Key Insights

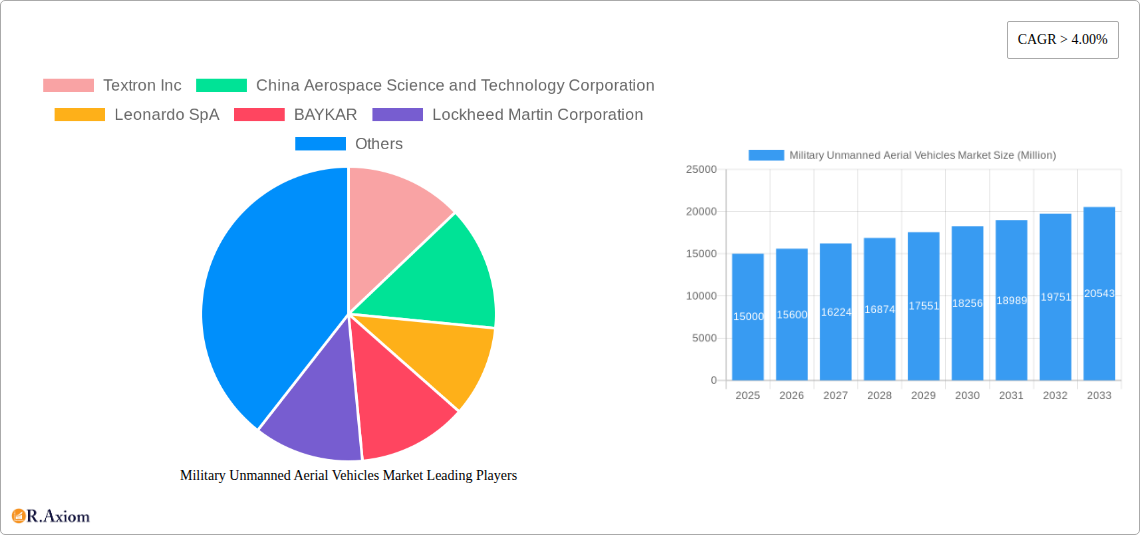

The Military Unmanned Aerial Vehicles (UAV) market is experiencing robust growth, driven by escalating geopolitical tensions, increasing demand for surveillance and reconnaissance capabilities, and the ongoing technological advancements in drone technology. The market's Compound Annual Growth Rate (CAGR) exceeding 4.00% indicates a consistent upward trajectory, projected to continue throughout the forecast period (2025-2033). Key market drivers include the need for cost-effective intelligence gathering, precision strike capabilities, and reduced risk to human pilots in combat situations. The increasing adoption of AI and machine learning for autonomous operation further fuels market expansion. Market segmentation reveals a significant share held by fixed-wing UAVs due to their longer endurance and greater payload capacity, while the VTOL (Vertical Take-Off and Landing) segment is experiencing rapid growth due to its operational flexibility. Applications are broadly categorized into combat and non-combat roles, with combat applications such as armed reconnaissance and targeted strikes currently dominating the market share, although non-combat applications like surveillance and border patrol are also experiencing substantial growth. Geographic analysis shows a strong market presence in North America and Europe, driven by significant defense budgets and technological advancements in these regions, while the Asia-Pacific region is projected to exhibit considerable growth potential due to increasing defense expenditure and modernization programs. The competitive landscape is marked by a mix of established defense contractors and innovative technology companies, resulting in fierce competition and continuous innovation in the market. The market will likely see continued consolidation among players, with larger companies acquiring smaller, more specialized firms to expand their capabilities and market share.

The restraints on market growth primarily include regulatory hurdles concerning the operation of military UAVs, concerns regarding cybersecurity vulnerabilities, and ethical considerations surrounding autonomous weapons systems. However, these challenges are likely to be addressed through technological innovations and the development of stronger regulatory frameworks. The continued miniaturization of UAVs, the development of swarm technologies, and enhanced integration with other military systems are expected to further drive market growth in the coming years. The focus on enhancing the intelligence, surveillance, and reconnaissance (ISR) capabilities of military UAVs is also a key growth catalyst. Looking ahead, the market anticipates a shift towards more autonomous, AI-powered systems with improved operational range and payload capacity. This signifies a future where UAVs will play an increasingly crucial role in modern warfare and military operations.

Military Unmanned Aerial Vehicles (UAV) Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Military Unmanned Aerial Vehicles (UAV) market, offering crucial insights for stakeholders across the defense and technology sectors. Covering the period from 2019 to 2033, with 2025 as the base and estimated year, this report meticulously examines market dynamics, technological advancements, and competitive landscapes to forecast future trends. The report utilizes a robust methodology incorporating historical data (2019-2024), current estimations (2025), and projections (2025-2033) to paint a comprehensive picture of this rapidly evolving market. Key players like Textron Inc, China Aerospace Science and Technology Corporation, Leonardo SpA, BAYKAR, Lockheed Martin Corporation, Elbit Systems Ltd, Israel Aerospace Industries (IAI), Safran SA, General Atomics, AeroVironment Inc, Aeronautics Ltd, Saab A, Northrop Grumman Corporation, and The Boeing Company are extensively analyzed. The report segments the market by type (Fixed-wing, VTOL) and application (Combat, Non-Combat), providing detailed analysis of each segment's growth trajectory and market size in Millions.

Military Unmanned Aerial Vehicles Market Concentration & Innovation

The Military UAV market exhibits a moderately concentrated landscape, with a few dominant players holding significant market share. However, the entry of smaller, agile companies with specialized technologies is disrupting the status quo. Innovation is a key driver, fueled by advancements in sensor technology, artificial intelligence (AI), and autonomous navigation systems. Regulatory frameworks, particularly concerning airspace management and data security, significantly impact market growth. Product substitutes, such as manned aircraft for certain missions, create competitive pressure. End-user trends, including a growing demand for increased operational efficiency and reduced reliance on manned platforms, are driving market expansion. M&A activity is relatively high, with significant deals valued at xx Million impacting market consolidation and technological advancement. For instance, in 2022, a merger between Company A and Company B valued at xx Million led to the integration of their respective UAV technologies. Market share distribution among the top five players is estimated at 60% in 2025, indicating a moderately concentrated market.

Military Unmanned Aerial Vehicles Market Industry Trends & Insights

The Military UAV market is experiencing robust growth, driven by escalating defense budgets globally and the increasing demand for surveillance, reconnaissance, and precision strike capabilities. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected at xx%, fueled by technological innovations, including the integration of AI and machine learning for enhanced autonomy and decision-making. This is complemented by an increasing preference for unmanned systems, reflecting reduced operational risk and cost-effectiveness compared to manned aircraft. Market penetration is expected to reach xx% by 2033, primarily driven by the adoption of UAVs in diverse military operations. However, challenges such as cybersecurity threats and regulatory hurdles necessitate strategic planning for successful market penetration. The competitive landscape is characterized by intense R&D activity and strategic partnerships, reflecting the ongoing drive for technological differentiation and market dominance.

Dominant Markets & Segments in Military Unmanned Aerial Vehicles Market

The North American region currently holds the largest market share in the Military UAV market, driven by robust defense spending and technological advancements. However, the Asia-Pacific region is projected to experience the fastest growth rate during the forecast period, owing to increasing military modernization efforts.

Key Drivers for North America:

- High defense budget allocation

- Advanced technological infrastructure

- Presence of major UAV manufacturers

Key Drivers for Asia-Pacific:

- Rising geopolitical tensions

- Increasing military modernization programs

- Government initiatives promoting domestic UAV development

Segment Dominance:

- By Type: Fixed-wing UAVs currently dominate the market due to their superior range and payload capacity, although VTOL UAVs are witnessing significant growth due to their operational flexibility.

- By Application: The Combat application segment is the largest, driven by the demand for surveillance, reconnaissance, and precision strike capabilities. The Non-Combat segment is also expanding rapidly, with growing applications in border patrol, disaster relief, and search and rescue operations.

Military Unmanned Aerial Vehicles Market Product Developments

Recent product developments focus on enhancing UAV autonomy, payload capacity, and operational range. Integration of advanced sensor systems, AI-powered image recognition, and swarm technologies are key features driving market competitiveness. Miniaturization efforts are leading to the development of smaller, more agile UAVs for diverse operational environments, while improvements in endurance are extending mission capabilities. This combination of technological advancements ensures improved market fit and competitive advantages for manufacturers.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Military UAV market across various segments.

By Type:

- Fixed-wing: This segment accounts for a significant market share, driven by its long-range capabilities and high payload capacity. The market is expected to witness steady growth during the forecast period, driven by technological advancements in this segment.

- VTOL: This segment is experiencing rapid growth owing to its operational flexibility and suitability for diverse missions. The market size is anticipated to increase significantly by 2033, as technological advancements enhance efficiency and reliability.

By Application:

- Combat: This segment is currently the largest, driven by the increasing demand for reconnaissance, surveillance, and precision strike capabilities. The market size is projected to grow steadily during the forecast period.

- Non-Combat: This segment is witnessing rapid growth, driven by increasing applications in border patrol, disaster relief, and search and rescue operations. Market growth is expected to accelerate during the forecast period.

Key Drivers of Military Unmanned Aerial Vehicles Market Growth

Several factors fuel the growth of the Military UAV market. Firstly, increasing defense budgets worldwide provide financial impetus for UAV procurement. Secondly, technological advancements, such as AI-powered autonomous flight and improved sensor integration, enhance operational capabilities. Thirdly, the demand for cost-effective and efficient surveillance and reconnaissance solutions drives adoption. Furthermore, the successful application of UAVs in various military operations has strengthened confidence in their efficacy.

Challenges in the Military Unmanned Aerial Vehicles Market Sector

Several challenges impede the growth of the Military UAV market. Stringent regulatory frameworks governing UAV operation and data security pose significant hurdles. Supply chain disruptions and the dependence on specialized components can impact production and delivery timelines. Intense competition among established players and new entrants creates pricing pressure. These challenges, if not addressed effectively, could negatively impact market growth by xx% by 2030.

Emerging Opportunities in Military Unmanned Aerial Vehicles Market

The Military UAV market presents substantial opportunities. The emergence of new applications, such as swarm technology and collaborative operations between manned and unmanned systems, opens new avenues for growth. Advancements in AI, machine learning, and sensor technology are creating more capable and versatile platforms. Expanding into new geographic markets and fostering strategic alliances can unlock further market potential.

Leading Players in the Military Unmanned Aerial Vehicles Market Market

- Textron Inc

- China Aerospace Science and Technology Corporation

- Leonardo SpA

- BAYKAR

- Lockheed Martin Corporation

- Elbit Systems Ltd

- Israel Aerospace Industries (IAI)

- Safran SA

- General Atomics

- AeroVironment Inc

- Aeronautics Ltd

- Saab A

- Northrop Grumman Corporation

- The Boeing Company

Key Developments in Military Unmanned Aerial Vehicles Market Industry

- Jan 2023: Company X launches a new long-range UAV with enhanced payload capacity.

- Mar 2023: Company Y announces a strategic partnership to develop AI-powered autonomous navigation systems.

- June 2023: Company Z secures a large contract for UAV deployment in a major military operation.

Strategic Outlook for Military Unmanned Aerial Vehicles Market Market

The Military UAV market is poised for continued expansion, driven by technological advancements and increased demand for sophisticated surveillance and strike capabilities. Future growth will hinge on the integration of AI, autonomous flight technologies, and advanced sensor systems. Strategic partnerships and collaborations will play a crucial role in unlocking new market opportunities and accelerating innovation. Companies that invest in R&D and adapt to evolving regulatory landscapes are best positioned to capture significant market share.

Military Unmanned Aerial Vehicles Market Segmentation

-

1. Type

- 1.1. Fixed-wing

- 1.2. VTOL

-

2. Application

- 2.1. Combat

- 2.2. Non-combat

Military Unmanned Aerial Vehicles Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Turkey

- 5.4. Rest of Middle East and Africa

Military Unmanned Aerial Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growing Proliferation of UAVs for Various Military Applications

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Military Unmanned Aerial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed-wing

- 5.1.2. VTOL

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Combat

- 5.2.2. Non-combat

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Military Unmanned Aerial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fixed-wing

- 6.1.2. VTOL

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Combat

- 6.2.2. Non-combat

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Military Unmanned Aerial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fixed-wing

- 7.1.2. VTOL

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Combat

- 7.2.2. Non-combat

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Military Unmanned Aerial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fixed-wing

- 8.1.2. VTOL

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Combat

- 8.2.2. Non-combat

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Military Unmanned Aerial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Fixed-wing

- 9.1.2. VTOL

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Combat

- 9.2.2. Non-combat

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Military Unmanned Aerial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Fixed-wing

- 10.1.2. VTOL

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Combat

- 10.2.2. Non-combat

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Military Unmanned Aerial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Military Unmanned Aerial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Rest of Europe

- 13. Asia Pacific Military Unmanned Aerial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Rest of Asia Pacific

- 14. Latin America Military Unmanned Aerial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Rest of Latin America

- 15. Middle East and Africa Military Unmanned Aerial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 Turkey

- 15.1.4 Israel

- 15.1.5 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Textron Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 China Aerospace Science and Technology Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Leonardo SpA

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 BAYKAR

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Lockheed Martin Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Elbit Systems Ltd

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Israel Aerospace Industries (IAI)

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Safran SA

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 General Atomics

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 AeroVironment Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Aeronautics Ltd

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Saab A

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Northrop Grumman Corporation

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 The Boeing Company

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.1 Textron Inc

List of Figures

- Figure 1: Global Military Unmanned Aerial Vehicles Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Military Unmanned Aerial Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Military Unmanned Aerial Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Military Unmanned Aerial Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Military Unmanned Aerial Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Military Unmanned Aerial Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Military Unmanned Aerial Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Military Unmanned Aerial Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Military Unmanned Aerial Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Military Unmanned Aerial Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Military Unmanned Aerial Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Military Unmanned Aerial Vehicles Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Military Unmanned Aerial Vehicles Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Military Unmanned Aerial Vehicles Market Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Military Unmanned Aerial Vehicles Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Military Unmanned Aerial Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Military Unmanned Aerial Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Military Unmanned Aerial Vehicles Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Military Unmanned Aerial Vehicles Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Military Unmanned Aerial Vehicles Market Revenue (Million), by Application 2024 & 2032

- Figure 21: Europe Military Unmanned Aerial Vehicles Market Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe Military Unmanned Aerial Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Military Unmanned Aerial Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Military Unmanned Aerial Vehicles Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Asia Pacific Military Unmanned Aerial Vehicles Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Asia Pacific Military Unmanned Aerial Vehicles Market Revenue (Million), by Application 2024 & 2032

- Figure 27: Asia Pacific Military Unmanned Aerial Vehicles Market Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Military Unmanned Aerial Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Military Unmanned Aerial Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Military Unmanned Aerial Vehicles Market Revenue (Million), by Type 2024 & 2032

- Figure 31: Latin America Military Unmanned Aerial Vehicles Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Latin America Military Unmanned Aerial Vehicles Market Revenue (Million), by Application 2024 & 2032

- Figure 33: Latin America Military Unmanned Aerial Vehicles Market Revenue Share (%), by Application 2024 & 2032

- Figure 34: Latin America Military Unmanned Aerial Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Military Unmanned Aerial Vehicles Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Military Unmanned Aerial Vehicles Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Middle East and Africa Military Unmanned Aerial Vehicles Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Middle East and Africa Military Unmanned Aerial Vehicles Market Revenue (Million), by Application 2024 & 2032

- Figure 39: Middle East and Africa Military Unmanned Aerial Vehicles Market Revenue Share (%), by Application 2024 & 2032

- Figure 40: Middle East and Africa Military Unmanned Aerial Vehicles Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Military Unmanned Aerial Vehicles Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Military Unmanned Aerial Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Military Unmanned Aerial Vehicles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Military Unmanned Aerial Vehicles Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Military Unmanned Aerial Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Military Unmanned Aerial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Military Unmanned Aerial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Military Unmanned Aerial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Japan Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: South Korea Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Asia Pacific Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Military Unmanned Aerial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Latin America Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Military Unmanned Aerial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: United Arab Emirates Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Saudi Arabia Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Turkey Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Israel Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of Middle East and Africa Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Military Unmanned Aerial Vehicles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 29: Global Military Unmanned Aerial Vehicles Market Revenue Million Forecast, by Application 2019 & 2032

- Table 30: Global Military Unmanned Aerial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: United States Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Canada Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Military Unmanned Aerial Vehicles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 34: Global Military Unmanned Aerial Vehicles Market Revenue Million Forecast, by Application 2019 & 2032

- Table 35: Global Military Unmanned Aerial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United Kingdom Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: France Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Germany Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Russia Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Europe Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Military Unmanned Aerial Vehicles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 42: Global Military Unmanned Aerial Vehicles Market Revenue Million Forecast, by Application 2019 & 2032

- Table 43: Global Military Unmanned Aerial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: China Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Japan Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: India Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Korea Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Military Unmanned Aerial Vehicles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 50: Global Military Unmanned Aerial Vehicles Market Revenue Million Forecast, by Application 2019 & 2032

- Table 51: Global Military Unmanned Aerial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: Brazil Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Latin America Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Global Military Unmanned Aerial Vehicles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 55: Global Military Unmanned Aerial Vehicles Market Revenue Million Forecast, by Application 2019 & 2032

- Table 56: Global Military Unmanned Aerial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 57: United Arab Emirates Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Saudi Arabia Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Turkey Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Middle East and Africa Military Unmanned Aerial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Military Unmanned Aerial Vehicles Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Military Unmanned Aerial Vehicles Market?

Key companies in the market include Textron Inc, China Aerospace Science and Technology Corporation, Leonardo SpA, BAYKAR, Lockheed Martin Corporation, Elbit Systems Ltd, Israel Aerospace Industries (IAI), Safran SA, General Atomics, AeroVironment Inc, Aeronautics Ltd, Saab A, Northrop Grumman Corporation, The Boeing Company.

3. What are the main segments of the Military Unmanned Aerial Vehicles Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growing Proliferation of UAVs for Various Military Applications.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Military Unmanned Aerial Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Military Unmanned Aerial Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Military Unmanned Aerial Vehicles Market?

To stay informed about further developments, trends, and reports in the Military Unmanned Aerial Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence