Key Insights

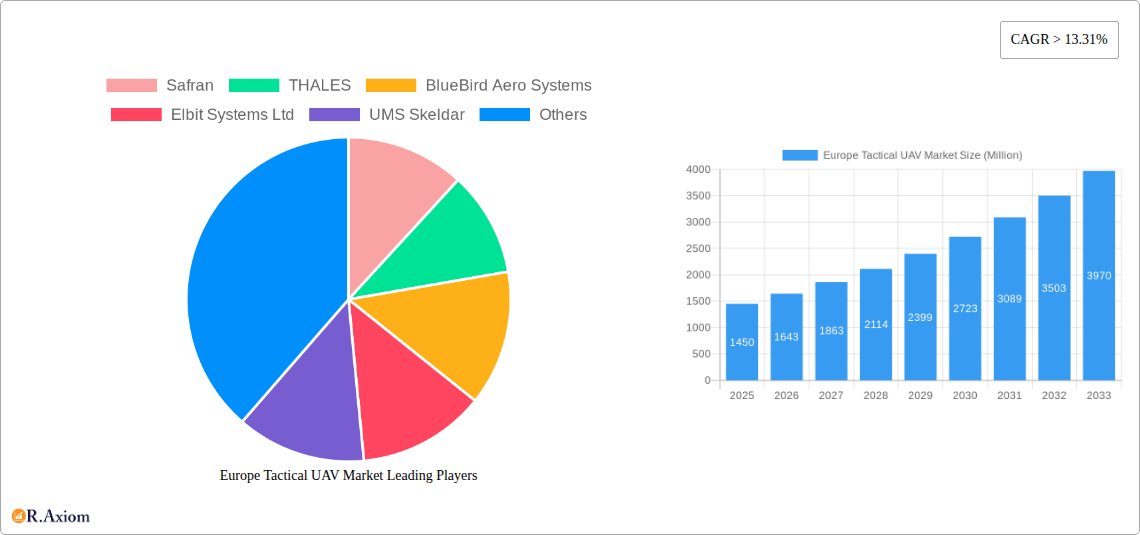

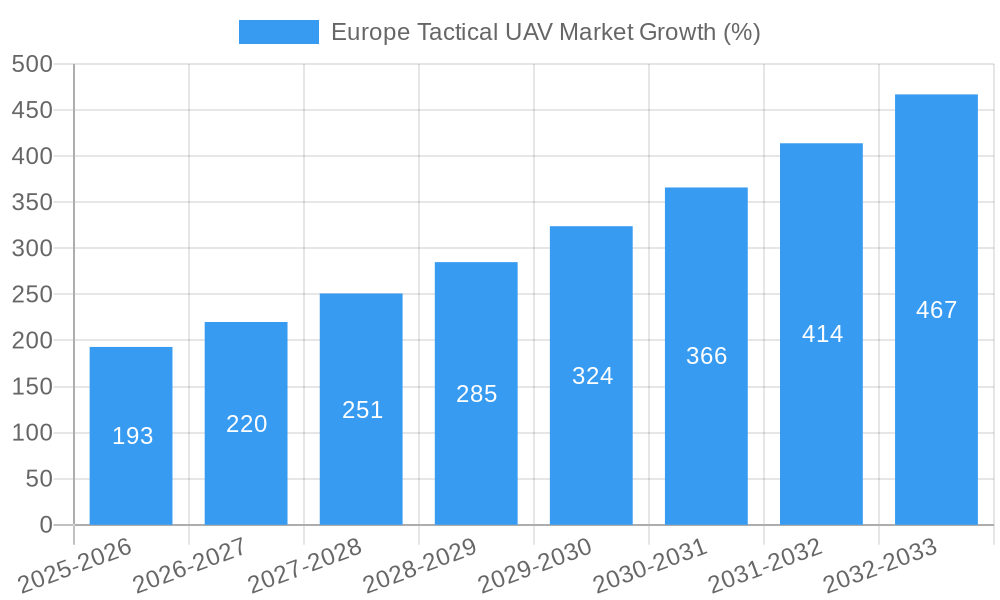

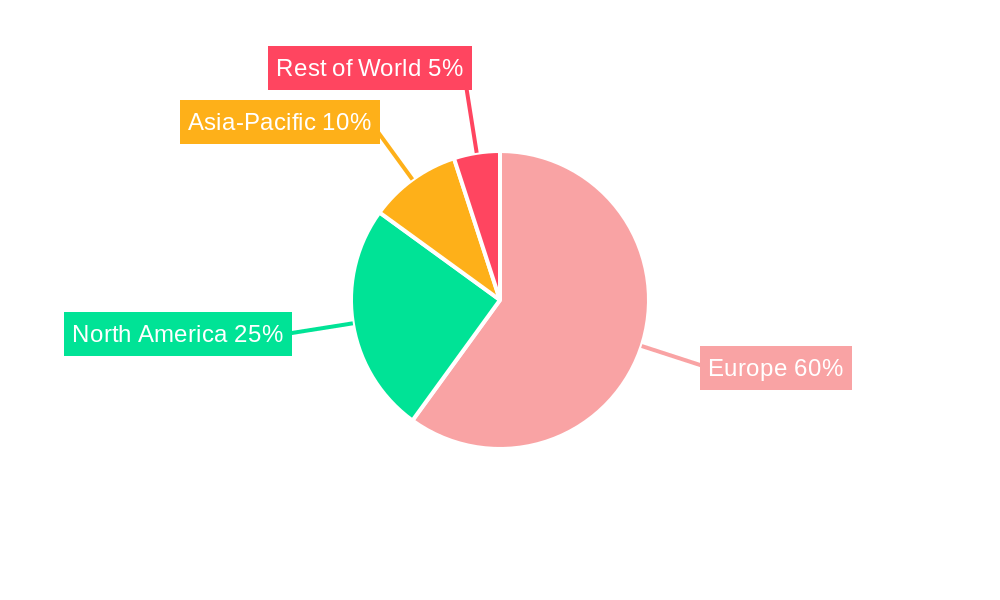

The European Tactical Unmanned Aerial Vehicle (UAV) market is experiencing robust growth, projected to reach a substantial size driven by increasing defense budgets across the region and the escalating demand for advanced surveillance and reconnaissance capabilities. The market's Compound Annual Growth Rate (CAGR) exceeding 13.31% from 2019 to 2024 indicates a significant upward trajectory. This growth is fueled by several key factors. Firstly, the ongoing geopolitical instability and the need for enhanced border security are prompting nations to invest heavily in tactical UAV technology. Secondly, advancements in UAV technology, such as improved sensor payloads, longer endurance, and greater autonomy, are expanding their operational capabilities and making them more attractive to both military and law enforcement agencies. Furthermore, the increasing integration of artificial intelligence and machine learning into UAV systems is further bolstering their effectiveness and driving market expansion. The market is segmented by application, with military and law enforcement sectors being the primary consumers. Leading players like Safran, Thales, and Elbit Systems are actively competing in this dynamic landscape, driving innovation and technological advancements. The competitive landscape is marked by both established defense contractors and emerging tech companies, leading to a diverse range of offerings. The presence of major players across Europe, notably in Germany, France, the UK and Italy, ensures a robust ecosystem of manufacturing, research, and development.

While the market presents significant opportunities, there are challenges to consider. These include the regulatory hurdles surrounding UAV operations, including airspace management and data privacy concerns. Furthermore, the high initial investment costs associated with purchasing and maintaining these sophisticated systems could limit widespread adoption by smaller agencies or nations with limited budgets. However, the long-term cost-effectiveness of UAVs compared to traditional manned aircraft, coupled with their versatile applications, is expected to mitigate these challenges. The forecast period (2025-2033) promises further growth, fuelled by continuing technological advancements and the ongoing need for cost-effective, adaptable surveillance and reconnaissance solutions. Europe's strategic location and active participation in various global conflicts contribute to the region’s high demand for these systems.

Europe Tactical UAV Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Tactical UAV market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033. The market is segmented by application: Military, Law Enforcement, and Other Applications. Key players analyzed include Safran, THALES, BlueBird Aero Systems, Elbit Systems Ltd, UMS Skeldar, AeroVironment Inc, Israel Aerospace Industries Ltd, BAYKAR TECH, General Atomic, Leonardo S p A, Northrop Grumman Corporation, and The Boeing Company. The report projects a market value of xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Europe Tactical UAV Market Market Concentration & Innovation

The European Tactical UAV market demonstrates a moderately concentrated landscape, with a few dominant players holding significant market share. Safran, Thales, and Elbit Systems Ltd. currently command a substantial portion of the market, driven by their established technological expertise, extensive product portfolios, and strong government relationships. However, the market exhibits a high degree of innovation, fueled by continuous advancements in sensor technology, autonomy, and artificial intelligence (AI). Regulatory frameworks, particularly concerning data privacy and airspace management, are evolving, impacting market dynamics. Product substitutes, such as advanced surveillance systems and manned aircraft, pose some level of competition, but the unique capabilities of tactical UAVs (enhanced situational awareness, reduced risk to personnel) continue to drive demand. End-user trends indicate a growing preference for smaller, more versatile UAVs adaptable to diverse mission profiles. Mergers and acquisitions (M&A) activity has been moderate, with deal values averaging xx Million in recent years, primarily focusing on enhancing technological capabilities and expanding market reach.

- Market Share: Safran (xx%), Thales (xx%), Elbit Systems Ltd (xx%), Others (xx%)

- M&A Deal Value (2019-2024): Approximately xx Million

Europe Tactical UAV Market Industry Trends & Insights

The European Tactical UAV market is experiencing robust growth, driven by several key factors. Increasing defense budgets across European nations, coupled with the need for enhanced surveillance and intelligence capabilities, are primary catalysts. Technological advancements, such as miniaturization, improved sensor technologies, and autonomous flight capabilities, are significantly enhancing the operational effectiveness of UAVs, broadening their applicability. Growing adoption of AI and machine learning is further driving market expansion, enabling improved target identification, data analysis, and autonomous decision-making. The market is also witnessing a shift towards modular and adaptable UAV platforms, enabling customization for diverse missions. However, the market faces challenges like cybersecurity threats and the need for robust regulatory frameworks to ensure safe and responsible UAV operation. The market penetration rate for tactical UAVs among European defense forces is expected to reach xx% by 2033, with a CAGR of xx% during the forecast period.

Dominant Markets & Segments in Europe Tactical UAV Market

The Military segment dominates the European Tactical UAV market, accounting for xx% of total revenue in 2024. This is largely driven by the increasing demand for improved surveillance, reconnaissance, and strike capabilities by defense forces across the region. Key drivers include:

- Increased Defense Spending: Significant investments in defense modernization initiatives across European countries.

- Geopolitical Instability: Growing concerns about regional conflicts and terrorism are fueling the demand for advanced surveillance systems.

- Technological Advancements: Improved UAV technologies offering enhanced performance and operational capabilities.

France and the UK are leading national markets within Europe, benefiting from strong domestic industries, significant defense budgets, and favorable regulatory environments. Other regions, such as Eastern Europe, are experiencing rapid growth, driven by modernization efforts and increasing defense investments.

Europe Tactical UAV Market Product Developments

Recent product innovations focus on enhancing payload capacity, flight endurance, and autonomy. Miniaturization and improved sensor technologies are critical aspects. Integration of AI and machine learning algorithms is providing enhanced situational awareness and autonomous capabilities. Market fit is driven by the need for cost-effective, adaptable solutions to meet diverse operational requirements. These developments are leading to increased competition and driving innovation.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the European Tactical UAV market, segmented by application:

- Military: This segment is the largest, driven by significant defense investments and the growing demand for enhanced surveillance and reconnaissance capabilities. The market size is projected to reach xx Million by 2033.

- Law Enforcement: This segment is experiencing steady growth, driven by the need for improved situational awareness and crime prevention tools. The market size is projected to reach xx Million by 2033.

- Other Applications: This segment encompasses various applications like agriculture, infrastructure inspection, and environmental monitoring. Growth is expected but at a slower pace than the military and law enforcement segments.

Key Drivers of Europe Tactical UAV Market Growth

Several key factors drive the growth of the European Tactical UAV market: the increasing demand for enhanced surveillance and reconnaissance capabilities; advancements in UAV technology leading to improved performance and capabilities; rising defense budgets across Europe; and government initiatives supporting the development and adoption of UAVs. The growing adoption of AI and machine learning further enhances operational efficiency and market expansion.

Challenges in the Europe Tactical UAV Market Sector

Challenges include stringent regulatory frameworks impacting UAV operations; supply chain disruptions, particularly concerning critical components; and intense competition among established and emerging players. These factors can impact market growth and profitability, leading to delayed projects and increased costs.

Emerging Opportunities in Europe Tactical UAV Market

Emerging opportunities include the integration of advanced sensors and payloads, the development of autonomous swarming technologies, and the expansion into new applications, such as search and rescue and disaster relief. The increasing adoption of cloud-based data analytics also presents a significant opportunity for market players.

Leading Players in the Europe Tactical UAV Market Market

- Safran

- THALES

- BlueBird Aero Systems

- Elbit Systems Ltd

- UMS Skeldar

- AeroVironment Inc

- Israel Aerospace Industries Ltd

- BAYKAR TECH

- General Atomic

- Leonardo S p A

- Northrop Grumman Corporation

- The Boeing Company

Key Developments in Europe Tactical UAV Market Industry

- June 2023: Greece signed a four-unit deal with Safran SA for the Patroller tactical UAV, replacing its Sperwer UAVs. Deliveries begin late 2024.

- December 2022: Elbit Systems Ltd. signed a five-year contract worth approximately USD 410 Million to supply Romania with up to seven "Watchkeeper X" UAS.

Strategic Outlook for Europe Tactical UAV Market Market

The European Tactical UAV market is poised for continued growth, driven by technological advancements, increased defense spending, and the expansion into new applications. The market presents significant opportunities for both established and emerging players. Strategic partnerships, technological innovation, and effective regulatory compliance will be key success factors for navigating the evolving market landscape and capitalizing on future growth prospects.

Europe Tactical UAV Market Segmentation

-

1. Application

- 1.1. Military

- 1.2. Law Enforcement

- 1.3. Other Applications

Europe Tactical UAV Market Segmentation By Geography

- 1. United Kingdom

- 2. France

- 3. Germany

- 4. Italy

- 5. Russia

- 6. Rest of Europe

Europe Tactical UAV Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 13.31% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Military Segment Will Showcase Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Tactical UAV Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Military

- 5.1.2. Law Enforcement

- 5.1.3. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.2.2. France

- 5.2.3. Germany

- 5.2.4. Italy

- 5.2.5. Russia

- 5.2.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. United Kingdom Europe Tactical UAV Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Military

- 6.1.2. Law Enforcement

- 6.1.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. France Europe Tactical UAV Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Military

- 7.1.2. Law Enforcement

- 7.1.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Germany Europe Tactical UAV Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Military

- 8.1.2. Law Enforcement

- 8.1.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Italy Europe Tactical UAV Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Military

- 9.1.2. Law Enforcement

- 9.1.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Russia Europe Tactical UAV Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Military

- 10.1.2. Law Enforcement

- 10.1.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Rest of Europe Europe Tactical UAV Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Military

- 11.1.2. Law Enforcement

- 11.1.3. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Germany Europe Tactical UAV Market Analysis, Insights and Forecast, 2019-2031

- 13. France Europe Tactical UAV Market Analysis, Insights and Forecast, 2019-2031

- 14. Italy Europe Tactical UAV Market Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Europe Tactical UAV Market Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Europe Tactical UAV Market Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Europe Tactical UAV Market Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Europe Tactical UAV Market Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Safran

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 THALES

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 BlueBird Aero Systems

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Elbit Systems Ltd

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 UMS Skeldar

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 AeroVironment Inc

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Israel Aerospace Industries Ltd

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 BAYKAR TECH

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 General Atomic

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Leonardo S p A

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.11 Northrop Grumman Corporation

- 19.2.11.1. Overview

- 19.2.11.2. Products

- 19.2.11.3. SWOT Analysis

- 19.2.11.4. Recent Developments

- 19.2.11.5. Financials (Based on Availability)

- 19.2.12 The Boeing Company

- 19.2.12.1. Overview

- 19.2.12.2. Products

- 19.2.12.3. SWOT Analysis

- 19.2.12.4. Recent Developments

- 19.2.12.5. Financials (Based on Availability)

- 19.2.1 Safran

List of Figures

- Figure 1: Europe Tactical UAV Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Tactical UAV Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Tactical UAV Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Tactical UAV Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Europe Tactical UAV Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Tactical UAV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Tactical UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Tactical UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Tactical UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Tactical UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Tactical UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Tactical UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Tactical UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Tactical UAV Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: Europe Tactical UAV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Europe Tactical UAV Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Europe Tactical UAV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Tactical UAV Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Europe Tactical UAV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Tactical UAV Market Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Europe Tactical UAV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Europe Tactical UAV Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Europe Tactical UAV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Tactical UAV Market Revenue Million Forecast, by Application 2019 & 2032

- Table 23: Europe Tactical UAV Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Tactical UAV Market?

The projected CAGR is approximately > 13.31%.

2. Which companies are prominent players in the Europe Tactical UAV Market?

Key companies in the market include Safran, THALES, BlueBird Aero Systems, Elbit Systems Ltd, UMS Skeldar, AeroVironment Inc, Israel Aerospace Industries Ltd, BAYKAR TECH, General Atomic, Leonardo S p A, Northrop Grumman Corporation, The Boeing Company.

3. What are the main segments of the Europe Tactical UAV Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.45 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Military Segment Will Showcase Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2023: Greece signed a four-unit deal with Safran SA via the NATO Support and Procurement Agency for the Patroller tactical unmanned air vehicle (UAV). The Patroller UAV will replace the Greek army’s current Sperwer UAVs. Deliveries of the UAVs will start in late 2024. Greece has also ordered three ground stations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Tactical UAV Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Tactical UAV Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Tactical UAV Market?

To stay informed about further developments, trends, and reports in the Europe Tactical UAV Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence