Lockheed Martin Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Elbit Systems Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Skydio

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 AeroVironment Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Thales Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 BAE Systems PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Parrot Drone SA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Israel Aerospace Industries Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 SZ DJI Technology Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Aeronautics Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Lockheed Martin Corporation

List of Figures

- Figure 1: North America Small UAV Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Small UAV Market Share (%) by Company 2024

List of Tables

- Table 1: North America Small UAV Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Small UAV Market Revenue Million Forecast, by UAV Type 2019 & 2032

- Table 3: North America Small UAV Market Revenue Million Forecast, by Propulsion Technology 2019 & 2032

- Table 4: North America Small UAV Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: North America Small UAV Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Small UAV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Small UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Small UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Small UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Small UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Small UAV Market Revenue Million Forecast, by UAV Type 2019 & 2032

- Table 12: North America Small UAV Market Revenue Million Forecast, by Propulsion Technology 2019 & 2032

- Table 13: North America Small UAV Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 14: North America Small UAV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Small UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Small UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Small UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Small UAV Market?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the North America Small UAV Market?

Key companies in the market include Lockheed Martin Corporation, Elbit Systems Ltd, Skydio, AeroVironment Inc, Thales Group, BAE Systems PLC, Parrot Drone SA, Israel Aerospace Industries Ltd, SZ DJI Technology Co Ltd, Aeronautics Ltd.

3. What are the main segments of the North America Small UAV Market?

The market segments include UAV Type, Propulsion Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Agriculture Industry to Witness Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In May 2022, Teledyne FLIR Defense signed a contract worth 14 million to deliver Black Hornet 3 drones to the US Army. The advanced nano UAVs augment squad and small unit surveillance and reconnaissance capabilities as part of the Army's Soldier Borne Sensor program.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Small UAV Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Small UAV Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Small UAV Market?

To stay informed about further developments, trends, and reports in the North America Small UAV Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence