Key Insights

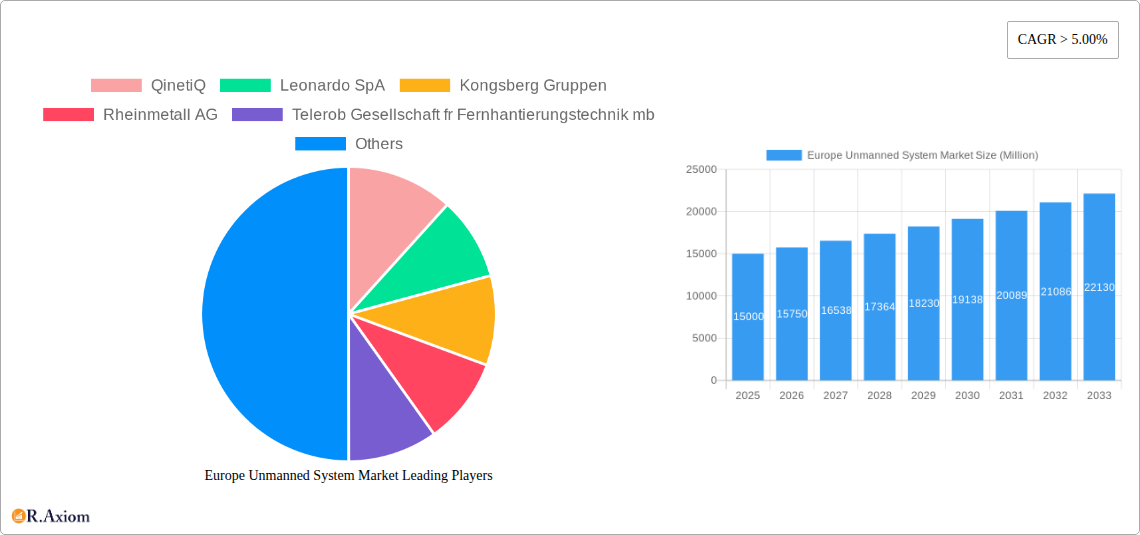

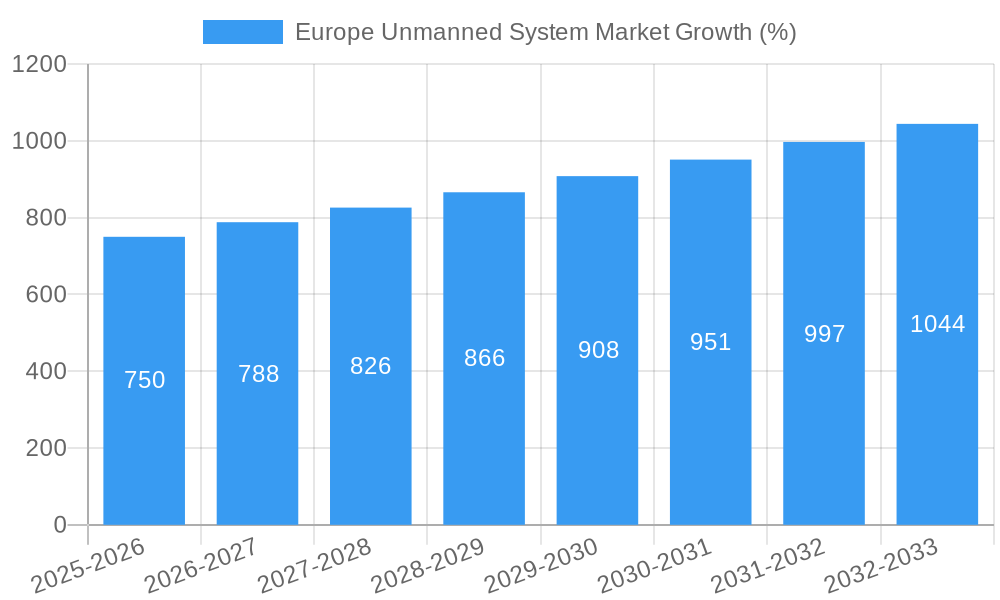

The European unmanned systems market is experiencing robust growth, driven by increasing defense budgets, advancements in autonomous technology, and the rising adoption of UAVs (Unmanned Aerial Vehicles), UGV (Unmanned Ground Vehicles), and UUVs (Unmanned Underwater Vehicles) across various sectors. The market, currently valued at approximately €X billion in 2025 (estimated based on a provided CAGR > 5% and a missing market size XX, assuming a reasonable starting point considering similar markets), is projected to maintain a compound annual growth rate (CAGR) exceeding 5% through 2033. This growth is fueled by several key factors: the increasing demand for cost-effective surveillance and reconnaissance solutions within the military and law enforcement sectors, the growing utilization of drones for civilian applications like infrastructure inspection, precision agriculture, and delivery services, and the ongoing development of more sophisticated autonomous systems capable of performing complex tasks. Key countries driving this growth include the United Kingdom, France, Germany, and others within the specified region.

Significant market segmentation exists based on vehicle type (UAVs, UGVs, UUVs) and application (military, civil/law enforcement). While the military segment currently holds a significant share, the civil and law enforcement sectors are witnessing exponential growth, indicating a shift toward broader adoption of unmanned systems across various industries. However, regulatory hurdles surrounding airspace management, data privacy concerns, and the need for robust cybersecurity measures pose significant challenges to market expansion. Nevertheless, continuous technological advancements, decreasing costs of unmanned systems, and growing government support are expected to overcome these obstacles and drive further market expansion in the forecast period. Competition is intense, with established defense contractors like QinetiQ, Leonardo SpA, and Thales Group competing alongside innovative companies like DJI and Milrem Robotics, creating a dynamic and evolving landscape.

Europe Unmanned System Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the European Unmanned System market, covering the period from 2019 to 2033. It offers valuable insights into market dynamics, growth drivers, challenges, and future opportunities, equipping stakeholders with actionable intelligence for strategic decision-making. The report utilizes data from the base year 2025 and offers projections until 2033, with a historical overview spanning 2019-2024. The total market size in 2025 is estimated at xx Million, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

Europe Unmanned System Market Concentration & Innovation

The European unmanned system market exhibits a moderately concentrated landscape, with key players like QinetiQ, Leonardo SpA, and Kongsberg Gruppen holding significant market shares. However, the market is also characterized by the presence of numerous smaller, specialized companies, particularly in the niche segments of unmanned aerial vehicles (UAVs) and unmanned ground vehicles (UGVs). Market share dynamics are influenced by factors such as technological innovation, regulatory changes, and successful M&A activities. Over the period 2019-2024, the total value of M&A deals in this sector was approximately xx Million. Innovation is driven by advancements in areas such as AI, autonomy, sensor technology, and battery life, which continue to enhance the capabilities and applications of unmanned systems. Regulatory frameworks vary across European nations, impacting market growth and adoption rates, particularly for military and security applications. This report analyzes the impact of these regulations, identifying opportunities and challenges. The substitution of conventional systems with unmanned alternatives is a significant growth factor, spurred by cost-effectiveness and enhanced operational capabilities. End-user trends reflect a growing demand for unmanned systems across various sectors, including defense, logistics, agriculture, and surveillance, influencing market segmentation.

- Key Market Concentration Metrics: Market share of top 5 players (xx%), Herfindahl-Hirschman Index (HHI) (xx).

- M&A Activity: Number of deals (xx), average deal value (xx Million).

- Innovation Drivers: AI, autonomy, sensor technology, battery technology.

- Regulatory Impacts: Variability across EU countries, impact on market access and adoption.

Europe Unmanned System Market Industry Trends & Insights

The European unmanned systems market is experiencing robust growth, driven by several key factors. The increasing adoption of unmanned systems by military and defense organizations for surveillance, reconnaissance, and combat operations is a major catalyst. Furthermore, the civil and law enforcement sectors are witnessing rapid uptake of drones and other unmanned platforms for applications such as search and rescue, infrastructure inspection, and traffic monitoring. Technological advancements, particularly in autonomous navigation and artificial intelligence, are also enhancing the capabilities and efficiency of unmanned systems, leading to wider adoption. Consumer preferences are shifting towards more sophisticated and user-friendly unmanned systems, with a focus on safety, reliability, and ease of operation. Competition in this dynamic market is intensifying, with established players expanding their product portfolios and emerging startups entering with innovative solutions. The market penetration of unmanned systems in specific sectors is increasing rapidly, particularly in the commercial drone segment for aerial photography and delivery. The forecast period projects a steady increase in market share for unmanned aerial vehicles (UAVs) due to technological advancements and reduced costs. This expansion is supported by a CAGR of xx% for the UAV segment and a xx% increase in market penetration in various sectors from 2025 to 2033. Furthermore, the increasing prevalence of sophisticated sensor technology across all types of unmanned systems is a major driver for market expansion, with projections estimating a xx% growth in sensor integration in the forecast period.

Dominant Markets & Segments in Europe Unmanned System Market

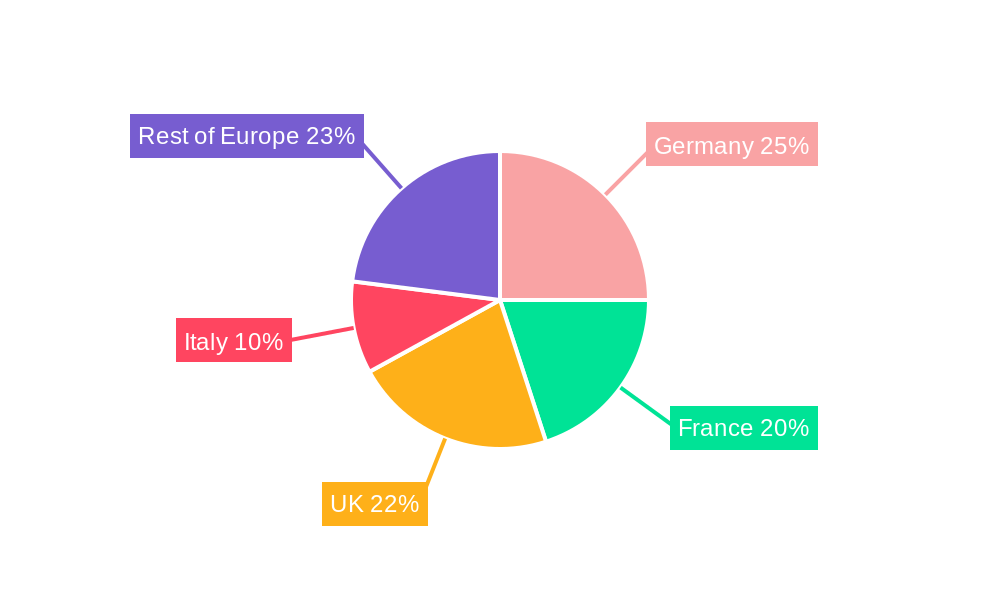

The United Kingdom and France are currently the dominant markets for unmanned systems in Europe, driven by strong defense budgets and robust technological capabilities. Germany is also a significant market, driven by both military and civilian applications. Within the product segment, unmanned aerial vehicles (UAVs) dominate the market, driven by the increasing demand for drone technology in various applications. The military segment is a significant driver of growth, followed by the civil and law enforcement segment. Russia also holds a notable market share, especially in military applications, although economic sanctions may impact future growth prospects.

Key Drivers for Dominant Markets:

- United Kingdom: Strong defense spending, advanced technological infrastructure, proactive government support.

- France: Significant military investment, focus on domestic innovation, expanding commercial applications.

- Germany: Robust industrial base, substantial investment in R&D, growing civilian drone market.

Dominant Segments:

- Type: Unmanned Aerial Vehicles (UAVs) – highest market share due to versatility and cost-effectiveness.

- Application: Military – highest spending due to defense requirements.

Europe Unmanned System Market Product Developments

Recent product developments in the European unmanned systems market emphasize enhanced autonomy, improved payload capacity, longer flight times, and increased resilience to adverse weather conditions. New systems are incorporating advanced sensor technologies, such as AI-powered image recognition and data analytics, to improve operational effectiveness. This focus on advanced capabilities is driving broader market adoption across diverse sectors, from agriculture and infrastructure inspection to search and rescue operations. The integration of artificial intelligence and machine learning is transforming unmanned systems into more intelligent and adaptable platforms. The competitive landscape is characterized by companies vying to offer the most advanced and versatile systems, fostering innovation and accelerating product development.

Report Scope & Segmentation Analysis

This report segments the European unmanned system market by type (Unmanned Aerial Vehicles, Unmanned Ground Vehicles, Unmanned Sea Systems), application (Civil and Law Enforcement, Military), and country (United Kingdom, France, Germany, Spain, Italy, Russia, Rest of Europe). Each segment is analyzed in detail, providing insights into market size, growth projections, and competitive dynamics. The UAV segment exhibits the fastest growth, driven by technological advancements and expanding applications. The military application segment is the largest, followed by the civil and law enforcement segments. The UK, France, and Germany represent the largest national markets, driven by strong defense budgets and active civilian sectors. Growth projections vary across segments and countries based on specific market drivers and challenges. The Rest of Europe segment showcases substantial growth potential, though it faces greater regulatory hurdles.

Key Drivers of Europe Unmanned System Market Growth

The European unmanned system market is propelled by several key growth drivers. First, increasing defense budgets across several European nations fuel demand for military-grade unmanned systems. Second, the rising adoption of unmanned systems for civilian applications, such as surveillance, agriculture, and delivery, is driving market expansion. Third, technological advancements in autonomy, AI, and sensor technologies are continuously enhancing the capabilities and efficiency of unmanned systems. Fourth, supportive government policies and initiatives aimed at fostering innovation and promoting the adoption of unmanned technologies contribute positively to market growth. Finally, cost reduction in production and maintenance of these systems also aids market expansion.

Challenges in the Europe Unmanned System Market Sector

The European unmanned system market faces certain challenges. Firstly, stringent regulatory frameworks and varying national standards across European countries pose hurdles to market penetration and standardization. Secondly, concerns surrounding data privacy, security, and safety, along with potential misuse of unmanned systems, create obstacles. Thirdly, supply chain disruptions and dependence on specific component manufacturers can impact market stability. Fourthly, intense competition among established players and emerging startups puts pressure on profit margins. Fifthly, high initial investment costs can deter adoption, particularly for smaller companies and organizations with limited budgets.

Emerging Opportunities in Europe Unmanned System Market

Emerging opportunities abound in the European unmanned system market. The growing integration of AI and machine learning is creating advanced autonomous systems with enhanced capabilities. The development of swarm technology opens up new possibilities for coordinated operations across multiple unmanned platforms. The expansion into new market segments such as precision agriculture, infrastructure inspection, and environmental monitoring offers significant growth potential. The increasing demand for secure and reliable communication solutions specifically for unmanned systems offers further business opportunities. Finally, the use of unmanned systems in disaster response and humanitarian aid provides a growing and valuable application space.

Leading Players in the Europe Unmanned System Market Market

- QinetiQ

- Leonardo SpA

- Kongsberg Gruppen

- Rheinmetall AG

- Telerob Gesellschaft fr Fernhantierungstechnik mb

- Maritime Robotics AS

- DJI

- Thales Group

- Parrot Drone SAS

- Nexter Group

- Milrem Robotics

- UAS Europe AB

- BAE Systems plc

- Saab AB

- Flyability SA

Key Developments in Europe Unmanned System Market Industry

- June 2023: QinetiQ announced a new partnership to develop advanced autonomous systems for military applications.

- March 2023: Leonardo SpA launched a new generation of UAV with enhanced capabilities.

- December 2022: Kongsberg Gruppen secured a major contract for the supply of unmanned maritime systems. (Further details on specific development events require further research and will vary year by year)

Strategic Outlook for Europe Unmanned System Market Market

The European unmanned system market holds significant growth potential. Continued technological advancements, increasing defense spending, and expanding civilian applications will drive market expansion. The focus on autonomous systems, improved sensor technologies, and enhanced safety features will fuel adoption. Companies that can effectively adapt to evolving regulatory frameworks and offer innovative, cost-effective solutions will be best positioned to capitalize on emerging opportunities. The market is expected to witness a sustained period of growth and innovation over the forecast period, driven by both military and commercial applications.

Europe Unmanned System Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Unmanned System Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Unmanned System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Military Segment Will Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Unmanned System Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Germany Europe Unmanned System Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Unmanned System Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Unmanned System Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Unmanned System Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Unmanned System Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Unmanned System Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Unmanned System Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 QinetiQ

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Leonardo SpA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Kongsberg Gruppen

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Rheinmetall AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Telerob Gesellschaft fr Fernhantierungstechnik mb

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Maritime Robotics AS

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 DJI

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Thales Group

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Parrot Drone SAS

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Nexter Group

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Milrem Robotics

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 UAS Europe AB

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 BAE Systems plc

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Saab AB

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Flyability SA

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.1 QinetiQ

List of Figures

- Figure 1: Europe Unmanned System Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Unmanned System Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Unmanned System Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Unmanned System Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Europe Unmanned System Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Europe Unmanned System Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Europe Unmanned System Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Europe Unmanned System Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Europe Unmanned System Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Unmanned System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Italy Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Netherlands Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sweden Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Europe Unmanned System Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 17: Europe Unmanned System Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 18: Europe Unmanned System Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Europe Unmanned System Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 20: Europe Unmanned System Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 21: Europe Unmanned System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United Kingdom Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Germany Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Italy Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Spain Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Netherlands Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Belgium Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Sweden Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Norway Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Poland Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Denmark Europe Unmanned System Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Unmanned System Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Europe Unmanned System Market?

Key companies in the market include QinetiQ, Leonardo SpA, Kongsberg Gruppen, Rheinmetall AG, Telerob Gesellschaft fr Fernhantierungstechnik mb, Maritime Robotics AS, DJI, Thales Group, Parrot Drone SAS, Nexter Group, Milrem Robotics, UAS Europe AB, BAE Systems plc, Saab AB, Flyability SA.

3. What are the main segments of the Europe Unmanned System Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Military Segment Will Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Unmanned System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Unmanned System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Unmanned System Market?

To stay informed about further developments, trends, and reports in the Europe Unmanned System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence